Professional Documents

Culture Documents

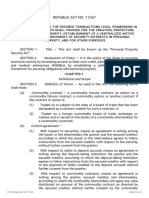

TRUST RECEIPT DOCTRINE AND MARGINAL DEPOSIT DEDUCTION

Uploaded by

yassercarlomanOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

TRUST RECEIPT DOCTRINE AND MARGINAL DEPOSIT DEDUCTION

Uploaded by

yassercarlomanCopyright:

Available Formats

-1-

5. ABAD V. CA

4. CONSOLIDATED BANK & TRUST CORPORATION v. CA

Doctrine: Where the debtor received the goods subject of the trust receipt before the trust

itself was entered into, the transaction in question is a simple loan and not a trust receipt

agreement.

Trust Receipt Doctrine: A trust receipt is a security transaction in favor of the bank for the

fulfillment of the debtors obligation to the bank in a letter-of-credit. It is a security

agreement pursuant to which a bank acquires a security interest in the goods.The bank does

not own the goods subject of the trust receipt. Apart from trust receipt, a marginal deposit

can be required from the debtor as security thereof.

Facts:

Continental Cement Corporation (Continental) and Lim obtained from Consolidated

Bank and Trust Corporation (CBTC) an LC in the amount of P1,068,150 to purchase

around 500,000 liters of bunker fuel oil from Petrophil Corporation (Petrophil).

Continental paid a marginal deposit of P320,445 to CBTC.

Petrophil directlydeliveredtheoilinCBTCsplantinBulacan.Continentalexecuted

a trust receipt for P1,001,520.93, with Lim as signatory.

CBTC filed a complaint in the RTC for sum of money with application of preliminary

attachment, alleging that Continental failed to turn over the goods covered by the

trust receipt.

Continental argued that the transaction was a simple loan and not a trust receipt

transactionaswellasCBTCsallegedamountdidnttakeintoaccountpaymentsit

already made.

Lim denied any personal liability and Continental even prayed for a reimbursement

as it claimed to have over paid P490,228.90.

Trial court dismissed the complaint and ruled it was a simple loan. CA affirmed.

Case Doctrine: A marginal deposit must be deducted from the principal obligation in a letter

of credit and to have charges computed only on the balance of the said obligation

Facts:

TOMCO, Inc., (now known as Southeast Timber Co. (Phils.), Inc.) applied for, and

was granted a domestic letter of credit by PCIB

TheletterofcreditwasinfavorofTOMCOssupplier,OregonIndustries,Inc.topay

for machinery (one Skagit Yarder with accessories).

PCIB paid to Oregon the price of the machinery at 80,000php against a bill of

exchange with recourse, presentment and notice of dishonor waived.

TOMCO made a marginal deposit of 28,000php and signed a trust receipt for the

same machinery delivered to the bank.

At the same time, Ramon Abad signed a Deed of Continuing Guaranty at the back

of the trust receipt, whereby he promisedtopayTOMCOsobligationjointlyand

severally.

However, no payment was made by TOMCO to PCIB, which prompted the latter to

file a collection suit against TOMCO and Abad as surety.

TOMCO admitted its liability to PCIB but alleged that the amount of the marginal

deposit (28k) should be deducted first from the principal obligation before PCIB

computes the interest charges on the balance.

Trial Court, however, ruled in favor of PCIB and made TOMCO pay the principal

obligation with charges without deducting the marginal deposit

AbadappealedthedecisionbutCAaffirmedtrialcourtsdecision.Thus,this

petition.

Issue:

WoN the transaction was a simple loan or a trust receipt transaction.

Held:

Petition is denied. The subject transaction is a simple loan.

Ratio:

As held in Colinares v. CA, a transaction is a simple loan when ownership over the

goods was already transferred to the debtor prior to the execution of a trust

receipt. In pure trust receipt transaction, ownership over the goods is transferred

after the execution of a trust receipt. The delivery to Continental of the goods

subject of the trust receipt occurred long before the trust receipt itself was

executed. The delivery commenced and completed on July 1982. The trust receipt

was only executed 2 months after full delivery of the oil.

- Cruz

Issue:

WoN the marginal deposit of Php28,000 in the possession of the bank should first

be deducted from its principal debt before computing the interest and other

charges due.

Held:

YES. Petition granted. Marginal deposit should be deducted first from the principal

debt.

CRUZ | MUTI | RAZON

NEGOTIABLE INSTRUMENTS | ATTY. AMPIL

-2-

WoN, in a case of estafa filed in violation of the terms of trust receipt, the person

prejudiced need necessarily be the owner of the property

Ratio:

Marginal deposit is a collateral security given by the debtor and is supposed to be

returned upon compliance with the obligation. The bank pays no interest on the

deposit, unlike ordinary deposit in a bank

It is only fair that the marginal deposit should be set-offagainstthedebtorsdebt,

for while the debtor earns no interest on the deposit, the bank, apart from being

able to use the said deposit, earns interest on the money it loaned to the debtor.

The bank would be unjustly enriched if the interest charges shall be computed from

the principal without deducting the marginal deposit

- Razon

6. PEOPLE VS. YU CHAI HO

Doctrine: In estafa based upon the conversion or misapproproation of money, goods, or

other personal property, it is essential that a person other than the accused is prejudiced by

such conversion or misappropriation, but the person so prejudiced need not necessarily be

the legal owner of the goods or property.

Facts:

Yu Chai Ho, in representation of his firm, Gui Sing & Co.(GSC), placed an order with

Wm. H. Anderson & Co.(WHAC) for a quantity of Colgate perfumes and soap to be

shipped from New York to Cebu.

The merchandise was shipped to Cebu with GSC as the consignee. The bill of lading and

the invoices were forwarded to the International Banking Corporation(IBC), subject to

delivery to GSC on payment of the purchase price.

The shipping documents were accompanied by a draft on GSC, who accepted the draft

but was unable to pay.

IBC, therefore, retained the shipping documents and invoices, without which the

merchandise could not be cleared through the customhouse and delivered to the

defendant or his firm. Through the intervention of WHAC, the IBC agreed to deliver the

documents to GSC upon their giving a trust receipt.

GSC executed a trust receipt in favor of IBC. GSC obtained and sold the merchandise

but, in violation of the terms of the trust receipt, failed to make payment to the IBC.

WHAC, as guarantors, were compelled to pay the amount of the draft.

Yu Chai Ho was found guilty for the crime of estafa. Yu Chai Ho argues that IBC had

suffered no loss, and that, therefore, an essential element of the crime of estafa was

lacking; that the only party prejudiced by the actions of the defendant was WHAC and

that as to the latter, the defendant had incurred a civil obligation

Issue:

CRUZ | MUTI | RAZON

Held:

No. Judgment modified by ordering the defendant to indemnify WHAC with subsidiary

imprisonment in case of insolvency

Ratio:

The person whose interests are prejudiced through the conversion or misappropriation

of the money, goods, or other personal property need not necessarily be the owner

thereof; if such had been the intention of the authors of the Code, the phrase "to the

prejudice of another" would have read "to the prejudice of the owner."

