Professional Documents

Culture Documents

Meaning of HUF Â " Hindu Undivided Family

Uploaded by

Kumar SaurabhOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Meaning of HUF Â " Hindu Undivided Family

Uploaded by

Kumar SaurabhCopyright:

Available Formats

10/29/2016

MeaningofHUFHinduUndividedFamily

SelectLanguage

HOME

APPEALS

Poweredby

TAX READY RECKONER

ASSESSMEMNTS

Search

Translate

COMPUTATION OF TOTAL INCOME

PENALTIES

TAX @ GLANCE

TAX PLANNING & SAVING

TAX @ KNOWLEDGEBASE

TAX MANAGEMENT & PROCEDURE

HUF @ KNOWLEDGEBASE

TRUSTS

TAXATION IN COMPANIES

NRI

BLOG

TAX MANAGEMENT BOOK ORDER

TAX MANAGEMENT BOOK CONTENTS

Meaning of HUF Hindu Undivided Family

TheexpressionHinduUndividedfamilyondissectionconsistsofthreewordsnamely

(i)Hindu,

(ii)Undividedand

(iii)family.

EachwordhasameaningofitsownanditisveryimportantforunderstandingtheconceptoftheHUF.

1.

The Hindu Religion according to the ancient scripts is believed to be over 8500 years old. The root of

the Hindu religion is Sindhu or Indus valley civilization in the Indian subcontinent. Hindu religion is also

known as Sanatan Dharma meaning a religion which is eternal or which always existed.

ThewordHinduconnotesthatessentiallyaHUFcanbeformedonlybythefollowersoftheHinduReligionandno

other religious community like Muslims, Christians etc can form a HUF: Broadly speaking in the Indian context

Bengalis,Marwaris,Marathis,Punjabis,Telgus,TamiliansetcwhoareHindusandJams,Sikhs,Buddhistsetc,

canformaHUF.TheDictionarymeaningofthewordHinduisonewhoprofessesHinduismparticularlyAryansof

India and it is the religion of the majority of the Indians. A Hindu is an adherent of Hinduism, the predominant

religious,philosophical and cultural system of Bharat (India). The word Hindu was originally a Persian word for

riverdwelleri.e.,someonewholivesaroundorbeyOndtheriverIndus,andmeantanyinhabitantofBharat,or

theIndiansubcontinent.Hinduismisbasicallypantheism,abeliefthatGodexistsineverythingintheuniverse.

Themeaninggivenhereinaboveisthegeneralmeaningusedindaytodayparlance.However,tounderstandthe

conceptofHUFinthelightoftaxatiOn,itisimportanttounderstandthemeaning

of the word Hindu as given in the vaiious Acts. The definition of the word Hindu is though not available in the

HinduSuccessionAct,Section2(1)oftheHinduSuccessionAct,1956statesthatitshallapplytoanypersonwho

isaHindu,Buddhist,lainorSikhbyreligion.Italsoappliestoanypersonwhoisaconvertorreconverttothesaid

religionsbutnottoaMuslim,Christian,ParsiorJewbyreligion.

InthecaseofCWTvsR.Sridharan,(1976)4SCC489,theApexCourthadconsideredthedefinitionofterm

Hindu and observed that it is a matter of common knowledge that Hinduism embraces within itself so many

diverseformsofbeliefs,faiths,practicesandworshipthatitisdifficulttodefinethetermHinduwithprecision.

ThereafteritobservedasfollowsinthecontextofthemeaningofthewordHinduatPara17.

