Professional Documents

Culture Documents

Treasury Proposal May Fine Tax Evaders Up To 200% of Amount Owed - World News - The Guardian

Uploaded by

Namkha NyingpoOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Treasury Proposal May Fine Tax Evaders Up To 200% of Amount Owed - World News - The Guardian

Uploaded by

Namkha NyingpoCopyright:

Available Formats

Treasury proposal may fine tax evaders up to 200% of amount owe...

https://www.theguardian.com/world/2016/aug/24/treasury-proposa...

Treasury proposal may fine tax evaders up

to 200% of amount owed

Tougher stance follows Theresa Mays leadership campaign promise to be more

punitive of tax evasion and avoidance

Juliette Garside

Wednesday 24 August 2016 19.49BST

The Treasury is proposing new rules to punish oshore tax evaders who fail to come

clean about their nances before September 2018, with nes of up to 200% of the

amount owed.

Published on Wednesday, the measures represent the second government consultation

in two weeks on sanctions against tax cheats.

The prime minister, Theresa May, promised to be tough on tax evasion and avoidance

last month during her campaign to become leader of the Conservatives. The Treasury

has acted swiftly to signal a tougher stance with greater powers for tax inspectors.

The requirement to correct measure will apply to individuals and corporations. Those

owing UK tax will be penalised and potentially named and shamed if they fail to declare

all the relevant information to HM Revenue & Customs.

Jane Ellison, nancial secretary to the Treasury, said: For too long it has been too easy

for people to hide their money overseas to evade tax. We are changing that.

The penalties range between 100% and 200% of the undeclared tax, and those caught

may also have to forfeit a percentage of their assets. The rates are higher than existing

nes, which can be reduced to zero for those who come forward and have been careless

rather than deliberately dishonest.

Ellison said the Treasury will be able to come down harder on evasion because tax

inspectors will soon have greater access to information on assets held oshore. This will

begin next year with the introduction of the common reporting standard, an

agreement between 100 countries to automatically share information about bank

accounts belonging to individuals, companies, trusts and foundations.

The UK is among a group of 54 early adopters who will start sharing this information by

2017, as are some of the better-known tax and secrecy havens, including the British

Virgin Islands, Cayman Islands, Luxembourg, Liechtenstein, the Isle of Man, Jersey and

Guernsey.

Switzerland, the Bahamas and Singapore will be involved by 2018, along with Panama.

The Central American country had previously refused to join the initiative but

1 of 2

24/08/2016, 23:34

Treasury proposal may fine tax evaders up to 200% of amount owe...

https://www.theguardian.com/world/2016/aug/24/treasury-proposa...

international condemnation after the publication of the Panama Papers led to an about

turn.

The US, where bank regulation is divided between federal and state agencies, has still

not signed up to the initiative.

Last week the Treasury published a consultation on new laws to punish the facilitators

of tax avoidance. It targets the accountants, lawyers, nancial advisers and banks who

market schemes that fall foul of the tax tribunals.

The measure will seek to discourage enablers of schemes such as the 290m structure in

which the radio presenter Chris Moyles and hundreds of others tried to save tax by

claiming losses incurred as secondhand car dealers.

This weeks measure rst announced by the then chancellor, George Osborne, in the

2015 autumn statement is likely to be introduced as part of the 2017 nance bill.

Under requirement to correct HMRC will be able to ne tax avoiders for incorrect

statements going back between four and 20 years, depending on whether the avoidance

was deliberate or not.

Want stories like this in

your inbox?

Sign up to The Guardian Today daily email and

get the biggest headlines each morning.

More news

Topics

Tax havens Theresa May British Virgin Islands Luxembourg Europe More

Save for later Article saved

Reuse this content

2 of 2

24/08/2016, 23:34

You might also like

- The Stop Tax Haven Abuse Act SummaryDocument11 pagesThe Stop Tax Haven Abuse Act SummaryCitizens for Tax Justice100% (1)

- Reforming HMRC: Making It Fit For The Twenty-First CenturyDocument37 pagesReforming HMRC: Making It Fit For The Twenty-First CenturylabourpressNo ratings yet

- Panama Papers: Dirty Money and Tax Tricks: How The Rich, The Powerful and Criminals Rip Us Off!Document40 pagesPanama Papers: Dirty Money and Tax Tricks: How The Rich, The Powerful and Criminals Rip Us Off!Vishwajit PatilNo ratings yet

