Professional Documents

Culture Documents

HW3 Problem

Uploaded by

عبدالله ماجد المطارنهOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

HW3 Problem

Uploaded by

عبدالله ماجد المطارنهCopyright:

Available Formats

Chapter 3 The Time Value of Money

4. You need to have $50,000 at the end of 10 years. To accumulate this sum, you have decided to save a

certain amount at the end of each of the next 10 years and deposit it in the bank. The bank pays 8

percent interest compounded annually for long-term deposits. How much will you have to save each

year (to the nearest dollar)?

5. Same as Problem 4 above, except that you deposit a certain amount at the beginning of each of the

next 10 years. Now, how much will you have to save each year (to the nearest dollar)?

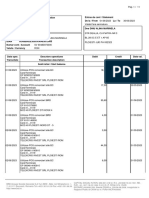

9. The H & L Bark Company is considering the purchase of a debarking machine that is expected to

provide cash flows as follows:

END OF YEAR

1

2

3

4

5

Cash flow

$1,200

$2,000

$2,400

$1,900

$1,600

Cash flow

6

$1,400

7

$1,400

END OF YEAR

8

$1,400

9

$1,400

10

$1,400

If the appropriate annual discount rate is 14 percent, what is the present value of this cash-flow

stream?

14. Establish loan amortization schedules for the following loans to the nearest cent (see Table 3.8 for an

example):

a. A 36-month loan of $8,000 with equal installment payments at the end of each month. The

interest rate is 1 percent per month.

b. A 25-year mortgage loan of $184,000 at a 10 percent compound annual interest rate with equal

installment payments at the end of each year.

15. You have borrowed $14,300 at a compound annual interest rate of 15 percent. You feel that you will

be able to make annual payments of $3,000 per year on your loan. (Payments include both principal

and interest.) How long will it be before the loan is entirely paid off (to the nearest year)?

17. Earl E. Bird has decided to start saving for his retirement. Beginning on his twenty-first birthday,

Earl plans to invest $2,000 each birthday into a savings investment earning a 7 percent compound

annual rate of interest. He will continue this savings program for a total of 10 years and then stop

making payments. But his savings will continue to compound at 7 percent for 35 more years, until

Earl retires at age 65. Ivana Waite also plans to invest $2,000 a year, on each birthday, at 7 percent,

and will do so for a total of 35 years. However, she will not begin her contributions until her thirtyfirst birthday. How much will Earl's and Ivana's savings programs be worth at the retirement age of

65? Who is better off financially at retirement, and by how much?

20. Suppose that an investment promises to pay a nominal 9.6 percent annual rate of interest. What is the

effective annual interest rate on this investment assuming that interest is compounded (a) annually?

(b) semiannually? (c) quarterly? (d) monthly? (e) daily (365 days)? (f) continuously? (Note: Report

your answers accurate to four decimal places - e.g., 0.0987 or 9.87%.)

22. It took roughly 14 years for the Dow Jones Average of 30 Industrial Stocks to go from 1,000 to 2,000.

To double from 2,000 to 4,000 took only 8 years, and to go from 4,000 to 8,000 required roughly 2

years. To the nearest whole percent, what compound annual growth rates are implicit in these three

index-doubling milestones?

You might also like

- Assignment of Time Value of MoneyDocument3 pagesAssignment of Time Value of MoneyMuxammil IqbalNo ratings yet

- BF Assign1Document3 pagesBF Assign1Mian Shawal67% (3)

- The Cash Account in The General Ledger of Hendry CorporationDocument1 pageThe Cash Account in The General Ledger of Hendry Corporationamit raajNo ratings yet

- Lease Demo SolutionDocument6 pagesLease Demo SolutionToufiqul IslamNo ratings yet

- B LawDocument240 pagesB LawShaheer MalikNo ratings yet

- Assignment 1 PDFDocument2 pagesAssignment 1 PDFJeevan GonaNo ratings yet

- FFCDocument17 pagesFFCAmna KhanNo ratings yet

- Presentation On The LBO (Leverraged Buy Out)Document14 pagesPresentation On The LBO (Leverraged Buy Out)aries_anu2304No ratings yet

- The Correct Answer For Each Question Is Indicated by ADocument19 pagesThe Correct Answer For Each Question Is Indicated by Aakash deepNo ratings yet

- Fundamental of FinanceDocument195 pagesFundamental of FinanceMillad MusaniNo ratings yet

- Dire Dawa University: College of Business and Economic Department of ManagementDocument20 pagesDire Dawa University: College of Business and Economic Department of ManagementEng-Mukhtaar CatooshNo ratings yet

