Professional Documents

Culture Documents

Wonderla ICR

Uploaded by

Saran KumarOriginal Description:

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Wonderla ICR

Uploaded by

Saran KumarCopyright:

Available Formats

See

discussions, stats, and author profiles for this publication at: https://www.researchgate.net/publication/292046958

Indias favourite amusement park operator

Wonderla is operating two of Indias biggest

amusement parks...

Article August 2015

CITATIONS

READS

49

1 author:

Vignesh Sbk

Karvy

7 PUBLICATIONS 0 CITATIONS

SEE PROFILE

Available from: Vignesh Sbk

Retrieved on: 25 November 2016

Aug 13, 2015

WonderlaAug

Holidays

Ltd

13, 2015

Consumer Discretionary - Recreation Facilities & Svcs

Wonderla Holidays Ltd

Bloomberg Code: WONH IN

BUY

India Research - Stock Broking

Wonder Land of Opportunities

Recommendation (Rs.)

Hyderabad & Chennai parks to kick start growth:

Target Price

CMP (as on Aug 12, 2015)

Hyderabad & Chennai Parks are expected to be operational by April 2016 &

December 2017 respectively. We expect footfall in Hyderabad park to be in the

range of 0.6-0.8 Mn in first year and in next couple of years, footfalls are likely to

reach 1 mn mark and ticket pricing to be similar to Bangalore park. Footfalls for the

existing parks along with Hyderabad park for the next couple of years is likely to see

CAGR growth of 17% during FY15-17E. Average Ticket Prices (ATP) are likely to

witness 10% annual growth.

Indian Amusement parks in nascent growth stage:

264.3

320.0

Upside (%)

21

Stock Information

Mkt Cap (Rs.mn/US$ mn)

14933 / 231

3M Avg. daily volume (mn)

0.1

52-wk High/Low (Rs.)

Beta (x)

Sensex/Nifty

0.9

27512 / 8349

O/S Shares(mn)

Indian amusement park industry is currently valued at Rs. 25 bn in 2015 and is

expected to grow at CAGR of 20% over the next five years to reach Rs. 60 bn.

We expect the footfalls to increase for theme parks in India, on the back of rise in

consumer discretionary spending and emergence of theme parks as entertainment

destination.

355 / 240

56.5

Face Value (Rs.)

10.0

Shareholding Pattern (%)

Promoters

71.0

FIIs

9.1

DIIs

2.0

Others

Valuation and Outlook

Wonderla is one of the leading amusement parks in India and industry is expected

to grow at CAGR of 20% in the next five years. Wonderla revenues are expected to

grow CAGR of 29% during FY15-17E and EBITDA to grow at CAGR of 29.5% during

the same period. Wonderla is currently trading 20.1x FY17E EPS & 11.1x FY17E

EBITDA and we value the company at 25x FY17E EPS and arrive at target price of

Rs.320 with an upside of 21% for holding period of 9-12 months with BUY rating.

Indian consumer discretionary stocks are currently trading at 29x FY17E EPS and

global amusement park players in Asia & USA are trading at 20x & 19x FY17E

EPS respectively. Considering the high topline growth and highest EBITDA margins

among its global peers, we feel the stock has potential on long term investment.

Key Risks

17.9

Stock Performance (%)

1M

Absolute

Relative to Sensex

3M

6M

12M

1 (12)

(7)

(4)

Source: Bloomberg

Relative Performance*

140

130

120

110

100

yyAccidents in the park.

90

Aug-14

yyDecline in consumer discretionary spending.

Nov-14

Feb-15

Wonderla

yyCapital intensive / land acquisition.

May-15

Aug-15

Sensex

Source: Bloomberg; *Index 100

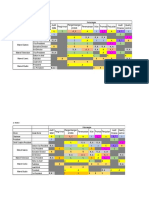

Exhibit 1: Valuation Summary (Rs. Mn)

YE Mar (Rs. Mn)

FY13

FY14

FY15

FY16E

FY17E

Net Sales

1378

1536

1818

2085

3043

EBITDA Margin (%)

45.4

45.8

44.3

47.6

44.4

8.0

9.5

9.2

10.1

13.1

28.8

26.2

20.1

EBITDA

Adj. Net Profit

EPS (Rs.)

RoE (%)

PE (x)

626

336

28.0

33.1

703

399

26.6

27.8

805

506

14.2

993

570

14.1

1350

742

16.0

Source: Company, Karvy Research

For private circulation only. For important information about Karvys rating system and other disclosures refer

to the end of this material. Karvy Stock Broking Research is also available on Bloomberg, KRVY<GO>,

Thomson Publishers & Reuters

Analyst Contact

Vignesh S B K

040 - 3321 6271

vignesh.sbk@karvy.com

Aug 13, 2015

Wonderla Holidays Ltd

Company Background

Company Financial Snapshot (Y/E Mar)

Profit & Loss (Rs. Mn)

FY15

FY16E

FY17E

Net sales

1818

2085

3043

EBITDA

805

993

1350

Optg. Exp (Adj for OI)

1013

Depreciation

162

Interest

17

Other Income

102

Tax

223

PBT

Adj. PAT

1092

203

68

1693

285

41

729

850

1107

506

570

742

281

365

Profit & Loss Ratios

EBITDA margin (%)

44.3

47.6

44.4

P/E (x)

28.8

26.2

20.1

Net margin (%)

27.8

EV/EBITDA (x)

18.6

Dividend yield (%)

0.5

27.3

15.1

0.5

24.4

11.1

Indias favourite amusement park operator operating two of

Indias biggest amusement parks, Wonderla Bangalore and

Cochin. Wonderla Bangalore is over 82 acres of land and is

located just 28 kms from Bangalore. Wonderla Cochin is spread

over 93 acres located just 16 kms outside Cochin. Wonderla

Kochi has been set up in 2000 and Wonderla Bangalore was

set up in 2005. Many of the rides have been custom made

and imported from reputed international suppliers, making

them unique in India. Wonderla also has the best safety record

for parks of this size and are both ISO 14001 and OHSAS

18001 certified. Wonderlas latest venture is the Wonderla

Resort, an 84 room luxury resort spread over 1,00,000 sq. ft

near the amusement park in Bangalore. Wonderla is the only

park in India to use Reverse Osmosis Treatment Technology

for treating water in pools. The park has a full fledged water

quality control laboratory which carries out 90 rigorous tests

on a regular basis.

