Professional Documents

Culture Documents

Analysis of Myanmar Foreign Investment Law - Part 2

Uploaded by

Paul KwongCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Analysis of Myanmar Foreign Investment Law - Part 2

Uploaded by

Paul KwongCopyright:

Available Formats

Myanmar Center

Bangkok

Client Alert

New Foreign Investment Regulations in Myanmar

Part 2

April 2013

In this Part 2 of our analysis of the Myanmar Foreign Investment Law

2012 (FIL) rules, we focus on Notification 11/2013 issued by the Ministry

of National Planning and Economic Development (the Rules) as it

impacts: (i) the ongoing rights and obligations of investors in key areas

during the life of an investment, (ii) the continuing reporting obligations

with which foreign investors must comply, and (iii) the penalties and other

actions that can be taken by the Myanmar Investment Commission (MIC)

if an investor does not comply with its obligations.

In Part 1 of our analysis, we focused on the investment approval process

for foreign investors seeking to invest in Myanmar through means of an

MIC approved investment (FIL Company) and on the permitted and nonpermitted investment activities and sectors described in the MIC

Notification.

For more information please contact

Pornapa L. Thaicharoen

Tel No.: +66 2636-2000 Ext. 4556

pornapa.thaicharoen@bakermckenzie.com

Clive Cook

Tel No.: +66 2636-2000 Ext. 4998

clive.cook@bakermckenzie.com

Since Part 1 was circulated, the Myanmar Parliament (Union Assembly)

has considered the percentage holding a foreign investor can take in a

restricted or prohibited business, as defined in the FIL. In a recent vote,

the Union Assembly upheld the original provision in the Rules, which

states that a foreign investor can take no more than an 80% stake in such

a joint venture.

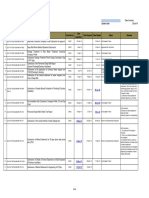

In addition to this alert, we have included a diagram showing the various

bodies involved in foreign investment in Myanmar.

Key Observations on the Rules

MIC Discretion: Under the Rules, significant powers and

discretion are vested in the MIC, including the ability to impose

strict sanctions on investors, stipulate areas of the country as

Economic Zones, and prescribe construction and life-of-theinvestment terms. Whether the Rules facilitate foreign investment

will largely depend on how the MIC exercises these wide powers

and discretion, including with respect to the issuance of new

Notifications. This creates uncertainty.

Investment Period: Investors are committed to the investment

period specified in their MIC approval. An earlier exit from the

investment could prove problematic, as discussed below.

Investors must commence business within a fixed period after

completing construction.

Land: The rules governing land and foreign exchange are fairly

clear but the rules concerning land in particular require careful

navigation.

Myanmar Center

Scrutiny and ongoing obligations: The Rules provide the MIC with

a framework to scrutinize and monitor investments.

Unfortunately, they also lay down vague but significant ongoing

obligations that will be challenging to interpret and apply.

DICA Consultation: Investors should secure a preliminary opinion

from the Directorate of Investment and Company Administration

as to whether the investment proposition is likely to be deemed a

restricted or prohibited business. This determination is often as

much about the impact the business may have (e.g. on the

environment) as the type of business it is.

Consultation of other stakeholders: For many projects, a wide

body of stakeholders must be consulted before MIC approval is

granted, including opinions sought from local residents who

stand to be impacted by the business, as well as relevant social

organizations.

Equity Limit: A foreign investor's stake in a restricted or prohibited

business will be capped at 80% of the equity.

Key Investor Rights and Obligations

Life of the Investment

Generally, an investor's MIC approval will lay down a period during which

the investment must be undertaken in Myanmar. MIC permission is

required to extend the life of an investment. The specified life of the

investment period should be coterminous with the length of the land lease

granted to the FIL Company. At the end of the period, the investor may

make an application to the MIC to extend the life of the investment.

