Professional Documents

Culture Documents

SharekhanTopPicks 31082016

Uploaded by

Jigar ShahOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

SharekhanTopPicks 31082016

Uploaded by

Jigar ShahCopyright:

Available Formats

Sharekhan Top Picks

Visit us at www.sharekhan.com

August 31, 2016

Sharekhan Top Picks

After consolidating in a tight range, the benchmark Nifty

index finally surged in the past few days to end August

with marginal gains. In addition to the benign global macro

environment, the fresh policy initiatives taken by the NDA

government to revive stalled projects and ease pressure

on construction companies seemed to support the positive

sentiment.

introduction Zee Entertainment in Top Picks on the back of

the sale of its sports business to Sony for $385 million. The

move leads to a considerable revision in earnings estimates

for ZEEL (see our latest stock update). On the other hand,

Reliance Industries could suffer due to the recent softness in

the benchmark global gross refining margins (GRM) and due

to its dispute with ONGC on the KG Basin offshore gas fields.

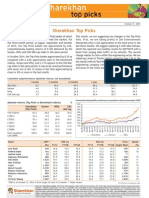

The Sharekhan basket of Top Picks appreciated by 4.2%

compared to 1.4% to 1.7% gains registered by the Sensex and

Nifty, respectively in August. Activity in the broader market

was much better than the benchmark indices in August, with

the CNX Midcap 100 index appreciating by 4%.

Lastly, we are including Rico Auto in the Top Picks portfolio

to bring in some exposure to the auto ancillary space. Rico

Auto has shown exceptionally strong Q1FY2017 results and

is on the path of significant improvement in its financial

performance going ahead. To make space for Rico Auto,

we are excluding Relaxo Footwear due to weak volume in

Q1FY2017, along with a tepid growth outlook in the near

term. However, we continue to remain positive on Relaxo

Footwear as a quality long-term investment option in the

consumer space.

For September, we are making three changes in the Top Picks

portfolio. We are booking profit in Bajaj Finance (with close

to 100% gains) and replacing it with Capital First as part of

churn in the NBFC space. Another change relates to the re-

Consistent outperformance (absolute returns; not annualised)

(%)

1 month

3 months

6 months

Top Picks

4.2

12.9

36.1

Sensex

1.4

6.6

23.5

Nifty

1.7

7.7

27.4

CNX MIDCAP

4.0

15.6

33.0

(%)

6.4

-5.6

CY2012

35.1

26.2

29.0

36.0

CY2011

-20.5

-21.2

-21.7

-25.0

CY2010

16.8

11.5

12.9

11.5

CY2009

116.1

76.1

72.0

114.0

300

200

100

Sharekhan

Sensex

Apr-16

8.5

Aug-16

12.4

Dec-15

CY2013

400

Apr-15

55.1

Aug-15

30.9

Dec-14

29.9

Apr-14

63.6

Aug-14

CY2014

500

Dec-13

6.5

Apr-13

-4.1

Aug-13

-5.1

Dec-12

13.9

Apr-12

CY2015

600

Aug-12

14.7

Dec-11

10.6

Apr-11

8.8

Aug-11

18.7

5 years

195.7

69.0

74.9

101.6

700

Dec-10

YTD CY2016

3 years

159.4

52.2

59.4

133.2

Constantly beating Nifty and Sensex (cumulative returns since April 2009)

Apr-10

CNX Midcap 100

Aug-10

Nifty

Dec-09

Sensex

Apr-09

Sharekhan

(Top Picks)

Aug-09

Absolute returns (Top Picks Vs Benchmark indices)

(%)

1 year

21.8

8.1

10.2

17.7

Nifty

Please note the returns are based on the assumption that at the beginning of each month an equal amount was invested in each stock of the Top Picks basket

Name

Ashok Leyland

Britannia Industries

Capital First

Finolex Cables

HDFC Bank

HUL

IndusInd Bank

Kansai Nerolac

Maruti Suzuki

PI Industries

Rico Auto

ZEE Entertainment

CMP*

(Rs)

88

3,454

700

444

1,291

914

1,191

371

5,053

807

62

540

FY16

22.5

49.8

38.4

27.2

26.5

47.4

31.0

55.6

33.4

36.3

25.0

48.3

PER (x)

FY17E

15.7

41.4

27.0

24.5

21.8

41.6

24.0

45.9

24.0

27.3

14.9

43.1

*CMP as on August 31, 2016 # Price target for next 6-12 months

Sharekhan

FY18E

13.1

34.5

19.0

21.8

17.8

34.9

18.3

38.1

19.8

22.9

12.0

28.4

** Under review

FY16

20.2

55.3

10.1

28.6

18.3

83.3

16.1

15.6

17.0

32.6

7.2

24.4

RoE (%)

FY17E

25.9

48.7

13.2

23.7

19.1

62.2

16.7

17.6

20.3

34.6

10.9

24.2

Price

FY18E target (Rs)#

27.5

120

43.9

**

16.7

840

23.3

475

20.1

1,415

52.3

995

17.6

1,290

19.4

405

21.0

5,790

34.1

890

12.2

72

29.5

620

Upside

(%)

