Professional Documents

Culture Documents

Role Play

Uploaded by

Praise BuenaflorOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Role Play

Uploaded by

Praise BuenaflorCopyright:

Available Formats

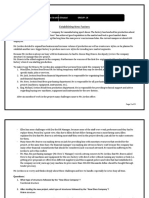

Examples of circumstances that may create intimidation threats for a professional

accountant in business include:

Threat of dismissal or replacement of the professional accountant in business or a

close or immediate family member over a disagreement about the application of an

accounting principle or the way in which financial information is to be reported.

A dominant personality attempting to influence the decision making process, for

example with regard to the awarding of contracts or the application of an

accounting principle.

So as said earlier for a threat to arise it does not necessarily have to explicitly

expressed to auditor it may be perceived by an auditor by others actions and most

of the time such threats in this profession are indirect. Although it may amount to

physical threatening but mostly it is about hurting auditors professionally. For

example:

by forced cancellation of contract by the client to deprive auditor to conduct

subsequent audit thus indirectly hurting auditors revenues

by dragging auditor in case laws or threatening to do so in order to hurt his

credibility in the eyes of current and potential other clients

by holding audit fee or the compensation for other work conducted by the auditor

by black mailing auditor for certain conduct that may be taken as professional

misconduct on part of auditor or may seriously derogate auditor to act objectively

by hurting auditors financial interests e.g. by taking down auditors investments in

entities where the other party can exercise influence

by giving physical threats to auditors family members, relatives or loved ones

by depriving auditor from basic needs at clients premises

by lodging complain with authority that regulates auditors licencing, discipline or

quality control

Examples of circumstances that create intimidation threats for a professional

accountant in public practice include:

(a)

A firm being threatened with dismissal from a client engagement.

(b)

An audit client indicating that it will not award a planned non-assurance

contract to the firm if the firm continues to disagree with the clients accounting

treatment for a particular transaction.

(c)

A firm being threatened with litigation by the client.

(d)

A firm being pressured to reduce inappropriately the extent of work

performed in order to reduce fees.

(e)

A professional accountant feeling pressured to agree with the judgment of a

client employee because the employee has more expertise on the matter in

question.

(f)

A professional accountant being informed by a partner of the firm that a

planned promotion will not occur unless the accountant agrees with an audit client's

inappropriate accounting treatment.]

You might also like

- 57740006Document74 pages57740006Aticha KwaengsophaNo ratings yet

- Assessment Rubric For Business Plan Final DefenseDocument2 pagesAssessment Rubric For Business Plan Final DefenseLileth ViduyaNo ratings yet

- CM Course Outline - EslscaDocument6 pagesCM Course Outline - EslscaSameh YassienNo ratings yet

- GELILA INTERNATIONAL SEMINARY COLLEGE QuestionnaireDocument18 pagesGELILA INTERNATIONAL SEMINARY COLLEGE QuestionnaireAbera DinkuNo ratings yet

- Act 201 Course OutlineDocument4 pagesAct 201 Course Outlineapi-538665209No ratings yet

- The Story of My LifeDocument2 pagesThe Story of My LifeAnonymous lPd10LcAeNo ratings yet

- Peer Evaluation Business Plan FINALSDocument2 pagesPeer Evaluation Business Plan FINALSJosa BilleNo ratings yet

- Management Information Systems: Course ManualDocument157 pagesManagement Information Systems: Course ManualRazel TercinoNo ratings yet

- Oral CommunicationDocument17 pagesOral Communicationmargilyn ramos100% (1)

- BUGS Form 1 - Admission FormDocument4 pagesBUGS Form 1 - Admission FormJahara N. Cuerdo100% (1)

- Modified Instrument Teaching Effectiveness 5 Copy 2Document1 pageModified Instrument Teaching Effectiveness 5 Copy 2Jun Greg MaboloNo ratings yet

- Part 2 InnopreneurshipDocument50 pagesPart 2 InnopreneurshipJohn Carlo SamsonNo ratings yet

- Final Rubrics For Sales PresentationDocument3 pagesFinal Rubrics For Sales PresentationNekoh Dela CernaNo ratings yet

- Bsba Peo PiloDocument1 pageBsba Peo PiloMonette de GuzmanNo ratings yet

- JOBS180 Carl Joseph-Sebastian-ResumeDocument1 pageJOBS180 Carl Joseph-Sebastian-ResumeCarl Joseph SebastianNo ratings yet

