Professional Documents

Culture Documents

400 - 610 ConsEPS 72B

Uploaded by

Zenni T XinOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

400 - 610 ConsEPS 72B

Uploaded by

Zenni T XinCopyright:

Available Formats

Dr. M.D.

Chase

Advanced Accounting 610 -72B

Long Beach State University

Consolidated Earnings Per Share

Page 1

Review of EPS

I. EARNINGS PER SHARE (Review)

A. Simple Capital Structure:

1. No potentially dilutive securities exist

EPS =

Net Income Available to CS

C/S outstanding*

* This is the weighted average number of shares outstanding if shares were outstanding for only part of a period

B. Complex Capital Structure:

1. Convertible securities, and/or stock options, warrants and rights are outstanding: In a complex capital structure a dual presentation of EPS

is required.

a. PEPS: Primary Earnings per share is defined as:

PEPS =

Net Income Available to CS

C/S outstanding + CSE

CSE =Common Stock Equivolents:-- Securities that derive a substantial portion of their value from the fact that they are convertible into

common stock;

-- SFAS-55 defines CSE as convertible securites whose effective yield at issuance is less than 2/3 the Aa Corporate Bond Yield

--Stock options, rights and warrants are always CSE;

--If CSE exist, CSE are always included in the denominator

b. FDEPS: Fully Diluted Earnings per share is defined as:

FDEPS =

Net Income Available to CS

C/S outstanding + CSE + All CS created under "if converted" method promulgated in APB-15

"If Converted" Method: Convertible securities are assumed to have been converted to CS at the beginning of the current period or at their

date of issuance, if issued during the period. All interest and/or dividends due these securities must be added back

to net income available to CS (increasing the numerator).

FDEPS must result in a lower EPS number than PEPS or it is not reported;

The Treasury Stock Method will be used to determine the dilutive effect of stock options rights and warrants;

1. Determine the proceeds to be received from the excercise of rights/warrants;

2.Determine the number of shares of C/S that can be acquired at average market price (PEPS) or the greater of average market price or

ending market price (FDEPS) using the proceeds as defined in step 1 above;

3.Determine the net increase in number of shares outstanding by deducting the number of shares acquired in step 2 from the number of

shares issued in step 1. This net increase is added to the denominator to the EPS algorithm.

4.If options, rights or warrants are outstanding for only part of a period, the net increase in shares must be weighted for the time period

outstanding (this is the same as the normal weighted average number of shares computation)

5. To be included under the TS method, all warrants/rights/options must be dilutive:

Dr. M.D. Chase

Advanced Accounting 610 -72B

Long Beach State University

Consolidated Earnings Per Share

Page 2

PEPS: average market $ > excercise $

FDEPS: greater of average market $ of ending market $ > excercise $

Short cut approach to TS method:

Net increase in shares = (Market Price per share - Excercise Price per share) x Number shares excercised

Market Price per share

II. CONSOLIDATED EARNINGS PER SHARE

A. Subsidiary Capital Structure:

1. Subsidiary has a "Simple Capital Structure" (no potentially dilutive securities)

a. Calculation of of Consolidated EPS is not affected; all normal procedures for the computation of EPS are followed by each firm; there is no

consolidated affect:

Consolidated EPS =

Consolidated Net Income

Parent C/S outstanding*

*Numerator/Denominator adjustments required due to Parent Dilutive Securities are handled in the normal manner

2. Subsidiary has a "Complex Capital Structure":

a. Issue: do subsidiary warrants, options and convertible securities enable the holders to acquire common stock of subsidiary or common stock

of parent

1. Subsidiary dilutive securities allow holder to acquire Sub C/S:

Step 1: Compute Subsidiary EPS in the normal manner;

Step 2: Compute Consolidated EPS using the Subsidiary EPS computed in step 1 as an adjustment to the numerator;

Subsidiary dilutive securities allow holder to acquire Sub C/S

Cons EPS = PIGNI + P EPS income adj + [("P" equiv Shares of "S" securities) x ("S" EPS)]

P C/S outstanding + Parents share adj.

