Professional Documents

Culture Documents

Ibc - A Guide To Your Ctax Bill 2016-17

Uploaded by

sachin_sawant1985Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Ibc - A Guide To Your Ctax Bill 2016-17

Uploaded by

sachin_sawant1985Copyright:

Available Formats

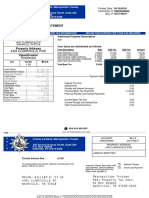

A GUIDE TO YOUR COUNCIL TAX BILL

If you have received a Council Tax bill and you wish to understand how your bill has been worked out, use

the guide below. Please check all the details are correct, if not please tell us immediately if anything is

wrong or missing.

IF YOUR CIRCUMSTANCES CHANGE, YOU MUST TELL US WITHIN 21 DAYS. IF YOU DO NOT, YOU

MAY RECEIVE A FINE

Name and Address This is the person/s responsible for paying the bill and their contact

address

Account Number This is your Council Tax Account Reference number (please quote this

number when you contact us)

Date of Bill This is the date your Council Tax bill was issued

Bill reason A Council Tax bill is sent to you each year in March and a revised bill is sent if there

are any changes to your account during the year

Property to which this bill relates This is the address that we are billing you for

Statement of Account This shows any charges, council tax reduction, discounts or exemptions

applied to your bill and the period it covers

At the bottom of this box, it will show the total amount you will have to pay for the year

Property Reference This number is unique to your property (but please quote your council tax

account reference number when you contact us)

Property Value Band This is the valuation band for your property. For more information on

property banding, contact the Valuation Office www.voa.gov.uk or call 03000 501 501

Charges This is the total Council Tax charge for your property. The relevant amounts are then

allocated to each organization for your bill. Ipswich Borough Council collects council tax on behalf

of itself, Suffolk County Council and the Police and Crime Commissioner.

Also shown is the percentage increase for each organization this year and the total figure

increase

Instalments to be paid This shows your method of payment for your Council Tax. For example

Direct Debit or Cash and also shows the due date that this will be paid

Date This shows the instalment date and amount you need to pay during the year.

Contact us:

Email

council.tax@ipswich.gov.uk

Online

www.ipswich.gov.uk

Phone

Helpline 01473 433910 (weekdays 8:30am 5pm)

In writing

Revenues, Grafton House, 15-17 Russell Road, Ipswich IP1 2DE

Ipswich Borough Council

Council Tax Bill for

2016/17

Pay Online: www.ipswich.gov.uk

6

5986

H

Account Number:

Date of bill:

Bill reason:

Property to which this bill relates:

33356169

01-MAR-2016

Annual

Statement of Account

1RUSSELL ROAD

IPSWICH

IP1 2DE

335 5540 3402 0003 0001

Please always quote your account number as below

24 Hour Payment Line: 01473 433777

Report a change online

MR JOE CUSTOMER

1 RUSSELL ROAD

IPSW ICH

IP1 2DE

To Pay

Charge For Period

Band A

25% Reduction For Single Occupancy

Council Tax Reduction

01-APR-2016 31-MAR-2017

01-APR-2016 31-MAR-2017

01-APR-2016 31-MAR-2017

1104.84

-276.21

-736.16

Property reference:

00060002900144

The property has been valued in Band

A

If you have a query about the band

please contact the Valuation Office.

The full charge due for band A for 2016/17 is

1104.84 and is made up as follows:

Authority

name

10

11

Amount Change

Suffolk County Council

751.02

Ipswich Borough Council

223.20

SCC Adult Social Care*

15.00

Police & Crime Commissioner 115.62

0.0

2.0

-2.0

Overall % change on previous year

2.0

Total due for this year

92.47

INSTALMENTS TO BE PAID BY: DIRECT DEBIT ON THE 1ST, MONTHLY

Date

01-APR-2016

01-MAY-2016

01-JUN-2016

11.47

9.00

9.00

01-JUL-2016

01-AUG-2016

01-SEP-2016

9.00

9.00

9.00

01-OCT-2016 9.00

01-NOV-2016 9.00

01-DEC-2016 9.00

Save time, go online

View your account online at: https://myaccount.ipswich.gov.uk

Using your online key: XXXXXXXXXX

Your online key will be updated every time a new bill or notice is produced.

*The council tax attributable to Suffolk County council includes a precept to fund adult social

Care.