The action is not one between the defendant and WHAC or between the defendant

and the IBC; it deals with a public offense and is brought against the defendant by the

People of the Philippine Islands. The very evident object of the article of the Penal Code

is to discourage dishonesty and unfaithfulness in the administration or care of money,

goods, or other personal property received for such purposes. The object is not simply

to enforce payment of indemnities.

The fact that the defendant gave surety for the fulfillment of his obligations under the

trust receipt, is of no consequence and does not alter the case.

DISSENT: The information is defective in alleging that the offense was committed in

prejudice of WHAC, when the facts show that the person truly prejudiced was IBC.

The judgment should be reversed, and the accused should be held to answer to a

new information in which it should be stated that the offense was committed to the

prejudice of IBC.

- Muti

7. PEOPLE v. CUEVO

Doctrine: One who was issued a trust receipt for imported goods who fails to deliver to the

bank or financial institution which issued the trust receipt the money covered thereby is

guilty of estafa. It does not matter that the money was received from the purchase of the

goods and not from the bank.

Facts:

Cuevo received 1,000 bags of grind yellow corn and 1,000 bags of palay specified in

a trust receipt in trust from Prudential Bank. Cuevo executed an LC in favor or

Prudential Bank for P24,000 to cover this transaction.

Cuevo had the obligation to sell, account for the merchandise, or to deliver and

turn over to Prudential Bank the sale proceeds.

NEGOTIABLE INSTRUMENTS | ATTY. AMPIL

-3-

Despite repeated demands, Cuevo misappropriated, misapplied and converted the

merchandise or the value to his own personal use and benefit to the damage and

prejudice of Prudential Bank.

Upon arraignment, Cuevo pleaded not guilty. He filed a Motion to Dismiss on the

ground that the facts alleged in the Information did not constitute an offense.

Judge Kapunan granted the motion and dismissed the complaint. He believed that

Cuevo could not have committed estafa under Art 315 (1) (b) because the Spanish

version of (b) wherein the expression used is resibido en deposito was not an

accurate translation of in trust, hence it did not cover the conversion or

misappropriation of the goods covered by a trust receipt. However, Judge Kapunan

also ruled that the dismissal was not to prejudice whatever civil action Prudential

Bank may take to recover P24,000 advanced to cover the price of the merchandise.

Prosecution appealed. Appeal was granted. The lower court ruled that the contract

covered by a trust receipt is merely a secured loan where the borrower is allowed

to dispose of the collateral, while in a deposit, the depositary is not empowered to

dispose the deposited property. Hence, the lower court concluded that the

violation of the provisions of the trust receipt gives rise to a civil action and not to a

criminal prosecution for estafa. Also, the lower court observed that the framers of

the Spanish Penal Code could not have contemplated the inclusion of the trust

th

receipt in Art 315 (1) (b) because that transaction did not exist in the 19 century.

One of the objectives of the Trust Receipts Law is to declare the misuse and/or

misappropriation of goods or proceeds realized from the sale of goods, documents

or instruments released under trust receipts as a criminal offense punishable

underArt315.(seeSec13oftheTrustReceiptsLaw).

Dissent:

A trust receipt transaction gives rise to a civil liability only based on the very

definition of a trust receipt which is a security arrangement. The liberal view that a

trust receipt violation gives rise to a civil liability only before the promulgation of

PD 115 when there was a highly debatable question about it under Art 315 of RPC,

is the more acceptable view because the transaction is a purely commercial one.

The transaction being contractual, the intent of the parties should govern. Since

the trust receipt has to be executed upon the arrival of the imported goods, and

acquires legal standing as such receipt transaction itself, the antecedent acts

consisting of the application and approval of the LC, the making of the marginal

deposit, and the effective importation of the goods--all through the efforts of the

importer---would negate any intent of subjecting the importer to criminal

prosecution.

- Cruz

8. SIA V. PEOPLE

Issue:

WoN violation of the terms of a trust receipt would constitute estafa.

Doctrine: Trust receipt transaction is a security of loan transaction only and thus, its breach

will give rise to a civil liability only

As seven justices voted to reverse the order of dismissal, the same has to be

affirmed. Hence, yes. A violation of the terms of a trust receipt constitutes estafa.

Facts:

Held:

Ratio:

Even if the accused did not receive the merchandise for deposit, Cuevo is covered

by Art 315 (1) (b) because after receiving the price of the sale, Cuevo did not

deliver the money to Prudential bank, or if he did not sell the merchandise, he did

st

not return it to bank. The 2 situations is covered by Art 315 (1) (b): 1 situation is

covered by the provision which refers to money received under the obligation

nd

involving the duty to deliver it to the owner of the merchandise sold; and the 2

situation is covered by the provision which refers to merchandise received under

st

the obligation to return it to the owner. The fact that the 1 case the money was

received from the purchaser of the merchandise and not from the bank does not

remove it from the operations of Art 315 (1) (b). Cuevo failed to either turn over

the sale proceeds or return said goods, hence he is liable for estafa.

CRUZ | MUTI | RAZON

Jose Sia, as General Manager of Metal Manufacturing Company of the Phils., Inc.,

applied for a letter of credit from the Continental Bank, to import steel sheets from

Japan

Application was approved and the letter of credit was opened in favor of the

supplier.

Siassideofstory:Thetrustreceiptwasexecutedlongaftertheimportedmaterials

were delivered to the company

ContinentalBanksstory:materialswerepermitteddeliveryonlyuponexecutionof

the trust receipt

The debt having fallen due, and the company not having paid the debt to

Continental Bank, the latter filed a complaint and Sia was charged with estafa.

Continental Bank alleged that Sia failed and refused to return the materials or

account for the proceeds thereof, if sold.

CFI convicted SIA, which was affirmed by CA.

NEGOTIABLE INSTRUMENTS | ATTY. AMPIL

-4-

price of a certain merchandise consisting of 23 ctns. Lab. Culture Media. She

executed trust receipt for the merchandise in favor of the bank.

An information was filed against Lee for violation of the trust receipt agreement in

relation to PD 115(estafa). Lee moved to quash the information on the ground that

the facts charged do not constitute an offense.

Lee questions the constitutionality of Sec. 13 of P.D. 115. She contends that it is

violative of the constitutional right that "No person shall be imprisoned for debt or

non-payment of a poll tax". She also cites the cases of People vs. Cuevo and Sia vs.

People where the accused was held civilly liable only.

Thus this petition. Sia contends that he should not be convicted of estafa, as he was

merely acting on behalf of the company and that the acts committed merely

constitute civil liability and not a criminal offense.

Issue:

WoN the violation of a trust receipt constitutes estafa under Art 315 1b of the RPC,

thus Sia could be convicted of estafa for failure of the company where he is an

officer, to settle its indebtedness, secured by a trust receipt, to Continental Bank.

