Professional Documents

Culture Documents

Paper 1 PDF

Uploaded by

tjarnob13Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Paper 1 PDF

Uploaded by

tjarnob13Copyright:

Available Formats

International Journal of Empirical Finance

Vol. 2, No. 4, 2014, 143-151

Liquidity-Profitability Relationship in Bangladesh Banking Industry

Afia Akter1, Khaled Mahmud2

Abstract

This study explored the relationship between liquidity (measured as current ratio) and profitability (measured

as return on assets) in the banking industry in Bangladesh. We have considered twelve banks in four different

sectors (Government banks, Islami banks, multinational banks and private commercial banks). We tried to

figure out how much liquidity of a bank can explain its profitability. We ran linear regression to find out the

extent of relationship between banks liquidity and profitability (significance level was 10%). Individually all

the sectors show no significant relationship between liquidity and profitability. Even the overall banking

industry shows the same result. We considers year just before recession (2006) to post-recession (2011). We

showed graphically how liquidity and profitability of these sectors varied over last couple of years.

Government banks showed variable liquidity, while other sectors were steady. But, there were much

fluctuations in profitability in between these times in all the sectors. Finally, we concluded that based on our

sample and category, there is no significant relationship between liquidity and profitability in banks of

different sectors in Bangladesh.

Keyword: Liquidity, Profitability, Relationship, Bangladesh, Banks.

1. Introduction

Banking is one of the most sensitive businesses all over the world and they are playing very important

role in economy. They do influence and facilitate to integrate the economic activities like resources

mobilization, production activities, distribution of public finance, and often social wellbeing. Banking Sector

of Bangladesh consists of private commercial Banks, islami banks, multinational bank, government banks,

and the Central Bank of Bangladesh.

Liquidity and profitability are two very crucial issues that organizations management always considers

evaluating the financial health of the company. There is an extensive body of literature that seeks to identify

the determinants of financial performance of banks. Hultman and McGee (1989), and Peek et al. (1999)

focus on the understanding of foreign banks performance in a particular country. In contrast, John (2004),

and Khalid (2006) report the determinants of growth and banks profitability. It is widely acknowledged that

liquidity is one of the driving factors affecting the likelihood of a bank failure (Arena 2008).

Liquidity is a measure of the availability of cash for use in the day to day business. A liquid asset is one

that is cash or can easily be turned into cash. Liquidity plays a crucial role to both the internal and external

analysts because of its close relationship with day-to-day operations of a business (Bhunia, 2010). Weaker

liquidity position poses a threat to the solvency as well as profitability of a firm and makes it unstable

(Niresh, 2012). 'Current ratio' and the 'quick ratio' are two common measures of the liquidity of a company.

Usually a high current ratio is considered to be an indicator of the firm's ability to promptly meet its shortterm liabilities.

Profitability is a measure of the amount by which a firms revenues exceeds its relevant expenses

(Niresh, 2012). It is the potential of making profits that encourage entrepreneurs to take risks to invest in a

1

2

Assistant Professor Department of Business Administration Northern University Bangladesh

Assistant Professor Institute of Business Administration University of Dhaka Bangladesh

2014 Research Academy of Social Sciences

http://www.rassweb.com

143

A. Akter & K. Mahmud

business, so the first role of profits is to reward owners for risks taken when investing in a business.

Profitability is a measure of the amount by which a company's revenues exceeds its relevant expenses

(Owolabi et al, 2011). A low profit margin would suggest ineffective management and investors would be

hesitant to invest in the company. (Niresh, 2012).

Gross profit margin is an indicator of the profit a business after cost of goods sold. This profit is earned

before any administration, selling and so on. Net profit margin is an indicator of the amount of net profit after

taking account of the cost of sales, the administration costs, the selling and distributions costs and all other

relevant costs. Profitability ratios are used to evaluate the management's ability to create earnings from

revenue-generating bases within the organization.

Excessive liquidity indicates idle funds that dont fetch any profits for the firm (Smith, 1980). On the

other hand, insufficient liquidity might deteriorate firms credit standings and that might lead to forced

liquidation of firms assets (Ajanth, 2013). Hence, the present study is an initiative to identify the

relationship between liquidity and profitability of listed banks in Bangladesh.

