Professional Documents

Culture Documents

Standalone & Consolidated Financial Results, Limited Review Report For September 30, 2016 (Result)

Uploaded by

Shyam SunderOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Standalone & Consolidated Financial Results, Limited Review Report For September 30, 2016 (Result)

Uploaded by

Shyam SunderCopyright:

Available Formats

Date: November7,2076

To,

The Manager,

Listing Department,

To,

NSE Limited,

Exchange Plaza, Bandra Kurla Complex,

Bandra (E), Mumbai- 400051.

The Manager,

Department of Corporate Relations,

BSE Limited, Pf Towers,

Dalal Street, Fort

Mumbai- 400001.

Dear Sir/Madam,

SUB: Outcome of Board Meeting - reg

Scrip Code: BSE

:532521

NSE: PALREDTEC

Dear Sir,

Pursuant to SEBI (Listing Obligations and Disclosure Requirements) Regulations, 2015, we

herewith submit that the Board of Directors of the Cornpany have at the Meeting held on November

7, 2016, interalia approved the Unaudited Financial Results (Standalone and Consolidated), for the

Second Quarter ended June 30, 2016 and taken on record the Limited Review Report of the

Statutory Auditor.

The meeting commenced at 04.00 PM and concluded at 7.00 PM on November 7,2016.

This is for the information and records of the Exchange.

Encl:

1) Highlights of Q2 Results and Forecast for Q3 Results.

2) Unaudited Financial Results (Standalone and Consolidated) along

with Limited Review Reports

for the Quarter ended September 30, 2015.

PATRED TECHNOTOGIES TIMITED

(FORttlRtY KNOWN AS FOUR SOFT LlMlrED)

CtN No. i L722OOAP1 990PLC033 1 3 1

Ptot No. 2,8'2-703/7/B, Road No. 12, Banjara Hitts, Hyderabad - 500 034'

Tel.efax: +91 40 67138810 I Website: www.palred.com

Dr

To,

07.11.2010

The Manager,

The Manager

Department of Corporate Relations,

Listing Department

National Stock Exchange of India Limited,

Bandra Kurla Complex, Bandra (E),

Mumbai- 400051.

BSE Limited

Pf Towers, Dalal Street,

Mumbai- 400001

Dear Sir,

Sub: Highlights of Consolidated Q2 Results and forecast

for Q3- reg

On a consolidated basis the Company has declared a Net Revenue of 10.11 Cr for ql rc-I7 vs 8.37

Cr in FY 15-16, being turnover of Palred Online Technologies Private Limited, a subsidiary of

Palred Technologies Limited.

In the month of fuly, LatestOne.com, in the process of redesigning the business model and setting

up Mumbai fulfrllment Centre, achieved Net Revenue of only 2.5 Cr against normal run rate of 4

Cr per month.

It also ran a one-time Sales campaign in the month of September which resulted in a loss of 25 lakhs

in 5 days, However, Latestone.com continues to be a direct cost breakeven operation.

LatestOne.com is forecasting to exceed 13 Cr in Net Revenue for Q3 16-17 and reduce losses from

2.5 Cr in the Q.16-17 to 1.0 Cr in Q3 16-17.

Regards,

Palem Sri

Chairman

PATRED TECHNOTOGIES IIMITED

(FORMERtY KNOWN AS FOUR SOFT tlMlTED)

CIN No. : L72200AP1990PLC0331 31

Ptot No. 2,8-2-703/2/8, Road No. 12, Banjara Hitls, Hyderabad - 500 034'

Tetefax : +91 40 67138810 | Website : www'patred.com

Walker Chandiok&Co LLP

Walker Chandiok & Co LLP

(Formerly Walker, Chandiok & Co)

7th Floor, Block lll, White House

Kundan Bagh, Begumpet

Hyderabad 500016

lndia

I t3li333:33;33

Review Report on Quartedy Consolidated Financial Results and Consolidated Year to Date

Results of the Company Putsuant to the Regulation 33 of the SEBI (Listing Obligations and

Disclosure Requirements) Regulations, 2015

To the Board of Directors of Palred Technologies Limited

1..

We have teviewed the accompanying statement of unaudited consolidated ftnanoid, tesults ("the

StatemenC) of Palred Technologies Limited ("the Company') and its subsidiaries (the Company

and its subsidiades together teferred to as "the Group'), fot the quarter ended 30 September 2016

and the year to date results for the period 1 April 201,6 to 30 September 201,6. This Statement is

the tesponsibiJity of the Company's Management and has been approved by the Board of

Directors. Out responsibility is to issue a report on the Statement based on our re.u'iew.

2.

We conducted our teview in accotdance vdth the Standard on Review Engagement (SRE) 2410,

Review of Interim Financial Information Performed by the Independent Auditor of the Entity,

issued by the Institute of Chattered Accountants of India. This standard requires that we plan and

petfotm the teview to obtain moderate assurallce as to whether the Statement is ftee of material

misstatement. A review is limited pdmarily to inquiries of company personnel and analyical

ptocedutes, applied to f,tnancial data arrd thus ptovides less assurance than an audit. We have not

pedormed an audit and accotdingln we do not express on audit opinion.

