Professional Documents

Culture Documents

Lecture 15 - Procedures and Reports On SPE

Uploaded by

Rachel LeachonOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Lecture 15 - Procedures and Reports On SPE

Uploaded by

Rachel LeachonCopyright:

Available Formats

DE LA SALLE UNIVERSITY MANILA

RVR COB DEPARTMENT OF ACCOUNTANCY

REVDEVT 3rd Term AY 14-15

Auditing Theory

AT Lecture 15

Prof. Francis H. Villamin

PROCEDURES AND REPORTS ON SPECIAL PURPOSE AUDIT ENGAGEMENTS

A. Audits of Financial Statements Prepared in Accordance with Special Purpose

Frameworks

General Consideration

PSA 800 (Revised and Redrafted), Special Considerations Audits of Financial Statements Prepared in

Accordance with Special Purpose Frameworks deals with special considerations in the application of

PSAs to an audit of financial statements prepared in accordance with a special purpose framework.

Examples of special purpose frameworks are:

A tax basis of accounting for a set of financial statements that accompany an entitys tax return;

The cash receipts and disbursements basis of accounting for cash flow information that an entity

may be requested to prepare for creditors;

The financial reporting provisions established by a regulator to meet the requirements of that

regulator, or

The financial reporting provisions of a contract, such as a bond indenture, a loan agreement, or

a project grant.

Requirements

The following general considerations and principles should be observed:

The auditor shall determine the acceptability of the financial reporting framework applied in the

preparation of the financial statements. In an audit of special purpose financial statements, the

auditor shall obtain an understanding of:

a) The purpose for which the financial statements are prepared;

b) The intended users; and

c) The steps taken by management to determine that the applicable financial reporting

framework is acceptable in the circumstances.

In planning and performing an audit of special purpose financial statements, the auditor shall

determine whether application of the PSAs requires special consideration in the circumstances

of the engagement.

The auditor is required to obtain an understanding of the entitys selection and application of

accounting policies. In the case of financial statements prepared in accordance with the

provisions of a contract, the auditor shall obtain an understanding of any significant

interpretations of the contract that management made in the preparation of those financial

statements. An interpretation is significant when adoption of another reasonable interpretation

would have produced a material difference in the information presented in the financial

statements.

When forming an opinion and reporting on special purpose financial statements, the auditor

shall apply the requirements in PSA 700 (Redrafted).

PSA 700 (Redrafted) requires the auditor to evaluate whether the financial statements

adequately refer to or describe the applicable financial reporting framework. In the case of

financial statements prepared in accordance with the provisions of a contract, the auditor shall

evaluate whether the financial statements adequately describe any significant interpretations of

the contract on which the financial statements are based.

The auditors report on special purpose financial statements should

a) The auditors report shall also describe the purpose for which the financial statements

are prepared and, if necessary, the intended users, or refer to a note in the special

purpose financial statements that contains that information; and

AT Lecture 15

Special Purpose Audit Engagements

Page 2

b) If management has a choice of financial reporting frameworks in the preparation of

such financial statements, the explanation of managements responsibility for the

financial statements shall also make reference to its responsibility for determining that

the applicable financial reporting framework is acceptable in the circumstances.

c) The auditors report on special purpose financial statements shall include an Emphasis

of Matter paragraph alerting users of the auditors report that the financial statements

are prepared in accordance with a special purpose framework and that, as a result, the

financial statements may not be suitable for another purpose. The auditor shall include

this paragraph under an appropriate heading.

B. Audits of Single Financial Statements and Specific Elements, Accounts or Items of a

Financial Statement

PSA 805 (Revised and Redrafted), Special Considerations Audits of Single Financial Statements and

Specific Elements, Accounts or Items of a Financial Statement, deals with special considerations in the

application of those PSAs to an audit of a single financial statement or of a specific element, account or

item of a financial statement. The single financial statement or the special element, account or item of a

financial statement may be prepared in accordance with a general or special purpose framework.

