Professional Documents

Culture Documents

Relaxo Footwear: Healthy Performance Maintain Buy

Uploaded by

Rajasekhar Reddy AnekalluOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Relaxo Footwear: Healthy Performance Maintain Buy

Uploaded by

Rajasekhar Reddy AnekalluCopyright:

Available Formats

investors eye

stock update

Relaxo Footwear

Reco: Buy

Stock Update

Healthy performance; maintain Buy

CMP: Rs523

Key points

Company details

Price target:

Rs635

Market cap:

Rs6,289 cr

52-week high/low:

Rs615/224

NSE volume:

(no. of shares)

26,091

BSE code:

530517

NSE code:

RELAXO

Sharekhan code:

RELAXO

Free float:

(no. of shares)

3.0 cr

Shareholding pattern

Healthy operating performance; adjusted earnings grew by 39.2% YoY: In

Q2FY2016, Relaxo Footwear (Relaxo)s revenue growth of 15.7% YoY was driven

by both volume and premiumisation improvement in the product mix. In a

muted demand environment, this double-digit growth in revenue on an

increasingly higher base (Q2FY2015 revenue grew at 25.7% YoY) is commendable

and signifies the strong on-ground execution and brand salience efforts of the

company. The growth in the revenue along with falling prices of raw materials

(EVA and other chemicals that are crude derivatives) boosted the OPM by 170BPS

in Q2FY2016. Driven by a healthy operating performance and increase in the

other income, the reported net earnings grew by a strong 56.2% YoY. Adjusting

for the one-off gain (reported in other income) on account of sale of investment

in an associate company, the adjusted earnings grew by 39.2% on a Y-o-Y basis.

Favourable industry dynamics coupled with enduring brands to keep

financials strong: With its economical price points (averaging at Rs115-120),

the company is well placed to cash in on the transition towards branded shoes

from the unorganised segment. We, thus, expect the company to post 21.3%

revenue CAGR over FY2015-17. Further, the initiatives to improve efficiency

and rationalise cost along with low raw material prices are likely to culminate

into a healthy 30.5% earnings growth (CAGR) over FY2015-17.

Strong brands, focused management; maintain Buy: Relaxos strong presence

in the lucrative mid-priced footwear segment (through its top-of-the-mind recall

brands like Hawaii, Flite and Sparx) along with its integrated manufacturing setup, lean working capital requirement and vigilant management puts it in a sweet

spot to cash in on the strong growth opportunity unfolding in the footwear category

due to a shift from unbranded to branded products. Thus, we remain positive on

the stock at an unchanged price target of Rs635 and maintain our Buy rating.

Price chart

Results

Rs cr

Particulars

Price performance

(%)

1m

3m

6m 12m

-1.9

-7.7

42.9 102.6

Relative -3.9

to Sensex

-2.9

43.1 108.8

Absolute

Net revenues

COGs

Sales (%)

Staff cost

Sales (%)

Other expenses

Sales (%)

Total expenses

Operating profit

OPM (%)

Interest expenses

Depreciation & amortisation

PBT

Tax

Reported PAT

Exceptional/one-off (net of taxes)

Adjusted PAT

Sharekhan

11

Q2FY16

Q2FY15

YoY %

Q1FY16

QoQ %

386.3

158.9

40.8

36.4

9.4

139.9

36.2

335.2

51.1

13.2

5.8

11.4

39.1

12.0

27.1

2.9

24.1

333.8

146.1

43.8

31.4

9.4

117.8

35.3

295.3

38.5

11.5

4.2

9.9

24.5

7.2

17.3

15.7

8.8

-14.8

-13.9

18.7

92BPS

13.5

32.8

170BPS

39.6

15.2

59.2

66.4

56.2

453.6

184.4

40.7

40.8

9.0%

159.5

35.2%

384.7

68.9

15.2%

5.3

10.2

53.4

17.5

35.9

-12.9

-25.8

-196BPS

9.3

11.7

-26.8

-31.3

-24.6

17.3

39.2

35.9

-32.8

November 02, 2015

16.1

Home

-10.7

4.8

-12.2

Next

investors eye

stock update

Valuations

Key developments

Particulars

FY14

FY15 FY16E FY17E

Net sales (Rs cr)

