Professional Documents

Culture Documents

Final Internship Report

Uploaded by

Sadam BirmaniOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

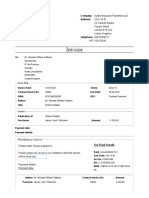

Final Internship Report

Uploaded by

Sadam BirmaniCopyright:

Available Formats

1

Internship

Report On MCB

DEDICATIONS

To almighty Allah, who created me as

crown of creation and enable me to learn.

To my parents who nurtured me well and

inculcated in me the spirit to learn more

and more.

To my teachers at all my stages of study

and developed my personality as a useful

citizen for the society and beyond them

to all my friends from whom I learned

much and to staff of the company who

Page1

who always guided me in right direction

Internship

Report On MCB

fully cooperated with me in the

Page2

completion of my tasks.

Internship

Page3

Report On MCB

Internship

Page4

Report On MCB

Internship

Page5

Report On MCB

Internship

Page6

Report On MCB

Internship

Report On MCB

ACKNOWLEDGMENT:

and ability to accomplish this work.

I also want to show my gratitude to my loving parents and teachers who make me able to be at

this position.

I am also thankful to all my friends and the staff members of the MCB KUTCHERY ROAD

D.G.KHAN.

*MR. SHAH JAHAN SAHIB

(Manager)

Page7

All Glories and honors are for Almighty Allah, who bestowed me with profound perseverance

Internship

* MADAM IMRANA PARVEEN

(Operational Manager)

* Mr. ABDUL LATEEF

(GBO)

* MADAM ASMA BALOUCH

(GBO)

* Mr. M.ARSALAN

(CASHIER)

* Mr. M.SHAHIZAD

(CASHIER)

* Mr. M.IMTIAZ

(CASH SORTER)

Page8

Report On MCB

Internship

Report On MCB

EXECUTIVE SUMMARY

MCB is Pakistans fourth largest bank by assets having an asset base of US$6.7 billion, and the

largest by market capitalization having a market capitalization of US$ 4.1 billion. The Bank has

a customer base of approximately 4 million and a nationwide distribution network of 1200

branches, including 8 Islamic banking branches, and over 300 ATMs, in a market with a

population of 160 million.

MCBs operations continued to be streamlined with focus on rationalization of expenses,

realignment of back end processing to increase productivity, enhancement of customer service

standards, process efficiency and controls. The bank has taken the lead in introducing the

innovative concept of centralizing Trade Services in the country by providing centralized foreign

trade services to branches with a view to improve efficiency, expertise and reduce delivery cost.

During my internship in MCB, I worked in Clearing Department, Remittance Department,

Foreign Exchange Department and Accounts Department and I successfully completed all the

During the course of internship I learned about different functions performed by Clearing,

Remittance, Foreign Exchange, Accounts Department and bank as a whole. I also learned banks

correspondence with their customers and within branches.

Page9

task/duties that were assigned to me.

10

Internship

Report On MCB

Overview of the Organization

MCB Bank Limited (formerly Muslim Commercial Bank) previously named

as

(Mansoor

Co-operative

Bank)

was incorporated by

the Adamjee

Group on July 9, 1947, under the Indian Companies Act, VII of 1913 as a

limited company. The bank was established to provide banking facilities to

the business community of South Asia. The bank was nationalized in 1974

during the government of Zulfikar Ali Bhutto. This was the first bank to be

privatized in 1991 and the bank was purchased by a consortium of Pakistani

corporate groups led by Nishat Group. As of June 2008, the Nishat Group

owns a majority stake in the bank. The president of the bank is Imran

Maqbool. Mian Mohammad Mansha is the Chairman of the group (and also MCB)

MCB is Pakistans fourth largest bank by assets having an asset base of US$7

billion as at quarter 1, 2012, and the largest by market capitalization having

a market capitalization recorded at $1.2 billion at year end 2011, which was

lower market value.

The bank has a customer base of approximately 4 million and a nationwide

distribution network of 1,190 branches, including 22 Islamic banking

branches (December 31, 2011) within Pakistan and eight branches outside

the country (December 31, 2011 including the Karachi Export Processing

Zone Branch), and over 650 ATMs in 110 cities, in a market with a population

of over 190 million.

Page10

comparatively lower than $1.8 billion the year before, mainly on account of

11

Internship

Report On MCB

Nationalization

In January 1974, the government of Pakistan nationalized MCB following the

banks Act 1947; Premier bank Limited merged with MCB.

Privatization

A wave of economic reforms swept Pakistan in the late 1990, introducing the

need for privatization of state owned banks companies. In April 1991, MCB

became Pakistans first privatized bank.

The government of Pakistan

transferred the management of the Bank to National Group, a group of

leading industrialists of the country by selling 26% shares of the bank. In

term of agreement between the government of Pakistan and the National

group, the Group, making their holding 50% has purchased additional 24%

shares.

MCB Bank ltd Today

Pakistan. A major financial institution, in scope and size, it symbolizes a fully

growing tree evergreen, strong, and firmly rooted.

Social Sector

The bank activity participating in the Prime Minister self-employment

Scheme. The application received from various applicants is being processed

on merit and disposed off as quickly as possible.

Foreign Operation

Page11

MCB today, a represents a bank that has grown with time, experience and

12

Internship

Report On MCB

Our banks foreign operation in Bangladesh and Sri Lanka continue to remain

profitable. In April 1999 the Bank opened its third branch in Sri Lanka at

Marinade a suburb of Colombo. Recently opened his branch in U.A.E.

Depend on us for stability

MCB Bank is committed to building on its strengths. Our strong balance

sheet, favorable capital adequacy ratio, geographical and financial spread,

and sheer presence in numbers of all stakeholders help us ground your

immovable faith.

Depend on us for advice

MCB Bank understands. We listen to your most determined ambitions and

your most private intentions. Between these two directions, we have a

wealth of products designed to cater to your every need administered by

highly qualified and committed relationship managers who insist on

Depend on us for reach

That undeniable fact that MCB Bank is just around the corner is not a

testament to convenience, but to inspiration. The fact that we are there for

you with over 1200 branches, stretching from the smallest towns and

villages to the countrys largest cities, is proof of our ever-expanding loyalty

to you.

Page12

excellence, service and advice.

13

Internship

Report On MCB

Depend on us for peace of mind

Our legendary stability has stood the test of time as the bedrock of financial

security for millions of customers. By working for your financial and lifestyle

security, we ensure your peace of mind. A state of being so well-empowered,

you are well-equipped to accept lifes challenges with spirit and resolve.

Depend on us for relationship

Before we invest in portfolios and funds, before we invest in local. Regional

or international markets, before we invest in new products and services, we

invest most importantly in the two of us. An equation which, over

generations, has translated into millions of satisfied relationships, and

Page13

growing.

Vision Statement

To be the leading financial services provider, partnering

with our customers for a more prosperous and secure

future.

14

Internship

Report On MCB

Mission Statement

To become the preferred provider of quality financial

services in the country with profitability and responsibility

We are a team of committed professionals, providing innovative and efficient

financial solutions to create and nurture long-term relationships with our customers.

In doing so, we ensure that our shareholders can invest with confidence in us.

Page14

and to be the best place to work.

15

Internship

Report On MCB

Depend on Our beliefs

Integrity

We are the trustees of public funds and serve our community with integrity. We

believe in being the best at always doing the right thing. We deliver on our

responsibilities and commitments to our customers as well as our colleagues.

Respect

We respect our customers values, beliefs, culture and history. We value the

equality of gender and diversity of experience and education that our

employees bring with them. We create an environment where each individual

is enabled to succeed.

Excellence

We take personal responsibility for our role as leaders in the pursuit of excellence.

We are a performance driven, result oriented organization where merit is the only

criterion for reward.

Customer Centricity

understanding their needs and aspirations, both realized and unrealized. We make

every effort to exceed customer expectations through superior services and

solutions.