3.

Based on out teview conducted as above, nothing has come

to out attention that causes us to

believe that the accompanying Statement ptepated in accotdance v'ith applicable accounting

standatds, as notified under the Companies (Accounting Standatds) Rules, 2006 rcadvdth Rule 7

of the Companies (Accounts) Rules, 201.4n respect of Section 1,33 of the Companies Act,2013

and othet tecognised accounting practices and policies has not disclosed the information required

to be disclosed in terms of Regulation 33 of the SEBI pisting Obligations and Disclosure

Requirements) Regulations,201.5, including the manner in vzhich it is to be disclosed, or that it

contains any rnatertal misstatement.

Chartered Accountants

Firm fi.eglstratiorlNo: 001076N/N5000

Partner

Membership No. 207660

Place : Hyderabad

Date:7November2016

Chartercd Accoutrtanb

Offices in Bengaluru, Chandigarh, Chennai, Gurgaon, l-tderabad, Kolkata, Mumbai, New Delhi, Noida and pune

wih limited liability

wih identi'fication number MG2085 and its registered

office at 141 Connaught Circus, New Delhi, 1i0001, India

Walker Chandiok & Co LLP is registered

PAIRED TECHNOLOGIES LIMITED

8-2-703/2/8, ?lot No.2, Road No.12, Bajm llills, llydembad-500 03d Tel

e)

Statcmert ofuoaudited Consolidated Finucial Results for the Ouarter and Six Monthe ended 30 Seotcriber 2016

fINo

{

SI

No.

Particulare

Refer N otes below)

in La}hs exceDt eminqs Der shue

Year ended

Halfyear ended

Ouarter ended

30-SeD-16

30-Iun-16

30-Sep-lli

30-Seo-15

3GSeo-15

runaudited)

(Unaudited)

(Unaudited)

(Unaudited)

(Unaudited)

3l-Mzr-16

(Audited)

Incone from opcrations

(a)

Net Sales/Incorc from Operations

1.02

7,73484

836 93

2,745 86

7,576.17

3,818.33

1,077 02

7,134 84

836 93

2,745 86

1,576.7'l

3,818 33

286 86

427 26

403.58

174'r2

619.72

7,521 06

'r3'l94

10.07

148 01

(60.52)

(e4.69,

146 47

131 02

101 81

217 49

193,00

474 68

17.03

18 07

11 04

260.96

215.08

1,01

(Net ofexcise duty)

@) Othet Opeating Income

Total income frcm Opentions (net)

2 E:rpenses

(a) Purchaes of stock-in-trade

Q) Chmges h inventories of stock-in-tade

(c) Emptoyee benefits expense

(Q Depteciation md mottisation expose

(e) Distribution expmses

(f Business Pronotion expenses

(g) Othet expenses

Total e:gensee

3

/ (Ioss) from

Profit

opemtions beforc other income

/ (Inss) fron ordinayactivities

Profit

beforc finmcr

35 10

23 30

57 56

476 04

413.78

990 55

2,483 97

339.22

464.21

619 68

803

49

7,769.36

718 41

159 29

229 52

337 70

342 60

79417

r,366_89

1,425 06

1,578 06

2,79195

2,70124

6,233 84

(1,184.41

(2,415 51)

(3ss.87)

Q90.22)

finance co6ts and exceptional iteme (1 - 2)

4 Othet income

Q2.e2)

Q4r.13)

59.56

(646.0e)

34 42

47.39

81.81

212.53

(321 45)

(242.83)

(681

s4

(s6428)

(e71 e4)

(2,108 61)

(242 83)

0.1e)

(68276)

0.38)

(321 45)

(564.28)

(e73 32)

Q8.74"

(2,147 35)

(321 4q\

(242 E3)

(682.76)

(564.28)

(e73.32)

(2,147.35)

(321 4q\

(242 83)

(682.76)

(s64.28)

(973 32)

(2,1s7

(321 45)

Q42.83)

(68276)

(s6428)

(e73.32)

(2,157.1s)

306.90

costs and exceptiond items (3 + 4)

6

Finmce costs

Prcfit

(Ioss) from ordinary activities afte. finaac

but bcfore exceptional items (5 1 6)

8

Exceptional

Prcfit

costr

iterc

(Iress) frcm ordinary activities bfor

td

(7+8)

10 Tar expmse

11

Net Prcfit

(e

(e 80)

(Loes) from ordinary activities after

tu

12 Extn-ordhary items (net of

tu

expense)

t3 Net prcfir / (Iase) for thc period

t4 Sbre of profit/(loss) of asociates

yezt

(ll+

12)

t5 Minotity interest

44 67

t6 Net Profit/(Iass) after tues, minodty interest md shan

of proft/(lose) of associates (13114115)

7-1

ls)

10)

Paid-up equity shue capital (Face value {1 0 per shre)

(refer note 4)

18 Resene excludhg tevaluation tesewes

47 42

746.69

86.09

257 00

484 73

(276.78)

Q0141)

(s36.07)

(478.19)

Q1632)

(1,673.02)

821 37

821 31

180 74

827 37

180.14

827 3r

per balmce sheet o

1,299 62

Pre\1ou rccombng yed

shre @eforc extnordinary items)

eech) (not annualised) (rcfer note 4) :

19.i Eamings per

(oft10/(a) Breic

37.

