Professional Documents

Culture Documents

Standalone Financial Results, Form A, Auditors Report For March 31, 2016 (Result)

Uploaded by

Shyam SunderOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Standalone Financial Results, Form A, Auditors Report For March 31, 2016 (Result)

Uploaded by

Shyam SunderCopyright:

Available Formats

firihants

Securities Ltd

New NO.30,Old No.138, Dr. Radhakrishnan Salai, Mylapore, Chen

Phone : 044 - 43434000 I 28444555 Fax: 044 - 43434030

E-mail: arihantssecurities@gmail.comCw: L..b 5"9931/11 ICfct 1.;-

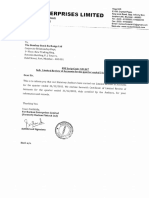

To,

- 600 004

Date: 28-05-201

The Corporate Relationship Department,

Bombay Stock Exchange Ltd.,

Phiroze JeeJeebhoy Towers,

zs" Floor, Dalal Street,

Mumbai - 400001.

Dear Sir,

Sub: Audited Financial Results for the Quarter and Year ended 31.03.2016

With reference to the above captioned subject matter, please find enclosed

following:

Pursuant to Regulation 33 of the SEBI (Listing Obligations and Disci

Requirements) Regulations, 2015 enclosed the Audited Financial Results

the Quarter and Year ended 31-03-2016.

Thanking you,

Yours faithfully, .

For Arihant's Securities Limited

ForARIHANT'S .SECURITIEr,LlM~D

.Q_tt1'-f~

Director

Ravikant Choudhry

Chairman & Director

(DIN: 00831721)

This is for your kind information. Kindly acknowledge receipt

C 027793

ARIHANT'S SECURITIES LIMITED

Registered Office: 138, Dr.Radhakrishrum Salai, Mylapore, Chennai - 600 004

Tel: (044)28444555,43434000Fax: (044)43434030

Email: arihantssecurities@gmail.com

CIN No. : L65993TNI994PLC027783

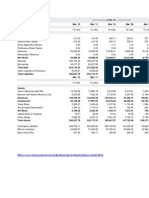

AUDITED FINANCIAL RESULTS FOR THE QUARTER AND YEAR ENDED 31.03.2016

FOR THE QUARTER ENDED

31.03.2016

31.12.2015

31.03.2015

S.No

Particulars

1 Income from Operations

a. Net Sales / Income From Operations

b. Other Operating Income

Total Income

Audited

Unaudited

17.06

Total Income from Operations (net)

2 Expenses

a. Cost of materials consumed

b. Purchases of stock-in-trade

c. Changes in inventories of finished goods, work

in-progress and stock-in-trade

d. Employee benefits expense

e. Depreciation and Amortisation Expense

f. Other expenses(Any item exceeding 10% of the

total expenses relating to continuing operations

to be shown separately)

Total Expenses

Profit/(Ioss) from Operations before Other

Income, finance costs and Exceptional Items

3 (1-2)

4 Other Income

Profit/ (Loss) from ordinary activities before

5 finance costs and exceptional items (3 +4)

Audited

9.61

Audited

41.70

42.90

Audited

65.68

17.06

9.61

41.70

42.90

65.68

17.06

9.61

41.70

42.90

65.68

6.46

3.62

4.66

11.12

1.80

5.42

4.86

15.16

1250

23.43

10.91

23.58

5.94

4.18

26.54

19.47

42.10

5.94

4.18

26.54

19.47

42.10

6 Finance Costs

Profit/ (Loss) from ordinary activities after

finance costs but before exceptional items

76)

(Rs. In Lakhs except per share data)

FOR THE YEAR ENDED

31.03.2016

31.03.2015

10.93

12.67

10.30

(5

5.94

4.18

26.54

19.47

42.10

5.94

4.18

26.54

19.47

42.10

10 Tax Expense

1.78

4.76

2.64

4.76

Net Profit(+VLoss(-) from Drdinary Activities

11 after Tax (9-10)

4.16

4.18

21.78

16.83

37.34

12 Extraordinary Items (Net of Tax Expenses Rs.)

4.16

4.18

21.78

16.83

37.34

SOO.OO

10.00

500.00

10.00

500.00

10.00

500.00

10.00

500.00

10.00

8 Exceptional items

Profit(+VLoss(-) from Ordinary Activities

9 before Tax (7+8)

13 Net Profit(+VLoss(-) for the period (11-12)

14 Paid Up Equity Share Capital

Face Value of the Share (In Rs.)