37

20

7

10

9

8

9

15

10

15

15

For Private Circulation only

Registered Office: Sharekhan Limited, 10th Floor, Beta Building, Lodha iThink Techno Campus, Off. JVLR, Opp. Kanjurmarg Railway Station, Kanjurmarg

(East), Mumbai 400042, Maharashtra. Tel: 022 - 61150000. Sharekhan Ltd.: SEBI Registration details: BSE INB/INF/INE011073351; NSE INB/INF/

INE231073330; MSEI: INB/INF-261073333, CD - INE261073330; DP-NSDL-IN-DP-NSDL-233-2003; CDSL-IN-DP-CDSL-271-2004; PMS-INP000000662; Mutual

Fund-ARN 20669 ; Commodity trading through Sharekhan Commodities Pvt. Ltd.: MCX-10080 ; (MCX/TCM/CORP/0425) ; NCDEX-00132 ; (NCDEX/TCM/

CORP/0142) ; NCDEX SPOT-NCDEXSPOT/116/CO/11/20626 ; For any complaints email at igc@sharekhan.com ; Disclaimer: Client shouldAugust

read the 2016

Risk

Disclosure Document issued by SEBI & relevant exchanges and Dos & Donts by MCX & NCDEX and the T & C on www.sharekhan.com before investing.

Sharekhan Top Picks

Name

Ashok Leyland

Remarks:

CMP

(Rs)

FY16

PER (x)

FY17E

FY18E

FY16

RoE (%)

FY17E

FY18E

Price

target (Rs)

Upside

(%)

88

22.5

15.7

13.1

20.2

25.9

27.5

120

37

Ashok Leyland (ALL) is the second largest commercial vehicle (CV) manufacturer in India with a market share

of 30% in the heavy truck segment and an even higher share of 45% in the bus segment.

The medium and heavy commercial vehicle (MHCV) volume has shown double-digit growth over the last two

years, led by improved profitability of fleet operators and huge pent-up demand on a low base (due to earlier

slowdown). We expect MHCV volume to remain buoyant over FY2016-FY2017, driven by a gradual pick-up in the

economic cycle, heightened road construction activity, new vehicle launches and phase-wise implementation

of the Bharat Stage IV norms across the country (leading to pre-buying).

ALL also has a strong presence in the overseas markets and continues to expand into newer geographies. The

company expects exports contribution to be around 25% of revenues over the next 3-5 years as against the

current level of 10%. Additionally, ALLs defence business is expected to get a leg-up due to the governments

focus on indigenous manufacturing of defence products and higher foreign direct investment (FDI) in the

defence sector.

ALLs operating profit margin (OPM) has recovered from the lows on the back of operating leverage benefits

and price hikes. Its OPM is expected to expand further, given the sustained demand momentum. We expect

ALLs balance sheet to get de-leveraged and the return ratios to improve on the back of buoyant operating

cash flows and minimal capex.

Britannia Industries

Remarks:

3,454

49.8

41.4

34.5

55.3

48.7

43.9

**

Britannia Industries (Britannia) is the second largest player in the Indian biscuit market with about 30% market

share. It has chalked out an aggressive growth strategy to sustain the double-digit volume growth in the biscuit

segment by enhancing its product portfolio. It is also striving to expand into the other categories, such as dairy

(market size of Rs75,000 crore) and adjacent snacking categories (market size of Rs30,000 crore).

It is likely to maintain a 14-15% revenue growth rate, underpinned by volume a growth of 10-11% (largely

driven by enhanced distribution reach and wider product portfolio). The OPM is expected to remain in the

range of 14-15% on the back of benign input cost inflation and better operating efficiency.

The company has a strong balance sheet with the free cash flow consistently improving over the past few

years. Its return ratios have also improved over the past few years and remains strong (upwards of 50%).

Under a new leadership, Britannia has been able to leverage and monetise its strong brand equity and leading

market position in the biscuit and snack segments. We believe that Britannia can sustain its fasterthanindustry growth rates, owing to an improving distribution reach, entry into newer categories and focus on cost

efficiency. We have a Buy rating on the stock.

Sharekhan

August 2016

Sharekhan Top Picks

Name

Capital First

Remarks:

CMP

(Rs)

PER (x)

RoE (%)

FY16

FY17E

FY18E

FY16

FY17E

700

38.4

27.0

19.0

10.1

13.2

FY18E

Price

target (Rs)

Upside

(%)

16.7

840

20

Capital First is growing at a decent pace, and is present in high-growth area of SME, Two Wheeler and

Consumer Durables finance. The company has emerged stronger after structurally transforming its business

model by prudently focusing on high-growth retail financing and downsising its wholesale book post FY2010.

