Professional Documents

Culture Documents

Practice Problems - Balance Sheet Solutions

Uploaded by

LLOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Practice Problems - Balance Sheet Solutions

Uploaded by

LLCopyright:

Available Formats

Solutions to Practice Problems - Balance

Sheet

Solutions to Practice Problems - Balance Sheet

Requirement 1:

Construct journal entries for each of the following hypothetical

transactions during the quarter. Also, indicate which of the following

balance sheet categories are affected by the transactions: current

assets (CA), non-current assets (NCA), current liabilities (CL), noncurrent liabilities (NCL), and shareholders equity (SE).

Example: Purchased $2,000 of short-term investments.

Short-term investments (CA) 2,000

Cash (CA)

2,000

1)

Issued common stock for $400,000 cash.

2)

Acquired land and a building costing $250,000. Issued a check

for $180,000, with the remainder payable in 2 years. Assigned a

value of $40,000 to the land and $210,000 to the building.

3)

Acquired $4,800 of inventories on account from vendors.

4)

Collected $22,000 of accounts receivables from its customers

who previously purchased on credit.

Solutions to Practice Problems - Balance

Sheet

5)

Prepaid $15,000 of selling, general, and administrative expenses.

6)

Collected $16,000 in advance from customers for deliveries to be

made in six months.

7)

Paid research and development costs of $100,000 that had been

accrued last quarter.

8)

Paid a $7,000 invoice from vendors for products purchased last

quarter.

9)

Signed a contract with Boeing to purchase a private jet for the

CEO for $5 million.

Solutions to Practice Problems - Balance

Sheet

Requirement 2:

Please comment on why the following events would generally not have

an effect on the balance sheet:

1) Placed an order for new equipment with a vendor.

2) Advised by a marketing consultant that the companys patents

are worth considerably more than their cost.

3) Entered into a contract with a hospital to provide a computerized

patient tracking system.

4) Contracted for the services of a financial officer at a high salary,

with employment set to begin next year.

Solutions to Practice Problems - Balance

Sheet

Requirement 3:

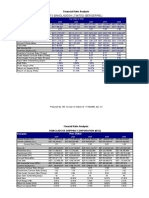

The following are Walt Disney Cos (NYSE:DIS) balance sheets as of the

beginning of October 2010 and 2009:

CONSOLIDATED BALANCE SHEETS

(in millions, except per share data)

October 2

,

2010

October 3

,

2009

$ 12,225

$ 11,889

56,981

51,228

$ 69,206

$ 63,117

$ 6,109

$ 5,616

2,350

1,206

2,541

2,112

11,000

8,934

10,130

11,495

2,630

6,104

1,819

5,444

Total current assets

Long-term assets

LIABILITIES AND EQUITY

Current liabilities

Accounts payable and other accrued liabilities

Current portion of borrowings

Unearned royalties and other advances

Total current liabilities

Borrowings

Deferred income taxes

Other long-term liabilities

Solutions to Practice Problems - Balance

Sheet

Total Equity

39,342

35,425

$ 69,206

$ 63,117

1) Compute Disneys current ratio and Debt/Equity ratio as of October

2, 2010.

Write a journal entry for each of the following transactions and state

how the transaction would affect Disneys current ratio and

Debt/Equity ratio. (Analyze each transaction independently.) All

numbers are in millions.

2) Borrow $1,000, to be repaid in two years, and purchase equipment

with the proceeds.

3) Borrow $1,000, to be repaid in six months, and purchase inventory

with the proceeds.

4) Receive cash of $500 from customers for earlier credit sales.

You might also like

- Wiley - Practice Exam 3 With SolutionsDocument15 pagesWiley - Practice Exam 3 With SolutionsIvan BliminseNo ratings yet

- Wiley - Practice Exam 1 With SolutionsDocument10 pagesWiley - Practice Exam 1 With SolutionsIvan Bliminse80% (5)

- Rev C5Document9 pagesRev C5Richard W YipNo ratings yet

- Quiz 2Document54 pagesQuiz 2Karthik Vee33% (3)

- Call Center Business PlanDocument20 pagesCall Center Business PlanMohit Singh100% (1)

- Sample Midterm QuestionsDocument14 pagesSample Midterm QuestionsdoofwawdNo ratings yet

