Professional Documents

Culture Documents

Instructions On How To Create A MACRS Depreciation Schedule

Uploaded by

MaryOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Instructions On How To Create A MACRS Depreciation Schedule

Uploaded by

MaryCopyright:

Available Formats

MACRS Depreciation Method - Instructions for Schedule

Property Class Under GDS Class recovery period (Useful Life) 3-year Asset types Tractor units for over-the-road use. Any race horse over 2 years old when placed in service. (All race horses placed in service after December 31, 2008, and before January 1, 2014, are deemed to be 3-year property, regardless of age.) Any other horse (other than a race horse) over 12 years old when placed in service. Qualified rent-to-own property (defined in pub. 946). Automobiles, taxis, buses, and trucks. Computers and peripheral equipment. Office machinery (such as typewriters, calculators, and copiers). Any property used in research and experimentation. Breeding cattle and dairy cattle. Appliances, carpets, furniture, etc., used in a residential rental real estate activity. Certain geothermal, solar, and wind energy property. Office furniture and fixtures (such as desks, files, and safes). Agricultural machinery and equipment. Any property that does not have a class life and has not been designated by law as being in any other class. Certain motorsports entertainment complex property placed in service before January 1, 2012 (defined later). Any natural gas gathering line placed in service after April 11, 2005. See Natural gas gathering line, natural gas distribution line, and electric transmission property, later. Vessels, barges, tugs, and similar water transportation equipment. Any single purpose agricultural or horticultural structure. Any tree or vine bearing fruits or nuts. Qualified small electric meter and qualified smart electric grid system (defined in pub. 946) placed in service on or after October 3, 2008. Certain improvements made directly to land or added to it (such as shrubbery, fences, roads, sidewalks, and bridges). Any retail motor fuels outlet (defined in pub. 946), such as a convenience store. Any municipal wastewater treatment plant. Any qualified leasehold improvement property (defined in pub. 946) placed in service before January 1, 2012. Any qualified restaurant property (defined in pub. 946) placed in service before January 1, 2012. Initial clearing and grading land improvements for gas utility property. Electric transmission property (that is section 1245 property) used in the transmission at 69 or more kilovolts of electricity placed in service after April 11, 2005. See Natural gas gathering line, natural gas distribution line, and electric transmission property, later. Any natural gas distribution line placed in service after April 11, 2005. See Natural gas gathering line, natural gas distribution line, and electric transmission property, later. Any qualified retail improvement property placed in service before January 1, 2012. Farm buildings (other than single purpose agricultural or horticultural structures). Municipal sewers not classified as 25-year property. Initial clearing and grading land improvements for electric utility transmission and distribution plants.

5-year

7-year

10-year

15-year

20-year

MJC Revised 1/2012

Page 1

MACRS Depreciation Method - Instructions for Schedule

Property Class Under GDS Class recovery period (Useful Life) 27.5-year Asset types Residential rental property. This is any building or structure, such as a rental home (including a mobile home), if 80% or more of its gross rental income for the tax year is from dwelling units. A dwelling unit is a house or apartment used to provide living accommodations in a building or structure. It does not include a unit in a hotel, motel, or other establishment where more than half the units are used on a transient basis. If you occupy any part of the building or structure for personal use, its gross rental income includes the fair rental value of the part you occupy. Nonresidential real property. This is section 1250 property, such as an office building, store, or warehouse, that is neither residential rental property nor property with a class life of less than 27.5 years.

31.5-year

Year 1 2 3 4 5 6 7 8 9 10 11 12 13 14 15 16 17 18 19 20 21

Table A-1 from IRS Publication 946 (2010) Depreciation rate for recovery period (decimal format)

3-year 5-year 7-year 10-year 15-year 20-year

.3333 .4445 .1481 .0741

.2000 .3200 .1920 .1152 .1152 .0576

.1429 .2449 .1749 .1249 .0893 .0892 .0893 .0446

.1000 .1800 .1440 .1152 .0922 .0737 .0655 .0655 .0656 .0655 .0328

.0500 .0950 .0855 .0770 .0693 .0623 .0590 .0590 .0591 .0590 .0591 .0590 .0591 .0590 .0591 .0295

.03750 .07219 .06677 .06177 .05713 .05285 .04888 .04522 .04462 .04461 .04462 .04461 .04462 .04461 .04462 .04461 .04662 .04661 .04462 .04461 .02231

MJC Revised 1/2012

Page 2

MACRS Depreciation Method - Instructions for Schedule

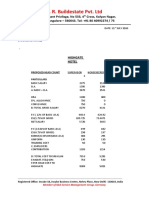

Love Thy Pets Inc., Depreciation Schedule MACRS For 5 Year Asset $20,000 5,000 5 Years