0.7

Source: Company, Karvy Research

Cash Flow (Rs. Mn)

Balance sheet (Rs. Mn)

FY15

FY16E

FY17E

Total Assets

3976

4376

4989

Current assets

2098

1452

837

Net fixed assets

1791

Other assets

87

Total Liabilities

Networth

Current Liabilities

175

4376

4989

110

88

289

Others

123

3978

3976

3564

Debt

2800

12

4031

241

15

4637

319

24

Balance Sheet Ratios

RoE (%)

14.2

RoCE (%)

20.3

Net Debt/Equity

0.0

Equity/Total Assets

0.8

P/BV (x)

4.1

14.1

20.8

0.0

0.9

3.7

Source: Company, Karvy Research

Exhibit 2: Shareholding Pattern (%)

DIIs

2.0%

16.0

23.8

0.0

0.9

3.2

PBT

Depreciation

Interest

Tax

Changes in WC

Others

CF from Operations

Capex

FY15

FY16E

FY17E

729

850

1107

17

162

(281)

(365)

(71)

(43)

(23)

562

959

(1400)

79

50

(2235)

1700

(87)

Dividends & Finance

(120)

Change in Cash

(179)

CF from Financing

647

(70)

(1220)

CF from Investing

Change in Debt

(91)

(371)

(1943)

Change in Equity

285

(252)

Investment

Others

203

1493

1000

(170)

(22)

(110)

(133)

345

943

(455)

(80)

(136)

(216)

288

Source: Company, Karvy Research

Exhibit 3: Revenue Segmentation - FY15 (%)

Others

17.9%

Bangalore

Resort 5.4

Kochi Park

39.2

FIIs

9.1%

Promoters

71.0%

Source: Company, Karvy Research

Bangalore

Park 55.4

Source: Company, Karvy Research

Aug 13, 2015

Wonderla Holidays Ltd

Amusement parks in India in nascent growth stage

Exhibit 4: India Amusement Park Industry

80

Indian amusement park industry is currently valued at Rs. 25 bn in 2015

and is expected to grow at CAGR of 20% over the next five years and is

expected to reach Rs. 60 bn. Amusement park footfalls are estimated at

58-60 Mn annually compared to 300 Mn & 165 Mn in US & Europe. We

expect the footfalls to increase for theme parks in India, on the back of rise

in consumer discretionary spending and emergence of theme parks as

entertainment destination.

60

60

40

20

25

2015

2020

India Amusement park industry Size ( In Bn Rs)

Source: Company, Karvy Research

Exhibit 5: Global Amusement Park Industry Market

share

Canada

2.0%

Global amusement park industry is valued at $29.5 bn in 2015 and is

expected to reach $32 bn in 2017. For amusement park industry, globally

2014 was good year with 4% attendance growth for the top theme parks.

US and Europe saw footfall growth of 2% and 3% respectively; and fastest

growing region was Asia with 5%.

Asia

Pacific

26.0%

EMEA

21.0%

Latin

America

1.0%

US

50.0%

Source: Company, Karvy Research

Exhibit 6: Region-wise Growth Rates (%)

8%

6%

Majority of the parks are located in United States and Europe where the

markets are attaining maturity stage. United States has approximately 400

parks with 300 Mn visitors and Europe has 330 parks with 165 Mn annual

visitors. Asia is the fastest growing geography and is expected to become

the largest market for the theme park industry in next 15 years.

6.3%

4%

2%

0%

2.0%

0.6%

US

EMEA

3.1%

Asia*

Global**

Theme parks

CAGR Growth rate 6 years

Source: Themed Entertainment Association (TEA), Karvy Research,

* Global 25 theme parks & others top 20,

** For Asia, CAGR growth rate for last 4 years

2008

223

60

123

138

215

117

58

58

2011

2012

Asia pacific -top 20

135

206

109

132

103

127

2010

EMEA Top 20

58

56

96

123

2009

United States Top 20

196

189

186

0

57

57

121

123

186

Exhibit 7: Annual Footfalls of Top Amusement parks (Mn)

2013

2014

Top 25 Theme parks Worldwide

Source: TEA, Karvy Research

Aug 13, 2015

Wonderla Holidays Ltd

Exhibit 8: Top 25 International Amusement Parks by Footfalls (Mn)

Rank

Amusement/Theme Parks

Location

2014

2013

Magic Kingdom at Walt Disney World

Florida

19.3

18.5

4.0

Disneyland

California

16.7

16.2

3.5

2

4

5

6

7

8

9

10

11

12

13

14

15

16

17

18

19

20

21

22

23

24

25

Tokyo Disneyland

Tokyo Disney Sea

Tokyo, Japan

Tokyo, Japan

Universal Studio

Epcot at Walt Disney world

Disney's Animal Kingdom

Disney's Hollywood Studios

Disneyland park at Disneyland Paris

Disney's CA Adventure

Universal Studio

Osaka , Japan

Florida

Florida

Florida

Paris,France

California

Florida

Islands of Adventure

Florida

Ocean park

Hongkong

Lotte world

Seoul, South Korea

Hong kong Disney land

Hongkong

Everland

Universal Studio, Hollywood

Songcheng Park

Nagashima Island

Chimelong Ocean Kingdom

Europa, Park

Seaworld

Gyeongi-Do, South Korea

California

Hangzhou, China

Kuwana, Japan

Hengqin, China

Rust, Germany

Orlando, Florida

Tivoli Gardens

Copenhagen,Denmark

De Efteling

Walt Disney Studios park a Disneyland paris

Year 2015 - Wonderla Parks*

Year 2018E - Wonderla Parks*

Source: TEA, Karvy Research, *Just for comparison

kaatsheuvel,Netherland

Marne-la-valee, France

2 Parks (Bangalore & Kochi)

4 Parks (Bangalore, Kochi,

Hyderabad & Chennai)

17.3

14.1

11.8

11.4

10.4

10.3

9.9

8.8

8.3

8.1

7.8

7.6

7.5

7.4

6.8

17.2

14.0

% change attendance

0.5

0.1

10.1

16.8

10.2

2.0

11.2

10.1

2.0

2.0

10.4

(4.7)

7.1

17.0

7.5

4.2

8.5

8.1

7.4

7.4

7.3

3.0

0.0

2.8

1.4

1.1

6.1

11.0

5.8

(3.6)

5.0

4.9

2.0

4.5

4.2

5.8

5.6

5.5

4.7

4.4

4.2

2.3

4.2

-

38.3

5.1

(8.0)

4.1

6.0

4.5

6.6

(4.7)

4.0

Wonderla after commissioning its two new parks in Hyderabad and Chennai, along with its existing parks, footfalls are likely to

breach 4 mn footfalls annually which would push the company to the big league.

Demographic dividend

Exhibit 9: Indian population segmentation based on

Age group

56+

11%

0-14

31%

41-55

14%

31-40

14%

15-30

30%

India has 61% of its population under the age of 30; and 31% below the age

of 14 years, according to Census. Young population are the main drivers of

consumer spending and look out for different modes of entertainment and

child population are the influencing factors for the parents to visit theme

parks & play zones. With majority of the population under the age of 30, we

expect the consumer discretionary spending as % of consumer spending to

increase from 55% in 2007 to 61% 2020. Average age of Indias population

in 2020 is expected to be 29 years which is the lowest in the world. This

demographic factor plays positive role in discretionary spending which is

positive for entertainment industry like amusement parks.