The company has clocked 40%+ CAGR in retail financing over FY2012-FY2016

CAFL has rationalised its wholesale book (to sub-15% of AUM) while increasing its retail share in total loan book

to 85%. It has also sharpened its focus on retail segments, entailing significant growth opportunities

To further strengthen retail lending growth, the company has invested in building processes, systems and

infrastructure to make inroads into high-growth, high-yield consumer durables, 2-wheelers and unsecured

business loan segments, which will help to maintain and improve retail margins

CAFLs conscious shift, from low-yielding secured SME to high-yielding and high growth consumer durables,

2-wheelers and unsecured business loans, is likely to boost overall yield, and profitability.

Finolex Cables

Remarks:

444

27.2

24.5

21.8

28.6

23.7

23.3

475

Finolex Cables (FCL) is a leading manufacturer of power and communications cables in India, having a

sizeable market share. The company is set to benefit from (1) an improving demand environment in its core

business of cables; (2) strategy to leverage its brand equity to build a high-margin consumer product business

(switchgears, fans etc). Currently, FCL is witnessing a healthy volume growth, which could improve further

once the domestic economy picks up pace.

Apart from retaining core strength in the electrical cables, FCL is gradually adding consumer electrical products

in its portfolio. Recently, it has launched fans and the switchgear facility is awaiting regulatory approval to

start production. We believe executing the strategy to add consumer-facing branded electrical products could

improve the overall profile of FCL in terms of margin and return ratios in the long term. In the near to medium

term, implementation of GST will be favorable for the company too.

While the overall business traction is steady, we highly appreciate the strong and consistent cash flow

generating ability of FCL. Prudent working capital management and a cash-rich balance sheet will enable FCL

to sustain very healthy return ratios (~20-25%). We are positive on FCL.

Sharekhan

August 2016

Sharekhan Top Picks

Name

HDFC Bank

Remarks:

CMP

(Rs)

FY16

PER (x)

FY17E

FY18E

FY16

RoE (%)

FY17E

FY18E

Price

target (Rs)

Upside

(%)

1,291

26.5

21.8

17.8

18.3

19.1

20.1

1,415

10

HDFC Bank has a pre-eminent presence in the retail banking segment (~50% of loan book) and has been able

to maintain a strong & consistent loan book growth, gradually gaining market share. Going forward, economic

recovery and improvement in consumer sentiment would be positive growth drivers for the banks loan growth,

which will in turn drive its profitability.

Backed by a current account & savings account (CASA) ratio of 40%+ and a high proportion of retail deposits,

the banks cost of funds remains among the lowest in the system, helping it to maintain higher net interest

margin (NIM). In addition, the banks loan book growth is driven by high-yielding retail products such as

personal loans, vehicle loans, credit cards, mortgages etc, mostly to own customers (which also positively

impacts NIMs).

HDFC Bank has been maintaining near impeccable asset quality, with its NPA ratios consistently been among

the lowest versus comparable peers. The bank has been able to maintain a robust asset quality due to its

stringent credit appraisal procedures, a client base and negligible exposure to troubled sectors.

HDFC Bank is well poised to tap the growth opportunities going ahead due to strong capital ratios, healthy

asset quality and steady revival in consumer spending. The bank is likely to maintain a healthy RoE of 18-20%

and RoA of 1.8% on a sustainable basis. Therefore, we expect it to sustain the valuation premium that it enjoys

vis--vis other private banks.

HUL

Remarks:

914

47.4

41.6

34.9

83.3

62.2

52.3

995

Hindustan Unilever (HUL) is Indias largest FMCG company with strong presence in personal care, home care

and packaged food segments in India. The company is a market leader in the personal wash, detergent and

shampoo segments in India.

Despite subdued demand environment, HULs volume growth stood at 6% in FY2016, up from 4% in FY2015 on

the back of relevant pricing actions and higher promotional spends.

We expect HULs volume growth trajectory to improve by 6-8% (from the current level of 4-6%) in the near

to medium term, spurred by the expected improvement in rural demand (in view of a better monsoon) and

better urban demand (due to implementation of 7th Pay Commission award and lower inflation). We expect

HULs earnings to grow at a CAGR of 15% over FY2015-FY2018 owing to higher volume growth and sustained

product innovation.

With negative working capital and strong cash generation ability, the company has a strong balance sheet

among its FMCG peers. Also, return ratios continue to remain high.

Given the improved earnings visibility, strong cash flows and higher return ratios, we have maintained a Buy

recommendation with a PT of Rs995.

Sharekhan

August 2016

Sharekhan Top Picks

Name

IndusInd Bank

Remarks:

CMP

(Rs)

PER (x)

RoE (%)

FY16

FY17E

FY18E

FY16

FY17E

1,191

31.0

24.0

18.3

16.1

16.7

FY18E

Price

target (Rs)

Upside

(%)

17.6

1,290

IndusInd Bank is among the fastest growing banks (26% CAGR over FY2012-FY2016), with a loan book of Rs93,678

crore and 1,000 branches across the country. About 55% of the banks loan book comprises of retail finance,

which is a high-yielding category, and is showing signs of growth.

Given the aggressive measures taken by the management, the deposit profile has improved considerably (CASA

ratio of ~35%). Going ahead, the bank would follow a differentiated branch expansion strategy (5% branch

market share in identified centers) to help in ensuring healthy growth in savings accounts and retail deposits.