Q) Diluted

19.ii

(2.4s)

(6.08.

(s.82:

(s 06)

05.01

(2.4s)

(6.08,

(5 82.

(s 06)

(1s.01

(2.45)

(6 08.

(s.82.

(s 06)

(1s.02

(2.4s)

(6 08.

(5.82.

(s 06)

0s 0z

Emings per shre (after extnordinary itens)

(oft10/- each) (aot annualised) (refer note 4) :

(a) Broic

@) Diluted

See accomgaying notes to the consolidated Enmcial results

Q.37,

(3 3r.

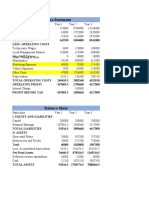

itatement of Assets and Liabilities

Particulare

As at

3GScp-16

(Unaudited)

A.

{ in lakhs

As at

3l-Mer-16

(Audited)

EQUITYAND LIABILITIES

Shueholdenr firnds

!)

Shae capital

827 31

p) Reseres md sulplus

Sub-total - Sharcholdemr funds

821

3l

2.847 84

3-299 62

3.669 15

4.120 93

89 28

85.07

2 Minority Intercst

3 Non-curent liabilities

Long-tem provisions

Sub-total - Non-curent liabilities

5.23

.a)

5.23

523

220 43

221 62

476 76

901 61

Cunent liabilities

ia) Trade payables

!)

Othet

orent

!) Shott-tem

liabilities

provisions

lub-total - Cunent liabilities

TOTAL - EQUITYAND LIABILITIES

001

001

636 60

1.135.30

4,400.26

5,346.53

B. {SSETS

1

Non-crent

assete

'a)

Fired assets

753.92

166 88

Goodwill on consolidation

405.30

324 96

t) Long-tem loms ud advuces

iub-total - Nol-cuncnt a66ets

974 54

841 27

2,450 98

3,409.23

41287

560 88

26277

378 72

239 94

102 59

9urnt as8ets

a) Curmt in=strnents

b) Invmtories

t) Cash md bark balmces

Q Short-tem loms md advmces

'e)

Odret

onmt

csets

719 82

108 50

iub-total - Curcnt a66ct6

3,48512

4,499 32

TOTAL. ASSETS

4400.26

5,346.53

\oteE:

Lhe above uaudlted consolldated 8nmc6l results ha1re been rcuewed by the Audlt

Comittee md

approved by the Boatd of Directors in its meettng held on

'

Novembet 2016

uder Regulation 33 of Seorities md Exchmge Boud of India (Listing Obligation md Disclosute Requirements) Regulations, 2015 is no

the Compmy hm only one repottable segrnent "Trading online in computets, mobiles, electronic ptoducts md ptoviding telated seryices" The Compm

prorides additiolal senices for such ttaded products to tlle customers. The group of ptoduct md senices are dated md subject to the sme risk md retums.

2 The

segment reporting

rp'plicable

3.

Key stmdalone fmmcial infomation of the Compay is qiven belowr

Quarter ended

Particulare

JU-JeD-rO I

#lun-lo

(Unaudited)l (Unaudited)

ncome ltom (JPetatrons

)rofit/(Loss) before tax

)tofit/(Loss) after w

(21.s0)

(29 20',

(27 50',

().(l

).(l

Half-Yer

ended

JU-SeD-D I JrJeD-lO I JrJeD-lt

(IJnauditcd) | (Unaudited)

(Uraudited)

(36.e4

(\6 q4

(s0.70)

Year ended

Jl-Mar-lb

(Audited)

23.06

(87.8D

/qR

Rl)

The Compmy has consolidated its 2 equity shres of {5 each into 1 equity shate of {10 each in its Ertta-Ordinay General neetiog held on 13 Norcmber 2015 Thr

Jompmy obtained the nece ssary approval from the stock exchmges md ttading of equity shres with new face value of {10 per shue has resued eFfective from 9 Ma,

1016. The effect of this consolidation of equity shres hm been given in computing emings per shre of all periods prcsented.