Reserve excluding Revaluation Reserves as per

15 Balance Sheet of previous accounting year

a. Basic and diluted EPS before Extraordinary

items (not annuaHsed)

0.08

0.08

0.44

0.34

0.75

b. Basic and diluted EPS after Extraordinary

items (not annuaHsed)

0.08

0.08

0.44

0.34

0.75

16 Earnings Per Share (EPS)

A.

PARTICULARS OF SHAREHOLDING

1 Public Shareholding

-Number of Shares

-Percentage of Shareholding

2,988,229

59.76%

2,988,229

59.76%

2,988,230

59.76%

2,988,229

59.76%

2,988,230

59.76%

Nil

N.A.

N.A.

Nil

N.A.

N.A.

Nil

N.A.

N.A.

Nil

N.A.

N.A.

Nil

N.A.

N.A.

N.A.

N.A.

N.A.

N.A.

N.A.

2,011,771

100%

2,011,771

100%

2,011,770

100%

2,011,573

100%

2,011,770

100%

40.24%

40.24%

40.24%

40.23%

40.24%

2 Promoters and Promoter Group Shareholding

a. Pledged / Encumbered

-Number of Shares

-Percentage of Shares (as a % of the total

shareholding of Promoter and Promoter Group)

-Percentage of Shares (as a % of the total

.share capital of the company)

b. Non-encumbered

-Number of Shares

-Percentage of Shares (as a % of the total

shareholding of promoter and promoter

group)

-Percentage of Shares (as a % of the total

share capital of the company)

Particulars

B.

Quarter ended

31.03.2016

INVESTOR COMPLAINTS

Pending at the beginning of the_'1uarter

Received during the quarter

Disposed off during the quarter

Remaining unresolved at the end of th"-'luarter

REPORTING OF SEGMEN1WISE

S.No

REVENUE, RESULTS AND CAPITAL EMPLOYED

Particulars

1 Segment Revenue

a. Loans

b. Trading of Shares and Derivatives

c. Others

Total

Less: Intersegment revenue

Net Sales/lucome from Operations

2 Segment Results

Profit(+)/Loss(-) before Tax

and Interest from each segment

a. Loans

b. Trading of Shares and Derivatives

d. Others

Total

Less: (i) Interest

(ii) Other Unallocable expenditure

net of Unallocable Income

Total Profit before Tax

3 Capital Employed

(Segment Assets - Segment Liabilities)

a. Loans

b. Trading of Shares and Derivatives

c. Trading of Commodities

d. Others

Total

Nil

1

1

Nil

FOR THE QUARTER ENDED

31.03.2016

31.122015

31.03.2015

(Rs In Lakhs)

FOR THE YEAR ENDED

31.03.2016

31.03.2015

Audited

Audited

Unaudited

17.06

17.06

17.06

Audited

41.70

9.61

41.70

9.61

41.70

9.61

Audited

4290

11.12

5.94

5.42

4.18

15.16

26.54

23.43

19.47

398.56

58.00

324.38

58.00

337.02

398.56

17.06

9.61

398.56

382.38

41.70

4290

9.61

65.68

41.70

-

17.06

7.08

58.59

42.90

65.68

7.08

58.59

42.90

4290

65.68

23.58

4210

58.00

337.02

395.02

398.56

395.02

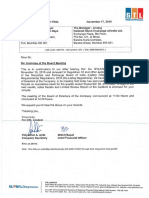

NOTES:

1. The above audited financial results for the year ended 31st March, 2016 have been reviewed by the Audit Committee and approved

by the Board of Directors of the Company at their respective meeting held on 28th May, 2016 and the report has been issued by the

Statutory Auditors there on. The information presented above is extracted from the audited financial statements as stated.

2. The figures for quarterly financial results for the quarter ended March 31, 2016 are the balancing figures between the Audited figures for the year

ended March 31, 2016 and the published year to date figures up to the third quarter ended December :t1, 2015, which were subjected to limited

review.

