Professional Documents

Culture Documents

Sample Paper 2013 Class XII Subject Accountancy: Time: 3hours Maximum Marks: 80 General Instructions

Uploaded by

Sikha KaushikOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Sample Paper 2013 Class XII Subject Accountancy: Time: 3hours Maximum Marks: 80 General Instructions

Uploaded by

Sikha KaushikCopyright:

Available Formats

http://www.cbseguess.

com/

Sample Paper 2013

Class XII

Subject Accountancy

Time : 3Hours

General instructions :-

i.

ii.

iii.

iv.

v.

vi.

Maximum Marks : 80

All questions are compulsory.

Working notes must be part of your answer (where require).

Avoid overwriting and cutting.

Write your roll no. on the question paper.

Dont leave blank page/pages in your answer-book .

(*) Before a question is an indication of inclusion of value based question.

Part A

1.

State any two cases of dissolution of partnership firm by the order of the

Court (Sec.44). 1

2.

Goodwill (According to capitalization of Super profit) =

100

Super profit

Normal Rate of Return

What do you mean by Super profit in above formula of calculating goodwill?

1

3.

How is new partner admitted to a partnership firm?

1

4.

Steffi and Sarapova were partners in a firm. They decided to admit Sania as a

partner in the firm and

Sania Brought Rs.40,00,000 as premium for goodwill in cash for 1/3rd share in

profits. Pass journal entry for distribution of premium for goodwill.

1

5.

What do you mean by Convertible Preference share?

1

www.cbseguess.com

Other Educational Portals

www.icseguess.com | www.ignouguess.com | www.dulife.com | www.magicsense.com | www.niosguess.com |

www.iitguess.com

http://www.cbseguess.com/

6.

State any two purposes for which amount of Securities Premium can be

utilised according to Section

78 of the Indian Companies Act, 1956.

1

7.

Why would investor prefer to invest in Debentures of a company rather than in its

shares?

1

8.

The net profit of a firm for the year ended 31st December, 2012 has been duly

distributed between its partners A and B in their agreed ratio 3 : 2 respectively. It

was discovered on 10th Jan. 2013 that the under mentioned transactions were not

recorded before distribution of Profits:

(i) Interest on As Capital Rs.6,000 and interest on Bs Capital Rs.4,000.

(ii) Interest on drawings @12% p.a. and drawings of A were Rs.2,000 in each

month during the year.

Pass an adjustment entry to rectify the above errors.

3

9.

Shivang Ltd. On 1st Jan. 2013 acquired assets of the value of Rs.8,00,000 and

liabilities worth Rs.90,000

from Saurya Ltd., at an agreed value of Rs.7,20,000. Shivang Ltd. Issued 12%

Debentures of Rs.100

each at a discount of 10% in full satisfaction of purchase consideration. The

debentures were

redeemable 3 years later at a premium of 5%. Pass journal entries to record the

above in the books of Shivang Ltd upto issue of Debentures.

3

10.

Suraj Infrastructure Limited redeemed its 20,000, 15% Debentures of Rs.100

each at a premium of 8% and redemption is carried out in the following ways:

i.

25% of the amount due to debentureholders was paid by cheques.

ii. 25% of the amount due was paid by conversion into 12% Preference Shares of

Rs.50 each

issued at 20% premium.

www.cbseguess.com

Other Educational Portals

www.icseguess.com | www.ignouguess.com | www.dulife.com | www.magicsense.com | www.niosguess.com |

www.iitguess.com

http://www.cbseguess.com/

iii. 25% of the amount due was paid by conversion into 11% Debentures of

Rs.100 each issued

at 10% discount.

iv. 25% of the amount due was paid by conversion into Equity Shares of Rs.50

each issued at Par.

Pass journal entries for redemption of debentures in the books of Suraj

Infrastructure Ltd.

3

11.

*Zenny and Zuzu were partners in a firm sharing profits in 7 : 3 ratio. They

admitted Sudesh (without any premium for goodwill) for 20% share into

partnership who has won 1st position in the national level Laughter competition.

However Gogoi brought Rs.2,00,000 as Capital. Sudesh acquired his share equally

from Zenny and Zuzu.

