Professional Documents

Culture Documents

04.0 Gen Credit Vs Alsons - Digest

Uploaded by

sarmientoelizabeth0 ratings0% found this document useful (0 votes)

444 views1 pageCorporation Code Case Digest

Original Title

04.0 Gen Credit vs Alsons_digest

Copyright

© © All Rights Reserved

Available Formats

DOC, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCorporation Code Case Digest

Copyright:

© All Rights Reserved

Available Formats

Download as DOC, PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

444 views1 page04.0 Gen Credit Vs Alsons - Digest

Uploaded by

sarmientoelizabethCorporation Code Case Digest

Copyright:

© All Rights Reserved

Available Formats

Download as DOC, PDF, TXT or read online from Scribd

You are on page 1of 1

G.R. No.

154975

January 29, 2007

GENERAL CREDIT CORPORATION (now PENTA CAPITAL FINANCE CORPORATION), Petitioner,

vs.

ALSONS DEVELOPMENT and INVESTMENT CORPORATION and CCC EQUITY CORPORATION,Respondents.

FACTS:

General Credit Corporation is a finance and investment company which established CCC franchise

companies in different urban centers of the country. Upon securing license to engage also in quasi-banking activities,

CCC Equity Corporation was organized by GCC for the purpose of, among other things, taking over the operations

and management of the various franchise companies. Respondent Alsons and Alcantara family were also

shareholders in GCC franchise companies.

Alsons and Alcantara family sold their shareholdings to Equity for a promissory note payable to bearer

amounting to P2,000,000 with 18% interest per annum at one-year maturity date. Four years later, Alcantara family

then assigned its rights and interests over the bearer note to Alsons.

Despite letters of demand Equity failed to pay Alsons as it no longer have assets or property to settle its

obligation nor being extended financial support by GCC. Hence, Alsons filed a complaint for sum of money against

Equity and GCC with the RTC of Makati. GCC was impleaded a party-defendant under the doctrine of piercing the

veil of corporate fiction alleging that Equity have been organized as a tool and mere conduit of GCC. GCC answered

that it is a distinct and separate entity from Equity.

Alson presented over 60 documentary evidence among which are as follows: Equity and GCC had common

directors/officers as well as stockholders. When [EQUITYs President] Labayen sold the shareholdings of EQUITY in

said franchise companies, practically the entire proceeds thereof were surrendered to GCC, and not received by

EQUITY . President Villanueva communicated to Equity President Labayen that GCC Board denied the Alcantaras

request to be paid out but authorized to pay interest out of Equitys operation income.

Trial court found Equity as a mere instrumentality or adjunct of GCC and ruled in favour of Alsons and

ordered GCC to pay. On appeal, Court of Appeals rendered decision, affirming that of the trial court. Having denied

the motion for reconsideration, petitioner filed the present petition.

ISSUE:

Whether or not doctrine of piercing GCCs veil of corporate identity is properly applied.

HELD:

YES. Under the doctrine "piercing the veil of corporate fiction" as in fact the court will often look at the

corporation as a mere collection of individuals or an aggregation of persons undertaking business as a group,

disregarding the separate juridical personality of the corporation unifying the group. Another formulation of this

doctrine is that when two (2) business enterprises are owned, conducted and controlled by the same parties, both law

and equity will, when necessary to protect the rights of third parties, disregard the legal fiction that two corporations

are distinct entities and treat them as identical or one and the same.

Authorities are agreed on at least three (3) basic areas where piercing the veil, with which the law covers

and isolates the corporation from any other legal entity to which it may be related, is allowed. 25 These are: 1) defeat of

public convenience; 2) fraud ; or 3) alter ego cases

Per the Courts count, the trial court enumerated no less than 20 documented circumstances and

transactions, which, taken as a package, strongly supported the conclusion that respondent EQUITY was but an

adjunct, an instrumentality or business conduit of petitioner GCC. This relation, in turn, provides a justifying ground to

pierce petitioners corporate existence as to ALSONS claim in question. Foremost of what the trial court referred to

as "certain circumstances" are the commonality of directors, officers and stockholders and even sharing of office

between petitioner GCC and respondent EQUITY; certain financing and management arrangements between the

two, allowing the petitioner to handle the funds of the latter; the virtual domination if not control wielded by the

petitioner over the finances, business policies and practices of respondent EQUITY; and the establishment of

respondent EQUITY by the petitioner to circumvent CB rules.