17.Itwillbeadvantageousatthisstagetorefertopage671ofMullaPrinciplesofHinduLaw(FourteenthEdn.),

wherethepositionisstatedthus:

TheWordHindudoesnotdenoteanyparticularreligionorcommunity.Duringthelasthundredyearsandmore

it has been a nomenclature used to refer comprehensively to various categories of people for purposes of

personal law. It has been applied to dissenters and nonconformists and even to those who have entirely

repudiatedBrahminism.Ithasbeenappliedtovariousreligioussectsandbeliefswhichatvariousperiodsandin

circumstances developed out of, or split off from, the Hindu system but whose members have nevertheless

continued_toliveundertheHindulawandthecourtshavegenerallyputaliberalconstructionuponenactments

relatingtothepersonallawsapplicabletoHindus.

b)Undividedmeansthatwhichisnotdividedorthatwhichisunitedorjointorcommoninmessor

income.

c)ThewordfamilydenotedagroupofpersonsnormallyParents,Childrenforminghousehold,Setof

ParentsandChildren,alldescendantsofcommonancestor.Insimplelanguageortheplainmeaning

ofthewordfamilymeansmorethanoneperson.

TheSupremeCourtinC.KrishnaprasadvsCIT(1974)97ITR493observed:Familyalwayssignifiesagroup.

Plurality of persons isan essential attribute of a family. A single person, male or female, does not constitute a

family.Afamilyconsistingofasingleindividualisacontradictioninterms,anentitydistinctanddifferentfroman

individual.AssessmentinthestatusofaHinduundividedfamilycanbemadeonlywhentherearetwoormore

members of the Hindu undivided family. An unmarried person though receiving ancestral property on partition

wouldcontinuetobeassessedasanIndividual.However,onmarriagewithadditionofwifewouldbeassessedin

thestatusofHUF.

LIBRARY@TaxManagement

TAX & INVESTMENT GUIDE FOR "NRI" NonResident

Indians !

GUIDE & FAQ @ TAX

GRAPHICAL PRESENTATION @ TAX

TIPS & TRICKS @ TAX

MANAGERIAL & FINANCIAL DECISIONS @ TAX

5 GOLDEN RULES OF TAX PLANNING

FAMILY TAX PLANNING

DEDUCTIONS FROM YOUR INCOME

EXEMPTED INCOMES

HUF FORMATION, MANAGEMENT & TAX PLANNING

COMPUTATION OF GROSS TOAL INCOME

INCOME TAX @ GLANCE

MULTIPLE KNOWLEDGEBASE ON TAX

51 TIPS ON TAX PLANNING

APPEALS UNDER INCOME TAX

ASSESSMENTS

PENALTIES UNDER IT DEPATMENTS

TAX SAVING SCHEMES

TAX READY RECKONER

TAX RATES

PROSECUTIONS UNDER INCOME TAX DEPARTMENT

TAXATION SYSTEM IN INDIA

CHARITABLE & RELIGIOUS TRUST TAXATION

KNOWLEDGE BASE !

http://incometaxmanagement.com/Pages/HUF/1Meaning_of_HUF%E2%80%93Hindu_Undivided_Family.html

1/4

10/29/2016

MeaningofHUFHinduUndividedFamily

Thus,itfollowsthataHUFisanentityconsistingofaHindufamily,allofwhosemembersaredescendantsofcommon

ancestor.TheworddescendanthasbeendefinedbyWebstersDictionaryasOnewhodescends,asoffspringfroman

ancestor.ThusitisessentialthatallthemembersofaHUFareformedofaCommonancestori.e.,thechildrenofsame

parentsorgrandparents.

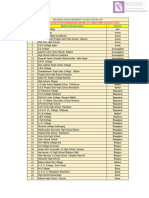

NewTopics@Tax

KnowledgeBase...

PenaltiesUnderIncomeTax

Act.1956

MORE TOPICS ....

Sec.143(3):ScrutinyAssessments

byIncomeTaxDepartment

Meaning of HUF Hindu Undivided Family

Meaning Of 'HUF' Under Tax Laws

Difference Between Joint Hindu Coparcenery Under The Hindu Law And HUF Under The IncomeTax Act, 1961

HowisaSearchOperation

ConductedbyIncomeTax

Department?