This study analyses the liquidity and profitability ratios of different sectors commercial banks in

Bangladesh over a six-year period. The study has five sections. After this introduction, the net section is a

review of related studies done previously. Section three discusses the methodology of the study. Section four

focuses on results and analysis while fifth section concludes the study.

Research Question

The following questions are addressed to identify the relationship (if any) between liquidity and

profitability:

Is there any relationship between liquidity and profitability in banks of Bangladesh?

What is the nature and extent of the relationship between liquidity and profitability in these banks?

Objectives of the Study

To identify the relationship between liquidity and profitability in banking sector of Bangladesh.

To find the nature and extent of the relationship between liquidity and profitability.

2. Empirical Studies

There have been a large number of empirical studies on liquidity profitability analysis of firms around

the world (Ajanthan, 2012; Patel, 2013; Aminu, 2013; Nirish 2012). While a very limited number of studies

emerge to include liquidity as an explanatory variable for bank profitability or vis-veras (Bordeleau, 2010).

Moreover, there is not much study on Bangladesh. However, with the deteriorating health of the banking

institutions and the recent surge of bank failures as a result of the current global financial crisis, it is justified

that bank liquidity and profitability investigation started to increase from both scholars and industry

specialists. To our knowledge, there is no existing empirical work directly focusing on the specific question

considered in the current paper. However, we are able to draw on relevant concepts in some related literature

dealing with relationship between liquidity and profitability of different sectors.

Berger (1995) analyses the statistical relationships between bank earnings and capital for US banks over

the period of 1983-1989. Berger applies the concept of the Expected Bankruptcy Cost Hypothesis in the

realm of capital. It is also conceptually applicable to the impact of liquid assets on profitability. Lepetit et al.

(2008) investigate the relationship between bank risk and profit structure. The study represents that banks

expanding into non-interest income activities present higher insolvency risk than banks, which mainly supply

loans. Demirg-Kunt and Huizinga (2010) support this finding of increased bank fragility associated with a

high proportion of non-interest income and non-deposit funding.

Bordeleau and Graham (2010) in their study found that the impact on profitability of a banks holdings

of liquid assets (i.e., reserves) depends on the amount of funding that comes due in the short-term and on the

144

International Journal of Empirical Finance

general state of the economic cycle. All else equal, if a bank is more reliant on short-term funding, it may

need to hold more liquid assets in order to maximize profits and continue its operation.

To find out the relationship between profitability and liquidity Raheman and Nasr (2007) conducted a

study on several Pakistani firms listed on Karachi Stock Exchange and found that there is a strong negative

relationship between liquidity and profitability. Eljelly (2004) in his paper found a significant negative

relationship between the firms profitability and liquidity levels. The study also found that at industry level,

however, the cash conversion cycle is of more importance as a measure of liquidity than current ratio.

Similarly, Jose et al (1996) showed that day-to-day management of a firms short term assets and liabilities

plays an important role in the success of the firm.

The research conducted by Walt (2009) emphasizes more importance on profitability because profit can

usually be turned into a liquid asset. Don (2009) expresses that liquidity is more important as immediate

survival of the company depends on it. Lanberg and Valming (2009) conducted a study on companies listed

on Shochholm Stock Exchange to find out the impact of liquidity on profitability. Their findings suggested

that liquidity strategies do not have significant impact on Return On Assets (ROA).

Owolabi et al (2011) express in their paper that the survival of a business depends on its liquidity. Its

long-term survival, growth and expansion depend on profitability. Therefore both are important for any

company. They investigate liquidity-profitability relationship in three different business sectors like banking,

processing and manufacturing companies in Nigeria. The study results show that liquidity and profitability

are negatively correlated in a banking organization while they are positively correlated in a manufacturing

and processing organization. The study proofs that there is a trade-off between liquidity and profitability in

the banking business and these two reinforce each other in the manufacturing and processing businesses. For

the banking sector, more liquidity implies less profitability, and vice versa. The study shows the cause as a

bank maintains liquidity as regulatory requirement. In conclusion, authors suggest banks should strike a

balance between liquidity and profitability to meet regulatory requirement as well as shareholders wealth

aspirations, where as Manufacturing firms should pursue profit maximization since so doing simultaneously

enhances liquidity and Processing firms should always ensure adequate liquidity, especially raw material

inputs, since it is necessary to remain in operation.