Held:

No. ACQUITTED.

Ratio:

The court considers the view that the transaction on the trust receipt was merely

one of a security of a loan, and that the trust element is but an inherent feature of

the security aspect of the arrangement where the goods were placed in the

possession of the entrustee.

The violation of the element of trust is not being intended to be in the same

concept as how it is understood in the criminal case.

The transaction being contractual, the intent of the parties should govern.

The court opines that unlike in the case of estafa, the entruster has the free

disposal of the goods held in trust by the entrustee. In the case of trust receipt, the

entruster does not have that free disposal of the goods, as the importer is the one

who has the free disposal of the same.

The trust receipt therefore, in the view that is only one of a security for a loan

transaction, breach of the same, would result to a civil liability only.

One DISSENT says this decision on the nature of the trust receipt, as the same in

estafa is contrary to previous decisions.

Issue:

1. WoN not the violation of a trust receipt agreement after the effectivity of PD 115

constitutes the crime of estafa. YES

2. WoN PD 115 is unconstitutional for being violative of the right against imprisonment for

non-payment of debt. NO

Held:

Trial court's orders are AFFIRMED and the case is remanded to the trial court for further

proceedings

Ratio:

1.

2.

- Razon

9. LEE VS. RODIL

Doctrine: Acts involving the violation of trust receipt agreements occurring after 29 January

1973 would make the accused criminally liable for estafa under RPC, pursuant to the explicit

provision in PD 115. It does not conflict with the constitutional prohibition against

imprisonment for non-payment of debt because the criminal liability springs from the

violation of of the trust receipt which is separate and distinct from the loan feature of letter

of credit-trust receipt arrangements.

Facts:

Lee, being then the duly authorized representative of C.S. Lee Enterprises, Inc.,

opened a letter of credit with Philippine Bank of Communications for the purchase

CRUZ | MUTI | RAZON

A closer look at the two decisions(Cuevo and Sia) cited by the petitioner shows

attendant facts that are different from those in the instant case. While those cases

were decided when PD 115 had already been promulgated, the decree was not

applied in either of the cases because the questioned acts were committed

before its effectivity.

Lee has failed to make out a strong case that P.D. 115 conflicts with the

constitutional prohibition against imprisonment for non-payment of debt. The

criminal liability springs from the violation of of the trust receipt. The nature of a

letter of credit-trust receipt arrangement is that the transaction involves a loan

feature represented by the letter of credit, and a security feature which is in the

covering trust receipt. Therefore, the loan feature is separate and distinct from the

trust receipt. PD 115 is a valid exercise of police power and the legislative intent is

to regulate the enforcement of rights arising from violations of trust receipt

arrangement.

- Muti

10. ALLIED BANKING CORPORATION v. ORDONEZ

Doctrine: The penal provision of PD 115 encompasses any act violative of an obligation

covered by a trust receipt. It is not limited to transactions of goods which are to be sold

(retailed), reshipped, stored or processed as a component of a product ultimately sold.

NEGOTIABLE INSTRUMENTS | ATTY. AMPIL

-5-

In an attempt to escape criminal liability, Ching claims: (a) PD 115 covers goods

which are ultimately destined for sale and not goods for use in manufacture; (b)

PBM is not in the business of selling the subject merchandise as it is a manufacturer

of steel and steel products; thus (c) PBM is not liable under PD 115. But the

wording of Sec 13 of PD 115 covers failure to turn over the proceeds of the sale of

entrusted goods, or to return said goods if unsold or disposed in accordance with

the terms of the trust receipts. The non-payment of the amount covered by a trust

receiptisanactviolativeoftheentrusteesobligationtopay.

Facts:

Philippine Blooming Mills (PBM), through its officer, Ching, applied for the issuance

of commercial LCs with Allied Bank to finance the purchase of 500 M/T Magtar

Branch Dolomites and a Lot High Fired Refractory Sliding Nozzle Bricks.

Allied Bank issued a revocable LC in favor of Nikko Industry (Nikko). Nikko drew 4

drafts which PBM accepted and duly honored. Allied Bank paid for the drafts.

Tosecurepaymentofthe drafts,andinconsiderationofAllied Bankstransferof

the possession of the goods to PBM, through Ching, the latter as entrustee,

executed4TrustReceiptArrangements,acknowledgingAlliedBanksownershipof

thegoodsandPBMsobligationtoturnovertheproceedsofthesaleifsold,orto

return the same if unsold within the stated period.

There was an overdue amount of P1,475,274.09. Despite written demands, PBM

failed to pay the amount or return the goods.

Allied Bank filed a criminal complaint against Ching for violation of PD 115. The

Fiscal found a prima facie case for violation of PD 115 on 4 counts and filed the

information in court.

ChingappealedtheFiscalsResolutiontotheDOJ.Chingclaimsthatatthetimeof

PBMsapplicationfortheissuanceoftheLCs,itwasnotrepresentedthattheitems

were intended for sale, hence there was no deceit resulting in a violation of the

trust receipt which would constitute a criminal liability.

DOJdeniedappeal.However,DOJSecretaryOrdonezrectifiedhispredecessors

supposed reversible error and said that what the law contemplates or covers are

goods which have, for their ultimate destination, their sale or if unsold, their

surrender to the entrustor, whether the goods are in their original form or in their

manufactured/processed state. Ordonez also said that since the goods covered by

the trust receipts are to be utilized in the operation of the equipment and

machineries of a corporation, they could not have been contemplated as being

covered by PD 115.

Allied Bank appealed but the appeal was denied.

Issue:

- Cruz

11. PEOPLE V. NITAFAN

Doctrine: The violation of the Trust Receipts Law is punishable under Art 315 1b of the RPC

as expressly provided by Sec. 13 of the said law. What it punishes is the dishonesty and abuse

of confidence and not the non-payment of loan.

Facts:

Betty Sia Ang allegedly received from Allied Banking Corporation goods (Gordon

Plastics, plastic sheeting) in the amount of Php398,000.00 specified in a trust receipt

and covered by a letter of credit, under the obligation to sell the same and account

for the proceeds of the sale if sold.

Betty Ang was able to pay only the amount of 20ok plus, with the remaining balance

of 114k, which she failed to account for.

Allied Bank then filed a complaint against Betty for the crime of estafa.

Betty filed a motion to quash on the ground that the complaint does not constitute

an offense

Trial court granted the motion in light of the decisions in Sia v. People and People v.

Cuevo, which laid down the rule that violation of trust receipt gives rise to civil

liability only.

Thus, Allied Bank and People interposed this petition for certiorari.

Issue:

WoN the penal provision of PD 115 apply when the goods covered by a trust

receipt do not form part of the finished products which are ultimately sold but are

instead, utilized/used up in the operation of the equipment and machineries of the

entrustee-manufacturer.