Source: Census India, Karvy Research

Aug 13, 2015

Wonderla Holidays Ltd

Exhibit 10: Discretionary spending in proportion to

consumer expending among BRIC Nations (%)

Indian consumer spending on leisure & education is expected to grow at

CAGR of 15.3% and reach $296 Bn in 2020 from $71 Bn in 2010. Indias

discretionary spending on total consumer expenditure stood at 56.5% in

2012 and is expected to reach 60.6% in 2020. Among the BRIC countries,

India is likely to witness the increase share of discretionary spending out

of total spending. Out of total consumer spending, spending on leisure &

education segment is expected to grow at fastest pace during the period

and the share of this segment is expected to increase from 7.2% in 2010

to 8.5% in 2020.

64

55

55

55

61

59

61

63

60

64

65

50

45

China

Russia

Brazil

2007

India

2020

Source: Euro monitor, Karvy Research

Exhibit 11: Trend of Indian Consumer Spending by 2020

Category

Spending in

Spending in

% CAGR

% Segment Share in

% Segment Share in

$ bn 2010

$ bn 2020

Growth Rate

Spending 2010

Spending 2020

Food

328

895

10.6

33.1

25.0

Transportation & Communication

168

664

14.7

17.0

18.5

Housing & Consumer Durables

186

Education & Leisure

Clothes & Footwear

752

71

296

15.3

49

183

14.1

59

Health

Others

15.0

225

129

18.8

7.2

14.3

570

21.0

8.3

6.0

6.3

4.9

16.0

5.1

13.0

15.9

Source: Euro monitor, BCG India Analysis, Karvy Research

Hyderabad & Chennai parks to kick start growth:

Hyderabad park is expected to be operational by April 2016 at an investment of Rs. 2500 Mn. Wonderla has acquired 49 acres

of land in Hyderabad. However, the company is utilizing only 27 acres of the land for setting up the park and the remaining land

is likely to be used for expansion. At initial stages, park could handle 10000 visitors per day and total number of rides is expected

to be 42, with 24 land rides and 18 water rides. 40% of the rides in Hyderabad are likely to be different while the remaining rides

are expected to be similar to Bangalore. We expect footfall to be in the range of 0.6-0.8 Mn in first year and in next couple of

years, footfalls are likely to reach 1 mn mark and ticket pricing to be similar to Bangalore park. Ticket prices are likely to see 10%

growth every year in Hyderabad park. With close to 12 Mn people in Hyderabad urban agglomeration, it is Indias fourth largest

city in terms of population and District with per capita income of Rs.132862 (in Current prices) which is one of the highest in

South India. Hyderabad District & Rangareddy district GDP have been growing at an average of 10% & 12.3% respectively in

the last 7 years which we expect to be the main catchment areas for the Hyderabad park.

Exhibit 12: Hyderabad park catchment area growth rate

Exhibit 13: Hyderabad District Per capita Income highest in the

state

150000

35

34

132862

25

100000

117752

95361

15

-5

50000

11

5

% contribution to the

State GDP

FY 06-12

8

FY12-25

Hyderabad & Rangareddy GDP Growth rate

Source: Directorate of Economics & Statistics, McKinsey Insights India, Karvy Research

Hyderabad

Ranga reddy

Telangana State

District wise per capita Income in 2013-2014 at current prices (Rs)

Source: Directorate of Economics & Statistics, Karvy Research

Aug 13, 2015

Wonderla Holidays Ltd

Chennai park is expected to be operational by end of 2017 with an investment of Rs. 3000 Mn. Majority of the funding is through

internal accruals and remaining through debt. Existing parks are generating free cash flows which will be utilized for funding the

Chennai park. During first year of operations in Chennai park, we expect the footfall to be 1 mn because of larger market. Most of

the rides are expected to be different from other Wonderla parks in order to attract footfalls and inorder to withstand the competition

from bigger regional players such as MGM dizee world, Kishkintha & Queensland which are operating for many years in Chennai.

Exhibit 14: Chennai Growth Matrix

GDP per capita change

GDP in 2014

GDP Per capita in 2014

2013-2014

(PPP in Mn$)

(PPP $)

Category

Status

Chennai

Developing

5.20

58625

6469

Bangalore

Developing

4.30

45313

5051

Hyderabad

Developing

Mumbai

4.20

Developing

Delhi

40186

4.60

Developing

5063

150853

4.40

7005

293637

12747

Source: Global Metro Monitor, Brookings Report, Karvy Research

Existing parks (Bangalore & Kochi) to support growth

Exhibit 15: Parkwise Footfall (Lakhs)

35

30

7.0

25

20

15

9.2

10.8

11.3

11.9

12.5

13.1

13.8

11.1

11.8

12.1

11.0

10.9

11.1

11.4

10

5

0

FY11 FY12 FY13 FY14 FY15 FY16E FY17E

Kochi park

Bangalore park

Hyderabad Park

Source: Company, Karvy Research

Footfalls & Average Revenue per Visitor (ARPV) to remain key

revenue drivers: The company has two parks operational at Bangalore,

IT hub of India & Kochi, one of the favorite tourist destinations where

spending power is high and easily accessible. Footfalls have been growing

at CAGR of 8% during the period FY05-15 and expected to grow at CAGR

of 4% during FY15-17E for existing parks. Footfall admissions differ for

the operational parks in Kochi and Bangalore. With 65% of footfall for

Bangalore park comes from Bangalore city & greater Bangalore whereas

in Kochi park only 10% of footfalls are from Kochi city. Major footfalls for

Kochi park are from other parts of Kerala and Tamil Nadu whereas footfalls

for Bangalore park constitute of other parts of Karnataka, Southern AP,

Northern Kerala, TN & others. We expect footfall for the existing parks to grow at CAGR of 4% and reach 25.1 lk in FY17E from

23.4 lk in FY15 for existing parks. Footfalls for the existing parks along with Hyderabad park for the next couple of years is likely

to see CAGR growth of 17% during FY15-17E.

Exhibit 16: Footfall & Growth

7.6

7.5

10.8

6.7

FY02

FY03

FY04

FY05

FY06

FY07

FY08

FY09

No of total visitors in lakh

FY10

25.1

24.2

23.4

22.9

20.3

16.1

16.1

15.3

10

14.4

15.0

20

23.4

50%

22.6

30

30%

10%

FY11

FY12

FY13

FY14

FY15

Growth (%)

FY16E FY17E

-10%

Source: Company, Karvy Research

Exhibit 17: Footfall admission for Kochi park

Exhibit 18: Footfall admission for Bangalore park

Karnataka

15%

Tn & Others

35%

Kochi

9%

Kerala

56%

Source: Company, Karvy Research

South AP,

Northern

Kerala, TN

& Others

20%

City &

Greater

Bangalore

65%

Source: Company, Karvy Research

Aug 13, 2015

Wonderla Holidays Ltd

Holiday & festive season days witness higher footfalls

Amusement park business is seasonal with Q1 & Q3 to be strong because of more number of holidays and festive season.

