Professional Documents

Culture Documents

Ias 41

Uploaded by

Chantal MangionOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Ias 41

Uploaded by

Chantal MangionCopyright:

Available Formats

IAS 41: Agriculture

This standard deals with biological assets and agricultural produce until

the point of harvest. A biological asset is a living animal, plant or tree. Ex:

The orange (before it is picked). When the agricultural produce has been

harvested we show it as inventory.

This standard does not apply to tangible or intangible assets that are used

in agricultural activity. These are dealt with in IAS16, IAS40 and IAS38.

Land that is used to grow crops (orchards, farms etc.) cannot be

accounted for in accordance with IAS41. IAS41 states that all biological

assets and agricultural produce until the point of harvest needs to be at

Fair Value less cost to sell. IAS 16 provides us with an option: cost or

revaluation models.

Agricultural produce could require further processing. Ex: The pig is a

biological asset from which we harvest the meat to produce sausages and

bacon. What is produced from the meat is not in the scope of IAS41 and is

considered as inventory.

Goods from the agricultural produce but require further processing are

accounted for in accordance with IAS2. Ex:

Cows

Milk

Cheese, butter

Biological asset

Agricultural produce

Inventory

IAS41

IAS41

IAS2

Agricultural activity: This is the management by an entity of the biological

transformation and harvest of biological assets for sale or for conversion

into agricultural produce or into additional biological assets. We can only

account under IAS41 if there is an agricultural activity.

Biological transformation: this comprises the processes of growth,

degeneration, production and procreation that cause qualitative or

quantitative changes in the biological asset.

Farmer takes out weeds, irrigates the crops, feeds the animals. He is the

third party who is aiding the biological transformation of this asset.

Whats the difference between the accounting treatment of fish farms and

fish in the open sea? Fish that are in the fish farm are fed and giving

medicine by a third party and thus there is management by an entity. We

accounting in accordance with IAS41. On the other hand, fish in the open

sea feed themselves and thus are not accounting for under IAS41.

Qualitative change: increase in quality: a flower becomes and orange, a

piglet becomes a pig.

Quantitative change: increase in the quantity: through procreation or

growth. A 4-year-old pig is worth more than a 1-year-old one because it

has more meat.

Recognition and measurement: An entity recognises a biological asset or

agricultural produce when:

The entity controls the asset as a result of past events

It is probable that future economic benefits associated with the

assets will flow to the entity

The fair value of the cost of the asset can be measured reliably: This

is important because the entity upon initial recognition and

subsequent accounting, the management has to account for the

biological asset or agricultural produce at fair value less cost to sell.

Fair value is the market price, however, we need to deduct the cost

to sell. Ex: Pitkali fees, transport costs, brokerage fees.

There is a presumption that a market exists. Any movement in fair value

less cost to sell finds itself in the income statement as income. This is

because you have incurred the expenses which you recorded in the profit

and loss. We need to match the revenue to the cost. If the expenses went

to the Income Statement, income needs to go there.

There might be rare instances where there is no active market for the

biological asset. Ex: Reptile that is caught every 20 years because it is not

sold on a regular basis. There is no active market. In these cases, the

biological assets or agricultural produce will be recognised at cost and

depreciated over the useful life of the asset.

A company cannot switch from fair value to cost. If it has established from

initial recognition that there is an active market, such market cannot

disappear. It has to continue using the fair value less cost to sell. If a

market appears after a period when there was no market, the company

has to switch from cost to the fair value model. However, it cannot switch

the other way round because some companies would want to do that to

arrest losses. This is called cooking the books and it misleads investors.

Yes

Is there an established

market?

Do not switch: active

market will never

disappear

Use cost model

No

Market appears:

switch to fair value

model.

For something to become extinct there needs to be a number of years.

You might also like

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (121)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (588)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (400)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5794)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (345)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (895)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (74)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- PWC Basics of Mining Accounting UsDocument133 pagesPWC Basics of Mining Accounting Ussharanabasappa baliger100% (1)

- 7-11 Franchising Paper PROPOSAL ONLYDocument42 pages7-11 Franchising Paper PROPOSAL ONLYYara AB100% (1)

- Financial AnalysisDocument9 pagesFinancial Analysisgem paolo lagranaNo ratings yet

- LCM Grade 3 Italian WordsDocument3 pagesLCM Grade 3 Italian WordsChantal MangionNo ratings yet

- 08.10.19 Access To FinanceDocument62 pages08.10.19 Access To FinanceChantal MangionNo ratings yet

- 08.10.19 Business PlanningDocument18 pages08.10.19 Business PlanningChantal MangionNo ratings yet

- Chromatic Scale WorksheetDocument2 pagesChromatic Scale WorksheetChantal MangionNo ratings yet

- Grade 2 Theory Test: DynamicsDocument2 pagesGrade 2 Theory Test: DynamicsChantal MangionNo ratings yet

- Dynamics: Grade 1 Theory Italian Sign EnglishDocument2 pagesDynamics: Grade 1 Theory Italian Sign EnglishChantal MangionNo ratings yet