You are required to

i. * Identify one value in admitting Mr. Sudesh into partnership.

1

ii. Pass journal entry for capital brought in by new partner and calculate new

profit sharing ratio. 3

12.

*ZaheerKhan, Ajay Jadeja and Chris Cairn entered into a partnership

business of sports equipments on 1st January 2012 with the capitals of

Rs.5,00,000 by each. Zaheer Khan also gave a loan of Rs.4,00,000 to the firm after

3 months of starting of their firm.. Partners decided to distribute Rs.1,00,000

sports items to 10 players of the city (In which firm is carrying its

business activities) for representing the state in different national level sports

competitions. After considering that expense but before considering any interest

on loan given by Zaheer Khan the Profits were Rs.3,55,000. Following adjustments

are also to be considered :

i. Interest on capital is to be allowed @4% p.a.

ii. Interest on drawings @6%p.a. Drawings were Ajay Jadeja-Rs.60,000 and Chris

Cairns-Rs.40,000

iii. Ajay Jadeja is allowed a commission of 2% on sales. Sales for the year were

Rs.20,00,000.

iv. 10% of the divisible profits is to be kept in a Reserve Account.

You are Required:

www.cbseguess.com

Other Educational Portals

www.icseguess.com | www.ignouguess.com | www.dulife.com | www.magicsense.com | www.niosguess.com |

www.iitguess.com

http://www.cbseguess.com/

a.* To state the value in forming the partnership firm and the value served

by the partners by taking

decision of distributing the sports items among players.

2

b. Show the distribution of profit after considering above adjustments.

4

13.

X Ltd. forfeited 500 shares of Rs.10 each(Rs.6 called-up) issued at a discount of

10% to Ram on which he has paid Rs.3 per share. Out of these 300 shares were reissued to Z as Rs.8 paid up for 6 per share.

(i) Give journal entries for forfeiture and re-issue of shares.

3

(ii) What is the minimum amount at which remaining 200 shares can be reissued

as fully paid up. 1

14.

Write the meaning of any two of the following:

4

(i) Sweat equity shares

(ii) Minimum Subscription

(iii) Reserve Capital

15. A, B and C were partners sharing profits in the ratio of 5 : 3 : 2. Their assets and

liabilities as on

31st March 2012 were as follows:

Assets:

Cash : Rs.16,000 ; Debtors : Rs.16,000 and other assets were

Rs.2,34,000.

Liabilities:

Creditors: Rs.20,000; Employees Compensation Fund: Rs.26,000;

As Capital: Rs.1,00,000 Bs Capital: Rs.70,000 and Cs Capital:

Rs.50,000.

C retires on the above date and it was agreed that:

(i)

Cs share of Goodwill was Rs.8,000;

(ii)

5% provision for doubtful debts was to be made on debtors;

(iii) Sundry creditors were valued Rs.4,000 more than the book value.

Pass necessary journal entries for the above transactions on Cs retirement.

4

www.cbseguess.com

Other Educational Portals

www.icseguess.com | www.ignouguess.com | www.dulife.com | www.magicsense.com | www.niosguess.com |

www.iitguess.com

http://www.cbseguess.com/

16.

X, Y and Z were partners sharing profits and losses in the ratio of 5:3:2. On 31st

March, 2012 their Assets and Liabilities were as under:

Assets :

Leasehold Rs.1,25,000 ; Patents Rs.30,000 ;

MachineryRs.1,50,000;

Stock-Rs.1,50,000;

Profit & Loss

A/c-Rs.40,000 and Cash at Bank- Rs.40,000

Liabilities :

Capitals : X-Rs.1,50,000, Y-Rs.1,25,000, Z-Rs.75,000;

General Reserve-Rs.30,000 ; Creditors- Rs.1,55,000

X died on 1st August, 2012 and it was agreed that:

(i) Goodwill of the firm is to be valued at Rs.3,50,000.

(ii) Interest on capital be provided @10% p.a.

(iii) Machinery is overvalued by 20% and Patents is undervalued by 25% .

(iv) Leasehold to be increased to Rs.1,50,000.

