Professional Documents

Culture Documents

How To Read Your Statement

Uploaded by

prakashthamankarOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

How To Read Your Statement

Uploaded by

prakashthamankarCopyright:

Available Formats

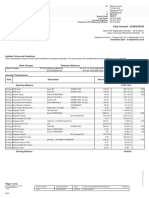

1

How to Read Your Account Statement

As a valuable E*TRADE customer, we are pleased to inform you that we have made some recent changes to your account

statement in order to provide you with a more complete picture of your wealth at E*TRADE .

The most notable difference is that your statement now includes the value of any Vested Employee Stock Plan assets you

might have in addition to any existing Securities and Cash holdings in your account. This combined value is reflected

throughout your statement in various charts, graphs, and summaries and is also displayed separately in the Portfolio Holdings

pages so you can see the detailed breakdown of your assets by holding type.

In addition to the value of your Vested Employee Stock Plans assets, your new statement also includes the value of any

Unvested Stock Plan assets you might have such as Unvested Employee Stock Options or Unvested Restricted Stock. Since

these assets are unrealized, Unvested Employee Stock Plan value will not be combined with the value of Vested Employee

Stock Plan assets or Securities and Cash holdings you may have in your account.

The rest of this document will guide you through your new account statement page-by-page and provide you with the

detailed information you need to fully understand these changes.

TABLE OF CONTENT

Account Portfolio at a Glance

Portfolio

Net Portfolio Value by Month

Account Holdings

ACCOUNT/PORTFOLIO

AT A GLANCE PAGE

PAGE 1 OF 7

July 1, 2009 - July 31, 2009

1234-5678

Account Number:

INDIVIDUAL

Account Type:

E*TRADE Securities LLC

E*TRADE CLEARING LLC

P.O. Box 1542

Merrifield, VA 22116

1-800-ETRADE-1 (1-800-387-2331)

etrade.com Member FINRA/SIPC

Customer Update:

NEW STATEMENT FORMAT - Your statement

now gives you a complete view of your stock

plan assets and brokerage assets - all in one

convenient, easy-to-read format. To learn

more about how to read your new statement,

visit www.etrade.com/ statement.

IMPORTANT INFORMATION:

ACCOUNT AT A GLANCE

The bar chart in the Portfolio at

a Glance section now includes

Vested Employee Stock Plan

Value (if any) in addition to any

Securities and Cash Value in your

account. These values are a

snapshot of the market values

on the last business day of the

current and previous statement

periods.

Vested Employee Stock Plan

Value is defined as vested in-themoney Employee Stock Options

and vested in-the money Stock

Appreciation Rights. Securities

and Cash Value represents any

long held shares and cash assets

in your account such as cash,

Mutual Fund, Stocks, and ETFs.

Vested Employee Stock Plan

Value and Securities and Cash

Value bar chart segments are

shaded differently and shown

with a separate value, in addition

to displaying the combined

Total Portfolio Value for each

statement period.

John Smith

123 Main Street

Anytown, ST 12345

NEW ONLINE ADVISOR - Rebuild your portfolio

one click at a time. See where you stand today,

create a diversified long-term plan, and get a

customized recommendation. Visit

etrade.com/ onlineadvisor to get started.

DEPOSIT SLIP

A deposit slip is included

with the statement as a

convenience, to be used

for future deposits into your

E*TRADE Securities account.

You can mail a personal check,

cashiers check or bank check

(no cash) with the deposit slip

to the address provided on the

business envelope.

Account At A Glance

$88,868.30

$158,264.34

Vested Employee

Stock Plan Value

$62,061.03 As of 07/31/09

- - As of 06/30/09

As of 06/30/09

As of 07/31/09

Net Change:

John Smith

123 Main Street

Anytown, ST 12345

Securities and

Cash Value

$96,203.31 As of 07/31/09

$88,868.30 As of 06/30/09

$69,396.04

Use This Deposit Slip

Acct: 1234-5678

Please do not send cash

Dollars

Make checks payable to E*TRADE Clearing LLC.

Mail deposite to:

E*TRADE CLEARING LLC

P.O. Box 1542

Merrifield, VA 22116 -1542

TOTAL DEPOSIT

Cents

Your funds will be available for

trading 5 business days after

your deposit is posted to your

brokerage account.

Additionally, funds are not

available for withdrawal

until they have been paid (are

cleared). Please allow 5

business days after posting

for deposited funds to clear.

PORTFOLIO OVERVIEW PAGE

PORTFOLIO OVERVIEW

The Portfolio Overview section provides the Total Net

Portfolio Value of your account at the beginning and

end of the current statement period. This value is the

sum of the Securities and Cash Value and Vested

Employee Stock Plan Value (if any) and includes the

Net Change

category from the beginning to

Account

Number:for each

1234-5678

the end of the current statement period.

Statement Period :

July 1, 2009 - July 31, 2009

Account Type:

INDIVIDUAL

PORTFOLIO ALLOCATION

C ustomer U pdate:

If you do not have any Vested Employee Stock Plan

Value, only the Securities and Cash Value will be

displayed and the converse applies if you do not

have any Securities and Cash Value in your account.

breakdown

of av

your

Portfolio

of the last/ iphone for m ore

E * T RA DE M obile

Pro is now

ailaTotal

ble forNet

iPhone.