As the relationships binding herein [respondent EQUITY and petitioner GCC] have been that of "parentsubsidiary corporations" the foregoing principles and doctrines find suitable applicability in the case at bar; and, it

having been satisfactorily and indubitably shown that the said relationships had been used to perform certain

functions not characterized with legitimacy, this Court feels amply justified to "pierce the veil of corporate entity".

GCC was the entity which initiated and benefited immensely from the fraudulent scheme perpetrated in violation of

the law.

It behooves the petitioner, as a matter of law and equity, to assume the legitimate financial obligation of a

cash-strapped subsidiary corporation which it virtually controlled to such a degree that the latter became its

instrument or agent.

The instant petition is DENIED.

You might also like

- General Credit v. Alsons DigestDocument2 pagesGeneral Credit v. Alsons Digestershaki100% (4)

- GCC Vs AlsonsDocument2 pagesGCC Vs AlsonsLindsay MillsNo ratings yet

- 01 Francisco V GSISDocument2 pages01 Francisco V GSISSam Sy-HenaresNo ratings yet

- Liability of persons acting as officers of non-existent corporationDocument2 pagesLiability of persons acting as officers of non-existent corporationjanpepotNo ratings yet

- Pacific Rehouse Corp vs. CADocument2 pagesPacific Rehouse Corp vs. CATheodore Dolar100% (1)

- Government of Philippine Islands vs. El Hogar FilipinoDocument3 pagesGovernment of Philippine Islands vs. El Hogar FilipinoCharmila SiplonNo ratings yet

- Tan Boon Bee & Co. v. Jarencio, 163 SCRA 205Document1 pageTan Boon Bee & Co. v. Jarencio, 163 SCRA 205hime mejNo ratings yet

- Wensha Spa vs. Yung Case DigestDocument1 pageWensha Spa vs. Yung Case DigestSheena Juarez100% (2)

- Le Chemise Lacoste vs. Fernandez (120 SCRA 377)Document1 pageLe Chemise Lacoste vs. Fernandez (120 SCRA 377)G SNo ratings yet

- Lozano vs. De Los Santos dispute over jeepney association leadershipDocument2 pagesLozano vs. De Los Santos dispute over jeepney association leadershipJan MartinNo ratings yet

- Citibank NA. vs. ChuaDocument3 pagesCitibank NA. vs. ChuaMacris Mallari0% (1)

- 2 Republic Vs Security Credit and Acceptance Corp.Document3 pages2 Republic Vs Security Credit and Acceptance Corp.BOEN YATOR100% (1)

- International Express Travel vs. CADocument1 pageInternational Express Travel vs. CAAllenMarkLuperaNo ratings yet

- Citibank v. Chua 220 SCRA 75 (G.R. No. 102300, March 17, 1993) FactsDocument2 pagesCitibank v. Chua 220 SCRA 75 (G.R. No. 102300, March 17, 1993) Factslinlin_17100% (1)

- Ramirez Vs Orientalist Co.Document2 pagesRamirez Vs Orientalist Co.Joovs Joovho67% (3)

- Philippine First Insurance Vs HartiganDocument2 pagesPhilippine First Insurance Vs HartiganCharmila SiplonNo ratings yet

- Halley vs. PrintwellDocument3 pagesHalley vs. PrintwellGRNo ratings yet

- De Los Santos vs. MC Grath (95 Phil 577)Document1 pageDe Los Santos vs. MC Grath (95 Phil 577)Rivera Meriem Grace MendezNo ratings yet

- Lozano V de Los SantosDocument3 pagesLozano V de Los SantosAndrea GatchalianNo ratings yet

- Everett Vs Asia Banking CorporationDocument3 pagesEverett Vs Asia Banking CorporationLara YuloNo ratings yet

- Corporation Law Case Digest: National Abaca vs. Apolonia PoreDocument2 pagesCorporation Law Case Digest: National Abaca vs. Apolonia PoreYlmir_1989No ratings yet

- De facto Corp DissolutionDocument1 pageDe facto Corp DissolutionLindsay MillsNo ratings yet

- Case DigestDocument4 pagesCase DigestEnzoNo ratings yet

- Pacific Farms Not Liable as Alter Ego for Debts of Insular FarmsDocument1 pagePacific Farms Not Liable as Alter Ego for Debts of Insular FarmsJepoy Francisco100% (1)

- Pirovano Et Al Vs The de La Rama SteamshipDocument3 pagesPirovano Et Al Vs The de La Rama SteamshipCJ50% (2)