Innovation

Page15

Our customers are at the heart of everything we do. We thrive on the challenge of

16

Internship

Report On MCB

We encourage and reward people who challenge the status quo and think beyond

the boundaries of the conventional. Our teams work together for the smooth and

Page16

efficient implementation of ideas and initiatives

17

Internship

Report On MCB

1.1OBJECTIVES OF STUDYING ORGANIZATION:

This study is for my academic interest and will be helpful in my future life

and it will become the foundation of my future studies. Most importantly this

internship allows me to distinguish myself from my classmates, as I gain a

competitive

advantage

by

connecting

my

coursework

with

industry

experience.

Following are important objectives of studying the organization:

Categorize the different products and services offered by the financial

institution and note how to most efficiently match those products and

services with the needs of customers.

Analyze the companys financial condition through the financial

statements (compute financial ratios and compare to the industry

averages).

To describe the impact of financial decisions on the health and

functioning of the overall organization.

To learn the various steps and procedures of credit risk management &

administration.

Finding out the weaknesses, short comings, strengths and beauties of

the credit administration department.

The purpose of the this study is to explore the functions, operations and

services of MCB Bank, and I think after preparing this; the readers of this

internship report will quickly understand the way MCB Branch works and

Page17

18

Internship

Report On MCB

through this concise report they might get the full-fledged idea of working of

Page18

banking industry of Pakistan.

19

Internship

Report On MCB

1.1.1PRODUCT & SERVICES:

Current Accounts

Saving Accounts

Term Deposit Accounts

1.2 Current Accounts

Current Account

Basic Banking Account

Business Account

1) Khushali Bachat Account

Khushali Bachat Account, a Rupee savings account is one of MCB Banks

most popular products. Due to the low initial deposit, the account can be

opened by people from all walks of life and still avail the facility of daily

product profit calculation.

Page19

1.2.1Current Account

20

Internship

Report On MCB

2) Mahana Khushali Bachat

MCB Monthly Khushali Scheme provides you with a steady income every

month. Just purchase a Monthly Khushali Certificate and you will enjoy a

steady income of your total deposit every month.

3) Pak Rupee Savings Account

MCBs Pak Rupee Savings Account offers you attractive returns on your Pak

Rupee investment.

In addition, you have access to a countrywide ATM network convenient cash

accessibility 24 hours a day. The facility also provides you with unlimited

daily transactions with a limit on maximum withdrawal amount through the

4) Pak Rupee Current Account

MCBs Pak Rupee Current Account offers you the convenience of unlimited

withdrawals i.e. access to your funds whenever you want without any notice.

There is no limit on the number of transactions you make in a day plus you

can avail finance facility up to 75% of the total deposit.

Page20

ATM machines.

21

Internship

Report On MCB

In addition, you have access to a countrywide ATM network convenient cash

accessibility 24 hours a day. The facility also provides you with unlimited

daily transactions with a limit on maximum withdrawal amount through the

ATM machines.

5) Pak Rupee Term Deposit

MCB Pak Rupee Term Deposit gives a higher rate of return. It gives you

choice of 1 month, 3 months, 6 months, 1 year, 2 years, 3 years, 4 years and

6) Saving 365

The MCB Saving 365 calculates profits on a daily product basis and gives you

the facility of unlimited withdrawals.

7) Foreign Currency Savings Account

Page21

5 year term deposits.

22

Internship

Report On MCB

MCBs Foreign Currency Savings Account offers you attractive returns on

your Foreign Currency investment.

You can invest in any of the four currencies i.e. US Dollar, UK Pound Sterling,

Japanese Yen or Euro

Your foreign currency account is exempted from Zakat and withholding tax

8) Foreign Currency Current Account

MCBs Foreign Currency Current Account offers you the convenience of

unlimited withdrawals i.e. access to your funds whenever you want without

any notice. There is no limit on the number of transactions you make in a

day.

Loan Products

MCB Business Sarmaya is the best Running Finance facility against your

residential property which empowers you to manage your business dealings

better. So act today and get MCB Business Sarmaya and thus improve your

business, avail lucrative opportunities and expand your business, with

absolute satisfaction of cash flows.

Page22

1) MCB Business Sarmaya

23

Internship

Report On MCB

2) MCB Car4u

Life is like a chess board. You plan your career options. You analyze your

business moves. But when you really want to improve your life, you make a

power move. MCB CAR4U Auto Finance is the power move that assists you in

more ways than you ever imagined. It is affordable, with lowest mark up,

flexible conditions, easy processing and above all, no hidden costs.

4) Easy Personal Loan

MCB Easy Personal Loan provides you with the financial advantage to do

things you've always wanted to but never had the sufficient funds for. Take

that much-needed holiday. Buy a car. Refurnish your house. Purchase a new

Page23

TV. Finance a better education for your children.

MCB Master Card

Since the beginning of time, people have tried to find more convenient ways

to pay, from gold to paper money and cheques. Today, money is moving

24

Internship

Report On MCB

away from distinct hard currencies and towards universal payment products

that transcend national borders, time zones, and, with the Internet, even

physical space. Plastic or "virtual" money, credit, debit, and electronic cash

products, inevitably will replace cash and cheques as the money of the

future.

MCB Rupee Traveler's Cheques

MCB Rupee Traveler's Cheques were first introduced in 1993 as safe cash for

traveling and travel related purposes. The product has been extremely

popular and is preferred over cash by customers while traveling and in all

walks of life.

Corporate Banking

1) Cash Management Services

MCBs network of over 1200 branches in Pakistan enables it to collect and

disburse payments efficiently with its cash management services. This also

enables it to offer you a choice of paper based or electronic fund transfer

solutions including collection amounts, cross branch on- line transactions etc.

Page24

MCB Rupee Traveler's Cheques- The safest way to Carry Cash.

25

Internship

Report On MCB

2) Working Capital Loans

Based on the customers specific needs, the Corporate Bank offers a number

of different working capital financing facilities including Running Finance,

Cash Finance, Export Refinance, Pre-shipment and Post- shipment etc. Tailormade solutions are developed keeping in view the unique requirements of

your business.

3) Term Loans

MCB offers Short to Medium Term Finance to meet capital expenditure and

short term working capital requirements of our customers. The loans are

structured on the basis of underlying project characteristics and cash flows of

4) Trade Finance Services

Under Corporate Banking MCB offers trade finance services that include an

entire range of import and export activities including issuing Letters of Credit

(L/Cs), purchasing export documents, providing guarantees and other

support services.

Page25

the business.

26

Internship

Report On MCB

STRUCTURE OF BRANCH:

Mr. Shah Jahan Sahib is acting as a branch Manager in Kutchery Road

branch. Operational Manager of branch Ms. Imrana Parveen handled the

05 subordinates. This team is also headed by Mr. Shah Jahan Sahib.For

effective handling of branch; it has been categorized into two segments with

different people handling each category. These categories are:

a) Operations Manager

b) Credit Manager

Operational Manager is to be responsible of these activities:

Accounts Department

System

Remittances

Clearing

General Services

Page26

A) Operational Manager:

27

Internship

Report On MCB

B) Credit Manager:

Credit Manager is to look after all credit facilities like, Term Loans, Running

Finance facilities etc.

Fields of Activities of MCB Kutchery Road Branch:

The purpose of banks is to provide some services to the general public. The

main functions and services which MCB Bank Limited Kutcher Road Branch

provides to different peoples are as follows.

1) Open Different accounts for different peoples

3) Accepting various types of deposits

4) Granting loans & advances

5) Undertaking of agency services and also general utility functions, few of

those areas under:

a) Collecting cheques and bill of exchange for the customers.

b) Collecting interest due, dividend, pensions and other sum due to

customers.

c) Transfer of money from place to place.