1,205.8 1,472.8 1,765.4 2,153.5

Change (%)

20.0

22.1

19.9

22.0

Operating profit (Rs cr)146.6

200.4

254.2

325.2

Change (%)

33.5

36.7

26.8

27.9

OPM (%)

12.2

13.6

14.4

15.1

Net earnings

65.6

103.1

133.3

179.9

Change (%)

46.5

57.0

29.3

35.0

Diluted EPS

5.5

8.6

11.1

15.0

PER (x)

98.0

62.4

48.3

35.8

EV/EBITDA

44.4

33.1

26.0

19.9

RoCE (%)

23.3

25.1

26.0

27.7

RoE (%)

20.4

23.4

22.1

22.3

FY18E

2,626.8

22.0

399.3

22.8

15.2

229.3

27.4

19.1

28.1

15.9

27.9

24.9

The companys foray into modern trade through

institutional sales and online shopping access to

customers to boost sales and have a presence in all

trade options are yielding positive results.

The company has already amicably settled the long

drawn litigation on its brand Sparx with Bata India,

adding further momentum to the growth as Sparx is

one of the most promising brands in its portfolio with

strong revenue and margin growth potential ahead.

To keep pace with the strong growth momentum, the

company is looking to augment its capacity for which

plans are on the drawing board stage. The company

has purchased a land parcel in Rajasthan (Bhilwara)

at a cost of Rs48 crore for the project.

Earnings highlights

Revenue growth aided by volume and realisation growth:

In Q2FY2016, Relaxo posted a healthy revenue growth of

15.7% on a year-on-year (Y-o-Y) basis, aided by both volume

and realisation growth. This double-digit growth coming

in an environment of muted consumer demand is

commendable and signifies the growing brand salience of

its brands along with its strong on-ground execution.

Its key raw materials, ethylene vinyl acetate (EVA) and

other chemicals, are crude derivatives and hence

follow crude cycle with a lag effect. Prices of EVA have

been ruling at 15-17% lower on a Y-o-Y basis and are

currently trading at around Rs120 per kg as against

Rs140-145 a kg a year ago. The management believes

that apart from crude, the demand supply dynamics

for EVA play an important role in determining the

prices, and the prices have largely bottomed with

minimal scope for further downside.

The company would remain focused on consumers with the

introduction of value-added and premium products under

each of its brands. The newly launched flip flop range,

Bahamas, has received a decent response from the market.

We expect revenues to grow at 21.3% over FY201517: Relaxos product presence in the economy category

and mid-priced category along with its integrated

manufacturing set-up puts it in a sweet spot to cash in on

the emerging consumer transition from the unorganised

to the organised segment, capturing the benefits at all

levels. We expect Relaxo to significantly outperform the

industry growth rates led by both volume and realisation

growth. We, thus, expect Relaxo to grow its revenues at

a compounded annual growth rate (CAGR) of 21.7% over

FY2015-17.

Soft raw material pricing led to robust margin expansion:

Product mix premiumisation along with falling prices of

raw materials (EVA and other chemicals that are crude

derivatives) was reflected as a reduction in the raw material

cost, which declined by 300 basis points (BPS) year on year

(YoY). The effect of these benefits was visible in strong

improvement in the operating profit margin (OPM). Despite

the increase in the fixed overheads (viz employee cost

[+16.1%] YoY and other expenses [+18.7%] YoY), the sharp

improvement in the gross profit margin (GPM) percolated

down at the operating level, resulting in a healthy 32.8%

Y-o-Y growth in the operating profit for the quarter,

consequently, the operating profit margin expanded by

170BPS YoY and was at 13.2% for the quarter.

Net earnings to grow at 30.5% CAGR over FY2015-17: A

robust revenue growth, low prices of raw materials

(rubber, EVA), the managements stiff eye on cost

rationalisation and efficiency improvement along with

efforts to weed out the loss-making stores are likely to

have a positive effect on the margins of the company. We

expect Relaxos OPM to further expand hereon and reach

15.2% by FY2017. The net earnings are expected to grow

at a 30.5% CAGR over FY2015-17. We have retained our

positive stance on the stock due to its structural growth

story. We have retained our Buy rating on it with an

unchanged price target of Rs635.