Construction Periods

If some form of construction is at the heart of the investment project, it

must be completed within the period specified in the MIC approval. The

MIC has discretion to extend the construction period on a one off basis

only, unless a force majeure event has occurred, in which case a further

extension may be granted. If construction is not completed within the

extended period, the approval may be revoked by the MIC without

payment of compensation to the investor.

Commencement of Business

The tax benefits and exemptions provided under the FIL take effect upon

commencement of the FIL company's business. There is a formal

process for establishing the commencement of business date, which

involves an MIC filing and approval. Certain additional requirements exist,

e.g. to begin exporting within 180 days after completion of construction;

to begin local sale within 90 days after completion of construction. If

engaging in an export business, the date will be stipulated in the

investor's first bill of lading; if local sale, the date of receipt of first income.

Generally, the Rules provide that commencement of business must occur

within a fixed period after completion of the construction period, which is

specified in the MIC approval.

Client Alert April 2013

Myanmar Center

Issues with respect to Land

Land issues can be problematic and complex in Myanmar. Some issues

to note in addition to those highlighted in Part 1 of our Alert are:

Permission of the Union Government and comments from the

Nay Pyi Taw Council or State/Regional Government are required

to lease land but the MIC will seek such comments on behalf of

the investor. An additional permission may be required from the

"Central Management Committee of Vacant, Fallow and Virgin

Land" to lease vacant, fallow, and virgin land. Such land will be

leased for an initial period of 30 years, with MIC discretion to

extend in accordance with the Vacant, Fallow, and Virgin Land

Management Law.

Annual rents for leased land must be approved by the MIC and

the State may require a premium for the grant of a lease.

Any alteration or repair to the natural surface or elevation of the

land requires permission of the relevant landlord.

If necessary to clear the land (i.e. removes dwellings, farms etc.),

the investor is permitted to reach arrangements with local

residents on compensation independent of the State.

All or a part of an investor's leased land will be taken back if

natural resources are discovered or it is required for

infrastructure or other special projects deemed in the interest of

the State. The investor will be paid compensation in such a

scenario but it is not clear if such compensation would include

lost profit or opportunity costs associated with the broader

business, or merely the value of the land.

Lease agreements must be carefully drafted, examined, and

negotiated to ensure an investor can realize some value in

respect to buildings and facilities constructed on the land during

the life of the Lease.

Foreign Capital and Foreign Exchange

An investor must commit to bringing into Myanmar a minimum

level of foreign investment in convertible currency, both in initial

capital and subsequent appropriations. Investors must report to

the MIC when bringing foreign currency into Myanmar to satisfy

these subsequent appropriations.

The MIC must be notified and grant approval to an investor if

bringing foreign capital into Myanmar above or below the amount

contemplated in the investment proposal or to a different

timescale.

Upon the liquidation of the investment, an investor may take out

the original capital in foreign currency, plus net profit.

An FIL Company/investor must set up a foreign exchange

account in Myanmar for the purpose of making foreign currency

payments in connection with the business locally.

Exiting the Investment

Client Alert April 2013

Whilst exiting an investment is normally achieved by a sale of

shares, there is nothing in the Rules to suggest that an investor

could not also exit by selling the business. An investor may sell

shares to another foreign investor or to a Myanmar-based

investor, in either case only with approval of the MIC. In exiting,

the existing MIC approval must be surrendered. If the transferee

is a Myanmar Citizen he must obtain a permit under the

Myanmar Citizens Investment Law; if a foreign investor, he must

Myanmar Center

re-apply to the MIC for a new approval but may conduct the

business through the existing or a new entity. The new investor

benefits from the existing tax exemptions but does not enjoy the

benefit of new tax holidays. The MIC may grant permission for a

partial exit only.

There has been some speculation that the FIL reflects or even

brings about a change in the policy of the Myanmar government

that prevents Myanmar Citizens from selling shares to

foreigners. We do not believe that is the case and there is

nothing in the Law to support such an assumption, although the

Governments policy may change in future.

