Professional Documents

Culture Documents

1 s2.0 S0305054806000153 Main

Uploaded by

dev2945Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

1 s2.0 S0305054806000153 Main

Uploaded by

dev2945Copyright:

Available Formats

Computers & Operations Research 34 (2007) 3516 3540

www.elsevier.com/locate/cor

Supplier selection and order lot sizing modeling: A review

Najla Aissaouia , Mohamed Haouaria, , Elka Hassinib

a Combinatorial Optimization Research Group-ROI, Ecole Polytechnique de Tunisie, BP 743, 2078, La Marsa, Tunisia

b DeGroote School of Business, McMaster University, 1280 Main St. West, Hamilton, ON, Canada L8S 4M4

Available online 9 March 2006

Abstract

With globalization and the emergence of the extended enterprise of interdependent organizations, there has been a steady increase

in the outsourcing of parts and services. This has led rms to give more importance to the purchasing function and its associated

decisions. One of those decisions which impacts all rmsareas is the supplier selection. Since the 1950s, several works have addressed

this decision by treating different aspects and instances. In this paper, we extend previous survey papers by presenting a literature

review that covers the entire purchasing process, considers both parts and services outsourcing activities, and covers internet-based

procurement environments such as electronic marketplaces auctions. In view of its complexity, we will focus especially on the nal

selection stage that consists of determining the best mixture of vendors and allocating orders among them so as to satisfy different

purchasing requirements. In addition, we will concentrate mainly on works that employ operations research and computational

models. Thereby, we will analyze and expose the main decisions features, and propose different classications of the published

models.

2006 Elsevier Ltd. All rights reserved.

Keywords: Purchasing; Outsourcing; Supplier selection; Order sizing; Decision models; Auctions

1. Introduction

In todays erce competitive environment, characterized by thin prot margins, high consumer expectations for

quality products and short lead-times, companies are forced to take advantage of any opportunity to optimize their

business processes. To reach this aim, academics and practitioners have come to the same conclusion: for a company to

remain competitive, it has to work with its supply chain partners to improve the chains total performance. Thus, being

the main process in the upstream chain and affecting all areas of an organization, the purchasing function is taking an

increasing importance.

1.1. The major purchasing decision processes

There are six major purchasing decision processes: (1) make or buy, (2) supplier selection, (3) contract negotiation,

(4) design collaboration, (5) procurement, and (6) sourcing analysis, as shown in Fig. 1.

In the make or buy decision process (1), depending on whether the part/service is a nished/semi-nished good

or not, a company would decide on whether a certain part or service should be produced internally or outsourced.

Corresponding author.

E-mail addresses: aissnaj@yahoo.fr (N. Aissaoui), mohamed.haouari@ept.rnu.tn (M. Haouari), hassini@mcmaster.ca (E. Hassini).

0305-0548/$ - see front matter 2006 Elsevier Ltd. All rights reserved.

doi:10.1016/j.cor.2006.01.016

N. Aissaoui et al. / Computers & Operations Research 34 (2007) 3516 3540

3517

Type of part/service

Raw material

Finished/semi-finished

1

1

Own source

Outsource

Purchase

Make

Supplier selection

2

Contract negotiation

3

Design collaboration

4

Procurement

5

6

Sourcing analysis

Fig. 1. Major purchasing processes.

In Fig. 1, we reserve the term outsourcing for the case when a nished/semi-nished part or service is being procured

and the term purchasing for the case when a raw material is being procured. That is, the distinguishing factor between

a purchased and an outsourced item is that in the latter the supplier undertakes processes that add value to the item.

The analysis at this stage would typically look at the economics of the part or service (i.e., is it cheaper to produce

internally?) as well as its strategic importance (i.e., is it a core product or service?). In this survey, we assume that the

company has already determined that the part or service is both benecial and strategically appealing to outsource or

purchase. Thus, the papers included in this review consider only decision processes [15] and the question of whether

the part is being outsourced or purchased is immaterial to the models therein. Therefore, to be consistent with most of

the literature on procurement, in the sequel, we use the terms purchasing and outsourcing interchangeably.

In the supplier selection process (2), a pool of suppliers is chosen for procurement according to a predened set of

criteria. A good proportion of the studies surveyed in this paper focus on this decision process. The problem of designing

a suitable contract is the subject of the contract negotiation process (3). Although, recently there is an increasing interest

in the subject of contract design for supply chain coordination, there is only a small number of papers that have focused

on procurement contracts (e.g., see [1] for a discussion of when it is appropriate to use a short- or long-term procurement

contract). A related decision process is that of design collaboration (4). At this stage the procurer and supplier work

closely to design parts/services that meet quality standards and customer specications. Here also, we found only a

small number of studies that consider design collaboration criteria in supplier selection models (e.g., see [2] for a model

that addresses the issue of achieving quality standards by concurrent tolerance design and supplier selection).

The procurement decision process (5) is concerned with the problem of guaranteeing that the suppliers would deliver

the part/service in time and with minimum costs. Supplier selection papers that address lot sizing and other inventory

related issues fall under this category. Finally, in the sourcing analysis (6) stage, a company would try to assess the

overall efciency of its procurement process. Here, issues like assortments (ordering a group of parts/services from

a single supplier), consolidation (shipping orders from more than one supplier together), and supplier performance

measurements would be considered.

Typically, it is only decision processes (2), (5), and (6) that are under the complete responsibility of the purchasing

department. For the remaining processes at least one other department, if not another company, would be involved:

marketing and strategic planning (top management) for (1), strategic planning and suppliers sales department for (3)

and engineering departments of both the company and its suppliers for (4). Consistent with the purchasing departments

3518

N. Aissaoui et al. / Computers & Operations Research 34 (2007) 3516 3540

major responsibilities, we found that the majority of the analytical studies on outsourcing decisions focus on processes

(2), (5), and (6). In the future we expect that more procurement studies will focus on decisions that span more than one

company.

Efcient management of the purchasing processes is particularly crucial for industries where outsourcing costs

constitute a signicant portion of their operating costs (e.g., hi-tech industry where outsourced services and parts

account for more than 80% of cost of nished goods [3]). Recent data about manufacturing outsourcing activities

(often called contract manufacturing) can only conrm this trend: the contract manufacturing industry is estimated to

be worth $120 billion in 2001 and has been the fastest growing sector among manufacturing industries, with a yearly

growth rate of more than 80% between 1996 and 2000. It is expected that 50% of manufacturing activities will be

outsourced by 2010 [4, p. 24].

1.2. Overview of the purchasing literature

Overall, there are two salient viewpoints in the literature:

The most important purchasing decision is undoubtedly selecting and maintaining close relationships with a few,

albeit reliable and high-quality vendors, in order to reduce product costs while maintaining excellent product quality

and customer services (e.g., [58]).

There is a strong need for a systematic approach to purchasing decision making especially in the area of identifying

appropriate suppliers and assigning orders among them (see e.g., [912]).

The Supplier Selection Problem (also called Vendor Selection Problem, used interchangeably in this paper) captures

the essential characteristics of the above decisions. Apart from limited number of studies that consider purchasing

services and contracts (e.g., studies by Degraeve et al. [13], Oliveira and Loureno [14]), the vast majority of published

works deal with the procurement of materials, particularly by industrial rms.