Examples of Specific Elements, Accounts, or Items of a Financial Statement

Accounts receivable, allowance for doubtful accounts receivable, inventory, the liability for

accrued benefits of a private pension plan, the recorded value of identified intangible assets, or

the liability for incurred but not reported claims in an insurance portfolio, including related

notes

A schedule of externally managed assets and income of a private pension plan, including

related notes

A schedule of net tangible assets, including related notes

A schedule of disbursements in relation to a lease property, including explanatory notes

A schedule of profit participation or employee bonuses, including explanatory notes

Requirements

The following guidelines should be observed:

The auditor is required to comply with all PSAs relevant to the audit. In the case of an audit of a

single financial statement or of a specific element of a financial statement, this requirement

applies irrespective of whether the auditor is also engaged to audit the entitys complete set of

financial statements. If the auditor is not also engaged to audit the entitys complete set of

financial statements, the auditor shall determine whether the audit of a single financial statement

or a specific element of those financial statements in accordance with PSAs is practicable.

The auditor is required to determine the acceptability of the financial reporting framework

applied in the preparation of the financial statements. In the case of an audit of a single

financial statement or of a specific element of a financial statement, this shall include whether

application of the financial reporting framework will result in a presentation that provides

adequate disclosures to enable the intended users to understand the information conveyed in

the financial statement or the element, and the effect of material transactions and events on the

information conveyed in the financial statement or the element.

PSA 210 (Redrafted) requires that the agreed terms of the audit engagement include the

expected form of any reports to be issued by the auditor. In the case of an audit of a single

financial statement or of a specific element of a financial statement, the auditor shall consider

whether the expected form of opinion is appropriate in the circumstances.

PSA 200 (Revised and Redrafted) states that PSAs are written in the context of an audit of

financial statements, they are to be adapted as necessary in the circumstances when applied to

audits of other historical financial information. In planning and performing the audit of a single

financial statement or of a specific element of a financial statement, the auditor shall adapt all

PSAs relevant to the audit as necessary in the circumstances of the engagement.

When forming an opinion and reporting on a single financial statement or on a specific element

of a financial statement, the auditor shall apply the requirements in PSA 700 (Redrafted),

adapted as necessary in the circumstances of the engagement.

If the auditor undertakes an engagement to report on a single financial statement or on a

specific element of a financial statement in conjunction with an engagement to audit the entitys

complete set of financial statements, the auditor shall express a separate opinion for each

engagement.

AT Lecture 15

Special Purpose Audit Engagements

Page 3

If the opinion in the auditors report on an entitys complete set of financial statements is

modified, or that report includes an Emphasis of Matter paragraph, the auditor shall determine

the effect that this may have on the auditors report on a single financial statement or on a

specific element of those financial statements. When deemed appropriate, the auditor shall

modify the opinion on the single financial statement or on the specific element of a financial

statement, or include an Emphasis of Matter paragraph or an Other Matter paragraph in the

auditors report, accordingly.

If the auditor concludes that it is necessary to express an adverse opinion or disclaim an opinion

on the entitys complete set of financial statements as a whole, PSA 705 (Revised and

Redrafted) does not permit the auditor to include in the same auditors report an unmodified

opinion on a single financial statement that forms part of those financial statements or on a

specific element that forms part of those financial statements. This is because such an

unmodified opinion would contradict the adverse opinion or disclaimer of opinion on the entitys

complete set of financial statements as a whole.

If the auditor concludes that it is necessary to express an adverse opinion or disclaim an opinion

on the entitys complete set of financial statements as a whole but, in the context of a separate

audit of a specific element that is included in those financial statements, the auditor

nevertheless considers it appropriate to express an unmodified opinion on that element, the

auditor shall only do so if:

a) The auditor is not prohibited by law or regulation from doing so;

b) The opinion is expressed in an auditors report that is not published together with the

auditors report containing the adverse opinion or disclaimer of opinion; and

c) The specific element does not constitute a major portion of the entitys complete set of

financial statements.