In order to wind up a business, apart from having to liquidate

under an antiquated piece of legislation (the Companies Act of

1913), investors will need the permission of the MIC. If that

permission is granted, the leased land must revert to whomever

has rights over it and all rent for future years under the lease

must be paid up in full. Winding up a venture before the end of its

specified life is likely to prove time-consuming and expensive.

Investor Obligations, Scrutiny and Penalties

General Investor Obligations

Rule 54 lays out broad-based requirements that an investor could easily

infringe, which is of particular concern given the sanctions for noncompliance can be severe. Apart from complying with environmental

conservation matters, an investor must implement the business in a

manner that is undertaken for the benefit of the State and the citizens

and take care that its products do not cause "damage to customers"

through lack of quality or by failing to comply with standard norms. As

the drafting of such provisions is vague, there is the potential for abuse.

In addition, there exists a further obligation to comply with Ministry

regulations and norms.

Scrutiny

Scrutiny is achieved in part by reporting requirements, which take

various forms, but principally involve submission to the MIC of a

quarterly business report, proof of payment of social security

arrears every six months, and annual staff training plans. FIL

Companies are also required to conduct an annual audit and

submit to inspections when required.

The Departmental Coordination Body, which consists of officers

from various ministries including Labor, Customs, Trade, Internal

Revenue, and the Central Bank of Myanmar, is given the primary

mission of monitoring FIL Companies and scrutinizing their

conduct and performance.

Investigations and Penalties

The MIC may form a body to investigate any situation where the investor

has failed to comply with the FIL or the many requirements of the Rules,

or where an investor has obtained a permit in breach of laws or

regulations.

Client Alert April 2013

Myanmar Center

Although it reports to the MIC, the Investigating Body has sole discretion

to apply any one of the four administrative penalties set out in the FIL: (i)

a warning, (ii) a temporary suspension of tax exemptions and reliefs, (iii)

a revocation of the MIC permit, or (iv) putting of the investor on a blacklist

that would prevent it from being granted a permit in the future.

Conclusion

The Rules are comprehensive but offer the MIC broad discretion in many

areas. In addition, there are ambiguities, difficulties of interpretation, and

potentially severe penalties for non-compliance. Still, in considering the

piece of legislation as whole, it has the potential to be very effective in

attracting investment if the bureaucracy that facilitates it is run effectively

and transparently.

Clive Cook

Tel No.: 0 2636-2000 ext. 4998

clive.cook@bakermckenzie.com

Dr. Saw Yu Win

Tel No.: 0 2636-2000 ext. 4556

sawyu.win@bakermckenzie.com

Client Alert April 2013

You might also like

- 5.2.3 Piling WorksDocument12 pages5.2.3 Piling WorksPaul KwongNo ratings yet

- Construction and Infrastructure Developments in Myanmar Feb 2014Document3 pagesConstruction and Infrastructure Developments in Myanmar Feb 2014Paul KwongNo ratings yet

- Conopy & Passge WayDocument5 pagesConopy & Passge WayPaul KwongNo ratings yet

- 5.2.2 Excavation & FillingDocument6 pages5.2.2 Excavation & FillingPaul KwongNo ratings yet

- Doing Business in BurmaDocument2 pagesDoing Business in BurmaPaul KwongNo ratings yet

- Colliers International Yangon Condominium Report 4Q 2014Document4 pagesColliers International Yangon Condominium Report 4Q 2014Paul KwongNo ratings yet

- Architectural Material Specification for SC Auto Bus FactoryDocument4 pagesArchitectural Material Specification for SC Auto Bus FactoryPaul Kwong100% (1)

- 5.2.4 Structural SteelworksDocument9 pages5.2.4 Structural SteelworksPaul KwongNo ratings yet

- 5.2.1 Concrete WorksDocument23 pages5.2.1 Concrete WorksPaul KwongNo ratings yet

- Analysis of Myanmar's Foreign Investment Law - Part 1Document3 pagesAnalysis of Myanmar's Foreign Investment Law - Part 1Paul KwongNo ratings yet