A synthesis of the purchasing literature reveals that there are three major decisions that are related to the supplier

selection problem:

What product to order? Up to half of the papers we surveyed are for situations in which vendors are selected for

only one product. In such cases, various interdependencies that could exist among the different products are not

taken into account. For instance, a supplier can be offering a large discount based on total sales volume, irrespective

of the product mix. Order costs could also be minimized by combining orders for several products into one single

order. Finally, quality audits for different products might be executed simultaneously. Only few models consider

purchasing simultaneously a set of products. Furthermore, many multiple-products vendor selection models handle

the problem on an item-by-item basis and have to be applied iteratively to select suppliers for multiple items.

In what quantities and from which supplier(s)? Basically, there are two kinds of purchasing situations: single or

multiple sourcing. With the rst alternative, all the suppliers can fully meet the buyers requests in terms of quantity,

quality, delivery, etc. Consequently, the only decision concerns the identication of the best supplier. Regarding

the second alternative, it is adopted either when none of the suppliers is able to satisfy the buyers total demands (due

to limitations on suppliers capacity, quality, delivery, price, etc.) or when procurement strategies aim at avoiding

dependency on a single source to protect from shortages and maintaining steady competition among suppliers. In

these circumstances, the problem is twofold: vendor selection and order quantity allocation.

In which periods? Inventory lot-sizing and supplier choice are closely interrelated. Incorporating the decision to

schedule orders over time with the vendor selection may signicantly reduce costs over the planning horizon. By

considering a multi-period horizon, one or more suppliers could be selected in each of these periods for the purchase

of products. Alternatively, products could be carried forward to a future period, incurring holding costs. The economic

ordering quantity (EOQ) concept could also be introduced into procurement lot-sizing decisions to incur the least total

cost possible in a supplier selection and procurement lot sizing process. Nevertheless, in spite of those advantages,

the majority of models that have been proposed up to now treat vendor selection without considering multi-period

inventory management issues.

The problem of selecting suitable suppliers is not new and a great number of conceptual and empirical works have

been published. In fact, before supply chain management became a buzzword, numerous publications have already

N. Aissaoui et al. / Computers & Operations Research 34 (2007) 3516 3540

3519

addressed vendor selection issues. First related papers can be traced back to the 1950s when applications of linear

programming and scientic computations were at their beginning. The rst recorded supplier selection model is that

used by the National Bureau of Standards in the United States of America to nd the minimum cost way for awarding

procurement contracts in the Department of Defense [1517]. It is worthwhile mentioning that none of the previous

literature reviews have mentioned these studies and other related works around that period of time. The existent literature

surveys focuses on papers starting from the mid 1960s. The earliest review is by Moore and Fearon [18] where they

focus on industry applications of computer-assisted supplier selection models. Many other interesting surveys in this

area followed thereafter:

Kingsman [19] highlights the inadequacy of classical inventory management models for tackling purchasing decisions

and describes some of the major models that were used for the different purchasing decision making stages.

Holt [20] reviewed and compared several decisional methods applied in contractor evaluation and selection.

Weber et al. [9] annotate and classify 74 articles with regard to the particular criteria mentioned in the study, the

purchasing environment and the decision technique used.

Degraeve et al. [21] presented some published supplier selection models as well and compared their relative efciency

using the total cost of ownership approach using a real life data set.

Unlike in previous survey papers, De Boer et al. [22] did not restrict the review to the nal choice models. The

authors recognized the prior steps to the ultimate stage and presented the main published works that deal with all

the supplier selection process.

Motivated by the above discussion, the purpose of this paper is to extend and update previous reviews. Similar to that

of De Boer et al. [22], our study deals with the entire selection process. Nevertheless, in view of its complexity, we focus

more on the nal selection stage especially in multiple sourcing contexts. In addition, we will concentrate mainly on

works that employ operations research and computational models. Contrary to the existing reviews that only describe

briey the published works, we propose a complete analysis of the various dimensions and characteristics of related

literature and provide different classications. Finally, our work stands previous studies by considering both parts and

services outsourcing activities and covering internet-based procurement environments such as electronic marketplaces

auctions.

The present paper is organized as follows. In Section 2, we describe the whole selection process giving a fair picture of

the variety of approaches available to support the nal choices prior steps. In Section 3, basing on an extensive survey of

the purchasing literature, we analyze and classify published nal selection models in both single and multiple sourcing

contexts. Supplier selection models for service industries and recent developments in the internet-based procurement

environments will be described in Sections 4 and 5. Finally, several conclusions will be drawn in Section 6.

2. The vendor selection process: different stages and characteristics

As reported by De Boer et al. [22], several decision-making steps make up the vendor selection process: at rst, a

preparation step is achieved by formulating the problem and the different decision criteria. After that, prequalication of

potential suppliers and nal choices are successively elaborated. De Boer et al. [22,23] present an interesting overview

of the literature on supplier selection models. It species the published works treating every stage of the selection

process for every purchasing situation.

In this section, we expose in a general way, the main objectives and features of each process step.

2.1. Problem denition

Due to shortened product life cycles, the search for new suppliers is a continuous priority for companies in order

to upgrade the variety and typology of their products range. On the other hand, purchasing environments such as

Just-In-Time, involve establishing close connections with suppliers leading to the concept of partnership, privileged

suppliers, long-term agreement, etc. Thereby, decision makers are facing different purchasing situations that lead to

different decisions. Consequently, in order to make the right choice, the purchasing process should start with nding

out exactly what we want to achieve by selecting a supplier.

3520

N. Aissaoui et al. / Computers & Operations Research 34 (2007) 3516 3540

In general, the majority of decision tools for problem denition are qualitative methods that assist decision-makers

in order to carefully identify the need for a decision and the alternatives that seem to be available.

2.2. Decision criteria formulation

Depending on the purchasing situation, selecting the right suppliers is inuenced by a variety of factors. This

additional complexity is essentially due to the multi-criteria nature of this decision. The analysis of this aspect has been

the focus of multiple papers since the 1960s. Cardozo and Cagley [24], Monczka et al. [25], Moriarity [26], Woodside

and Vyas [27], Chapman and Carter [28], Tullous and Munson [29] propose diverse empirical researches emphasizing

the relative importance of different supplier attributes. Among works that are a reference for the majority of papers we

distinguish Dicksons study [30]. Based on a questionnaire sent to 273 purchasing agent and managers from United

States and Canada, it identied 23 different criteria evaluated in vendor selection. Among these, the price, delivery, and

quality objectives of the buyer, as well as the abilities of the vendors to meet those objectives, are particularly important

factors in deciding how much to order from the available vendors. In the same way, Weber et al. [9] observed that price,

delivery, quality, production capacity and localization are the criteria most often treated in the literature. Although the

evolution of the industrial environment modied the degrees of the relative importance of supplier selection criteria

since the 1960s, the 23 ones presented by Dickson still cover the majority of those presented in the literature until today.

A series of experimental studies was conducted by Verma and Pullman [31] to examine how managers effectively

choose suppliers. The empirical results reveal that they perceive quality to be the most important attribute in the selection

process. Nevertheless, the same sample of managers assign more weight to cost and delivery performance than quality

when actually choosing a supplier. Cusumano and Takeishi [32] note as well that the choice of criteria may differ from

one culture to another.

Generally, two basic types of criteria are dealt with when deciding which suppliers to select: objective and subjective

ones. These former can be measured by a concrete quantitative dimension like cost whereas the latter cannot be like

the quality of design. Another factor complicating the decision is that some criteria may conict each other. Wind and

Robinson [33] identied possible contradictions such as the vendor offering the lowest price may not have the best

quality, or the vendor with the best quality may not deliver on time. As a result, it is necessary to make a trade-off

between conicting tangible and intangible factors to nd the best suppliers. Observe that in compensatory models, a

poor performance on one criterion (generally represented by a score) can be compensated by a high performance in

another one whereas in non-compensatory models, different minimum levels for each criterion are required.