- 5th PAPBE Accreditation Invitation LetterDocument5 pages5th PAPBE Accreditation Invitation LetterfeasprerNo ratings yet

- Implementing Total Quality ManagementDocument11 pagesImplementing Total Quality ManagementChristine SalazarNo ratings yet

- Thesis Defense RubricDocument1 pageThesis Defense RubricStephen Janseen DelaPeña BaloNo ratings yet

- Performance Management and AppraisalDocument29 pagesPerformance Management and AppraisalMoiz AdnanNo ratings yet

- Benchmarking and Its ImportanceDocument15 pagesBenchmarking and Its ImportanceShruti DhawanNo ratings yet

- Placement of Items Type of Test Knowledge Comprehension Analysis Application Synthesis EvaluationDocument2 pagesPlacement of Items Type of Test Knowledge Comprehension Analysis Application Synthesis EvaluationQueng ElediaNo ratings yet

- Poster Grading RubricDocument1 pagePoster Grading RubricJulius ColminasNo ratings yet

- Balance Sheet Valuation Methods: Book Value MeasureDocument43 pagesBalance Sheet Valuation Methods: Book Value MeasureodvutNo ratings yet

- Toyota Product RecallDocument1 pageToyota Product RecallJunegil FabularNo ratings yet

- Facilitation RubricDocument1 pageFacilitation Rubricdire4straitsNo ratings yet

- Apply Business Math in Water Refilling StationDocument22 pagesApply Business Math in Water Refilling StationsdfdsfNo ratings yet

- Leadership Styles & TheoriesDocument28 pagesLeadership Styles & TheoriesEbsa AdemeNo ratings yet

- Wood Project RubricDocument2 pagesWood Project Rubricapi-266808022No ratings yet

- Strategic Management Revision PackageDocument30 pagesStrategic Management Revision PackagesurajNo ratings yet

- Effective Organizing & Org - CultureDocument63 pagesEffective Organizing & Org - CultureAmjad Baabaa50% (2)

- Internship Syllabus PDFDocument4 pagesInternship Syllabus PDFJessame De Guzman VallejosNo ratings yet

- College Application Interview Rubric Guidelines FinalDocument3 pagesCollege Application Interview Rubric Guidelines FinalAhmadnur Jul100% (1)

- Surigao Del Sur State University: Outcomes-Based Course Syllabus in 1 Semester, A.Y. 2019 - 2020Document11 pagesSurigao Del Sur State University: Outcomes-Based Course Syllabus in 1 Semester, A.Y. 2019 - 2020Casey Maureen ArrezaNo ratings yet

- Thesis 4.0Document23 pagesThesis 4.0Michelle Manalo CanceranNo ratings yet

- Activity 1Document4 pagesActivity 1Ronnel Dela CruzNo ratings yet

- Work Immersion Portfolio RubricDocument2 pagesWork Immersion Portfolio RubricRomeo Pilongo100% (1)

- 2263-1659508748206-Unit 43 Business Strategy AssignmentDocument29 pages2263-1659508748206-Unit 43 Business Strategy AssignmentdevindiNo ratings yet

- The Manager's Role in Strategic Human Resource ManagementDocument25 pagesThe Manager's Role in Strategic Human Resource ManagementHadi345214No ratings yet

- Reading 19: Introduction To Financial Statement AnalysisDocument43 pagesReading 19: Introduction To Financial Statement AnalysisAlex PaulNo ratings yet

- Case Study - Packer TelecomDocument2 pagesCase Study - Packer TelecomMalkiNo ratings yet

- Quantitative Techniques Course OutlineDocument1 pageQuantitative Techniques Course OutlineMrcharming Jadraque100% (1)

- Script College of Orientation ProgramDocument7 pagesScript College of Orientation ProgramCara GreatNo ratings yet

- Prodman Course Syllabus 2CDocument5 pagesProdman Course Syllabus 2CKhaye Alexa CeatrizNo ratings yet

- MPhil Degree Model Exam Questions on Research MethodologyDocument2 pagesMPhil Degree Model Exam Questions on Research MethodologyVino Vinu100% (1)