The auditor shall express an unmodified opinion on a single financial statement of a complete

set of financial statements if the auditor has expressed an adverse opinion or disclaimed an

opinion on the complete set of financial statements as a whole. This is the case even if the

auditors report on the single financial statement is not published together with the auditors

report containing the adverse opinion or disclaimer of opinion. This is because a single

financial statement is deemed to constitute a major portion of those financial statements.

C. Summary Financial Statements

The objective of PSA 810 is to outline the auditors responsibility on determining:

a) Whether it is acceptable to accept appointment to report on summary financial statements

b) Where the auditor accepts appointment to report on summary financial statements:

i. to form an opinion on the summary financial statements based on the evaluation of

conclusions drawn from the evidence obtained ; and

ii. to express clearly that opinion through a written report that also describes the basis for that

opinion

PSA 810, at paragraph 4 contains the following definitions relevant to this PSA:

Applied Criteria

The criteria applied by management in the preparation of the summary financial statements.

Audited Financial Statements

Financial statements audited by the auditor in accordance with PSAs, and from which the summary

financial statements are derived.

Summary Financial Statements

Historical financial information that is derived from financial statements but that contains less detail

than the financial statements, while still providing a structured representation consistent with that

provided by the financial statements of the entitys economic resources or obligations at a point in

time or the changes therein for a period of time. Different jurisdictions may use different terminology

to describe such historical financial information.

AT Lecture 15

Special Purpose Audit Engagements

Page 4

Acceptance

The PSA requires the auditor to accept appointment to report on summary financial statements only

when the auditor has been engaged to audit the financial statements in accordance with PSAs from

which the summary financial statements have been derived.

If the auditor has been engaged to audit the financial statements in accordance with PSAs, then before

accepting engagement to report on the summary financial statements, the auditor shall:

Determine whether the applied criteria are acceptable.

Obtain the agreement of management that it acknowledges and understands its responsibility:

i.

for the preparation of the summary financial statements in accordance with the applied

criteria

ii.

to make the audited financial statements available to the intended users of the summary

financial statements without undue difficulty (or, if law or regulation provides that the

audited financial statements need not be made available to the intended users of the

summary financial statements and establishes the criteria for the preparation of summary

financial statements, to describe that law or regulation in the summary financial statements)

and

iii.

to include the auditors report on the summary financial statements in any document that

contains the summary financial statements and that indicates that the auditor has reported

on them

Agree with management the form of opinion to be expressed on the summary financial

statements .

UNACCEPTABLE APPLIED CRITERIA OR UNOBTAINABLE MANAGEMENT AGREEMENT

Where the auditor concludes that the applied criteria is unacceptable, or is unable to obtain the

agreement of management as set out above, the auditor shall not accept appointment to report on the

summary financial statements, unless a law or regulation requires the auditor to accept appointment to

report on the summary financial statements. Where the auditor has to accept appointment because law

or regulation compels the auditor to do so, the auditors report on the summary financial statements must

not indicate that the engagement was conducted in accordance with PSA 810 and such reference to thi s

fact must be made in the terms of the engagement

AUDIT PROCEDURES

The auditor must perform the following procedures as required by PSA 810. In addition, the auditor must

also perform any additional audit procedures they consider necessary as the basis for the auditors

opinion on the summary financial statements

1. Evaluate whether the summary financial statements adequately disclose their summarized nature

and identify the audited financial statements.

2. When summary financial statements are not accompanied by the audited financial statements,

evaluate whether they clearly describe:

(i)

From whom or where the audited financial statements are available

or

(ii)

The law or regulation that specifies that the audited financial statements need not be

made available to the intended users of the summary financial statements and

establishes the criteria for the preparation of the summary financial statements

3. Evaluate whether the summary financial statements adequately disclose the applied criteria

4. Compare the summary financial statements with the related information in the audited financial

statements to determine whether the summary financial statements agree with or can be

recalculated from the related information in the audited financial statements

5. Evaluate whether the summary financial statements are prepared in accordance with the applied

criteria .