Regarding available methods, there is a lack in the purchasing literature for the formulation of criteria and their

qualication. As for the previous phase, it consists essentially of applying qualitative methods that include tools for

visualizing and analyzing the decision-makers perception of a problem situation and tools for brainstorming about

possible alternative solutions. In the survey proposed by De Boer et al. [22], only two applications are mentioned and

some operational research methods such as Rough Sets Theory [34,35], and Value Focused Thinking [36] are proposed

as suitable alternatives for criteria identication and selection.

Regardless of the method used, supplier selection criteria formulation affects several activities including inventory

management, production planning and control, cash ow requirements, product/service quality [37]. Therefore such

decision must be made under the consensus of a multidisciplinary group of decision makers with various points of view

and representing the different services of the company [3840].

2.3. Pre-selection of potential suppliers

Todays co-operative logistics environment requires a low number of suppliers as it is very difcult to manage a high

number. Therefore, the purpose of this processs stage is to rule out the inefcient candidates and reduce the set of all

suppliers to a small range of acceptable ones.

Among the existing alternatives, it is possible to use an elimination method which excludes suppliers that do not

satisfy the selection rule. With a conjunctive rule, we eliminate the suppliers whose mark, with respect to a criterion,

is lower than the minimal threshold already xed [41]. This is justied by the fact that if a supplier cannot satisfy

a minimal threshold compared to a certain criterion, it cannot be selected in spite of its possible effectiveness with

respect to other criteria because of intolerable possible consequences on quality or other constraints or objectives of

the company.

N. Aissaoui et al. / Computers & Operations Research 34 (2007) 3516 3540

3521

In a lexicographic rule [42], on a rst level, the most signicant criterion is identied. Then, we compare suppliers

with respect to this criterion. If a supplier satises it much better than the other suppliers then it is chosen, if not, we

compare the suppliers with respect to the second criterion, and so on.

Timmerman [43] proposes a categorical method to sort suppliers into three classes by considering historical data. It is

a simple and inexpensive qualitative rating model that requires a minimum of performance data. It consists of evaluating

and categorizing suppliers performance on each criterion as either good (+), neutral (0) or unsatisfactory () and

combining them into a total rating. However, such method is very sensitive to changes in ratings and depends heavily

on human judgment. It also weights the criteria equally, which rarely happens in practice. In view of those limitations,

such method is inadequate to the nal choice phase.

Likewise, as reported rst by Hinkle et al. [44] and later by Holt [20], using a classication algorithm, cluster analysis

(CA) allows classifying suppliers described by a set of numerical attribute scores in groups of comparable suppliers.

In this way, the difference between suppliers performance within a cluster are minimal whereas it is maximal between

different clusters. Holt [20] contends that CA offers greatest potential for pre-qualifying all suppliers. That is, CA

reduces the probability of rejecting a good supplier too early in the process via subjective reduction of the often large

original set. CA would enlarge the scope for rationalization of the selection process by identifying the criteria involved.

Another method that aids decision makers in classifying the suppliers or their bids into a group of efcient suppliers

and a group of inefcient ones is the data envelopment analysis (DEA). Due to its usefulness in evaluating multi-criterion

systems and providing improvement targets, this method has been widely applied to address various decision analysis

problems. DEA is a mathematical programming technique that calculates the relative efciencies (ration of weighted

outputs (benet criteria) to weighted inputs (cost criteria)) of multiple decision making units. Its use in supplier selection

was primarily discussed by Weber and Ellram [45]. Weber and Desai [46] applied a combination of DEA and parallel

coordinates representation to evaluate the performance of vendors and develop negotiation strategies with inefcient

ones. Dealing with the procurement of an individual product under multiple criteria, the authors had also shown the

advantages of applying DEA to such a system. Later, Liu et al. [47] extended Weber and Desais research using DEA

in supplier evaluation for an individual product.

Talluri and Narasimhan [48] stated that multi-factor vendor evaluation methods such as DEA have primarily relied

on evaluating vendors based on their strengths and failed to incorporate their weaknesses into the selection process.

They also added that such approaches would not be able to effectively differentiate between vendors with comparable

strengths but signicantly different weaknesses. Consequently, the authors proposed an approach based on minmax

productivity methods that estimates vendor performance variability measures, which are then used in a non-parametric

statistical technique in identifying homogeneous vendor groups for effective selection. In this way, buyers are provided

with effective alternative choices within a vendor group. This allows the buyer to base the nal decision on other

intangible factors that could not be incorporated into the analysis.

2.4. Final selection

Being the emergent part of the buying process, most of the publications in the area of supplier selection have focused

on determining the best mixture of vendors to supply all needed items. Therefore, at this stage, the ultimate supplier(s)

are identied and orders are allocated among them while considering the systems constraints and taking into account

a multitude of quantitative and/or qualitative criteria.

The research survey reveals that great attention has been paid to develop effective vendor selection models. In the

remainder of this paper, we will cover in detail the state-of-the-art decision models available at present.

3. Decision models for the nal choice phase: Review of the existing literature

As stated earlier, the vast majority of the decision models existing in literature concern the nal choice phase of

the buying process. To classify them, a rst distinction can be made by considering the second decision related to

the supplier selection problem that is to say adopting sole-sourcing where the total demand is procured from the best

vendor or multiple sourcing where it is split among several vendors. Below, we present consecutively the main works

dealing with each alternative.

Most models in the literature have assumed all problems parameters to be known with certainty. We will highlight the

models that incorporated uncertainty, mostly in pricing, in each of the single sourcing and multiple sourcing categories.

3522

N. Aissaoui et al. / Computers & Operations Research 34 (2007) 3516 3540

3.1. Single sourcing models

When a relatively small number of parts are externally procured, the total demand can be supplied by only one

vendor. Such a single sourcing scenario seems tenable especially in the last decade, which has seen a signicant shift

in the sourcing strategy of many rms, moving from the traditional concept of having many suppliers to rely largely

on one source with which a long term winwin partnership is established. In these circumstances, the decision consists

of selecting one supplier for one order to meet the total buyers demand. This can be made while considering a single

criterion or a multitude of criteria. The literature survey reveals that except the multi-item weighting model proposed

by Grando and Sianesi [49] and the mathematical programming models developed by Benton [50] and Akinc [51], the

quasi totality of published works dealing with sole sourcing concern the procurement of a single item and does not

carry over into inventory management over time.

3.1.1. Single criterion approaches

Generally, in a situation with a single criterion, one retains the cost as the most important criterion. Traditionally,

vendor selection and evaluation were based on picking the least invoice cost supplier, ignoring other important sources

of indirect supplier costs like those associated with late delivery times, production breaks, poor quality of delivered

goods, etc. To overcome such limitations while considering cost-oriented selection, Timmerman [43] proposed the cost

ratio method which has the potential to yield much better decisions. It evaluates supplier performances by considering

indirect costs using tools of standard cost analysis. This total cost approach aims at quantifying for every purchased

item the costs associated with working with a specic vendor as much as possible in monetary units. Consequently, it

collects all the costs related to quality, delivery and service and expresses them as a benet or penalty percentage on unit

price. This percentage is then used to adjust the vendors quoted price to obtain a net adjusted cost gure. Operationally

speaking, the cost ratio method is an extremely complex approach, requiring a comprehensive cost-accounting system

to generate precisely the required cost data. Roodhooft and Konings [52] suggest the use of the activity based costing

approach (ABC) to compute total costs caused by a supplier in a rms production process. As in Timmermans model,

the system chooses the supplier who minimizes the total additional costs associated with the purchase decision (e.g.,

price differentials and supplementary estimated internal production costs caused by the supplier). A vendor evaluation

can also be done by comparing budgeted and actual scores after delivery of the products.