- Dr. Carlos S. Lanting College Test Item AnalysisDocument1 pageDr. Carlos S. Lanting College Test Item AnalysisEdna Grace Abrera TerragoNo ratings yet

- Expense Object DBM GroupingDocument6 pagesExpense Object DBM GroupingSeleneAdrasteiaPasiphaeNo ratings yet

- Impact of Online Reviews On Consumer Buying BehaviorDocument12 pagesImpact of Online Reviews On Consumer Buying BehaviorVaibhav KatariaNo ratings yet

- Learning Packet (FABM1)Document14 pagesLearning Packet (FABM1)Judy Anne RamirezNo ratings yet

- Research Report RubricDocument1 pageResearch Report RubricJessica Huffaker100% (1)

- Bambad National High SchoolDocument10 pagesBambad National High Schoolneddie lyn franciscoNo ratings yet

- Establishing New Factory Project ChallengesDocument3 pagesEstablishing New Factory Project ChallengesAhmed Elhadad100% (1)

- Odesk Social Media Marketing Test QuestionsDocument5 pagesOdesk Social Media Marketing Test QuestionsNabin Sayeed100% (1)

- Cost Accounting-Lesson PlanDocument2 pagesCost Accounting-Lesson PlanChristian Clyde Zacal ChingNo ratings yet

- Course Outline - ICT JHS 1Document3 pagesCourse Outline - ICT JHS 1edwizard lenardoNo ratings yet

- IT6010: Student Activity Set #1 Word Problems Converted Into Algebra Problems Problem 1: Percentage Increase and DecreaseDocument2 pagesIT6010: Student Activity Set #1 Word Problems Converted Into Algebra Problems Problem 1: Percentage Increase and DecreaseFatima HussainNo ratings yet

- 2012 Planning - ExamDocument21 pages2012 Planning - ExamLaura McCubbinNo ratings yet

- Managerial Accounting in The Information Age: QuestionsDocument12 pagesManagerial Accounting in The Information Age: QuestionsMister GamerNo ratings yet

- Zaraz - Mia by Law 2Document7 pagesZaraz - Mia by Law 2Nur Izzah IlyanaNo ratings yet

- Code of Ethics For Professional Accountants-2Document25 pagesCode of Ethics For Professional Accountants-2davidwijaya1986100% (1)

- Pervezvikiyo - 3498 - 17836 - 2 - Ethics, Threats & Safeguards (Nov 1, 2021)Document11 pagesPervezvikiyo - 3498 - 17836 - 2 - Ethics, Threats & Safeguards (Nov 1, 2021)Sadia AbidNo ratings yet

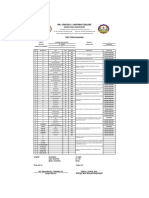

- General Payroll for Land Transportation Franchising and Regulatory BoardDocument1 pageGeneral Payroll for Land Transportation Franchising and Regulatory BoardPraise BuenaflorNo ratings yet

- Republic of The Philippines Kagawaran NG Pananalapi Kawanihan NG Ingatang Yaman Risk NumberDocument2 pagesRepublic of The Philippines Kagawaran NG Pananalapi Kawanihan NG Ingatang Yaman Risk NumberPraise BuenaflorNo ratings yet

- April28-30 DifferentialDocument1 pageApril28-30 DifferentialPraise BuenaflorNo ratings yet

- Ratios Liquidity Ratios:: Days Sales OutstandingDocument3 pagesRatios Liquidity Ratios:: Days Sales OutstandingPraise BuenaflorNo ratings yet

- Members Contribution Remittance Form (MCRF)Document3 pagesMembers Contribution Remittance Form (MCRF)Praise BuenaflorNo ratings yet

- 2020 General LedgerDocument202 pages2020 General LedgerPraise BuenaflorNo ratings yet

- Regional Franchising & Regulatory Office XiiDocument1 pageRegional Franchising & Regulatory Office XiiPraise BuenaflorNo ratings yet

- Aging of Due and Demandable Obligations LTFRB Region XIIDocument2 pagesAging of Due and Demandable Obligations LTFRB Region XIIPraise BuenaflorNo ratings yet

- Solution (A) Arithmetic and Geometric Average ReturnsDocument6 pagesSolution (A) Arithmetic and Geometric Average ReturnsPraise BuenaflorNo ratings yet

