Professional Documents

Culture Documents

Nature and Sources of Risk

Uploaded by

Sheila Mae Guerta LaceronaCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Nature and Sources of Risk

Uploaded by

Sheila Mae Guerta LaceronaCopyright:

Available Formats

Nature and sources of Risk

One of the paradoxes of the recent global nancial crisis is that the crisis erupted

in an era when risk management was at the heart of the management of the largest and

most sophisticated nancial institutions. For institutions that see their role as making

money by taking judicious risks, the management of those risks is pivotal in their daily

operations. The risk manager quoted above was merely re-a rming the rms goals.

The risk managers task is to enable the rm to fulll its purpose by providing the

framework for measuring risks accurately, enabling the rm to take advantage of greater

precision so as to extract the last ounce of return from the rms portfolio. Financial risk

is endogenous due in large part to the reasoning embedded in the opening quote.

Endogenous risk refers to risks that are generated and amplied within the nancial

system, rather than risks from shocks that arrive from outside the nancial system. The

precondition for endogenous risk is the conjunction of circumstances where individual

actors react to changes in their environment and where those individuals actions a ect

their environment.

Risk identification sets out to identify an organisations exposure to uncertainty.

This requires an intimate knowledge of the organisation, the market in which it operates,

the legal, social, political and cultural environment in which it exists, as well as the

development of a sound understanding of its strategic and operational objectives,

including factors critical to its success and the threats and opportunities related to the

achievement of these objectives. Risk identification should be approached in a

methodical way to ensure that all significant activities within the organization have been

identified and all the risks flowing from these activities defined. All associated volatility

related to these activities should be identified and categorized.

Business activities and decisions can be classified in a range of ways, examples of

which include:

Strategic - This concern the long-term strategic objectives of the organization. They

can be affected by such areas as capital availability, sovereign and political risks, legal

and regulatory changes, reputation and changes in the physical environment.

making poor market decisions

Focused on the wrong target market

Incorrectly estimated demand (way too optimistic)

Priced the product/service incorrectly

Failed to study/understand customer needs

Unaware of technological changes in manufacturing or innovations in

service delivery

Ignored competitor actions that impact demand, pricing, marketing

strategy or new product/service development

Operational - These concern the day-today issues that the organization is confronted

with as it strives to deliver its strategic objectives.

-is exposure to loss due to poor systems and controls (poor

management)

A poor business plan

Unfavorable lease arrangements

Poor supply chain controls and disruptions

Ineffective quality assurance program

Information system data loss (viruses and corruption)

Dependence on independent contractors

Poor security and inventory control (theft)

Employee incompetence

Financial - These concern the effective management and control of the finances of

the organization and the effects of external factors such as availability of credit, foreign

exchange rates, interest rate movement and other market exposures.

Interest rate changes, which affect the cost of capital for a growing

company

Foreign exchange rates when the company is doing business

globally

The availability of credit

Product liability and warranty claims

Cash flow/liquidity problems

Loss of revenues

Knowledge management - These concern the effective management and control of

the knowledge resources, the production, protection and communication thereof.

External factors might include:

the unauthorized use or abuse of intellectual property,

area power failures,

Competitive technology.

Internal factors might be:

System malfunction or loss of key staff.

Some common sources of risk

o

The strategic decisions you make (or fail to make)

o Economic/Financial risks

o Technological changes

o Nonpayment of debts by customers

You might also like

- Environmental ScanningDocument18 pagesEnvironmental ScanningShivangi DhamijaNo ratings yet

- Credit Card Types, Benefits & RisksDocument14 pagesCredit Card Types, Benefits & RisksAsef KhademiNo ratings yet

- Ross Casebook 2006 For Case Interview Practice - MasterTheCaseDocument96 pagesRoss Casebook 2006 For Case Interview Practice - MasterTheCaseMasterTheCase.com100% (1)

- NLSDU Teachers Guide To DebateDocument31 pagesNLSDU Teachers Guide To DebateAndrei BăcanuNo ratings yet

- Managing RiskDocument39 pagesManaging Riskjerusalem nigussie100% (1)

