Professional Documents

Culture Documents

Results Press Release For September 30, 2016 (Result)

Uploaded by

Shyam SunderOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Results Press Release For September 30, 2016 (Result)

Uploaded by

Shyam SunderCopyright:

Available Formats

PRESS RELEASE

BANK OF INDIA ANNOUNCES FINANCIAL RESULTS

FOR QUARTER SEPTEMBER, 2016 (Q2, FY 2017)

Bank of India announced its reviewed results for the Q2 of FY 2017, following the

approval of its Board of Directors on November 10, 2016.

BUSINESS:

Bank earned a PBT of Rs.197 crore and a PAT of Rs. 127 crore for the Q2,

FY 2017. Its Net Loss has reduced sequentially from Rs.3,587 crore in March

2016 to Rs.741 crore in June 2016. During the corresponding quarter of

FY2016 Bank had posted a Net Loss of Rs.1,126 crore.

Global business of the Bank stood at Rs.893,978 crore as of September 2016

as compared to Rs. 885,573 crore of June 2016 and Rs.894,667 crore as of

March 2016. The Global business improved by 0.95% compared to June 2016

and declined by 0.08% as compared to March 2016. This was a result of

Banks strategy to consolidate the Balance Sheet.

CASA Deposits grew by 13% YOY and its share in domestic deposits

improved from 31% in September 2015 to 36% in September 2016.

The Gross Advances at Rs.388,698 crore grew sequentially by 0.29% over

Q1 of FY2017. On a YOY basis, advances declined by 1.79%.

The share of Corporate loans in Total Domestic Advances was brought down

from 54% in September 2015 to 51% as of September 2016.

The share of Retail Loan Portfolio (Non-Corporate Loans) has grown from

46% in September 2015 to 49% in September 2016.

Retail advances increased by 11.36% YOY at Rs. 38,908 crore and its share

in Total Domestic Advances increased from 12.54% in September 2015 to

14.18% in September 2016.

The Retail Time Deposit of Rs. One crore & below increased to 75% of Total

Deposit in September 2016 as against 64% in September 2015.

Slippages in NPA during Q2 FY2017, declined from Rs.6,233 crore in June

2016 to Rs. 3,963 crore in September 2016, thereby continuing the reversal of

trend started from June 2016. After taking into account recovery, upgradation

etc. the net accretion to NPAs was Rs.388 crore in Q2 FY2017 as compared

to Rs.1,995 crore in Q1FY2017, Rs.13,360 crore in Q4, FY2016 and Rs.6,626

crore in Q3 FY2016.

Head office: Star House, C-5, G Block, Bandra-Kurla Complex, Bandra (East), Mumbai-400051

Website: www.bankofindia.co.in

Page 1 of 2

The Provision Coverage Ratio improved from 51.14% in March 2016 to

55.23% in September 2016.

Priority Sector advances stood at Rs. 109,636 crore which constitutes 40.10%

of ANBC thereby achieving the regulatory target for the quarter ended

September 2016.

PROFIT:

The Banks Operating Profit was Rs.2,493 crore in Q2 FY2017 as against

Rs.1,458 crore in Q2 FY2016. PAT stood at Rs.127 crore (PBT: Rs.197 crore)

as compared to PAT of Rs.-1,126 crore for the corresponding quarter of

September 2015.

NET INTEREST MARGIN:

The Domestic Net Interest Margin (NIM) has improved from 2.54% in quarter

June 2016 to 2.62% in September 2016.

The Global NIM has dropped from 2.20% to 2.15% on QoQ basis.

ASSET QUALITY:

The Gross NPA ratio stood at 13.45% as on September 30, 2016 as

compared to 13.38% as at June 30, 2016. Net NPA ratio reduced to 7.56% as

against 7.78% in June 30, 2016.

Total Restructured Standard Assets of the Bank were Rs. 12,012 crore as at

September 30, 2016. The total Stressed Assets (GNPA + Restructured

Standard Assets) are 16.53% of the Gross Advances.

CAPITAL ADEQUACY:

The CRAR on standalone basis (Basel III) is 12.50% as at September 30,

2016 improved from 12.01% as at March 2016. Out of this, the Tier-I Capital

is 9.37% and Tier -II Capital is 3.13%.