Mathematical programming was also employed by Benton [50] to select only one vendor to supply all needed items.

Using the economic ordering concept (EOQ), the author developed a nonlinear program and a heuristic procedure

using Lagrangian relaxation for supplier selection and lot sizing under conditions of multiple items, multiple suppliers,

resource limitations and all-unit quantity discounts. The buyers objective is to minimize the sum of purchasing cost,

inventory cost and ordering costs subject to an aggregate inventory investment constraint and an aggregate storage

limitation constraint.

3.1.2. Multi-criteria approaches

A large number of the researches dealing with procurement decision are concerned with selecting the best supplier

taking into account the multi-objective nature of the problem. In this area, several methods have been suggested in the

literature. The most common approach that has been rstly endorsed by Wind and Robinson [33] in supplier selection

uses linear weighting models to assess the vendors performance. This approach produces useful and reasonably reliable

data, and is relatively easy to implement. Made known principally by Zenz [53] and Timmerman [43], the basic model

is described as follows: giving some form of scoring methods, it consists in assigning weights to each criterion so that

the biggest score indicates the highest importance. After that, ratings on the criteria are multiplied by their weights and

summed in order to obtain a single gure for each vendor. Finally, the supplier who has the best mark compared to the

whole of the weighted criteria is chosen. We point out that such method is also suitable for the pre-selection phase of

the buying process. In this situation, we retain a set of suppliers having the highest scores.

Except for Grando and Sianesi [49] that do not combine ratings on different criteria into one overall score and De

Boer et al. [54] which propose a partially compensatory approach, these and similar methods are usually referred to

as compensatory approaches. In fact, as a result of summing of the scores, a poor performance on one score can be

compensated by a high one on another.

Although giving weights to the various criteria remains a subjective process, an interesting point which is common

to weighting models is that they all make some kind of trade-off between tangible and intangible factors to nd the

N. Aissaoui et al. / Computers & Operations Research 34 (2007) 3516 3540

3523

best supplier. On the other hand, besides requiring a standardization of all the factor units, one problem in the linear

weighting model is the difculty to objectively determine the score of a supplier on a criterion or the importance of

some criterion with a high degree of precision. Dulmin and Mininno [55] focused on the problem of criteria weights

assessment. They propose an interesting survey of most commonly used methods and contend that the set of weights

should be a dynamic vector, because of modications in supply markets, product life cycle or changes in rms strategies

that lead decision makers to periodically update priorities in supplier performance.

A wide variety of slightly different models have been suggested for supplier choice. They principally differ on the

methods used to derive partial scores and weights for the criteria. As a rst adaptation of the basic model, we discern

the model proposed by Gregory [56]. It has linked this basic approach to a matrix representation of data and then rated

the different vendors for their quota allocations.

Using pairwise comparison, a more accurate scoring method that has been applied on supplier selection is the

analytical hierarchy process (AHP). Narasimhan [37], Partovi et al. [57], Nydick and Hill [58], Barbarosoglu and

Yazga [59], Yahya and Kingsman [60], Masella and Rangone [61], Tam and Tummala [62], Lee et al. [63], Handeld

et al. [64] and Colombo and Francalanci [65] propose the use of this technique to cope especially with determining

scores. It is a decision-making tool that can help describe the general decision operation by decomposing a complex

problem into a multi-level hierarchical structure of objectives, criteria, sub-criteria and alternatives [66]. In a recent

study, Liu and Hai [67] presented the voting analytical hierarchy process (VAHP) that is a novel easier weighting

procedure in place of AHPs paired comparison. The analytical network process (ANP), a more sophisticated version

of AHP, was also applied for vendor selection by Sarkis and Talluri [68,69]. In the same way, Willis et al. [70] use

dimensional analysis in a model where a series of pairwise comparisons are made among suppliers using a Vendor

Performance Index such that each criterion is measured in its own units.

Categorized by Degraeve et al. [21] and De Boer et al. [22] as a total cost approach, Monczka and Trecha [71]

combined this approach with rating systems for criteria such as service and delivery performance for which it is more

difcult to obtain the cost gures. As a result, it proposed multiple criteria vendor service factor ratings and an overall

supplier performance index using linear weighting models to adjust the net price for non performance costs associated

with the supplier. Smytka and Clemens [72] developed similarly a more elaborated total cost approach in which they

rst assess risk factors on a go/no-go basis. After that, they developed rates on several business desirable factors

such as delivery performance. Finally, they collected information on a very extensive list of measurable cost factors

and calculated the total cost.

Simple linear weighting models have also been adapted to deal with uncertainty in decision making deriving from

incomplete and qualitative data and unstructured purchasing situations (e.g., dynamic and subjective criteria and

alternatives). For the major part of the proposed models, the common feature to the techniques is that we do not directly

have to provide precise numerical parameters such as criteria weights.

Soukup [73] presents a method to deal with the uncertainty issue that focuses on the requirements uncertainty.

The author modied the linear weighting method by using probabilities for the criterion weights and a payoff matrix

representing alternative scenarios with different sets of performance scores and probabilities.

Other approaches not requiring precise weight assessments are statistical, such as those proposed by Williams [74],

Min [75] and Petroni and Braglia [76]. They respectively suggest the use of conjoint-analysis, indifference trade-off

method and principal component analysis.

Thompson [77] introduces Monte Carlo simulation to reduce the uncertainty innate to the rating mechanism. Afterward, he applied the Thurstone Case V scaling technique [78]. In this manner, setting criteria weights and assigning

performance score are not required and it sufces to give ranges of scores or simply qualitative rank-order information.

Fuzzy Theory (FST) was also looked at as a tool for vendor selection. Being able to model human judgment and

multi-criteria information, some papers (e.g., [20]) discussed its application when facing uncertainty. As a result, it was

combined in many studies with weighting models. Li et al. [79] propose a fuzzy set methodology by introducing the

SUR index that takes the inconsistency of the evaluator into account for each qualitative criterion. Morlacchi [80,81],

developed a model combining FST with AHP to evaluate small suppliers in the engineering and machine sectors.

Later, he focused on the design process of such model, highlighting the advantages and disadvantages of using hybrid

approaches of techniques [82].

With linear weighting models, it is not possible to take into account some quantitative aspects or factors of the

purchasing decision. To cope with this limitation, mathematical programming is a suitable alternative. Akinc [51]

proposed a decision support approach to select vendors in a single sourcing context under the conicting criteria

3524

N. Aissaoui et al. / Computers & Operations Research 34 (2007) 3516 3540

of minimizing the annual material costs, reducing the number of suppliers and maximizing suppliers delivery and

quality performances. Mathematical programming was used to elaborate several models exploring the trade-off between

material costs and number of suppliers under a variety of scenarios (problem instances) dened with respect to specic

quality and delivery performance standards that vendors must achieve. In this way, a rst model nds the set of vendors

that minimize the total invoice cost regardless of their numbers. After that, a second model is used to nd the smallest

set of vendors who can supply all materials within the desired minimal quality and delivery parameters. Then, those

two solutions are used as benchmarks and a third model is employed to explore the quantitative trade-off between these

extreme solutions.