V isValue

it w w was.etrade.com

dow nload

forof

free

iT unes .statement period. If the Portfolio

inform ation orbusiness

day

theatcurrent

POR T FOLIO OV E R V IE W

PORTFOLIO ALLOCATION (AS OF 07/31/09)

The Portfolio Allocation pie chart displays the percentage

Allocation pie chart is not displayed, this means you have a

zero or negative Net Portfolio balance.

0.04% - Cash & Equivalents

Last Statement Date : June 30, 2009

Beginning Portfolio

Value (On 06/30/09) :

Ending Portfolio

Value (On 07/31/09) :

Net C hange:

S ec urities and

C ash V alue

V es ted E m ploy ee

S tock Plan V alue

T otal Net

Portfolio V alue

$88,868.30

--

$88,868.30

$96,203.31

$62,061.03

$158,264.34

$7,335.01

$62,061.03

$69,396.04

39.21% - Vested Employee Stock Plan Value

60.74% - Stocks, Options & ETF (Long)

For current rates, please visit w w w .etra de.c om/rates

PORTFOLIO VALUE SUMMARY

This section provides a more detailed view of

your Net Portfolio Value by Cash and Cash

Equivalents, Margin Balance, Stock, Options

and ETFs (long and short), and the newly added

Vested Employee Stock Plan Value. In addition,

this section displays the percentage change in

value of the individual categories previously

described and the Net Portfolio Value from the

last statement period.

POR T FOL IO V AL U E S U M M AR Y

AS OF 07/31/09

C ash & E quiv alents

C ash Holdings/ M argin Debt

AS OF 06/30/09

% CHANGE

68.31

68.31

3,068.30

3,068.30

-97.77%

-97.77%

S tocks, O ptions & E T F ( Long)

M arket V a lue of S ecurities

96,135.00

96,135.00

85,800.00

85,800.00

12.05%

12.05%

V es ted E m ploy ee S toc k Plan Value

62,061.03

N et Portfolio V alue

158,264.34

-88,868.30

-78.09%

NET PORTFOLIO VALUE BY MONTH PAGE

NET PORTFOLIO VALUE BY MONTH

Account Number: 1234-5678

Statement Period : July 1, 2009 - July 31, 2009

The Net Portfolio Value by Month bar chart provides a Account Type: INDIVIDUAL

month-over-month view of your portfolio values for a twelve

month period with each bar chart segment displaying the

PORTFOLIO TRANSACTION SUMMARY

net percentage change in your portfolio value for that

DESCRIPTION

YEAR TO DATE

month

over the previous month. THIS PERIOD

NET PORTFOLIO VALUE BY MONTH END

$200,000

$184,615

$169,231

78.09%

$153,846

$138,462

$123,077

$107,692

If you are a new account holder and do not have twelve

months of history, you will only see the bar chart segments

which correspond to the length of your account history.

16.18%

$92,308

22.08%

$76,923

27.49%

$61,538

266.09%

$46,154

$30,769

$

0.00 Employee $

-145,943.39

ecurities

Purchased

As inSthe

Portfolio

at a Glance section,

Vested

0.00

$

129,183.86

Sold

StockS ecurities

Plan Value

is displayed in a$ separately

shaded section

fromDividends

SecuritiesReceived

and Cash Value in each bar chart segment.

If your account only contained Vested Employee Stock Plan

$

0.00

$

97.50

ValueTaxable

or Securities and Cash Value

in any given

month, only

$

0.01

$

0.14

Tax Ex empt

the corresponding information will be displayed.

-1.84%

15.79%

$15,385

-18.76% -15.34%

12.88%

1.61%

-3.50%

0.94%

$0

JUL-08

AUG-08

SEP-08

OCT-08

NOV-08

DEC-08

JAN-09

FEB-09

Vested Employee Stock Plan Value

MAR-09

APR-09

MAY-09

JUN-09

Securities and Cash Holdings

TOP PORTFOLIO HOLDINGS (ON 07/31/09)

0.04% - DEMO

39.21% - DEMO*

60.74% - DEMO

JUL-09

Please note that Vested Employee Stock Plan Values were

added to the statement as of August 2009 so data for the

months preceding August 2009 will not be reflected in your

statement, even if your account contained Vested Employee

Stock Plan Value during these periods.

NET PORTFOLIO VALUE BY MONTH PAGE (CONTINUED)

Account Number: 1234-5678

Statement Period : July 1, 2009 - July 31, 2009

PORTFOLIO TRANSACTION SUMMARY

NET PORTFOLIO VALUE BY MONTH END

This section is unchanged and provides a

summary of values of Securities Purchased or

Sold (including Mutual Funds), Interest and

$200,000

Dividends received, and Contributions &

$184,615

Distributions by the current statement period

$169,231

78.09%

and by year-to-date.

$153,846

PORTFOLIO TRANSACTION SUMMARY

DESCRIPTION

S ecurities Purchased

S ecurities Sold

THIS PERIOD

$

$

0.00

0.00

$

$

-145,943.39

129,183.86

$

$

0.00

0.01

$

$

97.50

0.14

$123,077

$107,692

16.18%

$92,308

22.08%

$76,923

27.49%

$61,538

266.09%

$46,154

$30,769

-1.84%

15.79%

$15,385

-18.76% -15.34%

12.88%

1.61%

-3.50%

0.94%

$0

JUL-08

AUG-08

SEP-08

OCT-08

NOV-08

DEC-08

JAN-09

FEB-09

Vested Employee Stock Plan Value

MAR-09

APR-09

MAY-09

JUN-09

JUL-09

Securities and Cash Holdings

TOP PORTFOLIO HOLDINGS

TOP PORTFOLIO HOLDINGS (ON 07/31/09)

The Top Portfolio Holdings pie chart displays your top ten portfolio

holdings which include Cash and Cash Equivalents, Stocks, Options

& ETFs, Mutual Funds, and Vested Employee Stock Plan Value.