Mitakshara Law & Dayabhaga Law HUF

Constitution Of HUF Property By Own Will Or Choice Of A Person

HUF Drawings or Expenses

Formation of HUF On Intestate Death of a Hindu Father

SurveysforCheckingOstentatious

Expenditure

Formation of HUF On A Son/Daughter Being Born To Hindu Parents

Bigger HUF And Smaller HUF

SurveysforEnforcingCompliance

withProvisionsofTDS

HUF Opening a Bank Account / DEMAT Account

HUF DEMAT OR DEPOSITORY Accounts

HUF Public Provident Fund PPF Account

SummonU/s131ofIncomeTax

Act.

HUF Capital Gain Account

HUF Deduction from HUF Business Income

InvestigationbyIncomeTax

Department:

Income Derived From Funds Of HUF Whether Individual Income Or Family Income

Gift by HUF to its Member

Gift To Minor Daughters Out Of HUF Property Prior To Marriage

AppellateAuthoritiesofIncome

TaxDepartment

Gift of HUF Property to Stranger or to any Person who is a Alien to HUF

Clubbing Provisions In Case Of Gifts Received By HUF

Applicability of Clubbing Provisions in case Karta of a HUF is a Partner in a Firm

PowertoCallforInformationU/s

Sec.133(6)ofIncomeTaxAct.

Gifts received by HUF from Aliens / Strangers

HUF Investment Options

SpecificSurveysU/s133A(1)of

IncomeTaxAct.

Concept of Multiple HUFs

Whether a Single Member can Constitute a HUF ?

Whether any Limit is placed on Number of Members of a HUF ?

Whether HUF Can Be Constituted with only Female Members ?

Drawings / Expenses of HUF

Whether HUF can be a Shareholder / Subscriber to the MOA Memorandum Of Association of a Company

Whether HUF can be a Member of a Cooperative Society ?

Whether HUF can be a Partner ?

Can KARTA of a HUF enter into Partnership with another Member of HUF ?

Most Popular Topics :

Can There Be A Partnership Between Two HUFs?

Effect Of Death Of Karta In Case Of Partnership Firm

Corporate Tax Taxation in Companies

Whether HUF Can Be A Proprietor ?

FAQ on TDS on Salaries

Whether HUF Can Be A Trustee / Settler ?

FAQ on Taxable Income

HUF Aliyasantana Law

FAQ on Filing of Income Tax Return

HUF Marumakkattayam Law

Graphical Chat Presentation of Provision of Motor Car

/ Other Vehicles [Rule 32A&B]

Power of KARTA in relation to HUF

Managing Members in relation to HUF

Tax Amendment at a Glance for Year 2015

Whether a Female can become a Karta ?

'Appeals' Under Income Tax Act. 1961.

Tax Planning TIPS for HUF

'Assessments' Under Income Tax Act. 1961.

HUF Meaning Of Important Term Ancestral

List of Exempted Incomes TaxFree Under Section

10

HUF Meaning Of Important Term Stridhan

HUF Meaning Of Important Term Mitakshara

Income Under the Head ' Business and Professions'

[Section 28 to 44]

HUF Meaning Of Important Term Dayabhaga

Meaning of the term Coparcener of HUF

Income Under the Head ' Capital Gain'

Power of Coparcener of HUF

Income Under the Head ' House Property '[Section

22 25 ]

Difference between a Coparcener and a Member

Whether Husband / Wife Can Constitute A HUF ?

Income Under the Head "Salary"

[Section 1517]

HUF RECOVERY PROVISIONS

Maintenance of Accounts by HUF

Income Tax on 'Partnership Firms'

Audit of Accounts by HUF

PENALTIES Under Income Tax Act. 1961.

Applicability Of The Accounting Standards On HUF

Tax Saving Schemes for Individual for AY 20152016

Instant Guide

Whether Merger Of Two HUF is Possible ?

Residential Status of the HUF under I.T. Act.1956

Income Tax Rates / Tax Slabs AY20142015 & 2015

2016

Coparcener Property under HUF

"Exempted Incomes" under Income Tax Act.