01-JAN-2017

9.00

Enquiries about your band:

Valuation Office Agency

Ground Floor

Ferrers House

Castle Meadow Road

Nottingham NG2 1AB

Phone: 03000 501 501

Email: cteast@voa.gsi.gov.uk

Who has to pay Council Tax?

There is one Council Tax bill for each home whether it is owned or rented.

In most cases the person (or people) aged 18 or nearest the top of the following list is responsible for

paying the tax:

Owner-occupiers;

Leaseholders;

People who pay rent;

Residents who have a license to occupy the property, for example, people who live in tied cottages;

Residents with no legal interest in the property;

People who own property but do not live in it.

Council Tax Banding

The amount of Council Tax you pay depends on the band that your property has been put into by the

Valuation Office Agency (VOA). The VOA puts each property into one of eight valuation bands based on

open market values at 1 April 1991.

Band

A

B

C

D

E

F

G

H

Value at 1/4/91

Up to 40,000

40,001 to 52,000

52,001 to 68,000

68,001 to 88,000

88,001 to

120,000

120,001 to

160,000

160,001 to

320,000

More than 320,000

Proportion of band

D

6/9

7/9

8/9

1

11/9

13/9

15/9

2

Council Tax Appeals

You may appeal to the Valuation Office against the banding of your property. Contact: The Listing Officer,

Council Tax East, Valuation Office Agency, Ground Floor, Ferrers House, Castle Meadow Road,

Nottingham NG2 1AB

cteast@voa.gsi.gov.uk

Tel: 03000 501 501

Liability

You can appeal against the councils decision that you are liable for Council Tax, that a property should or

should not be exempt, whether a discount should or should not be allowed, or any decision taken by the

Council in respect of the amount of Council Tax Reduction applied to your bill.

In the first instance, appeals of this nature must be made in writing to the address on your bill.

Making an appeal does not mean you can withhold payment of Council Tax. If your appeal is successful,

future payments will be reduced and any overpayments refunded.

Is my property exempt from Council Tax?

You may be entitled to an exemption from Council Tax if your property is:

Unoccupied

BEmpty and owned by a charity (exemption up to six months only)

DLeft empty by a person in prison or other form of detention

ELeft empty by a person permanently resident in a hospital or care home

FLeft empty where the liable person has died and the deceased's executors or personal representatives

are now liable (up to six months after grant of Probate)

GA property where occupation is prohibited by law

HEmpty and held for occupation by a minister of religion from which to perform his/her duties

ILeft empty by a person receiving care

JLeft empty by a person providing care

KLeft empty by a student who owns the property

LUnoccupied and in the possession of the mortgagee

QLeft empty by a bankrupt where the Trustee in bankruptcy is liable

RAn empty caravan pitch or boat mooring

TAn unoccupied annex unable to be let separately

Occupied

MHalls of residence

NOccupied by full-time students and non-British spouses of students

OOccupied by the Ministry of Defence (MOD) for armed forces accommodation (e.g. forces barracks or

married quarters)

POccupied by a member of a relevant visiting force (for example, the United States Air Force)

SOccupied only by persons aged under 18

UOccupied only by persons who are severely mentally impaired

VA property that is the main residence of a person with diplomatic privilege or immunity

W - An annex occupied by certain dependant relatives of the resident(s) living in the main property

Do I qualify for a discount?

The full Council Tax assumes there are two or more adults living in a property. If only one adult lives in a

property, the Council Tax is reduced by 25%. People in the following groups may not be liable for Council

Tax and may not count towards the number of adults resident in a property:

Full-time students and non-British spouses of students, student nurses, apprentices and Youth

Training trainees

Patients resident in a hospital or care home permanently

People who are severely mentally impaired

People who are staying in certain hostels for the homeless or night shelters

18 and 19 year olds who are at, or have just left school and Child Benefit is in payment

Certain types of care workers, usually working for charities

People caring for someone with a disability who is not a spouse, partner or child under 18

Members of religious communities

People in prison or other forms of detention

People with diplomatic privilege or immunity

Members and dependants of International Headquarters and Defence Organisations

Members or dependants of visiting forces

Reductions for people with disabilities

The Council Tax bill may be reduced for properties that have a special room set aside for the needs of a

resident disabled person or an additional bathroom or kitchen required by the disabled person or sufficient

floor space to allow the use of a wheelchair indoors. The relief is the equivalent to reducing the valuation

band to the one below, and ensures that disabled people do not pay more because of a need for extra

space. The reduction includes band A dwellings.