0.04% - DEMO

Vested Employee Stock Plan Value will be displayed separately from

other stock positions in the same company and is denoted with an

asterisk following the ticker symbol in the pie chart.

39.21% - DEMO*

If this section is not displayed in your statement, this means you

have a zero or a negative Net Portfolio balance.

60.74% - DEMO

YEAR TO DATE

Dividends Received

Taxable

Tax Ex empt

$138,462

Account Type: INDIVIDUAL

ACCOUNT HOLDINGS PAGE

Account Number:

1234-5678

Statement Period :

July 1, 2009 - July 31, 2009

Account Type:

INDIVIDUAL

ACCOUNT HOLDINGS

ACCOUNT HOLDINGS

This section is unchanged and displays holdings by asset type, the value of each

CASH & CASH EQUIVALENTS ( 0.04 % of Holdings)

holding at the end of the current statement period, and the allocation

percentage of these holdings in relation to your overall portfolio.

DES C R IPT ION

OPE NIN G

DEMO

T OT AL C AS H & CAS H E QU IV A LE NT S

T OT AL C AS H & CAS H E QU IV A LE NT S YT D DIV IDE NDS (S W E E P ONL Y)

B ALAN C E

C LO SIN G

B ALAN C E

3,068.30

68.31

$3,068.30

$0.14

$68.31

POR T FOL IO

(% )

0.04

AV G

BAL AN C E

1,161.80

0.04%

STOCKS, OPTIONS & EXCHANGE-TRADED FUNDS ( 60.74 % of Holdings)

DES C R IPT ION

S YM B OL/

C US IP

AC C T

T YPE

DEMO

DEMO

Cash

QU AN TIT Y

6,500

P RIC E

14.7900

T OT AL S T O CK S , OPT IONS & E T F

T OT AL MK T

V ALUE

96,135.00

$96,135.00

TOTAL PRICED PORTFOLIO HOLDINGS

TOTAL PRICED PORTFOLIO HOLDINGS (ON 07/31/09)

P OR TF OLIO

(% )

60.74

60.74%

ES T. AN NU AL

IN C OME

E S T . ANN UAL

YIE LD (% )

260.00

0.27%

$260.00

0.27%

$96,203.31

$260.00

Total Priced Portfolio Holdings is the sum of asset values

such as Cash & Cash

Equivalents, Stock, Options & Exchange Traded Funds, Preferred Stocks, Mutual

Funds, and Fixed Income currently held in your account. Total Estimated

Portfolio Holdings Annual Income is the sum of the Estimated Annual Income

VESTED EMPLOYEE STOCK OPTIONS (39.21 % of Total Net Portfolio

values of Value)

the individual securities held in the account.

T OT AL E S T IM AT E D AC C OU NT HO LDING S ANNU A L INC OM E

N UMB ER

T Y PE

S Y MB OL /

C US IP

AC C T

TY PE

QUANT IT Y

EX E R C IS AB LE

GR ANT

PR IC E

MAR KE T

PR I C E

T OT AL ES T MK T

V ALUE (P RE -TAX )

3/3/2003

111111

NQ

DEMO

StkPln

800

$19.39

$21.25

$1,490.00

0.94%

9/2/2003

111111

NQ

DEMO

StkPln

600

$27.38

$21.25

$0.00

0.00%

3/1/2004

111111

NQ

DEMO

StkPln

1,600

$34.62

$21.25

$0.00

0.00%

3/1/2005

111111

NQ

DEMO

StkPln

300

$42.58

$21.25

$0.00

0.00%

4/29/2005

111111

NQ

DEMO

StkPln

1,000

$31.71

$21.25

$0.00

0.00%

3/1/2006

111111

NQ

DEMO

StkPln

1,250

$39.90

$21.25

$0.00

0.00%

9/1/2006

111111

NQ

DEMO

StkPln

600

$28.15

$21.25

$0.00

0.00%

1/12/2001

111111

NQ

DEMO

StkPln

2,756

$10.02

$21.25

$30,961.73

19.56%

G R ANT

DATE

POR TFOLIO (% )

PAGE 5 OF 7

ACCOUNT HOLDINGS PAGE (CONTINUED)

Account Number:

1234-5678

Statement Period :

July 1, 2009 - July 31, 2009

Account Type:

INDIVIDUAL

ACCOUNT HOLDINGS

CASH & CASH EQUIVALENTS ( 0.04 % of Holdings)

VESTED EMPLOYEE STOCK PLAN HOLDINGS

DES C R IPT ION

OPE NIN G your Vested Employee

C LO SIN Stock

G PORPlan

T FOLHoldings

IO

This is a new section and displays

B ALAN C E

B ALAN C E

(% )

broken down by Vested Employee Stock Options and Vested Stock

Appreciation Rights. Each section displays detailed grant information such as

3,068.30

68.31

0.04

Grant Date, Grant Price, Quantity Exercisable, Market Price, and Total Estimated

$68.31

0.04%

Market Value (pre-tax) as $3,068.30

of the last business day of the

statement

period. This

$0.14Vested Employee Stock Plan shares.