Charitable & Religious Trust :Formation, Registration,

& Taxation

Hindu Undivided Family [HUF] Formation,

Management and Taxation

Most Popular Links :

Computation of Gross

Total Income

Deductions from Taxable

Income

Family Tax Planning

HUF Formation,

Management & Tax

Planning

Tax Saving Scheme

http://incometaxmanagement.com/Pages/HUF/1Meaning_of_HUF%E2%80%93Hindu_Undivided_Family.html

Clubing of Income

Deduction U/s 80C

Allowances Us173

ExemptionSalary

Tax Amendment2015

Taxable Income

Clubing of Income

Tax Deductions

HUF Deduction

HUF Investment

Gift by HUF

HUF Tax Planning Tips

Tax Saving Schemes

Tax Planning Tips

Refund of Tax

Fringe Benefit TaxFBT

Return Filing

Assessment / Scrutiny

Notice from I.T. Dept.

Incomes Types @ TDS

2/4

10/29/2016

MeaningofHUFHinduUndividedFamily

ExemptionsTax Returns

Summon U/s 131

'Black Money' @ I.Tax

Big Gifts To Be Taxed

'Appeals' under I.Tax

Assessment @ I.Tax

Exempted Incomes

Capital Gain

Business & Professions

House Property

Scrutiny assessment refers to the examination of a return of income by giving an opportunity to the assessee to substantiate the income declared

and the expenses, deductions, losses, exemptions, etc. claimed in the return with the help of evidence..

Salaries @ I.Tax

Partnership Firm

'Penalty' under I.Tax Act.

Tax Ready Reckoner

Charitable Trust

Useful Links @ I.Tax

How is a Search Operation Conducted by Income Tax Department ?

The provisions relating to search and seizure are contained in section 132 of the Income Tax Act, 1961.

Sec. 1433 : Scrutiny Assessments by Income Tax Department

Penalties Under Income Tax Act. 1956

Penalties by way of monetary payments are charged under the Income Tax Act for various defaults relating to payment of taxes, maintenance of

accounts, for noncompliance and non cooperation during proceedings, for evasion of tax, etc..

Income of Individuals And HUFs As a Tax Payers Under Income Tax Act, 1961.

The individual tax payers and also the HUFs while proceeding to calculate the net taxable income in the first phase are required to arrive at the

gross total income under different heads of income...

Types Of Income Subject To TDS [Deduction Of Tax At Source]

The following types of incomes are mainly subject to deduction of tax at source: a Salaries Section 192. b Interest on securities Section 193..

PreRequisite For Claiming Income Tax Refund

For claiming income tax refund the first prerequisite is that there should have been excess tax paid or deducted at source on the basis of return of

income.

Section1391 : Provision for Voluntary Income Tax Return

Every person, a being a company or a firm; whether having income or loss or b being a person other than a company or a firm if his total

income or the total ncome of any other person in respect of which he is assessable under this Act during the previous year exceeded the

maximum amount which is not chargeable to incometax, shall file a return of his income in the prescribed form.

Benefits of Filing Income Tax Returnsn

We have heard many a times that every individual whose total income exceeds the maximum exemption limit is obligated to furnish his/her

Income Tax Return or ITR.

Section1399: Defective Tax Return

Where the Assessing Officer considers that the return of income furnished by the assessee is defective, he may intimate the defect to the assessee

and give him an opportunity to rectify the defect within a period of 15 days from the date of intimation.

Section 1395 : Revised Income Tax Return

If any person, having furnished a return u/s 1391, or in pursuance of a notice issued under section 1421, discovers any omission or any wrong

statement therein, he may furnish a revised return at any time.

Section1394A : Income Tax Return of Charitable and Religious Trusts

Every person in receipt of income derived from property held under trust or other legal obligation wholly or partly for charitable or religious

purposes or of income being voluntary contributions referred to in section 224iia shall.

Section1394 : Belated Income Tax Return

If an assessee has not furnished a return of his income within the time allowed to him under section 1391 or within the time allowed under a

notice issued under section 1421.