WoN an entrustee in a trust receipt agreement who fails to deliver the proceeds of

the sale or to return the goods if not sold to the entruster-bank is liable for the crime

of estafa

Held:

Held:

YES. PETITION GRANTED. Betty Ang must be convicted of estafa.

Yes. The penal provision of PD 115 applies. Petition is granted.

Ratio:

CRUZ | MUTI | RAZON

Ratio:

NEGOTIABLE INSTRUMENTS | ATTY. AMPIL

-6-

Sec. 13 of PD 115 expressly provides that violation of the trust receipts law is

punishable under Art 315 1b of RPC.

The enactment of PD 115 is a valid exercise of police power by the State.

The offense is mala prohibitum.

What the law punishes is the dishonesty and abuse of confidence in handling of

money or goods to the prejudice of the bank.

What it seeks to recover is not the payment of the loan but rather the accounting of

the proceeds of the goods delivered to entrustee to hold in trust for the entruster.

The decisions in Sia was reached because the offense was committed prior to the

effectivity of PD 115

Unless repealed, the law must be applied.

- Razon

12. PRUDENTIAL BANK VS. NLRC

Doctrine: Security interest of the entruster becomesalien onthegoodsastheentrusters

advances will have to be settled first before the entrustee can consolidate his ownership over

the goods. Entruster has discretion to avail or seek alternative action at any time upon

default or failure of entrustee to comply with any of the terms and conditions of trust

arrangement.

Facts:

Interasia Container Industries, Inc.(INTERASIA), was embroiled in 3 labor cases

which were eventually resolved against it. Labor Arbiter declared the closure or

shutdown of operations effected by INTERASIA as illegal and awarded to

complainants wage differentials, separation pay and other benefits.

The Sheriff levied on execution personal properties located in the factory of

INTERASIA. Prudential Bank(bank) filed an Affidavit of Third-Party Claim asserting

ownership over the seized properties on the strength of trust receipts executed by

INTERASIA in its favor. Labor Arbiter denied the claim of petitioner and directed the

Sheriff to proceed with the levy of the properties. Sheriff declared Peliglorio the

highest bidder in the public auction sale.

The bank assails the sale and raises issue on the extent of its security title over the

properties subject of the levy on execution, submitting that while it may not have

absolute ownership over the properties, still it has right, interest and ownership

consisting of a security title which attaches to the properties. The bank maintains

that it is a preferred claimant to the proceeds from the foreclosure to the extent of

its security title in the goods

NLRC claims to rely on the pronouncement on trust receipts in the Vintola case

where the court held that trust receipts are mere security transactions which do

NOT vest upon petitioner any title of ownership.

CRUZ | MUTI | RAZON

NLRC also argues that inasmuch as the bank did not cancel the Trust Receipt

Agreements and took possession of the properties it could not claim ownership of

the properties

Issue:

1.

2.

WoN the entruster/banks claim from a trust receipt is a preferred claim on the

proceeds from the foreclosure of the property covered by the trust receipt. YES

WoN the cancellation of trust receipt and possession of goods is an obligation of

the entruster, failure of which is fatal to its claim over the property. NO

Held:

Petition GRANTED. Resolutions of NLRC are are SET ASIDE and a new judgment is

entered GRANTING the Third-Party Claim and ORDERING the Sheriff or his

representative to immediately deliver to petitioner PRUDENTIAL BANK the

properties subject of the Trust Receipt Agreements.

Ratio:

st

On the 1 ISSUE:

Sec. 12. Validity of entruster's security interest as against creditors. The

entruster's security interest in goods, documents, or instruments pursuant to the

written terms of a trust receipt shall be valid as against all creditors of the

entrustee for the duration of the trust receipt agreement.

The security interest of the entruster becomes a "lien" on the goods because the

entruster's advances will have to be settled first before the entrustee can

consolidate his ownership over the goods. A contrary view would be disastrous. For

to refuse to recognize the title of the banker under the trust receipt as security for

the advance of the purchase price would be to strike down a bona fide and honest

transaction of great commercial benefit and advantage.

The only exception to the rule is when the properties are in the hands of an

innocent purchaser for value and in good faith. The records however do NOT show

that the winning bidder is such purchaser.

nd

On the 2 ISSUE:

Sec. 7. Rights of the entruster. The entruster may cancel the trust and take

possession of the goods, documents or instruments subject of the trust or of the

proceeds realized therefrom xxxx

The law uses the word "may" in granting to the entruster the right to cancel the

trust and take possession of the goods. The bank has the discretion to avail of such

right or seek any alternative action, such as a third-party claim or a separate civil

action which it deems best to protect its right, at anytime upon default or failure of

the entrustee to comply with any of the terms and conditions of the trust

agreement.

NEGOTIABLE INSTRUMENTS | ATTY. AMPIL

-7-

- Muti

one on reasonable doubt and does not preclude a suit to enforce the civil liability

for the same act or omission under Art 29 of the Civil Code.

By signing a trust receipt, Catipon caused PNB to believe he assumed the

obligations provided with his co-signor. PNB acted on this assumption. Catipon

induced PNB to believe such, hence Catipon cannot deny liability for equity

purposes. Catipon is estopped.

Catipons payment to his co-signor cannot diminish PNBs rights since the trust

receipt expressly obligated Catipon to pay PNB and not to his co-signor.

13. PNB v. CATIPON

Doctrine: The decision of acquittal on the charge of estafa does not preclude or bar the filing

of this action to enforce liability of one of the signors of the trust receipt because the

execution of a trust receipt makes the signors liable ex contractu for its breach, whether he

did or did not misappropriate, misapply or convert the said merchandise.

- Cruz

Facts:

Catipon bought onions from J.V. Ramirez & Co. Catipon signed a trust receipt.

Catipon claimed that he paid J.V. Ramirez Co. and not PNB for the onions. There

werereceiptstoprovethatCatiponssignaturewasaffixedattheDivsioriaMarket

when a son of Ramirez came to Catipon and explained that the only way to get the

onions was to sign said trust receipt. Catipons signature was affixed long after

Ramirez signed.

PNB filed a complaint charging Catipon with estafa for having misappropriated,

misapplied and converted the merchandise covered by the trust receipt.

Ramirez on the other hand claimed that PNB filed this complaint because PNB did

not realize any cent out of its claim filed in a previous insolvency proceeding of J.V.

Ramirez and Co.

The trial court acquitted Catipon.

Hence this action to recover the value of the goods. PNB won, hence Catipon

appealed. Catipon claimed that: (a) his acquittal in theestafacaseisabartoPNBs

instituting the present civil action as PNB did not reserve the right to separate the

enforcement of civil liability from the criminal case; and (b) should he be held

liable, he should only be liable for one-half of the value of the goods under trust,

there being no stipulation that he would be solidarily liable with his co-signer.

14. ONG V. CA

Doctrine: Sec. 13 of the Trust Receipts Law, in case of violation of such, makes an officer of a

corporation liable for the crime of estafa even if he is signing merely on behalf of the

corporation, but the civil obligation shall be imposed upon the corporation as the entrustee,

unless the officer made himself liable in his personal capacity.