The 6ores for prerious oeriod/veu had been teaouoed/reclmsified

wherevet necessd.

of the

Bord

of Directors of

Limited

'lace: Hydetabad

)ate: 7 November 2016

Dircctor

Walker Chandiok&Co LLP

Walker Chandiok & Co LLP

(Formerly Walker, Chandiok & Co)

7th Floor, Block lll, White House

Kundan Bagh, Begumpet

Hyderabad 500016

india

T +91 40 6630 8200

F +91 40 6630 8230

Review Report on Quartedy Financial Results and Consolidated Year to Date Results of the

Company Putsuant to the Regulation 33 of the SEBI (Listing Obligations and Disclosure

Requirements) Regulations, 2015

To the Board of Directors of Palted Technologies Limited

L

We have reviewed the accompanying statement of unaudited standalone ltnancial results ("the

Statement') of Palred Technolog'ies Limited ("the Company') for the quarter ended 30 September

2016 and the yeat to date tesults for the pedod 1 April 2016 to 30 September2016. This Statement

is the tesponsibility of the Company's Management and has been approved by the Board of

Directots. Out responsibility is to issue a report on the Statement based on our review.

We conducted out teview in accotdance with the Standard on Review Engagement (SRE) 2410,

Review of Interirn Financial Information Performed by the Independent Auditor of the Entity,

issued by the Institute of Chateted Accountants of India. This standard requires that we plan and

perfotm the review to obtain modetate assurance as to whether the Statement is free of material

misstatement. A teview is limited pf,rrrartly to inquiries of company personnel and analyical

procedutes, appJied to financial data and thus provides less assurance than an audit. We have not

petfotmed an a:udit and accordingly, we do not express an audit opinion.

Based on out teview conducted as above, nothing has come

to our attention that causes us to

believe that the accompanying Statement prepared in accordance with applicable accounting

standatds, as notified under the Companies (Accounting Standards) Rules, 2006 readwith Rule 7

of the Companies (Accounts) Rules, 201,4 n respect of Section 1.33 of the Companies Act,2013

and othet recognised accounting ptactices and policies has not disclosed the information required

to be disclosed in tetms of Regulation 33 of the SEBI (I-isting Obligations and Disclosure

Requtrements) Regulations,20'1.5, including the manner in which it is to be disclosed, or that it

contains any material misstatement.

h?s#.

\n$'

Chartered Accountants

FirmfRegistration No:

001

076N/N50001

Partner

Membetship No. 207660

Place : Hyderabad

Date:7November2016

Chartered Accountants

Offices in Bengaluru, Chandigarh, Chennai, curgaon, Hyderabad, Kolkata, Mumbai, New Delhi, Noida and pune

Walker Chandiok & Co LLP is registered with limited tiabitity

with identification number MC-2085 and its registered

otfice at 141 Connaught Circus, New Delhi, 110001, Indja

PALRED TECHNOLOGIES LIMITED

ftI.No.8-2-703/2/8. Plot No.2. Road No.12. Banira Hills. Hvdembad-500 034. Telmsma)

StateEent of Unaudited Stmdalone Fimcial Results for the Qurter and Six Mmths Ended 30 September 2015

sl.

No.

{ in La}hs except emings pa shr,

Yer ended

ver ended

Half

Quarter ended

3G.Sep-16

3O-Im-16

30-Sep-15

(Unaudited)

(Unaudited)

(Unaudited)

16.06

15.98

22.94

32.0'

4.95

4.8',1

5.93

9.8'.

15.55

8.13

9.23

,d) Legal aod professional

'e) Rates md taxes

4.80

8.69

2.67

fl Other

Refer Notes below)

30-Sep-16

I

30-See'15

31-Mr-16

(Unaudited)

(Audited)

I lncone from Operations

Net Sales/Income from Opentions

acise duty)

.a)

J.,let of

Other Operating Income

!)

fotal income from Operations (net)

2 Expmses

a) Employee beaeEts upense

ilo)

Depreciation md mortisation expense

t)

Office maintmance

expenses

fotal expenses

J

Profit / (Ioss) from operations before other income

inmce costs md exceptional items (1 :2)

Jthet income

48.71

100.08

lJ.Jr

26.49

23.6i

18.81

4.01

5.72

13.41

16.81

63.73

7.00

3.82

9.6',

8.2

13.48

8.47

9.72

25 03

18.1

52.50

5439

72.0'1

106.81

(s4 3e)

Q2.07)

006.8e

(52.50)

)).tl

(1

43.8r

61.15

749.8.

307.00

49.83

(307.00)

31.00

25.19

fnmct

(21.50)

Qe,20)

Q6.2e)

(t

iinance costs

lrofit / (Inss) fiom ordinary activities after finmct

(21.s0)

(2e.20)

Q6.e4)

(s0 70

23.0r

(81 8T

Q1.s0)

Qe.20)

(36. e4)

(s0 70

230

(87.87)

Ql.s0)

Qe.20)

(36. e4)

(s0 70

230

(e8.81)

(21.s0)

Qe.20)

Q6.e4)

(s0.70

230

(e8.81)

827.3

827.3

780.74

827.3

780.7

827.37

Profit

/ (Inss) from ordinary activities

before

:osts end exceptiond items (3 + 4)

(0.6s)

:osts but before exceptional items (5 + 6)

8

56.1!

itms

lrofit / (Loss) fiom ordinary activities before tu

'7+8)

773.5,

(so.7o

(0.6s

fu apense

t1 t{et Profit / (Loss) from ordinary activities after

'9

84

00.e4)

til

10)

ixtra-ordinary items (net of

(Loss) for the

B {et profit /

tu

expense)

peiod / yen (ll ! li2)

Pzid-up equity shre capitd (Face value {10

tefer note 3)

15 Reserue excluding Revaluation Resen'es m

rf pterious accounting

t6.i

(0

ixceptional

10

1,4

220.04

(87.00)

pu shre)

pu balmce

sheet

5,007.91

yer

Emings per shae (before extraordinary items)

(of t10/- each) (not mualised) (refer note 3) :

l)

Bmic

(0.26.