Get Updated ...

http://incometaxmanagement.com/Pages/HUF/1Meaning_of_HUF%E2%80%93Hindu_Undivided_Family.html

3/4

10/29/2016

MeaningofHUFHinduUndividedFamily

Tax Ready Reckoner

Computation of Total Income

Tax Saving & Tax Planning

Business Tax Management & Proceedure

Taxation in Companies

Appeals

Assessments

Penalties

Guide & FAQ on Tax

Knowledgebase @ Taxation

Income Tax @ Glance

HUF Formation, Planning & Taxation

TRUSTs Formation, Management & Taxation

NRI Tax Planning,Saving,Investemnt

________________________________________________________________________________________

Disclaimer:

All efforts are made to keep the content of this site correct and uptodate. But, this site does not make any claim regarding the information provided on its pages as correct and uptodate. The contents of this site cannot be treated or

interpreted as a statement of law. In case, any loss or damage is caused to any person due to his/her treating or interpreting the contents of this site or any part thereof as correct, complete and uptodate statement of law out of

ignorance or otherwise, this site will not be liable in any manner whatsoever for such loss or damage.

The visitors may click here to visit the web site of Income Tax Department for resolving their doubts or for clarifications

Contact Us :

SWAYAM EDUCATION

Mandal Bagicha, Hemkapada,

Sunhat, Balasore756002 Odisha

Mob: 9437264738

eMail ID : incometaxmanagement@gmail.com

www.IncomeTaxManagement.Com

http://incometaxmanagement.com/Pages/HUF/1Meaning_of_HUF%E2%80%93Hindu_Undivided_Family.html

4/4

You might also like

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Study Centre List 2022Document6 pagesStudy Centre List 2022Kumar SaurabhNo ratings yet

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (895)

- 2HC VakalatnamaDocument1 page2HC VakalatnamaKumar SaurabhNo ratings yet

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5794)

- Light Street Led PDFDocument12 pagesLight Street Led PDFlahsivlahsiv684No ratings yet

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (400)

- Irctcs E-Ticketing Service Electronic Reservation Slip (Personal User)Document2 pagesIrctcs E-Ticketing Service Electronic Reservation Slip (Personal User)Himanshu GuptaNo ratings yet

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- Nou Prospectus 2022Document173 pagesNou Prospectus 2022Kumar SaurabhNo ratings yet

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- Class A-Untitled DocumentDocument7 pagesClass A-Untitled DocumentKumar SaurabhNo ratings yet

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- NHSRCL Application Form 1511507405 Application Form PsuDocument5 pagesNHSRCL Application Form 1511507405 Application Form PsuKumar SaurabhNo ratings yet

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- Train List From Mughal Sarai-Journey PlannerDocument2 pagesTrain List From Mughal Sarai-Journey PlannerKumar SaurabhNo ratings yet

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (588)

- NCW - 1reviews of Laws Relating To WomenDocument3 pagesNCW - 1reviews of Laws Relating To WomenKumar SaurabhNo ratings yet

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Detailed Analysis of HUF With Hindu Succession Act 1956 and Income Tax Act 1961 by K.CDocument10 pagesDetailed Analysis of HUF With Hindu Succession Act 1956 and Income Tax Act 1961 by K.CKumar SaurabhNo ratings yet

- Overview and Updated On Street Lighting Standards and Practices - by PK BandyopadhayDocument46 pagesOverview and Updated On Street Lighting Standards and Practices - by PK Bandyopadhayaehque04No ratings yet

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- 09 Chapter 2Document70 pages09 Chapter 2Kumar SaurabhNo ratings yet

- Hindu Personal Law - WikipediaDocument2 pagesHindu Personal Law - WikipediaKumar SaurabhNo ratings yet

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- Category - Hindu Law - Wikipedia PDFDocument3 pagesCategory - Hindu Law - Wikipedia PDFKumar SaurabhNo ratings yet

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (73)