Facts:

Edward Ong, as representative of ARMAGRI was charged with 2 counts of estafa for

violation of the trust receipts law, for the failure of ARMAGRI to account for the

proceeds of the goods (urea) covered by 2 trust receipts signed by Ong on behalf of

ARMAGRI in favor of SOLIDBANK.

After trial, the court convicted Ong of the charges.

On appeal, Ong contends that he merely signed the same on behalf of ARMAGRI,

and there was no evidence that he personally received the goods subject of the

trust receipts. He insisted that it was ARMAGRI that is liable as the goods were

received by the corporation and it was ARMAGRI which failed to turn over the

balance of the proceeds of the sale of the goods.

CA however affirmed the conviction. Thus, this appeal

Issue:

WoN Catipon is liable to PNB; and

Assuming arguendo that Catipon is liable, WoN he is solidarily liable.

Issue:

WoN Ong can be held liable for estafa by merely signing as agent of ARMAGRI

Held:

Yes. Catipon is solidarily liable to PNB but he has the right to claim from his cosignor, Ramirez. PNB wins.

Held:

YES. Conviction is affirmed.

Ratio:

Catipons acquittal in the estafa case was predicated on the conclusion that the

guiltofthedefendanthasnotbeensatisfactorilyestablished.Thisisequivalentto

CRUZ | MUTI | RAZON

Ratio:

NEGOTIABLE INSTRUMENTS | ATTY. AMPIL

-8-

Sec. 13 if the Trust Receipts Law expressly provides that if a corporation committed

the violation, its officers, employees or persons therein responsible for the offense

shall be held liable to answer for the criminal offense.

Ong, by signing the trust receipts, was the person responsible for the acts of the

corporation.

It was held that the reason for the same was that a corporation, being a juridical

entity, cannot be subject to the punishment of imprisonment, thus its officers or

employees are the ones subjected to criminal prosecution.

The corporation, being the real entrustee, however, in such a case, must shoulder

the civil liability. The only exception is when the employee makes himself

personally liable for such.

- Razon

15. CHING VS. CA

Doctrine: A civil action for declaration of nullity of documents(trust receipt) and for

damages does not constitute a prejudicial question to a criminal case for estafa where the

alleged prejudicial question in the civil case does not juris et de jure determine the guilt or

innocence of the accused in the criminal action.

Facts:

Ching executed a trust receipt agreement in favor of Allied Banking

Corporation(Allied) for certain goods(dolomites and refractory sliding nozzle bricks).

Allied filed informations against Ching for violation of the trust receipt agreement.

Ching, together with Philippine Blooming Mills Co. Inc.(PBMC), filed a case for

declaration of nullity of documents and for damages. Ching also filed for the

suspension of the criminal proceedings on the ground of prejudicial question in a civil

action. The petition for suspension was denied. Ching brought the petition to CA.

CA ruled that the declaration of nullity of the trust receipts in question is not a

prejudicial question to the Criminal Case.

Chingsfirstcomplaint in RTC: the documents were intended as collateral or security.

Chingsamendedcomplaint:thedocumentsareevidenceofsimpleloans.

Notwithstanding CAs decision, the RTC admitted Chings amended complaint and

declared the trust receipts null and void for failure to express the true intent and

agreement of the parties. RTC declared it as one of simple and pure loan.

Allied filed an amended answer to RTC that the transaction was a letter of

credit/trust receipt accommodation and not a pure and simple loan.

Pending the civil case, Ching seeked the intervention of SC.

Issue:

CRUZ | MUTI | RAZON

WoN the pendency of a civil action for damages and declaration of nullity of

documents, specifically trust receipts, warrants the suspension of criminal

proceedings for estafa in relation to PD 115

Held:

No. Petition DISMISSED and RTC directed to proceed with the hearings of crim. case.

Ratio:

The alleged prejudicial question in the civil case for declaration of nullity of

documents and for damages, does not juris et de jure determine the guilt or

innocence of the accused in the criminal action for estafa.

The criminal liability of the acacused for violation of Article 315 of RPC, may still be

shown through the presentation of evidence to the effect that: (a) the accused

received the subject goods in trust or under the obligation to sell the same and to

remit the proceeds thereof to Allied, or to return the goods, if not sold; (b) that Ching

misappropriated or converted the goods and/or the proceeds of the sale; (c) that

Ching performed such acts with abuse of confidence to the damage and prejudice of

Allied; and (d) that demand was made by the bank to herein petitioner.

Even on the assumption that the documents are declared of null, it does not ipso

facto follow that such declaration of nullity shall exonerate the accused from criminal

prosecution and liability.

An act violative of a trust receipt agreement is only one mode of committing estafa

under the abovementioned provision of the Revised Penal Code. Stated differently, a

violation of a trust receipt arrangement is not the sole basis for incurring liability

under Article 315 1 (b) of the RPC.

- Muti

16. PILIPINAS BANK v. ONG

Doctrine: Mere failure to deliver the proceeds of the sale or the goods, if not sold,

constitutes violation of PD No. 115. However, what is being punished by the law is the

dishonesty and abuse of confidence in the handling of money or goods to the prejudice of

another regardless of whether the latter is the owner.

Facts:

Baliwag Mahogany Corporation (BMC), through its President, Ong, applied for a

domestic commercial LC with Pilipinas Bank to finance the purchase of about

100,000 board feet of air dried, dark red Lauan sawn lumber.

Pilipinas Bank approved the application and issued the LC for P3.5M. To secure

payment, BMC, through Ong, executed 2 trust receipts providing that it shall turn

NEGOTIABLE INSTRUMENTS | ATTY. AMPIL

-9-

over the proceeds of the goods to Pilipinas Bank, if sold, or return the goods, if

unsold, upon dates of maturity.

BMC failed to comply with the trust receipt agreement. BMC filed with SEC a

Petition for Rehabilitation and for a Declaration in a State of Suspension of

Payments under Sec 6 (c) of PD 902-A. BMCs creditors, including Pilipinas Bank,

heldacreditorsmeetingtoavertanyactionwhichwouldaffectBMCsoperations

and decide on a common course of action to restore BMC to sound financial

footing.

SEC issued an order creating a Management Committee wherein Pilipinas Bank is

represented. The Committee shall undertake BMCs management, take custody

and control of all its existing assets and liabilities, study, review and evaluate its

operation and/or feasibility of its being restructured.

BMC and 14 of its creditor banks entered into a MPA rescheduling payment of

BMCsexistingdebts.

SEC approved the rehabilitation plan and declared BMC is a state of suspension of

payments.

BMC and Ong defaulted in the payments. Hence, Pilipinas Bank filed a complaint

against BMC and Ong because they failed to pay their obligations under the trust

receipts despite demand.

Assistant Prosecutor Bautista issued a Resolution recommending the dismissal of

the complaint. This was approved. Pilipinas Bank filed an MR but this was denied.