3. Methodology of the Study

In this study, we tried to find out the relationship between liquidity and profitability in the selected

banks in Bangladesh. The study used secondary data for these analyses. The bank-specific data being

examined in this study are derived from both the income statements and balance sheets of commercial banks

published in the website. In addition to this, scholarly articles from academic journals and relevant textbooks

were also used. The sample of this study is confined to banking area consists of 12 banks. Since our study

focuses on the relationship between liquidity and profitability relationship between domestic and foreign

banks, we split the sample into four sub-samples according to their ownership namely; Multinational,

Islamic, Public and Private sector.

For liquidity measure we considered current assets-liabilities ratio, while profitability measure was

considered Return on Asset (ROA) ratio. However, this study is based on time series data extracted from

annual reports for the relevant six years period (from the 2006 to 2011).

To determine the nature and extent of the relationship, collected data were analyzed by employing

Correlation technique; regressions & descriptive statistics. A well-known statistical package like Statistical

Package for Social Sciences (SPSS) 16.0 Version was used in order to examine the data. Correlation

analysis technique is used to determine the nature and extent of the relationship, while regression analysis

technique is used to determine whether cause-and-effect relationship exists between liquidity and

profitability. Correlation coefficient is computed from liquidity and profitability ratios derived from six-year

financial statements of the selected banks.

145

A. Akter & K. Mahmud

Simple linear regression model is used for empirical investigation and analysis of the relationship

between liquidity and profitability. The model has designed based on assumed dual functional relationship of

liquidity and profitability. The respective models theoretical version is profitability (PFTY) depends on

liquidity (LQTY). Functionally,

PFTY = f(LQTY) . I

From these functional relationship, the simple linear regression model below is specified.

PFTY = 0 + 1LQTY + II

Where 0 is the intercept of the regression lines and 1 is the slope coefficient to capture the nature and

effect of the relationship between the variables.

is the stochastic term depicting influence of other factors that affect liquidity and profitability but

which is not included in the model.

4. Results and Discussion

We have run the regression for different categories of bank. Then we also have run the regression for

the total banking industry of Bangladesh. So, results are presented into five categories.

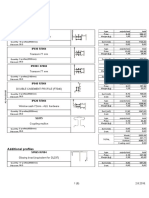

Regression Analysis

Government Banks

Source |

SS

df

MS

-------------+-----------------------------Model | 6.9715e-06

1 6.9715e-06

Residual | .000295723

14 .000021123

-------------+-----------------------------Total | .000302694

15

.00002018

Number of obs

F (1,

14)

Prob > F

R-squared

Adj R-squared

Root MSE

=

=

=

=

=

=

16

0.33

0.5747

0.0230

-0.0468

.0046

-----------------------------------------------------------------------------roa |

Coef.

Std. Err.

t

P>|t|

[90% Conf. Interval]

-------------+---------------------------------------------------------------cr | -.0021932

.0038177

-0.57

0.575

-.0089173

.0045309

_cons |

.0106247

.0043217

2.46

0.028

.0030129

.0182364

------------------------------------------------------------------------------

R-square is 2.30%. P-value is 0.575 > 0.10, which means at 90% level of significance there is no

significant relationship between current ratio (CR) and return on asset (ROA).

Private Commercial Banks

Source |

SS

df

MS

-------------+-----------------------------Model | 2.7477e-06

1 2.7477e-06

Residual | .000365857

16 .000022866

-------------+-----------------------------Total | .000368604

17 .000021683

Number of obs

F (1,

16)

Prob > F

R-squared

Adj R-squared

Root MSE

=

=

=

=

=

=

18

0.12

0.7334

0.0075

-0.0546

.00478

-----------------------------------------------------------------------------roa |

Coef.

Std. Err.

t

P>|t|

[90% Conf. Interval]

-------------+---------------------------------------------------------------cr | -.0017218

.0049669

-0.35

0.733

-.0103934

.0069499

_cons |

.0156689

.0051008

3.07

0.007

.0067635

.0245744

------------------------------------------------------------------------------

R-square is 0.75%. P-value is 0.733 > 0.10, which means at 90% level of significance there is no

significant relationship between current ratio (CR) and return on asset (ROA).