Reported net earnings included one-offs; adjusted

earnings grew healthy by 39.2% YoY: Led by a strong

operational performance and higher other income (which

came at Rs5 crore for the quarter are one-offs in nature;

owing to sale of long-term investment in the associate

company), the reported net earnings grew by a strong 56.2%

YoY. Adjusting for the one-offs other income (on a post-tax

basis), the adjusted earnings grew by 39.2% on a Y-o-Y basis.

Sharekhan Limited, its analyst or dependant(s) of the analyst might be holding or having a position in the companies mentioned in the article.

Sharekhan

12

November 02, 2015

Home

Next

You might also like

- Assignment On HulDocument20 pagesAssignment On HulParam SimaarNo ratings yet

- The Heart of A Leader Fifty-Two Emotional Intelligence Insights To Advance Your Career PDFDocument203 pagesThe Heart of A Leader Fifty-Two Emotional Intelligence Insights To Advance Your Career PDFJia LaoNo ratings yet

- Luxury Real Estate PDFDocument11 pagesLuxury Real Estate PDFMarc Moore100% (1)

- Brand ExtensionDocument2 pagesBrand ExtensionUtkarsh MaheshwariNo ratings yet

- Tivo Case Analysis: A. Swot Analysis StrengthDocument4 pagesTivo Case Analysis: A. Swot Analysis StrengthAfshin SalehianNo ratings yet

- Selan Exploration TechnologyDocument3 pagesSelan Exploration TechnologyPaul GeorgeNo ratings yet

- TVS Motor Company: Another Quarter of Dismal EBITDA Margin Retain SellDocument5 pagesTVS Motor Company: Another Quarter of Dismal EBITDA Margin Retain SellSwastik PradhanNo ratings yet

- Tata Motors (TELCO) : Domestic Business Reports Positive Margins!Document12 pagesTata Motors (TELCO) : Domestic Business Reports Positive Margins!pgp28289No ratings yet

- TTK Prestige (TTKPRE) : Hopes Pinned On Revival in DemandDocument8 pagesTTK Prestige (TTKPRE) : Hopes Pinned On Revival in DemandsgNo ratings yet

- GSK Consumer: Excessive Price Hikes May Upset Price-Value EquationDocument6 pagesGSK Consumer: Excessive Price Hikes May Upset Price-Value EquationHimanshuNo ratings yet

- Ajanta Pharma ReportDocument15 pagesAjanta Pharma Reportmayankpant1No ratings yet

- Linc Pen & Plastics LTD.: CMP INR 161.0 Target Inr 218 Result Update - BuyDocument6 pagesLinc Pen & Plastics LTD.: CMP INR 161.0 Target Inr 218 Result Update - Buynare999No ratings yet

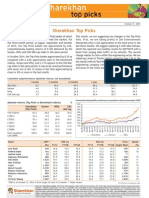

- Sharekhan Top Picks: Absolute Returns (Top Picks Vs Benchmark Indices) % Sharekhan Sensex Nifty CNX (Top Picks) Mid-CapDocument7 pagesSharekhan Top Picks: Absolute Returns (Top Picks Vs Benchmark Indices) % Sharekhan Sensex Nifty CNX (Top Picks) Mid-CapRajesh KarriNo ratings yet

- Emami 060516 PDFDocument3 pagesEmami 060516 PDFMarutisinh RajNo ratings yet

- IDirect IndiaCement CoUpdate Oct16Document4 pagesIDirect IndiaCement CoUpdate Oct16umaganNo ratings yet

- J. P Morgan - Pidilite IndustriesDocument36 pagesJ. P Morgan - Pidilite Industriesparry0843No ratings yet

- Indag Rubber Note Jan20 2016Document5 pagesIndag Rubber Note Jan20 2016doodledeeNo ratings yet