- Assignment Time Value and MoneyDocument2 pagesAssignment Time Value and MoneySaqib Mirza0% (1)

- Finca Bank ProjectDocument12 pagesFinca Bank Projectumar sohailNo ratings yet

- IBA Suggested Solution First MidTerm Taxation 12072016Document9 pagesIBA Suggested Solution First MidTerm Taxation 12072016Syed Azfar HassanNo ratings yet

- Meezan Vs Bank IslamicDocument42 pagesMeezan Vs Bank IslamicIsma Nizam50% (2)

- Q No. 1 Assume That You Are Given Assignment To Evaluate The Capital Budgeting Projects of The CompanyDocument3 pagesQ No. 1 Assume That You Are Given Assignment To Evaluate The Capital Budgeting Projects of The CompanyMuneeb Qureshi0% (1)

- HBLDocument6 pagesHBLharis nadeemNo ratings yet

- Executive Summary NewDocument37 pagesExecutive Summary NewSaqib Naeem100% (1)

- EbitDocument3 pagesEbitJann KerkyNo ratings yet

- Air University BS Accounting & Finance 7 Financial Modelling Assignment 5 - Cost of Equity (Van Horne)Document2 pagesAir University BS Accounting & Finance 7 Financial Modelling Assignment 5 - Cost of Equity (Van Horne)mishal zikriaNo ratings yet

- ICMA Questions Dec 2012Document55 pagesICMA Questions Dec 2012Asadul HoqueNo ratings yet

- SBP Export Refinance SchemeDocument20 pagesSBP Export Refinance Schemesaeedkhan2288No ratings yet

- Company LawDocument3 pagesCompany LawArslan Akram0% (1)

- N.B.P FinalDocument47 pagesN.B.P Finalammar_acca100% (1)

- Case StudyDocument5 pagesCase StudyMD FAISALNo ratings yet

- Business Plan (Unit 3)Document17 pagesBusiness Plan (Unit 3)Mahbobullah Rahmani100% (1)

- Quiz No-02Document2 pagesQuiz No-02kalir12100% (1)

- Lecture 7 Adjusted Present ValueDocument19 pagesLecture 7 Adjusted Present ValuePraneet Singavarapu100% (1)

- Au Mod - 1Document8 pagesAu Mod - 1Keyur PopatNo ratings yet

- Sample PaperDocument8 pagesSample Paperneilpatrel31No ratings yet

- Assignment IIDocument4 pagesAssignment IIAfifa TonniNo ratings yet

- ACC 1102 Case StudyDocument1 pageACC 1102 Case StudyMohammad Mosharof HossainNo ratings yet

- Chapter 15 Company AnalysisDocument51 pagesChapter 15 Company Analysissharktale282850% (2)

- Advanced Corporate Finance Group Assignment PDFDocument8 pagesAdvanced Corporate Finance Group Assignment PDFaddisie temesgenNo ratings yet

- QuizDocument2 pagesQuizRepunzel RaajNo ratings yet

- Institute of Business Management: 2 Assignment - Fall 2019Document2 pagesInstitute of Business Management: 2 Assignment - Fall 2019Intasar ZaidiNo ratings yet

- UBL Analysis ObDocument8 pagesUBL Analysis ObSyed Sheraz Ahmed Shah100% (1)

- The Impact of Government Policy and Regulation On BankingDocument15 pagesThe Impact of Government Policy and Regulation On BankingAmna Nasser100% (1)

- CH 12Document31 pagesCH 12Mochammad RidwanNo ratings yet

- Question 2: Ias 19 Employee Benefits: Page 1 of 2Document2 pagesQuestion 2: Ias 19 Employee Benefits: Page 1 of 2paul sagudaNo ratings yet

- Question (Apr 2012)Document49 pagesQuestion (Apr 2012)Monirul IslamNo ratings yet

- Chapter 7 (An Introduction To Portfolio Management)Document28 pagesChapter 7 (An Introduction To Portfolio Management)Abuzafar AbdullahNo ratings yet

- Financial Markets QuestionsDocument54 pagesFinancial Markets QuestionsMathias VindalNo ratings yet

- Couresot LineDocument2 pagesCouresot LineSeifu BekeleNo ratings yet

- Vision and MissionDocument4 pagesVision and MissionMadiha NazNo ratings yet

- Audit and Assurance - Past Papers Question With AnswerDocument153 pagesAudit and Assurance - Past Papers Question With AnswerMuhammad SufyanNo ratings yet