This model is appropriate for both PEPS AND FDEPS

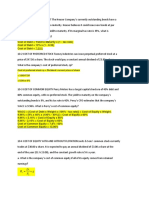

EXAMPLE:

--"S", an 80% sub of "P" has 5000 shares of stock outstanding

--"S" also has 1000 warrants good for 1000 shares of "S" C/S

(option price=$10/sh; avg mrkt price=$20/sh; Yr end Price=$25/sh)

--"S" has debentures convertible into 2000 shares of "S" C/S

--"P" owns 500 warrants and 90% of the debentures (which are CSE)

--"P" has outstanding debentures (CSE) that pay $5000 interest/yr and are convertible into 3000 shares of "P" C/S

--interest on "S" debentures is $3000 annually

--"S" NI (adjusted for intercompany items) was $22,000

--"S" declared a $2000 dividend on nonconvertible P/S (not held by P)

--"P" internally generated NI=$40,000 and 10,000 shares C/S outstanding

Required:

1. Compute PEPS for subsidiary (USE TREASURY STOCK METHOD)

2. Compute Consolidated PEPS

Dr. M.D. Chase

Advanced Accounting 610 -72B

Long Beach State University

Consolidated Earnings Per Share

Page 3

Solution: (1)

Subsidiary PEPS = $22,000 - $2000(a) + $3000(b) = $3.07

5000 + 2000(c) + 500(d)

(a) dividend on P/S

(b) add back expense on convertible debentures (CSE)

(c) shares issued on conversion of debentures

(d) share adjustment on warrants (1000x$10)/$20=500; 1000-500=500

Solution: (2)

Cons EPS = $40,000 + $5000(a) + $12,280(b) + $5525(c) + $768(d) = $4.89

10,000 + 3000(e)

(a) add back interest on CSE debentures

(b) "P" interest in "S" NI associated with C/S:(.8)(5,000x$3.07)

(c) "P" interest in "S" NI associated with debentures: (1800/2000)(2000x$3.07)=$5526

(d) "P" interest in "S" NI associated with warrants:

(500/1000)(500 incremental shares O/S x $3.07)=$768

(e) adjust number of shares O/S under "if converted" method

2. Subsidiary securities enable the holder to acquire CS of the Parent

a. Securities are not included in the computation of subsidiary EPS but must be included in the Parents share adjustment for

consolidated EPS.

Subsidiary securities enable the holder to acquire CS of the Parent

Cons

EPS

= PIGNI + P NI Adj + [("P" Equiv Shares of"S") x (S EPS)] + Adj to P NI due to S CS which allow holder to acquire P C/S

"P" C/S outstanding + adjustments to "P" stock outstanding

EXAMPLE:

--"P" has NI of $20,000 and 10,000 shares of C/S outstanding

--"P" has outstanding dilutive securities which are CSE,

they pay $1000/yr interest and are convertible into 2000 shares of C/S.

--"S" has NI of $7,000 and 4000 shares of C/S outstanding

--"S" has convertible P/S which are convertible into 2000 shares of "P" C/S.

This stock pays $1,200 dividend and is a CSE for computing "P" EPS.

--"S" also has outstanding 100 warrants to acquire 100 shares of "P" C/S.

(option price=$10; avg mrkt price+$20; ending market price=$25)

--"P" owns 90% of "S" C/S

Cons

PEPS = $20,000 + $1,0009(a) + (.9)(4000 x $7,000 - $1,200)(b) + $1,200(c))

4000

10,000 + 2000 +2000 + 50 (d)

= $1.95

(a) adjust "P" NI for its convertible securities (CSE)

(b) adjust "P" NI for "S" securities effecting consolidated EPS

(c) add back dividends on "S" securities that will not be paid under the "if converted" method but will effect consolidated EPS only.

(d) adjust "P" C/S outstanding for potentially dilutive securities.

NOTE:1. When acquisitions of potentially dilutive subsidiary securities occur during the reporting period normal requirements of

computing the weighted average number of shares apply. Remember to exclude purchased net income where applicable.