Pilipinas Bank filed a petition for certiorari and mandamus seeking to annul DOJ

resolution. CA ruled for Pilipinas Bank.

BMC and Ong filed an MR and was granted on the ground that the MOA

constituted a novation which placed Pilipinas Bank in estoppels to insist on the

original trust relation and constitutes a bar to the filing of any criminal information

for violation of PD 115.

Rehabilitation and Declaration in a State of Suspension of Payments. Also, when

Pilipinas Bank made a demand upon BMC, the SEC Managmenet Committee

already had control and custody of BMCs assets and liabilities, including the

lumber subject of the trust receipts, and authorized their use in the ordinary course

of business operations. It was the Management Committee which could settle

BMCsobligations.

The court also discovered that Ong paid P21M in compliance with the equity

infusion required by the MOA. The mala prohibita nature of the offense

notwithstanding, Ongs intent to misuse or misappropriate the goods or their

proceeds has not been established by the records.

TheMOAdidnotonlyrescheduleBMCsdebts,butmoreimportantly,itprovided

principal conditions which are incompatible with the trust agreement. Hence, the

MOA novated and effectively extinguished BMC's obligations under the trust

receipt agreement.

What is automatically terminated in case BMC failed to comply with the conditions

under the MOA is not the MOA itself but merely the obligation of the lender (the

bank) to reschedule the existing credits. Moreover, it is erroneous to assume that

the revesting of "all the rights of lenders against the borrower" means that Pilipinas

Bank can charge BMC and Ong for violation of the Trust Receipts Law under the

original trust receipt agreement. The execution of the MOA extinguished BMC and

Ongsobligationunderthetrustreceipts,andifthereisliability,itwillonlybecivil

in nature since the trust receipts were transformed into mere loan documents after

the execution of the MOA. This is reinforced by the fact that the mortgage

contracts executed by the BMC survive despite its non-compliance with the

conditions set forth in the MOA.

- Cruz

Issue:

WoN the MOA was a novation of the trust agreement between the parties.

Held:

Yes.TheMOAnovatesthetrustagreement.PilipinasBankspetitionisdenied.

Ratio:

Mere failure to deliver the proceeds of the sale or the goods, if not sold,

constitutes violation of PD No. 115. However, what is being punished by the law is

the dishonesty and abuse of confidence in the handling of money or goods to the

prejudice of another regardless of whether the latter is the owner. In the case at

bar, no dishonesty nor abuse of confidence can be attributed to BMC and Ong.

Record shows that BMC failed to comply with its obligations upon maturity of the

trust receipts due to serious liquidity problems, prompting it to file a Petition for

CRUZ | MUTI | RAZON

NEGOTIABLE INSTRUMENTS | ATTY. AMPIL

You might also like

- FRIA DigestsDocument14 pagesFRIA DigestsTen LaplanaNo ratings yet

- Land Titles Transcript Midterm - Part 2 PDFDocument10 pagesLand Titles Transcript Midterm - Part 2 PDFMar Darby ParaydayNo ratings yet

- Carriers exempted from liability in certain casesDocument12 pagesCarriers exempted from liability in certain casesLouis pNo ratings yet

- Labor Law 2019Document32 pagesLabor Law 2019Mitchay0% (1)

- South City Homes v BA Finance on suretyship, novation, trust receiptsDocument2 pagesSouth City Homes v BA Finance on suretyship, novation, trust receiptsMylesNo ratings yet

- Corporation Law Case Digests 1Document113 pagesCorporation Law Case Digests 1Arah Mae BonillaNo ratings yet

- Commercial Law Review Cases Batch 2Document42 pagesCommercial Law Review Cases Batch 2KarmaranthNo ratings yet

- The Registry of PropertyDocument2 pagesThe Registry of PropertyChem MaeNo ratings yet

- Negotiable Instruments and Holder in Due Course StatusDocument6 pagesNegotiable Instruments and Holder in Due Course StatusTonifranz SarenoNo ratings yet

- RA 11057 Personal Property Security Act20181024-5466-60b906Document17 pagesRA 11057 Personal Property Security Act20181024-5466-60b906denbar15No ratings yet

- Gabriel V R.D. RizalDocument2 pagesGabriel V R.D. RizalValerie Aileen AnceroNo ratings yet

- Ledesma v. Enriquez (1949)Document5 pagesLedesma v. Enriquez (1949)Reinerr NuestroNo ratings yet

- Letter of Credit Q&A GuideDocument7 pagesLetter of Credit Q&A GuideIra Francia Alcazar100% (1)

- Deregulation of The Philippine Shipping Industry: Easing Restrictions On The Cabotage LawDocument7 pagesDeregulation of The Philippine Shipping Industry: Easing Restrictions On The Cabotage Laweric-paolo-smith-6354No ratings yet

- Magna Carta of Airline Passengers RightsDocument16 pagesMagna Carta of Airline Passengers RightsTonyo Cruz100% (2)

- Naguiat vs Court of Appeals agency disputeDocument1 pageNaguiat vs Court of Appeals agency disputeLawrence RiodequeNo ratings yet

- Montances, Bryan Ian L. Torts Monday 530 To 730pm Atty HiguitDocument1 pageMontances, Bryan Ian L. Torts Monday 530 To 730pm Atty HiguitJewel MP DayoNo ratings yet

- Act N0. 3893 Bonded Warehouse ActDocument2 pagesAct N0. 3893 Bonded Warehouse ActMafarNo ratings yet

- 01 FORTUNATA LUCERO VIUDA DE SINDAYEN V THE INSULAR LIFE ASSURANCE CO., LTD., PDFDocument2 pages01 FORTUNATA LUCERO VIUDA DE SINDAYEN V THE INSULAR LIFE ASSURANCE CO., LTD., PDFCheska VergaraNo ratings yet

- Phil-Am General Insurance Company v. CADocument2 pagesPhil-Am General Insurance Company v. CAWayneNoveraNo ratings yet

- Credit Transactions - Notes 03Document21 pagesCredit Transactions - Notes 03Katharina CantaNo ratings yet

- Week 9 NegoDocument18 pagesWeek 9 NegoyassercarlomanNo ratings yet

- SEC Jurisdiction Over Removal of Corporate OfficersDocument2 pagesSEC Jurisdiction Over Removal of Corporate OfficersMatt LedesmaNo ratings yet

- San Beda College of Law: Contract of Transportation/ CarriageDocument43 pagesSan Beda College of Law: Contract of Transportation/ CarriageMae Jansen DoroneoNo ratings yet

- Succession 2010Document81 pagesSuccession 2010hotjurist100% (1)

- Registered Attachment Lien Superior to Earlier Unregistered DeedDocument2 pagesRegistered Attachment Lien Superior to Earlier Unregistered DeedLei MorteraNo ratings yet

- Tables - Succession - Printable PDFDocument6 pagesTables - Succession - Printable PDFColeen Navarro-Rasmussen100% (1)