section only appears if you have

DEMO

T OT AL C AS H & CAS H E QU IV A LE NT S

T OT AL C AS H & CAS H E QU IV A LE NT S YT D DIV IDE NDS (S W E E P ONL Y)

STOCKS, OPTIONS & EXCHANGE-TRADED FUNDS ( 60.74 % of Holdings)

DES C R IPT ION

S YM B OL/

C US IP

AC C T

T YPE

DEMO

DEMO

Cash

QU AN TIT Y

6,500

T OT AL S T O CK S , OPT IONS & E T F

TOTAL PRICED PORTFOLIO HOLDINGS (ON 07/31/09)

1,161.80

Vested Employee Stock Options: This section displays individual

P RIC E

T OT AL

MK T that contain

P OR TF OLIO

ES T. AN NU AL

E S T . ANN UAL

Employee

Stock Options

grants

vested and exercisable

V ALUE

)

IN C OME

shares. The Total Estimated

Market Value of(%each

grant is calculated

by taking YIE LD (% )

the Market Price less the Grant Price, times Quantity Exercisable within each

14.7900

96,135.00

60.74

260.00

0.27%

grant. Total Estimated Market Value will be zero if the Grant Price is greater than

$96,135.00

60.74%

$260.00

0.27%

the Market Price at the end of the statement period.

$96,203.31

T OT AL E S T IM AT E D AC C OU NT HO LDING S ANNU A L INC OM E

VESTED EMPLOYEE STOCK OPTIONS (39.21 % of Total Net Portfolio Value)

Vested Stock Appreciation Rights: This section displays individual

$260.00that contain vested and exercisable shares.

Stock Appreciation Right grants

The Total Estimated Market Value of each grant is calculated by taking the

Market Price less the Grant Price, times Quantity Exercisable within each grant.

Total Estimated Market Value will be zero if the Grant Price is greater than the

Market Price at the end of the statement period.

N UMB ER

T Y PE

S Y MB OL /

C US IP

AC C T

TY PE

QUANT IT Y

EX E R C IS AB LE

GR ANT

PR IC E

3/3/2003

111111

NQ

DEMO

StkPln

800

$19.39

9/2/2003

111111

NQ

DEMO

StkPln

600

$27.38

3/1/2004

111111

NQ

DEMO

StkPln

1,600

$34.62

3/1/2005

111111

NQ

DEMO

StkPln

300

$42.58

4/29/2005

111111

NQ

DEMO

StkPln

1,000

$31.71

3/1/2006

111111

NQ

DEMO

StkPln

1,250

$39.90

$21.25

$0.00

0.00%

9/1/2006

111111

NQ

DEMO

StkPln

600

$28.15

$21.25

$0.00

0.00%

1/12/2001

111111

NQ

DEMO

StkPln

2,756

$10.02

$21.25

$30,961.73

19.56%

G R ANT

DATE

AV G

BAL AN C E

MAR KE T

T OT AL ES T MK T

POR TFOLIO (% )

V ALUE (P REStock

-TAX ) Plan Value: The Total Vested Employee

PR I C EVested Employee

Total

Stock Plan Value is the sum of the total Vested Employee Stock Options

0.94%

and$21.25

Total Vested Stock $1,490.00

Appreciation Rights

values.

$21.25

$0.00

0.00% Employee Stock Options and

Vested

Employee Stock Plan Value,

which includes Vested

Vested Employee Stock Appreciation Rights, is an estimate based on information provided

$21.25

$0.00

0.00%nor its clearing firm, E*TRADE

by your

company, for which neither

E*TRADE Securities

Clearing, are responsible. This value is displayed here solely as a service to you, does not

$21.25 assets held in your brokerage

$0.00 account, and

0.00%

represent

is not protected by SIPC. Note that

the actual percentage allocation of long securities and cash holdings would be greater

$0.00Employee Stock

0.00%

than$21.25

what is shown above, if Vested

Plan Value was not included.

PAGE 5 OF 7

ACCOUNT HOLDINGS PAGE (CONTINUED)

Account Number:

1234-5678

Statement Period :

July 1, 2009 - July 31, 2009

Account Type:

VESTED EMPLOYEE STOCK OPTIONS (Continued)

G R ANT

DATE

N UMB ER

T Y PE

S Y MB OL /

C US IP

AC C T

TY PE

QUANT IT Y

EX E R C IS AB LE

GR ANT

PR IC E

MAR KE T

PR I C E

T OT AL ES T MK T

V ALUE (P RE -TAX )

8/1/2001

111111

NQ

DEMO

StkPln

1,208

$15.41

$21.25

$7,060.76

4.46%

2/1/2002

111111

NQ

DEMO

StkPln

1,460

$14.51

$21.25

$9,836.75

6.22%

8/1/2002

111111

NQ

DEMO

StkPln

1,708

$13.81

$21.25

$12,711.79

8.03%

$62,061.03

39.21%

TOTAL

VESTED EMPLOYEE STOCK OPTIONS

TOTAL VESTED EMPLOYEE STOCK PLAN VALUE (ON 07/31/2009)

TOTAL NET PORTFOLIO VALUE (ON 07/31/2009)

TOTAL NET PORTFOLIO VALUE

POR TFOLIO (% )

$62,061.03

$158,264.34

Vested Employee Stock Plan Value, which includes Vested Employee Stock Options and Vested Employee Stock Appreciation Rights, is an estimate based on information provided by your

The E*TRADE

Total Net

Portfolio

Value is the

company, for which neither E*TRADE Securities nor its clearing firm,

Clearing,

is responsible.