- Multicultural Education Issues and Perspectives Seventh Edition - Chapter 10 ReviewDocument5 pagesMulticultural Education Issues and Perspectives Seventh Edition - Chapter 10 ReviewElizabeth Dentlinger100% (4)

- Bouyer - The Decomposition of CatholicismDocument59 pagesBouyer - The Decomposition of Catholicismhobojoe9127No ratings yet

- Η ΙΣΤΟΡΙΑ ΤΗΣ ΠΕΡΑΜΟΥ ΤΗΣ ΜΙΚΡΑΣ ΑΣΙΑΣDocument18 pagesΗ ΙΣΤΟΡΙΑ ΤΗΣ ΠΕΡΑΜΟΥ ΤΗΣ ΜΙΚΡΑΣ ΑΣΙΑΣNick KouzosNo ratings yet

- Cry Freedom SummaryDocument4 pagesCry Freedom SummaryIvr FloresNo ratings yet

- Tax Avoidance &tax Havens Undermining Democracy: Created by Alok (8) Dinesh (21) Diwakar (23) Naveen (36) PramodDocument49 pagesTax Avoidance &tax Havens Undermining Democracy: Created by Alok (8) Dinesh (21) Diwakar (23) Naveen (36) PramodPramod JuyalNo ratings yet

- Representation of Feminism in 21st Century Indian Culture: A Study of The Legend of Lakshmi Prasad by Twinkle KhannaDocument4 pagesRepresentation of Feminism in 21st Century Indian Culture: A Study of The Legend of Lakshmi Prasad by Twinkle KhannaIJELS Research JournalNo ratings yet

- Tackling Tax Avoidance Evasion and Other Forms of Non-Compliance WebDocument68 pagesTackling Tax Avoidance Evasion and Other Forms of Non-Compliance WebT HNo ratings yet

- Dismemberment of PakistanDocument103 pagesDismemberment of Pakistanshakeelbachakhan0% (1)

- In The Matter - MacasaetDocument6 pagesIn The Matter - MacasaetJolo RomanNo ratings yet

- The Happiness Industry by William Davies Review - Why Capitalism Has Turned Us Into Narcissists - Books - The GuardianDocument3 pagesThe Happiness Industry by William Davies Review - Why Capitalism Has Turned Us Into Narcissists - Books - The GuardianNamkha Nyingpo100% (1)

- Narrative Report in Global Handwashing 2015Document4 pagesNarrative Report in Global Handwashing 2015Ginalyn Huqueriza100% (18)

- You Think The Government Is Fighting Tax Avoidance - Think Again - Richard Brooks - Opinion - The GuardianDocument3 pagesYou Think The Government Is Fighting Tax Avoidance - Think Again - Richard Brooks - Opinion - The GuardianJoe OgleNo ratings yet

- A Giant Bonfire of Taxpayers' Money' - Fraud and The UK Pandemic Loan Scheme - Financial TimesDocument13 pagesA Giant Bonfire of Taxpayers' Money' - Fraud and The UK Pandemic Loan Scheme - Financial TimespaulicalejerNo ratings yet

- Tax EvasionDocument32 pagesTax EvasionNayamotNo ratings yet

- Pressure Mounts On Premier League Bosses: Rangers Sack WarnockDocument32 pagesPressure Mounts On Premier League Bosses: Rangers Sack WarnockCity A.M.No ratings yet

- Factiva 20191022 1018 PDFDocument3 pagesFactiva 20191022 1018 PDFAnonymous tTk3g8No ratings yet

- UK Companies Increased Profit Shifting During The COVID-19 PandemicDocument7 pagesUK Companies Increased Profit Shifting During The COVID-19 Pandemicmalejandrabv87No ratings yet

- Factiva 20191022 1027 PDFDocument2 pagesFactiva 20191022 1027 PDFAnonymous tTk3g8No ratings yet

- Question: What's The Difference Between Tax Avoidance and Tax Evasion?Document4 pagesQuestion: What's The Difference Between Tax Avoidance and Tax Evasion?TshewangDemaNo ratings yet

- Factiva 20191022 1026 PDFDocument2 pagesFactiva 20191022 1026 PDFAnonymous tTk3g8No ratings yet

- MunDocument3 pagesMunGirish SreeneebusNo ratings yet

- Team GB Storms The Paralympics: Agolden WeekendDocument23 pagesTeam GB Storms The Paralympics: Agolden WeekendCity A.M.No ratings yet