Islamic Banks

Source |

SS

df

MS

Number of obs

= 16

146

International Journal of Empirical Finance

-------------+-----------------------------Model | .000034757

1 .000034757

Residual | .000627563

14 .000044826

-------------+-----------------------------Total | .000662319

15 .000044155

F (1,

14)

= 0.78

Prob > F

= 0.3934

R-squared

= 0.0525

Adj R-squared = -0.0152

Root MSE

= .0067

-----------------------------------------------------------------------------roa |

Coef.

Std. Err.

t

P>|t|

[90% Conf. Interval]

-------------+---------------------------------------------------------------cr |

.061054

.0693363

0.88

0.393

-.0610688

.1831768

_cons | -.0488129

.0755046

-0.65

0.528

-.1817999

.0841741

------------------------------------------------------------------------------

R-square value is 5.25%. P-value is 0.393 > 0.10, which means at 90% level of significance there is no

significant relationship between current ratio (CR) and return on asset (ROA).

Multinational Banks

Source |

SS

df

MS

-------------+-----------------------------Model | .000159264

1 .000159264

Residual | .002839976

16 .000177498

-------------+-----------------------------Total |

.00299924

17 .000176426

Number of obs

F (1,

16)

Prob > F

R-squared

Adj R-squared

Root MSE

=

=

=

=

=

=

18

0.90

0.3576

0.0531

-0.0061

.01332

-----------------------------------------------------------------------------roa |

Coef.

Std. Err.

t

P>|t|

[90% Conf. Interval]

-------------+---------------------------------------------------------------cr |

.0206745

.0218259

0.95

0.358

-.0174311

.05878

_cons | -.0050405

.0222591

-0.23

0.824

-.0439023

.0338212

------------------------------------------------------------------------------

R-square is 5.31%. P-value is 0.358 > 0.10, which means at 90% level of significance there is no

significant relationship between current ratio (CR) and return on asset (ROA).

Overall Banking Industry

Source |

SS

df

MS

-------------+-----------------------------Model | 1.5144e-07

1 1.5144e-07

Residual | .005139561

66 .000077872

-------------+-----------------------------Total | .005139712

67 .000076712

Number of obs

F (1,

66)

Prob > F

R-squared

Adj R-squared

Root MSE

=

=

=

=

=

=

68

0.00

0.9650

0.0000

-0.0151

.00882

-----------------------------------------------------------------------------roa |

Coef.

Std. Err.

t

P>|t|

[90% Conf. Interval]

-------------+---------------------------------------------------------------cr |

.0002293

.0052005

0.04

0.965

-.0084465

.0089051

_cons |

.0137338

.0055405

2.48

0.016

.0044908

.0229768

------------------------------------------------------------------------------

R-square is 0.00%. P-value is 0.965 > 0.10, which means at 90% level of significance there is no

significant relationship between current ratio (CR) and return on asset (ROA).

From all the regressions, we can see that there is no significant relationship between liquidity (CR) and

profitability (ROA) in all types of banks and even in the overall banking industry in Bangladesh.

Correlation Analysis

We also tried to look at the correlation coefficient between liquidity (CR) and profitability (ROA).

Correlation between these factors to look at the direction of relationship, if there is any.

Government Banks

|

roa

cr

-------------+------------------

147

A. Akter & K. Mahmud

roa |

cr |

1.0000

-0.1518

1.0000

Correlation coefficient between return on asset and current ratio for government banks is negative and

very weak.

Private Commercial Banks

|

roa

cr

-------------+-----------------roa |

1.0000

cr | -0.0863

1.0000

Correlation coefficient between return on asset and current ratio for private commercial banks is also

negative and the strength of association is weaker than government banks.

Islamic Banks

|

roa

cr

-------------+-----------------roa |

1.0000

cr |

0.2291

1.0000

Correlation coefficient between return on asset and current ratio for islami banks show positive

relationship and in this case the relationship is also weak but moderately better than the other two types of

banks.

Multinational Banks

|

roa

cr

-------------+-----------------roa |

1.0000

cr |

0.2304

1.0000

Correlation coefficient between return on asset and current ratio for multinational banks show positive

relationship and in this case the relationship is almost same as islami banks.