(0 36

(0.42)

(0.62

1r

(0.8e)

Jo) Diluted

(0.26

(0 36

Q.a)

(0.62

1r

(0.8e)

(o.26.

(0.36

(0.42)

(0.62

0.1r

(0.8e)

(0.26.

(0.36

(0.42)

(0.62

0.1t

(0.8e)

t6.n Eamings per share (a.fter extraordinary items)

,a)

{10/- each) (not mualised) (refer note 3)

Buic

!)

Diluted

3ee

accompanying notes to the stmdalone Enancial results

(of

itatement of Assets md Liabilities

( m l2Kn

Stmddone

Particulrs

30-Sep-16

As at

As at

31-Mar-16

(Unaudited)

(Audited)

A, EQUITYAND LIASILITIES

I Shueholders' funds

(a) Share capital

821.31

821 31

(b) Reserues and surplus

4,957 2',

5-007 9t

Sub-total - Shareholders' funds

5.778.5t

5,829.21

77:

1.7:

114

1.

Non-cment liabilities

(a) Long-tem provisioos

Sub-total - Non-cwent liabilitics

/:

Curent liabilities

(a) Other

curent liabilities

Sub-total -

Cuent liabilities

TOTAL . EQUITY AND LIABILITIES

38 5t

48 9l

38.5t

48 9l

5,818.9(

5,879.9!

B. ASSETS

1

Non-cuent

assets

(a) Fixed assets

49.21

5822

@) Non-current inrestmeots

(c) hng-tem loans and advances

3,354 0(

48s3.0(

Sub-total - Non-curent assets

3-751 8!

5,262.71

2,072.8:

513 6(

41 9l

40.3:

60

01:

3.0!

2.061 01

611.21

5,818.91

5,879.9!

Curent

(a)

348.6t

(d) Other current assets

Sub-total -

Cuent

assets

TOTAL - ASSETS

\,lotes:

-I'he

)-',

assets

Curent inrestments

@) Cash and bank balances

(c) Short-tem loans and advances

1.

Jf I

01:

aborc unaudited standalone hnancial results have been reviewed by the Audit Comittee and apptor-ed by the Board of Directors in its meeting held on

November 2016

2 Pusuant to the sa.le of

ttansportation and logistics softwtre products business in 2073-14 znd completion of capital reduction plm, the nanagement of th(

Company is evaluating busiress opportunities in the areas oF

3 The

Company has consolidated its 2 equity shares of

{5

IT

solutions and sen'ices md cwendy has no reportable segment

into 1 equity shue of {10 each in its Extra-Ordinary General meeting held on 13 November 2015

The Company obtained the necessary approval from the stock exchanges and trading of equity shres with new face va.lue of {10 pet share has reswed effectivr

Itoa 9 Mzy 2076. The effect of this corsolidation of equity shares has been given in computing ernings per share of all periods presented

each

4. The frgures for prer.ious period,/vear had been resrouoed/reclassiFred whererrcr necssary,

Botd

Place: Hyderabad

Date: 7 Novmber 2016

of Directors of

You might also like

- Provincial Facilitation for Investment and Trade Index: Measuring Economic Governance for Business Development in the Lao People’s Democratic Republic-Second EditionFrom EverandProvincial Facilitation for Investment and Trade Index: Measuring Economic Governance for Business Development in the Lao People’s Democratic Republic-Second EditionNo ratings yet

- Standalone & Consolidated Financial Results, Limited Review Report For September 30, 2016 (Result)Document6 pagesStandalone & Consolidated Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderNo ratings yet

- Miscellaneous Intermediation Revenues World Summary: Market Values & Financials by CountryFrom EverandMiscellaneous Intermediation Revenues World Summary: Market Values & Financials by CountryNo ratings yet

- Standalone Financial Results, Limited Review Report For June 30, 2016 (Result)Document4 pagesStandalone Financial Results, Limited Review Report For June 30, 2016 (Result)Shyam SunderNo ratings yet

- Standalone & Consolidated Financial Results, Auditors Report For March 31, 2016 (Result)Document9 pagesStandalone & Consolidated Financial Results, Auditors Report For March 31, 2016 (Result)Shyam SunderNo ratings yet

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Document5 pagesStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderNo ratings yet

- Standalone Financial Results, Limited Review Report For June 30, 2016 (Result)Document3 pagesStandalone Financial Results, Limited Review Report For June 30, 2016 (Result)Shyam SunderNo ratings yet