- Ryder Cuptriumph: Xstrata and Glencore To Back Tie-UpDocument23 pagesRyder Cuptriumph: Xstrata and Glencore To Back Tie-UpCity A.M.No ratings yet

- Cityam 2012-01-31Document48 pagesCityam 2012-01-31City A.M.No ratings yet

- Australian Workers TaxDocument4 pagesAustralian Workers TaxRankin ChopraNo ratings yet

- The Hypocritical Hegemon: How the United States Shapes Global Rules against Tax Evasion and AvoidanceFrom EverandThe Hypocritical Hegemon: How the United States Shapes Global Rules against Tax Evasion and AvoidanceNo ratings yet

- Cookyng-Strategy 1Document22 pagesCookyng-Strategy 1Mike McPowelNo ratings yet

- SMH 23jul18Document5 pagesSMH 23jul18John GriffithNo ratings yet

- Factiva 20191022 1029 PDFDocument2 pagesFactiva 20191022 1029 PDFAnonymous tTk3g8No ratings yet

- A European-Style Tax?Document3 pagesA European-Style Tax?Emil BautistaNo ratings yet

- Briefing AvoidanceDocument2 pagesBriefing Avoidanceapollo smithNo ratings yet

- Uk Is Facing A Lost Decade For Growth: The Bottle OpenerDocument31 pagesUk Is Facing A Lost Decade For Growth: The Bottle OpenerCity A.M.No ratings yet

- Ey Panama Temp Suspension of Payment of Public ServiceDocument3 pagesEy Panama Temp Suspension of Payment of Public ServiceharryNo ratings yet

- The British Evasion: Nicole GelinasDocument6 pagesThe British Evasion: Nicole GelinasBruno GarschagenNo ratings yet

- Cityam 2012-03-06Document36 pagesCityam 2012-03-06City A.M.No ratings yet

- Tax ArticleDocument8 pagesTax Articlecanuck1234No ratings yet

- Private Client and CharitiesDocument3 pagesPrivate Client and CharitiesEmeka NkemNo ratings yet

- Tackling Fraud and Error in The Benefit and Tax Credits SystemsDocument51 pagesTackling Fraud and Error in The Benefit and Tax Credits Systemssara_park_9No ratings yet

- Tax Amnesty: Benefits and Controversies: Kevin SuwandiDocument8 pagesTax Amnesty: Benefits and Controversies: Kevin SuwandiKevin SuwandiNo ratings yet

- WSJ#4Document2 pagesWSJ#4さくら樱花No ratings yet

- Taxlaws MuntazaliDocument12 pagesTaxlaws MuntazaliiatfirmforyouNo ratings yet

- In A Nutshell: Government Legal ServiceDocument2 pagesIn A Nutshell: Government Legal ServiceEmeka NkemNo ratings yet

- Factiva 20191022 1023 PDFDocument2 pagesFactiva 20191022 1023 PDFAnonymous tTk3g8No ratings yet

- International Tax LawDocument9 pagesInternational Tax LawMonisha ChaturvediNo ratings yet

- 16 July 2013 2013/17 Compliance in Focus 2013Document6 pages16 July 2013 2013/17 Compliance in Focus 2013Political AlertNo ratings yet

- Autumn Statement 2014Document5 pagesAutumn Statement 2014Martin ForsytheNo ratings yet

- Dropping The BombDocument6 pagesDropping The BombDevi PurnamasariNo ratings yet

- Stamp Dutyhike To 7Pc For 2M Homes: Bank: Low Rates Keep Dud Firms On Life SupportDocument40 pagesStamp Dutyhike To 7Pc For 2M Homes: Bank: Low Rates Keep Dud Firms On Life SupportCity A.M.No ratings yet

- Cityam 2012-06-26Document32 pagesCityam 2012-06-26City A.M.No ratings yet

- TAX AssignmentsDocument2 pagesTAX Assignmentsmshafkan7No ratings yet

- Tackling Global Tax Havens ShaxonDocument5 pagesTackling Global Tax Havens Shaxonoskar pipejerNo ratings yet

- US Challenges 'Unfair' Tech Taxes in The UK and EUDocument4 pagesUS Challenges 'Unfair' Tech Taxes in The UK and EUselviNo ratings yet

- InternationalTreasurer1998Feb16 Tax Abuse or Good Tax Policy?Document2 pagesInternationalTreasurer1998Feb16 Tax Abuse or Good Tax Policy?itreasurerNo ratings yet