- Commercial Law For AccountantsDocument19 pagesCommercial Law For AccountantsChantal MangionNo ratings yet

- Finger Number: Game Idea From Becki LewisDocument2 pagesFinger Number: Game Idea From Becki LewisChantal MangionNo ratings yet

- Timetable-DraftDocument2 pagesTimetable-DraftChantal MangionNo ratings yet

- Management in A Dynamic EnvironmentDocument21 pagesManagement in A Dynamic EnvironmentChantal MangionNo ratings yet

- Timetable-DraftDocument2 pagesTimetable-DraftChantal MangionNo ratings yet

- The Environment - Values and ChoicesDocument2 pagesThe Environment - Values and ChoicesChantal MangionNo ratings yet

- 3.technology As A ProcessDocument3 pages3.technology As A ProcessChantal MangionNo ratings yet

- Sidney Sheldon ChecklistDocument1 pageSidney Sheldon ChecklistChantal MangionNo ratings yet

- HkfrspeDocument340 pagesHkfrspeTommy KoNo ratings yet

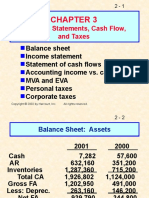

- Financial Statements, Cash Flow, and TaxesDocument40 pagesFinancial Statements, Cash Flow, and Taxessalma fitriaNo ratings yet

- Eyedropper Clinic: Accounting Equation: Current Assets Non Current AssetsDocument5 pagesEyedropper Clinic: Accounting Equation: Current Assets Non Current AssetsSofía MargaritaNo ratings yet

- Finance Case Competition Team 8 Executive Report PDFDocument11 pagesFinance Case Competition Team 8 Executive Report PDFRyan TeichmannNo ratings yet

- Form AOC-4-11122019 - SignedDocument16 pagesForm AOC-4-11122019 - SignedNi007ckNo ratings yet

- Lecture 2 Depreciation, Accruals and CashflowDocument30 pagesLecture 2 Depreciation, Accruals and CashflowSalahuddin KhanNo ratings yet

- Financial Statements Year Ended December 31, 20X5: ABC CompanyDocument11 pagesFinancial Statements Year Ended December 31, 20X5: ABC CompanysaraNo ratings yet

- Corporate Finance Mini CaseDocument6 pagesCorporate Finance Mini CaseMashaal FNo ratings yet

- TerotechnologyDocument1 pageTerotechnologyLuciano RibeiroNo ratings yet

- Profit Center AccountingDocument55 pagesProfit Center AccountingBala RanganathNo ratings yet

- Caterpillar IndicadoresDocument24 pagesCaterpillar IndicadoresChris Fernandes De Matos BarbosaNo ratings yet

- 20 - Muhammad Greyfan SetyadiDocument15 pages20 - Muhammad Greyfan SetyadigreyfanNo ratings yet

- (Xii) 2023 Solved Sample Target Paper C.G, PST, Acc, Stats by Sir IrfanDocument30 pages(Xii) 2023 Solved Sample Target Paper C.G, PST, Acc, Stats by Sir IrfanSaira ShahaniNo ratings yet

- Inflation Accounting: Presented ByDocument24 pagesInflation Accounting: Presented ByjasminerathodNo ratings yet

- BAFM6102 - Prelim Quiz 1 - Attempt ReviewDocument4 pagesBAFM6102 - Prelim Quiz 1 - Attempt ReviewKinglaw PilandeNo ratings yet

- 1 20180905052123Document194 pages1 20180905052123Gupllo Kin'emonJrNo ratings yet

- December 2021 Financial Acocunting and Reporting UK GAAPDocument11 pagesDecember 2021 Financial Acocunting and Reporting UK GAAPChoo LeeNo ratings yet

- Ranbaxy Laboratories LTD.: Accounting For Managers ProjectDocument7 pagesRanbaxy Laboratories LTD.: Accounting For Managers ProjectAnmol SinghviNo ratings yet

- Week 6 Assignment FNCE UCWDocument1 pageWeek 6 Assignment FNCE UCWamyna abhavaniNo ratings yet

- FI AIAB JPN Create Settlement RulesDocument18 pagesFI AIAB JPN Create Settlement RulesnguyencaohuyNo ratings yet

- Commonwealth Bank Financial AnalysisDocument11 pagesCommonwealth Bank Financial AnalysisMuhammad MubeenNo ratings yet

- #1-Illustrative ProblemDocument19 pages#1-Illustrative ProblemNisharie AbanNo ratings yet

- Partnership and Piecemeal DistributionDocument46 pagesPartnership and Piecemeal DistributionPadmalochan NayakNo ratings yet

- On IFRS, US GAAP and Indian GAAPDocument64 pagesOn IFRS, US GAAP and Indian GAAPrishipath100% (1)

- Unit II Lesson 5 and 6 ADJUSTING ENTRIES and FSDocument25 pagesUnit II Lesson 5 and 6 ADJUSTING ENTRIES and FSAlezandra SantelicesNo ratings yet

- 2607y Maliyyə Hesabatı SABAH (En)Document34 pages2607y Maliyyə Hesabatı SABAH (En)leylaNo ratings yet