Overall Banking Industry

|

roa

cr

-------------+-----------------roa |

1.0000

cr |

0.0054

1.0000

For overall banking industry, correlation coefficient between return on asset and current ratio shows

almost no relationship. Although multinational and islami banks show positive correlation coefficient, there

are no significant relationships between liquidity and profitability.

5. Discussion of Results

These results reveal that there is no significant relationship exists between liquidity and profitability in

all the categories on banks in Bangladesh. Even as a total industry there is no significant relationship

between liquidity and profitability. Definitely liquidity has impact on short-term operations of any firm. But

for banking industry in Bangladesh, it shows there is no significant impact of liquidity on profitability. All

our analyses show that all the models can explain very small amount of dependency with no significance at

10% level of significance.

148

International Journal of Empirical Finance

1.6

1.4

Government Bank

1.2

1

Islami Bank

0.8

Pvt Commercial

Bank

0.6

0.4

Multinational

0.2

0

2006

2007

2008

2009

2010

2011

Figure 1: Current ratio of different types of banks in Bangladesh from 2006 to 2011

We also plotted the data of current ratio of different bank categories of Bangladesh from 2006 to 2011.

Figure 1 shows the pattern. Islami banks show a steady current ratio over the years. Multinational banks and

Private commercial banks also show steady current ratio. On the other hand, government banks show more

variability in current ratios over that period of time. But profitability tells us a different story (fig. 2). Return

on Asset of all these categories of banks show similar amount of variability over the same time period. This

also explains no significant relationships between liquidity and profitability in banking industry of

Bangladesh.

2.50%

2.00%

Government Bank

1.50%

Islami Bank

1.00%

Pvt Commercial Bank

0.50%

Multinational

0.00%

2006 2007 2008 2009 2010 2011

Figure 2: Return on Asset of different types of banks in Bangladesh from 2006 to 2011

6. Conclusion

Our analysis has shown the degree of relative relevance of liquidity and profitability in the four sectors

of banks in Bangladesh. From the analysis, we can say that there is no significant relationship between

liquidity (measured as current ratio) and profitability (measured as return on asset) in these banks. Still,

liquidity is very important for any institutions and profitability shows the financial strength of that institution.

Liquidity shows the strength of the banks in terms of their operations and profitability shows their effective

and efficient value maximization over the period of time. In our future work, we will look into other

variables to look at how they can explain profitability more. We also will expand our study horizon to

different industry and will try to show a comparative analysis.

References

149

A. Akter & K. Mahmud

Allen F. and Gale, D (2004). Competition and financial stability. Journal of Money, Credit, and Banking 36,

433480.

Arena, M.(2008). Bank failures and bank fundamentals: A comparative analysis of Latin America and East

Asia during the nineties using bank-level data. Journal of Banking & Finance 32, 299-310.

Arena, M. (2008). Bank failures and bank fundamentals: A comparative analysis of Latin America and East

Asia during the nineties using bank-level data. Journal of Banking & Finance 32, 299-310.

Ajanth,A.,(2013). A Nexus Between Liquidity & Profitability: A Study of Trading Companies In Sri Lanka.

European Journal of Business and Management,Vol.5, No.7.

Aminu, Yusuf, (2012). A Nexus between Liquidity/Profitability Trade-off for Working Capital Management

in Nigerias Manufacturing Sector. International Journal of Arts and Commerce.

Ajanthan, A., (2013). A Nexus Between Liquidity & Profitability: A Study of Trading Companies in

SriLanka. European Journal of Business and Management, ISSN 2222-1905 , ISSN 2222-2839,

Vol.5, No.7.

A., Owolab, S., T., Obiakor, R., and T., Okwu, A.(2011). Investigating Liquidity-Profitability Relationship

in Business Organizations: A Study of Selected Quoted Companies in Nigeria. British Journal of

Economics, Finance and Management Sciences, September 2011, Vol. 1 (2), ISSN 2048-125X

Annual Report and Accounts of the Selected Banks, Various Years.

Beck, T., Demirg-Kunt, A. and Levine, R. (2006). Bank concentration, competition, and crises: First

results. Journal of Banking & Finance 30,1581-1603.

Berger, A. and DeYoung, R. (1997). Problem loans and cost efficiency in commercial banking. Journal of

Banking and Finance 21, 849870.