Page27

2) Accepting various types of deposits

28

Internship

Report On MCB

d) Acting an executor, trustee or attorney for the customers.

e) Issuing of travelers cheques and letters of credit to give credit

facilities.

f) Accepting bills of exchange on behalf of customers.

g) Purchasing shares for the customers.

h) Undertaking foreign exchange business.

i) Furnishing trade information and tendering advice to customers.

DEPARTMENTS OF MCB BANK:

Organizations cannot function without proper arrangements for its specific

takes and duties. The process of grouping jobs according to some logical

arrangements is called departmentalization. MCB Bank Ltd is divided into

five departments. Following are five types of the departments established in

Deposits Department

Remittances Department

Clearing Department

Advances Department

Foreign Exchange Department

But in first two weeks I worked in tow departments, Deposits and

Remittances departments.

Page28

the said branch to facilitate the customers.

29

Internship

Report On MCB

Deposits Department:

Deposit department is one of the most important and main department of

the bank. It performs the vital function in the bank because it deals with the

supply of money to the bank. Deposits are the inputs of a bank. Deposits

department is just like a heat, as it function other department also run,

otherwise the whole system paralysis. Each and every bank tries its best to

increase their deposits. Deposits depict the financial strength of a bank.

Muslim Commercial Bank Limited is a unique and crucial institution, which is

Current account.

Saving account

Fixed account

Page29

able to increase credit in the country.

30

Internship

Report On MCB

Remittances Department:

Remittance department performs the function of remitting funds i.e. to

transfer funds for customers from one location to another. The transfer of

funds may be from one branch to another or from one bank to other

Remittances mean the transfer of money or fund from one place to another

place through bank. It may be inland remittance or Remittance

Within locality.

Outside locality.

Within Locality:When a branch situated in DG Khan is required to send the draft to any other

branch situated in the same locality, the process will say to be within locality.

I.e. MCB Tower branch DG Khan, send any draft to MCB Kutcery Road

Branch, this is known as within locality.

Pay Order

Pay order is used for payment within the cities; the main purpose of pay

Bank charge the commission for its services. The purchaser fill an application

form, which includes the amount of payment or order, the name of the payee

and complete address of purchaser and payee application form is also signed

by the purchaser.

Outside locality:Outside locality is an important type of inland remittances. Outside locality

means the transfer of money payable outside the city i.e. MCB Tower branch

Page30

order is to make payment in record this payment in the bank as evidence.

31

Internship

Report On MCB

DG Khan, sent any draft to a branch situated in Multan city. It is commonly

done through the following four means.

Kutchery Road Branch.)

Telegraphic transfer.

Demand draft

Mail transfer

Bank Draft

Telegraphic Transfer:

Telegraphic transfer is an important mode of remittance. It is the quickest

mean of transferring the funds from one place to another place by the use of

telephone or telegraphic. Now a day, new technology is used for this purpose

i.e. fax, e-mail. The big traders and businessman use this method of

remittance in this method of remittance the purchaser is not responsible for

the dispatch.

Demand Draft & Pay Order:

For safe, speedy, and reliable way to transfer money, Muslim commercial

reasonable rates. Any person whether an account holder of the bank or not,

can purchase a Demand Draft from a bank branch. A demand draft is an

order drawn by a bank on its branch or on another bank in a different place

requiring the later to pay on demand the sum of money specified in the

draft. Pay order is just like demand draft except the pay order is made for

local transfer of money whereas demand draft is meant for remittances of

funds from one city to another.

Mail Transfer:

Page31

bank Demand Drafts and pay orders are available for customers at very

32

Internship

Report On MCB

Mail transfer draft is one of the bank modes of remittance. Mail transfer is

issued by one branch of bank to another branch of the same bank by

instructing to branch to pay the other branch by issuing mail transfer

receipts. In M.T the purchaser is not responsible for dispatch, but the bank

will be responsible for dispatch.

Bank Draft:

Bank draft is the most important type of remittance. Draft is an instrument

issued by a bank. Draft is issued by one branch to another branch out of the

city. The difference branches of same bank can issue the bank draft to each

other and it is also called the banker cheques i.e. the main branch of MCB in

D.G.khan issued the draft to the MCB Multan.

PRODUCT FEATURES & ELIGIBILITY CRITERIA

CURRENT ACCOUNT

Non-profit

bearing

Account

transactional restrictions

PKR 1,000

account

Activation

Deposit

Min

Balance PKR 10,000

Requirement

Permissible

PKR

Currency

Transaction

Unlimited withdrawals and deposits

with

absolutely

no

Page32

Benefit

33

Internship

Report On MCB

Limit

Virtual

Available

Banking, MCB

Mobile

and

Call Center

Zakat

Taxes

No Zakat is deducted on Current Accounts as per the Zakat

& Usher Ordinance, 1980

as per No Zakat is deducted on Current Accounts as per the Zakat

applicable

& Usher Ordinance, 1980

Government

Laws

As

Eligibility

Individuals, Firms (Sole Proprietor, Partnership), Companies

(Public and Private Limited), Trust/ Clubs/ Societies and

BASIC BANKING ACCOUNT

Benefit

A Non-profit bearing account for small depositors who cannot

maintain a minimum balance in their accounts and who wish

Account

Activation

Deposit

to carry out the basic banking needs.

PKR 1000

Page33

Associations

34

Internship

Report On MCB

Min Balance NIL

Requiremen

t

Transaction

Limit

2 Free over the counter deposits (per month) & 2 Free over

the counter withdrawals (per month)

Charges

Available

Virtual

Banking,

MCB Mobile

and

Call

Center

Zakat

No Zakat is deducted on Current Accounts as per the Zakat &

Taxes

Usher Ordinance, 1980

As per Income Tax Ordinance 2001

Eligibility

Individuals only

Limitation

In case where balance in BBA remains ZERO for a

SAVING ACCOUNTS

Benefit

A regular Savings account for everyone with no transactional

Account

restrictions

PKR 100

Activation

Deposit

Min Balance NIL

Requiremen

t

Page34

continuous 06 month period, the account will be closed.

35

Internship

Report On MCB

Profit

Expected rate of return

Profit

Average Monthly Balance

Calculation

Profit

Semi Annually

Payout

Transaction

Unlimited withdrawals and deposits.

Limit

Internet

Available

Banking,

MCB Mobile,

SMS

Alerts

and

Call

Center

Zakat

Zakat is deducted as per the Zakat & Usher Ordinance, 1980

Taxes

Tax is deducted on Profit and Cash Withdrawals as per

Eligibility

Income Tax Ordinance 2001

Individuals, Firms (Sole Proprietor, Partnership), Companies

(Public and Private Limited), Trust/ Clubs/ Societies and

365 Savings Gold Account

Benefit

A Daily Product for high net worth customers with monthly

Account

returns and higher profit on higher deposits

PKR 100

Activation

Deposit

Min Balance NIL

Requiremen

Page35

Associations.

36

Internship

Report On MCB

t

Profit

Profit

As per declared profit rates

Average Monthly Balance

Calculation

Profit

Monthly

Payout

Transaction

Unlimited withdrawals and deposits

Limit

Zakat

Taxes

Zakat is deducted as per the Zakat & Usher Ordinance, 1980

Tax is deducted on Profit and Cash Withdrawals as per

Income Tax Ordinance 2001.

Fixed Deposit Account

Flexi

PKR 500,000

Deposit

Account

Profit

Profit

expected rate of return

On actual number of days in a year

Available

1 month, 2 months, 3 months, 6 months, 9 months, 1 year, 2

Profit

years, 3 years and 5 years

Quarterly, Semi Annually, Annually and Maturity.

Payment

Options

Zakat

Taxes

Eligibility

Zakat is deducted as per the Zakat & Usher Ordinance, 1980

Tax is deducted on Profit as per Income Tax Ordinance 2001.

Existing Account Holders Individuals, Firms and Companies. It

is a mandatory requirement for booking a Term Deposit to

Page36

Calculation

Tenors

37

Internship

Report On MCB

have a checking account (Current/Savings) in the Bank.