- CH - 7 Project Risk ManagemtnDocument20 pagesCH - 7 Project Risk Managemtnamit_idea1No ratings yet

- Finman ReviewerDocument17 pagesFinman ReviewerSheila Mae Guerta LaceronaNo ratings yet

- Shea Kortes $348+ Per Day Method - My Top 8 Marketing Methods PDFDocument19 pagesShea Kortes $348+ Per Day Method - My Top 8 Marketing Methods PDFShiva RakshakNo ratings yet

- Chap 1 Basis of Malaysian Income Tax 2022Document7 pagesChap 1 Basis of Malaysian Income Tax 2022Jasne OczyNo ratings yet

- Sales (De Leon)Document737 pagesSales (De Leon)Bj Carido100% (7)

- Operational Risk Management NCBA&E MultanDocument43 pagesOperational Risk Management NCBA&E MultanAstro RiaNo ratings yet

- Answer Key Chapters 1 7Document40 pagesAnswer Key Chapters 1 7Sheila Mae Guerta Lacerona74% (38)

- Principles of Marketing - Quarter 3 - Module 1 (For Print)Document10 pagesPrinciples of Marketing - Quarter 3 - Module 1 (For Print)Stephanie Minor100% (1)

- The Fast Forward MBA in Project ManagementDocument19 pagesThe Fast Forward MBA in Project Managementالمهندسالمدني0% (1)

- Risk Management 2Document45 pagesRisk Management 2virajNo ratings yet

- Business EnvironmentDocument62 pagesBusiness EnvironmentNathan Williams100% (1)

- r0001 Erm Coso FrameworkDocument13 pagesr0001 Erm Coso FrameworkDewi DarmaNo ratings yet

- Risk management key factorsDocument4 pagesRisk management key factorsИвана ДиневаNo ratings yet

- Managing Enterprise Risks EffectivelyDocument7 pagesManaging Enterprise Risks EffectivelyJeric Lagyaban AstrologioNo ratings yet

- UCU Graduation List For October 27th 2017Document102 pagesUCU Graduation List For October 27th 2017The Campus TimesNo ratings yet

- Implementing ERM in The Banking IndustryDocument5 pagesImplementing ERM in The Banking IndustryOlmedo Farfan100% (2)

- Risks Supply Chain VulnerabilityDocument95 pagesRisks Supply Chain VulnerabilitypravanthbabuNo ratings yet

- Organizations External EnvironmentDocument3 pagesOrganizations External EnvironmentShashi BhushanNo ratings yet

- Nature of AdvertisingDocument13 pagesNature of AdvertisingMitzi Gia CuentaNo ratings yet

- SAP Authorization Management GuidelinesDocument3 pagesSAP Authorization Management GuidelinesMohiuddin BabanbhaiNo ratings yet

- Individual Performance Commitment and Review Ipcr Blank FormDocument1 pageIndividual Performance Commitment and Review Ipcr Blank FormAt Day's Ward100% (4)

- Unit 7 - Risk Management and CGDocument31 pagesUnit 7 - Risk Management and CGKeshav SoomarahNo ratings yet

- Erm ReviewerDocument7 pagesErm ReviewerAron AbastillasNo ratings yet

- BSBRSK501Document22 pagesBSBRSK501naveenNo ratings yet

- Risk Management 1Document3 pagesRisk Management 1astraiaNo ratings yet

- Task Nobel The Reasons of FinancialDocument3 pagesTask Nobel The Reasons of FinancialMohammad Fayez UddinNo ratings yet

- Csme - Risk ManagementDocument17 pagesCsme - Risk ManagementAdebola OguntayoNo ratings yet

- Practical Risk Management InsightsDocument4 pagesPractical Risk Management InsightsAstxilNo ratings yet

- Risk Management Essentials for IT ProtectionDocument30 pagesRisk Management Essentials for IT ProtectionHannett WoodNo ratings yet

- Financial Risk ManagementDocument3 pagesFinancial Risk ManagementMayankTayalNo ratings yet

