Professional Documents

Culture Documents

Altair Awardletter

Uploaded by

News-Press0 ratings0% found this document useful (0 votes)

1K views2 pagesThe Sept. 9, 2014 tax refund certification for Altair.

Copyright

© © All Rights Reserved

Available Formats

PDF or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentThe Sept. 9, 2014 tax refund certification for Altair.

Copyright:

© All Rights Reserved

Available Formats

Download as PDF or read online from Scribd

0 ratings0% found this document useful (0 votes)

1K views2 pagesAltair Awardletter

Uploaded by

News-PressThe Sept. 9, 2014 tax refund certification for Altair.

Copyright:

© All Rights Reserved

Available Formats

Download as PDF or read online from Scribd

You are on page 1of 2

ee DEG) ecm:

SER SERN

Septenber 9, 2014

(Me. Brisn Jones

Chief Executive Officer

Altar Training Solutions, In,

P.O. Box 112521

"Naples, ora 34108

Re: Qualified Target Industry (“OTT Tax Refund Cetfcation

Dear Mr Jone:

‘We are pleased to inform you that, based onthe application tht was submited for Altar Treining

Solutions Inc. be "Company", “you” of “sour”) at the other documents and information provided

‘os, and subjee to the factual deserpions, assumptions, qualifications and Fmittions inthis Fer,

eserbed in the Company's application (the “Projet”. Plese note that the Award has been

‘automatically reduced from $1,008,000 to $806 400 to reflect the waiver of the local financial support

requirement in connection withthe Project based on Hendry County's designation as a “rural

community” within the meaning of Section 106(2X(p) ofthe Florida Statutes.

(Ourdetermination ofthe Company's eligibility for the Awards based in pat on the following fctul

sssumpioas

1. The Award ital tothe Company's decision to locate the Project in Florida, andthe Company

submited it application prior to deciding to locate the Project in Florida;

2, The local community suppons the Project

13. The Project wil be located in a “rural community” within the meaning of Section 1062)() of

the Florida Statutes;

4, The Company will create at Jeast 144 net newsto-Fpida fullsime-oquivalent jobs in

connostion with the Projet paying an average annualizod wage ofa east $62,162, which is

‘equal to 184% ofthe everage annual private Secor wage in Hendry County forthe year ended

December 31,2012; and

5. The Project wil operate in Florida's qualified target industry—HYomeland Security and

Defense Educational Services

eri ero Opty lil Bung | 07 Maan Sent | hace, F209

‘ecru sae | 02005 50971322

otaau Ob teak cgr Ono

‘Sepers mrss os dort aud pane eg TICS apm bas ay ee

Mr. Bran Jones

Altar Training Solutions, inc

September 9, 2014

Page20f2

‘Subject tothe Company’ etisficton ofthe epplicable perfomance requirements, the Award will be

Aisbused in accordance with the following schedule:

iacal Year ‘Scheduled Masiovum Tax Refund

2015-16 $26,600,

2016-17 $96,600

2017-18, $201,600

2018.19 $201,600

2019-20 $175,000

2020-21, $105,000

Total $805,400

"Notwithstanding anything inthis eter to the contrary, the Company's righ to receive all or any portion

‘ofthe Award is contingent onthe Company or a designated affliat approved by DEO entering into

OTT Tax Refi Agrecment (the “Agreement” with DEO witin ninety (90) days of the date of thi

Jette, in form and substance stsfctory to DEO in its sole disretion. Accordingly, tis eter i not

iended to and doesnot constitute an offeror agreement to grat the Award ort enter into a definitive

‘agreement with respect to an Award, and DEO wil have no oigations of any kind whatsoever with

respect thereto by virtue ofthis letter or any other written o oral expression by our representatives

nies and until a definitive agreement betwen us is executed end delivered,

Subject to the immediately preceding paragraph, this Iter i for your sole benefit and nothing

cepresced oriole i this leer will give or be construed to give any person or extyany legal or

‘etitble right hereunder. ‘This leteris governed by the laws ofthe State of Frida, without regard

to conics of aw principles.

‘We are very excited sbout the opportunites offered by the Projet. We Took forward to working with

you and your team toward a succesful traeaction and future. Ifyou have any questions concersing

{his eter or the Agreement, please call our Managing Analyst, Maureen Smith, at (850) 717-8978,

Nod

‘ee! Tony Burkart, Enterprise Florida, In.