(iv) For the purpose of calculating Xs share in the profits of 2012-2013, the profits

should be

taken to have accrued on the same scale as in 2011-2012, which were

Rs.1,50,000.

Prepare Revaluation Account and Xs Capital A/c to be rendered to his

executor.

6

17. Srijan ltd. invited applications for issuing 50,000 equity shares of Rs.10 each. The

amount was payable

As follows :

On Application Rs.3 per share, on allotment Rs.4 per share and balance on 1St

and final call.

Applications were received for 75,000 shares and pro-rata allotment was made as

follows :

Applicants for 40,000 shares were allotted 30,000 shares on pro-rata basis.

Applicants for 35,000 shares were allotted 20,000 shares on pro-rata basis.

Ravi to whom 1,200 shares were allotted out of the group applying for 40,000

shares failed to pay the

allotment money. His shares were forfeited immediately after allotment.

www.cbseguess.com

Other Educational Portals

www.icseguess.com | www.ignouguess.com | www.dulife.com | www.magicsense.com | www.niosguess.com |

www.iitguess.com

http://www.cbseguess.com/

Shashi, who had applied for 700 shares out of the group applying for 35,000

shares failed to pay the

1st and final call. His shares were also forfeited. All the forfeited shares were

reissued for Rs.40,000.

Pass necessary journal entries to record the above transactions.

8

OR

X Ltd. with a nominal capital of Rs.50,00,000 divided into equity shares of Rs10

each, issued 2,00,000 equity shares at a premium of 20%. Amount was payable

Rs.3 on application, Rs.5(including premium) on allotment and balance on 1st and

Final call after 3 months of allotment. All the shares were applied for and money

due on allotment was duly received except one shareholder of 2,000 shares who

failed to pay the allotment money, while another shareholder who held 3,000

shares paid for the first and final call also. Expenses on issue of shares were

Rs.60,000 which were paid on the date of allotment and written off against the

securities premium.

Pass the necessary Journal entries in the companys books to record the

above transactions upto allotment of shares and show the companys

Balance Sheet also.

18.

P and Q are in partnership sharing profits and losses in the ratio of 3:2. Their

balance sheet as on 31st March, 2012 was as under:

Liabilities

Creditors

Rs.

1,50,000 Cash

General Reserve

1,20,000 Debtors

Rs.2,00,000

Less: Provision

8,000

6,00,000 Patents

Ps Capital Account

Assets

Rs.

50,000

1,92,000

Rs.

1,48,000

www.cbseguess.com

Other Educational Portals

www.icseguess.com | www.ignouguess.com | www.dulife.com | www.magicsense.com | www.niosguess.com |

www.iitguess.com

http://www.cbseguess.com/

Qs Capital Account

Ps Current Account

Q Current Account

3 00,000 Investments

1,00,000 Fixed Assets

20,000 Goodwill

12,90,000

80,000

7,20,000

1,00,000

12,90,000

They admit R on the following terms :

i.

Additional provision of 1% on debtors is to be created.

ii.

Accrued Income of Rs.15,000 does not appear in the books and Rs.50,000 are

outstanding for

salaries.

iii. Present market value of investments is Rs.60,000. P takes over the

Investments at this value.

iv. New profit sharing ratio of partners will be 4 : 3 : 2. R will bring in Rs.2,00,000

as his capital.

v.

R is to pay in cash an amount equal to his share in Firms Goodwill valued at

twice the average

profits of the last 3 years which were Rs.3,00,000; Rs.2,60,000 and

Rs.2,50,000 respectively.

vi. Half the amount of goodwill is withdrawn by old partners.

You are required to prepare Revaluation Account, Partners Capital Accounts,

Current Accounts and the opening Balance Sheet of the new firm.