- Payroll Appendix for DOTr Regional Franchising OfficeDocument2 pagesPayroll Appendix for DOTr Regional Franchising OfficePraise BuenaflorNo ratings yet

- CourseHero FSDocument4 pagesCourseHero FSPraise BuenaflorNo ratings yet

- Payroll Appendix for DOTr Regional Franchising OfficeDocument2 pagesPayroll Appendix for DOTr Regional Franchising OfficePraise BuenaflorNo ratings yet

- Accounts PayableDocument1 pageAccounts PayablePraise BuenaflorNo ratings yet

- 2020 RegistryDocument124 pages2020 RegistryPraise BuenaflorNo ratings yet

- Amortization Schedule CalculatorDocument2 pagesAmortization Schedule CalculatorPraise BuenaflorNo ratings yet

- MRD - January 2020Document1 pageMRD - January 2020Praise BuenaflorNo ratings yet

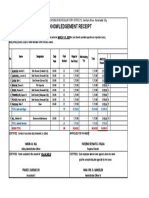

- Acknowledgement Receipt of Job Orders - March 2020Document1 pageAcknowledgement Receipt of Job Orders - March 2020Praise BuenaflorNo ratings yet

- Acknowledgement Receipt of Job Orders - March 2020Document1 pageAcknowledgement Receipt of Job Orders - March 2020Praise BuenaflorNo ratings yet

- 2 FAR 4 - FebruaryDocument30 pages2 FAR 4 - FebruaryPraise BuenaflorNo ratings yet

- Amr Loan AmortizationDocument2 pagesAmr Loan AmortizationPraise BuenaflorNo ratings yet

- Accounts PayableDocument1 pageAccounts PayablePraise BuenaflorNo ratings yet

- Sales: San Beda College of LawDocument37 pagesSales: San Beda College of LawMarvi Blaise CochingNo ratings yet

- Consolidation Purok PagkakaisaDocument15 pagesConsolidation Purok PagkakaisaPraise BuenaflorNo ratings yet

- COVID-19 Operations LTFRB-III Budgetary RequirementsDocument1 pageCOVID-19 Operations LTFRB-III Budgetary RequirementsPraise BuenaflorNo ratings yet

- Acknowledgement Receipt of Job Orders - March 2020Document1 pageAcknowledgement Receipt of Job Orders - March 2020Praise BuenaflorNo ratings yet

- Final File Case KalipaDocument60 pagesFinal File Case KalipaPraise BuenaflorNo ratings yet

- Final File Case KalipaDocument60 pagesFinal File Case KalipaPraise BuenaflorNo ratings yet

- Taxation ReviewerDocument145 pagesTaxation ReviewerJingJing Romero95% (95)

- 12 FAR 4 - DecemberDocument30 pages12 FAR 4 - DecemberPraise BuenaflorNo ratings yet

- Taxation ReviewerDocument145 pagesTaxation ReviewerJingJing Romero95% (95)

- Family Law Basic Skills: Trial PreparationDocument17 pagesFamily Law Basic Skills: Trial Preparationcleincolorado100% (6)

- Callanta Notes Criminal Law1 PDFDocument10 pagesCallanta Notes Criminal Law1 PDFAyra ArcillaNo ratings yet

- Land Lease Dispute Between Eleizegui and Manila Lawn Tennis ClubDocument5 pagesLand Lease Dispute Between Eleizegui and Manila Lawn Tennis ClubSALMAN JOHAYRNo ratings yet

- 23 - G.R. No. L-1553 - People V ConcepcionDocument2 pages23 - G.R. No. L-1553 - People V ConcepcionMyrna B RoqueNo ratings yet

- Full Download Human Biology 13th Edition Mader Test BankDocument13 pagesFull Download Human Biology 13th Edition Mader Test Banksheathe.zebrinny.53vubg100% (24)

- John Edward Power Wallis, C.J., T. Sadasiva Iyer, Napier and Murray Coutts-Tratter, JJDocument7 pagesJohn Edward Power Wallis, C.J., T. Sadasiva Iyer, Napier and Murray Coutts-Tratter, JJAadhitya NarayananNo ratings yet

- Application Letter & CV Hendry Ardi Marpaung PDFDocument3 pagesApplication Letter & CV Hendry Ardi Marpaung PDFHendry Ardi MNo ratings yet