IndusInd Bank has maintained its asset quality despite sluggish economic growth and higher proportion of

Retail finance in its loan book. The banks asset quality is among the best in the industry, with total stressed

loans (restructured loans + gross NPAs) forming just 1.4% of the loan book.

A likely revival in the domestic economy will further fuel growth in the banks consumer finance division

while strong capital ratios will support future growth plans. The stock should continue to trade at a premium

valuation, underpinned by strong loan growth, quality management, high RoAs and healthy asset quality. We

have a positive outlook on IndusInd Bank.

Kansai Nerolac

Remarks:

Sharekhan

371

55.6

45.9

38.1

15.6

17.6

19.4

405

Kansai Nerolac Paints (KNPL) is the third largest paint company in India with an overall market share of ~16%

in the decorative paints segment. The implementation of the Seventh Pay Commission recommendations and

the introduction of GST (shift from non-branded to branded products) would help boost the urban consumption

of paints, while a normal monsoon would boost rural demand.

KNPL is a market leader in the industrial paints business with a 60% market share. Around 75% of its industrial

paints business revenues come from auto coatings. A favourable outlook for the auto industry for the next 1-2

years will boost the companys industrial segment revenues.

KNPLs decorative paints business has better margins compared to the industrial paints business. KNPLs

growing thrust on enhancing its presence in the decorative paint business and expectations of stable raw

material prices in the near term are expected to lift the operating profit margin by 40-50BPS in the next couple

of years.

KNPLs revenues and earnings are expected to clock a CAGR of 14% and 19%, respectively over FY2016-FY2018

on the back of its relentless focus on enhancing presence in the decorative paints business and the expected

improvement in the sales of automotive paints. We have a positive view on KNPL.

August 2016

Sharekhan Top Picks

Name

Maruti Suzuki

Remarks:

Sharekhan

FY16

PER (x)

FY17E

FY18E

FY16

RoE (%)

FY17E

FY18E

Price

target (Rs)

Upside

(%)

5,053

33.4

24.0

19.8

17.0

20.3

21.0

5,790

15

Maruti Suzuki India (Maruti) is Indias largest passenger vehicle (PV) manufacturer with a strong 47% market

share. The company has been able to gain market share over the last two years due to new product launches,

vast distribution network (with an increased focus on the rural markets) and a shift in consumer preference

to petrol models from diesel models.

The recently launched premium hatchback Baleno has received a strong response, which will help Maruti to

expand its market share in the segment. Also, the company recently entered the compact sports utility vehicle

(SUV) space with the launch of Vitara Brezza and has received an encouraging response. Both the new products

command a waiting period of 6-8 months each. Further, Maruti recently entered into the light commercial

vehicle (LCV) segment, which would further boost its topline.

Maruti is poised to reap the benefits of an increase in discretionary spending from the 7th Pay Commission

pay-out. The commencement of the first phase of the Gujarat plant with a 2.5 lakh capacity is scheduled in

Q4FY17. The management plans to double its sales and premium distribution network (NEXA) in order to

achieve its target of doubling the domestic volumes over the next five years.

PI Industries

Remarks:

CMP

(Rs)

807

36.3

27.3

22.9

32.6

34.6

34.1

890

10

PI Industries (PII) is one of the leading companies in the Indian agro-chemicals industry with a unique business

model. Its key focused areas are branded products (in-license products) and custom synthesis & manufacturing

(CSM) (high-growth segment).

PII makes and market a niche product in agrochemicals, which help it to outpace the industry growth. CSM is

contributing ~60% to the total revenue. This segment is growing at CAGR of ~30% for the last three years, and

we believe it would be the key growth driver in the coming years.

PII has guided for a strong outlook for both, the domestic business (on expectations of a normal monsoon)

as well as the CSM business, citing a better demand scenario (three new molecules added in FY2016 and 1 in

Q1FY2017) and capacity addition at Jambusar (likely to support 18-20% revenue growth over the next couple

of years.

On the EBIDTA margin front, PII has guided for 100-150BPS improvement on account of better operational

efficiency (reduction in fixed costs) and a favorable product mix. The companys order book remains steady at

$850 million. PII has lined up a capex of ~Rs200 crore for FY2017 and ~Rs150 crore for FY2018.

August 2016

Sharekhan Top Picks

Name

Rico Auto

Remarks:

PER (x)

RoE (%)

FY16

FY17E

FY18E

FY16

FY17E

62

25.0

14.9

12.0

7.2

10.9

FY18E

Price

target (Rs)

Upside

(%)

12.2

72

15

Rico Auto Industries (RAI) is among the leading players in the auto component space in India. It manufactures

and supplies world-class high precision and fully machined components & assemblies (both aluminum and

ferrous) to leading OEMs and Tier 1 customers across the globe. The company has hived off its loss-making

subsidiaries / JVs in the past.

oing ahead, a strong demand outlook from key clients - Hero MotoCorp and Maruti Suzuki - would fuel growth

G

for the company. RAI has commissioned a new plant in Chennai targeted at Renault, and would gradually tie up

with other automobile OEMs in South India. Further, it is in the process of setting up a new plant in Rajasthan,

which is likely to go on stream by Q3FY2018.