6. Evaluate in view of the purpose of the summary financial statements, whether the summary

financial statements contain the information necessary, and are at an appropriate level of

aggregation, so as not to be misleading in the circumstances

7. Evaluate whether the audited financial statements are available to the intended users of the

summary financial statements without undue difficulty, unless law or regulation provides that they

need not be made available and establishes the criteria for the preparation of the summary

financial statements

AT Lecture 15

Special Purpose Audit Engagements

Page 5

REPORTING

Where the auditor determines an unmodified opinion is appropriate, PSA 810 requires use of one of the

following phrases (unless otherwise required by law or regulation):

a) The summary financial statements are consistent, in all material respects, with the audited

financial statements, in accordance with [applied criteria]

b) The summary financial statements are a fair summary of the audited financial statements, in

accordance with [the applied criteria].

In some jurisdictions, law or regulation may prescribe different wording to that in (a) or (b) above, In

such situations, the auditor is required to:

a) Apply the procedures described in 1-7 above and any further procedures necessary to enable

the auditor to express the prescribed opinion and

b) Evaluate whether the users of the summary financial statements might understand the auditors

opinion on the summary financial statements and, if so, whether additional explanation in the

auditors report on the summary financial statements can mitigate possible misunderstanding

In situations where the auditor concludes that any additional explanation could not mitigate possible

misunderstanding, the auditor shall not accept appointment unless law or regulation requires the auditor

to do so. Where the auditor is compelled by law or regulation to accept appointment, their report on the

summary financial statements must not indicate that the engagement was carried out in accordance with

this PSA .

The auditors report on the summary financial statements must include the following elements:

a) A title clearly indicating it as the report of an independent auditor

b) An addressee

c) An introductory paragraph that:

(i) identifies the summary financial statements on which the auditor is reporting, including the

title of each statement included in the summary financial statements

(ii) identifies the audited financial statements

(iii) refers to the auditors report on the audited financial statements, the date of that report and,

subject to any modifications to the opinion, emphasis of matter paragraph or other matter

paragraph in the auditors report, the fact that an unmodified opinion is expressed on the

audited financial statements;

(iv) if the date of the auditors report on the summary financial statements is later than the date

of the auditors report on the audited financial statements, states that the summary financial

statements and the audited financial statements do not reflect the effects of events that

occurred subsequent to the date of the auditors report on he audited financial statements ;

and

(v) a statement indicating that the summary financial statements do not contain all the

disclosures required by the financial reporting framework applied in the preparation of the

audited financial statements, and that reading the summary financial statements is not a

substitute for reading the audited financial statements

d) A description of managements responsibility for the summary financial statements, explaining

that management is responsible for the preparation of the summary financial statements in

accordance with the applied criteria

e) A statement that the auditor is responsible for expressing an opinion on the summary financial

statements based on the procedures required in this PSA

MODIFIED OPINIONS

Where the auditor has expressed a modified opinion or has included an emphasis of matter paragraph in

the audited financial statements, but considers the summary financial statements to be consistent, in all

material respects, with the audited financial statements, the auditors report on the summary financial

statements must state that the auditors report on the audited financial statements contains a qualified

opinion or an emphasis of matter paragraph or other matter paragraph. The auditors report on the

summary financial statements must also describe the basis for the qualified opinion, emphasis of matter

paragraph or other matter paragraph and the effect such a qualification or emphasis of matter paragraph

or other matter paragraph has on the summary financial statements

AT Lecture 15

Special Purpose Audit Engagements

Page 6

ADVERSE OR DISCLAIMER OF OPINIONS

Where the auditor has expressed an adverse or disclaimer of opinion on the audited financial

statements, the auditors report on the summary financial statements must:

State that the auditors report on the audited financial statements contains an adverse or

disclaimer of opinion

Describe the basis for that adverse opinion or disclaimer of opinion

State that, as a result of the adverse opinion or disclaimer of opinion, it is inappropriate to

express an opinion on the summary financial statements

In situations where the auditor concludes that the summary financial statements are not consistent, in all

material respects, or are not a fair summary of the audited financial statements, the auditor must express

an adverse opinion

DISTRIBUTION

There may be occasions when the audited financial statements of an entity are prepared in accordance

with a special purpose framework or where the use of the auditors report on the audited financials

statements is restricted. In such instances, the auditor must include a similar restriction or alert the user

in the auditors report on the summary financial statements that the audited financial statements have

been prepared in accordance with a special purpose framework

***************************

You might also like

- Chapter 14Document32 pagesChapter 14faye anneNo ratings yet

- Chapter 1 - Overview of Government AccountingDocument4 pagesChapter 1 - Overview of Government AccountingChris tine Mae MendozaNo ratings yet