- AE 17 Prosecution Response To Defense Request To File Ex Parte Supplement PDFDocument4 pagesAE 17 Prosecution Response To Defense Request To File Ex Parte Supplement PDFMatthew KeysNo ratings yet

- Garcia Vs Montague - AnnulmentDocument3 pagesGarcia Vs Montague - AnnulmentWinnie Ann Daquil LomosadNo ratings yet

- Application For Lien Sale Authorization and Lienholder'S CertificationDocument2 pagesApplication For Lien Sale Authorization and Lienholder'S CertificationBob WiserNo ratings yet

- M.D. Fla. 21-cv-00764 DCKT 000032 - 000 Filed 2021-08-18Document26 pagesM.D. Fla. 21-cv-00764 DCKT 000032 - 000 Filed 2021-08-18charlie minatoNo ratings yet

- LIBERALISM IDEOLOGY SUMMARYDocument21 pagesLIBERALISM IDEOLOGY SUMMARYamanNo ratings yet

- Garrett Hardin: Science, New Series, Vol. 162, No. 3859. (Dec. 13, 1968), Pp. 1243-1248Document7 pagesGarrett Hardin: Science, New Series, Vol. 162, No. 3859. (Dec. 13, 1968), Pp. 1243-1248Felipe Fajardo VanegasNo ratings yet

- IBPS Law Officer Study Material Company Law MCQDocument31 pagesIBPS Law Officer Study Material Company Law MCQRohanPuthalathNo ratings yet

- Jorge v. Mayor (1964), Deocampo, EH 202Document3 pagesJorge v. Mayor (1964), Deocampo, EH 202Jewel Vernesse Dane DeocampoNo ratings yet

- Torts OutlineDocument57 pagesTorts Outlineang3lwings100% (1)

- Child Rights Violation and Mechanism For Protection of Children Rights in Southern Africa: A Perspective of Central, Eastern and Luapula Provinces of ZambiaDocument13 pagesChild Rights Violation and Mechanism For Protection of Children Rights in Southern Africa: A Perspective of Central, Eastern and Luapula Provinces of ZambiaAnonymous izrFWiQNo ratings yet

- Novartis v. Union of India: Implications for access to medicinesDocument48 pagesNovartis v. Union of India: Implications for access to medicinesMOTIPATHANIANo ratings yet

- Pure Barre - 2018-11-13 (Amended From 2018-04-09) - FDD - Xponential FitnessDocument246 pagesPure Barre - 2018-11-13 (Amended From 2018-04-09) - FDD - Xponential FitnessFuzzy PandaNo ratings yet

- Uniform Customs and Practice (Ucp)Document18 pagesUniform Customs and Practice (Ucp)Karan KapoorNo ratings yet

- D-1-GV-12-000863 Order On State's Motion For Partial Summary JudgmentDocument2 pagesD-1-GV-12-000863 Order On State's Motion For Partial Summary JudgmentPeopleNewspapersDallasNo ratings yet

- BPTC Centralised Papers Syllabus 2014/15Document22 pagesBPTC Centralised Papers Syllabus 2014/15Chan Choon YewNo ratings yet

- Ghana ACT 690 Copyright ActDocument34 pagesGhana ACT 690 Copyright ActRichard OppongNo ratings yet

- Teachers Coop Canteen MoaDocument6 pagesTeachers Coop Canteen Moavioleta sagunNo ratings yet

- Prahalad Saran Gupta Case StudyDocument13 pagesPrahalad Saran Gupta Case Studyaridaman raghuvanshi0% (1)

- Ninth Circuit Case Madhuri Trivedi v. DHS 17-15217Document291 pagesNinth Circuit Case Madhuri Trivedi v. DHS 17-15217MadhuriNo ratings yet

- Marcos V ComelecDocument2 pagesMarcos V ComelecDenDen GauranaNo ratings yet

- Precalculus Mathematics For Calculus 7th Edition Stewart Solutions ManualDocument24 pagesPrecalculus Mathematics For Calculus 7th Edition Stewart Solutions ManualKathyHernandeznobt100% (33)

- Custodial Investigation Cases 2Document1 pageCustodial Investigation Cases 2hiltonbraiseNo ratings yet

- LSUC Letter Explaining NCADocument1 pageLSUC Letter Explaining NCAJohn PapNo ratings yet