Circumstances where other discounts may apply

The following types of property may be eligible for a reduced rate of Council Tax:

A property which is empty and unfurnished (28 days)

A property that is uninhabitable or undergoing major structural repair work (maximum 12 months).

Long term Empty Property

From 1st April 2013 properties that have been empty and unfurnished for over two years, will be charged an

empty homes premium of 50% in addition to the full charge.

The Council Tax Reduction Scheme

Council Tax Benefit will no longer exist from 31st March 2013. Each council will now have a new scheme

called the Council Tax Reduction Scheme. If you are on a low income, you may qualify for help. Any

Council Tax Reduction you are awarded will be shown on your Council Tax bill and will reduce the amount

you have to pay. You could receive help, even if you are working. However, if you have more than 16,000

in savings or investments you will not usually qualify. The reduction awarded will depend on the amount

you are liable to pay; the needs of your family; your income; your savings and anyone else living with you.

Anyone who would have previously qualified for Council Tax Benefit as at 1st April 2013 will automatically

be awarded any reduction under the new scheme. If you do not have any reduction showing on your bill

and think you may qualify, you will need to submit an application.

Please go to www.ipswich.gov.uk

Reminders and Summonses

Everyone has the right to pay Council Tax by instalments, but you must pay regularly and on or before the

instalment due date shown on your bill. If your payments fall behind more than twice in a year, you can lose

that right.

We check accounts every month. If you do not pay an instalment when it is due, we will send you a

reminder asking you to pay it within seven days. If you do not pay after the reminder, or it is the third time

that you have fallen behind with your payments, you may lose your right to pay by instalments. If this

happens, you will have seven days to pay the balance of your account (the amount outstanding for the rest

of the financial year). If you do not pay your account in full, we will send a court summons for the

outstanding balance. Court costs will be added. If you are having problems paying your bill, tell us

immediately. You might qualify for a discount, or we may be able to help by making a special payment

arrangement.

Financial Information

Financial information about your Council, the County Council and the Police and Crime Commissioner is no

longer included with your bill but is available online. Please go to www.ipswich.gov.uk.

Frequently Asked Questions

I am on benefit, why have I got a bill to pay?

If all the named Council tax payers in your property are working- age (under Pension age) you will have to

pay some Council Tax

I pay by Direct Debit do I need to do anything?

No. Your Direct Debit will automatically carry over to your new bill and we will collect the installments on the

date shown.

How do I set up a Direct Debit?

Complete the online form on www.ipswich.gov.uk or call us (details are on the back of your bill).

I pay by Standing Order. What do I need to do?

Tell your bank the account number shown on your bill and ask it to adjust the figures to the new instalment

plan shown.

How can I pay?

Payment options that are available are:

Direct Debit

Online payment system via www.ipswich.gov.uk

By telephone: 01473 433777 (available 24 hours)

At a Payzone or Post Office, using the barcode on your bill

More details are available on www.ipswich.gov.uk

How much has my bill gone up?

The percentage difference is on your bill. Financial information about your Council, the County Council and

the Police and Crime Commissioner is no longer included with your bill but is available online. Please go to

www.ipswich.gov.uk.

I dont agree with my Council Tax band what can I do?

You can view the band for your property on the Valuation Office Agency website www.voa.gov.uk. If you

think the band is wrong, you can find out how to request a review.

My circumstances have changed and my bill needs updating?

If your address details have changed, you can report this online at www.ipswich.gov.uk. If you think you

may qualify for an exemption or a discount, you can find more information on the website.

I have already told the Council that my circumstances have changes or that I have moved, yet my

bill still shows the old information?

The bills were produced based on the information on our system at the end of February. If we were

contacted on or around that date, your bill will still show the original information. A new bill will be issued

when we have dealt with your most recent correspondence.