- Quizzer 4Document5 pagesQuizzer 4Raraj100% (1)

- Quiz 1 AuditingDocument1 pageQuiz 1 AuditingSashaNo ratings yet

- CH 13Document19 pagesCH 13pesoload100No ratings yet

- IntAcct Cash CashEquivalents 1Document3 pagesIntAcct Cash CashEquivalents 1Arkhie DavocolNo ratings yet

- Final Exam: Fall 1997 This Exam Is Worth 30% and You Have 2 HoursDocument84 pagesFinal Exam: Fall 1997 This Exam Is Worth 30% and You Have 2 HoursJatin PanchiNo ratings yet

- 10.28.2017 MT (Audit of Receivables)Document7 pages10.28.2017 MT (Audit of Receivables)PatOcampo100% (1)

- AT Quizzer 6 - Planning and Risk Assessment PDFDocument18 pagesAT Quizzer 6 - Planning and Risk Assessment PDFJimmyChao0% (1)

- Completing The AuditDocument7 pagesCompleting The AudityebegashetNo ratings yet

- Audit CH 6 and 7Document30 pagesAudit CH 6 and 7Nanon WiwatwongthornNo ratings yet

- Chapter 28 AnsDocument9 pagesChapter 28 AnsDave ManaloNo ratings yet

- Auditing Theory - MockDocument10 pagesAuditing Theory - MockCarlo CristobalNo ratings yet

- Session 3 AUDITING AND ASSURANCE PRINCIPLESDocument29 pagesSession 3 AUDITING AND ASSURANCE PRINCIPLESagent2100No ratings yet

- Logo Here Auditing Theory Philippine Accountancy Act of 2004Document35 pagesLogo Here Auditing Theory Philippine Accountancy Act of 2004KathleenCusipagNo ratings yet

- Quick Guide To Auditing in An IT EnvironmentDocument8 pagesQuick Guide To Auditing in An IT EnvironmentKarlayaanNo ratings yet

- Auditing The Investing and Financing Cycles PDFDocument6 pagesAuditing The Investing and Financing Cycles PDFGlenn TaduranNo ratings yet

- Completion of Audit Quiz ANSWERDocument9 pagesCompletion of Audit Quiz ANSWERJenn DajaoNo ratings yet

- ACCO 30043: Quiz Number 1 (Introduction To Assurance and Audit Services)Document16 pagesACCO 30043: Quiz Number 1 (Introduction To Assurance and Audit Services)pat lanceNo ratings yet

- 07 Rittenberg TB Ch7Document22 pages07 Rittenberg TB Ch7Karlo Jude AcideraNo ratings yet

- First PreboardDocument5 pagesFirst PreboardRodmae VersonNo ratings yet

- Chapter 6 Quiz KeyDocument3 pagesChapter 6 Quiz Keymar8357No ratings yet

- Long Problems For Prelim'S Product: Case 1Document7 pagesLong Problems For Prelim'S Product: Case 1Mae AstovezaNo ratings yet

- PsaDocument2 pagesPsaMarikh RianoNo ratings yet

- APPLIED AUDITING Module 1Document3 pagesAPPLIED AUDITING Module 1Paul Fajardo CanoyNo ratings yet

- Discussion Money Market Problem SolvingDocument1 pageDiscussion Money Market Problem SolvingDanicaNo ratings yet

- Modified Opinion, Emphasis of Matter Paragraph or Other Matter Paragraph in The Auditor's Report On The Entity's Complete Set of Financial StatementsDocument29 pagesModified Opinion, Emphasis of Matter Paragraph or Other Matter Paragraph in The Auditor's Report On The Entity's Complete Set of Financial Statementsfaye anneNo ratings yet