Thissum

value is displayed here solely as a service to you, does not represent assets held

of

your

Total

Priced

Portfolio

Holdings

in your brokerage account, and is not protected by SIPC. Note that the percentage allocation of long securities and cash holdings would be greater than what is shown above if Vested

and the Total Vested Employee Stock

Employee Stock Plan Value was not included.

Plan Value. This line will only be shown

if you have Vested Employee Stock Plan

Value in your account.

INDIVIDUAL

10

UNVESTED EMPLOYEE STOCK PLAN HOLDINGS

Account Number:

This is a new section and displays your Unvested Employee Stock Plan Holdings broken down by Unvested Employee

Stock Options, Unvested Stock Appreciation Rights, and Unvested Restricted Stock. Each section displays detailed

grant information

such :as Grant

Market

July 1,Date,

2009 - Grant

July 31,Price,

2009 Quantity Unvested, Market Price, and Total Estimated

Account

Type: Value

INDIVIDUAL

Statement Period

(pre-tax) as of the last business day of the statement period. This section only appears if you have Unvested Employee

Stock Plan shares.

1234-5678

UNVESTED EMPLOYEE STOCK OPTIONS

Unvested

Stock Options:

section displays

individual

Employee

AC C T Employee

Q UANT ITY

G RANThis

T

MAR KE

T

TOTAL

ES T MK T Stock Options grants that

contain

and

shares.

Total EstimatedPR

Market

of E-T

each

T Y vested

PE

UNV Eexercisable

S TE D

PR I CThe

E

IC E

VValue

ALUE (PR

AX )grant is calculated by taking the

Market Price less the Grant Price, times Quantity Exercisable within each grant. Total Estimated Market Value will be

the Grant Price is250

greater than the

Market Price at the end

of the statement$0.00

period.

3/1/2006

111111

NQ

DEMO zero ifStkPln

$39.90

$21.25

Unvested Stock Appreciation Rights: This section displays individual Stock Appreciation Rights grants with

TOTAL UNVESTED EMPLOYEE STOCK OPTIONS

$0.00

unvested shares. The Total Estimated Market Value of each grant is calculated by taking the Market Price less the

Grant Price, times Quantity Unvested within each grant. Total Estimated Market Value will be zero if the Grant Price is

TOTAL UNVESTED EMPLOYEE STOCK PLAN VALUE (ON 07/31/2009)

$0.00

greater than the Market Price at the end of the statement period.

Unvested Employee Stock Plan Value, which includes Unvested

Employee Stock Options and Unvested Employee Stock Appreciation Rights, and Unvested Restricted Stocks, is an

Unvested

Stocks:

section

displays

grants

with unvested

shares. The Total

estimate based on information provided by your company, forwhich

neither Restricted

E*TRADE Securities

norThis

its clearing

firm,

E*TRADEindividual

Clearing, isRestricted

responsible.Stock

This value

is displayed

here solely

as a service to you, does not represent assets held in your brokerage

account,

and is Value

not protected

bygrant

SIPC. is calculated by taking the Market Price less the Grant Price, times Quantity

Estimated

Market

of each

Unvested within each grant. Total Estimated Market Value will be zero if the Grant Price is greater than the Market

Price at the end of the statement period.

TRANSACTION HISTORY

G R ANT

DATE

NUMB ER

T YPE

S Y MB OL /

C US I P

Unvested Employee Stock Plan Value, which includes Unvested Employee Stock Options, Unvested Employee Stock Appreciation

Rights, and Unvested Restricted Stocks is an estimate based on information provided by your company, for which neither E*TRADE

Y MB OL/firm, E*TRADE Clearing, are responsible. This value is displayed here solely asAMOU

Securities nor its Sclearing

a service

NT to you, does not AMOUN T

C U S IPin your brokerage account, and is not protected by SIPC.

DE B IT ED

C RE DITE D

represent assets held

DIVIDENDS & INTEREST ACTIVITY

DATE

T RAN S AC TION

DE S C RIP TION

T YPE

TRANSACTION

HISTORY

07/27/09

Dividend

DEMO

This section

is unchanged

and

MONTHLY

DIVIDEND

displays individual entries

for

DEMO

0.01

Securities Purchased or Sold

$0.01

T OT

A L DIV

IDE N Fund

DS & IN

T E R E Slisted

T A C T IV IT Y

(with

Mutual

activity

$0.01

N Eseparately),

T DIV IDE N DSWithdrawals

& IN T E R E S T&A C T IV IT Y

Deposits, Dividends

& Interests,

WITHDRAWALS

& DEPOSITS

and Money Fund activity which

DE S C RIP TION

DATE

T RAN S AC TION

occurred

in the current

T YPE

statement period.