3. The previous financial quarter/ year figures have been regrouped/rearranged

wherever necessary to make them comparable.

4. The penalty '. 15,16,860/- paid in protest on 25th November 2014 to Bombay Stock Exchange for Non-Compliance of

Clause 35 and 41 of the Listing Agreement, is not debited to Revenue Account, as the appeal is in progress, as per the explanation given.

On behalf of the Board

Place: Chennai

Date: 28.05.2016

LJ~TEy

For ARIHANT'S SE~yRI~I~S

iLo1 f~-(~~r

Ravikant Chaudhry

Qirectof

You might also like

- Statement of Assets & Liabilites As On March 31, 2016 (Result)Document6 pagesStatement of Assets & Liabilites As On March 31, 2016 (Result)Shyam SunderNo ratings yet

- Standalone Financial Results, Form A, Auditors Report For March 31, 2016 (Result)Document8 pagesStandalone Financial Results, Form A, Auditors Report For March 31, 2016 (Result)Shyam SunderNo ratings yet

- Standalone & Consolidated Financial Results, Limited Review Report For June 30, 2016 (Result)Document5 pagesStandalone & Consolidated Financial Results, Limited Review Report For June 30, 2016 (Result)Shyam SunderNo ratings yet

- Standalone Financial Results, Form A, Auditors Report For March 31, 2016 (Result)Document12 pagesStandalone Financial Results, Form A, Auditors Report For March 31, 2016 (Result)Shyam SunderNo ratings yet

- Standalone Financial Results, Limited Review Report For June 30, 2016 (Result)Document4 pagesStandalone Financial Results, Limited Review Report For June 30, 2016 (Result)Shyam SunderNo ratings yet

- Standalone & Consolidated Financial Results, Auditors Report For March 31, 2016 (Result)Document6 pagesStandalone & Consolidated Financial Results, Auditors Report For March 31, 2016 (Result)Shyam SunderNo ratings yet

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Document4 pagesStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderNo ratings yet

- Standalone & Consolidated Financial Results For June 30, 2016 (Result)Document4 pagesStandalone & Consolidated Financial Results For June 30, 2016 (Result)Shyam SunderNo ratings yet

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Document5 pagesStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderNo ratings yet

- Standalone & Consolidated Financial Results, Limited Review Report For June 30, 2016 (Result)Document8 pagesStandalone & Consolidated Financial Results, Limited Review Report For June 30, 2016 (Result)Shyam SunderNo ratings yet

- Standalone Financial Results, Limited Review Report For June 30, 2016 (Result)Document4 pagesStandalone Financial Results, Limited Review Report For June 30, 2016 (Result)Shyam SunderNo ratings yet

- Standalone Financial Results For September 30, 2016 (Result)Document23 pagesStandalone Financial Results For September 30, 2016 (Result)Shyam SunderNo ratings yet

- Standalone Financial Results, Form A, Auditors Report For March 31, 2016 (Result)Document8 pagesStandalone Financial Results, Form A, Auditors Report For March 31, 2016 (Result)Shyam SunderNo ratings yet

- Standalone Financial Results, Limited Review Report For June 30, 2016 (Result)Document3 pagesStandalone Financial Results, Limited Review Report For June 30, 2016 (Result)Shyam SunderNo ratings yet

- Standalone Financial Results For September 30, 2016 (Result)Document4 pagesStandalone Financial Results For September 30, 2016 (Result)Shyam SunderNo ratings yet

- Standalone Financial Results, Limited Review Report For June 30, 2016 (Result)Document6 pagesStandalone Financial Results, Limited Review Report For June 30, 2016 (Result)Shyam SunderNo ratings yet

- Financial Results, Limited Review Report For December 31, 2015 (Result)Document4 pagesFinancial Results, Limited Review Report For December 31, 2015 (Result)Shyam SunderNo ratings yet

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Document4 pagesStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderNo ratings yet

- Financial Results, Limited Review Report For December 31, 2015 (Result)Document4 pagesFinancial Results, Limited Review Report For December 31, 2015 (Result)Shyam SunderNo ratings yet