- Dinio V LaguesmaDocument2 pagesDinio V LaguesmaAngela Conejero100% (1)

- Bangus Fry Fisherfolk Vs LanzanasDocument6 pagesBangus Fry Fisherfolk Vs LanzanasHariette Kim TiongsonNo ratings yet

- PALEA Vs CacdacDocument1 pagePALEA Vs CacdacKyle ChanNo ratings yet

- Tax RemediesDocument14 pagesTax RemediesMatt Marqueses PanganibanNo ratings yet

- Vda. De Maglana vs Hon. Consolacion and Afisco Insurance Corp (1992Document2 pagesVda. De Maglana vs Hon. Consolacion and Afisco Insurance Corp (1992NC BergoniaNo ratings yet

- Civ Rev - Carried Lumber Company Vs ACCFADocument9 pagesCiv Rev - Carried Lumber Company Vs ACCFALudica Oja100% (1)

- PPSA Handouts PDFDocument11 pagesPPSA Handouts PDFNikkandra MarceloNo ratings yet

- Balatoc Mining vs Benguet ConsolidatedDocument2 pagesBalatoc Mining vs Benguet ConsolidatedSharon G. BalingitNo ratings yet

- Azucena Book Digest Labrel PP 79-336Document68 pagesAzucena Book Digest Labrel PP 79-336KalEl100% (1)

- Election Law CasesDocument9 pagesElection Law Casescode4saleNo ratings yet

- Tax WK 10 DigestsDocument18 pagesTax WK 10 Digestsjovelyn davoNo ratings yet

- MHC and MHICL Not Liable for Palace Hotel Worker's DismissalDocument42 pagesMHC and MHICL Not Liable for Palace Hotel Worker's DismissalABNo ratings yet

- Bulk Sales Law: Reference: Reviewer of Commercial Law 2014 Ed. by JR Sundiang SR, and TB Aquino Rex BookstoreDocument17 pagesBulk Sales Law: Reference: Reviewer of Commercial Law 2014 Ed. by JR Sundiang SR, and TB Aquino Rex BookstoreJaneth NavalesNo ratings yet

- Agrarian Law Pointers (Midterms)Document65 pagesAgrarian Law Pointers (Midterms)Mary Licel Regala100% (1)

- Filipinas Vs Nava May 20, 1966Document1 pageFilipinas Vs Nava May 20, 1966Alvin-Evelyn GuloyNo ratings yet

- QuestionnaireDocument9 pagesQuestionnaireWenchie DiwaNo ratings yet

- Communication Materials and Design Inc. vs. CADocument25 pagesCommunication Materials and Design Inc. vs. CATammy YahNo ratings yet

- Financial Rehabilitation Act InsightsDocument27 pagesFinancial Rehabilitation Act InsightsAngela AcompañadoNo ratings yet

- Clark Vs Sellner DigestDocument1 pageClark Vs Sellner Digestjim jim100% (1)

- FEATI BANK vs. COURT OF APPEALSDocument1 pageFEATI BANK vs. COURT OF APPEALSJan Mar Gigi GallegoNo ratings yet

- Agrarian Law and Social LegislationDocument10 pagesAgrarian Law and Social LegislationClaireNo ratings yet

- Tort vs Contract: Key DifferencesDocument5 pagesTort vs Contract: Key Differencesashee618No ratings yet

- Silicon Phils Inc Vs CirDocument1 pageSilicon Phils Inc Vs CirlacbayenNo ratings yet

- Republic of The Philippines Supreme Court Manila: Judge StationDocument3 pagesRepublic of The Philippines Supreme Court Manila: Judge StationParubrub-Yere TinaNo ratings yet

- Supreme Court Rules on Director Election Dispute in Corporate Joint VentureDocument4 pagesSupreme Court Rules on Director Election Dispute in Corporate Joint VenturepurplebasketNo ratings yet

- XcvxcbnvchjtyhwerrfsafDocument252 pagesXcvxcbnvchjtyhwerrfsafNigel GarciaNo ratings yet

- Insurance DigestDocument16 pagesInsurance DigestDianne MendozaNo ratings yet

- Board Resolution-Commonwealth Rural Bank (Gangan)Document6 pagesBoard Resolution-Commonwealth Rural Bank (Gangan)Gaspar ascoNo ratings yet

- Negotiable Instruments Reviewer For FinalsDocument10 pagesNegotiable Instruments Reviewer For FinalsAireen Villahermosa PiniliNo ratings yet

- Transportation Law 2013-2014 405 Tld-HycDocument40 pagesTransportation Law 2013-2014 405 Tld-HycLeo Joselito Estoque BonoNo ratings yet

- Metropolitan Bank vs. Court of AppealsDocument8 pagesMetropolitan Bank vs. Court of AppealsSteve SmithNo ratings yet

- G.R. No. L-42735, January 22, 1990 Ramon L. Abad vs. CaDocument6 pagesG.R. No. L-42735, January 22, 1990 Ramon L. Abad vs. CaChloe Sy Galita100% (1)

- DBP vs Prudential Bank: Ruling on Validity of Trust Receipts and MortgagesDocument3 pagesDBP vs Prudential Bank: Ruling on Validity of Trust Receipts and MortgagesylessinNo ratings yet

- Batch 10 NegoDocument40 pagesBatch 10 NegoJet GarciaNo ratings yet

- 20 Puyat & Sons, Inc. vs. Arco Amusement Co.Document8 pages20 Puyat & Sons, Inc. vs. Arco Amusement Co.yassercarlomanNo ratings yet

- Week 14 NegoDocument13 pagesWeek 14 NegoyassercarlomanNo ratings yet

- NEGO Trust Receipts Law: Emergency RecitDocument8 pagesNEGO Trust Receipts Law: Emergency RecityassercarlomanNo ratings yet

- Lim V CADocument13 pagesLim V CAyassercarlomanNo ratings yet

- Week 8 Nego PDFDocument13 pagesWeek 8 Nego PDFRay SantosNo ratings yet

- Nego Case List 4: Emergeny RecitDocument24 pagesNego Case List 4: Emergeny RecityassercarlomanNo ratings yet

- NEGO Week 12 Documents of Title, General Bonded Warehouse ActDocument9 pagesNEGO Week 12 Documents of Title, General Bonded Warehouse ActyassercarlomanNo ratings yet

- Week 2 Nego PDFDocument29 pagesWeek 2 Nego PDFyassercarlomanNo ratings yet

- Nego Case List 6 and 7 Sec 70 To 118Document19 pagesNego Case List 6 and 7 Sec 70 To 118yassercarlomanNo ratings yet

- 20 Puyat & Sons, Inc. vs. Arco Amusement Co.Document8 pages20 Puyat & Sons, Inc. vs. Arco Amusement Co.yassercarlomanNo ratings yet