You might also like

- TMBC Council Tax Charges Supplementary Information 2021 2022Document2 pagesTMBC Council Tax Charges Supplementary Information 2021 2022georgerouseNo ratings yet

- Council Tax BenifitDocument5 pagesCouncil Tax BenifitPaula Starling100% (1)

- Citizens Advice - Council TaxDocument6 pagesCitizens Advice - Council Taxphoebe_62002239No ratings yet

- Help With Your Rent and Council Tax: ProofsDocument28 pagesHelp With Your Rent and Council Tax: Proofsjason_preciousNo ratings yet

- SMART Compendium Notes ACCA P6 (40 Pages) For Exams in 2014Document46 pagesSMART Compendium Notes ACCA P6 (40 Pages) For Exams in 2014Miskat HM Saiful IslamNo ratings yet

- Property Tax - Rent Rebate in PennsylvaniaDocument2 pagesProperty Tax - Rent Rebate in PennsylvaniaJesse WhiteNo ratings yet

- 135635occ AnnexDocument2 pages135635occ AnnexbabajeeeeNo ratings yet

- TAXATION - Filing of Returns + Tax Penalties and RemediesDocument7 pagesTAXATION - Filing of Returns + Tax Penalties and RemediesJohn Mahatma Agripa100% (1)

- Smart Notes Acca f6 2015 (35 Pages)Document38 pagesSmart Notes Acca f6 2015 (35 Pages)SrabonBarua100% (2)

- Benefits Update May 2015Document8 pagesBenefits Update May 2015sawweNo ratings yet

- Tax 2 Review Returns ChartsDocument7 pagesTax 2 Review Returns ChartsTristan TongsonNo ratings yet

- Brochure Filing A Tax Return in The NetherlandsDocument8 pagesBrochure Filing A Tax Return in The Netherlandssonazinus6847No ratings yet

- Budget Statement 16 March 2016Document9 pagesBudget Statement 16 March 2016accountshouseNo ratings yet

- Tax & Wealth Advisory Firm GuideDocument27 pagesTax & Wealth Advisory Firm GuideSumit BawejaNo ratings yet

- Tax Guidance For Junior DoctorsDocument12 pagesTax Guidance For Junior DoctorsnishantNo ratings yet

- Help to Buy ISA GuideDocument4 pagesHelp to Buy ISA GuidefsdesdsNo ratings yet

- Report Income TaxDocument6 pagesReport Income TaxLudmila DorojanNo ratings yet

- Tax exemptions defined for individuals, organizations and investmentsDocument4 pagesTax exemptions defined for individuals, organizations and investmentsLuiza ŢîmbaliucNo ratings yet

- Notes To Transfer Taxes Under TRAIN LawDocument7 pagesNotes To Transfer Taxes Under TRAIN LawDustin PascuaNo ratings yet

- Family Friendly Facts BookletDocument32 pagesFamily Friendly Facts BookletPhyo ThihabookNo ratings yet

- A Guide To Business Rates in England Wales and ScotlandDocument2 pagesA Guide To Business Rates in England Wales and ScotlandnykeNo ratings yet

- Taxation: The Tax Credit SystemDocument3 pagesTaxation: The Tax Credit SystemJames O'RourkeNo ratings yet

- BurgerDocument4 pagesBurgerauroradurianNo ratings yet

- Taxes and Benefits: Information For Our Lesbian, Gay, Bisexual and Transgender CustomersDocument20 pagesTaxes and Benefits: Information For Our Lesbian, Gay, Bisexual and Transgender CustomersAshtagonNo ratings yet

- (ENG) 외국인 지원센터 안내문 - 한글버전 - 복호화 - 한영 - 완료Document1 page(ENG) 외국인 지원센터 안내문 - 한글버전 - 복호화 - 한영 - 완료inkorea202425No ratings yet

- Household Charge Form - An PostDocument5 pagesHousehold Charge Form - An PostIrl_tax_expertNo ratings yet

- Important Information To Include On Your Tax Return Before Sending It To UsDocument10 pagesImportant Information To Include On Your Tax Return Before Sending It To UsChristopherJonesNo ratings yet

- Donor's Tax Rates and ExemptionsDocument5 pagesDonor's Tax Rates and ExemptionsKim EspinaNo ratings yet

- 2010 - Easy - Guide For Foreigner's Year-End Tax SettlementDocument94 pages2010 - Easy - Guide For Foreigner's Year-End Tax Settlement안수현No ratings yet

- Fact Sheet On Senior BillDocument2 pagesFact Sheet On Senior BillSusie CambriaNo ratings yet

