Professional Documents

Culture Documents

14 Altprob 8e

Uploaded by

Rama DulceOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

14 Altprob 8e

Uploaded by

Rama DulceCopyright:

Available Formats

Exercise 14-1

Determine the

price of bonds;

EXERCISES

issuance; effective

interest

Exercise 14-2

Convertible bonds

LO 14-5

Text: E 14-24

LO 14-2

Text: E 14-3

Ticket, Inc. issued 10% bonds, dated January 1, with a face amount of $240

million on January 1, 2016. The bonds mature in 2025 (10 years). For bonds of

similar risk and maturity the market yield is 12%. Interest is paid semiannually

on June 30 and December 31.

Required:

1. Determine the price of the bonds at January 1, 2016.

2. Prepare the journal entry to record their issuance by Ticket on January 1,

2016.

3. Prepare the journal entry to record interest on June 30, 2016 (at the effective

rate).

4. Prepare the journal entry to record interest on December 31, 2016 (at the

effective rate).

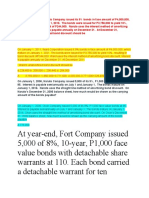

On January 1, 2016, Schmidt Security issued $60 million of 9%, 10-year

convertible bonds at 102. The bonds pay interest on June 30 and December 31.

Each $1,000 bond is convertible into 40 shares of Schmidt's $1 par common

stock. Facial Mapping Company purchased 10% of the issue as an investment.

Required:

1. Prepare the journal entries for the issuance of the bonds by Schmidt and the

purchase of the bond investment by Facial Mapping.

2. Prepare the journal entries for the June 30, 2018, interest payment by both

Schmidt and Facial Mapping assuming both use the straight-line method.

3. On July 1, 2021, when Schmidts common stock had a market price of $33 per

share, Facial Mapping converted the bonds it held. Prepare the journal entries

by both Schmidt and Facial Mapping for the conversion of the bonds (book

value method).

AlternateExercisesandProblems

Copyright2015McGrawHillEducation.Allrightsreserved.

141

Exercise 14-3

Problem 14-1

Reporting bonds at

fair value

Straight-line and

effective interest

compared

LO 14-6

LO 14-2

Text: E 14-30

Text: P 14-3

On January 1, 2016, Unnatural Stone issued $400 million of its 8% bonds for

$368 million. The bonds were priced to yield 10%. Interest is payable

semiannually on June 30 and December 31. Unnatural Stone records interest at

the effective rate and elected the option to report these bonds at their fair value.

On December 31, 2016, the fair value of the bonds was $376 million as

determined by their market value on the NYSE. Unnatural determined that

$2,000,000 of the increase in fair value was due to a decline in general interest

rates.

PROBLEMS

Required:

1. Prepare the journal entry to record interest on June 30, 2016 (the first

interest payment).

2. Prepare the journal entry to record interest on December 31, 2016 (the

second interest payment).

3. Prepare the journal entry to adjust the bonds to their fair value for

presentation in the December 31, 2016, balance sheet.

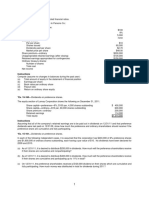

On January 1, 2016, Lamb Services issued $200,000, 9%, four-year bonds.

Interest is paid semiannually on June 30 and December 31. The bonds were

issued at $193,537 to yield an annual return of 10%.

Required:

1. Prepare an amortization schedule that determines interest at the effective

interest rate.

2. Prepare an amortization schedule by the straight-line method.

3. Prepare the journal entries to record interest expense on June 30, 2018, by

each of the two approaches.

4. Explain why the pattern of interest differs between the two methods.

5. Assuming the market rate is still 10%, what price would a second investor pay

the first investor on June 30, 2018, for $20,000 of the bonds?

142

Copyright2015McGrawHillEducation.Allrightsreserved.IntermediateAccounting,

8/e

Problem 14-2

Problem 14-3

Note and

installment note

with unrealistic

interest rate

Early

extinguishment

LO 14-3

Text: P 14-15

LO 14-5

Text: P 14-13

Warren Machinery, Inc. constructed an industrial lathe for

Nelson Equipment that was completed and ready for use on

January 1, 2016. Nelson paid for the conveyor by issuing a $500,000, 4-year

note that specified 5% interest to be paid on December 31 of each year. The

conveyor was custom-built for Nelson so its cash price was unknown. By

comparison with similar transactions it was determined that a reasonable interest

rate was 10%.