Dr. M.D. Chase

Advanced Accounting 610 -72B

Long Beach State University

Consolidated Earnings Per Share

Page 4

a. When the acquisition is a pooling the computation of Consolidated EPS includes "S" income for the entire period;

b. When the acquisition is a purchase the computation of Consolidated EPS includes "S" income since acquisition date;

Consolidated EPS and FDEPS: Illustrative Example

"P" Acquires 80% of "S" on 1/1/x2. As of 12/31/x4 the following facts applied:

Internally Generated Net Income..........................

$

C/S outstanding during year..............................

Warrants to acquire "P" stock outstanding during year....

5% convertible $100 par preferred stock outstanding......

Non convertible $100 par preferred stock outstanding.....

"P"

50,500

$

20,000 shares

2,000 warrants

"S"

56,000

12,000 shares

1,000 warrants

800 shares

1,000 shares

Additional Information:

a. The warrants to Acquire "P" stock were issued in 20x3. Each warrant can be exchanged for one share of "P" common stock (exercise price

$12/share). The three month test was met in 20x3.

b. Each share of convertible preferred stock can be converted into two shares of "S" common. The preferred stock pays an annual dividend

totaling $4,000. When issued in 20x2, the Aa bond yield was 6%. "P" owns 60% of the convertible preferred stock.

c. The nonconvertible preferred stock was isued on 7/1/x4, and payed a six month dividend totalling $500.

d. Relevant market prices per share of "P" common stock during 20x4 were:

Average

Ending

1st Quarter.............

$10

$11

2nd Quarter.............

12

14

3rd Quarter.............

13

15

4th Quarter.............

16

15

Required:1.Compute primary and fully diluted consolidated EPS for the year ended 12/31/x4

Solution: Computation of Consolidated PEPS and FDEPS

Note:1. Under the treasury stock method, warrants must be dilutive (Average Market $ > Exercise $); therefore for the first two quarters

of 20x4 the warrants will not be included

2. Average price is used for PEPS; Ending price is used for FDEPS

3. Subsidiary convertible PS is not CSE (effective yield > 2/3 of Aa corporate bond)

Dr. M.D. Chase

Advanced Accounting 610 -72B

Long Beach State University

Consolidated Earnings Per Share

Page 5

A. Computation of Subsidiary EPS: [(Subsidiary has complex capital structure, PS is convertible but not CSE)]

1. Subsidiary PEPS =

Net Income Available to CS

C/S outstanding + CSE

=

2. Susidiary FDEPS

$56,000 - $4,000 div to PS

12,000 + 0

$4.33

Net Income Available to CS

C/S outstanding + CSE + All CS created under "if converted" method promulgated in APB-15

=

$56,000

12,000 + 0 + (800 x 2)

$4.12

B. Computation of Consolidated EPS:(Complex capital Structure; CSE: warrants outstanding; Convertible securities allow purchase of "P" C/S)

1. Consolidated PEPS:

Cons

P NI

Adj to P NI due to S sec which

PEPS = P NI + Adj + [("P" Equiv Shares of"S") x (S EPS)] + allow holder to acquire P C/S

"P" C/S outstanding + adjustments to "P" stock outstanding

= ($50,500 - $500) + (.80 x 12,000 shares)($4.33) + 0

20,000 + 163* + 82*

= $50,000 + $41,568

20,245

= $4.52

*Short cut approach to TS method:

Net increase in shares = (Market Price per share - Excercise Price per share) x Number shares excercised

Market Price per share

Warrants held by "P":

Quarter 1: Average Market $ < Excercise $; not dilutive

Quarter 2: Average Market $ = Excercise $; not dilutive

Quarter 3: [$13 - $12/$13] (2000) = 154 shares x 1/4 year = 38 weighted average shares

Quarter 4: [$16 - $12/$16] (2000) = 500 shares x 1/4 year = 125 weighted average shares

Total weighted average shares...................... 163 weighted average shares

Warrants held by "S":

Quarter 1: Average Market $ < Excercise $; not dilutive

Quarter 2: Average Market $ = Excercise $; not dilutive

Quarter 3: [$13 - $12/$13] (1000) = 77 shares x 1/4 year = 19 weighted average shares