Especially Q1 tends to the strongest season because of summer holidays with close to 50 days of Holidays & Q3 is strong

quarter because more number of festivals come in during the quarter such as Dussehra, Diwali, Christmas & New Year. In Kochi,

Q2 is good quarter because of festivals such as Ramzan, Onam & Bakrid falling in this quarter. Footfalls for the amusement

parks are mainly driven by holidays and new rides in the park. Number of holidays in 2015 & extended weekends for Karnataka

& Kerala are higher than previous year.

Exhibit 19: Bangalore Peak Season

Exhibit 20: Kochi Peak Season

Festival Holidays

Festival Holidays

Diwali

Nov 11-15

Ramzan

Dec 24-27

Bakrid

Dussehra

Oct 22- 25

New Year

Dec 31-Jan 3

Christmas

July18-21

Onam

Aug 27- 30

Christmas

Dec 24-27

Sep 24-17

New Year

Source: Company, Karvy Research

Dec 31-Jan 3

Source: Company, Karvy Research

In general, Wonderla parks generally see 3500 footfalls per day and see higher number during weekends & peak season which

is during holidays. Wonderla parks are currently handling at 29% and has a licensed capacity to handle 12000 visitors per day

in existing parks. Footfall mix combined for both the parks is in the ratio of 70:30 with general crowd and corporate group 70%

and remaining from school & college students. Bangalore park has slightly higher general crowd compared to Kochi park and

students are generally given discounts. School & college crowd are mostly influenced by discount offered to them.

Exhibit 21: No. of Calendar Holidays

Years

Number of Holidays Excluding

Sundays

Exhibit 22: Parkwise Licensed Capacity

Number of extended weekends

(Friday/Monday)

Karnataka

Kerala

Kerala

Karnataka

2014

22

19

11

2015

24

25

14

10

Capacity Footfall per day

Average Footfall

Weekend Footfall

Weekday Footfall

Bangalore

Kochi

Hyderabad

12000

12000

10000

6000

6000

3500

3000

Peak Season Footfall

8000

3500

3000

8000

Source: Company, Karvy Research

Source: Karnataka & Kerala Gov, Karvy Research

Wonderla generally adds a ride every two years and they are planning to add an interesting roller coaster ride in Bangalore

which would be Indias first reversing roller coaster and will be open to public by year end. Consistent addition of new rides and

thrilling rides would help to attract footfalls for the parks.

Exhibit 23: Consistent Addition of Rides in Bangalore & Kochi Parks

2011

2012

2013

2014

2015

32

34

34

33

39

22

22

22

22

23

54

56

56

55

62

Land Rides

Kochi

Bangalore

32

33

33

35

39

Water Rides

Kochi

Bangalore

20

20

20

20

20

Total Rides

Kochi

Bangalore

Hyderabad 45 rides in 2016

52

53

53

55

59

Source: Company, Karvy Research

Aug 13, 2015

Wonderla Holidays Ltd

Flexible pricing and discount strategy to activate footfalls

Footfall is the critical factor for any amusement park and consistent increase in footfalls are necessary to sustain the amusement

park industry. Wonderla has opted for flexible pricing strategy to activate footfalls by offering lower prices during weekdays where

the footfalls will be lower. During weekends, footfall is likely to be around 6000 per day compared to 3000 during weekdays and

ticket prices are charged at premium of 25% to the weekday prices. Peak season which is generally during holidays & festive

season, parks witness footfall of 8000 per day and tickets are priced at premium of 10% to the weekend tickets.

2000

Regular

Fastrack

Weekdays (Mon-Fri) Weekends (Sat&Sun)

Peak Season

Adult

Child

Regular

Regular

Fastrack

740

980

890

1340

1480

1780

Fastrack

670

1120

560

1000

500

Regular

1440

1500

720

1580

990

Fast track Weekends Fastrack

790

1440

720

900

1440

580

500

720

1000

1160

1500

1960

2000

1980

Exhibit 25: Wonderla Bangalore Ticket Prices (Rs.)

1800

Exhibit 24: Wonderla Kochi Ticket Prices

Regular

Fastrack

Weekdays (Mon-Fri) Weekends (Sat&Sun)

Peak Season

Adult

Child

Source: Company, Karvy Research

Source: Company, Karvy Research

Fast track tickets are available which enables the visitor for privilege entry for the rides & attractions by avoiding long queues.

These tickets are priced at 100% premium to the regular tickets and number of tickets issues is limited to 500 numbers in a day.

Average ticket prices (ATP) have been growing at CAGR of 11% over the last 5 years and has reached Rs.618 in FY15 from

Rs. 383 in FY11. In next couple of years, ticket prices are expected to reach Rs.748 in FY17E which is likely to grow at CAGR of

10% driven by price hike & sale of fast track tickets which are sold at twice the price of regular tickets. Ticket price increase every

year for multi-decade-long period is the global phenomena in theme park industry, indicating enormous price elasticity. Global

theme park player Disney land has been consistently increasing its ticket price annually at the rate of 9% for the last 44 years,

(though wonderla is not comparable to its size).

ATP

Source: Company, Karvy Research

Growth in ATP

20

10%

0%

Price ($)

2020

20%

2015

40

2010

30%

2005

60

2000

40%

1995

80

1990

FY17E

FY16E

FY15

FY14

50%

1985

10

100

1980

15

60%

1975

20

1970

10.0

120

1965

618

11.9

540

11.1

482

434

FY12

360

383

200

FY11

7.5

FY10

400

6.3

14.5

FY13

13.4

600

10.0

680

800

Exhibit 27: Disney Land Average Ticket Prices ($) & Growth (%)

748

Exhibit 26: Wonderla Average Ticket Price (Rs.) & Growth (%)

Growth (%)

Source: TEA Attendance Report, Industry, Karvy Research

Schools & college students form 35% of the total footfall for the parks. In order to attract this segment, discounts up to 35% &

20% are offered to school and college students respectively. The companys increased marketing efforts to schools & colleges

would lead to sustained footfalls from these segments. Special packages for corporate groups and stay at Bangalore resort will

lead to discount of ticket prices of theme park. Privilege member cards are offered where they can get discount on entry tickets

and tie up with Bangalore Metropolitan Transport Corporation (BMTC) Volvo bus service.

Aug 13, 2015

Wonderla Holidays Ltd

Non-ticket revenues to grow at faster pace

Non-ticket revenue in the last four years grew at CAGR of 20% and is expected to grow at CAGR of 33% during FY15-17E

driven by Food and Beverages (F&B) segment & share of revenues from restaurants. Wonderla parks have 7 restaurants in

both Bangalore & Kochi parks and are operated under revenue sharing model. Wonderla owns waves restaurants in both the

parks and other 6 restaurants share 25% of their revenues to Wonderla. The company aims to increase F&B segment revenue

contribution to 20% of total revenues from the current 8% in line with global amusement parks. Wonderla sells the products at

MRP whereas in other parks it has been sold at a premium. Spending Per Head (SPH) has increased from Rs.35.5 in 2011 to

Rs.96 in FY15. We expect the SPH to reach Rs. 127 in FY17E from Rs.96 in FY15.