- Graded Quesions Complete Book0 PDFDocument344 pagesGraded Quesions Complete Book0 PDFFarrukh AliNo ratings yet

- CE Analysis 2007 HKCE P/A PAST PAPERS ANALYSISDocument95 pagesCE Analysis 2007 HKCE P/A PAST PAPERS ANALYSISyiu0908100% (1)

- Chap 007Document16 pagesChap 007dbjn100% (1)

- Feasabilitysoap FactoryDocument23 pagesFeasabilitysoap FactoryAnjani Kumar Mohanty100% (5)

- Balance Sheet QuestionsDocument9 pagesBalance Sheet Questionskmillat0% (1)

- Chapter 3 The Double-Entry System: Discussion QuestionsDocument16 pagesChapter 3 The Double-Entry System: Discussion QuestionskietNo ratings yet

- Principles of Accounting Code 8401 Assignments of Spring 2023Document13 pagesPrinciples of Accounting Code 8401 Assignments of Spring 2023zainabjutt0303No ratings yet

- Aud and atDocument21 pagesAud and atVtgNo ratings yet

- Graded Quesions Complete Book0Document344 pagesGraded Quesions Complete Book0Irimia Mihai Adrian100% (1)

- Case Set 7 - Subsequent Events and Going ConcernDocument5 pagesCase Set 7 - Subsequent Events and Going ConcernTimothy WongNo ratings yet

- F7 Revision Test Section A and B 1Document15 pagesF7 Revision Test Section A and B 1Farman ShaikhNo ratings yet

- Acc10007 P1Document8 pagesAcc10007 P1Vuong Bao KhanhNo ratings yet

- Chapter 23 - SCF - Aug 2012Document11 pagesChapter 23 - SCF - Aug 2012bebo3usaNo ratings yet

- Lecture 9 - Statement of Cash FlowsDocument51 pagesLecture 9 - Statement of Cash FlowsTabassum Sufia Mazid100% (1)

- Fin622 McqsDocument25 pagesFin622 McqsShrgeel HussainNo ratings yet

- Pro Hac Vice) : United States Bankruptcy Court Southern District of New YorkDocument11 pagesPro Hac Vice) : United States Bankruptcy Court Southern District of New YorkChapter 11 DocketsNo ratings yet

- Mcboard - 2Nd Year (191) and 3Rd Year (181) : Financial Accounting and Reporting (Board Exam Subject)Document14 pagesMcboard - 2Nd Year (191) and 3Rd Year (181) : Financial Accounting and Reporting (Board Exam Subject)Vonna TerribleNo ratings yet

- Acc101 - Chapter 14: Statement of Cash FlowsDocument12 pagesAcc101 - Chapter 14: Statement of Cash FlowsSyed Asad Ali GardeziNo ratings yet

- Financial Reporting Objectives and StandardsDocument10 pagesFinancial Reporting Objectives and StandardsYoshidaNo ratings yet

- AS Advanced Audit Assurance May June 2012Document4 pagesAS Advanced Audit Assurance May June 2012Laskar REAZNo ratings yet

- Week 1 OneslideperpageDocument73 pagesWeek 1 OneslideperpageBarry AuNo ratings yet

- 003 ExDocument14 pages003 ExanandhuNo ratings yet

- CH 3 - The Statement of Financial Position and Financial DisclosuresDocument37 pagesCH 3 - The Statement of Financial Position and Financial DisclosuresZulqarnain KhokharNo ratings yet

- Financial Accounting: Topic 2: Accounting For Plant AssetsDocument58 pagesFinancial Accounting: Topic 2: Accounting For Plant AssetsDanielle ObenNo ratings yet

- Cash Flow StatementsDocument16 pagesCash Flow Statementsadnan arshadNo ratings yet

- Foundations in Financial ManagementDocument17 pagesFoundations in Financial ManagementchintengoNo ratings yet

- Cash Flow Statement NotesDocument8 pagesCash Flow Statement NotesAbdullahNo ratings yet

- Asignacioìn 1 AISDocument5 pagesAsignacioìn 1 AISElia SantanaNo ratings yet

- Acc 124Document5 pagesAcc 124KISSEY ESTRELLANo ratings yet

- BSBFIM601 Hints For Task 2Document32 pagesBSBFIM601 Hints For Task 2Marwan Issa71% (7)