- How Your Council Tax Bill Has Been Worked Out How Your Council Tax Bill Has Been Worked OutDocument2 pagesHow Your Council Tax Bill Has Been Worked Out How Your Council Tax Bill Has Been Worked Outmagurean.viorel18No ratings yet

- Covid-19 Fact SheetDocument7 pagesCovid-19 Fact SheetCiprian DumitrasNo ratings yet

- Botswana Tax Lecture Slides, SydneyDocument84 pagesBotswana Tax Lecture Slides, SydneysmedupeNo ratings yet

- Calculating Donor's Tax for Various Property DonationsDocument12 pagesCalculating Donor's Tax for Various Property DonationsKathrine CruzNo ratings yet

- Taxation of Public Entertainment EventsDocument8 pagesTaxation of Public Entertainment Eventsmiiro duncan nelsonNo ratings yet

- MR Nizarali Musa Bhanji Kajani Flat 5 25 Nottingham Place London W1U 5Ll by EmailDocument3 pagesMR Nizarali Musa Bhanji Kajani Flat 5 25 Nottingham Place London W1U 5Ll by EmailMalik waqarNo ratings yet

- Ontario Trillium Benefit eligibility and paymentsDocument6 pagesOntario Trillium Benefit eligibility and paymentsmoizitouNo ratings yet

- What Is Taxation AutosavedDocument7 pagesWhat Is Taxation AutosavedMila Casandra CastañedaNo ratings yet

- Tax at Source Rules for Zurich CantonDocument4 pagesTax at Source Rules for Zurich CantoncavalaticaNo ratings yet

- Pre Authorized Payment ApplicationDocument4 pagesPre Authorized Payment ApplicationStephanie MathersNo ratings yet

- Property Tax BillDocument2 pagesProperty Tax BillAnonymous GF8PPILW5No ratings yet

- Kaua'i Real Property Tax Guide: Everything Homeowners Need to KnowDocument2 pagesKaua'i Real Property Tax Guide: Everything Homeowners Need to KnowSewSkinnyNo ratings yet

- CustomsDocument28 pagesCustomsDamasceneNo ratings yet

- TO DO List - EnglishDocument6 pagesTO DO List - Englishilobanovska77No ratings yet

- TaxReturn GuideDocument32 pagesTaxReturn Guideehsany100% (1)

- Welsh Rates of Income Tax FaqsDocument4 pagesWelsh Rates of Income Tax Faqsdhinakaranme3056No ratings yet

- Use This Form To Claim Housing Benefit, Council Tax Benefit, Free School Meals and School Clothing AllowanceDocument22 pagesUse This Form To Claim Housing Benefit, Council Tax Benefit, Free School Meals and School Clothing AllowanceafacewithoutanameNo ratings yet

- Minnesota Property Tax Refund: Forms and InstructionsDocument28 pagesMinnesota Property Tax Refund: Forms and InstructionsJeffery MeyerNo ratings yet

- My Islington Council Tax DocumentDocument4 pagesMy Islington Council Tax DocumentYerina Elizabeth Feliz PinedaNo ratings yet

- Revctel Smi (Ed)Document3 pagesRevctel Smi (Ed)bobriley070No ratings yet

- Concepts of Taxation and Income TaxationDocument10 pagesConcepts of Taxation and Income TaxationPinks D'CarlosNo ratings yet

- Pritchard and Co Budget OutcomesDocument5 pagesPritchard and Co Budget Outcomesadmin866No ratings yet

- Business Rates Explanatory Notes 1Document3 pagesBusiness Rates Explanatory Notes 1jamNo ratings yet

- TB Guide Working UKDocument11 pagesTB Guide Working UKMaRi KiYaNo ratings yet

- ACCA P6 SMART Compendium Notes (40 Pages) For June 2016Document62 pagesACCA P6 SMART Compendium Notes (40 Pages) For June 2016Aziz Ur Rehman100% (2)

- DIRECT AND INDIRECT TAXESDocument41 pagesDIRECT AND INDIRECT TAXESlakshyaNo ratings yet

- 1040 Exam Prep: Module II - Basic Tax ConceptsFrom Everand1040 Exam Prep: Module II - Basic Tax ConceptsRating: 1.5 out of 5 stars1.5/5 (2)