2.4

3.2

3.3

2.8

80

60%

45.5%

50%

18.8%

100

80.5

79.0

79.5

78.9

96

81.8

50

20

13.3

13.4

15.3

17.1

17.7

17.3

FY11

FY12

FY13

FY14

FY15

Non ticket revenues

Ticket revenues

18.3

FY16E FY17E

Resort revenues

Source: Company, Karvy Research

81

86.6

5.6%

15.0%

56

86.7

40

48.7%

FY12

FY13

40%

30%

15.0%

20%

10%

37

60

150

127

2.8

100

Exhibit 29: SPH (Rs.) & Growth (%)

111

Exhibit 28: Revenue Composition (%)

FY14

FY15

SPH

FY16E

FY17E

0%

Growth in SPH

Source: Company, Karvy Research

Leading South Indian Player

In India, most of the large amusement parks are concentrated in metros & Tier-I cities especially in North India. Wonderla is the

largest southern player in the Amusement park industry with two operations in Kochi and Bangalore and cementing its position

as market leader with third & fourth parks coming up in Hyderabad & Chennai.

Wonderla ticket prices for a visitor are much lower than other theme parks such as Adlabs Imagica and Essel world which are

large parks. Amusement parks provide entertainment for entire day/weekend and there is not much competition from other

forms of entertainment such as malls, movies and plays which is for few hours. In cities where Wonderla operates, there are no

big theme parks to compete with them. There are about 165 parks in India with only 10% recognized as large parks. Parks are

categorized based on annual footfalls and with any park more than 0.5 Mn are categorized as large parks.

Exhibit 30: Amusement Park Landscape in India

Type

Number of Parks

Annual Visitors

Large Parks

15

<0.5 Mn

Small Parks

100

Less than 0.3 Mn

Medium Parks

Source: Company, Karvy Research

50

Between 0.3-0.5 Mn

Exhibit 31: Amusement Park Landscape in India

Amusement Parks

Location

Wonderla

Bangalore

Adventure island

Delhi

Ocean Park

Hyderabad

Ticket Prices

In

(Rs.)

Acres

720

83

650

62

Essel World & Water Kingdom Mumbai

1090

Adlabs Imagica

Mumbai

1399

300

Noida

999

44

Worlds of wonder

MGM Dizee world

GRS Fantasy Park

Nicco Park

Chennai

Mysore

Kolkota

350

899

575

520

64

20

27

30

40

Source: Respective Sites, Karvy Research

Aug 13, 2015

Wonderla Holidays Ltd

Glance at Wonderlas competition in its city of operations

Hyderabad

Exhibit 32: Population (Mn)

City with population close to 8.9 Mn hasnt seen any full fledged theme

parks which are going to be opportunity for Wonderla to capture. Hyderbad

city population is likely to reach 12.7 mn by 2030 and will become mega

city, according to UN. Hyderabad, being one of the metropolitan cities in

India and spending power is higher compared to other Tier-II & III cities.

Hyderabad has very hot climate and during summers temperature would

inch above 40oC. There are just couple of small water parks located in

Hyderabad and apart from that, there is Ramoji film city which is in different

genre.

14

12

12.8

10

8

10.3

8.9

11.2

4

2

0

2015

2020

2025

2030

Source: UN Report, Karvy Research

Exhibit 33: Theme Parks in Hyderabad

Amusement & Theme Park

Rides

Ticket Prices (Rs.)

Category

Acres

Wonderla

42

720

Large

47

Ocean Park

25

250

Small

Jalavihar

10

Mount Opera

200

20

425

Small

12.5

Small

20

Source: Respective Companies, Karvy Research

Bangalore

Bangalore park has seen its footfall grow at CAGR of 8% during the last four years consistently which is giving us more confidence

that Hyderabad would also receive similar response going forward. During winters, Wonderla parks would provide hot waters in

the pool as it wouldnt have any impact on footfalls. Despite other forms of entertainment, Bangalore park has proven that it is

niche form of entertainment segment & not comparable with others such as movies, malls & plays. Rides provide the thrill and

enthusiasm among the visitors, mainly kids & youth which induce them to revisit.

Exhibit 34: Theme Parks in Karnataka

City

Amusement & Theme Park

Rides

Ticket Prices (Rs.)

Size

Wonderla

60

720

Large

GRS Fantasy Park

15

575

Bangalore

Bangalore

Fun world

Mysore

Mangalore

Manasa Park

38

15

700

Medium

300

Small

Small

Source: Respective Companies, Karvy Research

Chennai

Exhibit 35: Chennai Population (Mn) & Growth (%)

15

3.0

10

5

0

11.2

5.8

1991

7.0

12.6

8.6

2001

2011

2021

2025

Chennai metro area population

CAGR Growth (%)

2.0

1.0

0.0

Chennai is one of the top metro cities and has population of 9 Mn and is

4th largest city in India. Chennai will have a population of 13 mn by 2030

and is projected to become megacity, according to UN. Chennai has very

hot humid climate for most part of the year which is the opportunity for

theme parks. However, Chennai has quite a few large theme parks which

are going to be challenging for Wonderla. Most of the theme parks are set

up long time back and rides must be used to the visitors and Wonderla

is likely to offer something new which should be one of the crowd pulling

factors.

Source: Census India, TN Government, Karvy Research

10

Aug 13, 2015

Wonderla Holidays Ltd

Exhibit 36: Theme Parks in Chennai

Amusement & Theme Park

Rides

Average Ticket Prices (Rs.)

Category

Acres

Wonderla*

45

800

Large

50

VGP Universal kingdom

37

325

Large

Queensland

51

Kishkinta

350

42

MGM Dizee world

Large

550

46

70

Large

899

120

Large

45

Source: Company, Karvy Research, *Our assumptions based on Hyderabad park

Bangalore Resort to be positioned as Vacation destination

Exhibit 37: Sources of Revenue - Wonderla vis-a-vis

International Trends (%)

80

80

60

40

50

20

15

Admission fees

Wonderla Parks

25

25

F&B +

Resort & Others

Mercahndising

International Theme Park

Source: Company, Karvy Research

Occupancy ratio in Bangalore resort has seen significant increase to 45%

in FY15 from 30% in FY14. Occupancy is likely to reach 60% in FY16E and

to reach 70% in FY17E on the back of increase in footfalls in Bangalore

park and improvement in corporate spending. The company has been

marketing to the corporate and the number of corporate events has seen

gradual increase in last few quarters. Most of the occupancy in the resort

is driven by footfalls in park and 60% of the footfall in resort is family

and remaining from corporate. Along with rooms, it has banquet halls &

conference rooms which have a capacity to hold 800 guests suitable for

hosting wedding receptions, meeting and corporate meetings. Bangalore

park has been designed as weekend destination for vacation where family

can stay in the resort which has amenities such as multi cuisine restaurant,

rest-o-bar, gym, solar heated swimming pool, recreation area and kids activity centre. Currently, resort contribution to revenues

is around 5 % which is less compared to other resorts globally where they derive 25% from the segment.