3.1.3. Single sourcing with uncertainties

Apart from the above adapted weighing models dealing with uncertainty, other works exist in the literature that

considers purchasing decisions with price uctuations. The earliest reported works date back to 1959. Fabian et al.

[83] developed a dynamic program to investigate the problem of determining monthly purchasing volumes for a single

commodity when prices and consumption are random variables. Morris [84] also uses dynamic programming to analyze

different purchasing strategies when future prices are considered random variables. He also provides conditions for the

optimality of a single purchasing strategy. Ammer [85] suggests using decision trees to examine different decision stages

and the possible probabilities in supplier negotiations. Golabi [86] extends the work of Morris [84] by considering

different assumptions about price distributions, planning horizon and the holding cost function. In a similar vein,

Kingsman [19] also assumes demand is deterministic and uses dynamic programming to nd optimal purchase policies

when prices are random, and possibly coming from different probability distributions. Recently, Polatoglu and Sahin

[87] investigated a multi-period procurement strategy where demand in each period is a random variable, the probability

distribution of which may depend on price and period.

3.2. Multiple sourcing models

A useful approach to ensure the reliability of a manufacturers supply stream is to follow a multiple sourcing policy.

In this situation, a buyer purchases the same item from more than one vendor and the total demand is split among them.

Even if this choice needs more exibility from the company, it is very interesting when one of the suppliers, for reasons

like price discount offers and possible limitations on capacity, quality, delivery, price, etc., cannot satisfy the assigned

demand. Researches such as Hong and Hayyas [88] have also argued that the use of multiple suppliers, in a majority

of cases especially in just-in-time environment, reduces the overall inventory and purchasing costs.

Due to their ability to optimize the explicitly stated objective subject to a multitude of constraints, mathematical

programming is the most appropriate technique that allows the decision maker to formulate such decision problems. It

allows considering internal policy constraints and externally imposed system constraints placed on the buying process

in order to determine an optimal ordering and inventory policy simultaneously while selecting the best combination

of suppliers. Gaballa [89] was the rst author who applied this technique to vendor selection in a real case. He used a

mixed integer programming model to formulate this decision making problem for the Australian Post Ofce. Until the

publication of the survey proposed by Weber et al. [9], only ten articles proposed the use of mathematical programming

techniques. But since that time, subsequent work in this area has been made and a great number of studies were

conducted considering different aspects and instances of the problem.

As highlighted in the beginning of this paper, when dealing with the supplier selection, a decision maker needs to

decide generally what to buy, from whom and when. As a result, to classify the published models in the situation of

multiple sourcing, two distinctions can be made. The former concerns the number of different purchased items and the

latter concerns the scheduling horizon.

3.2.1. Single and multiple item models

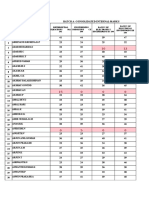

Fig. 2 and Table 1 show four major categories when considering the number of items purchased, recognizing two

particularly important features: single or multiple products ordered and the presence of any form of quantity discount

offered by vendors.

As stated earlier, various interdependencies could exist among the different products and taking into account the

different advantages of the synergy generated by the multiple products models (e.g. reducing purchasing, ordering and

transportation costs) is protable both for buyer and supplier especially in presence of quantity discounts. On the other

N. Aissaoui et al. / Computers & Operations Research 34 (2007) 3516 3540

3525

What product

to order?

Single item

model

Without

discount

Multiple item

model

With

discount

All units

Incremental

Without

discount

Quantity discount

With

discount

Business volume

discount

Bundle discount

All units

Incremental

Fig. 2. Single and multiple item models.

Table 1

Classication of single item/multiple item models

Single item model

Without discount

With discount

Multiple item model

All-unit

Incremental

Other forms

Without discount

With discount

All-unit

Incremental

Business volume discount

Bundling

Other forms

Buffa and Jackson [110], Pan [111], Hong and Hayya [88], Weber

et al. [112], Current and Weber [113], Rosenblatt et al. [114],

Ghodsypour and OBrien [115], Zeng [116], Liao and Kuhn [117]

Chaudhry et al. [93], Tempelmeier [12]

Chaudhry et al. [93], Tempelmeier [12]

Chaudhry et al. [93]

Oliver [118], Rule [119], Chappell [120], Williams and Redwood [121], Bender et al. [122], Narasimhan and Stoynoff [123],

Kasilingam and Lee [124], Jayaraman et al. [125], Karpak et al.

[126], Bonser and Wu [127], Basnet and Leung [128]

Gaballa [89], Pirkul and Aras [92]

Sadrian and Yoon [96]

Rosenthal et al. [102], Sarkis and Semple [103], Murthy et al. [104]

Stanley et al.[15], NBS [16], Gainen [17], Waggener and Suzuki [90],

Austin and Hogan [91], Turner [105], Sharma et al. [106], Crama

et al. [109]

hand, when price break schedules that depend on the size of the order quantity placed are combined with the systems

constraints, selecting orders quantities becomes a difcult problem to solve. Consequently, the simplest problems in

Fig. 2 are successively the single item and multiple item models without considering discounts and the more complex

but more advantageous are those which consider a form of quantity discount while purchasing a range of products.

Classical inventory models traditionally involve two main types of discounts structure: quantity discounts and business

volume discounts. In the context of quantity discount, the sales volume of a product does not affect the prices and

discounts of the other products. Such structure can be applied to single item models as well as multiple item models

wherein products costs are considered independently, although they are offered by the same vendor. This class of

discounting strategy can be either noncumulative (incremental) or cumulative (all-units) which is the case in the

majority of practical situations. The earliest studies have used a modied form of the transportation problem to model

bid evaluations for procurements at the US Department of Defense [1517]. The linear programming model considers

different forms of pricings including quantity discounts and prices that increase with order quantities. Waggener and

Suzuki [90] use a similar model that is of a larger size and accounts for more pricing and supplier requirements scenarios.

Later, Austin and Hogan [91] extended this model to a mixed integer program that account for cases where a supplier

indicates a minimum acceptable quantity.

Gaballa [89] uses a mixed integer programming model to minimize total discounted price (all-units form) of allocated

items to the vendors, under constraints of vendors capacity and demand satisfaction. Pirkul and Aras [92] analyzed

as well the problem of determining order quantities for multiple items in the presence of all-unit quantity discounts.

The objective was to minimize the sum of aggregate purchasing costs, holding costs, and ordering costs subject to a

3526

N. Aissaoui et al. / Computers & Operations Research 34 (2007) 3516 3540

linear resource constraint. They formulated their problem as a non linear program and developed a solution algorithm

using Lagrangian relaxation. Besides, Chaudhry et al. [93] presented a mixed linear integer programming formulation

to minimize the purchasing costs for individual items over a single period. The authors consider capacity constraints,

delivery performance and quality with successively cumulative and noncumulative quantity discounts. An extension to

goal programming was also proposed. Finally, in Tempelmeiers model [12], suppliers offer for a single product all-units

and/or incremental quantity discounts which may vary over time. As a result, Tempelmeier formulated an uncapacitated

multi-supplier order quantity problem with time varying all-units discounts as a mixed integer linear optimization

problem and an uncapacitated multi-supplier order quantity problem with time varying incremental discounts as a

mixed integer nonlinear optimization problem. A heuristic was developed for the resolution.