B Cost $20,000 $20,000 $20,000 $20,000 $20,000 $20,000 C Depreciation Rate .2000 .3200 .1920 .1152 .1152 .0576 D Annual Depreciation Expense $4,000 $6,400 $3,840 $2,304 $2,304 $1,152 E Accumulated Depreciation $ 4,000 $10,400 $14,240 $16,544 $18,848 $20,000 F Book Value At end of year $16,000 $ 9,600 $ 5,760 $ 3,456 $ 1,152 $ 0

Cost of Asset Residual Value Useful Life

A End of year 1 2 3 4 5 6

Systematic Instructions Always start with the three-line header, which in this case includes the name of the corporation, the title of the form, and the assets useful life. 1. On the first line place the title Cost of Asset and then the dollar value of the asset. 2. On the second line place the title Residual Value and the dollar value of the asset at the end of its useful life to the corporation. 3. On the third line place the title Useful Life and the amount of years the asset will be of value to the corporation. You can use the first two charts to determine what the useful life of the asset will be for the corporation. Please take note that an asset does not cease to exist just because it is no longer useful to the corporation. 4. On the fourth line label the columns alphabetically. 5. On the fifth line use the following labels:

Depreciation Rate Annual Depreciation Expense Accumulated Depreciation Book Value At end of year

End of year

Cost

MJC Revised 1/2012

Page 3

MACRS Depreciation Method - Instructions for Schedule

6. Column A list one more year than the assets useful life. This will result in six rows for an asset with a useful life of five years after the header. 7. Column B list the original cost of the asset in each row after the header for this column. 8. Column C copy the information from Table A-1 for the recovery year identify on line 3. 9. Column D multiply the cost of the asset column B by the depreciation rate column C to get the dollar value for the annual depreciation expense. 10. Column E is the sum total of all the annual depreciation taken up to the current period. The first years accumulated depreciation will be the same as the annual depreciation since no prior depreciation has been taken. Thereafter the current years depreciation will be added to the prior years accumulated depreciation to arrive at the current years accumulated depreciation. Unlike the other forms of depreciation residual value is not taken into consideration when using the MARCS method of depreciation. 11. Column F is arrived at by subtracting the value in column E accumulated depreciation from the value in column B which is the cost of the asset. Note that residual value is not considered when depreciation is taken using MACRS.

MJC Revised 1/2012

Page 4

You might also like

- Basic Instructions On How To Create A Sum-of-the-Years'-Digits Depreciation ScheduleDocument4 pagesBasic Instructions On How To Create A Sum-of-the-Years'-Digits Depreciation ScheduleMary100% (1)

- SUTA and FUTA CalculationsDocument2 pagesSUTA and FUTA CalculationsMary83% (12)

- FIT-Percentage Method ChartsDocument4 pagesFIT-Percentage Method ChartsMary67% (3)

- Stop DepreciationDocument8 pagesStop DepreciationDeepak GhugardareNo ratings yet

- Partial PaymentsDocument1 pagePartial PaymentsMaryNo ratings yet

- Labor Variance FormulasDocument2 pagesLabor Variance FormulasMaryNo ratings yet

- US CMA PPT 3 Investments in DebtDocument11 pagesUS CMA PPT 3 Investments in DebtmohammedNo ratings yet

- Accounting Entry (FI)Document9 pagesAccounting Entry (FI)Manoj PradhanNo ratings yet

- Calendars For Sales TermsDocument2 pagesCalendars For Sales TermsMaryNo ratings yet

- Basic Instructions For LIFO Inventory MethodDocument4 pagesBasic Instructions For LIFO Inventory MethodMary100% (4)

- Instructions On How To Create A Units of Production Depreciation ScheduleDocument2 pagesInstructions On How To Create A Units of Production Depreciation ScheduleMary100% (3)

- SAP FI Table NamesDocument2 pagesSAP FI Table NamesharibabuNo ratings yet

- Federal Insurance Contributions ActDocument3 pagesFederal Insurance Contributions ActMaryNo ratings yet

- Transaction AnalysisDocument14 pagesTransaction AnalysisMaryNo ratings yet

- 1 Section: Customer Material Info RecordsDocument8 pages1 Section: Customer Material Info RecordsGogoNo ratings yet

- Owners Equity Statement Form InstructionsDocument2 pagesOwners Equity Statement Form InstructionsMary100% (4)

- Analyzes of A Business TransactionDocument13 pagesAnalyzes of A Business TransactionMary100% (1)