Exhibit 38: Hotel Occupancy in International Theme Parks

Name of the park

Hotels owned

Rooms

Occupancy (%)

Disneyland & Disney Sea

705

90

Universal Studios, Japan

2500

85

Disneyland Paris

5800

87

Source: Imacs Report, Karvy Research

Brand recall & efficient management can scale the company to be one of the leading players in Indian Amusement

park industry

Wonderla is ranked among the top 25 Amusement parks in Asia and best amusement park in India to visit, according to Trip

advisor. Wonderla getting listed in top Asian theme parks to visit induces confidence for the company to expand. With such

reputation in the industry and couple of parks are being opened in next few years and total of 4 parks would be operational by

2018 and Wonderla is planning to enter north India and become pan Indian player.

Exhibit 39: Top 10 Amusement / Water Parks - India

Exhibit 40: Top 10 Amusement Parks - Asia

Rank

Rank

Amusement/Theme Park

Location

Amusement/Theme Park

Location

Country

1 Wonderla Amusement Park

Bangalore

1 Universal Studios

Sentosa Island

Singapore

3 Adlabs, Imagica

Mumbai

3 Hong Kong Disneyland

Hongkong

China

2 Wonderla Amusement Park

4 Ramoji Film City

5 Essel World

6 Science City

7 Water Kingdom

8 Adventure Island

9 Funworld

10 GRS Fantasy

Source: Trip Advisor, Karvy Research

Kochi

Hyderabad

Mumbai

Kolkota

Mumbai

Delhi

Rajkot

Mysore

2 Ocean Park

4 Tokyo, Disneyland

5 Tokyo, DisneySea

6 Vinpearl Amusement park

7 Wonderla Amusement park

Hong Kong

Urayasu

Urayasu

Nha Trang

Bangalore

8 Harbin Ice & Snow Amusement World Harbin

9 Wonderla Amusement park

10 Funabashi Andersen Park

Kochi

Funabashi

China

Japan

Japan

Vietnam

India

China

India

Japan

Source: Trip Advisor, Karvy Research

11

Aug 13, 2015

Wonderla Holidays Ltd

Setting up amusement park is capital intensive and to set the right model is

challenging task. Wonderla management has experience of 15 years in the

industry and is running two successful parks and is replicating the similar

model in other parks where they intend to expand. New parks which are set

to come up would have land size of 50 acres as the prices are escalating

compared to 90 acres in Bangalore & Kochi. The company manufactures

one third of rides by itself with its efficient in-house manufacturing team

of close to 200 people. Team visits other international amusement parks

and replicates the rides which would suit our domestic people. Through inhouse manufacturing, the company saves on import duty & transportation

expenses and higher maintenance charges. Wonderla has manufactured

Exhibit 41: Rides

Imported

26%

In House

manufactured

38%

Domestically

Sourced

36%

Source: Company, Karvy Research

42 rides and attractions for its park and going forward, it plans to expand its in-house team and manufacture more rides by

itself for its upcoming park in Hyderabad and Chennai. Other rides are imported from Italy & US or domestically outsourced.

The company has water harvest systems in place in its existing parks and in Hyderabad park it has got industrial water supply.

Company does RO treatment technology for treating water in pools.

Capex needed to commission Hyderabad & Chennai Parks to be funded by internal accruals:

Hyderabad has been chosen as the next location for the expansion of Wonderla and is expected to be operational by April

2016. Total investment for Hyderabad is Rs. 2500-2600 Mn and is funded by cash raised through IPO during April-May 2014

for an amount of Rs. 1812.5 Mn. For Chennai park, the investment would be Rs. 3000 Mn and is expected to be commissioned

towards 2017. For Chennai parkmajority of the funding is liekly to be done by internal accruals. Management has guided for

1 Mn footfalls in Chennai during the first year of operation as it is bigger market and more number of new rides are expected.

Along with existing parks and Hyderabad park, Chennai park would start generating cash flows going forward which would be

helpful for opening up new theme parks across India and limit the dependence on debt. The company is planning to open one

new theme park every 4 years and has plans to become a pan Indian player in Amusement park Industry.

Exhibit 42: Hyderabad Capex break Up

Hyderabad Capex break Up

Land, Development & Civil construction

Amusement rides

Machinery & Equipments

Furnishing & vehicles

Consultant fees & others

Pre operative expenses

Contingencies

Rs. Mn

994

1067

261

114

24

63

38

Source: RHP, Karvy Research

12

Aug 13, 2015

Wonderla Holidays Ltd

Exhibit 43: Business Assumptions

Y/E Mar (Rs. Mn)

FY14

FY15E

FY16E

FY17E Comments

Revenue

1536

1818

2085

Revenue Growth (%)

11.4

18.4

14.7

3043 Revenues for the period FY15-17E are expected to

grow at CAGR of 30% , driven by footfall increase

45.9 of 17% & increase in ATP by 10%.

EBITDA

703

805

993

1350

EBITDA Margins (%)

45.8

44.3

47.6

PAT (normalized)

399

506

Fully Diluted EPS Growth (%)

18.7

(3.2)

India Business (Standalone)

Fully Diluted EPS (Rs.)

9.5

570

9.2

10.1

9.7

Source: Company, Karvy Research

EBITDA margins are likely to witness dip due to

initiation of Hyderabad park. However, it is likely to

44.4 improve going forward.

742 PAT is likely to witness CAGR growth of 21%

13.1 during FY15-17E, from Rs.506 mn in FY15 to

30.2 Rs.742 mn in FY17E.

Exhibit 44: Karvy vs Consensus

Karvy

Consensus

Divergence (%)

FY16E

2085

2112

(1.2)

FY17E

3043

3052

(0.3)

FY16E

993

986

0.8

FY17E

1350

1356

(0.4)

FY16E

10.1

10.6

(4.7)

FY17E

13.1

13.3

(1.6)

Revenues (Rs. Mn)

EBITDA (Rs. Mn)

EPS (Rs.)

Source: Bloomberg, Karvy Research

13

Aug 13, 2015

Wonderla Holidays Ltd

Exhibit 45: Revenue (Rs. Mn) & Growth (%)

3300

1378

18.4

FY13

FY14

FY15

Revenues (Rs. Mn)

3043

14.7

40

2085

1100

11.4

1536

21.8

1818

2200

60

45.9

20

0

FY17E

Growth (%)

FY16E

Revenues for the period FY11-15 grew at CAGR of 20%, driven mainly

by 13% average ticket price (ATP) growth. During FY15-17E, revenues

are expected to grow from Rs. 1818.4 mn to 3042.8 mn at CAGR of 30%

during FY15-17E, driven by commissioning of Hyderabad park. During

this period, footfall & ATP are likely to witness growth of 17% & 10%

respectively.