Jain Bhushan

General Manager & CFO

November 10, 2016

Mumbai

Head office: Star House, C-5, G Block, Bandra-Kurla Complex, Bandra (East), Mumbai-400051

Website: www.bankofindia.co.in

Page 2 of 2

You might also like

- Mutual Fund Holdings in DHFLDocument7 pagesMutual Fund Holdings in DHFLShyam SunderNo ratings yet

- JUSTDIAL Mutual Fund HoldingsDocument2 pagesJUSTDIAL Mutual Fund HoldingsShyam SunderNo ratings yet

- Settlement Order in Respect of R.R. Corporate Securities LimitedDocument2 pagesSettlement Order in Respect of R.R. Corporate Securities LimitedShyam SunderNo ratings yet

- Financial Results & Limited Review Report For Sept 30, 2015 (Standalone) (Result)Document4 pagesFinancial Results & Limited Review Report For Sept 30, 2015 (Standalone) (Result)Shyam SunderNo ratings yet

- PR - Exit Order in Respect of Spice & Oilseeds Exchange Limited (Soel)Document1 pagePR - Exit Order in Respect of Spice & Oilseeds Exchange Limited (Soel)Shyam SunderNo ratings yet

- Financial Results For June 30, 2014 (Audited) (Result)Document3 pagesFinancial Results For June 30, 2014 (Audited) (Result)Shyam SunderNo ratings yet

- Settlement Order in Respect of Bikaner Wooltex Pvt. Limited in The Matter of Sangam Advisors LimitedDocument2 pagesSettlement Order in Respect of Bikaner Wooltex Pvt. Limited in The Matter of Sangam Advisors LimitedShyam SunderNo ratings yet

- HINDUNILVR: Hindustan Unilever LimitedDocument1 pageHINDUNILVR: Hindustan Unilever LimitedShyam SunderNo ratings yet

- Order of Hon'ble Supreme Court in The Matter of The SaharasDocument6 pagesOrder of Hon'ble Supreme Court in The Matter of The SaharasShyam SunderNo ratings yet

- Exit Order in Respect of The Spice and Oilseeds Exchange Limited, SangliDocument5 pagesExit Order in Respect of The Spice and Oilseeds Exchange Limited, SangliShyam SunderNo ratings yet

- Financial Results, Limited Review Report For December 31, 2015 (Result)Document4 pagesFinancial Results, Limited Review Report For December 31, 2015 (Result)Shyam SunderNo ratings yet

- Standalone Financial Results, Auditors Report For March 31, 2016 (Result)Document5 pagesStandalone Financial Results, Auditors Report For March 31, 2016 (Result)Shyam SunderNo ratings yet

- Financial Results For Mar 31, 2014 (Result)Document2 pagesFinancial Results For Mar 31, 2014 (Result)Shyam SunderNo ratings yet

- Financial Results & Limited Review Report For June 30, 2015 (Standalone) (Result)Document3 pagesFinancial Results & Limited Review Report For June 30, 2015 (Standalone) (Result)Shyam SunderNo ratings yet

- Financial Results For June 30, 2013 (Audited) (Result)Document2 pagesFinancial Results For June 30, 2013 (Audited) (Result)Shyam SunderNo ratings yet

- Financial Results For September 30, 2013 (Result)Document2 pagesFinancial Results For September 30, 2013 (Result)Shyam SunderNo ratings yet

- PDF Processed With Cutepdf Evaluation EditionDocument3 pagesPDF Processed With Cutepdf Evaluation EditionShyam SunderNo ratings yet

- Financial Results For Dec 31, 2013 (Result)Document4 pagesFinancial Results For Dec 31, 2013 (Result)Shyam Sunder0% (1)

- Standalone Financial Results For September 30, 2016 (Result)Document3 pagesStandalone Financial Results For September 30, 2016 (Result)Shyam SunderNo ratings yet

- Standalone Financial Results For June 30, 2016 (Result)Document2 pagesStandalone Financial Results For June 30, 2016 (Result)Shyam SunderNo ratings yet

- Standalone Financial Results, Limited Review Report For June 30, 2016 (Result)Document3 pagesStandalone Financial Results, Limited Review Report For June 30, 2016 (Result)Shyam SunderNo ratings yet

- Standalone Financial Results For March 31, 2016 (Result)Document11 pagesStandalone Financial Results For March 31, 2016 (Result)Shyam SunderNo ratings yet

- Standalone Financial Results, Limited Review Report For June 30, 2016 (Result)Document4 pagesStandalone Financial Results, Limited Review Report For June 30, 2016 (Result)Shyam SunderNo ratings yet

- Standalone Financial Results, Limited Review Report For December 31, 2016 (Result)Document5 pagesStandalone Financial Results, Limited Review Report For December 31, 2016 (Result)Shyam SunderNo ratings yet

- Standalone Financial Results, Limited Review Report For December 31, 2016 (Result)Document3 pagesStandalone Financial Results, Limited Review Report For December 31, 2016 (Result)Shyam SunderNo ratings yet

- Standalone Financial Results, Limited Review Report For December 31, 2016 (Result)Document4 pagesStandalone Financial Results, Limited Review Report For December 31, 2016 (Result)Shyam SunderNo ratings yet

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Document4 pagesStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderNo ratings yet

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Document4 pagesStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderNo ratings yet