In the context of business volume discount, multi-item models are considered and a vendor offers discounts on the

total dollar amount of sales volume, not on the quantity or variety of the products purchased. According to Sadrian and

Yoon [94] and Katz et al. [95], this strategy has many benets to both vendors and buyers. However, the computational

difculties due to interdependence of product prices tied to a single discount schedule were the obstacle for buyers

attempting to purchase needed products under the business volume discount strategy. Sadrian and Yoon [96] treated

such form of discount by proposing a mixed integer programming model to optimize the total cost of purchases in the

presence of business volume discounts for one period.

Apart from quantity discounts and business volume discounts, a third class of discount strategy dealt with in multiitem models is the bundling. It is a scheme wherein the price of an item depends on the order quantities of other items.

This occurs when two or more related items are sold together as a bundle. Several studies have identied conditions

under which bundling is protable for the seller or when it needs to be avoided (e.g., [97101]).

Rosenthal et al. [102] were the rst who applied bundling in the context of supplier selection. The authors developed

a mixed linear integer programming to minimize purchasing costs over one period with constraints addressing vendor

capacities, demand satisfaction, quality and delivery requirements. The authors proposed also as extension to export the

idea of product bundling to an EOQ context. Later, Sarkis and Semple [103] suggested a reformulation of the problem

proposed by Rosenthal et al. [102]. Thus, they signicantly reduced the computational workload and eliminated some

limitations and a paradox revealing a more cost effective purchasing strategy. Recently, Murthy et al. [104] addressed

the buyers vendor selection problem for make-to-order items where the goal is to minimize sourcing and purchasing

costs in the presence of xed costs, shared capacity constraints, shared setup costs, and volume-based discounts for

bundles of items. Giving quotes in the form of single sealed bids or facing dynamic auction involving open bids, the

model has to determine the best bid among those proposed or winners at each stage of a dynamic auction. Due to the

complexity of the mixed integer programming formulated, a heuristic procedure based on the Lagrangian relaxation

technique was developed to solve the problem.

Slight different discount schemes also exist in literature. Treating a vendor selection problem faced by British Coal,

Turner [105] discussed three types of discounts: deferred rebates based on the total value of the order, deferred rebates

based on the order quantity, and marginal discounts based on the total value of the order. The problem was formulated as

a mixed integer program that minimizes total contract cost, and constrained by demand satisfaction, vendor capacities,

minimum and maximum order quantities and geographic region purchasing restrictions. This model relaxed, however,

any dependence of unit price on size of order quantity. The linear program was costly to solve, so a quasi-optimizing

heuristic routine was adopted. Sharma et al. [106] proposed a nonlinear, mixed integer, goal programming model. They

considered price, quality, delivery and service as goals. The cost goal was nonlinear and the total cost of purchased

materials was inversely proportional to quantity purchased and lead time, but increased linearly as the quality level

increased.

Related research work dealing with price breaks regimes when selecting suppliers, concerns not only discounts but

also surcharges. Contrary to the discounts offers where unit price of a vendor declines as the order quantity placed

increased, with surcharges, it increases. Such situation is faced whenever the ordered material is a scare source, like an

energy product [107]. To our knowledge, only Chaudhry et al. [93] considered the presence of surcharge and focused

on the impact of considering price break schedules (all-unit vs. incremental, and discounts vs. surcharges).

Finally, from our analysis of the works currently being reported for supplier selection we can conclude that considering

price discounts is a decisive factor for selection and order quantity allocation. Effectively, it inuences signicantly

the nal decision that is why it has been considered in several studies combining the supplier selection issue with

other features. By way of example, Ganeshan et al. [108] strike a balance between the use of just one supplier, and the

perceived cost benets of using several while considering reliability and discounts. Crama et al. [109] presented also an

N. Aissaoui et al. / Computers & Operations Research 34 (2007) 3516 3540

3527

interesting extension of the basic supplier selection problem that considers price discounts. It focused on procurement

decisions in presence of total quantity discounts and alternative product recipes which increased the complexity of

the problem. The authors consider a medium-term purchasing decision faced by a multi-plant chemical company.

Assuming that each product made by the company can be processed according to several recipes, where each recipe

species which proportion of each ingredient, the rm aims at simultaneously optimizing its procurement plan and its

production plan while considering quantity discounts based on the total quantity of ingredients purchased over a year.

They formulated the corresponding cost-minimization problem as a nonlinear mixed 01 programming problem and

proposed various ways to linearize it.

3.2.2. Single and multiple period models

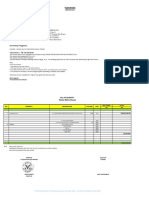

Regarding the second distinction related to the third decision of the supplier selection problem (i.e., in which periods?),

the vast majority of approaches that have been investigated up to now are single period models solving only a short term

planning problem. In reality, when planning horizon covers several periods, the problem becomes harder, but has the

potential to yield much better procurement plan by considering inventory management. This balances ordering costs

and holding costs and permits to select the supplier with a low ordering cost when frequent ordering is necessary due

to inventory management reasons (e.g., perishable inventory). In addition, this exibility of deciding when to receive

deliveries and how large they will be may signicantly reduce ordering and purchasing costs especially whenever there

are quantity discounts, by establishing a trade-off between receiving a quantity discount and the inventory holding

costs when buying larger lot-sizes. Thereby, as shown in Fig. 3 and Table 2 , we conclude that approaches developed

to model supplier selection can be classied as single period models that do not consider inventory management over

time and multi-period models which consider inventory management by determining an order sizing policy scheduling

while selecting suppliers.

Multi-period inventory lot-sizing has been one of the most studied problems in production and inventory management

literature. Bahl et al. [129] proposed an interesting review of related literature providing four categories for classifying

works in this area: (1) single-level unconstrained resources, (2) single-level constrained resources, (3) multiple-level

constrained resources, and (4) multiple-level unconstrained resources. Levels refer to the different levels in a bill of

In which periods?

Single period (no inventory management) Multi-period (with inventory management)

Multi-period horizon

EOQ concept

Stationary parameters

Dynamic parameters

Fig. 3. Single and multiple period models.

Table 2

Classication of single period/multiple period models

Single period model

Multiple period model

EOQ

t [1, T ]

Stanley et al. [15], NBS [16], Gainen [17], Oliver [118], Waggener and

Suzuki [90], Rule [119], Chappell [120], Williams and Redwood [121], Gaballa [89], Austin and Hogan [91], Pirkul and Aras [92], Narasimhan and

Stoynoff [123], Turner [105], Pan [111], Chaudhry et al. [93], Weber et al.

[112], Hong and Hayya [88], Current and Weber [113], Sadrian and Yoon

[96], Rosenthal et al. [102], Kasilingam and Lee [124], Jayaraman et al.

[125], Karpak et al. [126], Sarkis and Semple [103], Zeng [116], Murthy et

al. [104], Crama et al. [109]

Rosenthal et al. [102], Rosenblatt et al. [114], Ghodsypour and OBrien

[115], Liao and Kuhn [117]

Buffa and Jackson [110], Bender et al. [122], Sharma et al. [106], Bonser

and Wu [127],Tempelmeier [12], Basnet and Leung [128]

3528

N. Aissaoui et al. / Computers & Operations Research 34 (2007) 3516 3540

material structure where dependency of requirements exists, and constrained resources refer to production capacity

limitations. To our knowledge, level dependencies have not been considered in supplier selection problems to date.