- Karkits Corporation PDFDocument4 pagesKarkits Corporation PDFRachel LeachonNo ratings yet

- Chapter 05 - Audit Evidence and DocumentationDocument44 pagesChapter 05 - Audit Evidence and DocumentationALLIA LOPEZNo ratings yet

- AFAR - Part 1Document18 pagesAFAR - Part 1Myrna LaquitanNo ratings yet

- AC 103 Midterm Exam PDFDocument28 pagesAC 103 Midterm Exam PDFXyriel RaeNo ratings yet

- Coursehero 11Document2 pagesCoursehero 11nhbNo ratings yet

- Philippine Standards and Practice Statements (Final) PDFDocument4 pagesPhilippine Standards and Practice Statements (Final) PDFMica R.No ratings yet

- Colegio de La Purisima Concepcion: School of The Archdiocese of Capiz Roxas CityDocument5 pagesColegio de La Purisima Concepcion: School of The Archdiocese of Capiz Roxas CityJhomel Domingo GalvezNo ratings yet

- Auditing Theory: Audit SamplingDocument11 pagesAuditing Theory: Audit SamplingFayehAmantilloBingcangNo ratings yet

- 4 Responsibility and Transfer Pricing Part 1Document10 pages4 Responsibility and Transfer Pricing Part 1Riz CanoyNo ratings yet

- 01 - Audit of Cash & Cash EquivalentsDocument4 pages01 - Audit of Cash & Cash EquivalentsEARL JOHN RosalesNo ratings yet

- P 1Document8 pagesP 1aneilrosethNo ratings yet

- Bus Com 7Document5 pagesBus Com 7Chabelita MijaresNo ratings yet

- M7 - Understanding The Entity and Its EnvironmentDocument3 pagesM7 - Understanding The Entity and Its EnvironmentAlain CopperNo ratings yet

- Module No. 1 - Week 1 Businessn CombinationDocument5 pagesModule No. 1 - Week 1 Businessn CombinationJayaAntolinAyusteNo ratings yet

- 3 4Document5 pages3 4RenNo ratings yet

- AP.2906 InvestmentsDocument6 pagesAP.2906 InvestmentsmoNo ratings yet

- Partnership Dissolution and Liquidation DrillsDocument6 pagesPartnership Dissolution and Liquidation DrillsMa. Yelena Italia TalabocNo ratings yet

- Aud ThEORY 2nd PreboardDocument11 pagesAud ThEORY 2nd PreboardJeric TorionNo ratings yet

- Long Term Construction Contract Quiz2020Document10 pagesLong Term Construction Contract Quiz2020Riza Mae AlceNo ratings yet

- Aaca Receivables and Sales ReviewerDocument13 pagesAaca Receivables and Sales ReviewerLiberty NovaNo ratings yet

- At 05 Audit Process - Accepting An EngagementDocument4 pagesAt 05 Audit Process - Accepting An EngagementJobby JaranillaNo ratings yet

- AT Quiz 2 - B1Document3 pagesAT Quiz 2 - B1AMNo ratings yet

- Quiz 1Document11 pagesQuiz 1VIRGIL KIT AUGUSTIN ABANILLANo ratings yet

- Revenue From Contracts With CustomersDocument39 pagesRevenue From Contracts With Customersnglc srzNo ratings yet

- CMPC312 QuizDocument19 pagesCMPC312 QuizNicole ViernesNo ratings yet

- Substantive Tests of Expenditure Cycle Accounts Substantive TestsDocument3 pagesSubstantive Tests of Expenditure Cycle Accounts Substantive TestsJuvelyn RedutaNo ratings yet

- Intercompany Sale of Merchandise - AdditionalDocument4 pagesIntercompany Sale of Merchandise - AdditionalJaimell LimNo ratings yet

- Auditing The Finance and Accounting FunctionsDocument19 pagesAuditing The Finance and Accounting FunctionsMark Angelo BustosNo ratings yet