07/06/09

Transfer

W IT HDR AW ALS

ACH WITHDRAWAL

REFID:123456789

3,000.00

N E T W IT HDR A W A LS & DE POS IT S

MONEY FUND ACTIVITY

DATE

( 0.0100 % 30-Day Yield/

TR ANS AC T ION TY PE

07/01/09

07/07/09

07/27/09

07/31/09

$3,000.00

Withdrawal

Deposit

0.0104 %APY Earned as of

DES C R IPTION

07/31/09 )

TR ANS AC T IO N AMO UNT

O PE N IN G B ALA N C E

$3,068.30

DEMO

DEMO

MONTHLY DIVIDEND REINVESTED

-3,000.00

0.01

C L OS IN G B A L A N C E

$68.31

DEPOS ITS

You might also like

- Nov 30 2010 PDFDocument10 pagesNov 30 2010 PDFEsther WilliamsNo ratings yet

- 1 WP03-0156-0047956-000 20231110 036Document3 pages1 WP03-0156-0047956-000 20231110 036komoNo ratings yet

- VzplanbillDocument15 pagesVzplanbillcrimesilkNo ratings yet

- Reference Letter SampleDocument2 pagesReference Letter SampleHEER PATELNo ratings yet

- StatementDocument5 pagesStatementpese022No ratings yet

- Your Account Statement: Payment Information Summary of Account ActivityDocument4 pagesYour Account Statement: Payment Information Summary of Account ActivityAndreina VillalobosNo ratings yet

- StatementDocument3 pagesStatementWilliam KelleyNo ratings yet

- Your Basic Banking Plan Account Summary: Here's What Happened in Your Account This Statement PeriodDocument2 pagesYour Basic Banking Plan Account Summary: Here's What Happened in Your Account This Statement PeriodMichael FissehaNo ratings yet

- Xapo Bank Statement - 2022-01-01-To-2022-12-31Document1 pageXapo Bank Statement - 2022-01-01-To-2022-12-31Raja Hermansyah0% (1)

- Easy Account 37Document2 pagesEasy Account 37luvuyo.mali83No ratings yet

- SCHNEIDERS (00102) Peridic Billing Statement Ending 03.15.2017 - RedactedDocument1 pageSCHNEIDERS (00102) Peridic Billing Statement Ending 03.15.2017 - Redactedlarry-612445No ratings yet

- ANZDocument82 pagesANZGharayaNo ratings yet

- Articles of OrganizationDocument1 pageArticles of Organizationminhdang03062017No ratings yet

- First Tech Credit Union Fees ScheduleDocument3 pagesFirst Tech Credit Union Fees ScheduleNamtien UsNo ratings yet

- UtilityBillingStatement AGO2022Document2 pagesUtilityBillingStatement AGO2022MexLex Tramites LegalesNo ratings yet

- Noa-Iit Ob2620220516204800b91Document2 pagesNoa-Iit Ob2620220516204800b91Tha OoNo ratings yet

- February 16, 2024Document3 pagesFebruary 16, 2024martinezcamilla3360No ratings yet

- Questions: Send Correspondence To: Mail Payments ToDocument4 pagesQuestions: Send Correspondence To: Mail Payments Tofinape6897No ratings yet

- Fidelity National Financial, Inc.: FORM 10-QDocument76 pagesFidelity National Financial, Inc.: FORM 10-Qrocky6182002No ratings yet

- Your RBC Personal Banking Account StatementDocument2 pagesYour RBC Personal Banking Account Statementkauraaaa0% (1)

- Softtech Engineers LimitedDocument5 pagesSofttech Engineers LimitedHimanshu ChavanNo ratings yet

- Bank Reconciliation Statement - Why & How To Prepare The - Statement PDFDocument2 pagesBank Reconciliation Statement - Why & How To Prepare The - Statement PDFAman KodwaniNo ratings yet

- Bank Reconciliation StatementDocument1 pageBank Reconciliation StatementAbdul RehmanNo ratings yet

- ClearDocument3 pagesClearOleg DaffNo ratings yet

- Type of Existing Policy:: Surrendering Company InformationDocument1 pageType of Existing Policy:: Surrendering Company InformationEjiroNo ratings yet

- City BankDocument3 pagesCity BankChong ShanNo ratings yet

- Statement 115376 2Document20 pagesStatement 115376 2Mary MacLellanNo ratings yet

- CFSB FIXNOOK Sep-Feb 24Document7 pagesCFSB FIXNOOK Sep-Feb 24DjibzlaeNo ratings yet

- 653MakroProductFinanceLoansEmailPostSmart E-Statement Apr2023 542Document1 page653MakroProductFinanceLoansEmailPostSmart E-Statement Apr2023 542judithkhosaNo ratings yet

- Statement Details: Your Account SummaryDocument3 pagesStatement Details: Your Account SummaryTJ JanssenNo ratings yet

- Wa0001.Document1 pageWa0001.alysNo ratings yet

- BillSTMT 4588260001812272 19Document2 pagesBillSTMT 4588260001812272 19EhitishamNo ratings yet

- Statement of Account: Penyata AkaunDocument3 pagesStatement of Account: Penyata AkaunWaNazren Wan KacangNo ratings yet

- Pop - A Aj GowerDocument2 pagesPop - A Aj GowerScavat NgwaneNo ratings yet

- Safari - Nov 2, 2017 at 4:13 PM PDFDocument1 pageSafari - Nov 2, 2017 at 4:13 PM PDFAmy HernandezNo ratings yet