- Transcript of The Investors / Analysts Con Call (Company Update)Document15 pagesTranscript of The Investors / Analysts Con Call (Company Update)Shyam SunderNo ratings yet

- Investor Presentation For December 31, 2016 (Company Update)Document27 pagesInvestor Presentation For December 31, 2016 (Company Update)Shyam SunderNo ratings yet

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5794)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (399)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (894)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (587)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (265)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (73)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (344)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2219)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (119)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- Masteringphys 14Document20 pagesMasteringphys 14CarlosGomez0% (3)

- Case Study IndieDocument6 pagesCase Study IndieDaniel YohannesNo ratings yet

- Efaverenz p1Document4 pagesEfaverenz p1Pragat KumarNo ratings yet

- Form Active Structure TypesDocument5 pagesForm Active Structure TypesShivanshu singh100% (1)

- IQ CommandDocument6 pagesIQ CommandkuoliusNo ratings yet

- Individual Performance Commitment and Review Form (Ipcrf) : Mfos Kras Objectives Timeline Weight Per KRADocument4 pagesIndividual Performance Commitment and Review Form (Ipcrf) : Mfos Kras Objectives Timeline Weight Per KRAChris21JinkyNo ratings yet

- Statistical Quality Control, 7th Edition by Douglas C. Montgomery. 1Document76 pagesStatistical Quality Control, 7th Edition by Douglas C. Montgomery. 1omerfaruk200141No ratings yet

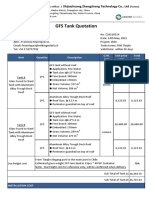

- GFS Tank Quotation C20210514Document4 pagesGFS Tank Quotation C20210514Francisco ManriquezNo ratings yet

- Chromate Free CoatingsDocument16 pagesChromate Free CoatingsbaanaadiNo ratings yet

- Legends and Lairs - Elemental Lore PDFDocument66 pagesLegends and Lairs - Elemental Lore PDFAlexis LoboNo ratings yet

- Induction ClassesDocument20 pagesInduction ClassesMichelle MarconiNo ratings yet

- AA ActivitiesDocument4 pagesAA ActivitiesSalim Amazir100% (1)

- Google Earth Learning Activity Cuban Missile CrisisDocument2 pagesGoogle Earth Learning Activity Cuban Missile CrisisseankassNo ratings yet

- Price List PPM TerbaruDocument7 pagesPrice List PPM TerbaruAvip HidayatNo ratings yet

- Shopping Mall: Computer Application - IiiDocument15 pagesShopping Mall: Computer Application - IiiShadowdare VirkNo ratings yet

- Uniform-Section Disk Spring AnalysisDocument10 pagesUniform-Section Disk Spring Analysischristos032No ratings yet

- Real Estate Broker ReviewerREBLEXDocument124 pagesReal Estate Broker ReviewerREBLEXMar100% (4)

- EN 12449 CuNi Pipe-2012Document47 pagesEN 12449 CuNi Pipe-2012DARYONO sudaryonoNo ratings yet

- United States Bankruptcy Court Southern District of New YorkDocument21 pagesUnited States Bankruptcy Court Southern District of New YorkChapter 11 DocketsNo ratings yet

- What Is A Problem?: Method + Answer SolutionDocument17 pagesWhat Is A Problem?: Method + Answer SolutionShailaMae VillegasNo ratings yet

- Training Customer CareDocument6 pagesTraining Customer Careyahya sabilNo ratings yet

- HVAC Master Validation PlanDocument51 pagesHVAC Master Validation Plannavas197293% (30)

- Crystallizers: Chapter 16 Cost Accounting and Capital Cost EstimationDocument1 pageCrystallizers: Chapter 16 Cost Accounting and Capital Cost EstimationDeiver Enrique SampayoNo ratings yet

- Three Comparison of Homoeopathic MedicinesDocument22 pagesThree Comparison of Homoeopathic MedicinesSayeed AhmadNo ratings yet

- Prasads Pine Perks - Gift CardsDocument10 pagesPrasads Pine Perks - Gift CardsSusanth Kumar100% (1)

- Ultra Slimpak G448-0002: Bridge Input Field Configurable IsolatorDocument4 pagesUltra Slimpak G448-0002: Bridge Input Field Configurable IsolatorVladimirNo ratings yet

- EIRA v0.8.1 Beta OverviewDocument33 pagesEIRA v0.8.1 Beta OverviewAlexQuiñonesNietoNo ratings yet

- Grading System The Inconvenient Use of The Computing Grades in PortalDocument5 pagesGrading System The Inconvenient Use of The Computing Grades in PortalJm WhoooNo ratings yet

- Unit 14 Ergonomics Design: AND ProductDocument24 pagesUnit 14 Ergonomics Design: AND ProductRämêşh KątúřiNo ratings yet