- Vetting Sheet SampleDocument4 pagesVetting Sheet SamplePaul KwongNo ratings yet

- Food and Beverage To Myanmar (Australia)Document5 pagesFood and Beverage To Myanmar (Australia)Paul KwongNo ratings yet

- Tax Flow ChartDocument1 pageTax Flow ChartPaul KwongNo ratings yet

- Tender Presentation: Qingjian International (Myanmar) Group Development Co., LTDDocument1 pageTender Presentation: Qingjian International (Myanmar) Group Development Co., LTDPaul KwongNo ratings yet

- YCDC Notification No 9 1999Document16 pagesYCDC Notification No 9 1999Paul KwongNo ratings yet

- YCDC Notification No 9 1999Document16 pagesYCDC Notification No 9 1999Paul KwongNo ratings yet

- Myanmar Capital Gains Tax Rates, and Property Income TaxDocument8 pagesMyanmar Capital Gains Tax Rates, and Property Income TaxPaul KwongNo ratings yet

- How To Develop Underdeveloped Countries Through Proper PlanningDocument3 pagesHow To Develop Underdeveloped Countries Through Proper PlanningPaul KwongNo ratings yet

- Myanmar - A Nation in CrisisDocument19 pagesMyanmar - A Nation in CrisisPaul KwongNo ratings yet

- Myanmar Government Reverses Prohibition On Foreign WinesDocument2 pagesMyanmar Government Reverses Prohibition On Foreign WinesPaul KwongNo ratings yet

- Doing Business in Burma - Commercial Guide 2014 (US)Document68 pagesDoing Business in Burma - Commercial Guide 2014 (US)Paul KwongNo ratings yet

- How To Develop Underdeveloped Countries Through Proper PlanningDocument3 pagesHow To Develop Underdeveloped Countries Through Proper PlanningPaul KwongNo ratings yet

- Myanmar New Tax LawDocument4 pagesMyanmar New Tax LawKo NgeNo ratings yet

- Trade Policy Reform-Myanmar - As of 23 Sept 14Document21 pagesTrade Policy Reform-Myanmar - As of 23 Sept 14Paul KwongNo ratings yet

- Material Catalogue Submission List (19-Aug-15)Document1 pageMaterial Catalogue Submission List (19-Aug-15)Paul KwongNo ratings yet

- Material Catalogue Submission List (6-Aug-15)Document2 pagesMaterial Catalogue Submission List (6-Aug-15)Paul KwongNo ratings yet

- Shop Drawings Submission List (6-Aug-15)Document3 pagesShop Drawings Submission List (6-Aug-15)Paul KwongNo ratings yet

- Date Over-Due Don't Need To Submit Revise & Resubmit M&E Shop Drawing Register Combine Service Drawing & Structural Electrical and Mechanical Drawing (CSD & SEM) Updated Date: 25-Jul-15Document36 pagesDate Over-Due Don't Need To Submit Revise & Resubmit M&E Shop Drawing Register Combine Service Drawing & Structural Electrical and Mechanical Drawing (CSD & SEM) Updated Date: 25-Jul-15Paul KwongNo ratings yet

- Tech SubDocument10 pagesTech SubPaul KwongNo ratings yet

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (587)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (890)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (399)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (73)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5794)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2219)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (344)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (265)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (119)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- Using Industry Average Multiples For ValuationDocument8 pagesUsing Industry Average Multiples For ValuationSaad AliNo ratings yet

- 1.3.3 Executed Option Agreement 15072014Document97 pages1.3.3 Executed Option Agreement 15072014Jorge De Lama VargasNo ratings yet

- Summarized Commercial Law ReviewerDocument56 pagesSummarized Commercial Law ReviewerGp BatacNo ratings yet

- Sources of Financial InformationDocument13 pagesSources of Financial InformationSanjit SinhaNo ratings yet

- Capital Gain Compensation Recd From Central GovernmentDocument45 pagesCapital Gain Compensation Recd From Central Governmentphani raja kumarNo ratings yet