Required:

1. Prepare the journal entry for Nelsons purchase of the conveyor on January 1,

2016.

2. Prepare an amortization schedule for the four-year term of the note.

3. Prepare the journal entry for Nelsons third interest payment on December 31,

2018.

4. If Nelsons note had been an installment note to be paid in four equal

payments at the end of each year beginning December 31, 2016, what would

be the amount of each installment?

5. Prepare an amortization schedule for the four-year term of the installment

note.

6. Prepare the journal entry for Nelsons third installment payment on December

31, 2018.

The long-term liability section of Westin Laboratories balance sheet as of

December 31, 2015, included 10% bonds having a face amount of $200 million

and a remaining premium of $30 million. On January 1, 2016, Eastern Post

retired some of the bonds before their scheduled maturity.

Required:

Prepare the journal entry by Westin to record the redemption of the bonds under

each of the independent circumstances below:

1. Westin called half the bonds at the call price of 102 (102% of face amount).

2. Westin repurchased $50 million of the bonds on the open market at their

market price of $52.5 million.

AlternateExercisesandProblems

Copyright2015McGrawHillEducation.Allrightsreserved.

143

You might also like

- 5 6071033631214665766Document3 pages5 6071033631214665766Monny MOM0% (1)

- 13 Altprob 8eDocument3 pages13 Altprob 8eedwin_dauzNo ratings yet

- Mid Term Advanced Accounting 2 - Negina - 19 April 2021Document2 pagesMid Term Advanced Accounting 2 - Negina - 19 April 2021NybexysNo ratings yet

- InstructionsDocument2 pagesInstructionsKhaled AlhowaimelNo ratings yet

- MODAUD2 Unit 4 Audit of Bonds Payable T31516 FINALDocument3 pagesMODAUD2 Unit 4 Audit of Bonds Payable T31516 FINALmimi960% (2)

- BondsDocument2 pagesBondsJuly LumantasNo ratings yet

- CE On Debt SecuritiesDocument2 pagesCE On Debt SecuritiesJean Pierre IsipNo ratings yet

- Far1 Notes ReceivableDocument4 pagesFar1 Notes ReceivableRico Jay EmejasNo ratings yet

- ACC 211 Group Discussion - Bonds PayableDocument2 pagesACC 211 Group Discussion - Bonds Payableglrosaaa cNo ratings yet

- Ch14 180205115701 Answers For The Practice QuestionsDocument72 pagesCh14 180205115701 Answers For The Practice QuestionsMikaela O.No ratings yet

- San Beda College Alabang Homework Exercise-Act851RDocument4 pagesSan Beda College Alabang Homework Exercise-Act851RJomel BaptistaNo ratings yet

- 1 - Notes Payable and Bonds Payable - Part 1Document1 page1 - Notes Payable and Bonds Payable - Part 1John Wendell EscosesNo ratings yet

- CE and HW On Debt SecuritiesDocument3 pagesCE and HW On Debt SecuritiesAmy SpencerNo ratings yet

- Lat NicolaiDocument7 pagesLat NicolaiKennyNovaniNo ratings yet

- Soal Se Akm 2 PDFDocument3 pagesSoal Se Akm 2 PDFrakhaNo ratings yet

- Preliminary Exam - Intermediate Accounting 3Document2 pagesPreliminary Exam - Intermediate Accounting 3ALMA MORENA0% (1)

- Midterm Exam MWF Released To StudentsDocument3 pagesMidterm Exam MWF Released To StudentsAliah AutenticoNo ratings yet

- IA2 Activity4Document8 pagesIA2 Activity4Lalaina EnriquezNo ratings yet

- Determine The Bond Issue Proceeds For Each of The BondsDocument1 pageDetermine The Bond Issue Proceeds For Each of The BondsTaimour HassanNo ratings yet

- INTERMEDIATE ACCOUNTING Vol. 2, Empleo and Robles 2006 Ed, Pp. 123-124Document1 pageINTERMEDIATE ACCOUNTING Vol. 2, Empleo and Robles 2006 Ed, Pp. 123-124Ronn Robby RosalesNo ratings yet

- Financial Liability at Amortized Cost Assignment ReDocument2 pagesFinancial Liability at Amortized Cost Assignment ReRodelLaborNo ratings yet

- Unlock Answers Here Solutiondone - OnlineDocument1 pageUnlock Answers Here Solutiondone - Onlinetrilocksp SinghNo ratings yet