Source: Company, Karvy Research

1500

FY13

FY14

14.5

805

626

500

12.4

703

13.1

FY15

40

30

993

23.4

1000

35.9

1350

Exhibit 46: EBITDA (Rs. Mn) & Growth (%)

20

10

FY16E

FY17E

EBITDA (Mn Rs)

EBITDA is expected to grow at CAGR of 29.5% during FY15-17E from

Rs.805.3 mn in FY15 to 1350 mn in FY17E. EBITDA margins are expected

to improve in FY16E; However, it is likely to dip in FY17E because of

commissioning of new park in Hyderabad. We expect the operating

margins to improve going forward, on the back of increase in footfalls in

Hyderabad park.

Growth (%)

Source: Company, Karvy Research

800

27.0

FY13

40

30

570

200

506

13.9

12.5

18.7

399

400

336

600

30.2

742

Exhibit 47: PAT (Rs. Mn) & Growth (%)

20

10

FY14

FY15

PAT (Rs. Mn)

FY16E

FY17E

Growth (%)

PAT is likely to witness CAGR growth of 21% during FY15-17E, from

Rs.506 mn in FY15 to Rs.742 Mn in FY17E. Profit margins are likely to

be at 24.4% in FY17E and expected to inch up going forward as footfall in

Hyderabad improves. PAT has been growing at CAGR of 14% during the

last four years.

Source: Company, Karvy Research

Exhibit 48: Healthy Retun Ratios (%)

FY13

FY14

RoE

FY15

FY16E

23.8

16.0

20.8

14.1

14.2

10

20.3

26.6

20

28.0

30

35.0

37.7

40

RoE is likely to improve from the current levels of 14% in FY15 to 16% in

FY17E. RoE has seen a fall in FY15 on the back of fresh issue of shares to

raise money for its Hyderabad park. Before the IPO, RoE for the company

stood at average of 29% from FY12 to FY14. RoCE is expected to improve

from 20.3% in FY15 to 23.8% in FY17E, on the back of decline in debt.

FY17E

RoCE

Source: Company, Karvy Research

14

Aug 13, 2015

Wonderla Holidays Ltd

Exhibit 49: RoA & Asset Turnover Ratio

0.9

0.8

20

0.8

0.6

19.9

0.6

0.5

12.7

10

14.9

20.2

15

1.0

0.8

13.0

25

0.4

5

0

0.2

FY13

FY14

RoA

FY15

FY16E FY17E

Asset Turnover ratio

0.0

RoA for Wonderla is expected to improve to 15% in FY17E from the current

levels of 12.7% in FY15. With improvement in margins expected, RoA is

expected to improve. Asset turnover ratio is expected to improve on the

back of increase in footfalls in the existing park as well as Hyderabad parks.

Asset turnover ratio is to improve from 0.45x in FY15 to 0.80x in FY 17E.

Source: Company, Karvy Research

Exhibit 50: Dividend Payout

0.7

2.0

1.5

1.0

0.5

0.0

0.5

0.5

1.5

1.5

FY15

DPS

FY16E

0.8

0.6

0.4

2.0

0.2

FY17E

Dividend Yield (%)

0.0

We expect the company to increase its dividend per share, driven by

increase in operating cash flows. We expect company to pay Rs.1.5 and

Rs.2 per share for FY16E & FY17E respectively. Dividend payout ratio is

likely to be maintained at 15% and management is expected to increase

the payout ratio after commissioning of Hyderabad & Chennai parks.

Source: Company, Karvy Research

Exhibit 51: Company Snapshot (Ratings)

Low

1

Quality of Earnings

Domestic Sales

Exports

Net Debt/Equity

Working Capital Requirement

Quality of Management

Depth of Management

Promoter

Corporate Governance

Source: Company, Karvy Research

33

High

2

33

33

33

33

33

33

33

33

15

Aug 13, 2015

Wonderla Holidays Ltd

Valuation & Outlook

Wonderla is one of the leading amusement parks in India and industry is expected to grow at CAGR of 20% in the next five

years. Wonderla revenues are expected to grow CAGR of 29% during FY15-17E and EBITDA to grow at CAGR of 29.5% during

the same period. Wonderla is currently trading at 20.1x FY17E EPS & 11.1x FY17E EBITDA and we value the company at 25x

FY17E EPS and arrive at target price of Rs.320 with an upside of 21% for holding period of 9-12 months with BUY rating.

Indian consumer discretionary stocks are currently trading at 29x FY17E EPS and global amusement park players in Asia &

USA are trading at 20x & 19x FY17E EPS respectively. Considering the high topline growth and highest EBITDA margins among

its global peers, we feel the stock has potential on long term investment.

Exhibit 52 (a): Comparative Valuation Summary - Global Amusement Park Players

Currency

CMP *

EV/EBITDA (x)

Mcap

($ Mn)

P/E (x)

P/B(x)

FY15

FY16E

FY17E

FY15

FY16E

FY17E

FY15

FY16E

FY17E

18.6

15.1

11.1

28.8

26.2

20.1

4.1

3.7

3.2

7.0

21.7

18.1

16.6

1.2

1.2

1.2

8.4

18.2

15.7

14.0

1.9

1.9

1.9

India

Wonderla

INR

264

231

Asia

Ocean Park

HKD

Ardent lesiure Group

AUD

Orient Land Co Ltd

Average

JPY

7992

812

9.4

8.3

22693

18.7

17.8

15.7

8090

13.2

12.0

10.4

764

11.5

9.9

36.9

25.6

34.1

22.6

29.5

20.0

4.5

2.5

4.3

2.4

3.8

2.3

Europe

Merlin Entertainment

GBP

399

6323

12.4

11.1

9.9

22.3

19.4

16.8

3.4

3.1

2.7

Walt Disney

USD

111

187352

12.7

11.7

11.0

22.0

19.8

17.8

4.0

3.8

3.6

Six Flag

USD

46

4348

13.4

12.3

11.2

29.7

28.8

24.9

Average

6323

12.4

11.1

9.9

22.3

19.4

16.8

3.4

3.1

2.7

USA

Cedar Fair

Average

USD

54

3050

64917

10.6

12.2

9.9

11.3

Source: Bloomberg, Karvy Research, *CMP of compaines are denominated in respective countrys currency

9.5

10.5

19.1

23.6

15.9

21.5

14.9

33.1

28.0

21.1

19.2

17.0

14.8

11.9

13.9

12.6

11.1

Exhibit 52 (b): Comparative Valuation Summary - Global Amusement Park Players

Currency

CMP *

Mcap

($ Mn)

% CAGR (FY15-17E)

EBITDA (%)

RoE (%)