- UNDP Interview Questions - GlassdoorDocument6 pagesUNDP Interview Questions - GlassdoorKumar SaurabhNo ratings yet

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (344)

- List of Acts of The Parliament of India - WikipediaDocument44 pagesList of Acts of The Parliament of India - WikipediaKumar SaurabhNo ratings yet

- Hindu Titles of Law - WikipediaDocument8 pagesHindu Titles of Law - WikipediaKumar SaurabhNo ratings yet

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- Dāyabhāga - WikipediaDocument6 pagesDāyabhāga - WikipediaKumar SaurabhNo ratings yet

- Technical Interconnection Requirements For Generators R 1320120206 CleanDocument90 pagesTechnical Interconnection Requirements For Generators R 1320120206 CleanKumar SaurabhNo ratings yet

- Hindu Code Bills - WikipediaDocument7 pagesHindu Code Bills - WikipediaKumar SaurabhNo ratings yet

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- CGLE 2014 NoticeDocument40 pagesCGLE 2014 Noticeasnair01No ratings yet

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- The Tribune, Chandigarh, India - Himachal Pradesh EditionDocument15 pagesThe Tribune, Chandigarh, India - Himachal Pradesh EditionKumar SaurabhNo ratings yet

- McGraw-Hill's Taxation of Business Entities, 2016 EditionDocument28 pagesMcGraw-Hill's Taxation of Business Entities, 2016 Editiontravelling100% (1)

- Essentials of Federal Taxation 2017 8th Edition Spilker Solutions ManualDocument47 pagesEssentials of Federal Taxation 2017 8th Edition Spilker Solutions Manualkieraquachbs2ir100% (23)

- 26 USC 6001, 6011, 6012 26 CFR 1.6001-1, 1.6011-1, 1.6012-1 (Upload)Document21 pages26 USC 6001, 6011, 6012 26 CFR 1.6001-1, 1.6011-1, 1.6012-1 (Upload)sovereign236315No ratings yet

- CH 20Document14 pagesCH 20KARISHMAATA2No ratings yet

- Cagayan Electric Vs CIRDocument4 pagesCagayan Electric Vs CIRRaymond MedinaNo ratings yet

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (121)

- Taxation I Cases Part 1Document63 pagesTaxation I Cases Part 1carinokatrinaNo ratings yet

- Chap 006Document59 pagesChap 006Bartholomew Szold93% (15)

- ECONOMIC BENEFIT THEORY - BIR Ruling No. 123-97 (Retirement and Separation Benefits Paid To Employees)Document2 pagesECONOMIC BENEFIT THEORY - BIR Ruling No. 123-97 (Retirement and Separation Benefits Paid To Employees)KriszanFrancoManiponNo ratings yet

- VogelDocument7 pagesVogelAntonioMarinielloNo ratings yet

- Republic Vs Ker & CompanyDocument17 pagesRepublic Vs Ker & Companycode4saleNo ratings yet

- Thirty Years of Tax Reform in India: Pecial ArticlesDocument9 pagesThirty Years of Tax Reform in India: Pecial ArticlesAayushi BhattacharyaNo ratings yet

- VatDocument13 pagesVatJohn Derek GarreroNo ratings yet

- Eden Tamrat Thesis Ready For PrintingDocument68 pagesEden Tamrat Thesis Ready For PrintingsenayNo ratings yet

- Direct & Indirect TaxesDocument33 pagesDirect & Indirect Taxesdinanikarim50% (2)

- R12 EtaxDocument66 pagesR12 Etaxsatya_raya8022No ratings yet

- Response: P50,000Document10 pagesResponse: P50,000JaehyunnssNo ratings yet

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- Full download Solution Manual for South Western Federal Taxation 2021 Individual Income Taxes 44th Edition James c Young Annette Nellen William a Raabe William h Hoffman Jr David m Maloney pdf full chapterDocument13 pagesFull download Solution Manual for South Western Federal Taxation 2021 Individual Income Taxes 44th Edition James c Young Annette Nellen William a Raabe William h Hoffman Jr David m Maloney pdf full chaptermanywisegroschen3ppq100% (16)