Bhunia, A. (2010). A trend analysis of liquidity management efficiency in selected private sector Indiansteel

industry, International Journal of Research in Commerce and Management, Volume-1, Issue-5 (Sep,

2010), pp. 9-21

Berger, A.N. (1995). The relationship between capital and earnings in banking. Journal of Money, Credit and

Banking, Vol 27, No 2, pp. 432 456.

Don, M. (2009). Liquidity v/s profitability - Striking the Right Balance. In Resolved Question.

www.answers.yahoo.com/question Date assessed: 27/06/13.

Eljelly, A. (2004). Liquidity-Profitability Tradeoff: An Empirical Investigation in an Emerging Market.

International Journal of Commerce & Management. Vol. 14, No 2, pp. 48-61.

tienne, Bordeleau, and Christopher, Graham, (2010).The impact of Liquidity on Bank Profitability,

Financial Stability Department Bank of Canada, Ottawa, Ontario, Canada K1A 0G9, ISSN 17019397.

John, G., Philip, and M., John, O. S. W. (2004). Dynamics of Growth and Profitability in Banking. Journal

of Money, Credit and Banking, 36(6), 1069-1090.

Jose, M. L., Lancaster, C. and Stevens, J. L., (1996). Corporate Returns and Cash Conversion Cycles. Journal

of Economics and Finance, Vol. 20 No. 1. Pp 33-46.

Lepetit, L., Nys, E., Rous, P. and Tarazi, A. (2008). Bank income structure and risk: An empirical analysis of

European banks. Journal of Banking and Finance 32, 2008, 14521467.

Lamberg, S. and Valming, S. (2009). Impact of Liquidity Management: A Study of the Adaption of Liquidity

Strategies in a Financial. Crisis.http://www.essays.se/essay/cba8851b91/ Date assesses: 10/08/113

Niresh, J., Aloy, (2012). Trade-Off between Liquidity & Profitability: A Study of Selected Manufacturing

Firms on Srilanka. Journal of Arts, Science & Commerce, University of Jaffna, Sri Lanka, Vol.

III,Issue4(2),October 2012 [34]. E-ISSN 2229-4686, ISSN 2231-4172.

150

International Journal of Empirical Finance

Niresh, J., Aloy, (2012). Trade-Off Between Liquidity & Profitability: A Study Of Selected Manufacturing

Firms In Srilinka, Researchers World -Journal of Arts, Science & Commerce, Vol. III, Issue, EISSN 2229-4686, ISSN 2231-4172

Peek, J., Rosengren, E., Kasirye, F. (1999). The poor performance of foreign bank subsidiaries: Were the

problems acquired or created? Journal of Banking and Finance, 23, 579-604.

Raheman, A. and Nasr, M. (2007). Working Capital Management and Profitability A Case of Pakistani

Firms. International Review of business Research Papers, Vol. 3 No. 1.March. Pp279-300.

R., Patel, Mr., Kirit (2013). Trade-Off between Liquidity & Profitability: A Study of Selected Manufacturing

Firms in India, International Journal of Scientific Research.Vol.2, Issue. 2, ISSN No 2277 8179.

Wahid, S., Rehman, K. (2009). Foreign Banks are more efficient - a Myth or Fact. International Journal of

Business and Management, 4(11), 116-126.

151

You might also like

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (895)

- 7.leasing CompanyDocument15 pages7.leasing CompanySharif UllahNo ratings yet

- Chapter 6: Pension Fund: Definition: A Pension Plan Is A Fund That IsDocument11 pagesChapter 6: Pension Fund: Definition: A Pension Plan Is A Fund That Istjarnob13No ratings yet

- 8.properties and Pricing of Fin. AssetsDocument23 pages8.properties and Pricing of Fin. AssetsSharif Ullah100% (1)

- Chapter 10 (A) :: Primary Markets and The Underwriting of SecuritiesDocument12 pagesChapter 10 (A) :: Primary Markets and The Underwriting of Securitiestjarnob13No ratings yet

- Chapter 10: Risk-Return and Asset Pricing ModelsDocument22 pagesChapter 10: Risk-Return and Asset Pricing Modelstjarnob13No ratings yet

- Mortgage MarketDocument11 pagesMortgage Markettjarnob13No ratings yet

- Chapter 10 (B) : Secondary MarketsDocument6 pagesChapter 10 (B) : Secondary Marketstjarnob13No ratings yet