- Chapter 3Document19 pagesChapter 3Amani Saeed100% (1)

- Compliance, Political and Strategic RiskDocument26 pagesCompliance, Political and Strategic RiskManny HermosaNo ratings yet

- Seedrox Case Analysis ToolsDocument21 pagesSeedrox Case Analysis ToolsMahua Adak MandalNo ratings yet

- 8-Chp 8 - RiskDocument13 pages8-Chp 8 - RiskAsad MuhammadNo ratings yet

- Environmental scanning techniques and analysisDocument6 pagesEnvironmental scanning techniques and analysisSsi SsiNo ratings yet

- DisertationDocument8 pagesDisertationInnocentNo ratings yet

- Business Environment For MBA.Document18 pagesBusiness Environment For MBA.keneyenanalioNo ratings yet

- Risk MGTDocument9 pagesRisk MGTCathlene Dela Paz GumbanNo ratings yet

- CH07 Introduction To Risk ManagementDocument20 pagesCH07 Introduction To Risk ManagementFrancis Ryan PorquezNo ratings yet

- HW6 - RiskDocument1 pageHW6 - RiskNHI VO NGOC BAONo ratings yet

- Strategic Management AssignmentDocument11 pagesStrategic Management AssignmentManinder KaurNo ratings yet

- Motilal Be NotesDocument14 pagesMotilal Be Notesrocky13bhai2001No ratings yet

- Form of A List of Risks Exercise People With An Extensive Knowledge of The Program or Process That Will Be Analyzed To Use A Prepared ListDocument4 pagesForm of A List of Risks Exercise People With An Extensive Knowledge of The Program or Process That Will Be Analyzed To Use A Prepared ListKeanne ArmstrongNo ratings yet

- Topic 5Document9 pagesTopic 5abasijohnson10No ratings yet

- Finance Credit & Risk ManagementDocument16 pagesFinance Credit & Risk Managementfatima siddiquiNo ratings yet

- Introduction To Managing Risk - 123906Document5 pagesIntroduction To Managing Risk - 123906Margaret IrunguNo ratings yet

- Report 1Document27 pagesReport 1CyrishNo ratings yet

- Operational riskDocument38 pagesOperational riskleechirayaNo ratings yet

- Multinational Company NoteDocument39 pagesMultinational Company Notetsion alemayehuNo ratings yet

- Risk Assessment Skill SummaryDocument24 pagesRisk Assessment Skill SummaryPriyanka SinghNo ratings yet

- Risk Test AnswersDocument6 pagesRisk Test AnswersFundikira HarunaNo ratings yet

- Module2 Businessenvironment 150627035534 Lva1 App6892Document53 pagesModule2 Businessenvironment 150627035534 Lva1 App6892zm7485689No ratings yet

- Bus2.6 Risk - ManagementDocument11 pagesBus2.6 Risk - ManagementshaanNo ratings yet

- Environmental Analysis and Organizational CapabilitiesDocument64 pagesEnvironmental Analysis and Organizational CapabilitiesShwetnisha DasNo ratings yet

- Best practices for managing project riskDocument17 pagesBest practices for managing project riskRishabh JainNo ratings yet

- CH 7. Establishing The Context (Almachar)Document4 pagesCH 7. Establishing The Context (Almachar)Hazell DNo ratings yet

- Chapter 6 Risk ManagementDocument11 pagesChapter 6 Risk Managementricojr.pagalanNo ratings yet

- Environmental ScanningDocument3 pagesEnvironmental ScanningIqraNo ratings yet

- Crisis and Risk ManagementDocument23 pagesCrisis and Risk ManagementDiane DominiqueNo ratings yet

- Submitted By:: Jay Gohil Riya VisanaDocument13 pagesSubmitted By:: Jay Gohil Riya VisanaSagar KotakNo ratings yet

- Risk Management PPT Week 1 Day 1Document18 pagesRisk Management PPT Week 1 Day 1Jessica MacaraigNo ratings yet