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Document4 pagesStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderNo ratings yet

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Document8 pagesStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderNo ratings yet

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Document4 pagesStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderNo ratings yet

- Standalone & Consolidated Financial Results, Limited Review Report For June 30, 2016 (Result)Document6 pagesStandalone & Consolidated Financial Results, Limited Review Report For June 30, 2016 (Result)Shyam SunderNo ratings yet

- Standalone Financial Results, Limited Review Report For June 30, 2016 (Result)Document4 pagesStandalone Financial Results, Limited Review Report For June 30, 2016 (Result)Shyam SunderNo ratings yet

- Financial Results, Limited Review Report For December 31, 2015 (Result)Document3 pagesFinancial Results, Limited Review Report For December 31, 2015 (Result)Shyam SunderNo ratings yet

- Standalone & Consolidated Financial Results, Limited Review Report For June 30, 2016 (Result)Document10 pagesStandalone & Consolidated Financial Results, Limited Review Report For June 30, 2016 (Result)Shyam SunderNo ratings yet

- Standalone Financial Results, Limited Review Report For June 30, 2016 (Result)Document5 pagesStandalone Financial Results, Limited Review Report For June 30, 2016 (Result)Shyam SunderNo ratings yet

- Financial Results, Limited Review Report For December 31, 2015 (Result)Document8 pagesFinancial Results, Limited Review Report For December 31, 2015 (Result)Shyam SunderNo ratings yet

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Document5 pagesStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderNo ratings yet

- Financial Results, Limited Review Report For December 31, 2015 (Result)Document9 pagesFinancial Results, Limited Review Report For December 31, 2015 (Result)Shyam SunderNo ratings yet

- Financial Results & Limited Review Report For Dec 31, 2015 (Standalone) (Result)Document4 pagesFinancial Results & Limited Review Report For Dec 31, 2015 (Standalone) (Result)Shyam SunderNo ratings yet

- Financial Results, Limited Review Report For December 31, 2015 (Result)Document3 pagesFinancial Results, Limited Review Report For December 31, 2015 (Result)Shyam SunderNo ratings yet

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Document4 pagesStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderNo ratings yet

- Announces Q1 Results (Standalone) & Limited Review Report (Standalone) For The Quarter Ended June 30, 2016 (Result)Document3 pagesAnnounces Q1 Results (Standalone) & Limited Review Report (Standalone) For The Quarter Ended June 30, 2016 (Result)Shyam SunderNo ratings yet

- Standalone Financial Results, Limited Review Report For June 30, 2016 (Result)Document2 pagesStandalone Financial Results, Limited Review Report For June 30, 2016 (Result)Shyam SunderNo ratings yet

- Standalone Financial Results, Limited Review Report For June 30, 2016 (Result)Document4 pagesStandalone Financial Results, Limited Review Report For June 30, 2016 (Result)Shyam SunderNo ratings yet

- Standalone Financial Results, Limited Review Report For June 30, 2016 (Result)Document6 pagesStandalone Financial Results, Limited Review Report For June 30, 2016 (Result)Shyam SunderNo ratings yet

- Standalone & Consolidated Financial Results, Limited Review Report For June 30, 2016 (Result)Document5 pagesStandalone & Consolidated Financial Results, Limited Review Report For June 30, 2016 (Result)Shyam SunderNo ratings yet

- Standalone & Consolidated Financial Results, Limited Review Report For September 30, 2016 (Result)Document11 pagesStandalone & Consolidated Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderNo ratings yet

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Document4 pagesStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderNo ratings yet

- Standalone Financial Results, Limited Review Report For June 30, 2016 (Result)Document3 pagesStandalone Financial Results, Limited Review Report For June 30, 2016 (Result)Shyam SunderNo ratings yet

- Standalone Financial Results, Limited Review Report For June 30, 2016 (Result)Document7 pagesStandalone Financial Results, Limited Review Report For June 30, 2016 (Result)Shyam SunderNo ratings yet

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Document4 pagesStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderNo ratings yet

- Announces Q3 Results (Standalone), Limited Review Report (Standalone) & Results Press Release For The Quarter Ended December 31, 2015 (Result)Document5 pagesAnnounces Q3 Results (Standalone), Limited Review Report (Standalone) & Results Press Release For The Quarter Ended December 31, 2015 (Result)Shyam SunderNo ratings yet

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Document5 pagesStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderNo ratings yet

- Standalone Financial Results, Limited Review Report For December 31, 2016 (Result)Document8 pagesStandalone Financial Results, Limited Review Report For December 31, 2016 (Result)Shyam SunderNo ratings yet

- Financial Results, Limited Review Report For December 31, 2015 (Result)Document4 pagesFinancial Results, Limited Review Report For December 31, 2015 (Result)Shyam SunderNo ratings yet