1

Mahana Profit Account

Mahana

PKR 500,000

Profit

Account

Profit

Tenors

expected rate of return

2 months, 3 months, 6 months, 9 months, 1 year, 2 years, 3

Available

Profit

years and 5 years

Monthly

Payment

Zakat

Taxes

Eligibility

Zakat is deducted as per the Zakat & Usher Ordinance, 1980

Tax is deducted on Profit as per Income Tax Ordinance 2001.

(Existing Account Holders) Individuals, Firms and Companies.

It is a mandatory requirement for booking a Term Deposit to

Page37

have a checking account (Current/Savings) in the Bank.

SPECIFIC DOCUMENT REQUIRED AS PER TYPE OF ACCOUNT

Individuals Accounts

A photocopy of any one of the following valid identity documents:

38

Internship

Report On MCB

i.

Computerized/ Smart National Identity Card (CNIC)/ (SNIC) issued by

ii.

NADRA.

National Identity Card for Overseas Pakistani (NICOP) issued by

iii.

iv.

NADRA

Pakistan Origin Card (POC) issued by NADRA

Passport; having valid visa on it or any other proof of legal stay

v.

along with passport (foreign national individuals only

In case of a salaried person, in addition to CNIC/SNIC, an attested

copy of his service card or last month salary slip or any other

acceptable evidence of service, including, but not limited to a

vi.

certificate from the employer will be obtained.

In case of individuals who are Self-Employed / Professionals /Private

Business Owners, BM must perform physical verification to ascertain

genuineness of customer and his/her source of funds and expected

type of counter parties. (Fact should be evidenced through VISIT

vii.

Report).

In case of non-salaried/un-employed individual, KYC should be

conducted with extra vigilance and source of income/ funds should

be validated prudently

For Housewife accounts, branches are required to obtain selfdeclaration for source of funds, funds providers,

beneficial

ownership of funds

Sole Trader / Proprietorship

Following documents must be obtained:

i.

ii.

iii.

iv.

v.

Photocopy of identity document of the proprietor.

Registration certificate for registered concerns.

Sales tax registration or NTN, wherever applicable.

Declaration of sole proprietorship on business letter head.

Account opening requisition on business letter head.

Page38

viii.

39

Internship

Report On MCB

Partnership Account

Following documents must be obtained:

i.

Photocopy of identity document of the all the partners and

ii.

authorized signatories.

Attested copy of Partnership Deed duly signed by all partners of

iii.

the firm.

Attested copy of Registration Certificate with Registrar of Firms.

In case the partnership is unregistered, this fact shall be clearly

iv.

mentioned on the Account Opening Form.

Authority letter from all partners, in original, authorizing the

person(s) to open and operate firms account while ensuring that

the given mandate does not violate or contradict with provisions

of the partnership deed. Accordingly it should be ensured that

v.

AOF/ SS card is signed by the authorized partners only.

AOF must contain full information about all partners regardless of

Page39

them being signatories or not.

Companies registered under companies ordinance 1984

i.

Certified copies of:

a. Resolution of Board of Directors for opening of account

specifying the person(s) authorized to open and operate

the account. (Duly Signed by all

40

Internship

Report On MCB

b. Directors OR Company Secretary) and company seal is

affixed however the signatories on Board of Resolution for

opening an account shall be governed by Authorities

spelled out in the Memorandum & Articles of Association

c. Memorandum and Articles of Association.

d. Certificate of Incorporation.

e. Certificate of Commencement of Business, wherever

applicable.

f. List of Directors

ii.

on

Form-A/Form-B

issued

under

Companies Ordinance 1984, as applicable.

g. Latest List of Directors.

Photocopies of identity documents of all the directors and

persons authorized to open and operate the account.

FUNDS TRANSFER

OVERVIEW

Fund Transfer Application (SF-100R) and Deposit Slip is used to transfer funds

from one account to another account OR to another branch of MCB OR to

another Bank (through Real Time Gross Settlement System). Branches should

ensure that the information on FTA is complete in every aspect; is signed by

verified and that the funds are available in the account before accepting the

FTA for processing. For strengthening control, Valid Crossed Cheque(s) of

equivalent amount will be taken from the customer along with FTA.

PROCEDURE FOR INTERNAL FUNDS TRANSFER

Customer: Presents duly completed Funds Transfer Application (FTA) along

with a crossed cheque to the TSO in order to credit Beneficiarys account.

Page40

the account holder(s)/ authorized signatory; signatures are religiously

41

Internship

Report On MCB

i.

Receives Funds Transfer Application from the customer along with

ii.

crossed cheque

Checks the FTA for completeness e.g. Date, Title of Account,

Account number, account holders Signature and contact number

iii.

(mandatory).

Verifies the details & customers signature given on FTA and

iv.

Crossed Cheque (both) with the CBS.

The Status of the Crossed cheque with the FTA should be valid. It

will be checked in CBS for validity of instrument serial number and

v.

vi.

that the status is not stopped / cancelled.

Ensures that any cutting on the FTA is signed by the account holder.

Affixes Transfer Stamp and sign as per assigned financial

vii.

transactional limit on the FTA.

Provides customers copy to the customer.

PROCEDURE FOR CHEQUE DEPOSIT

Customer Presents duly completed deposit slip along with the cheque to the

i.

ii.

Receives cheque along with deposit slip from the customer.

Before processing the transaction, verifies Drawers signature and

iii.

iv.

check sufficient funds are available in the account

Marks his initials on reverse side of cheque.

Affixes Transfer Stamp and signs as per assigned financial

v.

transactional limit on Deposit Slip and Cheque,

Provides copy B to the customer.

MCB HOME REMITTANCES

Customer will provide digit code/ Pin to Designated Officer.

Page41

TSO:

42

Internship

Report On MCB

1. Express Money

2. SPEED CASH

Designated Officer

i.

Enters digit code/ Pin provided by the customer in SSO System web

ii.

based application and extract detail of the message/ transaction.

Matches the beneficiary detail with original valid CNIC / Passport

/Driving License and obtain copy and stamp it as Original Seen

iii.

and sign off.

After being satisfied with the credential of customer, confirms the

transaction on SSO and takes print of detail and prepares cash debit

iv.

voucher and sign off.

Vouchers and supporting documents are forwarded to BOM for

v.

approval.

/BOM after validation of transaction with source document, counter

LOCKER MANAGEMENT

OVERVIEW

Branches all over the country offer Safe Deposit Lockers facility to their

customers. The lockers are invariably to be installed in the Strong Room of

the Branch to ensure maximum security against burglary, theft and riots.

Each locker irrespective of its size has a separate number and is fitted with a

Page42

signs the voucher and forward to TSO for cash payment

43

Internship

Report On MCB

double key lock which cannot be opened except with the two keys, one being

Master Key under the custody of Manager/Authorized Officer and the other

possessed by the customer. The relationship subsisting between Bank and

Person to whom locker is rented out will be that of a Licensee and a Licensor

and not that of a customer and banker.

ISSUE OF LICENSE

Before issuing a license for the use of Locker, the branch must make sure:

i.

Licensee maintains an account in any MCB branch in the same city,

preferably but not necessarily in the branch where the Locker

ii.

iii.

facility is required.

KYC is updated

A license for this purpose can be issued in single or joint names

PROCEDURE FOR ISSUANCE OF NEW LOCKER

Customer requests for Locker facility. Lockers will not be issued against cash;

customers will be required to open an account with the bank to avail this

facility. General Banking Officer: gets the following forms / formalities

i.

ii.

iii.

iv.

Locker Application Form

Specimen Signature Card

Valid copy of CNIC.

The Locker can be issued against a singly or jointly operated

account. If Locker is opened in the name of joint account holders

then particulars of all the applicants will be entered in the Locker

Application Form. However, Lockers Specimen Signature Cards are

obtained for only those customers / mandate holders who are

authorized to operate the Locker.