- SM Module 1Document10 pagesSM Module 1Jeevan ManjunathNo ratings yet

- Practical Techniques To Improve ProfitabilityDocument1 pagePractical Techniques To Improve ProfitabilityNOVA MELADNo ratings yet

- Chapter 5Document4 pagesChapter 5Casper VillanuevaNo ratings yet

- FSAQ1 QuestionsDocument2 pagesFSAQ1 QuestionsAllan CamachoNo ratings yet

- Risk Management, Swaps & VARDocument55 pagesRisk Management, Swaps & VARsashaathrgNo ratings yet

- Notes 4Document19 pagesNotes 4lucynouter1No ratings yet

- Environmental AnalysisDocument11 pagesEnvironmental AnalysisIsaac OsoroNo ratings yet

- ARTICLE 1458 SALES CONTRACT DEFINITIONDocument17 pagesARTICLE 1458 SALES CONTRACT DEFINITIONAngel NavarrozaNo ratings yet

- RIZAL TECHNOLOGICAL UNIVERSITY MOCK EXAMDocument8 pagesRIZAL TECHNOLOGICAL UNIVERSITY MOCK EXAMSheila Mae Guerta LaceronaNo ratings yet

- Diversity and Management SkillsDocument27 pagesDiversity and Management SkillsSheila Mae Guerta LaceronaNo ratings yet

- Audtheo Questions Set B 150 CopiesDocument8 pagesAudtheo Questions Set B 150 CopiesSheila Mae Guerta LaceronaNo ratings yet

- Forec Ast Ac Curac Y: Measures Used To Evaluate Forecast AccuracyDocument9 pagesForec Ast Ac Curac Y: Measures Used To Evaluate Forecast AccuracySheila Mae Guerta LaceronaNo ratings yet

- Auditing Theories Test Bank P1Document22 pagesAuditing Theories Test Bank P1Sheila Mae Guerta LaceronaNo ratings yet

- Leasing As A Form of DebtDocument24 pagesLeasing As A Form of DebtSheila Mae Guerta LaceronaNo ratings yet

- OD CaseformatDocument3 pagesOD CaseformatSheila Mae Guerta LaceronaNo ratings yet

- Banks and Money SupplyDocument5 pagesBanks and Money SupplySheila Mae Guerta LaceronaNo ratings yet

- Auditing Theories Test Bank P1Document22 pagesAuditing Theories Test Bank P1Sheila Mae Guerta LaceronaNo ratings yet

- The Rites of PassageDocument17 pagesThe Rites of PassageSheila Mae Guerta LaceronaNo ratings yet

- Cost of RiskDocument2 pagesCost of RiskSheila Mae Guerta LaceronaNo ratings yet

- Risk and A Single InvestmentDocument3 pagesRisk and A Single InvestmentSheila Mae Guerta LaceronaNo ratings yet

- Land in Your Dream Company.: Ace Your Job InterviewDocument19 pagesLand in Your Dream Company.: Ace Your Job InterviewSheila Mae Guerta LaceronaNo ratings yet

- Chap 6-8Document9 pagesChap 6-8Sheila Mae Guerta LaceronaNo ratings yet

- Summary of IFRS 3Document11 pagesSummary of IFRS 3Sheila Mae Guerta LaceronaNo ratings yet

- Resume FormatDocument2 pagesResume FormatSheila Mae Guerta LaceronaNo ratings yet

- 2012revisedgeneral Rules of DebateDocument5 pages2012revisedgeneral Rules of DebateSheila Mae Guerta LaceronaNo ratings yet

- Business Research Methods and TechniquesDocument44 pagesBusiness Research Methods and TechniquesSheila Mae Guerta LaceronaNo ratings yet

- Business CombinationDocument37 pagesBusiness CombinationSheila Mae Guerta LaceronaNo ratings yet

- General Partnership AgreementDocument15 pagesGeneral Partnership AgreementSelva Bavani Selwadurai100% (1)

- Processing of Applications For PartnershipsDocument2 pagesProcessing of Applications For PartnershipsSheila Mae Guerta LaceronaNo ratings yet