- TQ U9 Profits 34 PDFDocument4 pagesTQ U9 Profits 34 PDFRafaelKwongNo ratings yet

- Working Capital AssignmentDocument2 pagesWorking Capital AssignmentBereket K.ChubetaNo ratings yet

- ACCT 310 Fall 2011 Midterm ExamDocument12 pagesACCT 310 Fall 2011 Midterm ExamPrince HakeemNo ratings yet

- Week 4Document5 pagesWeek 4Erryn M. ParamythaNo ratings yet

- Ac550 FinalDocument4 pagesAc550 FinalGil SuarezNo ratings yet

- MTQs F2Document8 pagesMTQs F2Menaal UmarNo ratings yet

- Chapter 1Document11 pagesChapter 1Mai PhurepongNo ratings yet

- UZ LB 301 - July 2020Document4 pagesUZ LB 301 - July 2020Clayton MutsenekiNo ratings yet

- Acct3708 Finals, Sem 2, 2010Document11 pagesAcct3708 Finals, Sem 2, 2010nessawhoNo ratings yet

- IF2 - Project 1 PDFDocument6 pagesIF2 - Project 1 PDFBillNo ratings yet

- DeVry University Walmart ProjectDocument12 pagesDeVry University Walmart ProjectKristin ParkerNo ratings yet

- # 2 Assignment On Financial and Managerial Accounting For MBA StudentsDocument7 pages# 2 Assignment On Financial and Managerial Accounting For MBA Studentsobsa alemayehuNo ratings yet

- Acct 504 Week 8 Final Exam All 4 Sets - DevryDocument17 pagesAcct 504 Week 8 Final Exam All 4 Sets - Devrycoursehomework0% (1)

- BSBFIM601 Hints For Task 2Document32 pagesBSBFIM601 Hints For Task 2Mohammed MGNo ratings yet

- Preparing Financial StatementsDocument14 pagesPreparing Financial StatementsAUDITOR97No ratings yet

- ACCT 221 Chapter 2Document29 pagesACCT 221 Chapter 2Shane Hundley100% (1)

- Question CMA December 2019 Exam.Document5 pagesQuestion CMA December 2019 Exam.F A Saffat RahmanNo ratings yet

- Fund Flow StatementDocument7 pagesFund Flow StatementvipulNo ratings yet

- Great Zimbabwe University Faculty of CommerceDocument5 pagesGreat Zimbabwe University Faculty of CommerceTawanda Tatenda HerbertNo ratings yet

- AUDITING - CUAC 202 ASSIGNMENT 1-12Document18 pagesAUDITING - CUAC 202 ASSIGNMENT 1-12Joseph SimudzirayiNo ratings yet

- Suspense QuestionsDocument15 pagesSuspense QuestionsChaiz MineNo ratings yet

- Assignment # 2 MBA Financial and Managerial AccountingDocument7 pagesAssignment # 2 MBA Financial and Managerial AccountingSelamawit MekonnenNo ratings yet

- Trắc nghiệmDocument8 pagesTrắc nghiệmHồ Đan Thục0% (1)

- Practice Set-2Document7 pagesPractice Set-2Abhishek Kumar100% (2)

- Chapter 12 Review Updated 11th EdDocument13 pagesChapter 12 Review Updated 11th Edangelsalvador05082006No ratings yet

- Wiley GAAP for Governments 2012: Interpretation and Application of Generally Accepted Accounting Principles for State and Local GovernmentsFrom EverandWiley GAAP for Governments 2012: Interpretation and Application of Generally Accepted Accounting Principles for State and Local GovernmentsNo ratings yet

- Accounting for Goodwill and Other Intangible AssetsFrom EverandAccounting for Goodwill and Other Intangible AssetsRating: 4 out of 5 stars4/5 (1)

- Practice 4 - Statement of Cash FlowsDocument8 pagesPractice 4 - Statement of Cash FlowsLLNo ratings yet

- Practice 3 - Income StatementDocument5 pagesPractice 3 - Income StatementLLNo ratings yet

- Practice Cases Session 1: Requirement 1 Data: Refer To The File "Practice Case - Obagi Annual Report - PDF" For Obagi'sDocument4 pagesPractice Cases Session 1: Requirement 1 Data: Refer To The File "Practice Case - Obagi Annual Report - PDF" For Obagi'sLLNo ratings yet