AI delivered a strong operating performance in Q1FY2017, driven by lower commodity prices, cost control

R

measures and improved performance from the JV/ subsidiaries. The companys revenue was up 8% YoY, which

was a surprise. Given the strong operating performance and benefits of operating leverage, the adjusted PAT

more than trebled in Q1FY2017. We expect the earnings to post a CAGR of 45% between FY16-FY18.

ZEE Entertainment

Remarks:

CMP

(Rs)

540

48.3

43.1

28.4

24.4

24.2

29.5

620

15

Among the key players of the domestic Cable TV industry, we expect the broadcasters to be the prime

beneficiaries of the mandatory digitisation process initiated by the government. The broadcasters would

benefit from higher subscription revenue at the least incremental capex, as the subscriber declaration standard

improves in the Cable TV industry

The ZEEL management maintains that the advertising spend will continue to grow in double digits going

ahead and it will be able to outperform the industry. Growth in the advertising spend will be driven by an

improvement in the macro-economic factors and ZEELs leading position in terms of market share to capture

the emerging opportunities

ZEELs management has confirmed the sale of sports business to Sony Pictures Network India (SPN) in an all

cash deal of Rs2,600 crore ($385 million). The deal will improve the balance sheet strength and ZEEL will be

in a much more comfortable position to accelerate inorganic or strategic investments

We view ZEELs move to exit from the loss-making sports business as a landmark deal. Also, the managements

intent to remain a pure play media company gives us confidence on the prudent capital allocation going

forward. The management has guided that strong momentum in advertising revenue growth would continue,

led by market share gains. We continue to see ZEEL as the prime beneficiary of the macro revival and ongoing

digitization trend.

Sharekhan Limited, its analyst or dependant(s) of the analyst might be holding or having a position in the companies mentioned in the article.

Disclaimer

This document has been prepared by Sharekhan Ltd. (SHAREKHAN) and is intended for use only by the person or entity to which it is addressed to. This Document may contain confidential and/or privileged material and is not for any type of circulation and any review, retransmission, or any

other use is strictly prohibited. This Document is subject to changes without prior notice. Kindly note that this document is based on technical analysis by studying charts of a stocks price movement and trading volume, as opposed to focusing on a companys fundamentals and as such, may

not match with a report on a companys fundamentals.(Technical specific) This document does not constitute an offer to sell or solicitation for the purchase or sale of any financial instrument or as an official confirmation of any transaction. Though disseminated to all customers who are due

to receive the same, not all customers may receive this report at the same time. SHAREKHAN will not treat recipients as customers by virtue of their receiving this report.

The information contained herein is obtained from publicly available data or other sources believed to be reliable and SHAREKHAN has not independently verified the accuracy and completeness of the said data and hence it should not be relied upon as such. While we would endeavour to

update the information herein on reasonable basis, SHAREKHAN, its subsidiaries and associated companies, their directors and employees (SHAREKHAN and affiliates) are under no obligation to update or keep the information current. Also, there may be regulatory, compliance, or other

reasons that may prevent SHAREKHAN and affiliates from doing so. This document is prepared for assistance only and is not intended to be and must not alone be taken as the basis for an investment decision. Recipients of this report should also be aware that past performance is not necessarily

a guide to future performance and value of investments can go down as well. The user assumes the entire risk of any use made of this information. Each recipient of this document should make such investigations as it deems necessary to arrive at an independent evaluation of an investment

in the securities of companies referred to in this document (including the merits and risks involved), and should consult its own advisors to determine the merits and risks of such an investment. The investment discussed or views expressed may not be suitable for all investors. We do not

undertake to advise you as to any change of our views. Affiliates of Sharekhan may have issued other reports that are inconsistent with and reach different conclusion from the information presented in this report.

This report is not directed or intended for distribution to, or use by, any person or entity who is a citizen or resident of or located in any locality, state, country or other jurisdiction, where such distribution, publication, availability or use would be contrary to law, regulation or which would

subject SHAREKHAN and affiliates to any registration or licencing requirement within such jurisdiction. The securities described herein may or may not be eligible for sale in all jurisdictions or to certain category of investors. Persons in whose possession this document may come are required

to inform themselves of and to observe such restriction.

The analyst certifies that the analyst has not dealt or traded directly or indirectly in securities of the company and that all of the views expressed in this document accurately reflect his or her personal views about the subject company or companies and its or their securities and do not

necessarily reflect those of SHAREKHAN. The analyst further certifies that neither he nor his relatives has any direct or indirect financial interest nor have actual or beneficial ownership of 1% or more in the securities of the company nor have any material conflict of interest nor has served

as officer, director or employee or engaged in market making activity of the company. Further, the analyst has also not been a part of the team which has managed or co-managed the public offerings of the company and no part of the analysts compensation was, is or will be, directly or

indirectly related to specific recommendations or views expressed in this document.