8

OR

A, B and C are three partners sharing profits in the ratio of 3 : 1 : 1. On 31st

October,2012 they

decided to dissolve their firm. On that date assets and liabilities of their firm was

as under:Assets :

Bank balance- Rs.16,700; Debtors-Rs.24,200; Stock in trade Rs.7,800

Furniture- Rs.1,000 and Sundry Assets- Rs.17,000

Liabilities: Creditors- Rs.6,000; Provision for Bad debts- Rs.1,200; Loan- Rs.1,5000

www.cbseguess.com

Other Educational Portals

www.icseguess.com | www.ignouguess.com | www.dulife.com | www.magicsense.com | www.niosguess.com |

www.iitguess.com

http://www.cbseguess.com/

As Capital- Rs.27,500;

Bs Capital- Rs.10,000 and Cs Capital-

Rs.7,000

It is agreed that:(i) A is to take over furniture at Rs.1800 and Debtors amounting to Rs.4,200 at

Rs.3,600; the

Creditors of Rs.6,000 to be paid by him at this figure.

(ii) B is to take over all the Stock in Trade at Rs.7,000 and some of the Sundry

Assets

at Rs.7,200 (being 20% more than book value).

(iii) C is to take over the remaining Sundry Assets at 90% of the book value- less

Rs.100 as

discount and assume the responsibility for the discharge of the loan

together with accrued

interest of Rs.300 which has not been recorded in the books.

(iv) The expenses of dissolution were Rs.1,270. The remaining debtors were

sold to a debt

collecting agency for 80% of the book value.

Prepare necessary Accounts to close the books of the firm.

Part - B

19. State with reason whether repayment of Non-Current Liabilities will result in

increase, decrease or no

Change in Debt-Equity ratio.

1

20. *SRF Ltd. earned profit after tax 6 times of the last year and also has very

huge cash inflow from its operating Activities. Company decided to distribute 20%

of the profit among employees as bonus and

also decide to upgrade its plant to improve the working conditions. State any

value served by the company in such decisions.

1

21. List any two items which result in inflow of cash and cash equivalent in Financing

Activities.

1

22. State two items for each of the following sub-heads of different major head of

Companys Balance Sheet (Write for any three sub-head.):

3

www.cbseguess.com

Other Educational Portals

www.icseguess.com | www.ignouguess.com | www.dulife.com | www.magicsense.com | www.niosguess.com |

www.iitguess.com

http://www.cbseguess.com/

23.

(i) Reserve & Surplus

(ii) Long Term Borrowings (iii)

(iv) Other Current Liabilities

(v) Inventories

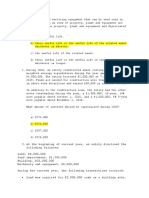

From the following Balance Sheets of Royal Industries as

2012, prepare a comparative Balance sheet:

4

Particulars

Not

e

No.

I

Short Term Provisions

on 31st March, 2011 and

31.03.201

1

Rs.

31.03.201

2

Rs.

5,00,000

1,00,000

8,00,000

1,00,000

3,00,000

4,00,000

1,00,000

10,00,000

2,00,000

15,00,000

EQUITY AND LIABILITIES :

Shareholders Funds :

Share Capital

Reserve and Surplus

Non-Current Liabilities

Long Term Borrowings

Current Liabilities

Short Term Borrowings

Total

II

Assets

Non-current Assets :

Current Assets :

Inventories

Trade Receivables

Cash & Cash Equivalents

Rs.

4,00,000

2,00,000

3,00,000

1,00,000

10,00,000

Rs.

6,00,000

3,00,000

4,00,000

2,00,000

15,00,000

Total

24.

Shareholders Fund Rs.6,00,000 ; 12% Debentures Rs.50,000; 10% Mortgage

Loan Rs.1,50,000; Total Assets Rs.10,80,000 ;

Income tax paid

Rs.63,000 ;

Rate of Income Tax was 50%.

With the help of above information of Rao Limited, Calculate :

(i)Debt-Equity ratio

(ii) Proprietary Ratio

(iii) Interest Coverage

ratio.

4

www.cbseguess.com

Other Educational Portals

www.icseguess.com | www.ignouguess.com | www.dulife.com | www.magicsense.com | www.niosguess.com |

www.iitguess.com

http://www.cbseguess.com/

25.

From the following statement, calculate the Cash Generated from

Operating Activities :

6

Statement of Profit and Loss

For the year ended 31st March, 2012

Particulars

Amount

Rs.