- Triveni Turbines: Growth On Track Maintain BuyDocument3 pagesTriveni Turbines: Growth On Track Maintain Buyajd.nanthakumarNo ratings yet

- Ashok Leyland-Aug13 15Document4 pagesAshok Leyland-Aug13 15ajd.nanthakumarNo ratings yet

- Alembic Pharma LTD (APL) Stock Update: Retail ResearchDocument5 pagesAlembic Pharma LTD (APL) Stock Update: Retail ResearchShashi KapoorNo ratings yet

- Relaxo Footwear: Performance HighlightsDocument16 pagesRelaxo Footwear: Performance HighlightsAngel BrokingNo ratings yet

- Marico Result UpdatedDocument10 pagesMarico Result UpdatedAngel BrokingNo ratings yet

- Ajanta Pharma May2015Document15 pagesAjanta Pharma May2015Ajit AjitabhNo ratings yet

- Top Textile CompaniesDocument7 pagesTop Textile CompaniesHafizUmarArshadNo ratings yet

- Relaxo Footwears: Promising FutureDocument13 pagesRelaxo Footwears: Promising FutureIrfan ShaikhNo ratings yet

- Profitability RatiosDocument6 pagesProfitability RatiosdanyalNo ratings yet

- Akamai Tech 14 02 10Document9 pagesAkamai Tech 14 02 10derek_2010No ratings yet

- Stock Advisory For Today - But Stock of Coal India LTD and Cipla LimitedDocument24 pagesStock Advisory For Today - But Stock of Coal India LTD and Cipla LimitedNarnolia Securities LimitedNo ratings yet

- Set For Strong Growth: FMCG Q2FY14 Result Preview 08 Oct 2013Document5 pagesSet For Strong Growth: FMCG Q2FY14 Result Preview 08 Oct 2013Abhishek SinghNo ratings yet

- India Equity Analytics For Today - Buy Stocks of CMC With Target Price From Rs 1490 To Rs 1690.Document23 pagesIndia Equity Analytics For Today - Buy Stocks of CMC With Target Price From Rs 1490 To Rs 1690.Narnolia Securities LimitedNo ratings yet

- Infosys (INFTEC) : Solid Beat Spoiled by Soft GuidanceDocument11 pagesInfosys (INFTEC) : Solid Beat Spoiled by Soft GuidanceumaganNo ratings yet

- Neuland Labs: Growth Trajectory Continues BuyDocument6 pagesNeuland Labs: Growth Trajectory Continues BuyshahavNo ratings yet

- Jubliant Food Works ReportDocument6 pagesJubliant Food Works ReportSrinivasan IyerNo ratings yet

- La Opala RG - Initiating Coverage - Centrum 30062014Document21 pagesLa Opala RG - Initiating Coverage - Centrum 30062014Jeevan PatwaNo ratings yet

- IDirect Infosys Q4FY16Document12 pagesIDirect Infosys Q4FY16umaganNo ratings yet

- IEA Report 31st JanuaryDocument24 pagesIEA Report 31st JanuarynarnoliaNo ratings yet

- Marico 4Q FY 2013Document11 pagesMarico 4Q FY 2013Angel BrokingNo ratings yet

- All Negatives Priced in Upgraded To Buy: Key PointsDocument4 pagesAll Negatives Priced in Upgraded To Buy: Key PointsPaul GeorgeNo ratings yet

- Strong Beat, Improving Visibility - Re-Rating To Follow: Q2FY16 Result HighlightsDocument9 pagesStrong Beat, Improving Visibility - Re-Rating To Follow: Q2FY16 Result HighlightsgirishrajsNo ratings yet

- Radico Khaitan: CMP: Inr97 TP: INR 115 BuyDocument6 pagesRadico Khaitan: CMP: Inr97 TP: INR 115 BuyDeepak GuptaNo ratings yet

- Investment Funds Advisory Today - Buy Stock of Escorts LTD and Neutral View On Hindustan UnileverDocument26 pagesInvestment Funds Advisory Today - Buy Stock of Escorts LTD and Neutral View On Hindustan UnileverNarnolia Securities LimitedNo ratings yet