Either SHAREKHAN or its affiliates or its directors or employees / representatives / clients or their relatives may have position(s), make market, act as principal or engage in transactions of purchase or sell of securities, from time to time or may be materially interested in any of the securities

or related securities referred to in this report and they may have used the information set forth herein before publication. SHAREKHAN may from time to time solicit from, or perform investment banking, or other services for, any company mentioned herein. Without limiting any of the

foregoing, in no event shall SHAREKHAN, any of its affiliates or any third party involved in, or related to, computing or compiling the information have any liability for any damages of any kind.

Sharekhan

The returns shown are exclusive of the transaction cost and therefore the actual returns from the Top Picks product may or may not exactly match the portfolio returns shown by us.

Compliance Officer: Ms. Namita Amod Godbole; Tel: 022-6115000; For any queries or grievances kindly email igc@sharekhan.com or contact: myaccount@sharekhan.com

August 2016

You might also like

- Policies to Support the Development of Indonesia’s Manufacturing Sector during 2020–2024: A Joint ADB–BAPPENAS ReportFrom EverandPolicies to Support the Development of Indonesia’s Manufacturing Sector during 2020–2024: A Joint ADB–BAPPENAS ReportNo ratings yet

- Motor Vehicle Towing Revenues World Summary: Market Values & Financials by CountryFrom EverandMotor Vehicle Towing Revenues World Summary: Market Values & Financials by CountryNo ratings yet

- Sharekhan Top Picks: Absolute Returns (Top Picks Vs Benchmark Indices) % Sharekhan Sensex Nifty CNX (Top Picks) Mid-CapDocument7 pagesSharekhan Top Picks: Absolute Returns (Top Picks Vs Benchmark Indices) % Sharekhan Sensex Nifty CNX (Top Picks) Mid-CapRajesh KarriNo ratings yet

- Top Picks: Research TeamDocument30 pagesTop Picks: Research TeamPooja AgarwalNo ratings yet

- Sharekhan Top Picks: CMP As On September 01, 2014 Under ReviewDocument7 pagesSharekhan Top Picks: CMP As On September 01, 2014 Under Reviewrohitkhanna1180No ratings yet

- SharekhanTopPicks 070511Document7 pagesSharekhanTopPicks 070511Avinash KowkuntlaNo ratings yet

- Sharekhan Top PicksDocument7 pagesSharekhan Top PicksLaharii MerugumallaNo ratings yet

- TopPicks 020820141Document7 pagesTopPicks 020820141Anonymous W7lVR9qs25No ratings yet

- Sharekhan Top Picks: Absolute Returns (Top Picks Vs Benchmark Indices) % Sharekhan Sensex Nifty CNX (Top Picks) Mid-CapDocument7 pagesSharekhan Top Picks: Absolute Returns (Top Picks Vs Benchmark Indices) % Sharekhan Sensex Nifty CNX (Top Picks) Mid-CapJignesh RampariyaNo ratings yet

- Top PicksDocument7 pagesTop PicksKarthik KoutharapuNo ratings yet

- Top Picks Sep 2012Document15 pagesTop Picks Sep 2012kulvir singNo ratings yet

- Sharekhan Top Picks: Absolute Returns (Top Picks Vs Benchmark Indices) Sharekhan Sensex Nifty CNX (Top Picks) Mid-CapDocument7 pagesSharekhan Top Picks: Absolute Returns (Top Picks Vs Benchmark Indices) Sharekhan Sensex Nifty CNX (Top Picks) Mid-CapchetanjecNo ratings yet

- CFA Equity Research Challenge 2011 - Team 9Document15 pagesCFA Equity Research Challenge 2011 - Team 9Rohit KadamNo ratings yet

- Sharekhan Top Picks: November 30, 2012Document7 pagesSharekhan Top Picks: November 30, 2012didwaniasNo ratings yet

- IDirect ModelPortfolioUpdate Dec14Document16 pagesIDirect ModelPortfolioUpdate Dec14yogjan15No ratings yet

- Hero MotoCorp Limited Q4 2011-12 Results UpdateDocument8 pagesHero MotoCorp Limited Q4 2011-12 Results UpdateVineet GalaNo ratings yet

- SharekhanTopPicks 030811Document7 pagesSharekhanTopPicks 030811ghachangfhuNo ratings yet

- When The Gap Between Perception and Reality Is The Maximum, Price Is The Best''Document20 pagesWhen The Gap Between Perception and Reality Is The Maximum, Price Is The Best''sukujeNo ratings yet

- Sharekhan Top Picks: October 26, 2012Document7 pagesSharekhan Top Picks: October 26, 2012Soumik DasNo ratings yet

- Mid Cap Ideas - Value and Growth Investing 250112 - 11 - 0602120242Document21 pagesMid Cap Ideas - Value and Growth Investing 250112 - 11 - 0602120242Chetan MaheshwariNo ratings yet

- Sharekhan Top Picks: October 01, 2011Document7 pagesSharekhan Top Picks: October 01, 2011harsha_iitmNo ratings yet