- Bonds Payable: Prepare The Entries To Record The Above TransactionsDocument6 pagesBonds Payable: Prepare The Entries To Record The Above TransactionsJay-L TanNo ratings yet

- Quiz On Other LiabilitiesDocument14 pagesQuiz On Other Liabilitiesimsana minatozakiNo ratings yet

- ACC 106 Final ExaminationDocument5 pagesACC 106 Final ExaminationJezz Culang0% (1)

- CH 14Document71 pagesCH 14Febriana Nurul HidayahNo ratings yet

- p1 24 Bonds PayableDocument5 pagesp1 24 Bonds PayablePrincess MangudadatuNo ratings yet

- Bonds and NotesDocument3 pagesBonds and Notesjano_art21No ratings yet

- Compound Financial Instruments and Note PayableDocument4 pagesCompound Financial Instruments and Note PayablePaula Rodalyn MateoNo ratings yet

- Topic 03 Non-Current Liabilities - Bonds Payable: Intermediate Accounting 2 - Bernadette L. Baul, CPADocument4 pagesTopic 03 Non-Current Liabilities - Bonds Payable: Intermediate Accounting 2 - Bernadette L. Baul, CPAhIgh QuaLIty SVTNo ratings yet

- Solutiondone 305Document1 pageSolutiondone 305trilocksp SinghNo ratings yet

- Exam 1 Practice Questions Summer 2017Document8 pagesExam 1 Practice Questions Summer 2017Sandip AgarwalNo ratings yet

- Financial Accounting Part 2Document5 pagesFinancial Accounting Part 2Christopher Price0% (1)

- A1c - SW#3 PDFDocument3 pagesA1c - SW#3 PDFLemuel ReñaNo ratings yet

- Kontabiliteti I Obligacioneve (Anglisht)Document11 pagesKontabiliteti I Obligacioneve (Anglisht)Vilma HoxhaNo ratings yet

- Bonds Payable QuizDocument2 pagesBonds Payable QuizCha Eun WooNo ratings yet

- Select The Best Answer For Each of The Following 1 OnDocument2 pagesSelect The Best Answer For Each of The Following 1 OnFreelance WorkerNo ratings yet

- Accounting Sample ProblemDocument2 pagesAccounting Sample ProblemMissie Jane AnteNo ratings yet

- 02 Notes Loans and Bonds Payables and Debt Restructuring PDFDocument6 pages02 Notes Loans and Bonds Payables and Debt Restructuring PDFKlomoNo ratings yet

- Be 13 - 1 DKKDocument3 pagesBe 13 - 1 DKKMetolit Kelas ANo ratings yet

- Instructions: (2) Make Amortization Schedule For 3 YearsDocument2 pagesInstructions: (2) Make Amortization Schedule For 3 YearsPatar ElmausNo ratings yet

- Pre-3 Mari HandoutsDocument10 pagesPre-3 Mari HandoutsEmerlyn Charlotte FonteNo ratings yet

- University of Luzon College of Accountnacy Acc 412 - NCL Part 2 NAME: - Problem 1Document3 pagesUniversity of Luzon College of Accountnacy Acc 412 - NCL Part 2 NAME: - Problem 1fghhnnnjmlNo ratings yet

- 15.501/516 Problem Set 7 Long-Term Debt, Leases and Off-Balance Sheet Financing I. Accounting For BondsDocument2 pages15.501/516 Problem Set 7 Long-Term Debt, Leases and Off-Balance Sheet Financing I. Accounting For BondsRadhika KapurNo ratings yet

- Non Current Liabilities San Carlos CollegeDocument12 pagesNon Current Liabilities San Carlos CollegeRowbby Gwyn50% (2)

- Tugas Materi KewajibanDocument1 pageTugas Materi KewajibanandNo ratings yet

- A Short-Term Obligation Can Be Excluded From Current Liabilities If The Company Intends To Refinance It On A Long-Term Basis.Document29 pagesA Short-Term Obligation Can Be Excluded From Current Liabilities If The Company Intends To Refinance It On A Long-Term Basis.cole sprouseNo ratings yet

- Problems - BPDocument11 pagesProblems - BPDM MontefalcoNo ratings yet

- The Following Transactions Were Completed by Montague Inc Whose FiscalDocument1 pageThe Following Transactions Were Completed by Montague Inc Whose Fiscaltrilocksp SinghNo ratings yet

- Financial AccountingDocument46 pagesFinancial AccountingNeil GriggNo ratings yet

- MODADV3 Handouts 2 of 2Document21 pagesMODADV3 Handouts 2 of 2Dennis ChuaNo ratings yet