In the survey proposed by Weber et al. [9], 14 papers that use the Economic Order Quantity concept in supplier

selection have been identied. More recently, Rosenblatt et al. [114] have used the EOQ model to develop a nonlinear

program for nding optimal supplier selection and order quantities for a single item. They have assumed that a supplierdependent xed cost will be incurred whenever a supplier is chosen. Ghodsypour and OBrien [115] also used the EOQ

concept in a single item model. Assuming that the suppliers lots arrive one after the former one is used up, a mixed

integer nonlinear programming model to minimize the total annual cost of logistics is proposed. It includes aggregate

price, ordering, and inventory costs, subject to suppliers capacity constraints and buyers demand and limitations

on budget and quality. The authors also discussed a second multiple objective programming approach to take into

account different weights for various criteria. In a similar vein, being an extension of Webers study [112], Liao and

Kuhn [117] proposed a multiobjective program for a single item model under the assumption that all suppliers lots

simultaneously arrive at the beginning of each replenishment period. The objectives are the minimization of the total

cost, the total quality rejection and the total delivery late while the constraints concern the capacity and demand

satisfaction. To deal with the multiobjective optimization, a Genetic Algorithm was applied. Further, two-objective

and three-objective optimization results are compared to Webers studies, which prove GA satisfying in solving such a

problem.

Included in the stream of researches integrating supplier selection and procurement lot sizing are works by Oliver

[118], Rule [119], Chappell [120], Williams and Redwood [121], Anthony and Buffa [130], Buffa and Jackson [110],

Bender et al. [122], Pan [111], Tempelmeier [12] and Basnet and Leung [128]. These works do not consider EOQ

concept to carry out procurement lot sizing decisions. Instead, they consider a multi-period planning horizon and

dene variables to determine the quantity purchased in each elementary period. Several works are based on a modied

version of the linear programming transportation model (e.g., [111,118121,130]).

Buffa and Jackson [110] presented a schedule purchase for a single product over a dened planning horizon via

a goal programming model considering price, quality and delivery criteria. It included buyers specication such as

material requirement and safety stock.

Bender et al. [122] studied a purchasing problem faced by IBM involving multiple products, multiple time periods,

and quantity discounts (the type of quantity discount was not mentioned). The authors described, but not developed,

a mixed integer optimization model, to minimize the sum of purchasing, transportation and inventory costs over the

planning horizon, without exceeding vendor production capacities and various policy constraints.

Contrary to single period models dealing with any form of price discount, by considering inventory management in

a multi-period horizon planning, Tempelmeier [12] incorporates a trade-off between ordering larger quantities to get a

reduction on purchasing costs and maintaining low inventories to minimize holding costs.

Basnet and Leung [128] balance ordering and holding costs in a multi-item model by considering a multi-period

scheduling horizon. They proposed an uncapacitated mixed linear integer programming that minimizes the aggregate

purchasing, ordering and holding costs subject to demand satisfaction. The authors proposed an enumerative search

algorithm and a heuristic to solve the problem.

Finally, we should highlight that only Tempelmeier [12] proposed a planning model for supporting short-term

selection and order sizing under time varying parameters (dynamic demand and time-varying price discounts). Due to

time dependency too, Hong et al. [131] divided the analyzed period into several meaningful period units. An elementary

period is dened as a period in which a sales environment can be distinguished from that of a previous period.

Indeed, almost all multi-period models do not consider any time depending (dynamic) parameter and assume them

to be constant. However, due to multiple reasons such as market environments added to changes of production and

delivery parameters and/or conditions, suppliers capabilities and buyers requirements may change over the periods.

In fact, it is difcult to maintain the same capability condition during all supply periods especially in types of industries

which have seasonal demands and have a wide uctuation of capability condition over time. Talluri and Sarkis [132]

report on a case where performance of a selected supplier is monitored across 18 time periods using DEA. They indicate

that the suppliers efciency changed from on period of time to another.

3.2.3. Technique-oriented classication

By considering the analysis of the above studies concerning the multiple sourcing supplier selection, it can be

concluded that apart from the two above distinctions (single item/multi-item and single period/multi-period), we can

N. Aissaoui et al. / Computers & Operations Research 34 (2007) 3516 3540

3529

Criteria

Multiple Objectives

Single objective

Linear Programming Mixed Integer Programming

Other

Multi Objective Programming Goal Programming

Fig. 4. Technique-oriented classication.

also propose a technique oriented classication. As shown in Fig. 4, published works can be divided into two groups

(1) single objective and (2) multiple objective.

Single objective techniques:

Linear programming method: Stanley et al. [15], NBS [16], Gainen [17], Oliver [118], Waggener and Suzuki [90],

Rule [119], Chappell [120], Williams and Redwood [121], Anthony and Buffa [130], Pan [112], Ghodsypour and

OBrien [133].

Mixed integer programming method: Gaballa [89], Austin and Hogan [91], Bender et al. [122], Narasimhan and

Stoynoff [123], Turner [105], Chaudhry et al. [93], Sadrian and Yoon [96], Rosenthal et al. [102], Kasilingam and

Lee [124], Jayaraman et al. [125], Sarkis and Semple [102], Ghodsypour and OBrien [115], Zeng [116], Talluri

[134], Tempelmeier [12], Murthy et al. [104], Crama et al. [109], Basnet and Leung [128].

Others:

Dynamic programming: Fabian et al. [83], Morris [84], Kingsman [19].

Nonlinear programming: Pirkul and Aras [92], Hong and Hayya [88], Rosenblatt et al. [114].

Stochastic programming: Bonser and Wu [127].

Decision theory: Ammer [85].

Multiple objective techniques:

Multi-objective programming method: Weber et al. [112], Ghodsypour and OBrien [115], Liao and Kuhn [117].

Goal programming method: Buffa and Jackson [110], Sharma et al. [106], Chaudhry et al. [93], Karpak et al. [126].

Other: Siying et al. [135] who used neural networks.

All of the above mentioned single objective programming methods aim at minimizing costs. Depending on models

type, they mainly include: purchasing price, xed cost of establishing a vendor, price breaks, and inventory costs for

multi-period models. Some penalties related to poor quality, shortage or inefcient utilization of supplier capacities are

also taken into account in some approaches. We should note that only Current and Weber [113], which demonstrated

that the vendor selection problem may be formulated within the mathematical constructs of facility location modeling,

consider minimizing the number of suppliers used. We remark too that very little attention has been paid to transportation

costs in the published works. For example, Kasilingam and Lee [124] had only incorporated the unit transportation

cost from the vendor in the product unit price and Ding et al. [136] consider the different transportation links between

the supplier and the warehouse.

By its nature, in single objective models only one criterion is considered as objective function. The other relevant

criteria such as quality and led-time are modeled as constraints. In this situation the criteria which are considered as

constraints are weighted equally which rarely happens in practice because decision makers often prioritize their criteria

differently. Moreover, as pointed out by Weber et al. [112], the trade-off between conicting criteria cannot be apparent.

To overcome these limitations and provide a more robust method addressing the multi-criteria nature of the decision,

some researches suggest the use of multi-objective programming and goal programming methods. As no one solution

exists which is optimal for all of the objectives, such methods aim at minimizing deviations from each goal, in order

of priority. Higher priority goals are satised at the expense of lower priority goals.