- Pakistan State Oil: SecuritiesDocument16 pagesPakistan State Oil: SecuritiesAmmad SheikhNo ratings yet

- Chevron Lubricants Lanka PLC (LLUB) - Q1 FY 16 - HOLDDocument11 pagesChevron Lubricants Lanka PLC (LLUB) - Q1 FY 16 - HOLDSudheera IndrajithNo ratings yet

- Sun Pharma: Annual Report 2014 AnalysisDocument8 pagesSun Pharma: Annual Report 2014 AnalysisSohamsNo ratings yet

- Marico: Performance HighlightsDocument12 pagesMarico: Performance HighlightsAngel BrokingNo ratings yet

- Nirmal Bang Sees 2% UPSIDE in United Spirits Better Than ExpectedDocument11 pagesNirmal Bang Sees 2% UPSIDE in United Spirits Better Than ExpectedDhaval MailNo ratings yet

- PI Industries DolatCap 141111Document6 pagesPI Industries DolatCap 141111equityanalystinvestorNo ratings yet

- Infosys (INFTEC) : Couldn't Ask For MoreDocument12 pagesInfosys (INFTEC) : Couldn't Ask For MoreumaganNo ratings yet

- Two-Wheelers Update 27aug2014Document12 pagesTwo-Wheelers Update 27aug2014Chandreyee MannaNo ratings yet

- Relaxo Footwear, 7th February, 2013Document12 pagesRelaxo Footwear, 7th February, 2013Angel BrokingNo ratings yet

- Aurobindo Pharma Result UpdatedDocument10 pagesAurobindo Pharma Result UpdatedAngel BrokingNo ratings yet

- Investor Update: Key HighlightsDocument24 pagesInvestor Update: Key Highlightsmanoj.samtani5571No ratings yet

- KPIT 2QFY16 Outlook ReviewDocument5 pagesKPIT 2QFY16 Outlook ReviewgirishrajsNo ratings yet

- Affle - Q2FY22 - Result Update - 15112021 Final - 15-11-2021 - 12Document8 pagesAffle - Q2FY22 - Result Update - 15112021 Final - 15-11-2021 - 12Bharti PuratanNo ratings yet

- SharekhanTopPicks 31082016Document7 pagesSharekhanTopPicks 31082016Jigar ShahNo ratings yet

- Deepak Nitrite - Initiation ReportDocument20 pagesDeepak Nitrite - Initiation Report9avinashrNo ratings yet

- Sintex Analysis Report From Motilal 28 Jan 2015Document12 pagesSintex Analysis Report From Motilal 28 Jan 2015MLastTryNo ratings yet

- Sharekhan Top Picks: Absolute Returns (Top Picks Vs Benchmark Indices) % Sharekhan Sensex Nifty CNX (Top Picks) Mid-CapDocument7 pagesSharekhan Top Picks: Absolute Returns (Top Picks Vs Benchmark Indices) % Sharekhan Sensex Nifty CNX (Top Picks) Mid-CapJignesh RampariyaNo ratings yet

- Tech Mahindra (TECMAH) : LacklustreDocument11 pagesTech Mahindra (TECMAH) : Lacklustrejitendrasutar1975No ratings yet

- KPIT Technologies (KPISYS) : Optimistic RecoveryDocument11 pagesKPIT Technologies (KPISYS) : Optimistic RecoverygirishrajsNo ratings yet

- John Keells Holdings: Key HighlightsDocument14 pagesJohn Keells Holdings: Key HighlightsSupunDNo ratings yet

- Jain Irrigation Motilal Oswal Aug 16Document12 pagesJain Irrigation Motilal Oswal Aug 16Kedar ChoksiNo ratings yet

- Research Scorecard: December 2015Document46 pagesResearch Scorecard: December 2015senkum812002No ratings yet

- Balkrishna Industries (BALIND) : Margins vs. Guidance! What Do You Prefer?Document9 pagesBalkrishna Industries (BALIND) : Margins vs. Guidance! What Do You Prefer?drsivaprasad7No ratings yet