- Corp LTD: (GMDV)Document3 pagesCorp LTD: (GMDV)api-234474152No ratings yet

- 15 Stocks Oct15th2018Document4 pages15 Stocks Oct15th2018ShanmugamNo ratings yet

- Amara Raja Batteries: CMP: INR861 TP: INR1,100 (+28%)Document8 pagesAmara Raja Batteries: CMP: INR861 TP: INR1,100 (+28%)Harshal ShahNo ratings yet

- Finolex Cables-Initiating Coverage 22 Apr 2014Document9 pagesFinolex Cables-Initiating Coverage 22 Apr 2014sanjeevpandaNo ratings yet

- Sinindus 20110913Document9 pagesSinindus 20110913red cornerNo ratings yet

- Opening Bell: Market Outlook Today's HighlightsDocument7 pagesOpening Bell: Market Outlook Today's HighlightsBharatNo ratings yet

- Ten Baggers - AmbitDocument18 pagesTen Baggers - Ambitsh_niravNo ratings yet

- Market Outlook Market Outlook: I-Direct Top PicksDocument9 pagesMarket Outlook Market Outlook: I-Direct Top PicksAnonymous W7lVR9qs25No ratings yet

- Tata Motors (TELCO) : Domestic Business Reports Positive Margins!Document12 pagesTata Motors (TELCO) : Domestic Business Reports Positive Margins!pgp28289No ratings yet

- Rambling Souls - Axis Bank - Equity ReportDocument11 pagesRambling Souls - Axis Bank - Equity ReportSrikanth Kumar KonduriNo ratings yet

- IEA Report 19th JanuaryDocument28 pagesIEA Report 19th JanuarynarnoliaNo ratings yet

- FM ProjectDocument13 pagesFM Projectabhi choudhuryNo ratings yet

- Fresh Capacities To Drive Growth Buy: Rating: Buy Target Price: 1,310 Share Price: 970Document10 pagesFresh Capacities To Drive Growth Buy: Rating: Buy Target Price: 1,310 Share Price: 970Vidhi MehtaNo ratings yet

- Sector Update Automobiles: IndexDocument6 pagesSector Update Automobiles: IndexSwetha Rakesh AdigaNo ratings yet

- IEA Report 31st JanuaryDocument24 pagesIEA Report 31st JanuarynarnoliaNo ratings yet

- Mid-Cap Marvels: RCM ResearchDocument20 pagesMid-Cap Marvels: RCM ResearchmannimanojNo ratings yet

- Dolat PreferredDocument45 pagesDolat PreferredAnonymous W7lVR9qs25No ratings yet

- Auto Two Wheelers-Shifting Into Top Gear!!Document91 pagesAuto Two Wheelers-Shifting Into Top Gear!!ronaksarda123No ratings yet

- Top 10 Stocks Motilal OswalDocument74 pagesTop 10 Stocks Motilal OswalAbhiroop DasNo ratings yet

- Sharekhan Top Picks: January 01, 2013Document7 pagesSharekhan Top Picks: January 01, 2013Rajiv MahajanNo ratings yet

- Force Motors Result UpdatedDocument11 pagesForce Motors Result UpdatedAngel BrokingNo ratings yet

- Stocks 2016 PDFDocument1 pageStocks 2016 PDFFakruddinNo ratings yet

- High Five StocksDocument7 pagesHigh Five Stockseswar414No ratings yet

- Ashok Leyland: Sell Investment ConcernsDocument8 pagesAshok Leyland: Sell Investment ConcernsPrabhakar SinghNo ratings yet

- Shanthi Gears LTD PDFDocument10 pagesShanthi Gears LTD PDFMBDangeNo ratings yet

- RHB Equity 360° - 02/03/2010Document4 pagesRHB Equity 360° - 02/03/2010Rhb InvestNo ratings yet

- Top 10 Mid-Cap Ideas: Find Below Our Top Mid Cap Buys and The Rationale For The SameDocument4 pagesTop 10 Mid-Cap Ideas: Find Below Our Top Mid Cap Buys and The Rationale For The Sameapi-234474152No ratings yet

- ICICI SecuritiesDocument37 pagesICICI SecuritiesDipak ChandwaniNo ratings yet

- Opening Bell: Market Outlook Today's HighlightsDocument8 pagesOpening Bell: Market Outlook Today's HighlightsNaleep GuptaNo ratings yet

- GEPL Top 10 Value Stock Picks PDFDocument12 pagesGEPL Top 10 Value Stock Picks PDFPravin YeluriNo ratings yet

- Idirect Bel Q4fy16Document13 pagesIdirect Bel Q4fy16khaniyalalNo ratings yet

- IDirect MuhuratPicks 2014Document8 pagesIDirect MuhuratPicks 2014Rahul SakareyNo ratings yet

- Market Outlook 11th October 2011Document5 pagesMarket Outlook 11th October 2011Angel BrokingNo ratings yet

- HDFC Sec Value Picks Sept15Document13 pagesHDFC Sec Value Picks Sept15sanjay901No ratings yet

- India Equity Analytics Today: Buy Stock of KPIT TechDocument24 pagesIndia Equity Analytics Today: Buy Stock of KPIT TechNarnolia Securities LimitedNo ratings yet