- AFP General Insurance v. CIRDocument19 pagesAFP General Insurance v. CIRUlyssesNo ratings yet

- Power of TaxationDocument6 pagesPower of TaxationJohn Nielven D EpisNo ratings yet

- Commissioner of Internal Revenue vs. The Stanley Works Sales (Phils.), IncorporatedDocument8 pagesCommissioner of Internal Revenue vs. The Stanley Works Sales (Phils.), IncorporatedJonjon BeeNo ratings yet

- Tax II Reviewer (Midterms)Document43 pagesTax II Reviewer (Midterms)Charmaine MejiaNo ratings yet

- Ra 11534 - Corporate Recovery & Tax Incentives For Enterprises Act (Create) Prepared By: Dr. Virginia Jeannie P. Lim Salient Changes Introduced AreDocument9 pagesRa 11534 - Corporate Recovery & Tax Incentives For Enterprises Act (Create) Prepared By: Dr. Virginia Jeannie P. Lim Salient Changes Introduced AreAlicia Jane NavarroNo ratings yet

- SAUCE (Phil - Tax)Document9 pagesSAUCE (Phil - Tax)Darren GreNo ratings yet

- Income Tax 1. Definition, Nature, and General Principles A. Criteria in Imposing Philippine Income TaxDocument36 pagesIncome Tax 1. Definition, Nature, and General Principles A. Criteria in Imposing Philippine Income TaxPascua PeejayNo ratings yet

- Taxation Law PDFDocument295 pagesTaxation Law PDFEdu FajardoNo ratings yet

- True/False: TAX REV 2021 - QUIZ #1 (JAN 31)Document9 pagesTrue/False: TAX REV 2021 - QUIZ #1 (JAN 31)Reyniere AloNo ratings yet

- Introduction To The Law of Double Tax Conventions S8Document16 pagesIntroduction To The Law of Double Tax Conventions S8adelemahe137No ratings yet

- 2011.10.21 NST Policy Handbook EnglishDocument28 pages2011.10.21 NST Policy Handbook Englishalphauser12345No ratings yet

- BIR Ruling (DA - (FIT-002) 054-10) - FWT, GRT and DST On Treasury Bonds and On Secondary TradingDocument14 pagesBIR Ruling (DA - (FIT-002) 054-10) - FWT, GRT and DST On Treasury Bonds and On Secondary TradingJerwin DaveNo ratings yet

- Case Digest Local GovernmentDocument188 pagesCase Digest Local GovernmentGideon Tangan Ines Jr.No ratings yet

- How to get US Bank Account for Non US ResidentFrom EverandHow to get US Bank Account for Non US ResidentRating: 5 out of 5 stars5/5 (1)

- Tax-Free Wealth: How to Build Massive Wealth by Permanently Lowering Your TaxesFrom EverandTax-Free Wealth: How to Build Massive Wealth by Permanently Lowering Your TaxesNo ratings yet

- Lower Your Taxes - BIG TIME! 2023-2024: Small Business Wealth Building and Tax Reduction Secrets from an IRS InsiderFrom EverandLower Your Taxes - BIG TIME! 2023-2024: Small Business Wealth Building and Tax Reduction Secrets from an IRS InsiderNo ratings yet

- Founding Finance: How Debt, Speculation, Foreclosures, Protests, and Crackdowns Made Us a NationFrom EverandFounding Finance: How Debt, Speculation, Foreclosures, Protests, and Crackdowns Made Us a NationNo ratings yet

- Tax Strategies: The Essential Guide to All Things Taxes, Learn the Secrets and Expert Tips to Understanding and Filing Your Taxes Like a ProFrom EverandTax Strategies: The Essential Guide to All Things Taxes, Learn the Secrets and Expert Tips to Understanding and Filing Your Taxes Like a ProRating: 4.5 out of 5 stars4.5/5 (43)