- Professional & Management Development Training Revenues World Summary: Market Values & Financials by CountryFrom EverandProfessional & Management Development Training Revenues World Summary: Market Values & Financials by CountryNo ratings yet

- Premarket CurrencyDaily ICICI 15.12.16Document4 pagesPremarket CurrencyDaily ICICI 15.12.16Rajasekhar Reddy AnekalluNo ratings yet

- Premarket Technical&Derivative Angel 15.12.16Document5 pagesPremarket Technical&Derivative Angel 15.12.16Rajasekhar Reddy AnekalluNo ratings yet

- Premarket MorningGlance SPA 15.12.16Document3 pagesPremarket MorningGlance SPA 15.12.16Rajasekhar Reddy AnekalluNo ratings yet

- Premarket MorningGlance SPA 20.12.16Document3 pagesPremarket MorningGlance SPA 20.12.16Rajasekhar Reddy AnekalluNo ratings yet

- Premarket MorningReport Dynamic 20.12.16Document7 pagesPremarket MorningReport Dynamic 20.12.16Rajasekhar Reddy AnekalluNo ratings yet

- Premarket CurrencyDaily ICICI 20.12.16Document4 pagesPremarket CurrencyDaily ICICI 20.12.16Rajasekhar Reddy AnekalluNo ratings yet

- Premarket MarketOutlook Motilal 20.12.16Document5 pagesPremarket MarketOutlook Motilal 20.12.16Rajasekhar Reddy AnekalluNo ratings yet

- Premarket MorningGlance SPA 21.12.16Document3 pagesPremarket MorningGlance SPA 21.12.16Rajasekhar Reddy AnekalluNo ratings yet

- Morning Report: Equity Latest % CHG NSE Sect. Indices Latest % CHG Nifty GainersDocument6 pagesMorning Report: Equity Latest % CHG NSE Sect. Indices Latest % CHG Nifty GainersRajasekhar Reddy AnekalluNo ratings yet

- Premarket CurrencyDaily ICICI 21.12.16Document4 pagesPremarket CurrencyDaily ICICI 21.12.16Rajasekhar Reddy AnekalluNo ratings yet

- Premarket MarketOutlook Motilal 19.12.16Document4 pagesPremarket MarketOutlook Motilal 19.12.16Rajasekhar Reddy AnekalluNo ratings yet

- Premarket OpeningBell ICICI 21.12.16Document8 pagesPremarket OpeningBell ICICI 21.12.16Rajasekhar Reddy AnekalluNo ratings yet

- Premarket Technical&Derivative Angel 21.12.16Document5 pagesPremarket Technical&Derivative Angel 21.12.16Rajasekhar Reddy AnekalluNo ratings yet

- Premarket MorningReport Dynamic 19.12.16Document7 pagesPremarket MorningReport Dynamic 19.12.16Rajasekhar Reddy AnekalluNo ratings yet

- Daily Derivatives: December 1, 2016Document3 pagesDaily Derivatives: December 1, 2016Rajasekhar Reddy AnekalluNo ratings yet

- Techno Funda Pick Techno Funda Pick: R Hal Research AnalystsDocument10 pagesTechno Funda Pick Techno Funda Pick: R Hal Research AnalystsRajasekhar Reddy AnekalluNo ratings yet

- Monthly Call: Apollo TyresDocument4 pagesMonthly Call: Apollo TyresRajasekhar Reddy AnekalluNo ratings yet

- Premarket CurrencyDaily ICICI 19.12.16Document4 pagesPremarket CurrencyDaily ICICI 19.12.16Rajasekhar Reddy AnekalluNo ratings yet

- Premarket DerivativesStrategist AnandRathi 30.11.16Document3 pagesPremarket DerivativesStrategist AnandRathi 30.11.16Rajasekhar Reddy AnekalluNo ratings yet

- Premarket CurrencyDaily ICICI 09.12.16Document4 pagesPremarket CurrencyDaily ICICI 09.12.16Rajasekhar Reddy AnekalluNo ratings yet

- Premarket Technical&Derivative Ashika 30.11.16Document4 pagesPremarket Technical&Derivative Ashika 30.11.16Rajasekhar Reddy AnekalluNo ratings yet