Revenue from Operations (Sales)

85,000

Add : Other Income :

Rs.

Profit on sale of machinery

5,000

Dividend Received

18,000

7,000

1,03,000

Income Tax Refund

6,000

Total Revenue

Less : Employees Benefit Expenses (Salaries)

10,000

Depreciation

20,000

Goodwill written off

8,000

Other Expenses : Rent

5,000

Loss on sale of Building

5,000

Profit Before Tax

Less : Provision for Tax

Net Profit for the Period

Less : Appropriations :

Proposed Dividend

Balance of profit

48,000

55,000

21,000

34,000

10,000

24,000

www.cbseguess.com

Other Educational Portals

www.icseguess.com | www.ignouguess.com | www.dulife.com | www.magicsense.com | www.niosguess.com |

www.iitguess.com

http://www.cbseguess.com/

The following additional information is available to you:

31-03-2011

Rs.

Trade Receivables

50,000

Inventories

25,000

Cash & Cash Equivalents

1,00,000

Trade Payables

75,000

Other Current Liabilities

25,000

31-03-2012

Rs.

60,000

20,000

1,25,000

90,000

15,000

www.cbseguess.com

Other Educational Portals

www.icseguess.com | www.ignouguess.com | www.dulife.com | www.magicsense.com | www.niosguess.com |

www.iitguess.com

You might also like

- FinQuiz - CFA Level 1, 2022 - Study PlanDocument2 pagesFinQuiz - CFA Level 1, 2022 - Study PlanSahibzada Muhammad Hamza Imran100% (1)

- Basics of Share MarketDocument15 pagesBasics of Share MarketashutoshNo ratings yet

- Swap ContractsDocument11 pagesSwap ContractsSanya rajNo ratings yet

- Valuing Wal Mart 2010 SolutionDocument8 pagesValuing Wal Mart 2010 SolutionAaron OrogNo ratings yet

- Corporate Finance - GBV PDFDocument12 pagesCorporate Finance - GBV PDFHesty SaniaNo ratings yet

- FR Revision NotesDocument340 pagesFR Revision NotesAashika SamaiyaNo ratings yet

- Open-Book Exam Question and Answer Booklet: 4UFM Level 4 Finance For ManagersDocument12 pagesOpen-Book Exam Question and Answer Booklet: 4UFM Level 4 Finance For ManagersTujuanna SmithNo ratings yet

- Securitization in India: Managing Capital Constraints and Creating Liquidity to Fund Infrastructure AssetsFrom EverandSecuritization in India: Managing Capital Constraints and Creating Liquidity to Fund Infrastructure AssetsNo ratings yet

- Bilans Stanja - BALANCE SHEETDocument2 pagesBilans Stanja - BALANCE SHEETLorimer01080% (10)

- Sample Paper 2013 Class XII Subject Accountancy: Time: 3hours Maximum Marks: 80 General InstructionsDocument8 pagesSample Paper 2013 Class XII Subject Accountancy: Time: 3hours Maximum Marks: 80 General Instructions9chand3No ratings yet

- 12 Accountancy Sample Paper 2014 04Document6 pages12 Accountancy Sample Paper 2014 04artisingh3412No ratings yet

- Test Paper 11Document8 pagesTest Paper 11Sukhjinder SinghNo ratings yet

- 2015 12 SP Accountancy Unsolved 07Document6 pages2015 12 SP Accountancy Unsolved 07BhumitVashishtNo ratings yet

- AccountancyDocument0 pagesAccountancyJaimangal RajaNo ratings yet

- Sample Paper Accountancy Class XIIDocument6 pagesSample Paper Accountancy Class XIIAcHu TanNo ratings yet

- Sample Paper (Cbse) - 2009 Accountancy - XiiDocument5 pagesSample Paper (Cbse) - 2009 Accountancy - XiiJanine AnzanoNo ratings yet

- Accountancy Model QuestionsDocument19 pagesAccountancy Model QuestionsSunil Kumar AgarwalaNo ratings yet