- Week 9 NegoDocument18 pagesWeek 9 NegoyassercarlomanNo ratings yet

- Nego Case List 5 - Sec 60 To 69 Liabilities of PartiesDocument22 pagesNego Case List 5 - Sec 60 To 69 Liabilities of PartiesyassercarlomanNo ratings yet

- Pineda V.De La Rama 121 Scra 671 JedDocument31 pagesPineda V.De La Rama 121 Scra 671 JedyassercarlomanNo ratings yet

- Negotiable Instruments Case List 1Document12 pagesNegotiable Instruments Case List 1yassercarlomanNo ratings yet

- Lim V CADocument13 pagesLim V CAyassercarlomanNo ratings yet

- 17 Nielson & Co., Inc V Lepanto Consolidated MiningDocument35 pages17 Nielson & Co., Inc V Lepanto Consolidated MiningyassercarlomanNo ratings yet

- Supreme Court upholds agent's reimbursement for insurance claimsDocument10 pagesSupreme Court upholds agent's reimbursement for insurance claimsyassercarlomanNo ratings yet

- Ker & Co V LingadDocument10 pagesKer & Co V LingadyassercarlomanNo ratings yet

- 37 Bordador v. LuzDocument15 pages37 Bordador v. LuzyassercarlomanNo ratings yet

- Philpotts V Phil ManufacturingDocument5 pagesPhilpotts V Phil ManufacturingyassercarlomanNo ratings yet

- 07 Rallos V Felx Go Chan & SonsDocument20 pages07 Rallos V Felx Go Chan & SonsyassercarlomanNo ratings yet

- 03 Litonjua JR Vs Eternit CorpDocument23 pages03 Litonjua JR Vs Eternit CorpyassercarlomanNo ratings yet

- 10 DBP vs. Emerald Hotel PDFDocument26 pages10 DBP vs. Emerald Hotel PDFyassercarlomanNo ratings yet

- 03 Ereña vs. Querrer-Kauffman PDFDocument25 pages03 Ereña vs. Querrer-Kauffman PDFyassercarlomanNo ratings yet

- 08 Briones-Vasquez Vs CADocument13 pages08 Briones-Vasquez Vs CAyassercarlomanNo ratings yet

- 11 Baluyut vs. Poblete PDFDocument19 pages11 Baluyut vs. Poblete PDFyassercarlomanNo ratings yet

- WWW - TamilRockers.la - Aaranya Kaandam (2011) Tamil 1080p HD AVC X264 3.6GBDocument84 pagesWWW - TamilRockers.la - Aaranya Kaandam (2011) Tamil 1080p HD AVC X264 3.6GBRupai SarkarNo ratings yet

- Nepal's Developing Financial SystemDocument8 pagesNepal's Developing Financial SystemRajendra LamsalNo ratings yet

- HDFC Hallan Nov 2018Document1 pageHDFC Hallan Nov 2018Hemansh AnandNo ratings yet

- Inclusive Growth With Disruptive Innovations: Gearing Up For Digital DisruptionDocument48 pagesInclusive Growth With Disruptive Innovations: Gearing Up For Digital DisruptionShashank YadavNo ratings yet

- Comparative Study Between Two BanksDocument26 pagesComparative Study Between Two BanksAnupam SinghNo ratings yet

- Guide To Cost-Benefit Analysis of Infrastructure ProjectsDocument133 pagesGuide To Cost-Benefit Analysis of Infrastructure ProjectstegelinskyNo ratings yet

- Executive Summary:: The Bank of PunjabDocument40 pagesExecutive Summary:: The Bank of PunjabLucifer Morning starNo ratings yet

- Temenos - Country Model Banks Generic ATM Framework Gpack - Atmi User GuideDocument91 pagesTemenos - Country Model Banks Generic ATM Framework Gpack - Atmi User GuideShaqif Hasan SajibNo ratings yet

- Oceanic Bank - Letter From John Aboh - CEODocument1 pageOceanic Bank - Letter From John Aboh - CEOOceanic Bank International PLCNo ratings yet

- Barangay Sambag BHERNDocument4 pagesBarangay Sambag BHERNCoffee CoxNo ratings yet

- Why Put Money in a BankDocument11 pagesWhy Put Money in a BankBlake AldridgeNo ratings yet

- Stopwatch JanFeb HIGHDocument76 pagesStopwatch JanFeb HIGHNATSOIncNo ratings yet

- Sarbati Devi v. Usha Devi AnalysisDocument10 pagesSarbati Devi v. Usha Devi AnalysisSameer Khedkar100% (1)

- United States Court of Appeals Fourth Circuit.: No. 12552. No. 12553Document14 pagesUnited States Court of Appeals Fourth Circuit.: No. 12552. No. 12553Scribd Government DocsNo ratings yet

- Quickbooks AssignmentDocument11 pagesQuickbooks AssignmentTauqeer Ahmed100% (1)

- Agreement 2006 Bank of AmericaDocument19 pagesAgreement 2006 Bank of AmericaNora WellerNo ratings yet

- YES Premia Credit Card - User GuideDocument17 pagesYES Premia Credit Card - User Guidesanjay mehtaNo ratings yet

- EVSDocument3 pagesEVSAjit JenaNo ratings yet

- Bank ADocument3 pagesBank ASARY MISHEL NUÑEZ ACEVEDONo ratings yet

- Confederate CurrencyDocument51 pagesConfederate CurrencyMarques YoungNo ratings yet

- English Proficiency Forum ScriptDocument8 pagesEnglish Proficiency Forum ScriptCeline LinNo ratings yet

- Report On Money LaunderingDocument3 pagesReport On Money LaunderingAJAY AGARWALNo ratings yet

- The Union Bank of The Philippines 11Document2 pagesThe Union Bank of The Philippines 11Sebastiel Dela RosaNo ratings yet

- Top 5 Major Objectives of Development Banks in IndiaDocument2 pagesTop 5 Major Objectives of Development Banks in Indiababa3673No ratings yet

- The History of Insurance Throughout The WorldDocument29 pagesThe History of Insurance Throughout The WorldNrnNo ratings yet

- Ledgerwood J. - Microfinance Handbook. An Institutional and Financial Perspective (1999)Document304 pagesLedgerwood J. - Microfinance Handbook. An Institutional and Financial Perspective (1999)ATAUR ROHMANNo ratings yet

- Introduction to Constructive Notice and Doctrine of Indoor ManagementDocument14 pagesIntroduction to Constructive Notice and Doctrine of Indoor ManagementAnkita ShuklaNo ratings yet

- Rural Financial Services and Effects On Livestock Production in EthiopiaDocument12 pagesRural Financial Services and Effects On Livestock Production in EthiopiaSikandar KhattakNo ratings yet

- Kebs108 PDFDocument26 pagesKebs108 PDFvasu kumarNo ratings yet

- Becsr Assignment 3 - 19202065 - Sec ADocument3 pagesBecsr Assignment 3 - 19202065 - Sec AViresh Gupta100% (1)