- Financial Results, Limited Review Report For December 31, 2015 (Result)Document4 pagesFinancial Results, Limited Review Report For December 31, 2015 (Result)Shyam SunderNo ratings yet

- Standalone Financial Results, Limited Review Report, Results Press Release For September 30, 2016 (Result)Document6 pagesStandalone Financial Results, Limited Review Report, Results Press Release For September 30, 2016 (Result)Shyam SunderNo ratings yet

- Inter Alia,: VikrantDocument18 pagesInter Alia,: VikrantShyam SunderNo ratings yet

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Document4 pagesStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderNo ratings yet

- Standalone & Consolidated Financial Results, Limited Review Report For September 30, 2016 (Result)Document5 pagesStandalone & Consolidated Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderNo ratings yet

- M iYN: Standalone Limited BoDocument5 pagesM iYN: Standalone Limited BoHimanshuNo ratings yet

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Document7 pagesStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderNo ratings yet

- Magni-Tech Industries BerhadDocument9 pagesMagni-Tech Industries Berhadkhai_tajolNo ratings yet

- Standalone Financial Results, Form A, Auditors Report For March 31, 2016 (Result)Document8 pagesStandalone Financial Results, Form A, Auditors Report For March 31, 2016 (Result)Shyam SunderNo ratings yet

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Document5 pagesStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderNo ratings yet

- Financial Results & Limited Review Report For June 30, 2015 (Standalone) (Result)Document4 pagesFinancial Results & Limited Review Report For June 30, 2015 (Standalone) (Result)Shyam SunderNo ratings yet

- Standalone & Consolidated Financial Results, Form A, Auditors Report For March 31, 2016 (Result)Document22 pagesStandalone & Consolidated Financial Results, Form A, Auditors Report For March 31, 2016 (Result)Shyam SunderNo ratings yet

- Standalone Financial Results For September 30, 2016 (Result)Document8 pagesStandalone Financial Results For September 30, 2016 (Result)Shyam SunderNo ratings yet

- Financial Results, Limited Review Report For December 31, 2015 (Result)Document4 pagesFinancial Results, Limited Review Report For December 31, 2015 (Result)Shyam SunderNo ratings yet

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Document5 pagesStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderNo ratings yet

- TTR RRL: LimitedDocument5 pagesTTR RRL: LimitedShyam SunderNo ratings yet

- Standalone & Consolidated Financial Results, Auditors Report For March 31, 2016 (Result)Document9 pagesStandalone & Consolidated Financial Results, Auditors Report For March 31, 2016 (Result)Shyam SunderNo ratings yet

- Standalone Financial Results, Limited Review Report For June 30, 2016 (Result)Document3 pagesStandalone Financial Results, Limited Review Report For June 30, 2016 (Result)Shyam SunderNo ratings yet

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Document5 pagesStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderNo ratings yet

- V-Guard Industries LTD 150513 RSTDocument4 pagesV-Guard Industries LTD 150513 RSTSwamiNo ratings yet

- Standalone Financial Results, Limited Review Report For December 31, 2016 (Result)Document4 pagesStandalone Financial Results, Limited Review Report For December 31, 2016 (Result)Shyam SunderNo ratings yet

- Financial Results, Limited Review Report For December 31, 2015 (Result)Document5 pagesFinancial Results, Limited Review Report For December 31, 2015 (Result)Shyam SunderNo ratings yet

- Standalone Financial Results, Form A For March 31, 2016 (Result)Document4 pagesStandalone Financial Results, Form A For March 31, 2016 (Result)Shyam SunderNo ratings yet

- Financial Results For Dec 31, 2015 (Standalone) (Result)Document3 pagesFinancial Results For Dec 31, 2015 (Standalone) (Result)Shyam SunderNo ratings yet

- Standalone Financial Results, Limited Review Report For June 30, 2016 (Result)Document5 pagesStandalone Financial Results, Limited Review Report For June 30, 2016 (Result)Shyam SunderNo ratings yet

- Standalone Financial Results, Form A, Auditors Report For March 31, 2016 (Result)Document6 pagesStandalone Financial Results, Form A, Auditors Report For March 31, 2016 (Result)Shyam SunderNo ratings yet