- QureshiDocument5 pagesQureshiAnonymous gKfTqXObkDNo ratings yet

- Lista Tranzactii: George Alexandru David RO76BRDE030SV04277010300 RON George Alexandru DavidDocument5 pagesLista Tranzactii: George Alexandru David RO76BRDE030SV04277010300 RON George Alexandru DavidDavid GeorgeNo ratings yet

- Tax Invoice / Statement of Account: Invoice Cukai / Penyata AkaunDocument3 pagesTax Invoice / Statement of Account: Invoice Cukai / Penyata Akaunqasihsuci82No ratings yet

- Transaction History Statement: Freelancer International Pty Limited ACN 134 845 748Document8 pagesTransaction History Statement: Freelancer International Pty Limited ACN 134 845 748HK UploadNo ratings yet

- Your Koodo Bill: Account SummaryDocument6 pagesYour Koodo Bill: Account SummaryMark SloanNo ratings yet

- CheckStub - 2021 08 27Document1 pageCheckStub - 2021 08 27Laila IbrahimNo ratings yet

- Westpac Pacific Internet Banking - Fiji - Make Immediate Payment ReceiptDocument1 pageWestpac Pacific Internet Banking - Fiji - Make Immediate Payment ReceiptViliameNo ratings yet

- Summary of Accounts: 102101645 Lori Fudens Hair Designing, Inc. 140 Island Fly CLEARFLTER BEACH FL 33767-2216Document3 pagesSummary of Accounts: 102101645 Lori Fudens Hair Designing, Inc. 140 Island Fly CLEARFLTER BEACH FL 33767-2216bobNo ratings yet

- Account - 7702322640 Busi Ness Checki NG: (Loui SVI Lle) P. O. BOX 630900 Lexi Ngton, KY 40507Document4 pagesAccount - 7702322640 Busi Ness Checki NG: (Loui SVI Lle) P. O. BOX 630900 Lexi Ngton, KY 40507Jonathan Seagull LivingstonNo ratings yet

- Moving Notification FormDocument1 pageMoving Notification FormdavidNo ratings yet

- Bell MOBILEDocument7 pagesBell MOBILExyrnh2gxj6No ratings yet

- Yoseph H Simanjuntak: Account SummaryDocument5 pagesYoseph H Simanjuntak: Account SummaryPutra UtamaNo ratings yet

- PDF StatementDocument3 pagesPDF StatementVikram KumarNo ratings yet

- Your TELUS Bill: Account SummaryDocument6 pagesYour TELUS Bill: Account SummarydawnNo ratings yet

- Traditional Individual Retirement Account - Advisory Solutions Fund Model Custodian: Edward Jones Trust CompanyDocument8 pagesTraditional Individual Retirement Account - Advisory Solutions Fund Model Custodian: Edward Jones Trust CompanyMike BarnhartNo ratings yet

- Chime Bank Statement-5Document1 pageChime Bank Statement-5dmarcumNo ratings yet

- Bank Monitoring Dec - 2011Document164 pagesBank Monitoring Dec - 2011chisteaNo ratings yet

- Fidelity Sample StatementDocument8 pagesFidelity Sample StatementPawPaul MccoyNo ratings yet

- Monthly Report 2023 06 enDocument7 pagesMonthly Report 2023 06 enDustin Knechtel-wickertNo ratings yet

- 2020 06 01 1050602027745 PDFDocument2 pages2020 06 01 1050602027745 PDFRhon Arvin Matel PobleteNo ratings yet

- NAB Choice Package Home LoanDocument2 pagesNAB Choice Package Home LoanMillie JaisinghaniNo ratings yet

- FNB Statement New PDFDocument8 pagesFNB Statement New PDFFreddy MosielengNo ratings yet

- Whelan CD 18-0614Document1 pageWhelan CD 18-0614Anthony PrestonNo ratings yet

- E StatementDocument3 pagesE StatementTimmy Sze0% (1)

- Financial Terms and RatiosDocument76 pagesFinancial Terms and Ratiosbanshidharbehera100% (1)

- The IEEE P1500 Embedded Core Test: Presented by Wei Chen, WangDocument13 pagesThe IEEE P1500 Embedded Core Test: Presented by Wei Chen, WangprakashthamankarNo ratings yet

- Digital Physical Design: Hierarchical and Low Power Implementation FlowsDocument37 pagesDigital Physical Design: Hierarchical and Low Power Implementation Flowsprakashthamankar100% (2)

- DFT Rules - PPT 0Document18 pagesDFT Rules - PPT 0prakashthamankar50% (4)

- Debugging Simulation Mismatches in Fastscan: by Geir Eide Last Modified: July 03, 2001Document21 pagesDebugging Simulation Mismatches in Fastscan: by Geir Eide Last Modified: July 03, 2001prakashthamankar100% (3)

- Mid SemDocument7 pagesMid SemprakashthamankarNo ratings yet

- Scan Chain Operation For Stuck at TestDocument15 pagesScan Chain Operation For Stuck at TestprakashthamankarNo ratings yet

- Scan Chain BasicsDocument8 pagesScan Chain Basicsprakashthamankar100% (3)

- LBISTDocument10 pagesLBISTprakashthamankarNo ratings yet

- DFT Rules - PPT 0Document18 pagesDFT Rules - PPT 0prakashthamankar50% (4)

- On Chip Clock Controller For At-Speed TestingDocument4 pagesOn Chip Clock Controller For At-Speed TestingSachin*123No ratings yet