- 2015-2018 Tax Bar QuestionsDocument42 pages2015-2018 Tax Bar QuestionsDenver Dela Cruz PadrigoNo ratings yet

- 52.A Dividend Which Is A Return To Stockholders of A Portion of Their Original Investments Is A A. Liquidating Dividend. B. Property Dividend. C. Liability Dividend. D. Participating DividendDocument4 pages52.A Dividend Which Is A Return To Stockholders of A Portion of Their Original Investments Is A A. Liquidating Dividend. B. Property Dividend. C. Liability Dividend. D. Participating DividendCarlo ParasNo ratings yet

- Commissioner of Internal Revenue vs. CA (301 SCRA 152, 1999)Document4 pagesCommissioner of Internal Revenue vs. CA (301 SCRA 152, 1999)eunice demaclidNo ratings yet

- IDX Fact Book 2012 New Hal PDFDocument195 pagesIDX Fact Book 2012 New Hal PDFisabellaNo ratings yet

- Asset Allocation & Portfolio Management Process - Lecture 2 - 2011Document45 pagesAsset Allocation & Portfolio Management Process - Lecture 2 - 2011phanquang144No ratings yet

- 2022 Proxy StatementDocument99 pages2022 Proxy StatementDhiangga JauharyNo ratings yet

- Investment BankingDocument4 pagesInvestment BankingNirajGBhaduwalaNo ratings yet

- Anagram 2011 PicksDocument17 pagesAnagram 2011 Picksnarsi76No ratings yet

- Financial Analysis Report on Wipro LimitedDocument60 pagesFinancial Analysis Report on Wipro Limitedparas bagde100% (1)

- A Theory of CooperationDocument22 pagesA Theory of Cooperationatilla arıcıoğluNo ratings yet

- ACCA Financial Management Dec Mock - Questions PDFDocument18 pagesACCA Financial Management Dec Mock - Questions PDFAmilah Fadhlin100% (1)

- 4.27.2020 US Weekly Kickstart - Narrow Breadth and High Dispersion Have Lifted Equity Market Concentration AboveDocument42 pages4.27.2020 US Weekly Kickstart - Narrow Breadth and High Dispersion Have Lifted Equity Market Concentration AboveChetanNo ratings yet

- Capital Gain TaxDocument3 pagesCapital Gain TaxvanvunNo ratings yet

- FMI7e ch25Document61 pagesFMI7e ch25lehoangthuchienNo ratings yet

- Learn Financial Statements from Berkshire Hathaway ReportsDocument15 pagesLearn Financial Statements from Berkshire Hathaway ReportsVik SinghNo ratings yet

- Part Ii March 2021 InsightDocument140 pagesPart Ii March 2021 Insightrowan betNo ratings yet

- Financial Ratios Guide Profitability and LiquidityDocument69 pagesFinancial Ratios Guide Profitability and LiquidityAlperen KaragozNo ratings yet

- 163 Stokes Vs Continental Trust Co. (Enriquez)Document2 pages163 Stokes Vs Continental Trust Co. (Enriquez)Jovelan EscañoNo ratings yet

- 222 BibliographyDocument6 pages222 BibliographyNadine SantiagoNo ratings yet

- SPTL Court RulingDocument1 pageSPTL Court RulingKiran ModiNo ratings yet

- Aud FeDocument11 pagesAud FeMark Domingo MendozaNo ratings yet

- Market Risk Practice QuestionsDocument5 pagesMarket Risk Practice QuestionsHitesh NaikNo ratings yet

- AA Strategic Plan AnalysisDocument47 pagesAA Strategic Plan Analysisedyta182100% (1)

- Chapter 6 - Risk and Return Self Test ST1 Year Ra RB rAB A B ABDocument17 pagesChapter 6 - Risk and Return Self Test ST1 Year Ra RB rAB A B ABDiva Tertia AlmiraNo ratings yet

- SLC NotesDocument803 pagesSLC NotesManishankar SharmaNo ratings yet