- Two Visions For Middle Class TaxesDocument4 pagesTwo Visions For Middle Class TaxesThe Virginian-PilotNo ratings yet

- The Top 10 UK Tax ComplexitiesDocument9 pagesThe Top 10 UK Tax ComplexitiesNicole SpiteriNo ratings yet

- Excerpt From "The Hidden Wealth of Nations" by Gabriel Zucman.Document7 pagesExcerpt From "The Hidden Wealth of Nations" by Gabriel Zucman.OnPointRadioNo ratings yet

- GOOGLE 'Double Irish, Dutch Sandwich' Tax Loophole GuardianDocument2 pagesGOOGLE 'Double Irish, Dutch Sandwich' Tax Loophole GuardianHan JinNo ratings yet

- Tax Avoidance CoursworkDocument6 pagesTax Avoidance CoursworkDavid ThomsonNo ratings yet

- Global Regulatory Briefing Aug 27Document40 pagesGlobal Regulatory Briefing Aug 27ahmedzafarNo ratings yet

- US Department of Justice Official Release - 01483-05 Tax 547Document2 pagesUS Department of Justice Official Release - 01483-05 Tax 547legalmattersNo ratings yet

- The Best Entrepreneurs and Rising Stars: Awards ShortlistDocument36 pagesThe Best Entrepreneurs and Rising Stars: Awards ShortlistCity A.M.No ratings yet

- Defence Firm Mega-Merger On The Brink: Aston Martin VanquishDocument27 pagesDefence Firm Mega-Merger On The Brink: Aston Martin VanquishCity A.M.No ratings yet

- Card Cheat CameronDocument2 pagesCard Cheat CameronSimply Debt SolutionsNo ratings yet

- Cityam 2012-03-29Document44 pagesCityam 2012-03-29City A.M.No ratings yet

- Trump Seeks To Slash Tax For BusinessesDocument2 pagesTrump Seeks To Slash Tax For BusinessesNelica-Elena BogdanNo ratings yet

- Diamond'S Fury: Osborne Foiled Over Pasty TaxDocument43 pagesDiamond'S Fury: Osborne Foiled Over Pasty TaxCity A.M.No ratings yet

- Childhood Concussion Linked To Lifelong Health and Social Problems - Science - The GuardianDocument3 pagesChildhood Concussion Linked To Lifelong Health and Social Problems - Science - The GuardianNamkha NyingpoNo ratings yet

- A Guide To Spanish Citizenship and Permanent Residence - Visas & Permits - Expatica SpainDocument18 pagesA Guide To Spanish Citizenship and Permanent Residence - Visas & Permits - Expatica SpainNamkha NyingpoNo ratings yet

- Don't Floss, Peel Veg or Wash Your Jeans: 40 Things You Can Stop Doing Right Now - Life and Style - The GuardianDocument4 pagesDon't Floss, Peel Veg or Wash Your Jeans: 40 Things You Can Stop Doing Right Now - Life and Style - The GuardianNamkha NyingpoNo ratings yet

- It Hits You Over The Head': Can I Survive My Midlife Crisis? - Life and Style - The GuardianDocument5 pagesIt Hits You Over The Head': Can I Survive My Midlife Crisis? - Life and Style - The GuardianNamkha NyingpoNo ratings yet

- Season of The Witch: Why Young Women Are Flocking To The Ancient Craft - World News - The GuardianDocument4 pagesSeason of The Witch: Why Young Women Are Flocking To The Ancient Craft - World News - The GuardianNamkha NyingpoNo ratings yet

- Angkor Anger - Naked Western Tourists Offend Cambodians at Sacred Temples - World News - The GuardianDocument3 pagesAngkor Anger - Naked Western Tourists Offend Cambodians at Sacred Temples - World News - The GuardianNamkha NyingpoNo ratings yet

- Dharma Wheel - View Topic - Sakya POV On The Origin of The Cakrasamvara TantrasDocument20 pagesDharma Wheel - View Topic - Sakya POV On The Origin of The Cakrasamvara TantrasNamkha NyingpoNo ratings yet

- Ash Wednesday 2015: What Is It and Why Is It An Important Day For Christians? - Home News - UK - The IndependentDocument7 pagesAsh Wednesday 2015: What Is It and Why Is It An Important Day For Christians? - Home News - UK - The IndependentNamkha NyingpoNo ratings yet