Many studies such as Webers work in 1993 [112], that was the rst to introduce a multi-objective programming

model for supplier selection, afrm that this alternative has several advantages over single objective analysis. The

authors assert that it allows the various criteria to be evaluated in their natural units of measurement (e.g., cost per

delivered unit, percent of nonconforming units, percent of units delivered on time) and therefore, eliminates the necessity

3530

N. Aissaoui et al. / Computers & Operations Research 34 (2007) 3516 3540

of transforming them to a common unit of measurement. They also added that such techniques present the decision

maker with a set of or nondominated solutions. Consequently, it permits the decision maker to incorporate personal

experience and insight in making nal decisions. The literature analysis shows also that multi-objective techniques

provide a methodology to analyze the impacts of decisions that entail a reordering of priorities on rms objectives.

As pointed out by Weber et al. [112], the proposed mathematical approaches to model supplier selection include two

kinds of constraints: system and policy constraints. System constraints are dened as those that are not directly under

the control of the purchasing rm whereas policy constraints are those which the purchasing department can directly

inuence.

In addition to the single objective models quality and total late requirements constraints, system constraints can also

include:

supplier capacities,

buyers storage capacity,

demand satisfaction,

minimum order quantities established by the suppliers,

price breaks,

limitation of purchasing budget.

Policy constraints may include depending on the rms strategy:

minimum and/or maximum number of suppliers selected,

minimum and/or maximum order quantities placed with suppliers,

geographic preferences and regional allocated bounds,

safety stock.

Some constraints may be ignored or fall into either of the constraint categories depending upon the purchasing context

or policy. By way of example, we point out that some models do not consider the supplier capacities [111,113,12,128].

In this situation, selecting suppliers and allocating orders are only imposed by factors such as quality and led time

requirements, minimum of suppliers to be selected, minimizing order and holding costs.

3.2.4. Alternative models

3.2.4.1. Total cost of ownership (TCO) models As stated earlier when we introduced the total cost approaches, TCObased models attempt to include all quantiable costs in the vendor choice process that are incurred throughout the

purchased items life cycle. Ellram [137] introduces the concept of TCO as applied to purchasing. She also compares

TCO to other purchasing framework and provides TCO model examples for supplier evaluation and selection. Degraeves et al. studies [138,139,13] are the main works that proposed mathematical programming models that minimize

the total cost of ownership. These models are based on the activities and cost drivers determined by an ABC system

that allows including all relevant costs categories.

Degraeve and Roodhooft [139] recognized three hierarchical levels in the decision support system to describe the

supplementary activities caused by the suppliers:

(1) The supplier level activities that include costs assigned to a supplier whenever he is used over the time horizon

considered in the procurement decision.

(2) The order level activities including costs incurred each time an order is placed with a supplier.

(3) The unit level activities where costs for the individual units of the products are considered.

Degraeve and Roodhooft [138] recognized also a fourth level related to specic batches. Using these levels, the authors

proposed formulations to select suppliers and determine order quantities over a multi-period time horizon for a single

item in [138] and for a range of items in [139]. In a similar vein, Degraeve et al. [13] developed a TCO based mathematical

programming model that selects suppliers of a multiple item service and simultaneously determines market shares of

the suppliers selected.

N. Aissaoui et al. / Computers & Operations Research 34 (2007) 3516 3540

3531

Note that such models reduce subjectivity by indicating and quantifying the supplementary activities caused by the

suppliers. Furthermore, the quantication of criteria and the trade-off between them is no longer a problem because the

objective function is dened with respect to the purchasing decisions caused by the vendor. Nevertheless, we should

add that supplier selection models using ABC are more costly to implement than traditional approaches. However,

experience shows that the incremental cost of data gathering for ABC systems is often overestimated and that rms

have implemented it at acceptable cost [140].

3.2.4.2. Integrated models Another stream of research suggests considering both quantitative and qualitative measures

to better model the multi-criteria nature of the decision. Ghodsypour and OBrien [133], Benyoucef et al. [40], Wang

et al. [141] and recently Hong et al. [131] proposed such global approaches. They are achieved in two phases. At rst,

a supplier evaluation is elaborated using a multi-criteria tool. In the rst three above references, the AHP method was

applied to make the trade-off between tangible and intangible factors and calculate a rating of suppliers. As for Hong

et al. [131], they apply a CA to segment and select candidate groups by periods in time in the prequalication step (the

paper treated the entire selection process).

The second stage of these global approaches consists of effectively selecting the suppliers and allocating orders

using mathematical programming to take into account the system constraints. Thereby, in [133], calculated ratings are

applied as coefcients of an objective function in a linear program such that the total value of purchasing becomes a

maximum. This single period single item model was constrained by the demand, capacity and quality requirements.

Likewise, Benyoucef et al. [40] proposed a multi-period single item mixed integer programming model that has a

similar objective function. The formulation considered constraints treating the requested demand, quality and lead time

satisfaction, and the minimum and maximum ordered quantity.

In addition to a goal that maximizes the total value of purchase (AHP ratings input), Wang et al. [141] considered

a second goal that minimizes the total cost of purchase. The resulted preemptive goal programming determines the

optimal order quantity from the chosen suppliers considering as constraints vendor capacities and demand requirements.

As for [131], after dividing suppliers into several groups having similar features of supply conditions during each

elementary period in the previous step, each group may satisfy some criteria of procurement condition in time t but may

not satisfy all the conditions. Consequently, the authors attempt to maximize the revenue by assigning more suppliers of

the group which meets the procurement conditions than for those of other groups. The authors propose a mixed integer

program to nd the optimal solution and assign orders while maximizing the revenue and satisfying the procurement

conditions.

3.2.4.3. Efciency-based vendor selection and negotiation models At this stage, we turn our attention towards the

vendor evaluation and negotiation models provided in the literature. Miller and Kelle [142] contend that limited

research have been paid to supplier negotiation. Weber and Desai [46] have shown how DEA can be used as a tool

for negotiation with inefcient suppliers. Subsequently, a series of studies was conducted to integrate the process of

supplier selection and negotiation in multiple sourcing contexts based on a DEA model by Weber et al. [143,144]. In

this rst paper, both multi-objective programming (MOP) and DEA are used and three approaches for the selection

and negotiation are described. In a rst stage, using the MOP model proposed by Weber and Current [112] the set of

selected and not selected suppliers are identied. Then, a negotiation is established with vendors which have not been

selected by the MOP model in order to become part of the solution set. In the second paper, the MOP and DEA are

used a similar problem solving approach to evaluate the number of vendors a rm may wish to employ to supply a

product or a service. The approach advocates developing vendor-order quantity solution (referred to as supervendor)

using MOP and then evaluating the efciency of these supervendors on multiple criteria using DEA.

Although Webers et al. studies provided innovative ways of approaching the vendor evaluation and negotiation

problem, it has certain limitations. It only allows for negotiation with inefcient vendors. In order to overcome these

limitations, Talluri [134] proposes a buyerseller game model minimizing the efciency for evaluation, selection and

negotiation. It evaluates the efciency of alternative bids, with respect to the ideal targets set by the buyer. Effective

negotiation strategies have also been proposed in order to make the unselected bids competitive. Four variations of

the model are developed also to assist the buyer in different types of purchasing situations. The model evaluations

are integrated into a 01 integer programming formulation in determining the optimal set of vendors to be selected in

meeting the demand requirements without violating the minimum order necessities of the vendors. Zhu [145] shows

that Talluris model is closely related to DEA and can be simplied. The paper presents a new buyerseller game model

3532

N. Aissaoui et al. / Computers & Operations Research 34 (2007) 3516 3540

where the efciency is maximized with respect to multiple targets set by the buyer. It allows the buyer to evaluate and

select the vendors in the context of best practice. By both minimizing and maximizing the efciency, the buyer can