- Accounting Entries Under GSTDocument9 pagesAccounting Entries Under GSTLovaraju RajuNo ratings yet

- Financial Accounting and ReportingDocument10 pagesFinancial Accounting and ReportingLý BằngNo ratings yet

- FI User Manual Cross ChargesDocument25 pagesFI User Manual Cross ChargesJose Luis Becerril BurgosNo ratings yet

- Trick To Remember Credit & DebitDocument3 pagesTrick To Remember Credit & Debitរ័ត្នវិសាល (Rathvisal)100% (1)

- Closing Journal Entries-Sole ProprietorshipDocument1 pageClosing Journal Entries-Sole ProprietorshipMary100% (3)

- Sap Fi GL Enduser Step by Step MaterialDocument100 pagesSap Fi GL Enduser Step by Step MaterialDhaval ChoksiNo ratings yet

- Accounts ReceivableDocument3 pagesAccounts Receivablesubrat100% (1)

- Gross Pay CalculationsDocument2 pagesGross Pay CalculationsMary100% (3)

- Terms of SaleDocument6 pagesTerms of SaleMary100% (1)

- Master Zen SecretDocument30 pagesMaster Zen SecretAnonymous N2Q5M6No ratings yet

- Flash Card SlidesDocument29 pagesFlash Card SlidesMary100% (2)

- Materials Variance FormulasDocument2 pagesMaterials Variance FormulasMary100% (1)

- KP26Document8 pagesKP26harikrishnaNo ratings yet

- SAP Standard Toolbar Buttons: Button Keyboard Shortcut DescriptionDocument6 pagesSAP Standard Toolbar Buttons: Button Keyboard Shortcut DescriptionManojNo ratings yet

- Posting To T-AccountsDocument19 pagesPosting To T-AccountsMary100% (9)

- Cost Sheet FormatDocument2 pagesCost Sheet FormatAMIN BUHARI ABDUL KHADERNo ratings yet

- 04 Accounting Study NotesDocument4 pages04 Accounting Study NotesJonas ScheckNo ratings yet

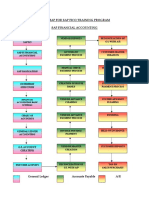

- Roadmap For SAP FICO Training ProgramDocument4 pagesRoadmap For SAP FICO Training ProgramCorpsalesNo ratings yet

- Periodic Inventory Valuation MethodsDocument10 pagesPeriodic Inventory Valuation MethodsMary100% (1)

- Debit Credit Chart PDFDocument7 pagesDebit Credit Chart PDFdbistaNo ratings yet

- Period End and Year End ProcessesDocument3 pagesPeriod End and Year End ProcessessrinivasNo ratings yet

- Basic Instructions For A Cash Budget StatementDocument4 pagesBasic Instructions For A Cash Budget StatementMary100% (6)

- AP Debit Memos and Credit Memos TrainingDocument9 pagesAP Debit Memos and Credit Memos TrainingyadavdevenderNo ratings yet

- Cash DiscountsDocument1 pageCash DiscountsMaryNo ratings yet

- COPA Report Trouble ShootDocument32 pagesCOPA Report Trouble ShootTarun AggarwalNo ratings yet

- How To Create A WorksheetDocument3 pagesHow To Create A WorksheetMary67% (3)

- Accounting CheatsheetDocument1 pageAccounting Cheatsheetalbatross868973No ratings yet

- Perpetual Inventory System MethodsDocument13 pagesPerpetual Inventory System MethodsMary100% (10)

- Awesome Macros - Save TimeDocument68 pagesAwesome Macros - Save TimeNguyen NgocNo ratings yet

- FS For GR IR Automatic ClearingDocument10 pagesFS For GR IR Automatic ClearingHridya PrasadNo ratings yet

- Continue or Eliminate AnalysisDocument3 pagesContinue or Eliminate AnalysisMaryNo ratings yet

- Ratio CalculationDocument8 pagesRatio CalculationSohel MahmudNo ratings yet

- SAP FICO Interview QuestionsDocument4 pagesSAP FICO Interview Questionsnagasuresh nNo ratings yet

- BOM (Bill of Material)Document13 pagesBOM (Bill of Material)Gowrikishore Kishore100% (1)

- Typical Accounts Receivable Journal EntriesDocument29 pagesTypical Accounts Receivable Journal EntriesDinesh MirajkarNo ratings yet

- Assignment 04 Cash Flow StatementDocument6 pagesAssignment 04 Cash Flow Statementumair iqbalNo ratings yet

- Jyotiraditya Banik 8712817833: Asset Disposal - Sales To A Customer: F-92 - With CustomerDocument3 pagesJyotiraditya Banik 8712817833: Asset Disposal - Sales To A Customer: F-92 - With CustomerJyotiraditya BanerjeeNo ratings yet