- 006 Chap 12bjgDocument3 pages006 Chap 12bjgsachin_sawant1985No ratings yet

- 007 Chap 13bjgDocument2 pages007 Chap 13bjgsachin_sawant1985No ratings yet

- 008 Chap 10bjgDocument3 pages008 Chap 10bjgsachin_sawant1985No ratings yet

- Maximising Independence RehabilitationDocument8 pagesMaximising Independence Rehabilitationsachin_sawant1985No ratings yet

- Catia v5 Structural Analysis For The DesignerDocument462 pagesCatia v5 Structural Analysis For The DesignerFlorin Manea92% (13)

- Modeling and Designing A Hydrostatic Transmission With A Fixed-DiDocument7 pagesModeling and Designing A Hydrostatic Transmission With A Fixed-Disachin_sawant1985No ratings yet

- 005 Chap 18bjgDocument2 pages005 Chap 18bjgsachin_sawant1985No ratings yet

- EO2 FormDocument6 pagesEO2 Formsachin_sawant1985No ratings yet

- Idael-Isar Boiler ManualDocument13 pagesIdael-Isar Boiler Manualsachin_sawant1985No ratings yet

- Matching of Charts A New Approach B WDocument26 pagesMatching of Charts A New Approach B WTej K ZadooNo ratings yet

- 200-CQDN-666574-ND - Job Description and Person SpecificationDocument6 pages200-CQDN-666574-ND - Job Description and Person Specificationsachin_sawant1985No ratings yet

- Vedic Chart PDFDocument23 pagesVedic Chart PDFsachin_sawant1985No ratings yet

- M S 0 2 - M S E 0 2: Hydraulic MotorsDocument36 pagesM S 0 2 - M S E 0 2: Hydraulic Motorssachin_sawant1985No ratings yet

- 200-CQDN-666574-ND - Job Description and Person SpecificationDocument6 pages200-CQDN-666574-ND - Job Description and Person Specificationsachin_sawant1985No ratings yet

- Create PDF ExamplesDocument1 pageCreate PDF Examplessachin_sawant1985No ratings yet

- A23503 50CrVA Steel Plate, A23503 50CrVA Spring SteelDocument2 pagesA23503 50CrVA Steel Plate, A23503 50CrVA Spring Steelsachin_sawant1985No ratings yet

- Eng - 5060 - Testing - of - Products Iss H PDFDocument2 pagesEng - 5060 - Testing - of - Products Iss H PDFsachin_sawant1985No ratings yet

- P Pir Process OverviewDocument28 pagesP Pir Process Overviewsachin_sawant1985No ratings yet

- Danfoss 520l0954Document32 pagesDanfoss 520l0954joeccorrrea100% (1)

- Basic Hydraulic and Components (Pub. ES-100-2) PDFDocument97 pagesBasic Hydraulic and Components (Pub. ES-100-2) PDFjayath100% (1)

- List D20CBDEC 5823 C41F 149E 1B2F71F6A8A5 BibliographyDocument1 pageList D20CBDEC 5823 C41F 149E 1B2F71F6A8A5 Bibliographysachin_sawant1985No ratings yet

- P Pir Process OverviewDocument28 pagesP Pir Process Overviewsachin_sawant1985No ratings yet

- Eng - 5020 - Ecr - Eco - Process - Iss L PDFDocument4 pagesEng - 5020 - Ecr - Eco - Process - Iss L PDFsachin_sawant1985No ratings yet

- 03082016Document1 page03082016sachin_sawant1985No ratings yet

- 6th Central Pay Commission Salary CalculatorDocument15 pages6th Central Pay Commission Salary Calculatorrakhonde100% (436)

- Q - 9150 - Test - and - Delivery - To - Warehouse Iss LDocument1 pageQ - 9150 - Test - and - Delivery - To - Warehouse Iss Lsachin_sawant1985No ratings yet

- Aerodynamics 2 SummaryDocument44 pagesAerodynamics 2 SummaryKrishna MyakalaNo ratings yet

- Music Theory: 12 Notes & Major Scale ConstructionDocument41 pagesMusic Theory: 12 Notes & Major Scale Constructionsachin_sawant1985No ratings yet

- Eng - 5010 - Npsi - Iss HDocument1 pageEng - 5010 - Npsi - Iss Hsachin_sawant1985No ratings yet

- 32-5-1 - Social ScienceDocument19 pages32-5-1 - Social Sciencestudygirl03No ratings yet