- Meeting Points of Science and SpiritualityDocument4 pagesMeeting Points of Science and SpiritualityNamkha NyingpoNo ratings yet

- Gendun Chöphel - Wikipedia, The Free EncyclopediaDocument3 pagesGendun Chöphel - Wikipedia, The Free EncyclopediaNamkha NyingpoNo ratings yet

- Sri Lanka To Deport British Tourist Over Buddha Tattoo - World News - The GuardianDocument2 pagesSri Lanka To Deport British Tourist Over Buddha Tattoo - World News - The GuardianNamkha NyingpoNo ratings yet

- Gendun ChophelDocument8 pagesGendun ChophelNamkha NyingpoNo ratings yet

- Benefits of Community Policing - Handout2aDocument3 pagesBenefits of Community Policing - Handout2astylo467567% (3)

- Language Maintenance and Shift: SociolinguisticDocument6 pagesLanguage Maintenance and Shift: SociolinguisticRaul LozanoNo ratings yet

- 11 Republic vs. Marcopper Mining Corp Cd1Document2 pages11 Republic vs. Marcopper Mining Corp Cd1Leigh AllejeNo ratings yet

- Concepts in Globalization (M1)Document35 pagesConcepts in Globalization (M1)Justin Marvin SanchezNo ratings yet

- Behavioral IsmDocument15 pagesBehavioral IsmGabriela LorenaNo ratings yet

- Blackbirded Sicilians LouisianaDocument2 pagesBlackbirded Sicilians LouisianaAuntie DogmaNo ratings yet

- Holden and HomosexualityDocument5 pagesHolden and Homosexualityapi-238981017No ratings yet

- Mans Social and Cultural BackgroundDocument36 pagesMans Social and Cultural BackgroundAngeline DiazNo ratings yet

- Material Wealth and Hard Work Material Wealth A Better LifeDocument9 pagesMaterial Wealth and Hard Work Material Wealth A Better LifeNgọc HânNo ratings yet

- Spcover Web - M-618 SPDocument113 pagesSpcover Web - M-618 SPerazorafael2502No ratings yet

- Thesis W Ref FV PDFDocument155 pagesThesis W Ref FV PDFDilshaan RavendranNo ratings yet

- SobhaDocument228 pagesSobhaVishal MoreNo ratings yet

- Tittytainment PDFDocument2 pagesTittytainment PDFerinNo ratings yet

- Draft 4 Writing 3 DelilaDocument3 pagesDraft 4 Writing 3 Deliladirk lethulurNo ratings yet

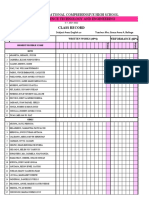

- New Lucena National Comprehensive High School Grade 10 Science Technology and EngineeringDocument11 pagesNew Lucena National Comprehensive High School Grade 10 Science Technology and EngineeringGrace Anne Adoracion-BellogaNo ratings yet

- India and China: The Freshwater Dispute Amongst The Two Thirsty Asian Giant'sDocument6 pagesIndia and China: The Freshwater Dispute Amongst The Two Thirsty Asian Giant'sEditor IJTSRDNo ratings yet

- The Evolution of Nigeria's Foreign Policy: From The Pre-Independence and Post-Independence PerspectivesDocument12 pagesThe Evolution of Nigeria's Foreign Policy: From The Pre-Independence and Post-Independence PerspectivesalexNo ratings yet

- Shaykh Saalih As-Suhaymee, Teacher at Prophet's Mosque (In Medinah) LetterDocument3 pagesShaykh Saalih As-Suhaymee, Teacher at Prophet's Mosque (In Medinah) LetterhinaqidNo ratings yet

- Secretary of National Defense vs. Manalo G.R. No. 180906, October 7, 2008Document9 pagesSecretary of National Defense vs. Manalo G.R. No. 180906, October 7, 2008jetzon2022No ratings yet

- Keamanan Pangan Sebagai Salah Satu Upaya PerlindunDocument16 pagesKeamanan Pangan Sebagai Salah Satu Upaya PerlindunMuhammad theo HandokoNo ratings yet

- Bribery and Corruption Plague Middle EastDocument2 pagesBribery and Corruption Plague Middle EastKhaled HaddadNo ratings yet

- Journal 2020 PLA Strategic Support ForceDocument48 pagesJournal 2020 PLA Strategic Support ForceDENo ratings yet