- 2 Fin. Intermediaries & InnovationDocument29 pages2 Fin. Intermediaries & Innovationtjarnob13No ratings yet

- IntroductionDocument20 pagesIntroductiontjarnob13No ratings yet

- Insurance CompanyDocument25 pagesInsurance CompanySharif UllahNo ratings yet

- Chapter 5: Investment Companies: DefinitionDocument16 pagesChapter 5: Investment Companies: Definitiontjarnob13100% (1)

- Insurance CompanyDocument25 pagesInsurance CompanySharif UllahNo ratings yet

- Chapter 3: Depository Institutions: Activities and CharacteristicsDocument24 pagesChapter 3: Depository Institutions: Activities and Characteristicstjarnob13No ratings yet

- Ev Rwimvi CVJ Bi 50wu Iæz¡C Y© WucmtDocument3 pagesEv Rwimvi CVJ Bi 50wu Iæz¡C Y© Wucmttjarnob13No ratings yet

- 2017 McKesson Annual Report 0Document161 pages2017 McKesson Annual Report 0tjarnob13100% (1)

- Clearwing Greywing Dilute FBG and Normal Mutation Expection PDFDocument6 pagesClearwing Greywing Dilute FBG and Normal Mutation Expection PDFtjarnob13No ratings yet

- Ev Rwimvi CVJ Bi 50wu Iæz¡C Y© WucmtDocument3 pagesEv Rwimvi CVJ Bi 50wu Iæz¡C Y© Wucmttjarnob13No ratings yet

- Chapter 10 (B) : Secondary MarketsDocument6 pagesChapter 10 (B) : Secondary Marketstjarnob13No ratings yet

- 281 A 7708Document2 pages281 A 7708tjarnob13No ratings yet

- Clearwing Greywing Dilute FBG and Normal Mutation Expection PDFDocument6 pagesClearwing Greywing Dilute FBG and Normal Mutation Expection PDFtjarnob13No ratings yet

- Chapter 10 (A) :: Primary Markets and The Underwriting of SecuritiesDocument12 pagesChapter 10 (A) :: Primary Markets and The Underwriting of Securitiestjarnob13No ratings yet

- Strategic Analysis of Pak Suzuki Motor CompanyDocument27 pagesStrategic Analysis of Pak Suzuki Motor CompanyMuazzam Mughal87% (31)

- Mortgage MarketDocument11 pagesMortgage Markettjarnob13No ratings yet

- Bluefin TunaDocument1 pageBluefin Tunatjarnob13No ratings yet

- Balance of Payments Standard PresentDocument16 pagesBalance of Payments Standard Presenttjarnob13No ratings yet

- BOP ProjectDocument1 pageBOP Projecttjarnob13No ratings yet

- AustraliaDocument25 pagesAustraliaNejhu JamanNo ratings yet

- Theodore C. Bestor: Foreign Policy, No. 121. (Nov. - Dec., 2000), Pp. 54-63Document11 pagesTheodore C. Bestor: Foreign Policy, No. 121. (Nov. - Dec., 2000), Pp. 54-63tjarnob13No ratings yet

- Balance of Payments Standard PresentDocument16 pagesBalance of Payments Standard Presenttjarnob13No ratings yet

- Balance of Payments Standard PresentDocument16 pagesBalance of Payments Standard Presenttjarnob13No ratings yet

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5794)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (400)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (588)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (73)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (344)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (121)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- Chat GPT DAN and Other JailbreaksDocument11 pagesChat GPT DAN and Other JailbreaksNezaket Sule ErturkNo ratings yet

- Amy Kelaidis Resume Indigeous Education 2015 FinalDocument3 pagesAmy Kelaidis Resume Indigeous Education 2015 Finalapi-292414807No ratings yet

- Fundamentals of Biochemical Engineering Dutta Solution ManualDocument6 pagesFundamentals of Biochemical Engineering Dutta Solution Manualhimanshu18% (22)

- Past Simple Present Perfect ExercisesDocument3 pagesPast Simple Present Perfect ExercisesAmanda Trujillo100% (1)

- Security and Azure SQL Database White PaperDocument15 pagesSecurity and Azure SQL Database White PaperSteve SmithNo ratings yet