- Naara Brochure AUSDocument4 pagesNaara Brochure AUSCatalin CosmaNo ratings yet

- What Is International Business?: Educator Resource PPT To AccompanyDocument41 pagesWhat Is International Business?: Educator Resource PPT To AccompanyArif Raza100% (1)

- Three Column Cash BookDocument3 pagesThree Column Cash Bookahmad381No ratings yet

- Chapter 10Document28 pagesChapter 10ahmedNo ratings yet

- E No Ad Release NotesDocument6 pagesE No Ad Release NotesKostyantinBondarenkoNo ratings yet

- ECS 1601 Learning Unit 7 Quiz: Key Concepts of the Circular Flow, Autonomous vs Induced Spending, Fiscal PolicyDocument4 pagesECS 1601 Learning Unit 7 Quiz: Key Concepts of the Circular Flow, Autonomous vs Induced Spending, Fiscal PolicyVinny HungweNo ratings yet

- Visual Basic Is Initiated by Using The Programs OptionDocument141 pagesVisual Basic Is Initiated by Using The Programs Optionsaroj786No ratings yet

- QUIZ - FinalsDocument5 pagesQUIZ - FinalsFelsie Jane PenasoNo ratings yet

- Marie Bjerede and Tzaddi Bondi 2012 - Learning Is Personal, Stories of Android Tablet Use in The 5th GradeDocument50 pagesMarie Bjerede and Tzaddi Bondi 2012 - Learning Is Personal, Stories of Android Tablet Use in The 5th Gradeluiz carvalhoNo ratings yet

- Ultrasonic Pulse Velocity or Rebound MeasurementDocument2 pagesUltrasonic Pulse Velocity or Rebound MeasurementCristina CastilloNo ratings yet

- Long Vowel SoundsDocument15 pagesLong Vowel SoundsRoselle Jane PasquinNo ratings yet

- Examination Handbook NewDocument97 pagesExamination Handbook Newdtr17No ratings yet

- Secure Password-Driven Fingerprint Biometrics AuthenticationDocument5 pagesSecure Password-Driven Fingerprint Biometrics AuthenticationDorothy ManriqueNo ratings yet

- Project Report On PepsiDocument87 pagesProject Report On PepsiPawan MeenaNo ratings yet

- Manufacturing and Service TechnologiesDocument18 pagesManufacturing and Service Technologiesajit123ajitNo ratings yet

- TOT Calendar Oct Dec. 2018 1Document7 pagesTOT Calendar Oct Dec. 2018 1Annamneedi PrasadNo ratings yet

- Haulmax HaulTruck 11.21.13 FINALDocument2 pagesHaulmax HaulTruck 11.21.13 FINALjogremaurNo ratings yet

- 2018 Scaffold and Access Inspection Checklist FDocument6 pages2018 Scaffold and Access Inspection Checklist FTaufiq YahayaNo ratings yet

- Practice Ch3Document108 pagesPractice Ch3Agang Nicole BakwenaNo ratings yet

- VISIONARCHDocument3 pagesVISIONARCHJHON YDUR REMEGIONo ratings yet

- Aaliyah Lachance Resume - DecDocument2 pagesAaliyah Lachance Resume - Decapi-240831551No ratings yet

- Presentasi AkmenDocument18 pagesPresentasi AkmenAnonymous uNgaASNo ratings yet

- Concreting PlantsDocument9 pagesConcreting PlantsSabrina MustafaNo ratings yet

- Condrada v. PeopleDocument2 pagesCondrada v. PeopleGennard Michael Angelo AngelesNo ratings yet

- Tool Selection For Rough and Finish CNC Milling OpDocument4 pagesTool Selection For Rough and Finish CNC Milling Opmatic91No ratings yet

- Huntersvsfarmers 131204084857 Phpapp01Document1 pageHuntersvsfarmers 131204084857 Phpapp01Charles BronsonNo ratings yet

- CAT Álogo de Peças de Reposi ÇÃO: Trator 6125JDocument636 pagesCAT Álogo de Peças de Reposi ÇÃO: Trator 6125Jmussi oficinaNo ratings yet

- Daily Timecard Entry in HoursDocument20 pagesDaily Timecard Entry in HoursadnanykhanNo ratings yet

- Ciphertext-Policy Attribute-Based EncryptionDocument15 pagesCiphertext-Policy Attribute-Based EncryptionJ_RameshNo ratings yet