- G.R. No. 201675 June 19, 2013 Juanito Ang, For and in Behalf of Sunrise Marketing (Bacolod), Inc., ANG, Respondents. Carpio, J.Document2 pagesG.R. No. 201675 June 19, 2013 Juanito Ang, For and in Behalf of Sunrise Marketing (Bacolod), Inc., ANG, Respondents. Carpio, J.LDNo ratings yet

- 002 Universal Mills Corp. v. Universal Textile Mills Inc.Document2 pages002 Universal Mills Corp. v. Universal Textile Mills Inc.joyce100% (3)

- Detective and Protective Bureau VsDocument1 pageDetective and Protective Bureau VsRaymart SalamidaNo ratings yet

- Hager vs. BryanDocument2 pagesHager vs. Bryanmitsudayo_No ratings yet

- De Silva Vs Aboitiz and CoDocument2 pagesDe Silva Vs Aboitiz and CoAJMordenoNo ratings yet

- Ang vs. AngDocument3 pagesAng vs. AngVeronica ChanNo ratings yet

- Yu v. YukayguanDocument1 pageYu v. YukayguanSG100% (1)

- Pnoc-Energy Development Corporation vs. National Labor Relations CommissionDocument1 pagePnoc-Energy Development Corporation vs. National Labor Relations CommissionKMNo ratings yet

- 68-Madrigal & Co. Vs ZamoraDocument2 pages68-Madrigal & Co. Vs ZamoraMaryrose100% (1)

- Power of Corporations - in GeneralDocument2 pagesPower of Corporations - in GeneralMIKHAEL MEDRANONo ratings yet

- Albert v. University Publishing (Jore)Document2 pagesAlbert v. University Publishing (Jore)mjpjoreNo ratings yet

- Macasaet V FranciscoDocument1 pageMacasaet V FranciscoMarioneMaeThiam100% (2)

- 183 - Mentholatum v. MangalimanDocument2 pages183 - Mentholatum v. Mangalimanmimiyuki_No ratings yet

- 172 - Financig Corporation Vs TeodoroDocument1 page172 - Financig Corporation Vs Teodoromimiyuki_No ratings yet

- Cojuangco v. SandiganbayanDocument2 pagesCojuangco v. SandiganbayanJay jogs100% (1)

- Gala Vs Ellice AgroDocument2 pagesGala Vs Ellice AgroJennilyn TugelidaNo ratings yet

- Esguerra V CA DigestDocument2 pagesEsguerra V CA DigestKrissie GuevaraNo ratings yet

- Carlos vs. Mindoro Sugar Co.Document2 pagesCarlos vs. Mindoro Sugar Co.Clark Edward Runes UyticoNo ratings yet

- 37 Soriano v. CA DigestDocument2 pages37 Soriano v. CA DigestGloria TrilloNo ratings yet

- Commissioner vs. ManningDocument2 pagesCommissioner vs. Manningshinjha73100% (5)

- Yamamoto v. Nishino G.R. No. 150283 CASE DIGESTDocument2 pagesYamamoto v. Nishino G.R. No. 150283 CASE DIGESTRose Ann Veloria0% (1)

- Fua Cun vs. SummersDocument3 pagesFua Cun vs. SummersRivera Meriem Grace MendezNo ratings yet

- Non Stock Corporation To Close CorporationsDocument7 pagesNon Stock Corporation To Close CorporationsMP Manliclic100% (1)

- Indian Chamber of Commerce Phils., Inc Vs Filipino Indian Chamber of Commerce in The Philippines, Inc. GR No. 184008, August 3, 2016Document3 pagesIndian Chamber of Commerce Phils., Inc Vs Filipino Indian Chamber of Commerce in The Philippines, Inc. GR No. 184008, August 3, 2016Ces DavidNo ratings yet

- Yu Vs YukayguanDocument1 pageYu Vs YukayguanLindsay MillsNo ratings yet

- Edward A. Keller & Co., Ltd. V. COB Group Marketing Inc. GR No. L-68907, 16 January 1986 Case DoctrineDocument11 pagesEdward A. Keller & Co., Ltd. V. COB Group Marketing Inc. GR No. L-68907, 16 January 1986 Case DoctrineGrey WolffeNo ratings yet

- Yu Chuck vs. Kong Li Po, GR No. L-22450Document3 pagesYu Chuck vs. Kong Li Po, GR No. L-22450Ronz RoganNo ratings yet

- Philippine National Bank v Landowners Court RulingDocument2 pagesPhilippine National Bank v Landowners Court RulingWilfred Martinez100% (1)

- Kwok Vs PCMCDocument2 pagesKwok Vs PCMCAnn Alejo-Dela TorreNo ratings yet

- Cease Vs CA DigestDocument2 pagesCease Vs CA DigestVictor Lim100% (2)