- General Partnership Agreement TemplateDocument10 pagesGeneral Partnership Agreement Templatechris lee100% (1)

- Prod ManDocument15 pagesProd ManSheila Mae Guerta LaceronaNo ratings yet

- Introduction To Operations ManagementDocument2 pagesIntroduction To Operations ManagementSheila Mae Guerta LaceronaNo ratings yet

- Course Title ED 1Document44 pagesCourse Title ED 1navalgund12No ratings yet

- Performance Management FinalsDocument2 pagesPerformance Management FinalsHasan Ali BokhariNo ratings yet

- SEC approval needed for merger validityDocument2 pagesSEC approval needed for merger validityGlaiza OtazaNo ratings yet

- CF BILPL ClickWrapTermsAndConditionDocument13 pagesCF BILPL ClickWrapTermsAndConditionNiaz RNo ratings yet

- IMC - Module 1Document71 pagesIMC - Module 1jameskuriakose24_521No ratings yet

- Chapter 1 - Basic Concepts of Strategic ManagementDocument6 pagesChapter 1 - Basic Concepts of Strategic ManagementMay JennNo ratings yet

- BORANG KEAHLIAN (Membership Form) : Persatuan Sindrom Down Malaysia (Reg. 478)Document2 pagesBORANG KEAHLIAN (Membership Form) : Persatuan Sindrom Down Malaysia (Reg. 478)royazraNo ratings yet

- Date Narration Chq./Ref - No. Value DT Withdrawal Amt. Deposit Amt. Closing BalanceDocument8 pagesDate Narration Chq./Ref - No. Value DT Withdrawal Amt. Deposit Amt. Closing BalanceProficient CyberNo ratings yet

- Jagruti Gharat: Work Experience SkillsDocument1 pageJagruti Gharat: Work Experience SkillsAnurag KumarNo ratings yet

- Dolat Capital Market - Vinati Organics - Q2FY20 Result Update - 1Document6 pagesDolat Capital Market - Vinati Organics - Q2FY20 Result Update - 1Bhaveek OstwalNo ratings yet

- Call 1 - Making an appointmentCall 2 - Leaving a message Call 3 - Asking for information2. Who is calling who in each caseDocument35 pagesCall 1 - Making an appointmentCall 2 - Leaving a message Call 3 - Asking for information2. Who is calling who in each caseHIẾU LÊ TRỌNGNo ratings yet

- Ripple Effect and Supply Chain Disruption Management New Trends and Research DirectionsDocument9 pagesRipple Effect and Supply Chain Disruption Management New Trends and Research DirectionsAwal AhmadNo ratings yet

- CHAPTER 1. Development of Internal AuditingDocument3 pagesCHAPTER 1. Development of Internal AuditingChristine Mae Manliguez100% (1)

- Marketing Strategies for T.Satyanarayana and CoDocument59 pagesMarketing Strategies for T.Satyanarayana and Cotarun nemalipuriNo ratings yet

- M4 - Lesson 1 - Introduction To Process ValidationDocument4 pagesM4 - Lesson 1 - Introduction To Process ValidationWilliam DC RiveraNo ratings yet

- FINANCIAL STATEMENT ANALYSIS OF Nokia Inc LTDDocument4 pagesFINANCIAL STATEMENT ANALYSIS OF Nokia Inc LTDROHIT SETHI100% (2)

- Make Way For The Algorithms Symbolic Actions and Change in A Regime of KnowingDocument26 pagesMake Way For The Algorithms Symbolic Actions and Change in A Regime of KnowingAbimbola PotterNo ratings yet

- Chap 5 KaizenDocument9 pagesChap 5 KaizenAnonymous FpRJ8oDdNo ratings yet

- 2007, JP PDFDocument21 pages2007, JP PDFJATINNo ratings yet

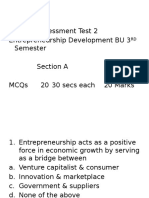

- Internal Assessment Test on Entrepreneurship ConceptsDocument28 pagesInternal Assessment Test on Entrepreneurship ConceptsRam Krishna KrishNo ratings yet