Quarter 4: [$16 - $12/$16] (1000) = 250 shares x 1/4 year = 63 weighted average shares

Total weighted average shares...................... 82 weighted average shares

Dr. M.D. Chase

Advanced Accounting 610 -72B

Long Beach State University

Consolidated Earnings Per Share

Page 6

2. Consolidated FDEPS: (Note: the same formula is appropriate for both PEPS and FDEPS)

Cons

P NI

Adj to P NI due to S sec which

FDEPS = P NI + Adj + [("P" Equiv Shares of"S") x (S EPS)] + allow holder to acquire P C/S

"P" C/S outstanding + adjustments to "P" stock outstanding

= ($50,500 - $500) + [(.80 x 12,000 C/S)]+[(.60)(1,600 C/S acquired "if converted")] ($4.12) + 0

20,000 + 296* + 148*

= $50,000 + $43,507 = $4.57 NOTE: This number would not be reported as it exceeds PEPS

20,444

NOTE: For FDEPS the market price is defined as the greater of Average or Year-end

Warrants held by "P":

Quarter 1: Ending Market $ < Excercise $; Not Dillutive

Quarter 2: [$14 - $12/$14] (2000) = 286 shares x 1/4 year = 71 weighted average shares

Quarter 3: [$15 - $12/$15] (2000) = 400 shares x 1/4 year = 100 weighted average shares

Quarter 4: [$16 - $12/$16] (2000) = 500 shares x 1/4 year = 125 weighted average shares

Total weighted average shares...................... 296 weighted average shares

Warrants held by "S":

Quarter 1: Ending Market $ < Excercise $; Not Dillutive

Quarter 2: [$14 - $12/$14] (1000) = 143 shares x 1/4 year = 36 weighted average shares

Quarter 3: [$15 - $12/$15] (1000) = 200 shares x 1/4 year = 50 weighted average shares

Quarter 4: [$16 - $12/$16] (1000) = 250 shares x 1/4 year = 62 weighted average shares

Total weighted average shares...................... 148 weighted average shares

You might also like

- CFA Level 1 Calculation Workbook: 300 Calculations to Prepare for the CFA Level 1 Exam (2023 Edition)From EverandCFA Level 1 Calculation Workbook: 300 Calculations to Prepare for the CFA Level 1 Exam (2023 Edition)Rating: 4.5 out of 5 stars4.5/5 (5)

- Solutions guide to valuation and corporate finance conceptsDocument51 pagesSolutions guide to valuation and corporate finance conceptsLuciana Martins71% (7)

- Stocks 136-141Document3 pagesStocks 136-141Rej Patnaan100% (1)

- Maximizing Shareholder Value Through Strategic Investment DecisionsDocument13 pagesMaximizing Shareholder Value Through Strategic Investment DecisionsMinh TaNo ratings yet

- Mid-Term ReviewDocument13 pagesMid-Term ReviewMOHAMED JALEEL MOHAMED SIDDEEKNo ratings yet

- Capital Structure and Leverage AssignmentDocument2 pagesCapital Structure and Leverage AssignmentFaisal FarooquiNo ratings yet

- Accounting For Retained EarningsDocument11 pagesAccounting For Retained EarningsSarah Johnson100% (1)

- Test Bank For Basic Finance An Introduction To Financial Institutions, Investments, and Management, 11th Edition - Herbert B. MayoDocument8 pagesTest Bank For Basic Finance An Introduction To Financial Institutions, Investments, and Management, 11th Edition - Herbert B. MayoamiraNo ratings yet

- Business Finance ExamDocument8 pagesBusiness Finance Examapi-342895963100% (3)

- Finance Practice File 1 With SolutionsDocument18 pagesFinance Practice File 1 With Solutionsdscgool1232100% (2)

- 400 - 515 Lease Review44BDocument6 pages400 - 515 Lease Review44BZenni T XinNo ratings yet

- 2024 Becker CPA Financial (FAR) Mock Exam AnswersDocument28 pages2024 Becker CPA Financial (FAR) Mock Exam AnswerscraigsappletreeNo ratings yet