- Club Filipino Tax Exemption CaseDocument3 pagesClub Filipino Tax Exemption CaseRoxanne PeñaNo ratings yet

- Alhambra Cigar vs. SECDocument2 pagesAlhambra Cigar vs. SECLilibeth Dee Gabutero67% (3)

- PNB Vs CA - DigestDocument2 pagesPNB Vs CA - DigestGladys Viranda100% (1)

- General Credit Corporation VS AlonsoDocument2 pagesGeneral Credit Corporation VS Alonsoasis.rilleNo ratings yet

- General Credit v. Alsons (D)Document2 pagesGeneral Credit v. Alsons (D)Ailene Labrague LadreraNo ratings yet

- Lee Hong Kok Vs DavidDocument6 pagesLee Hong Kok Vs DavidGorgeousENo ratings yet

- Efficient Use of Paper Rule A.M. No. 11-9-4-SCDocument3 pagesEfficient Use of Paper Rule A.M. No. 11-9-4-SCRodney Atibula100% (3)

- Collado Vs CADocument32 pagesCollado Vs CAsarmientoelizabethNo ratings yet

- Efficient Use of Paper Rule A.M. No. 11-9-4-SCDocument3 pagesEfficient Use of Paper Rule A.M. No. 11-9-4-SCRodney Atibula100% (3)

- 6.0 Baron Vs DavidDocument1 page6.0 Baron Vs DavidsarmientoelizabethNo ratings yet

- 43.0 Guevara Vs Guevara - Batch3Document1 page43.0 Guevara Vs Guevara - Batch3sarmientoelizabethNo ratings yet

- 2.0 Cruz Vs de Jesus - Batch3Document2 pages2.0 Cruz Vs de Jesus - Batch3sarmientoelizabethNo ratings yet

- 16.0 Chin Ah Foo Vs ConcepcionDocument2 pages16.0 Chin Ah Foo Vs Concepcionsarmientoelizabeth100% (1)

- 42.0 Ajero Vs Ca - Batch3Document2 pages42.0 Ajero Vs Ca - Batch3sarmientoelizabethNo ratings yet

- 6.0 ALI Vs TagleDocument7 pages6.0 ALI Vs TaglesarmientoelizabethNo ratings yet

- 6.0 Baron Vs DavidDocument1 page6.0 Baron Vs DavidsarmientoelizabethNo ratings yet

- 36.0 Panay Autobus Vs Beruno - DigestDocument1 page36.0 Panay Autobus Vs Beruno - DigestsarmientoelizabethNo ratings yet

- 1.0 Ventura Vs Militante - Batch3Document1 page1.0 Ventura Vs Militante - Batch3sarmientoelizabethNo ratings yet

- 59.0 Liwayway Vs FortuneDocument2 pages59.0 Liwayway Vs FortunesarmientoelizabethNo ratings yet

- 16.0 Chin Ah Foo Vs ConcepcionDocument2 pages16.0 Chin Ah Foo Vs Concepcionsarmientoelizabeth100% (1)

- 60.0 Dreamworks Vs JaniolaDocument2 pages60.0 Dreamworks Vs JaniolasarmientoelizabethNo ratings yet

- 4th Case Digest - 2nd Set - EfsarmientoDocument5 pages4th Case Digest - 2nd Set - EfsarmientosarmientoelizabethNo ratings yet

- SC upholds blocking of parol evidence in lease disputeDocument2 pagesSC upholds blocking of parol evidence in lease disputesarmientoelizabethNo ratings yet

- Republic Vs Ca GR 103882Document2 pagesRepublic Vs Ca GR 103882sarmientoelizabeth100% (5)

- LEGMED Rosit Vs Davao Doctor HospitalDocument1 pageLEGMED Rosit Vs Davao Doctor HospitalsarmientoelizabethNo ratings yet

- LEGMED Rosit Vs Davao Doctor HospitalDocument1 pageLEGMED Rosit Vs Davao Doctor HospitalsarmientoelizabethNo ratings yet

- Labor Case DigestsDocument8 pagesLabor Case DigestssarmientoelizabethNo ratings yet

- Far Eastern Vs HernandezDocument2 pagesFar Eastern Vs HernandezsarmientoelizabethNo ratings yet

- 07.0 Manila Jockey Club Vs Ca - DigestDocument2 pages07.0 Manila Jockey Club Vs Ca - Digestsarmientoelizabeth100% (2)