- Basic Instructions For Retained Earnings StatementDocument1 pageBasic Instructions For Retained Earnings StatementMary100% (5)

- Interview StudyDocument34 pagesInterview StudyJyotirmay SahuNo ratings yet

- God Made The Country and Man Made The Town': Narrative Essay A Morning WalkDocument2 pagesGod Made The Country and Man Made The Town': Narrative Essay A Morning WalkSittaraNo ratings yet

- Code O. Backup Withholding. This Is Your Share of The Credit For Backup Withholding OnDocument3 pagesCode O. Backup Withholding. This Is Your Share of The Credit For Backup Withholding OnRochelle GardnerNo ratings yet

- Seem 2440A/B - Engineering Economics First Term (2011 - 2012)Document3 pagesSeem 2440A/B - Engineering Economics First Term (2011 - 2012)Sun KelvinNo ratings yet

- EconomicsDocument5 pagesEconomicsPriyanka MannaNo ratings yet

- Basic Impact of Everyday Journal Entries On The Income StatementDocument2 pagesBasic Impact of Everyday Journal Entries On The Income StatementMary100% (1)

- End of The Year Adjustment For Allowance For Doubtful AccountsDocument1 pageEnd of The Year Adjustment For Allowance For Doubtful AccountsMary100% (1)

- Basic Everyday Journal Entries Retained Earnings and Stockholders EquityDocument2 pagesBasic Everyday Journal Entries Retained Earnings and Stockholders EquityMary100% (2)

- Diagram of Accounting EquationDocument1 pageDiagram of Accounting EquationMary100% (3)

- Adjusting Entries For Bank ReconciliationDocument1 pageAdjusting Entries For Bank ReconciliationMaryNo ratings yet

- Analysis of Financial Statements RatiosDocument2 pagesAnalysis of Financial Statements RatiosMaryNo ratings yet

- Kirkpatrick + ModelDocument1 pageKirkpatrick + ModelMaryNo ratings yet

- Accounting Journal Entries Flowchart PDFDocument1 pageAccounting Journal Entries Flowchart PDFMary75% (4)

- Cash Flows Statement Indirect MethodDocument2 pagesCash Flows Statement Indirect MethodMary100% (1)

- Horizontal Analysis of A Balance SheetDocument3 pagesHorizontal Analysis of A Balance SheetMary100% (6)

- Continue or Eliminate AnalysisDocument3 pagesContinue or Eliminate AnalysisMaryNo ratings yet

- Circle of LifeDocument1 pageCircle of LifeMaryNo ratings yet

- Scaffolding MethodDocument1 pageScaffolding MethodMaryNo ratings yet

- Chunking Method DiagramDocument1 pageChunking Method DiagramMaryNo ratings yet

- ARCS Method of MotivationDocument1 pageARCS Method of MotivationMaryNo ratings yet

- Journal Entry Format PDFDocument1 pageJournal Entry Format PDFMaryNo ratings yet

- Current Assets, Liabilities, and Stockholders' Equity Normal BalancesDocument1 pageCurrent Assets, Liabilities, and Stockholders' Equity Normal BalancesMaryNo ratings yet

- Labor Variance FormulasDocument2 pagesLabor Variance FormulasMaryNo ratings yet

- Gross Profit Section of Income Statement-Periodic SystemDocument3 pagesGross Profit Section of Income Statement-Periodic SystemMary67% (3)

- Partial Income Statement For Manufacturing CompanyDocument1 pagePartial Income Statement For Manufacturing CompanyMary50% (2)

- Analyzes of A Business TransactionDocument13 pagesAnalyzes of A Business TransactionMary100% (1)

- General Ledger 4 ColmDocument2 pagesGeneral Ledger 4 ColmMaryNo ratings yet

- Financial StatementsDocument1 pageFinancial StatementsMary100% (4)

- Materials Variance FormulasDocument2 pagesMaterials Variance FormulasMary100% (1)

- Calendars For Sales TermsDocument2 pagesCalendars For Sales TermsMaryNo ratings yet

- General Ledger PageDocument2 pagesGeneral Ledger PageMaryNo ratings yet

- How To Create Corporation WorksheetDocument4 pagesHow To Create Corporation WorksheetMaryNo ratings yet

- Periodic Inventory Valuation MethodsDocument10 pagesPeriodic Inventory Valuation MethodsMary100% (1)

- Account ClassificationDocument2 pagesAccount ClassificationMary96% (23)