- Standalone Financial Results, Form A, Auditors Report For March 31, 2016 (Result)Document5 pagesStandalone Financial Results, Form A, Auditors Report For March 31, 2016 (Result)Shyam SunderNo ratings yet

- Standalone Financial Results, Form A, Auditors Report For March 31, 2016 (Result)Document6 pagesStandalone Financial Results, Form A, Auditors Report For March 31, 2016 (Result)Shyam SunderNo ratings yet

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Document4 pagesStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderNo ratings yet

- Standalone & Consolidated Financial Results, Form A, Auditors Report For March 31, 2016 (Result)Document13 pagesStandalone & Consolidated Financial Results, Form A, Auditors Report For March 31, 2016 (Result)Shyam SunderNo ratings yet

- Standalone Financial Results, Limited Review Report For June 30, 2016 (Result)Document4 pagesStandalone Financial Results, Limited Review Report For June 30, 2016 (Result)Shyam SunderNo ratings yet

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Document4 pagesStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderNo ratings yet

- Standalone Financial Results, Auditors Report For March 31, 2016 (Result)Document7 pagesStandalone Financial Results, Auditors Report For March 31, 2016 (Result)Shyam SunderNo ratings yet

- Dabur Balance SheetDocument30 pagesDabur Balance SheetKrishan TiwariNo ratings yet

- Standalone & Consolidated Financial Results, Limited Review Report For September 30, 2016 (Result)Document6 pagesStandalone & Consolidated Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderNo ratings yet

- Financial Results, Limited Review Report For December 31, 2015 (Result)Document4 pagesFinancial Results, Limited Review Report For December 31, 2015 (Result)Shyam SunderNo ratings yet

- Standalone Financial Results, Form A, Auditors Report For March 31, 2016 (Result)Document7 pagesStandalone Financial Results, Form A, Auditors Report For March 31, 2016 (Result)Shyam SunderNo ratings yet

- Financial Results, Limited Review Report For December 31, 2015 (Result)Document6 pagesFinancial Results, Limited Review Report For December 31, 2015 (Result)Shyam SunderNo ratings yet

- Segment Reporting (Rs. in Crore)Document8 pagesSegment Reporting (Rs. in Crore)Tushar PanhaleNo ratings yet

- Standalone Financial Results, Auditors Report For June 30, 2016 (Result)Document4 pagesStandalone Financial Results, Auditors Report For June 30, 2016 (Result)Shyam SunderNo ratings yet

- Miscellaneous Intermediation Revenues World Summary: Market Values & Financials by CountryFrom EverandMiscellaneous Intermediation Revenues World Summary: Market Values & Financials by CountryNo ratings yet

- Mutual Fund Holdings in DHFLDocument7 pagesMutual Fund Holdings in DHFLShyam SunderNo ratings yet

- Exit Order in Respect of The Spice and Oilseeds Exchange Limited, SangliDocument5 pagesExit Order in Respect of The Spice and Oilseeds Exchange Limited, SangliShyam SunderNo ratings yet

- JUSTDIAL Mutual Fund HoldingsDocument2 pagesJUSTDIAL Mutual Fund HoldingsShyam SunderNo ratings yet

- HINDUNILVR: Hindustan Unilever LimitedDocument1 pageHINDUNILVR: Hindustan Unilever LimitedShyam SunderNo ratings yet

- Settlement Order in Respect of Bikaner Wooltex Pvt. Limited in The Matter of Sangam Advisors LimitedDocument2 pagesSettlement Order in Respect of Bikaner Wooltex Pvt. Limited in The Matter of Sangam Advisors LimitedShyam SunderNo ratings yet

- Settlement Order in Respect of R.R. Corporate Securities LimitedDocument2 pagesSettlement Order in Respect of R.R. Corporate Securities LimitedShyam SunderNo ratings yet

- Order of Hon'ble Supreme Court in The Matter of The SaharasDocument6 pagesOrder of Hon'ble Supreme Court in The Matter of The SaharasShyam SunderNo ratings yet

- PR - Exit Order in Respect of Spice & Oilseeds Exchange Limited (Soel)Document1 pagePR - Exit Order in Respect of Spice & Oilseeds Exchange Limited (Soel)Shyam SunderNo ratings yet