Page43

completed from the customer:

44

Internship

Report On MCB

v.

In case of photo account, branch must ensure to take fresh

photographs of the customers and paste them on the Locker SS

card.

TERMINATION OF LICENSE

Customer can terminate the contract by giving a written request to the bank.

The designated Locker custodian / authorized staff will check for pending

Locker rent. In case the rent has not been recovered for the last term (or

earlier) the customer will be required to deposit the amount before Locker

can be surrendered. The customer will also handover the Locker key to the

designated Locker custodian / authorized staff.

Once the Locker has been surrendered by the customer it needs to be

cancelled in CBS in order to make it available for re-assignment to another

customer.

In order to cancel a Locker in CBS designated officer has to first refund the

Locker Key Deposit.

System will not allow closing of Locker, if Locker related charges are

customer account to process further.

So Lockers holder will deposit uncollected charges into his account and

system will settle these uncollected charges automatically during End of Day

(EOD). Once uncollected Lockers charges have been recovered, designated

officer will initiate the Locker closure process.

Page44

uncollected. Designated Officer has to recover uncollected charges from

45

Internship

Report On MCB

USE OF LOCKER

The locker will not be used or permitted to be used for any purpose other

than the deposit of documents, jewelry or other valuables etc. No property of

an explosive or harmful nature and any contraband items etc. will be

deposited therein.

KEY DEPOSIT

Apart from rent/License fee presently in force, a 'Certain' amount as per

Schedule of Bank Charges will be payable as key deposit. This amount will be

refunded to the licensee on surrendering of Locker and key and clearance of

dues, if any. System will automatically deduct and refund Locker key deposit

at the time of Locker issuance and surrender to link account.

PAYMENT OF RENT

The Lockers rent / License fee as per the Schedule of Bank Charges will be

payable in advance on yearly basis and will not be refunded in the event of

the Locker being surrendered earlier than the expiry of the term of the

License.

Annual Locker rent will be deducted in advance on the basis of

automatically deduct annual Locker Rent (in advance) on yearly basis from

link account.

AUTOMATED TELLER MACHINE

ATM is a self-service multi-functional system which, not only provides

convenience and flexibility to customers but also helps the Bank to reduce

the work load and cash handling cost at the branches counters.

ATM MANAGEMENT GUIDELINES

Page45

information captured at the time of Locker issuance in system. System will

46

Internship

Report On MCB

i.

ATM CCTV/DVR Surveillance Camera. CCTV stands for Closed Circuit

TV. CCTV uses one or more video cameras to transmit video images

and sometimes audio images to a monitor, set of monitors or video

recorder. ATM CCTV / DVR systems are used for surveillance of all

ii.

customer transactions that take place at ATM premises.

The purpose to install ATM CCTV / DVR setup across the ATMs is to

ensure the surveillance of transactions and any kind of unforeseen

event; The CCTV / DVR setup can help to provide a satisfactory &

secure

iii.

environment

for

the

customers

as

per

regulatory

requirement.

It is of utmost importance that all the ATM lobbies must have CCTV /

DVR setup installed. Branch must intimate ATM Support Team if

camera is not available as soon as the circular is issued. It is the

responsibility of the BM & BOM to ensure that the already installed

CCTV / DVR setup is in working condition. All DVR Cameras must be

iv.

connected with UPS and Genset.

The Camera in the ATM lobby should be installed in such a way that

it should not capture the ATM PIN Pad. Also it should be placed to

clearly record and visualize all the activities in ATM vicinity.

(wherever possible) and out of reach of the customer.

24*7 ATM HOTLINES

Hotlines are dedicated PTCL lines that are installed across the ATMs as

per the instructions of the regulator. These hotlines are directly

connected to 24*7 MCB Call Center to resolve day to day operational

issues at ATMs.

Page46

Additionally, it should be ensured that the camera is hidden

47

Internship

Report On MCB

i.

The purpose of hotlines is to provide immediate assistance to the

customers via phone. When customer picks up the phone

installed at ATM premises he/she comes in contact with the call

center agent for immediate support. All hotlines installed at ATM

locations are connected to PRIs which bypasses the IVR option on

calls generating from ATM booths. These PRIs route the customer

calls to call center agent directly in order to provide immediate

ii.

support to customer.

The branch is solely responsible for the maintenance & upkeep of

hotlines. Branch must engage its local PTCL office or technical

resources in case of malfunctioning of the hotlines. The records

of the communication / follow-up with PTCL should be filed

iii.

iv.

properly for reference.

All branches must pay their monthly bills without any delay.

The ATM custodian branch is responsible to ensure phone set(s)

availability in ATM lobby all the time. Any broken phone set must

be replaced as soon as it is found damaged / lost.

v.

COMPLAINT BOXES

required to ensure that ATM Claim forms are also placed in ATM vicinity

at all times so that customers can lodge claims in-case of ATM

transaction failure. The purpose of complaint boxes is to maintain the

environment for communication between customer and bank and to

resolve customer queries / complaints / claims as quickly as possible. It

is necessary to visit ATM vicinity on daily basis and clear the box

thereof and send the customer complaints on following address.

ATM TRANSACTION CUSTOMER SNAPS

Page47

The complaint boxes are installed across the ATMs. Branches are

48

Internship

Report On MCB

ATM captures 3 snaps of customer during a transaction. These snaps are

taken at the time of Card Insertion, when cash is presented and when card is

ejected. These snaps are archived on a centralized location on daily basis.

ATM transaction snaps are used as secondary evidence incase customer logs

the claim against any ATM transaction.

Guidelines

a. Sufficient lighting in ATM lobby and also ensure that the light is NOT

directly reflecting on ATM camera.

b. Regular ATM room cleanliness, to avoid dust particles entered in ATM

camera protected glass shield.

c. Incase ATM room has glass wall/door, proper cover either through

branding or stickers should be pasted to minimize direct sunlight and

provide confidentiality and secrecy to the customer during the ATM

usage

d. Necessary preventive action should also be taken on avoid direct

sunlight to ATM screen/camera.

ATM CASH REPLENISHMENT

It has been experienced that there is availability of fake currency in the

market so it is really essential to check cash before replenishing it in the

ATM. Proper checking of notes will minimize fake currency circulation and

also helps to avoid customer inconvenience. This is branch responsibility to

feed fresh currency notes in ATM. it is better to feed sequence wise notes.

Soiled, stapled, stacked low quality notes are strictly not allowed as such

notes cause ATM damages. Note sorters should be used wherever available.

Page48

Checking Fake Currency Notes

49

Internship

Report On MCB

Replenishment Procedure

ATM Custodians are required to visit the ATM for Cash Replenishment

purpose at 12:00 Hrs. on a daily basis and shift the ATM status from Active

to Supervisory Mode and will:

i.

ii.

Remove the Scroll along with summaries printed by the machine.

Remove the remaining cash from all cassettes including Divert

iii.

Cassette.

Clear Cash Counter before replenishment the new cash in ATM.

iv.

Physically count and load the cassettes with fresh cash.

Start the ATM for next cycle.

CASH MANAGEMENT OVER LONG WEEKENDS/OFF-DAYS & HOLIDAYS

To ensure continuous availability of ATM facility during long weekends, offdays, bank holidays and specially during Eid days a branch must ensure the

sufficient cash availability in ATM round the clock. Cash outages make ATMs

unavailable

to

the

customers

resulting

into

customer's

inconvenience/dissatisfaction and also expose the Bank to reputational/

weekends/ offdays/ holidays. To minimize occurrence of cash outages in

general and particularly over long weekends/ offdays/ holidays, branches

need to be more vigilant while replenishing ATMs on last working days before

long holidays.