- CW6 - MaterialityDocument3 pagesCW6 - MaterialityBeybi JayNo ratings yet

- Audit Program For EquityDocument12 pagesAudit Program For EquityIra Jean DaganzoNo ratings yet

- Psa 600Document9 pagesPsa 600Bhebi Dela CruzNo ratings yet

- Ap 9004-IntangiblesDocument5 pagesAp 9004-IntangiblesSirNo ratings yet

- Eugenio v. VelezDocument4 pagesEugenio v. VelezRachel LeachonNo ratings yet

- 6banking - Eto TalagaDocument23 pages6banking - Eto TalagaRachel LeachonNo ratings yet

- G.R. No. 119308 - People v. Espanola y PaquinganDocument22 pagesG.R. No. 119308 - People v. Espanola y PaquinganRachel LeachonNo ratings yet

- The Fourth Asian Roundtable On Corporate Governance: Moving Towards Transparency of Ownership and Control: A Case StudyDocument15 pagesThe Fourth Asian Roundtable On Corporate Governance: Moving Towards Transparency of Ownership and Control: A Case StudyRachel LeachonNo ratings yet

- San Beda College of Law: Emory IDDocument1 pageSan Beda College of Law: Emory IDRachel LeachonNo ratings yet

- San Beda College of Law: Dividend in InsolvencyDocument2 pagesSan Beda College of Law: Dividend in InsolvencyRachel LeachonNo ratings yet

- Back Page - CivilDocument1 pageBack Page - CivilRachel LeachonNo ratings yet

- Hiyas Savings and Loan Bank v. Acuna PDFDocument4 pagesHiyas Savings and Loan Bank v. Acuna PDFRachel LeachonNo ratings yet

- 2d-3d LaborDocument4 pages2d-3d LaborRachel LeachonNo ratings yet

- MercialDocument38 pagesMercialRachel LeachonNo ratings yet

- STATCON Midterms - Legal MaximsDocument5 pagesSTATCON Midterms - Legal MaximsRachel LeachonNo ratings yet

- 1code of CommerceDocument5 pages1code of CommerceRachel LeachonNo ratings yet

- Article 10Document2 pagesArticle 10Rachel LeachonNo ratings yet

- 6th Central Pay Commission Salary CalculatorDocument15 pages6th Central Pay Commission Salary Calculatorrakhonde100% (436)

- 2table Jurisdiction RemDocument7 pages2table Jurisdiction RemRachel LeachonNo ratings yet

- Supplement in Criminal Law: Entralized AR PerationsDocument2 pagesSupplement in Criminal Law: Entralized AR PerationsRachel LeachonNo ratings yet

- 2digest CivilDocument121 pages2digest CivilRachel LeachonNo ratings yet

- Case Digests: OF DoctrinesDocument25 pagesCase Digests: OF DoctrinesRachel LeachonNo ratings yet

- 1sod CivilDocument47 pages1sod CivilRachel LeachonNo ratings yet

- Addendum in Remedial Law: San Beda College of LawDocument9 pagesAddendum in Remedial Law: San Beda College of LawRachel LeachonNo ratings yet

- San Beda College of Law: 2005 C B O Annex B T R CDocument3 pagesSan Beda College of Law: 2005 C B O Annex B T R CRachel LeachonNo ratings yet

- Endencia V DavidDocument1 pageEndencia V DavidRachel LeachonNo ratings yet

- Codal LaborDocument5 pagesCodal LaborRachel LeachonNo ratings yet

- G.R. No. 215383Document5 pagesG.R. No. 215383Rachel LeachonNo ratings yet

- Custom Search: Today Is Sunday, May 13, 2018Document4 pagesCustom Search: Today Is Sunday, May 13, 2018Rachel LeachonNo ratings yet

- Jurnal Perdata K 1Document3 pagesJurnal Perdata K 1Edi nur HandokoNo ratings yet

- Supply Chain Management: A Framework of Understanding D. Du Toit & P.J. VlokDocument14 pagesSupply Chain Management: A Framework of Understanding D. Du Toit & P.J. VlokchandanaNo ratings yet