- Financial Results & Limited Review Report For June 30, 2015 (Standalone) (Result)Document3 pagesFinancial Results & Limited Review Report For June 30, 2015 (Standalone) (Result)Shyam SunderNo ratings yet

- Financial Results & Limited Review Report For Sept 30, 2015 (Standalone) (Result)Document4 pagesFinancial Results & Limited Review Report For Sept 30, 2015 (Standalone) (Result)Shyam SunderNo ratings yet

- Financial Results, Limited Review Report For December 31, 2015 (Result)Document4 pagesFinancial Results, Limited Review Report For December 31, 2015 (Result)Shyam SunderNo ratings yet

- Standalone Financial Results, Auditors Report For March 31, 2016 (Result)Document5 pagesStandalone Financial Results, Auditors Report For March 31, 2016 (Result)Shyam SunderNo ratings yet

- Financial Results For Mar 31, 2014 (Result)Document2 pagesFinancial Results For Mar 31, 2014 (Result)Shyam SunderNo ratings yet

- Financial Results For June 30, 2014 (Audited) (Result)Document3 pagesFinancial Results For June 30, 2014 (Audited) (Result)Shyam SunderNo ratings yet

- Standalone Financial Results For September 30, 2016 (Result)Document3 pagesStandalone Financial Results For September 30, 2016 (Result)Shyam SunderNo ratings yet

- Standalone Financial Results For June 30, 2016 (Result)Document2 pagesStandalone Financial Results For June 30, 2016 (Result)Shyam SunderNo ratings yet

- Financial Results For June 30, 2013 (Audited) (Result)Document2 pagesFinancial Results For June 30, 2013 (Audited) (Result)Shyam SunderNo ratings yet

- Financial Results For Dec 31, 2013 (Result)Document4 pagesFinancial Results For Dec 31, 2013 (Result)Shyam Sunder0% (1)

- Financial Results For September 30, 2013 (Result)Document2 pagesFinancial Results For September 30, 2013 (Result)Shyam SunderNo ratings yet

- PDF Processed With Cutepdf Evaluation EditionDocument3 pagesPDF Processed With Cutepdf Evaluation EditionShyam SunderNo ratings yet

- Standalone Financial Results, Limited Review Report For June 30, 2016 (Result)Document3 pagesStandalone Financial Results, Limited Review Report For June 30, 2016 (Result)Shyam SunderNo ratings yet

- Standalone Financial Results For March 31, 2016 (Result)Document11 pagesStandalone Financial Results For March 31, 2016 (Result)Shyam SunderNo ratings yet

- Standalone Financial Results, Limited Review Report For December 31, 2016 (Result)Document5 pagesStandalone Financial Results, Limited Review Report For December 31, 2016 (Result)Shyam SunderNo ratings yet

- Standalone Financial Results, Limited Review Report For December 31, 2016 (Result)Document3 pagesStandalone Financial Results, Limited Review Report For December 31, 2016 (Result)Shyam SunderNo ratings yet

- Transcript of The Investors / Analysts Con Call (Company Update)Document15 pagesTranscript of The Investors / Analysts Con Call (Company Update)Shyam SunderNo ratings yet

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Document4 pagesStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderNo ratings yet

- Standalone Financial Results, Limited Review Report For June 30, 2016 (Result)Document4 pagesStandalone Financial Results, Limited Review Report For June 30, 2016 (Result)Shyam SunderNo ratings yet

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Document4 pagesStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderNo ratings yet

- Investor Presentation For December 31, 2016 (Company Update)Document27 pagesInvestor Presentation For December 31, 2016 (Company Update)Shyam SunderNo ratings yet

- Standalone Financial Results, Limited Review Report For December 31, 2016 (Result)Document4 pagesStandalone Financial Results, Limited Review Report For December 31, 2016 (Result)Shyam SunderNo ratings yet

- FTCP - Sxsxsxsxeminar 6 - 2015 - AnswersDocument4 pagesFTCP - Sxsxsxsxeminar 6 - 2015 - AnswersLewis FergusonNo ratings yet