FINANCES / ADVANCES DEPARTMENT:

Besides deposits the other major function of the bank is to advance money

to the client. This function of the bank contributes great deal to the revenues

Page49

regulatory risks and likelihood of such occurrences are even higher on long

50

Internship

Report On MCB

of the bank. Due to its importance for the bankers success, this area is given

special importance and attention. The primary purpose of this department is

to encourage small business to take loans and help them in their business.

The bank earns from the advancement of loan to the people or organization

and charges a certain percentage of interest on it and bank earns profits.

Besides deposits the other major function of the bank is to advance money

to the client. This function of the bank contributes great deal to the revenues

of the bank. Due to its importance for the bankers success, this area is given

special importance and attention.

The bank also makes advances to small size businesses and construction

companies etc. Many MCB branches are having department for granting

advances to the borrowers.

By Cash Credit:

Through this credit facility, the bankers advances loan to the borrower after

having tangible asset as a security. Main characteristics of this facility is that

the total amount is not given to the borrower at one rather it is given in

installments, or whenever required. The borrower has to pay the interest only

large commercial and industrial enterprises. The cash credit facility is given

through hypothecation or pledging of goods. Some requirements in

hypothecation:

Custody of stock remains with the borrower.

Banks lien on the stock.

Stock hypothecated must be insured against ire etc.

Customer must submit the stock report on monthly basis.

Page50

on the amount outstanding against him. This credit facility is very liked by

51

Internship

Report On MCB

Frequent stock verification to be done by MCB.

Bank may sent officers or staff in order to supervise verification.

Some characteristics of pledging assets against loan.

Stocks are pledged with the bank under banks lock and key.

Stock must be duly insured against fire and burglary.

On monthly basis stock report has to be prepared by the borrower duly

incorporating delivery of goods, if any during the months.

Delivery of Goods / stock is made against cash payments.

By Discounting Bills Of Exchange:

This credit is a very advanced form of advancing money / credit to the

borrower. It is also termed as factoring. In this facility the bank

purchases the bills of exchange from the borrower. The bank gives face

value of the bill to the borrower after deducting interest on the

Page51

remaining period required for the bill to mature.

STRUCTURE & FUNCTIONS OF ACCOUNTS/FINANCE:

Accounts department is responsible to keep the record of each and every

transaction and prepare reports about the amount of deposits and advances

52

Internship

Report On MCB

and sent to Head office or State Bank of Pakistan on monthly, quarterly and

yearly basis.

DEPARTMENTS OF ACCOUNTS/FINANCE:

The Accounts and Finance department of MCB Kutchery Road Branch

D.G.Khan deals with various routine activities for the bank. The main

activities performed by it are:

a) Budgeting

b) Reporting

c) Maintenance & depreciation of fixed assets

d) Miscellaneous functions

Budgeting:

Accounts and Finance department of a MCB Kutchery Road Branch, for a

year makes budget of branch. Fiscal year of bank starts from January 01 and

ends on December 31. The accounts department starts preparing budget

from October for the next year.

Reporting:

various departments together. Each and every minute detail is provided in

weekly, monthly and annual reports. The reports are submitted to head

office, SBP and to the government. The accounts department prepares many

reports, of which the most common are:

Statement of Affairs

Income & Expenditure

Business Report

SBP Report

Page52

Accounts and Finance department, in the form of reports, clubs the details of

53

Internship

Report On MCB

Outstand Receipt Report

Maintaining of Fixed Assets & their Depreciation:

Accounts and Finance department maintains the record of all the assets and

charges depreciation on them. The bank normally uses the straight-line

method to compute the depreciation. It is calculated on monthly basis and

charged yearly. Bank not only depreciates the existing assets but also the

assets but also the assets transferred in and transferred out.

Miscellaneous Functions:

Accounts and Finance department also performs some other miscellaneous

Closing Entries

Daily activity checking

Report Generation

Minor expense recording

Closing Entries:

Accounts and Finance department also passes the closing entries on

monthly, 6 monthly and yearly bases to calculate the profit and analyze the

overall performance for a certain period.

Daily Activity Checking:-

Page53

functions like

54

Internship

Report On MCB

All the operations performed in various departments of MCB Bank Kutchery

Road Branch D.G.Khan are computerized. The functions are performed

through the customized software. In order to facilitate double-checking of all

the transactions done, every concerned official also passes vouchers and

cheques manually. At the day end all the vouchers passed by various officers

working in different departments are given to Accounts Department

Report Generation:

The reports generated by the accounts department on a daily, weekly,

monthly, biyearly and yearly are written in a proper format. It is neither

necessary nor possible to get acquainted by all of these reports in a short

Daily Advance and Deposit Position:-

Daily Exchange Position

Daily Fund Management

Closing Reports

Monthly Assets & Liabilities

Monthly Budget Review Report

Monthly Monitory Statement

Page54

period of time. Some of the common reports are:

55

Internship

Report On MCB

Monthly Performance Review Report

Monthly fixed investment

From these statements, five reports carry extreme importance. The five

reports are:-

Daily position of advances and deposits

Statement of affairs

Daily exchange position report

Fixed assets statement

Monthly Review of performance.

Minor Expense Recording:

The account department of MCB Bank Kutchery Road Branch has to record

even the minor expenses of the branch like tea for the staff, stationery for

the branch.

Cash Department:

In cash department both deposits and withdrawals go side by side. This

department works under the accounts department and deals with cash

deposits and payments. This department maintains the following sheets,

Cash received voucher sheet.

Cash paid voucher sheet.

Paying-in-slip

Cheque Book

Cash balance book

Page55

books, ledger of account:

56

Internship

Report On MCB

Cash department is performing its job completely through computers. Only

two peoples are working in cash department. The only instrument that can

be used to withdraw an amount from an account is the Cheque book. Cashier

manually inspects the Cheque for following:

Signature & date

Cross cutting

Drawee's a/c title

Amounts in words & figures

Two signatures at the back

The cheques should not be stated as postdated. If in the Cheque there May

discrepancy regarding any of the aspects described above the Cheque is

returned to the customer for rectification. On other hand if the Cheque is

valid in all respects, the cashier enters the necessary inputs in the computer

and posts the entry so that account balance is updated. The cashier at the

same time maintains the Cash Voucher Received Record Sheet". Then

inspect the signature of the customer cancellation mark of checking officer

customer.

Cash Received:

For depositing the cash into customers accounts, there is need to fill in the

paying in slip giving the related details of the transaction. This paying-in-slip

contains the date, a/c/no, a/c title, particulars, amount being deposited and

details of the cash. There are two portion of the paying-in-slip. The depositor

signs the one part of the paying-in-slip one is retained by the bank to show

Page56

and stamp of POSTED is placed on Cheque before hand over the cash to

57

Internship

Report On MCB

an acceptance of the entries made in the slip. The paying-in-slip serves as a

voucher to update to computerized transaction ledger.

The cashier is responsible to receive both the paying-in-slip and cash from

the depositor. The cashier checks the necessary details provided in the

paying-in-slip and counts the cash before he/she tallies with the amount

declared in the slip. If the amount does not tally with the cash given, the

deposit is not entertained until the customer removes the discrepancy. On

the other hand if the two amounts tally, the cashier fills in the Cash voucher

received Record Sheet and assigns a voucher no. Accountant verifies all the

entries in the two documents, if the entry in the two documents tally with

one another, the accountant authenticates the two by singing on the two

documents and posting stamps on the slip. One part of the slip is then

returned to the customer and other is given to the computer operator.

The 2nd cashier posts the transaction entries in computer ledger. This ledger

contains the a/c no, a/c title, voucher no, voucher date, transaction code,

transaction amount. After posting these entries, computer display before

an output of transaction ledger. He assigns the stamp POSTED on the

voucher to show voucher transaction entries are posted.

Cash Book Balance:

At the end of the working day cashier is responsible to maintain the cash

balance book. The cash book contain the date, opening balance, detail of

cash payment and received in figures, closing balance, denomination of

government notes (Currency). It s checked by manager. The consolidated

Page57

posting balance and after posting. On every transaction computer generates

58

Internship

Report On MCB

figure of receipt and payment of cash is entered in the cash book and the

closing balance of cash is drawn from that i.e.