- Standalone Financial Results, Limited Review Report For June 30, 2016 (Result)Document4 pagesStandalone Financial Results, Limited Review Report For June 30, 2016 (Result)Shyam SunderNo ratings yet

- Standalone Financial Results, Form A, Auditors Report For March 31, 2016 (Result)Document6 pagesStandalone Financial Results, Form A, Auditors Report For March 31, 2016 (Result)Shyam SunderNo ratings yet

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Document4 pagesStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderNo ratings yet

- Standalone Financial Results, Limited Review Report For June 30, 2016 (Result)Document5 pagesStandalone Financial Results, Limited Review Report For June 30, 2016 (Result)Shyam SunderNo ratings yet

- Standalone Financial Results, Limited Review Report For June 30, 2016 (Result)Document5 pagesStandalone Financial Results, Limited Review Report For June 30, 2016 (Result)Shyam SunderNo ratings yet

- Financial Results & Limited Review Report For Dec 31, 2015 (Standalone) (Result)Document3 pagesFinancial Results & Limited Review Report For Dec 31, 2015 (Standalone) (Result)Shyam SunderNo ratings yet

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Document4 pagesStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderNo ratings yet

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Document5 pagesStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderNo ratings yet

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Document4 pagesStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderNo ratings yet

- Announces Q2 Results (Standalone), Limited Review Report (Standalone) & Results Press Release For The Quarter Ended September 30, 2016 (Result)Document7 pagesAnnounces Q2 Results (Standalone), Limited Review Report (Standalone) & Results Press Release For The Quarter Ended September 30, 2016 (Result)Shyam SunderNo ratings yet

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Document6 pagesStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderNo ratings yet

- Standalone Financial Results, Limited Review Report For June 30, 2016 (Result)Document5 pagesStandalone Financial Results, Limited Review Report For June 30, 2016 (Result)Shyam SunderNo ratings yet

- Standalone Financial Results, Limited Review Report For June 30, 2016 (Result)Document5 pagesStandalone Financial Results, Limited Review Report For June 30, 2016 (Result)Shyam SunderNo ratings yet

- Financial Results, Limited Review Report For December 31, 2015 (Result)Document7 pagesFinancial Results, Limited Review Report For December 31, 2015 (Result)Shyam SunderNo ratings yet

- Standalone Financial Results, Form A, Auditors Report For March 31, 2016 (Result)Document7 pagesStandalone Financial Results, Form A, Auditors Report For March 31, 2016 (Result)Shyam SunderNo ratings yet

- Standalone Financial Results, Limited Review Report For June 30, 2016 (Result)Document4 pagesStandalone Financial Results, Limited Review Report For June 30, 2016 (Result)Shyam SunderNo ratings yet

- Standalone Financial Results, Limited Review Report For June 30, 2016 (Result)Document4 pagesStandalone Financial Results, Limited Review Report For June 30, 2016 (Result)Shyam SunderNo ratings yet

- Standalone & Consolidated Financial Results, Limited Review Report For September 30, 2016 (Result)Document6 pagesStandalone & Consolidated Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderNo ratings yet

- Standalone Financial Results, Limited Review Report For June 30, 2016 (Result)Document3 pagesStandalone Financial Results, Limited Review Report For June 30, 2016 (Result)Shyam SunderNo ratings yet

- Financial Results, Limited Review Report, Results Press Release For December 31, 2015 (Result)Document8 pagesFinancial Results, Limited Review Report, Results Press Release For December 31, 2015 (Result)Shyam SunderNo ratings yet

- Standalone Financial Results, Limited Review Report For September 30, 2015 (Result)Document8 pagesStandalone Financial Results, Limited Review Report For September 30, 2015 (Result)Shyam SunderNo ratings yet

- Standalone Financial Results, Limited Review Report For December 31, 2016 (Result)Document4 pagesStandalone Financial Results, Limited Review Report For December 31, 2016 (Result)Shyam SunderNo ratings yet

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Document5 pagesStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderNo ratings yet

- Standalone Financial Results, Limited Review Report For June 30, 2016 (Result)Document3 pagesStandalone Financial Results, Limited Review Report For June 30, 2016 (Result)Shyam SunderNo ratings yet

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Document4 pagesStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderNo ratings yet

- PDF Processed With Cutepdf Evaluation EditionDocument3 pagesPDF Processed With Cutepdf Evaluation EditionShyam SunderNo ratings yet

- Standalone Financial Results For March 31, 2016 (Result)Document11 pagesStandalone Financial Results For March 31, 2016 (Result)Shyam SunderNo ratings yet

- Standalone Financial Results For September 30, 2016 (Result)Document3 pagesStandalone Financial Results For September 30, 2016 (Result)Shyam SunderNo ratings yet

- Standalone Financial Results, Limited Review Report For June 30, 2016 (Result)Document3 pagesStandalone Financial Results, Limited Review Report For June 30, 2016 (Result)Shyam SunderNo ratings yet

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Document4 pagesStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderNo ratings yet