- Cost of Goods Manufactured ScheduleDocument4 pagesCost of Goods Manufactured ScheduleMary82% (11)

- Financial Accounting Ifrs Edition 2nd Edition Weygandt Test BankDocument26 pagesFinancial Accounting Ifrs Edition 2nd Edition Weygandt Test BankDannyJohnsonobtk100% (48)

- Equity Program FAQDocument14 pagesEquity Program FAQNikhil SinghalNo ratings yet

- Euro Disney or Euro DisasterDocument8 pagesEuro Disney or Euro Disastersili coreNo ratings yet

- Ncnda+ ImfpaDocument10 pagesNcnda+ ImfpaRailesUsados89% (9)

- Tax1 Q1 Summer 17Document3 pagesTax1 Q1 Summer 17Sheena CalderonNo ratings yet

- City Government of San Pablo V ReyesDocument2 pagesCity Government of San Pablo V ReyesNikita BayotNo ratings yet

- Business Intelligence Applied in Small Size For Profit CompaniesDocument13 pagesBusiness Intelligence Applied in Small Size For Profit CompaniesMiguel de la CruzNo ratings yet

- Cost EstimationDocument11 pagesCost EstimationTamiko MitzumaNo ratings yet

- MIRA 101, English, v14.1 PDFDocument4 pagesMIRA 101, English, v14.1 PDFNaee ARNo ratings yet

- MAnagerial Economics - Lesson PlanDocument5 pagesMAnagerial Economics - Lesson Planmukesh040% (1)

- Memoire Finance Julien BOUSQUET Synergie Valuation in M ADocument77 pagesMemoire Finance Julien BOUSQUET Synergie Valuation in M AManal DassallemNo ratings yet

- Alfacurrate AAA PMS Jul16Document39 pagesAlfacurrate AAA PMS Jul16flytorahulNo ratings yet

- Lass 12 Subject Economics Paper Set 1 With Solutions: (Macro Economics) Question 1: (Marks 1)Document10 pagesLass 12 Subject Economics Paper Set 1 With Solutions: (Macro Economics) Question 1: (Marks 1)sandeep11116No ratings yet

- Ex2 Accounting For FOHDocument5 pagesEx2 Accounting For FOHMhelren DE LA PEnANo ratings yet

- Econ 11 SyllabusDocument5 pagesEcon 11 Syllabustikki0219No ratings yet

- Housekeeping ProposalDocument2 pagesHousekeeping Proposalprabhav_rrcNo ratings yet

- W-8BEN: Certificate of Foreign Status of Beneficial Owner For United States Tax Withholding and Reporting (Individuals)Document1 pageW-8BEN: Certificate of Foreign Status of Beneficial Owner For United States Tax Withholding and Reporting (Individuals)Lucian OlteanuNo ratings yet

- Curriculum Vitae - Andrian PratamaDocument2 pagesCurriculum Vitae - Andrian PratamaAndrian Pratama SumendapNo ratings yet

- PL FA&R Class SummaryDocument12 pagesPL FA&R Class SummaryRazib DasNo ratings yet

- Merger and Acquisition in The Telecom Industry An Analysis of Financial Performance of Vodafone PLC and Hutchison EssarDocument16 pagesMerger and Acquisition in The Telecom Industry An Analysis of Financial Performance of Vodafone PLC and Hutchison EssarRima ParekhNo ratings yet

- Boral Investor PresentationDocument43 pagesBoral Investor PresentationTim MooreNo ratings yet

- Stratagic1 31502733Document172 pagesStratagic1 31502733Alok SinghNo ratings yet

- Ii. Corporate Taxpayers Corporation Under The NIRCDocument7 pagesIi. Corporate Taxpayers Corporation Under The NIRCRon RamosNo ratings yet

- CH 16Document63 pagesCH 16Marleen GloriaNo ratings yet

- Indian Income Tax Return Acknowledgement 2021-22: Assessment YearDocument1 pageIndian Income Tax Return Acknowledgement 2021-22: Assessment YearRaveendra MoodithayaNo ratings yet

- R.A 8367 PDFDocument6 pagesR.A 8367 PDFreshell100% (1)

- Zulfikarali Nasirali Sidhpura 2021Document1 pageZulfikarali Nasirali Sidhpura 2021zuber shaikhNo ratings yet

- Cross Border Tax LeasingDocument4 pagesCross Border Tax LeasingDuncan_Low_4659No ratings yet

- Role of Board of DirectorsDocument3 pagesRole of Board of DirectorsFarhan JawedNo ratings yet

- Long Business Systems, Inc. (Lbsi)Document13 pagesLong Business Systems, Inc. (Lbsi)semirbekNo ratings yet