- Assigment 6 - Managerial Finance Capital BudgetingDocument5 pagesAssigment 6 - Managerial Finance Capital BudgetingNasir ShaheenNo ratings yet

- Inventory List With Reorder Highlighting1 (PURE GOLD)Document1 pageInventory List With Reorder Highlighting1 (PURE GOLD)Muchena Stephen GiftNo ratings yet

- Tutorial 06 Solution For Additional ProblemsDocument6 pagesTutorial 06 Solution For Additional ProblemsTrung ĐàmNo ratings yet

- Document 5Document23 pagesDocument 5Chi ChengNo ratings yet

- Week 5 Tutorial QuestionsDocument2 pagesWeek 5 Tutorial QuestionsWOP INVESTNo ratings yet

- FM Reliance IndustriesDocument30 pagesFM Reliance IndustriesAkshata Masurkar100% (2)

- Deal Structuring Process (Part-I) : Presented by Prof. (DR.) Manish PopliDocument35 pagesDeal Structuring Process (Part-I) : Presented by Prof. (DR.) Manish PopliABHISHEK PARASA PGP 2019-21 Batch100% (1)

- Financial Management TheoryDocument7 pagesFinancial Management TheoryAnandhi SomasundaramNo ratings yet

- Intermediate-Accounting Handout Chap 11Document3 pagesIntermediate-Accounting Handout Chap 11Joanne Rheena BooNo ratings yet

- Portfolio MGMT SynopsisDocument3 pagesPortfolio MGMT Synopsiskhushbookhetan0% (1)

- Preliminary Examination in Financial ManagementDocument6 pagesPreliminary Examination in Financial ManagementJken OrtizNo ratings yet

- Problem 3Document4 pagesProblem 3Rio De LeonNo ratings yet

- SBSA Statement 2023-02-02Document3 pagesSBSA Statement 2023-02-02Melissa Albertyn-BrowneNo ratings yet

- Syllabus of BBI (3rd Year)Document9 pagesSyllabus of BBI (3rd Year)sameer_kiniNo ratings yet

- Financial Statement Analysis and Valuation 4th Edition Easton Test BankDocument44 pagesFinancial Statement Analysis and Valuation 4th Edition Easton Test Bankmrsbrianajonesmdkgzxyiatoq100% (30)

- CMT Level I Sample Exam AnswersDocument14 pagesCMT Level I Sample Exam AnswersZahamish MalikNo ratings yet

- 1 Introduction To Financial ManagementDocument48 pages1 Introduction To Financial ManagementTHE EXTRAODRINARYNo ratings yet

- Ecs3703 2019 2 TL 201Document8 pagesEcs3703 2019 2 TL 201Anseeta SajeevanNo ratings yet

- Forward Contracts and Futures MarketsDocument28 pagesForward Contracts and Futures MarketskevinNo ratings yet

- Forex Trade - ArticlesDocument55 pagesForex Trade - ArticlesRohith HegdeNo ratings yet

- Global Vectra HelicorpDocument13 pagesGlobal Vectra HelicorpSiddhartha KhemkaNo ratings yet

- MAT Minimum Alternate Tax - 8 Marks (A) (I) Basic: Simple Hai !Document3 pagesMAT Minimum Alternate Tax - 8 Marks (A) (I) Basic: Simple Hai !srushti thoratNo ratings yet

- Intangible Assets Test Bank PDFDocument11 pagesIntangible Assets Test Bank PDFAB CloydNo ratings yet

- 08 - Chapter 1Document29 pages08 - Chapter 1aswinecebeNo ratings yet

- Financial Economics - Introduction - : Antoine BommierDocument7 pagesFinancial Economics - Introduction - : Antoine BommierSangwoo KimNo ratings yet

- Lesson 6 Lyst4255Document9 pagesLesson 6 Lyst4255sneha bhongadeNo ratings yet

- Duties and Responsibilities of The Asset Management CompanyDocument19 pagesDuties and Responsibilities of The Asset Management Companysumairjawed8116100% (1)

- Balance Sheet of Axis BankDocument8 pagesBalance Sheet of Axis BankKushal GuptaNo ratings yet

- Adobe Scan 02-Feb-2023Document3 pagesAdobe Scan 02-Feb-2023Lokesh SenNo ratings yet