- Presentation On State Bank of PakistanDocument61 pagesPresentation On State Bank of PakistanMuhammad WasifNo ratings yet

- Analysis of Stockholders EquityDocument8 pagesAnalysis of Stockholders EquityHamza ZainNo ratings yet

- Garden Wizards Provides Gardening Services To Both Commercial and ResidentialDocument1 pageGarden Wizards Provides Gardening Services To Both Commercial and Residentialtrilocksp Singh0% (1)

- Corporate Financial Reporting - Chapter I-1Document18 pagesCorporate Financial Reporting - Chapter I-1Namrata BhaskarNo ratings yet

- Q No.1 Use Following Title of Accounts To Complete Journal Entries of Given TransactionsDocument5 pagesQ No.1 Use Following Title of Accounts To Complete Journal Entries of Given TransactionsNoorNo ratings yet

- Working CapitalDocument66 pagesWorking CapitalAamit KumarNo ratings yet

- Al BarakaDocument40 pagesAl Barakalonelydezire100% (2)

- Strategic Management - Meezan Bank Complete ReportDocument17 pagesStrategic Management - Meezan Bank Complete ReportHaris KhanNo ratings yet

- The Four Walls: Live Like the Wind, Free, Without HindrancesFrom EverandThe Four Walls: Live Like the Wind, Free, Without HindrancesRating: 5 out of 5 stars5/5 (1)

- Strategic Cost Cutting After COVID: How to Improve Profitability in a Post-Pandemic WorldFrom EverandStrategic Cost Cutting After COVID: How to Improve Profitability in a Post-Pandemic WorldNo ratings yet

- Value Chain Management Capability A Complete Guide - 2020 EditionFrom EverandValue Chain Management Capability A Complete Guide - 2020 EditionNo ratings yet

- Assign 2Document3 pagesAssign 2Abdul Moqeet100% (1)

- 991財管題庫Document10 pages991財管題庫zzduble1No ratings yet

- Corporate Reporting On The Internet and The Expectations Gap New Face of An Old ProblemDocument26 pagesCorporate Reporting On The Internet and The Expectations Gap New Face of An Old Problemعبدالله ماجد المطارنهNo ratings yet

- International Financial Markets: South-Western/Thomson Learning © 2003Document44 pagesInternational Financial Markets: South-Western/Thomson Learning © 2003عبدالله ماجد المطارنهNo ratings yet

- Abdullah Hammad Al-Matarneh Department of MBA Mu'ta University Dr. Muntaha Bani-HaniDocument11 pagesAbdullah Hammad Al-Matarneh Department of MBA Mu'ta University Dr. Muntaha Bani-Haniعبدالله ماجد المطارنهNo ratings yet

- Mid. Fm2014 20152 ادارة مالية باللغة الانجليزيةDocument5 pagesMid. Fm2014 20152 ادارة مالية باللغة الانجليزيةعبدالله ماجد المطارنهNo ratings yet

- Chap6 PDFDocument46 pagesChap6 PDFعبدالله ماجد المطارنهNo ratings yet

- David TIF Ch01Document24 pagesDavid TIF Ch01radislamyNo ratings yet

- Ch12 Planning For Capital InvestmentsDocument62 pagesCh12 Planning For Capital Investmentsعبدالله ماجد المطارنهNo ratings yet

- TB ch02 5e MADocument8 pagesTB ch02 5e MAعبدالله ماجد المطارنهNo ratings yet

- Ch07 Incremental AnalysisDocument47 pagesCh07 Incremental Analysisعبدالله ماجد المطارنهNo ratings yet

- Circular No. 300 - Guidelines Implementing The Pag-IBIG Fund Housing Loan Restructuring and Penalty Condonation ProgramDocument10 pagesCircular No. 300 - Guidelines Implementing The Pag-IBIG Fund Housing Loan Restructuring and Penalty Condonation ProgramRogerMacadangdangGeonzonNo ratings yet

- BEC 3303 Financial Economics Session 2Document58 pagesBEC 3303 Financial Economics Session 2Tharindu PereraNo ratings yet

- Functions of RbiDocument4 pagesFunctions of RbiMunish PathaniaNo ratings yet

- "A Study On Cryptocurrency in India - Boon or Bane": Mr.J.P.Jaideep,, Mr. K.Rao Prashanth JyotyDocument6 pages"A Study On Cryptocurrency in India - Boon or Bane": Mr.J.P.Jaideep,, Mr. K.Rao Prashanth JyotyJagan MbaNo ratings yet