- CBSE 12th Accountancy 2014 Unsolved Paper Outside DelhiDocument7 pagesCBSE 12th Accountancy 2014 Unsolved Paper Outside DelhiAmlan ChakravortyNo ratings yet

- AHLCON PUBLIC SCHOOL Accountancy Class XII AssignmentDocument59 pagesAHLCON PUBLIC SCHOOL Accountancy Class XII Assignmentrajat0% (1)

- XII AccountancyDocument4 pagesXII AccountancyAahna AcharyaNo ratings yet

- Sample Paper 4Document6 pagesSample Paper 4Ashish BatraNo ratings yet

- CBSE 12th Accountancy 2010 Unsolved Paper SolutionsDocument7 pagesCBSE 12th Accountancy 2010 Unsolved Paper Solutionsbrainhub50No ratings yet

- 2016 12 SP Accountancy Solved 01Document8 pages2016 12 SP Accountancy Solved 01Sto BreakerNo ratings yet

- Accountancy: Time Allowed: 3 Hours Maximum Marks: 80Document50 pagesAccountancy: Time Allowed: 3 Hours Maximum Marks: 80Sidharth NahataNo ratings yet

- Class 12 Cbse Accountancy Sample Paper 2012 Model 2Document20 pagesClass 12 Cbse Accountancy Sample Paper 2012 Model 2Sunaina RawatNo ratings yet

- XII - Accy. QP - Revision-15.2.14Document6 pagesXII - Accy. QP - Revision-15.2.14devipreethiNo ratings yet

- CBSE Class 12 Accountancy Sample Paper-01 (For 2013)Document7 pagesCBSE Class 12 Accountancy Sample Paper-01 (For 2013)cbsestudymaterialsNo ratings yet

- CBSE Sample Paper Accountancy Class 12 SolvedDocument16 pagesCBSE Sample Paper Accountancy Class 12 SolvedShreya PalejkarNo ratings yet

- Class 12 Cbse Accountancy Sample Paper 2013-14Document24 pagesClass 12 Cbse Accountancy Sample Paper 2013-14Sunaina RawatNo ratings yet

- Accountancy Sample Question PaperDocument20 pagesAccountancy Sample Question PaperrahulNo ratings yet

- Accountancy For Class XII Full Question PaperDocument35 pagesAccountancy For Class XII Full Question PaperSubhasis Kumar DasNo ratings yet

- 12 Accountancy Sample Paper 2014Document26 pages12 Accountancy Sample Paper 2014Rachit JainNo ratings yet

- ACCOUNTANCY-Practice QuestionsDocument6 pagesACCOUNTANCY-Practice QuestionsMary JaineNo ratings yet

- Class 12 Accountancy Solved Sample Paper 1 - 2012Document34 pagesClass 12 Accountancy Solved Sample Paper 1 - 2012cbsestudymaterialsNo ratings yet

- Partnership Accounts Problems and SolutionsDocument4 pagesPartnership Accounts Problems and SolutionsSmita AdhikaryNo ratings yet

- Suraj Gir's Guess Paper For AISSCE-2008: Accountancy (67/1/2)Document5 pagesSuraj Gir's Guess Paper For AISSCE-2008: Accountancy (67/1/2)Shalini SharmaNo ratings yet

- CBSE 12th Accountancy 2012 Unsolved Paper Delhi BoardDocument7 pagesCBSE 12th Accountancy 2012 Unsolved Paper Delhi Boardbrainhub50No ratings yet

- Corporate Accounting QUESTIONSDocument4 pagesCorporate Accounting QUESTIONSsubba1995333333100% (1)

- CBSE Class 12 Accountancy Sample Paper-02 (For 2012)Document20 pagesCBSE Class 12 Accountancy Sample Paper-02 (For 2012)cbsesamplepaperNo ratings yet

- Part - A Partnership, Share Capital and Debentures: General InstructionsDocument7 pagesPart - A Partnership, Share Capital and Debentures: General InstructionsGaurav JaiswalNo ratings yet

- CBSE Sample Papers 2018-19Document84 pagesCBSE Sample Papers 2018-19simran ThapaNo ratings yet

- XIIAccountancySQP 2018-19 PDFDocument10 pagesXIIAccountancySQP 2018-19 PDFShivam SinghNo ratings yet