- Top Picks: Research TeamDocument30 pagesTop Picks: Research Team3bandhuNo ratings yet

- Ambit - Highest Conviction Buys & Sells From AmbitDocument11 pagesAmbit - Highest Conviction Buys & Sells From Ambitmaamir2000No ratings yet

- Steering & Steering Parts (C.V. OE & Aftermarket) World Summary: Market Values & Financials by CountryFrom EverandSteering & Steering Parts (C.V. OE & Aftermarket) World Summary: Market Values & Financials by CountryNo ratings yet

- Radio & Television Broadcasting Revenues World Summary: Market Values & Financials by CountryFrom EverandRadio & Television Broadcasting Revenues World Summary: Market Values & Financials by CountryNo ratings yet

- Maruti Suzuki ReportDocument45 pagesMaruti Suzuki Reportsagar bhamareNo ratings yet

- Maruti Suzuki Report (Marketing)Document11 pagesMaruti Suzuki Report (Marketing)Tushar RajpalNo ratings yet

- Maruti Suzuki Rural Marketing PlanDocument11 pagesMaruti Suzuki Rural Marketing Plansagar srivastavaNo ratings yet

- Dokumen - Tips - Maruthi Suzuki Wikipedia PDFDocument13 pagesDokumen - Tips - Maruthi Suzuki Wikipedia PDFVishal NigamNo ratings yet

- Man Power Planning Jyoti DubeyDocument95 pagesMan Power Planning Jyoti DubeydhruvNo ratings yet

- Pak Suzuki Supply ChainDocument21 pagesPak Suzuki Supply Chainshanesmith12No ratings yet

- Weld Information Collection SystemDocument46 pagesWeld Information Collection SystemGift A Life0% (1)

- Vishal's ProjectDocument95 pagesVishal's Projectsanchittkool100% (1)

- Report On Petrol and Diesel CarsDocument13 pagesReport On Petrol and Diesel Carskaweriorr75% (8)

- Mech - Automobile Repairing & Servicing WorkshopDocument10 pagesMech - Automobile Repairing & Servicing WorkshopShivam Pandey100% (1)

- Maruti Suzuki India Limited Strategic Management: (A Case Study)Document28 pagesMaruti Suzuki India Limited Strategic Management: (A Case Study)Sachin PhadkeNo ratings yet

- Car 3k..3364Document643 pagesCar 3k..3364Sameen AyeshaNo ratings yet

- Maruti SuzukiDocument33 pagesMaruti SuzukiNaman Arya100% (4)

- The Growth of The Indian Automobile Industry - Analysis of The Roles of Government Policy and Other Enabling Factors - SpringerLinkDocument24 pagesThe Growth of The Indian Automobile Industry - Analysis of The Roles of Government Policy and Other Enabling Factors - SpringerLinkRamk TandonNo ratings yet

- Webandcrafts - Vehicle PassDocument1 pageWebandcrafts - Vehicle PassJasmel PcNo ratings yet

- Sample Car OwnersDocument84 pagesSample Car OwnersShahal ShaNo ratings yet

- Customer Satisfaction Towards Maruti SwiftDocument71 pagesCustomer Satisfaction Towards Maruti SwiftMohit kolli50% (2)

- Maruti Suzuki India LimitedDocument11 pagesMaruti Suzuki India LimitedAnurag SinghNo ratings yet

- Daikin Exedy Por Mayor U DetalleDocument45 pagesDaikin Exedy Por Mayor U DetalleAlejandro SaraviaNo ratings yet

- Maruti Suzuki India Limited DesriptionDocument6 pagesMaruti Suzuki India Limited DesriptionSiddhant JoshiNo ratings yet

- Maruti Suzuki Dealer Showrooms in New DelhiDocument14 pagesMaruti Suzuki Dealer Showrooms in New DelhiSamrat KangjamNo ratings yet

- Buying Behavior of Customers at Maruthi Suzuki Mba Marketing Project ReportDocument94 pagesBuying Behavior of Customers at Maruthi Suzuki Mba Marketing Project ReportBabasab Patil (Karrisatte)100% (1)

- PAK Suzuki Case StudyDocument15 pagesPAK Suzuki Case Studyzahranqv1No ratings yet

- Mini Project Report-1Document46 pagesMini Project Report-1DimpleNo ratings yet

- Internship ReportDocument82 pagesInternship Reportpriti_guptag100% (1)

- Surabhi MarutiDocument80 pagesSurabhi Marutirahulsogani123100% (1)

- A Study On Employee Engagement For Cars IndiaDocument65 pagesA Study On Employee Engagement For Cars IndiaMohamed BhathurudeenNo ratings yet

- 07suzuki (97 99)Document3 pages07suzuki (97 99)mohaamed dwgNo ratings yet

- Customer Satisfaction RefDocument58 pagesCustomer Satisfaction RefArjun NbNo ratings yet

- Suzuki India - ReportDocument57 pagesSuzuki India - Reportanon_912873003No ratings yet