- Chapter 10Document30 pagesChapter 10Mahmoud Abu ShamlehNo ratings yet

- Chapter 7 ParcorDocument10 pagesChapter 7 Parcornikki syNo ratings yet

- BUS 330 Exam 1 - Fall 2012 (B) - SolutionDocument14 pagesBUS 330 Exam 1 - Fall 2012 (B) - SolutionTao Chun LiuNo ratings yet

- Dilutive Dan EpsDocument18 pagesDilutive Dan EpsCepi Juniar PrayogaNo ratings yet

- Chapter 11 (Financial Management)Document48 pagesChapter 11 (Financial Management)tsy0703No ratings yet

- Share ValuationDocument7 pagesShare ValuationroseNo ratings yet

- CH 11 SolDocument9 pagesCH 11 SolCampbell YuNo ratings yet

- Minggu 05: Manajemen Keuangan I IDocument25 pagesMinggu 05: Manajemen Keuangan I ISalsabila KhairiNo ratings yet

- Dr. M.D. Chase Long Beach State University Advanced Accounting 810-51Cd Special Issues: Changes in Ownership InterestDocument3 pagesDr. M.D. Chase Long Beach State University Advanced Accounting 810-51Cd Special Issues: Changes in Ownership InterestZenni T XinNo ratings yet

- Discussion Questions: AnswerDocument5 pagesDiscussion Questions: AnswerMegachan MegamanNo ratings yet

- Financial Ratios for Capital Structure and Risk AssessmentDocument17 pagesFinancial Ratios for Capital Structure and Risk Assessmentsamuel_dwumfourNo ratings yet

- Quiz Week 1 SolnsDocument8 pagesQuiz Week 1 SolnsRiri FahraniNo ratings yet

- FINANCIAL MANAGEMENT MODULE 1 6 Cost of CapitalDocument27 pagesFINANCIAL MANAGEMENT MODULE 1 6 Cost of CapitalMarriel Fate CullanoNo ratings yet

- Tutorial 2Document6 pagesTutorial 2杰克 l孙No ratings yet

- Answers to Concepts Review and Critical Thinking Questions on Business Risk, Financial Risk, and Capital StructureDocument7 pagesAnswers to Concepts Review and Critical Thinking Questions on Business Risk, Financial Risk, and Capital StructureMohitNo ratings yet

- Cost of CapitalDocument11 pagesCost of CapitalJOHN PAOLO EVORANo ratings yet

- F9FM-Session10 d08vzzxDocument26 pagesF9FM-Session10 d08vzzxErclanNo ratings yet

- Chapter 10Document22 pagesChapter 10hoalongkiemNo ratings yet

- Financial management test analysisDocument4 pagesFinancial management test analysisAbhishek GhoshNo ratings yet

- GRETA Chinh SuaDocument10 pagesGRETA Chinh SuaHưng NguyễnNo ratings yet

- FIN4102Document4 pagesFIN4102Arlo WatsonNo ratings yet

- Answer: eDocument17 pagesAnswer: eMary Benedict AbraganNo ratings yet

- ACC1002X Optional Questions - SOLUTIONS CHP 10Document5 pagesACC1002X Optional Questions - SOLUTIONS CHP 10edisonctrNo ratings yet

- Sample Exam # 1Document11 pagesSample Exam # 1calebkinneyNo ratings yet

- CV Midterm Exam 1 - Solution GuideDocument11 pagesCV Midterm Exam 1 - Solution GuideKala Paul100% (1)

- 2019 100,000 2 200,000 Eps (2020) 410,00/230,000 Eps (2019) 350,000/200,000 2020 100,000 3/12 25,000 120,000 9/12 90,000 115,000 2 230,000Document5 pages2019 100,000 2 200,000 Eps (2020) 410,00/230,000 Eps (2019) 350,000/200,000 2020 100,000 3/12 25,000 120,000 9/12 90,000 115,000 2 230,000XienaNo ratings yet

- Revision Pack 4 May 2011Document27 pagesRevision Pack 4 May 2011Lim Hui SinNo ratings yet

- Dilutive Securities and Earnings Per Share: True-FalseDocument53 pagesDilutive Securities and Earnings Per Share: True-FalseRupa SatyalNo ratings yet