Opening Balance of Cash + Receipts - Payments = Balance

The closing balance of today will be the opening balance of tomorrow.

Clearing department:

Every bank performs the function of paying and collecting. The cheque

drawn on other bank by the customer of the bank is collected by the bank for

or without charging fees is called clearing.

Clearing of bank instrument include collection and payments of cheque,

demand draft, payment order and dividend warrant etc. it is the greatest

service provided by the bank. It facilitates the customer a lot essential

function of commercial bank is to receive deposit and to honor cheque drawn

Collection and payments of instrument are known as outward and inward

clearing. During my training in clearing department Mr. Ishfaq and qaisar

abbas help me a lot.

Types of clearing:

Following are the three types of clearing;

Outward clearing

Inward clearing

Page58

upon them. Usually cheque is used for making payment to account holder.

59

Internship

Report On MCB

Same day clearing

Outward clearing:

Scrutiny of the deposit slip:

During my internship in clearing department I check that deposit slip and the

cheque should be properly scrutinized before accepting them.

a)

b)

c)

d)

e)

Title and account number are mentioned

Amount tallies with that of cheque

The amount in words and figures are same

There are no unauthorized alternation

The amount, account number, and the title of account in the

customer copy are same as in the original pay in slip.

f) The pay in slip bears the depositors signature and contact number.

Scrutiny of instrument:

Following point should be properly check

b)

c)

d)

e)

dated or incomplete dated

There is no unauthorized alteration on the cheque

Payee name and drawer signature is present

Particulars of cheque should be written with permanent ink.

The amount in both words and figures is required and both should be

f)

match

Any endorsement and special crossing are in order

Procedure for the outward clearing:

Customer present duly completed deposit slips with this instrument to the

clearing teller. Clearing teller receive deposit slip and instrument and check

deposit slip

a) Account number and title of account

b) Signature on the deposit slip along with depositors contact no.

Page59

a) The cheque is not postdated or undated or stale dated or invalid

60

Internship

Report On MCB

c) Amount in words and figures are same/identical

I

d) nstrument amount tally with amount mention on deposit slip.

Scrutinizes instruments.

a)

b)

c)

d)

e)

Validate the customer account number

Endorsement and special crossing are in order

No un_ authorized alteration

Amount in words and figures are identical

The instrument is neither post dated nor undated or stale

Instrument pertain to within city

Intercity instrument will be sent via intercity clearing or collection

arrangement.

Than a fix banks clearing stamp and sign off deposit slip and return

customer copy B to the depositor customer receive B copy of slip and leave

the branch. Clearing processors endorse and sign of on the reverse of

instrument as per the requirement.

Than detach deposit slip from the instrument and enter details on manual

1.

Account number

2.

Title of the beneficiary

3.

Name of bank

4.

Name of city

5.

Total amount

Same day clearing: customer present duly completed deposit slip along

with the instrument to the clearing processor. Clearing processor determine

whether it is same day clearing same is categorize as below.

1.

Amount 500k and above

Page60

register or on an excel sheet detail include

61

Internship

Report On MCB

2.

Both receiving and paying bank are member of same day clearing NIFT

3.

Cheque is received before 9:30 am

Types of cheque collected by clearing department:

a) Transfer cheque

b) Transfer delivery cheque

c) Clearing cheque

Transfer cheque: transfer cheque is collected and paid by the same branch

of the bank.

Transfer delivery cheque: which are collected and paid by two different

branches of a bank located in same city this is called transfer delivery

cheque.

Clearing cheque: when the endorser and endorsee of cheque maintain

their accounts in different banks the collecting bank can receive the amount

of cheque from the endorsee bank .It can send its delegate to each of the

paying to collect the amount of cheque. But this procedure is risky and time

SHORT FALL/WEAKNESSES OF THE ORGANIZATION:

There are the following shortfalls, which I have observed during my internship period in the

MCB Bank.

A behavior has been noted that bank tries to feel at ease with good looking, rich and

educated people and the poor looking customers feel some bit strange in the environment

of the bank. The bank employees should try to accommodate behaviorally all type of

customers.

Page61

wasting. It can maintain account with different paying bank.

62

Internship

Report On MCB

In MCB there is lack of specialized skill because of job rotation policy of human resource

department. The bank should concentrate upon increasing its abilities on individual

service basis.

Mismanagement of time is another big mistake in MCB branches, the bank official time

of closing is 5:30 pm but due mismanagement of time allocation and work the staff is

normally on their seats till 7:00 or 8:00 clock.

MCB is centralized. It means authority is not delegated to branch level. Manager cannot

take initiative regarding different financial decision.

The majority of people are not well aware about the products of MCB Bank it is due to

their very low services of promotional activity.

There is low level of motivation in the employees of the bank.

Rupee Traveler Cheques of MCB Bank can be used in the Pakistan only, because of that

MCB Bank is not able to enhance its revenues and funds.

Bank is not introducing new products these days, so bank should boost the product

development and increase the range of facilities offered for customers to enhance its

Page62

deposits. And the rates of interest on its various products have been reduced.

CONCLUSION:

No doubt MCB is having a lot customers and resources (financial, Human resources, etc) but the

time is came when competition will force company to change its policies to become favorite in

banking world within Pakistan & keep its current place & customer base because at present the

Pakistan economy is feeling heat of recession, as a result banking sector in Pakistan will be

directly affected.

63

Internship

Report On MCB

Almost all the financial indicators of MCB are in the favor of company and also for the investors

under the period of analysis from fiscal year 2008-2013 .It is established that MCB is one of

those banks, whose progress is good comparatively and a higher profit rate. The profit of MCB

has grown consistently during the last few years and this trend is expected to continue into the

future. Therefore, it is concluded that MCB has a very prosperous present and future, which

assures the shareholders of wealth maximization. Side by side of it I think that if bank would be

able to cover and control on the above mentioned recommendations then it would be in such a

situation that will really lead it towards the road of prosperity, development and integrity and

with the above mentioned sentences I think there is too fault of the customers and in order to

make the proper working of the bank the customers should also cooperate with the bank which

will be really a good, ambitious and diligent condition for the bank and then bank will be really

Page63

in such a situation and to compete its competitors in the country as well as on international level.

Recommendations

i.

Before adopting or changing any rules or policies of the bank, efforts should be made to

first of all provide sufficient training to the staff. Providing proper training to the staff

member periodically

64

Internship

Report On MCB

ii.

For avoiding duty timing problem, all the departments should have appropriate staff

members.

iii.

The banks may choose to make its existing products distinctive or to introduce new

products. It is often easier to benefit from adverse changes made by other banks than to

attract customers by innovations.

iv.

A short term promotional technique is to offer price incentives, for example, low interest

rates on advances or limited issue high profit bearing term deposits. Longer term, a Loss

Leader may be offered. For example, profit bearing current accounts are not very

lucrative but any bank can not afford not to offer these. The reduced profits can be

augmented by profits made on other products.

v.

It might be possible to attract another type of personal customers through business

accounts, namely directors and denier employees, etc. Again an incentive package could

be put together.

vi.

It is widely known that there is a substantial Black Economy in Pakistan, Where people

earn income that is undisclosed to the revenues authorities.

vii.

Arguably, there has been a little encouragement from banks to persuade people to open a

viii.

It is also possible to attract/retain personal customers by investment in new technology

like ATMs and Telephone Banking facilities, which made the services quicker, easier,

cheaper and more flexible.

References

Mr.ShahJahan Tareen (Manager MCB)

Page64

bank account.