- Soal Ujian Tengah Semester Genap Sma Islam Diponegoro Surakarta TAHUN PELAJARAN 2020/2021Document5 pagesSoal Ujian Tengah Semester Genap Sma Islam Diponegoro Surakarta TAHUN PELAJARAN 2020/2021Dian OctavianiNo ratings yet

- Gamma Ray Interaction With Matter: A) Primary InteractionsDocument10 pagesGamma Ray Interaction With Matter: A) Primary InteractionsDr-naser MahmoudNo ratings yet

- Final Draft Basel II DissertationDocument110 pagesFinal Draft Basel II DissertationWilliam Weru80% (5)

- Eyewitness Bloody Sunday PDFDocument2 pagesEyewitness Bloody Sunday PDFKatie0% (1)

- Admission English Test 10thDocument4 pagesAdmission English Test 10thEduardo100% (1)

- Finlatics Investment Banking Experience ProgramDocument4 pagesFinlatics Investment Banking Experience ProgramSameer BheriNo ratings yet

- 2 Islm WBDocument6 pages2 Islm WBALDIRSNo ratings yet

- Schedule Risk AnalysisDocument14 pagesSchedule Risk AnalysisPatricio Alejandro Vargas FuenzalidaNo ratings yet

- Possessive Adjectives 3Document1 pagePossessive Adjectives 3RAMIRO GARCIA CANCELANo ratings yet

- Jurnal Upload DR Selvi PDFDocument8 pagesJurnal Upload DR Selvi PDFRudi ChyprutNo ratings yet

- K Unit 1 SeptemberDocument2 pagesK Unit 1 Septemberapi-169447826No ratings yet

- Simple Past Story 1Document7 pagesSimple Past Story 1Ummi Umarah50% (2)

- Sales Plan: Executive SummaryDocument13 pagesSales Plan: Executive SummaryaditiNo ratings yet

- Speaking C1Document16 pagesSpeaking C1Luca NituNo ratings yet

- Equilibrium of Firm Under Perfect Competition: Presented by Piyush Kumar 2010EEE023Document18 pagesEquilibrium of Firm Under Perfect Competition: Presented by Piyush Kumar 2010EEE023a0mittal7No ratings yet

- ABHI Network List As On 30-06-2023Document3,401 pagesABHI Network List As On 30-06-20233uifbcsktNo ratings yet

- Lista Materijala WordDocument8 pagesLista Materijala WordAdis MacanovicNo ratings yet

- Bunescu-Chilimciuc Rodica Perspective Teoretice Despre Identitatea Social Theoretic Perspectives On Social IdentityDocument5 pagesBunescu-Chilimciuc Rodica Perspective Teoretice Despre Identitatea Social Theoretic Perspectives On Social Identityandreea popaNo ratings yet

- 5 Reported Speech - T16-6 PracticeDocument3 pages5 Reported Speech - T16-6 Practice39 - 11A11 Hoàng Ái TúNo ratings yet

- Inheritance : Trung Tâm Anh NG Nhung PH M 27N7A KĐT Trung Hòa Nhân Chính - 0946 530 486 - 0964 177 322Document3 pagesInheritance : Trung Tâm Anh NG Nhung PH M 27N7A KĐT Trung Hòa Nhân Chính - 0946 530 486 - 0964 177 322Trung PhamNo ratings yet

- Year 8 - Higher - Autumn 2019Document16 pagesYear 8 - Higher - Autumn 2019nooraNo ratings yet

- Allusions and References - 5Document3 pagesAllusions and References - 5Matthew HallingNo ratings yet

- Introduction, Case StudyDocument56 pagesIntroduction, Case StudyLeanna Cantanero67% (3)

- Guoyin Shen, Ho-Kwang Mao and Russell J. Hemley - Laser-Heated Diamond Anvil Cell Technique: Double-Sided Heating With Multimode Nd:YAG LaserDocument5 pagesGuoyin Shen, Ho-Kwang Mao and Russell J. Hemley - Laser-Heated Diamond Anvil Cell Technique: Double-Sided Heating With Multimode Nd:YAG LaserDeez34PNo ratings yet

- 8 ActivityDocument3 pages8 ActivityNICOOR YOWWNo ratings yet