- FA2 03 Bonds Payable PDFDocument3 pagesFA2 03 Bonds Payable PDFdasdsadsadasdasdNo ratings yet

- (INTACC2) Sample ProblemsDocument8 pages(INTACC2) Sample ProblemsAngelyn AmadorNo ratings yet

- Chapter 14Document54 pagesChapter 14wennstyleNo ratings yet

- Bonds ReviewerDocument7 pagesBonds ReviewerDM MontefalcoNo ratings yet

- متوسطة 2 - د. أحمدDocument4 pagesمتوسطة 2 - د. أحمدLT pudgeNo ratings yet

- Answer Key - M1L2 PDFDocument4 pagesAnswer Key - M1L2 PDFEricka Mher IsletaNo ratings yet

- Soalan Tutorial Liabiliti Bukan SemasaDocument5 pagesSoalan Tutorial Liabiliti Bukan Semasaa194900No ratings yet

- The Asian Bond Markets Initiative: Policy Maker Achievements and ChallengesFrom EverandThe Asian Bond Markets Initiative: Policy Maker Achievements and ChallengesNo ratings yet

- 15 Building Regression Models Part2Document17 pages15 Building Regression Models Part2Rama DulceNo ratings yet

- 6 KWW (16) LTLiab HWSolDocument28 pages6 KWW (16) LTLiab HWSolRama DulceNo ratings yet

- 12 Altprob 8eDocument4 pages12 Altprob 8eRama DulceNo ratings yet

- 13 Altprob 8eDocument3 pages13 Altprob 8eRama DulceNo ratings yet

- Chap 002Document48 pagesChap 002samNo ratings yet

- 16 Altprob 8eDocument4 pages16 Altprob 8eRama DulceNo ratings yet

- 12 Multiple Regression Part2Document9 pages12 Multiple Regression Part2Rama DulceNo ratings yet

- 14 Building Regression Models Part1-2Document15 pages14 Building Regression Models Part1-2Rama DulceNo ratings yet

- 16 Review of Part IIDocument17 pages16 Review of Part IIRama DulceNo ratings yet

- 09 Inference For Regression Part1Document12 pages09 Inference For Regression Part1Rama DulceNo ratings yet

- 14 Building Regression Models Part1-2Document15 pages14 Building Regression Models Part1-2Rama DulceNo ratings yet

- 01 Probability and Probability DistributionsDocument18 pages01 Probability and Probability DistributionsRama DulceNo ratings yet

- 11 Multiple Regression Part1Document13 pages11 Multiple Regression Part1Rama Dulce100% (1)

- Review of Part I Topics OutlineDocument19 pagesReview of Part I Topics OutlineRama DulceNo ratings yet

- 04 Decision Analysis Part2-2 PDFDocument16 pages04 Decision Analysis Part2-2 PDFRama Dulce100% (1)

- 13 Multiple Regression Part3Document20 pages13 Multiple Regression Part3Rama DulceNo ratings yet

- 10 Inference For Regression Part2Document12 pages10 Inference For Regression Part2Rama DulceNo ratings yet

- 07 Simple Linear Regression Part2Document9 pages07 Simple Linear Regression Part2Rama DulceNo ratings yet

- 05 Statistical Inference-2 PDFDocument14 pages05 Statistical Inference-2 PDFRama DulceNo ratings yet

- 04 Decision Analysis Part2-2 PDFDocument16 pages04 Decision Analysis Part2-2 PDFRama Dulce100% (1)

- 06 Simple Linear Regression Part1Document8 pages06 Simple Linear Regression Part1Rama DulceNo ratings yet

- 02 Describing DistributionsDocument14 pages02 Describing DistributionsRama DulceNo ratings yet

- 03 Decision Analysis Part1Document11 pages03 Decision Analysis Part1Rama DulceNo ratings yet

- 05 Statistical Inference-2 PDFDocument14 pages05 Statistical Inference-2 PDFRama DulceNo ratings yet

- Chapter 7Document46 pagesChapter 7Rama DulceNo ratings yet

- Multiple RegressionDocument100 pagesMultiple RegressionAman Poonia100% (1)

- AmylaseDocument1 pageAmylaseRama DulceNo ratings yet

- Home PriceDocument2 pagesHome PriceRama DulceNo ratings yet

- Admin ExcelDocument3 pagesAdmin ExcelRama DulceNo ratings yet

- Option Chain New Website Data NewerDocument77 pagesOption Chain New Website Data Newerudhaya kumarNo ratings yet