- Stockholders Equity MCQ QuizDocument10 pagesStockholders Equity MCQ QuizEricka AlimNo ratings yet

- Solution - Financial Leverage and Capital StructureDocument7 pagesSolution - Financial Leverage and Capital StructureEkjon DiptoNo ratings yet

- TCCB REVISIONDocument44 pagesTCCB REVISION21070119No ratings yet

- Activity Questions 6.1 Suggested SolutionsDocument6 pagesActivity Questions 6.1 Suggested SolutionsSuziNo ratings yet

- Finance Test Review 3Document32 pagesFinance Test Review 3Shaolin105No ratings yet

- FIN331 2010 Extra Credit 2 Problems 101209Document17 pagesFIN331 2010 Extra Credit 2 Problems 101209bradshawwNo ratings yet

- Tute 5 PDFDocument4 pagesTute 5 PDFRony Rahman100% (1)

- Filter rule evidence against EMH semi-strong formDocument3 pagesFilter rule evidence against EMH semi-strong formTaySyYinNo ratings yet

- Ias 33 - EpsDocument26 pagesIas 33 - Epsnissiem10% (1)

- Manajemen Keuangan - Cost of CapitalDocument44 pagesManajemen Keuangan - Cost of CapitalMuhamad ArnaldoNo ratings yet

- 400 710 InterCoPS 51CbDocument3 pages400 710 InterCoPS 51CbZenni T XinNo ratings yet

- 9 - Earnings Per ShareDocument30 pages9 - Earnings Per ShareRifky ApriandiNo ratings yet

- Dividend PolicyDocument9 pagesDividend PolicyKavita PoddarNo ratings yet

- ACCT-UB 3 - Financial Statement Analysis Module 3 HomeworkDocument2 pagesACCT-UB 3 - Financial Statement Analysis Module 3 HomeworkpratheekNo ratings yet

- Chapter # 06 - Cost of CapitalDocument36 pagesChapter # 06 - Cost of CapitalshakilhmNo ratings yet

- Cost of Capital ExplainedDocument18 pagesCost of Capital ExplainedRina ZulkifliNo ratings yet

- Miterm 2 2011 Spring AnsDocument14 pagesMiterm 2 2011 Spring AnsKrystle KhanNo ratings yet

- MCQs On Financial Statement Analysis For Practice - With - KeyDocument5 pagesMCQs On Financial Statement Analysis For Practice - With - Keyr G100% (2)

- Finance Module 6 Long-Term FinancingDocument5 pagesFinance Module 6 Long-Term FinancingJOHN PAUL LAGAO0% (1)

- Dwnload Full Foundations of Financial Management Canadian 10th Edition Block Solutions Manual PDFDocument20 pagesDwnload Full Foundations of Financial Management Canadian 10th Edition Block Solutions Manual PDFfruitfulbrawnedom7er4100% (10)

- Chapter Nine: Cost of Capital & Capital Structure Learning ObjectivesDocument6 pagesChapter Nine: Cost of Capital & Capital Structure Learning Objectivesabraha gebruNo ratings yet

- Dividend QuestionsDocument6 pagesDividend QuestionsperiNo ratings yet

- 610 1BFinStmtsRev+AcctsRoleDocument25 pages610 1BFinStmtsRev+AcctsRoleZenni T XinNo ratings yet

- 400 - 817 Mutual HoldingsExmpl 63BDocument4 pages400 - 817 Mutual HoldingsExmpl 63BZenni T XinNo ratings yet

- 610 2C CVPRelationshipsDocument7 pages610 2C CVPRelationshipsZenni T XinNo ratings yet

- 610 2BCostTermsDocument5 pages610 2BCostTermsZenni T XinNo ratings yet

- 400 - 815 IndirectMutualHold 61BDocument1 page400 - 815 IndirectMutualHold 61BZenni T XinNo ratings yet

- 400 - 1310 ExercisesInPartnershipAcct 88BDocument11 pages400 - 1310 ExercisesInPartnershipAcct 88Bwaiting4yNo ratings yet