- Pigeon Racing PigeonDocument7 pagesPigeon Racing Pigeonsundarhicet83No ratings yet

- Executive SummaryDocument3 pagesExecutive SummarySofia ArissaNo ratings yet

- Semiotics Study of Movie ShrekDocument15 pagesSemiotics Study of Movie Shreky2pinku100% (1)

- Fort - Fts - The Teacher and ¿Mommy Zarry AdaptaciónDocument90 pagesFort - Fts - The Teacher and ¿Mommy Zarry AdaptaciónEvelin PalenciaNo ratings yet

- Duterte Vs SandiganbayanDocument17 pagesDuterte Vs SandiganbayanAnonymous KvztB3No ratings yet

- PS4 ListDocument67 pagesPS4 ListAnonymous yNw1VyHNo ratings yet

- Activity-Based Management (ABM) Is A Systemwide, Integrated Approach That FocusesDocument4 pagesActivity-Based Management (ABM) Is A Systemwide, Integrated Approach That FocusestogarikalNo ratings yet

- Delegated Legislation in India: Submitted ToDocument15 pagesDelegated Legislation in India: Submitted ToRuqaiyaNo ratings yet

- Grope Assignment 1Document5 pagesGrope Assignment 1SELAM ANo ratings yet

- Economics and Agricultural EconomicsDocument28 pagesEconomics and Agricultural EconomicsM Hossain AliNo ratings yet

- Lecture 4 PDFDocument9 pagesLecture 4 PDFVarun SinghalNo ratings yet

- 4-Page 7 Ways TM 20Document4 pages4-Page 7 Ways TM 20Jose EstradaNo ratings yet

- Military - British Army - Clothing & Badges of RankDocument47 pagesMilitary - British Army - Clothing & Badges of RankThe 18th Century Material Culture Resource Center94% (16)

- Living Greyhawk - Greyhawk Grumbler #1 Coldeven 598 n1Document2 pagesLiving Greyhawk - Greyhawk Grumbler #1 Coldeven 598 n1Magus da RodaNo ratings yet

- For FDPB Posting-RizalDocument12 pagesFor FDPB Posting-RizalMarieta AlejoNo ratings yet

- Post Cold WarDocument70 pagesPost Cold WarZainab WaqarNo ratings yet

- TOURISM AND HOSPITALITY ORGANIZATIONS Di Pa TapooosDocument97 pagesTOURISM AND HOSPITALITY ORGANIZATIONS Di Pa TapooosDianne EvangelistaNo ratings yet

- Tesmec Catalogue TmeDocument208 pagesTesmec Catalogue TmeDidier solanoNo ratings yet

- Chapter 6 Bone Tissue 2304Document37 pagesChapter 6 Bone Tissue 2304Sav Oli100% (1)

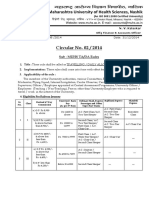

- Circular No 02 2014 TA DA 010115 PDFDocument10 pagesCircular No 02 2014 TA DA 010115 PDFsachin sonawane100% (1)

- Catalogue 2021Document12 pagesCatalogue 2021vatsala36743No ratings yet

- Medication ErrorsDocument5 pagesMedication Errorsapi-456052042No ratings yet

- What Is An Ethical Dilemma?: Decision-Making ProcessDocument7 pagesWhat Is An Ethical Dilemma?: Decision-Making ProcessGauravsNo ratings yet

- Elements of PoetryDocument5 pagesElements of PoetryChristian ParkNo ratings yet

- Book TurmericDocument14 pagesBook Turmericarvind3041990100% (2)

- Cabot - Conductive Carbon Black For Use in Acrylic and Epoxy CoatingsDocument2 pagesCabot - Conductive Carbon Black For Use in Acrylic and Epoxy CoatingsLin Niu0% (1)

- Verb To Be ExerciseDocument6 pagesVerb To Be Exercisejhon jairo tarapues cuaycalNo ratings yet

- Describe The Forms of Agency CompensationDocument2 pagesDescribe The Forms of Agency CompensationFizza HassanNo ratings yet