- Vi Cheat SheetDocument2 pagesVi Cheat Sheetvaaz205No ratings yet

- Scan Chain BasicsDocument8 pagesScan Chain Basicsprakashthamankar100% (3)

- Good VLSI Design Test Power TutorialDocument1,515 pagesGood VLSI Design Test Power TutorialprakashthamankarNo ratings yet

- TransModeler BrochureDocument12 pagesTransModeler BrochureedgarabrahamNo ratings yet

- Draft Cavite MutinyDocument1 pageDraft Cavite MutinyaminoacidNo ratings yet

- I. Inversion: Grammar: Expressing EmphasisDocument7 pagesI. Inversion: Grammar: Expressing EmphasisSarah BenraghayNo ratings yet

- Transition Case StudyDocument4 pagesTransition Case StudyNobert BulindaNo ratings yet

- How To Write A ThesisDocument14 pagesHow To Write A ThesisPiyushNo ratings yet

- Medication Instructions Prior To SurgeryDocument11 pagesMedication Instructions Prior To Surgeryhohj100% (1)

- The Scopes TrialDocument10 pagesThe Scopes Trialapi-607238202No ratings yet

- Gordon College: Lived Experiences of Family Caregivers of Patients With SchizophreniaDocument128 pagesGordon College: Lived Experiences of Family Caregivers of Patients With Schizophreniaellton john pilarNo ratings yet

- Hayat e Imam Abu Hanifa by Sheikh Muhammad Abu ZohraDocument383 pagesHayat e Imam Abu Hanifa by Sheikh Muhammad Abu ZohraShahood AhmedNo ratings yet

- Quiz Simple Present Simple For Elementary To Pre-IntermediateDocument2 pagesQuiz Simple Present Simple For Elementary To Pre-IntermediateLoreinNo ratings yet

- Compulsory CounterclaimDocument4 pagesCompulsory CounterclaimAlexandria FernandoNo ratings yet

- Code of Conduct of Dabur Company - 1Document5 pagesCode of Conduct of Dabur Company - 1Disha KothariNo ratings yet

- MULTIPLE CHOICE. Choose The One Alternative That Best Completes The Statement or Answers The QuestionDocument6 pagesMULTIPLE CHOICE. Choose The One Alternative That Best Completes The Statement or Answers The QuestionBoshra BoshraNo ratings yet

- Demonstration MethodDocument16 pagesDemonstration Methodfrankie aguirreNo ratings yet

- ShakespeareDocument12 pagesShakespeareapi-510189551No ratings yet

- DragonflyDocument65 pagesDragonflyDavidNo ratings yet

- The Effectiveness of Peppermint Oil (Mentha X Pepipirita) As Mosquito RepellentDocument4 pagesThe Effectiveness of Peppermint Oil (Mentha X Pepipirita) As Mosquito RepellentKester PlaydaNo ratings yet

- Numerical Analysis: Prof. Dr. Süheyla ÇEHRELİDocument15 pagesNumerical Analysis: Prof. Dr. Süheyla ÇEHRELİEzgi GeyikNo ratings yet

- Brenda Alderman v. The Philadelphia Housing Authority, 496 F.2d 164, 3rd Cir. (1974)Document16 pagesBrenda Alderman v. The Philadelphia Housing Authority, 496 F.2d 164, 3rd Cir. (1974)Scribd Government DocsNo ratings yet

- Pdf-To-Word EditedDocument48 pagesPdf-To-Word EditedJames Genesis Ignacio LolaNo ratings yet

- 6 Ci Sinif Word Definition 6Document2 pages6 Ci Sinif Word Definition 6poladovaaysen11No ratings yet

- Principles of Natural Justice Justice Brijesh Kumar: Judge, Allahabad High CourtDocument7 pagesPrinciples of Natural Justice Justice Brijesh Kumar: Judge, Allahabad High CourtTarake DharmawardeneNo ratings yet

- Handwriting Examination Lesson 4.2Document3 pagesHandwriting Examination Lesson 4.2Edrie Boy OmegaNo ratings yet

- Physical Education: Learning Activity SheetDocument13 pagesPhysical Education: Learning Activity SheetRhea Jane B. CatalanNo ratings yet

- Module 1 Lesson 1 Activity and Analysis: Special Needs EducationDocument2 pagesModule 1 Lesson 1 Activity and Analysis: Special Needs EducationShalyn ArimaoNo ratings yet

- Gender Stereotypes and Performativity Analysis in Norwegian Wood Novel by Haruki Murakami Devani Adinda Putri Reg No: 2012060541Document35 pagesGender Stereotypes and Performativity Analysis in Norwegian Wood Novel by Haruki Murakami Devani Adinda Putri Reg No: 2012060541Jornel JevanskiNo ratings yet

- ResumeDocument2 pagesResumeKeannosuke SabusapNo ratings yet

- Bottoms y Sparks - Legitimacy - and - Imprisonment - Revisited PDFDocument29 pagesBottoms y Sparks - Legitimacy - and - Imprisonment - Revisited PDFrossana gaunaNo ratings yet

- Meralco v. CastilloDocument2 pagesMeralco v. CastilloJoven CamusNo ratings yet

- Lecture - 4 - 28june2023Document18 pagesLecture - 4 - 28june2023vanshikaNo ratings yet