- Premarket CurrencyDaily ICICI 30.11.16Document4 pagesPremarket CurrencyDaily ICICI 30.11.16Rajasekhar Reddy AnekalluNo ratings yet

- Premarket MorningGlance SPA 30.11.16Document3 pagesPremarket MorningGlance SPA 30.11.16Rajasekhar Reddy AnekalluNo ratings yet

- Premarket OpeningBell ICICI 30.11.16Document8 pagesPremarket OpeningBell ICICI 30.11.16Rajasekhar Reddy AnekalluNo ratings yet

- Premarket KnowledgeBrunch Microsec 30.11.16Document5 pagesPremarket KnowledgeBrunch Microsec 30.11.16Rajasekhar Reddy AnekalluNo ratings yet

- Premarket MorningReport Dynamic 30.11.16Document7 pagesPremarket MorningReport Dynamic 30.11.16Rajasekhar Reddy AnekalluNo ratings yet

- PHME311 Week2 Day4 Module6PriceMix2CDecisionandStrategiesDocument46 pagesPHME311 Week2 Day4 Module6PriceMix2CDecisionandStrategiesJanella GarciaNo ratings yet

- Haataja MariaDocument61 pagesHaataja MariaBhavna KankaniNo ratings yet

- Cadbury Consumer SatisfactionDocument57 pagesCadbury Consumer SatisfactionMona DuhanNo ratings yet

- Using Aims and Objectives To Create A Business Strategy - A Kellogg's Case Study PDFDocument4 pagesUsing Aims and Objectives To Create A Business Strategy - A Kellogg's Case Study PDFSeethalakshmy NagarajanNo ratings yet

- Business Studies Project Class 12 1Document7 pagesBusiness Studies Project Class 12 1Harshit MahajanNo ratings yet

- Case StudyDocument17 pagesCase StudyE&M TEAMNo ratings yet

- Harley Davidson: Case StudyDocument4 pagesHarley Davidson: Case StudyAlena ProtasovaNo ratings yet

- Strategic Management Report On Unilever PakistanDocument23 pagesStrategic Management Report On Unilever PakistanAbdur RehmanNo ratings yet

- TouchpointsDocument74 pagesTouchpointsAeron DizonNo ratings yet

- THX-1 Case-8 5Document5 pagesTHX-1 Case-8 5BonitoNo ratings yet

- Daraz Case StudyDocument17 pagesDaraz Case StudyAdeena Zaheer AhmedNo ratings yet

- BS DUOngDocument25 pagesBS DUOngye yeNo ratings yet

- Nabulsi Shaheen - International MarketingDocument5 pagesNabulsi Shaheen - International Marketingmohamed fathyNo ratings yet

- QuestionnaireDocument3 pagesQuestionnaireAnamika Singh0% (1)

- I Plan To Redeem My Points For Amazon Gift CardsDocument3 pagesI Plan To Redeem My Points For Amazon Gift CardsAbel OropezaNo ratings yet

- Case Study FedEx GROUP 22Document6 pagesCase Study FedEx GROUP 22Engel QuimsonNo ratings yet

- Modern Advertising Buyers GuideDocument10 pagesModern Advertising Buyers GuideMohit ANo ratings yet

- Project Report On Coca ColaDocument44 pagesProject Report On Coca ColaAlisha SharmaNo ratings yet

- HUL Multibrand Kheloge Toh JeetoDocument8 pagesHUL Multibrand Kheloge Toh JeetoRIDHIMA YADAVNo ratings yet

- 31 C143Document6 pages31 C143Naveed RehmanNo ratings yet

- Fabindia HRM Change in DynamicsDocument7 pagesFabindia HRM Change in DynamicsSampurnaNo ratings yet

- Relaunch of Good MilkDocument9 pagesRelaunch of Good MilkSehrish HudaNo ratings yet

- pp04Document25 pagespp04Asif RashidNo ratings yet

- Positioning AssignmentDocument7 pagesPositioning AssignmentGovindasamy ArumugamNo ratings yet