- 03.0 Francisco Motors Vs Ca - DigestDocument1 page03.0 Francisco Motors Vs Ca - DigestsarmientoelizabethNo ratings yet

- FAR Handout Depreciation Part 2Document7 pagesFAR Handout Depreciation Part 2Chesca Marie Arenal Peñaranda100% (1)

- Mahmood Textile MillsDocument33 pagesMahmood Textile MillsParas RawatNo ratings yet

- 1 The Accounting Equation Accounting Cycle Steps 1 4Document6 pages1 The Accounting Equation Accounting Cycle Steps 1 4Jerric CristobalNo ratings yet

- CV Marius Horincar 2010Document5 pagesCV Marius Horincar 2010Stoicescu VladNo ratings yet

- Formula SheetDocument5 pagesFormula SheetAnna-Maria Müller-SchmidtNo ratings yet

- Hablon Production Center Statement of Financial Performance For The Years Ended December 31Document41 pagesHablon Production Center Statement of Financial Performance For The Years Ended December 31angelica valenzuelaNo ratings yet

- Currency DerivativesDocument17 pagesCurrency DerivativesRimjhimNo ratings yet

- Solution Manual Chapter 1Document52 pagesSolution Manual Chapter 1octorp77% (13)

- Bbbscamtrackerannualreport Final 2017Document48 pagesBbbscamtrackerannualreport Final 2017KOLD News 13No ratings yet

- Mr. Kishore Biyani, Managing Director: Download ImageDocument32 pagesMr. Kishore Biyani, Managing Director: Download ImagedhruvkharbandaNo ratings yet

- Business Finance - 5 - 24 - 23Document8 pagesBusiness Finance - 5 - 24 - 23Angel LopezNo ratings yet

- Form 7Document5 pagesForm 7NagamaheshNo ratings yet

- Chapter 13 Capital Budgeting Estimating Cash FlowsDocument5 pagesChapter 13 Capital Budgeting Estimating Cash FlowsStephen Ayala100% (1)

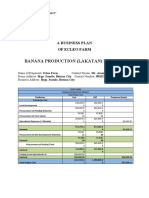

- Banana Production (Lakatan) Project: A Business Plan of Ecleo FarmDocument20 pagesBanana Production (Lakatan) Project: A Business Plan of Ecleo Farmmarkgil1990No ratings yet

- Private Program Opportunity - Procedure - From 25K An Up + Small Cap Flash - Jan 16, 2024Document6 pagesPrivate Program Opportunity - Procedure - From 25K An Up + Small Cap Flash - Jan 16, 2024Esteban Enrique Posan BalcazarNo ratings yet

- CGPA Calculator For PGP IDocument43 pagesCGPA Calculator For PGP IVimal AnbalaganNo ratings yet

- Invoice DocumentDocument1 pageInvoice DocumentAman SharmaNo ratings yet

- Treehouse Toy Library Business PlanDocument16 pagesTreehouse Toy Library Business PlanElizabeth BartleyNo ratings yet

- Agricultural Project Planning Module-IIDocument96 pagesAgricultural Project Planning Module-IIGetaneh SeifuNo ratings yet

- CH 7 Stocks Book QuestionsDocument9 pagesCH 7 Stocks Book QuestionsSavy DhillonNo ratings yet

- IRS Publication Form 8594Document2 pagesIRS Publication Form 8594Francis Wolfgang UrbanNo ratings yet

- Case Study of The Moldovan Bank FraudDocument20 pagesCase Study of The Moldovan Bank FraudMomina TariqNo ratings yet

- Acctg for changes in group structureDocument4 pagesAcctg for changes in group structureJane KoayNo ratings yet

- Internship Report ON National Bank of Pakistan.: Submitted BYDocument21 pagesInternship Report ON National Bank of Pakistan.: Submitted BYUmair SaeedNo ratings yet

- Memo Model Netting ActDocument12 pagesMemo Model Netting ActChristine LiuNo ratings yet

- Whats Is The Line ItemDocument54 pagesWhats Is The Line Itemcrazybobby007No ratings yet

- The Determinants of Venture Capital: Research PaperDocument12 pagesThe Determinants of Venture Capital: Research PaperSehar SajjadNo ratings yet

- About Mutual Funds Lakshmi SharmaDocument83 pagesAbout Mutual Funds Lakshmi SharmaYogendra DasNo ratings yet

- Articles of CooperationDocument39 pagesArticles of CooperationFe LaudNo ratings yet

- MMBC Faces Light Beer Market ChallengeDocument19 pagesMMBC Faces Light Beer Market ChallengeAnshul Yadav100% (1)