- DocumentDocument15 pagesDocumentTanuNo ratings yet

- IPCC MTP2 AccountingDocument7 pagesIPCC MTP2 AccountingBalaji SiddhuNo ratings yet

- Delhi Public School: ACCOUNTANCY - (Subject Code: 055)Document4 pagesDelhi Public School: ACCOUNTANCY - (Subject Code: 055)AbhishekNo ratings yet

- CBSE Class 12 Accountancy Sample Paper-03 (For 2014)Document17 pagesCBSE Class 12 Accountancy Sample Paper-03 (For 2014)cbsestudymaterialsNo ratings yet

- CBSE ACCOUNTANCY 2018 QUESTIONSDocument18 pagesCBSE ACCOUNTANCY 2018 QUESTIONSMohamedZiaudeenNo ratings yet

- Class 12 Accountancy Solved Sample Paper 2 - 2012Document37 pagesClass 12 Accountancy Solved Sample Paper 2 - 2012cbsestudymaterialsNo ratings yet

- TH TH STDocument3 pagesTH TH STsharathk916No ratings yet

- Xii Comm Holiday Homework 2020 23Document44 pagesXii Comm Holiday Homework 2020 23Mohit SuryavanshiNo ratings yet

- Cbse Sample Papers For Class 12 Accountancy With Solution PDFDocument24 pagesCbse Sample Papers For Class 12 Accountancy With Solution PDFVicky PawarNo ratings yet

- Module-2 Sample Question PaperDocument18 pagesModule-2 Sample Question PaperRay Ch100% (1)

- Holidays Home Work Xii 2023-24Document5 pagesHolidays Home Work Xii 2023-24Akshat TiwariNo ratings yet

- Sample Question Paper 2022-23 Acc XiiDocument12 pagesSample Question Paper 2022-23 Acc XiiTûshar ThakúrNo ratings yet

- CBSE 12th Accountancy 2009 Unsolved Paper Delhi BoardDocument7 pagesCBSE 12th Accountancy 2009 Unsolved Paper Delhi Boardbrainhub50No ratings yet

- Accountancysp PDFDocument10 pagesAccountancysp PDFRupesh ChouhanNo ratings yet

- Class XII Accountancy Paper For Half Yearly PDFDocument13 pagesClass XII Accountancy Paper For Half Yearly PDFJoshi DrcpNo ratings yet

- ACCOUNTANCY EXAM PAPERDocument58 pagesACCOUNTANCY EXAM PAPER9chand3No ratings yet

- Accountancy Previous QuestionsDocument4 pagesAccountancy Previous QuestionsmurthyNo ratings yet

- Dr. Vinod Kumar: Contact DetailDocument2 pagesDr. Vinod Kumar: Contact Detailyokesh ashokNo ratings yet

- XII Acct Sample Paper SolvedDocument5 pagesXII Acct Sample Paper SolvedDeepakPhalkeNo ratings yet

- Accountancy exam questions on partnership, companies, debenturesDocument8 pagesAccountancy exam questions on partnership, companies, debenturesVijayNo ratings yet

- Cbse-Class 12 Sample PaperDocument24 pagesCbse-Class 12 Sample PapervenumadhavNo ratings yet

- Class 12th Accounts Unsolved Sample Paper 1Document9 pagesClass 12th Accounts Unsolved Sample Paper 1Vikrant NainNo ratings yet

- Important Que Advanced Cor AccDocument18 pagesImportant Que Advanced Cor Accvineethaj2004No ratings yet

- ASP SEALING PRODUCTS LTD. PENDING INDENTSDocument118 pagesASP SEALING PRODUCTS LTD. PENDING INDENTSSikha KaushikNo ratings yet

- All 29Document134 pagesAll 29Sikha KaushikNo ratings yet

- Areawise 30Document26 pagesAreawise 30Sikha KaushikNo ratings yet

- All 29Document134 pagesAll 29Sikha KaushikNo ratings yet

- ASP SEALING PRODUCTS LTD. Pending Indent(Purchase Order) on Dated 05-DEC-2016 For "AllDocument22 pagesASP SEALING PRODUCTS LTD. Pending Indent(Purchase Order) on Dated 05-DEC-2016 For "AllSikha KaushikNo ratings yet