- Statement of Axis Account No:923010035321735 For The Period (From: 15-06-2023 To: 15-07-2023)Document2 pagesStatement of Axis Account No:923010035321735 For The Period (From: 15-06-2023 To: 15-07-2023)Usha DeviNo ratings yet

- SV90483973000 2023 06Document11 pagesSV90483973000 2023 06Alina DinuNo ratings yet

- TRANSCRIPT: 3rd Public Hearing of The Senate Blue Ribbon Committee On The $81-M Money Laundering CaseDocument302 pagesTRANSCRIPT: 3rd Public Hearing of The Senate Blue Ribbon Committee On The $81-M Money Laundering CaseBlogWatchNo ratings yet

- Current & Saving Account Statement: Vishnu Gupta S/O Jagdish Gupta HNO 417 Mo Arya Nagar Shiv Ganj EtahDocument6 pagesCurrent & Saving Account Statement: Vishnu Gupta S/O Jagdish Gupta HNO 417 Mo Arya Nagar Shiv Ganj Etahvishnu guptaNo ratings yet

- Bank Statement: Account Number: 19267853 Sort Code: 040605 Statement For: 1 Nov 2023 - 30 Nov 2023Document1 pageBank Statement: Account Number: 19267853 Sort Code: 040605 Statement For: 1 Nov 2023 - 30 Nov 2023aamir zahoorNo ratings yet

- Master Tile Internship UOGDocument54 pagesMaster Tile Internship UOGAhsanNo ratings yet

- Banking LiesDocument13 pagesBanking LiesJua89% (9)

- Miss Jane Citizen Level 1, 8 Name Street Sydney NSW 2000: Account Details Account DetailsDocument3 pagesMiss Jane Citizen Level 1, 8 Name Street Sydney NSW 2000: Account Details Account DetailsYoutube MasterNo ratings yet

- Al Dhaid Trading & Contracting Al Dhaid Trading ContractingDocument5 pagesAl Dhaid Trading & Contracting Al Dhaid Trading ContractingAbi JithNo ratings yet

- E-Banking Ref No: Recurring Deposit Installment ReportDocument2 pagesE-Banking Ref No: Recurring Deposit Installment ReportSaurabh JainNo ratings yet

- Econ 101E (Module 3) Hand-Out Money-Time Relationship 1st Sem 2020-2021Document5 pagesEcon 101E (Module 3) Hand-Out Money-Time Relationship 1st Sem 2020-2021May May MagluyanNo ratings yet

- Application Form For Cheque Book and Debit Card IssuanceDocument2 pagesApplication Form For Cheque Book and Debit Card IssuanceAltoheed channelNo ratings yet

- Strategic Risk Management Paper 2014Document11 pagesStrategic Risk Management Paper 2014Ale BessNo ratings yet

- FXD Depst CalDocument2 pagesFXD Depst CalKhalid DarNo ratings yet

- Economics of Money Banking and Financial Markets Canadian 6th Edition Mishkin Solutions ManualDocument22 pagesEconomics of Money Banking and Financial Markets Canadian 6th Edition Mishkin Solutions Manuala364474898100% (2)

- Customer Accaunt OpeningDocument96 pagesCustomer Accaunt OpeningMahammed UsmailNo ratings yet

- Step by Step Guide On How Use and To Trade Safely With Bitcoin On Paxful. Make Over $3 Profit Per DayDocument8 pagesStep by Step Guide On How Use and To Trade Safely With Bitcoin On Paxful. Make Over $3 Profit Per DayChangamkia WorksNo ratings yet

- HDFC Bank Credit CardDocument1 pageHDFC Bank Credit CardRamesh BabuNo ratings yet

- Study of Risk Management in Selected Indian Banks: Synopsis ONDocument7 pagesStudy of Risk Management in Selected Indian Banks: Synopsis ONRavi JoshiNo ratings yet

- Saunders 8e PPT Chapter05Document33 pagesSaunders 8e PPT Chapter05sdgdfs sdfsfNo ratings yet

- MBFinance Chap06-Pbms-finalDocument20 pagesMBFinance Chap06-Pbms-finalLinda YuNo ratings yet

- Debit CardDocument8 pagesDebit CardnaazkinzaNo ratings yet

- Festus Jan To Now StatementDocument10 pagesFestus Jan To Now StatementAkanwi BrightNo ratings yet

- Marty SweetenDocument2 pagesMarty SweetenmartysweetenpNo ratings yet

- Topic 3 Example of Trial BalanceDocument6 pagesTopic 3 Example of Trial BalanceSalsabilaFahimNo ratings yet