- Natureview Farm Case StudyDocument12 pagesNatureview Farm Case StudyAditya R Mohan100% (2)

- BBF612S - Understanding Financial PerfomanceDocument5 pagesBBF612S - Understanding Financial PerfomanceReana GeminaNo ratings yet

- Financial Performance Analysis of Bangladesh Commerce Bank LtdDocument10 pagesFinancial Performance Analysis of Bangladesh Commerce Bank Ltdcric6688100% (1)

- Akun LKSDocument6 pagesAkun LKSNiken PurnamasariNo ratings yet

- Financial Statements and Financial Statement Analysis McqsDocument10 pagesFinancial Statements and Financial Statement Analysis McqsNirmal PrasadNo ratings yet

- QuickBooks AdvancedDocument111 pagesQuickBooks Advancedismail shabbirNo ratings yet

- Berger Paints Bangladesh Ltmited (Bergerpbl) : ElementsDocument4 pagesBerger Paints Bangladesh Ltmited (Bergerpbl) : Elementskowsar088No ratings yet

- Reviewer1 PDFDocument4 pagesReviewer1 PDFspur iousNo ratings yet

- Ifrs 16 Leases MiningDocument48 pagesIfrs 16 Leases MiningBill LiNo ratings yet

- General Journal EntriesDocument5 pagesGeneral Journal EntriesCallisto RegulusNo ratings yet

- Common Good Report Fife CouncilDocument28 pagesCommon Good Report Fife CouncilpetitionerNo ratings yet

- Divine Aura Final Project 12Document20 pagesDivine Aura Final Project 12Usva SaleemNo ratings yet

- Answers Lease 1Document10 pagesAnswers Lease 1els emsNo ratings yet

- Mock Exam: Operations and Supply Chain ManagementDocument24 pagesMock Exam: Operations and Supply Chain ManagementShrey ThakkarNo ratings yet

- Research ProposalDocument19 pagesResearch Proposalዝምታ ተሻለNo ratings yet

- From The Following Information, Prepare A Cash Flow StatementDocument2 pagesFrom The Following Information, Prepare A Cash Flow StatementAgANo ratings yet

- Britannia DCF CapmDocument12 pagesBritannia DCF CapmRohit Kamble100% (1)

- Columban College, Inc: The Following Are The Account Titles and Their Normal BalancesDocument3 pagesColumban College, Inc: The Following Are The Account Titles and Their Normal BalancesAriaiza SanpiaNo ratings yet

- Managerial Accounting CalculationsDocument4 pagesManagerial Accounting CalculationsJudy1928No ratings yet

- Assignment 4.1 Admission of New Partner BASANDocument4 pagesAssignment 4.1 Admission of New Partner BASANHardi Louise BasanNo ratings yet

- Balance Sheet FormatDocument1 pageBalance Sheet FormatMahima GirdharNo ratings yet

- Act. Partnership AccountDocument10 pagesAct. Partnership AccountPaupau100% (1)

- CH 12 Intangible AssetsDocument57 pagesCH 12 Intangible AssetsSamiHadadNo ratings yet

- Montee Company Income Statement For The Month Ended July 31, 2017 Debit Credit Revenue $ 6,150 Expenses $ 2,600 950 600 400 150 4,700 $1,450Document3 pagesMontee Company Income Statement For The Month Ended July 31, 2017 Debit Credit Revenue $ 6,150 Expenses $ 2,600 950 600 400 150 4,700 $1,450Gerald DiazNo ratings yet

- 3Q 2022 INDF Indofood+Sukses+Makmur+TbkDocument164 pages3Q 2022 INDF Indofood+Sukses+Makmur+TbkAdi Gesang PrayogaNo ratings yet

- IFRS 7 Presenting Financial InstrumentsDocument26 pagesIFRS 7 Presenting Financial InstrumentsSalman AhmedNo ratings yet

- Sharjah UAE accountant seeks finance roleDocument2 pagesSharjah UAE accountant seeks finance roleAbdul GhafoorNo ratings yet

- Full Download Solution Manual For Interpreting and Analyzing Financial Statements 6th Edition by Schoenebeck PDF Full ChapterDocument36 pagesFull Download Solution Manual For Interpreting and Analyzing Financial Statements 6th Edition by Schoenebeck PDF Full Chapterooezoapunitory.xkgyo4100% (17)