- BBBB 9amDocument34 pagesBBBB 9amSikha KaushikNo ratings yet

- Nabb RQMT Mail - 29Document12 pagesNabb RQMT Mail - 29Sikha KaushikNo ratings yet

- Asp Sealing Products Ltd. A-7, UPSIDC Industrial Area, Gajraula, Distt.J.P. Nagar, U.P. Assembly Production Detail (Daily)Document8 pagesAsp Sealing Products Ltd. A-7, UPSIDC Industrial Area, Gajraula, Distt.J.P. Nagar, U.P. Assembly Production Detail (Daily)Sikha KaushikNo ratings yet

- 9831anupam Accounts PreDocument10 pages9831anupam Accounts PreSikha KaushikNo ratings yet

- Solved Problems and Exercises-DepreciationDocument7 pagesSolved Problems and Exercises-DepreciationKaranNo ratings yet

- IFRS in Focus: Accounting Considerations Related To The Coronavirus 2019 DiseaseDocument25 pagesIFRS in Focus: Accounting Considerations Related To The Coronavirus 2019 DiseaseTaskin Reza KhalidNo ratings yet

- Seatwork Income MaDocument3 pagesSeatwork Income MaJoyce Ann Agdippa Barcelona0% (1)

- Book Value per Share CalculatorDocument3 pagesBook Value per Share CalculatorRheu ReyesNo ratings yet

- PM PPDocument30 pagesPM PPpriyanshu.goel1710No ratings yet

- Net Present Value (NPV) Definition - Calculation - ExamplesDocument3 pagesNet Present Value (NPV) Definition - Calculation - ExamplesKadiri OlanrewajuNo ratings yet

- Item 1. BusinessDocument222 pagesItem 1. BusinessVashirAhmadNo ratings yet

- Chapter 1 MFDocument11 pagesChapter 1 MFmanisha manuNo ratings yet

- Week 7 Far PretestDocument16 pagesWeek 7 Far PretestCale HenituseNo ratings yet

- CPA Review School of The Philippines ManilaDocument4 pagesCPA Review School of The Philippines ManilaSophia PerezNo ratings yet

- Managerial Accounting For Managers 3Rd Edition Noreen Solutions Manual Full Chapter PDFDocument67 pagesManagerial Accounting For Managers 3Rd Edition Noreen Solutions Manual Full Chapter PDFKennethRiosmqoz100% (9)

- GmfiDocument3 pagesGmfiRizki ImamiNo ratings yet

- Cash Flow Statement AnalysisDocument3 pagesCash Flow Statement AnalysisDan Andrei BongoNo ratings yet

- Chapter FiveDocument7 pagesChapter FiveChala tursaNo ratings yet

- Chapter 9 Practice Questions PDFDocument6 pagesChapter 9 Practice Questions PDFleili fallahNo ratings yet

- Philequity FundDocument1 pagePhilequity FundArnulfo Baruc Jr.No ratings yet

- Practice Exam: TEXT: PART A - Multiple Choice QuestionsDocument12 pagesPractice Exam: TEXT: PART A - Multiple Choice QuestionsMelissa WhiteNo ratings yet

- SFM Wrigley JR Case Solution HBRDocument17 pagesSFM Wrigley JR Case Solution HBRHayat Omer Malik100% (1)

- Reform's Impact on Indian Capital Markets: A Historical PerspectiveDocument30 pagesReform's Impact on Indian Capital Markets: A Historical PerspectiveNiketu Shah0% (1)

- SME and SE ParagraphDocument2 pagesSME and SE ParagraphAimee CuteNo ratings yet

- Consolidations - Subsequent To The Date of Acquisition: Multiple Choice QuestionsDocument221 pagesConsolidations - Subsequent To The Date of Acquisition: Multiple Choice QuestionsAurcus JumskieNo ratings yet

- SCF AnsDocument11 pagesSCF AnsA.J. ChuaNo ratings yet