- Investor Presentation For December 31, 2016 (Company Update)Document27 pagesInvestor Presentation For December 31, 2016 (Company Update)Shyam SunderNo ratings yet

- Transcript of The Investors / Analysts Con Call (Company Update)Document15 pagesTranscript of The Investors / Analysts Con Call (Company Update)Shyam SunderNo ratings yet

- Standalone Financial Results, Limited Review Report For December 31, 2016 (Result)Document4 pagesStandalone Financial Results, Limited Review Report For December 31, 2016 (Result)Shyam SunderNo ratings yet

- ACCA F5 Class NotesDocument177 pagesACCA F5 Class NotesAzeezNo ratings yet

- Abm Acctg Firm Section 2am 2Document40 pagesAbm Acctg Firm Section 2am 2Diana Rosales CalNo ratings yet

- Basis of Accounting: Cash Basis Accrual BasisDocument4 pagesBasis of Accounting: Cash Basis Accrual BasisAndraNo ratings yet

- Cma p1 Mock Exam 2 ADocument34 pagesCma p1 Mock Exam 2 ATalalTANo ratings yet

- Working Capital Management (Divya Jadi Booti)Document61 pagesWorking Capital Management (Divya Jadi Booti)Michael AdhikariNo ratings yet

- ACC106 Assignment AccountDocument5 pagesACC106 Assignment AccountsyafiqahNo ratings yet

- F & B Management Notes 6th Semester IHMDocument113 pagesF & B Management Notes 6th Semester IHMSpatiha Pathmanaban94% (17)

- Sukalp Parihar1Document45 pagesSukalp Parihar1Vandita KhudiaNo ratings yet

- M&A - Cia Ii: Gammon India Ltd. and AtslDocument7 pagesM&A - Cia Ii: Gammon India Ltd. and AtslAnurag JaiswalNo ratings yet

- Cfas NotesDocument15 pagesCfas NotesGio BurburanNo ratings yet

- Capital Investment Decisions: 1: Question IM 13.1 AdvancedDocument7 pagesCapital Investment Decisions: 1: Question IM 13.1 AdvancedrahimNo ratings yet

- I. Title: Tax Refund Case of Philippine Airlines On Its Imported Cigarettes, Wines, and LiquorsDocument16 pagesI. Title: Tax Refund Case of Philippine Airlines On Its Imported Cigarettes, Wines, and LiquorsEina Rivera TapnioNo ratings yet

- ABC FinalsDocument10 pagesABC Finalsnena cabañesNo ratings yet

- Midland Energy Resources Case AssignmentDocument10 pagesMidland Energy Resources Case AssignmentAndrew ChoiNo ratings yet

- Income From Business and ProfessionDocument14 pagesIncome From Business and Professionimdadul haqueNo ratings yet

- 02 The Analysis of Financial StatementsDocument26 pages02 The Analysis of Financial StatementsAidil IdzhamNo ratings yet

- AF301 Unit 7 Positive Accounting TheoryDocument41 pagesAF301 Unit 7 Positive Accounting TheoryNarayan DiviyaNo ratings yet

- Formative Assesment m2 - ConfrasDocument3 pagesFormative Assesment m2 - ConfrasAngel DIMACULANGANNo ratings yet

- International Financial Reporting Standards - FinaDocument13 pagesInternational Financial Reporting Standards - FinanishanthanNo ratings yet

- Cost Management Accounting SystemDocument239 pagesCost Management Accounting SystemPathshala ki duniyaNo ratings yet

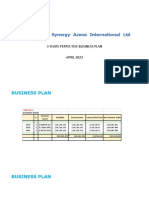

- Synergy Arena International LTD: 3 Years Perpective Business Plan APRIL 2023Document10 pagesSynergy Arena International LTD: 3 Years Perpective Business Plan APRIL 2023brook emenikeNo ratings yet

- Salary Slip - Jan - 2024Document1 pageSalary Slip - Jan - 2024lonely mudasirNo ratings yet

- Report To Pam Bondi Regarding PDFDocument65 pagesReport To Pam Bondi Regarding PDFAngela V. Woodhull, Ph.D.No ratings yet

- 01 Equity MethodDocument41 pages01 Equity MethodAngel Obligacion100% (1)

- Acca TX Uk Fa 2021 Manual Notes.Document65 pagesAcca TX Uk Fa 2021 Manual Notes.Max Lino PayyampallilNo ratings yet

- Urban Water PartnersDocument2 pagesUrban Water Partnersutskjdfsjkghfndbhdfn100% (2)

- Document 6Document2 pagesDocument 6Daniel YaremenkoNo ratings yet

- Form No. 16A: From ToDocument2 pagesForm No. 16A: From ToMurthy KarumuriNo ratings yet

- Comparative Financial Performance of HDFDocument20 pagesComparative Financial Performance of HDFShaheen AlviNo ratings yet

- Corporate Taxation: Marilou Pacho-Garcia, CPA, MBADocument39 pagesCorporate Taxation: Marilou Pacho-Garcia, CPA, MBAMarilou Garcia100% (3)