- Dr. M. D. Chase Long Beach State University Advanced Accounting 1510-96B Government and Nonprofit AccountingDocument15 pagesDr. M. D. Chase Long Beach State University Advanced Accounting 1510-96B Government and Nonprofit AccountingZenni T XinNo ratings yet

- Advanced Accounting Exam 1AADocument20 pagesAdvanced Accounting Exam 1AASehoon OhNo ratings yet

- These Instructions May Result in A Failing GradeDocument18 pagesThese Instructions May Result in A Failing GradeZenni T XinNo ratings yet

- 400 - 1305 PartnershipAcctConcepts 87BDocument9 pages400 - 1305 PartnershipAcctConcepts 87BZenni T XinNo ratings yet

- Dr. M. D. Chase Long Beach State University Advanced Accounting 1510-96B Government and Nonprofit AccountingDocument15 pagesDr. M. D. Chase Long Beach State University Advanced Accounting 1510-96B Government and Nonprofit AccountingZenni T XinNo ratings yet

- 400 - 812 IntercoTransSubsInvBondsPs 56BDocument5 pages400 - 812 IntercoTransSubsInvBondsPs 56BZenni T XinNo ratings yet

- 400 - 1310 ExercisesInPartnershipAcct 88BDocument11 pages400 - 1310 ExercisesInPartnershipAcct 88Bwaiting4yNo ratings yet

- 400 - 1315 PartnershipLiquidations 89BDocument5 pages400 - 1315 PartnershipLiquidations 89BZenni T XinNo ratings yet

- AVANZADA21SFAS52 Comprehensive Example 85BDocument4 pagesAVANZADA21SFAS52 Comprehensive Example 85Bkarenxiomara7No ratings yet

- 400 1005 ForeignCurncyTranslation Transactions 83BDocument13 pages400 1005 ForeignCurncyTranslation Transactions 83BZenni T XinNo ratings yet

- 400 710 InterCoPS 51CbDocument3 pages400 710 InterCoPS 51CbZenni T XinNo ratings yet

- Dr. M.D. Chase Long Beach State University Advanced Accounting 810-51Cd Special Issues: Changes in Ownership InterestDocument3 pagesDr. M.D. Chase Long Beach State University Advanced Accounting 810-51Cd Special Issues: Changes in Ownership InterestZenni T XinNo ratings yet

- 400 - 805 ChangesInOwnershipIntrst51cDocument5 pages400 - 805 ChangesInOwnershipIntrst51cZenni T XinNo ratings yet

- 400 705 Special Issues DirectAcq51CaDocument1 page400 705 Special Issues DirectAcq51CaZenni T XinNo ratings yet

- 400 - 817 Mutual HoldingsExmpl 63BDocument4 pages400 - 817 Mutual HoldingsExmpl 63BZenni T XinNo ratings yet

- Dr. M.D. Chase Long Beach State University Advanced Accounting 807-54B Sale of Ownership Interest Page 1Document5 pagesDr. M.D. Chase Long Beach State University Advanced Accounting 807-54B Sale of Ownership Interest Page 1Zenni T XinNo ratings yet

- SFAS-95 Statement of Cash Flows ReviewDocument9 pagesSFAS-95 Statement of Cash Flows ReviewZenni T XinNo ratings yet

- Intercompany Lease EliminationsDocument8 pagesIntercompany Lease EliminationsZenni T XinNo ratings yet

- Dr. M.D. Chase Long Beach State University Advanced Accounting 520-45B Intercompany Leases:Adjumstments & Eliminations Page 1Document3 pagesDr. M.D. Chase Long Beach State University Advanced Accounting 520-45B Intercompany Leases:Adjumstments & Eliminations Page 1Zenni T XinNo ratings yet

- Dr. M.D. Chase Long Beach State University Advanced Accounting 510-42B Review Problem With Intercompany Bonds Page 1Document5 pagesDr. M.D. Chase Long Beach State University Advanced Accounting 510-42B Review Problem With Intercompany Bonds Page 1Zenni T XinNo ratings yet

- Lecture 8 - Share CapitalDocument15 pagesLecture 8 - Share CapitalJason LuximonNo ratings yet