- DMGT512 Financial Institutions and ServicesDocument264 pagesDMGT512 Financial Institutions and Serviceskrisari9No ratings yet

- Futures 1Document56 pagesFutures 1Rajat KatariaNo ratings yet

- Compilation of ProblemsDocument9 pagesCompilation of ProblemsCorina Mamaradlo CaragayNo ratings yet

- Maf603-Question Test 2 2021 JulyDocument4 pagesMaf603-Question Test 2 2021 JulyWAN MOHAMAD ANAS WAN MOHAMADNo ratings yet

- SEBI's Role in Capital MarketDocument57 pagesSEBI's Role in Capital MarketSagar Agarwal100% (9)

- FM423 Practice Exam IDocument8 pagesFM423 Practice Exam IruonanNo ratings yet

- Company Profile SharekhanDocument7 pagesCompany Profile Sharekhangarima_rathi0% (2)

- National Institute of Securities Markets: Improving Indian Securitization MarketsDocument21 pagesNational Institute of Securities Markets: Improving Indian Securitization MarketsMehul PaniyaNo ratings yet

- Upload 6Document3 pagesUpload 6Meghna CmNo ratings yet

- Credit Default SwapDocument12 pagesCredit Default SwapHomero García AlonsoNo ratings yet

- SWAP Cocept Construction & ValuationDocument71 pagesSWAP Cocept Construction & ValuationKaushik BhattacharjeeNo ratings yet

- ACTGIA2 CH07 Compound-Financial-InstrumentDocument20 pagesACTGIA2 CH07 Compound-Financial-InstrumentchingNo ratings yet

- Unit 6 Example 2Document2 pagesUnit 6 Example 2RicardoMoody100% (1)

- Role of Private Equity and Venture Capital in Indian Startup CultureDocument78 pagesRole of Private Equity and Venture Capital in Indian Startup CultureJaimin VasaniNo ratings yet

- IDX Monthly-Nov-2015Document111 pagesIDX Monthly-Nov-2015miiekoNo ratings yet

- 2013-9 Doric - The ABCs of ABSDocument16 pages2013-9 Doric - The ABCs of ABSawang90No ratings yet

- Yash Singhal PGSF 2136 - FSA Valuation RatiosDocument3 pagesYash Singhal PGSF 2136 - FSA Valuation RatiosYash SinghalNo ratings yet

- ACCTG 002 HandoutDocument5 pagesACCTG 002 HandoutMelana Muli100% (3)

- Chapter 6 Slides - Orange Coloured Slides Slide 1Document7 pagesChapter 6 Slides - Orange Coloured Slides Slide 1MartinNo ratings yet

- Financial Instrument: What Are Financial Instruments?Document8 pagesFinancial Instrument: What Are Financial Instruments?Sarvan KumarNo ratings yet

- Home ProductDocument4 pagesHome ProductHasibul Islam83% (6)

- Central Depository Company OF Pakistan Limited: An OverviewDocument22 pagesCentral Depository Company OF Pakistan Limited: An OverviewFa De-qNo ratings yet

- Option Profit - Loss Graph Maker - Free From Corporate Finance InstituteDocument5 pagesOption Profit - Loss Graph Maker - Free From Corporate Finance InstituteDestin WillowNo ratings yet

- How To Profit From Theta When Trading SPX Options Business News Minyanville's Wall StreetDocument4 pagesHow To Profit From Theta When Trading SPX Options Business News Minyanville's Wall Streetkljlkhy9No ratings yet

- Differences Between Cash Dividends and Stock DividendsDocument4 pagesDifferences Between Cash Dividends and Stock DividendsUme Aiman Binte NasarNo ratings yet

- Capital Market Instruments Are Basically Either Equity (Stock) Securities or Debt (Bond)Document2 pagesCapital Market Instruments Are Basically Either Equity (Stock) Securities or Debt (Bond)maryaniNo ratings yet

- Finm3404 NotesDocument20 pagesFinm3404 NotesHenry WongNo ratings yet

- Fraud in The Micro-Capital Markets Including Penny Stock FraudDocument559 pagesFraud in The Micro-Capital Markets Including Penny Stock FraudScribd Government DocsNo ratings yet

- The Most Common Market Trap and How To Avoid It. - Trading Articles - Trade2WinDocument10 pagesThe Most Common Market Trap and How To Avoid It. - Trading Articles - Trade2Winf carbullidoNo ratings yet