(Gregg Gilman, Hendry County Economic Development Commision

Project ID: 14-00762

You might also like

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- A Look Back: The 1992 Fort Myers Green WaveDocument33 pagesA Look Back: The 1992 Fort Myers Green WaveNews-PressNo ratings yet

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (895)

- Helping Our Seniors Get The Covid 19 VaccineDocument1 pageHelping Our Seniors Get The Covid 19 VaccineNews-PressNo ratings yet

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5794)

- Paramedicine Vaccine Administration Memorandum of Agreement Cape CoralDocument29 pagesParamedicine Vaccine Administration Memorandum of Agreement Cape CoralNews-PressNo ratings yet

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (400)

- Kitson Proposal For Civic CenterDocument52 pagesKitson Proposal For Civic CenterNews-Press0% (1)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- Signed Paramedicine Agreement With DOH - EsteroDocument32 pagesSigned Paramedicine Agreement With DOH - EsteroNews-PressNo ratings yet

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- Helping Our Seniors Get The Covid 19 VaccineDocument1 pageHelping Our Seniors Get The Covid 19 VaccineNews-PressNo ratings yet

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- Letters of Findings From CCPS To Charles MaurerDocument9 pagesLetters of Findings From CCPS To Charles MaurerNews-PressNo ratings yet

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- North Collier COVID-19 Vaccine MemorandumDocument6 pagesNorth Collier COVID-19 Vaccine MemorandumNews-PressNo ratings yet

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (588)

- Lee Health Board of Directors LetterDocument2 pagesLee Health Board of Directors LetterNews-PressNo ratings yet

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Publix Pharmacy Covid 19 Vaccine FL Store List Jan 18, 2021Document7 pagesPublix Pharmacy Covid 19 Vaccine FL Store List Jan 18, 2021Michelle MarchanteNo ratings yet

- Eo 21-46Document2 pagesEo 21-4610News WTSPNo ratings yet

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- From The Archives: Homicide of Betty Jeanette RuppertDocument7 pagesFrom The Archives: Homicide of Betty Jeanette RuppertNews-PressNo ratings yet

- State of Florida: The Governor Executive NumberDocument3 pagesState of Florida: The Governor Executive NumberNews-PressNo ratings yet

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- Ethics Complaint Credit CardsDocument15 pagesEthics Complaint Credit CardsNews-PressNo ratings yet

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (73)

- FHSAA 2020-21 Season OptionsDocument1 pageFHSAA 2020-21 Season OptionsNews-PressNo ratings yet

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (344)

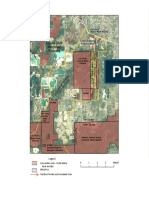

- Dec-01 David Dorsey WatershedMap No ContoursDocument1 pageDec-01 David Dorsey WatershedMap No ContoursNews-PressNo ratings yet

- CCPS COVID-19 WaiverDocument2 pagesCCPS COVID-19 WaiverNews-PressNo ratings yet

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- Lee Schools Memorandum of UnderstandingDocument15 pagesLee Schools Memorandum of UnderstandingNews-PressNo ratings yet

- Honorable Lisa Davidson 04-27-20Document2 pagesHonorable Lisa Davidson 04-27-20News-PressNo ratings yet

- LCSD COVID-19 Student Release FormDocument2 pagesLCSD COVID-19 Student Release FormNews-PressNo ratings yet

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- Lee Schools Memorandum of UnderstandingDocument15 pagesLee Schools Memorandum of UnderstandingNews-PressNo ratings yet

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- Ivey Nelson Response EmailsDocument2 pagesIvey Nelson Response EmailsNews-PressNo ratings yet

- FHSAA 2020 Football OptionsDocument3 pagesFHSAA 2020 Football OptionsNews-PressNo ratings yet

- US Sugar LawsuitDocument26 pagesUS Sugar LawsuitNews-PressNo ratings yet

- A Federal Judge Found Rick Scott Vilified Ex-Broward Elections SupervisorDocument15 pagesA Federal Judge Found Rick Scott Vilified Ex-Broward Elections SupervisorNews-PressNo ratings yet

- US District 24-2018 General Election Ballot ProofsDocument6 pagesUS District 24-2018 General Election Ballot ProofsNews-PressNo ratings yet

- North Fort Myers High School Family LetterDocument2 pagesNorth Fort Myers High School Family LetterNews-PressNo ratings yet

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (121)

- ComplaintDocument21 pagesComplaintNews-PressNo ratings yet

- US District 24-2018 General Election Ballot ProofsDocument6 pagesUS District 24-2018 General Election Ballot ProofsNews-PressNo ratings yet

- William "Coot" Ferrell Jr.Document1 pageWilliam "Coot" Ferrell Jr.News-PressNo ratings yet

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)