65

Internship

Report On MCB

Mrs.Imrana Perveen (Manager Operation MCB)

Mr. Abdul Lateef

(General Banking Officer)

Mr. M.Arsalan

(Cashier MCB)

www.mcb.com.pk

MCB Annual Report

www.sbp.gov.pk

www.wikipedia.org

www.google.com

Page65

You might also like

- Your Business Fundamentals Checking: Account SummaryDocument10 pagesYour Business Fundamentals Checking: Account SummaryLando SimmondsNo ratings yet

- Vision and MissionDocument10 pagesVision and MissionMun YeeNo ratings yet

- Fo Task List For Night ShiftDocument2 pagesFo Task List For Night ShiftKumar Aditya ChambyalNo ratings yet

- Wells Fargo Expresssend Remittance Transfer RecordDocument1 pageWells Fargo Expresssend Remittance Transfer RecordCarlos Eduardo Najera Farias100% (1)

- Delivering the Ultimate Client Experience: Less Stress, More Income, Greater Personal FreedomFrom EverandDelivering the Ultimate Client Experience: Less Stress, More Income, Greater Personal FreedomNo ratings yet

- English NurseryDocument6 pagesEnglish NurserySadam Birmani100% (1)

- L2 Merchant AcquiringV1.0Document59 pagesL2 Merchant AcquiringV1.0Shweta AgrawalNo ratings yet

- Silk Bank Internship ReportDocument33 pagesSilk Bank Internship Reportsohail merchant0% (1)

- Successful Hiring for Financial Planners: The Human Capital AdvantageFrom EverandSuccessful Hiring for Financial Planners: The Human Capital AdvantageNo ratings yet

- Reviewer in NegoDocument9 pagesReviewer in NegoMhayBinuyaJuanzonNo ratings yet

- Account Statement: Folio Number: 1017949588Document2 pagesAccount Statement: Folio Number: 1017949588Z Limtsukiu Khiungrü YimchungerNo ratings yet

- Report Final For Ahad For PrintDocument67 pagesReport Final For Ahad For PrintSadam BirmaniNo ratings yet

- Internship Report On MCB BAnk 2010Document105 pagesInternship Report On MCB BAnk 2010Its_Aurangzeb100% (1)

- USM Final Internship ReoprtDocument40 pagesUSM Final Internship ReoprtShining Eyes100% (1)

- Internship Report On MCB Bank LimitedDocument42 pagesInternship Report On MCB Bank Limitedbbaahmad89No ratings yet

- Internship Report ON Muslim Commercial Bank: Branch ManagerDocument35 pagesInternship Report ON Muslim Commercial Bank: Branch ManagerRida FatimaNo ratings yet

- MCBDocument84 pagesMCBTari Baba100% (2)

- Internship Report On MCB Bank Ltd. (Specialization in Banking & Finance)Document95 pagesInternship Report On MCB Bank Ltd. (Specialization in Banking & Finance)Khurram JavedNo ratings yet

- Business OperationsDocument27 pagesBusiness Operationsluckyhappy786No ratings yet

- MCBDocument31 pagesMCBkinza buttNo ratings yet

- Internship Report On MCB Bank LimitedDocument40 pagesInternship Report On MCB Bank Limitedbbaahmad89No ratings yet

- Stm-Question BDocument8 pagesStm-Question BfelistasNo ratings yet

- New Microsoft Office Word DocumentDocument101 pagesNew Microsoft Office Word DocumentKhursheed AhmadNo ratings yet

- Shahid, S Report On Abl LTDDocument46 pagesShahid, S Report On Abl LTDShahid IqbalNo ratings yet

- Qdoc - Tips Internship Report On MCBDocument50 pagesQdoc - Tips Internship Report On MCBRaza AliNo ratings yet

- Internship Report On MCB Bank LTDDocument66 pagesInternship Report On MCB Bank LTDbbaahmad89No ratings yet

- Dubai BankDocument43 pagesDubai BankArslanMehmoodNo ratings yet

- BC12010 (M)Document109 pagesBC12010 (M)Life EndNo ratings yet

- MCB Bank LTDDocument30 pagesMCB Bank LTDanam tariqNo ratings yet

- MCB Project ReportDocument18 pagesMCB Project ReportAyaan Muhammad0% (1)

- MCB ReportDocument30 pagesMCB ReportCrazy FootballNo ratings yet

- MBL Internship ReportDocument34 pagesMBL Internship ReportAyman Ahmed Cheema0% (1)

- A Financial Study of MTBL BangladeshDocument38 pagesA Financial Study of MTBL BangladeshMd. Kamrul Islam RofeNo ratings yet

- Full ReportDocument32 pagesFull ReportmyrepoortNo ratings yet

- NIB Bank Business Policy and StrategyDocument29 pagesNIB Bank Business Policy and StrategymedrekNo ratings yet

- HBL Internship ReportDocument25 pagesHBL Internship ReportLuqman AliNo ratings yet

- Internship Report On MCB Bank LimitedDocument41 pagesInternship Report On MCB Bank LimitedAmanullah KhanNo ratings yet

- Internship Report of MCBDocument65 pagesInternship Report of MCBbbaahmad89No ratings yet

- Full Report RecDocument56 pagesFull Report RecRehan UllahNo ratings yet

- Chap - 2-3Document20 pagesChap - 2-3shaik iftiNo ratings yet

- Xecutive SummaryDocument21 pagesXecutive SummaryAli ImranNo ratings yet

- An Overview of BRAC Bank LimitedDocument4 pagesAn Overview of BRAC Bank LimitedHuq Ziaul100% (1)

- An Appraisal of The Performance of Mercantile Bank LimitedDocument68 pagesAn Appraisal of The Performance of Mercantile Bank LimitedarcrusselNo ratings yet

- Ahmed ReportDocument36 pagesAhmed Reporthassan_shazaibNo ratings yet

- The City BankDocument6 pagesThe City BankSafin MostafizNo ratings yet

- Bank Alfalah Limited 2Document113 pagesBank Alfalah Limited 2Imtiaz HussainNo ratings yet

- Objective of The ProjectDocument25 pagesObjective of The ProjectNazmul Islam Khan TutulNo ratings yet

- NIB Bank Business Policy and StrategyDocument29 pagesNIB Bank Business Policy and StrategyFaizan Tafzil100% (10)

- Akif ZiaDocument86 pagesAkif ZiaSajjAd HAiderNo ratings yet

- Habib Bank Intership Report by Junaid JavaidDocument40 pagesHabib Bank Intership Report by Junaid JavaidniceandfineNo ratings yet

- R177014C Caroline Nhunzvi: First Capital Bank in Association With Barclays: Retail DepartmentDocument33 pagesR177014C Caroline Nhunzvi: First Capital Bank in Association With Barclays: Retail DepartmentTapiwa AmisiNo ratings yet

- Final Project MCBDocument49 pagesFinal Project MCBAmber RazaNo ratings yet

- Introduction of MCB: IncorporationDocument11 pagesIntroduction of MCB: IncorporationAli Jameel75% (4)

- Internship ReportDocument50 pagesInternship ReportAbdul Rauf RajperNo ratings yet

- Submitted To:: "Your Satisfaction First"Document77 pagesSubmitted To:: "Your Satisfaction First"Rajiv KharbandaNo ratings yet

- Federal-Bank Cheat SheetDocument6 pagesFederal-Bank Cheat Sheetshagun guptaNo ratings yet

- Internship ReportDocument65 pagesInternship ReportPakassignmentNo ratings yet

- Meezan BankDocument83 pagesMeezan BankAsifaNoreenNo ratings yet

- Bop (Amna)Document114 pagesBop (Amna)Aminah TariqNo ratings yet

- Prime Bank LimitedDocument63 pagesPrime Bank LimitedRobayeth RobsNo ratings yet

- Term Paper On AIBLDocument35 pagesTerm Paper On AIBLpriya.sahaNo ratings yet

- Achievements: - Business Internship ReportDocument10 pagesAchievements: - Business Internship ReportSamad AbbasNo ratings yet

- AboutDocument3 pagesAboutIbrar Ul HassanNo ratings yet