- FIN 514 Financial Management: Spring 2021 InstructionsDocument4 pagesFIN 514 Financial Management: Spring 2021 InstructionsAkash KarNo ratings yet

- Financial Accounting Vol. 2 Example QuestionsDocument8 pagesFinancial Accounting Vol. 2 Example QuestionsMarisolNo ratings yet

- Test Bank 2 - GitmanDocument56 pagesTest Bank 2 - GitmanCamille Santos67% (3)

- ACC135 Corporation Notes 2nd Sem, AY 2022 2023Document28 pagesACC135 Corporation Notes 2nd Sem, AY 2022 2023Arielle D.No ratings yet

- Activity 6B CapStructure FinmaDocument4 pagesActivity 6B CapStructure FinmaDiomela BionganNo ratings yet

- Chapter 2 - EPS - IAS 33 - 2 - Basic EPSDocument17 pagesChapter 2 - EPS - IAS 33 - 2 - Basic EPSXuyên LươngNo ratings yet

- Intermediate Financial Accounting Part 1b by Zeus Millan Compress - CompressDocument174 pagesIntermediate Financial Accounting Part 1b by Zeus Millan Compress - CompresswalsondevNo ratings yet

- Problem 27Document3 pagesProblem 27Jhon Paul BalabaNo ratings yet

- Ratios Formulas CommentsDocument5 pagesRatios Formulas CommentsMariano DumalaganNo ratings yet

- Cma Esp Additional Practice Questions Part 2 FinalDocument175 pagesCma Esp Additional Practice Questions Part 2 FinalPattyNo ratings yet

- Reduction of Share CapitalDocument25 pagesReduction of Share CapitalJuniko AkinetsuNo ratings yet

- EduInsight - Accounting 2014 Support Seminar Answer PaperDocument18 pagesEduInsight - Accounting 2014 Support Seminar Answer PaperSanduni WijewardaneNo ratings yet

- A4-Equity ValuationDocument3 pagesA4-Equity ValuationMariya PatelNo ratings yet

- Far670 Solution Jul 2020Document4 pagesFar670 Solution Jul 2020siti hazwaniNo ratings yet

- Bonus Assignment 1Document4 pagesBonus Assignment 1Zain Zulfiqar100% (2)

- 06-Earnings-Per-Share Practice Problems Faisal & CODocument10 pages06-Earnings-Per-Share Practice Problems Faisal & COsyed asim shahNo ratings yet

- Compound Annual Growth Rate CalculatorDocument3 pagesCompound Annual Growth Rate CalculatorAccounting GuyNo ratings yet

- Fundamentals of Advanced Accounting 8th Edition Hoyle Test Bank 1Document30 pagesFundamentals of Advanced Accounting 8th Edition Hoyle Test Bank 1toddvaldezamzxfwnrtq100% (27)

- Re BVPS EpsDocument4 pagesRe BVPS EpsVeron BrionesNo ratings yet

- Ra-4850 Laguna Lake Development AuthorityDocument5 pagesRa-4850 Laguna Lake Development AuthorityElvira Baconga NeriNo ratings yet

- Exam Three FIN 4310.004Document4 pagesExam Three FIN 4310.004An KouNo ratings yet

- Business FinanceDocument7 pagesBusiness FinanceMaria Veronica BubanNo ratings yet

- Finman2 Material1 MidtermsDocument8 pagesFinman2 Material1 MidtermsKimberly Laggui PonayoNo ratings yet

- Corporations: Organization and Capital Stock Transactions: Learning ObjectivesDocument61 pagesCorporations: Organization and Capital Stock Transactions: Learning ObjectivesFria maeNo ratings yet

- Restructuring of FCCBs - Global Absolute - Raj Rajinder Singh NegiDocument9 pagesRestructuring of FCCBs - Global Absolute - Raj Rajinder Singh NegiAnkit JainNo ratings yet

- Corporate Finance A Focused Approach 5th Edition Ehrhardt Solutions ManualDocument38 pagesCorporate Finance A Focused Approach 5th Edition Ehrhardt Solutions Manualdoraphillipsooeot100% (16)