Sales

EBITDA

EPS

FY15

FY16E

FY17E

FY15

FY16E

FY17E

231

29.4

29.5

21.0

44.3

47.6

44.4

14.2

14.1

16.0

812

14.5

16.0

39.5

39.1

764

23.7

26.2

19.6

20.1

India

Wonderla

INR

264

Asia

Ocean Park

HKD

Ardent lesiure Group

AUD

Orient Land Co Ltd

Average

JPY

7992

22693

4.8

14.1

9.0

10.6

31.2

8.2

40.6

31.7

33.8

5.0

13.6

5.5

6.4

12.7

13.4

20.7

10.3

11.1

9.8

10.8

16.8

9.6

12.5

8090

14.3

17.1

11.0

30.1

30.3

31.7

6323

9.2

11.2

15.1

32.0

32.5

33.2

15.9

16.7

16.7

16.8

Europe

Merlin Entertainment

Average

GBP

399

USD

USD

6323

9.2

11.2

15.1

32.0

32.5

33.2

15.9

111

187352

6.9

8.0

12.1

30.3

30.9

31.0

18.4

21.7

18.9

46

4348

37.9

39.1

40.5

USA

Walt Disney

Cedar Fair

Six Flag

Average

USD

54

3050

3.5

6.0

15.9

36.2

64917

5.3

7.7

12.3

34.8

5.6

9.2

Source: Bloomberg, Karvy Research, *CMP of compaines are denominated in respective countrys currency

8.9

37.6

37.9

35.9

36.5

18.4

21.7

18.9

16

Aug 13, 2015

Wonderla Holidays Ltd

Exhibit 53: PE Band

Exhibit 54: PB Band

45

5.5

40

5.0

35

4.5

30

4.0

25

Aug-14

Oct-14

Dec-14

Feb-15

PE

SD2

Apr-15

Jun-15

Average

-1SD

3.5

Aug-14

Aug-15

SD1

Source: Company, Karvy Research

Oct-14

PB

SD2

Dec-14

Feb-15

Apr-15

Average

-1SD

Jun-15

Aug-15

SD1

Source: Company, Karvy Research

Exhibit 55: EV/EBITDA

30

26

22

18

14

Aug-14

Oct-14

Ev/EBITDA

Dec-14

Average

Feb-15

Apr-15

Jun-15

SD1

SD2

Aug-15

-1SD

Source: Company, Karvy Research

Exhibit 56 (a): Comparative Valuation Summary - Indian Consumer Discretionary Stocks

CMP (Rs.)

Wonderla

INOX

PVR

Jubliant Foodworks

Source: Karvy Research

264

239

824

1781

EV/EBITDA (x)

Mcap

(Rs. Mn)

14933

23078

34359

116832

P/E (x)

EPS (Rs.)

FY15

FY16E

FY17E

FY15

FY16E

FY17E

FY15

FY16E

FY17E

18.6

15.1

11.1

28.8

26.2

20.1

9.2

10.1

13.1

10.0

8.2

24.0

3.1

19.3

30.1

15.2

11.0

42.1

32.2

12.6

8.8

22.2

95.0

38.8

91.0

65.9

236.2

38.0

26.6

43.1

2.1

19.2

5.1

7.4

26.7

40.8

Exhibit 56 (b): Comparative Operational Metrics Summary - Indian Consumer Discretionary Stocks

CAGR % (FY15-17E)

RoE (%)

Price Perf (%)

Sales

EBITDA

FY15

FY16E

FY17E

Wonderla

29

29

14.2

14.1

16.0

PVR

21

35

3.2

15.9

20.6

INOX

Jubliant Foodworks

Source: Karvy Research

32

28

32

36

2.9

23.3

6.5

28.1

3m

6m

1.2

(12.5)

30.8

21.8

8.5

64.4

33.4

29.8

Net Sales (Rs. Mn)

12m

1.4

FY15

1818

FY16E

2085

FY17E

3043

37.9

59.5

10168

12457

15128

16.9

69.1

20745

26240

34209

26.6

13864

17937

21694

Key Risks

yyAccidents in the park.

yyDecline in consumer discretionary spending.

yyCapital intensive / land acquisition.

17

Aug 13, 2015

Wonderla Holidays Ltd

Financials

Exhibit 57: Income Statement

YE Mar (Rs. Mn)

FY13

FY14

FY15

FY16E

FY17E

Revenues

1378

1536

1818

2085

3043

753

833

1013

1092

1693

13.1

12.4

14.5

23.4

35.9

15

24

102

68

Growth (%)

Operating Expenses

EBITDA

Growth (%)

Depreciation & Amortization

Other Income

21.8

626

118

11.4

703

132

EBIT

522

595

PBT

500

579

Interest Expenses

Tax

Adjusted PAT

Growth (%)

22

164

336

16

180

399

18.4

805

162

14.7

993

203

45.9

1350

285

41

746

858

1107

729

850

1107

17

223

506

281

570

365

742

13.9

18.7

27.0

12.5

30.2

FY13

FY14

FY15

FY16E

FY17E

Cash & Cash Equivalents

29

200

83

428

716

Inventory

28

33

41

47

69

1943

1455

1394

Source: Company, Karvy Research

Exhibit 58: Balance Sheet

YE Mar (Rs. Mn)

Sundry Debtors

Loans & Advances

Investments

Gross Block

Net Block

CWIP

Miscellaneous

Total Assets

Current Liabilities & Provisions

Debt

Other Liabilities

74

55

1558

1587

57

201

1440

27

55

74

111

162

1555

2614

3810

398

390

452

39

943

2410

41

1660

2002

3976

4376

186

203

110

88

222

52

248

52

281

20

225

32

3526

56

4989

303

41

Total Liabilities

460

503

412

345

352

Reserves & Surplus

779

1079

2999

3466

4072

Shareholders Equity

Total Networth

Total Networth & Liabilities

Source: Company, Karvy Research

420

1199

1660

420

1499

2002

565

3564

3976

565

4031

4376

565

4637

4989

18

Aug 13, 2015

Wonderla Holidays Ltd

Exhibit 59: Cash Flow Statement

YE Mar (Rs. Mn)

FY13

FY14

FY15

FY16E

FY17E

PBT

500

579

729

850

1107

Depreciation

Interest

Tax Paid

Inc/dec in Net WC

Other Income

Other non cash items

Cash flow from operating activities

Inc/dec in capital expenditure

Inc/dec in investments

Others

Cash flow from investing activities

Inc/dec in borrowings

Issuance of equity

Dividend paid

Interest paid

Cash flow from financing activities

Net change in cash

Source: Company, Karvy Research

118

22

132

16

162

17

203

285

(151)

(198)

(252)

(281)

(365)

(3)

(11)

(79)

(49)

(2)

(2)

1

486

(17)

1

502

(374)

(275)

16

(23)

8

562

(91)

6

647

(70)

959

(371)

(1220)

(1400)

79

50

(1943)

(371)

(259)

(2235)

(170)

(455)

1700

(27)

(21)

(15)

29

(73)

(74)

(111)

(71)

(22)

4

172

(87)

1000

(22)

943

(80)

(99)

(103)

(136)

1493

(133)

(216)

(179)

(8)

345

288

Exhibit 60: Key Ratios

YE Mar

FY13

FY14

FY15

FY16E

FY17E

EBITDA Margin (%)

45.4

45.8

44.3

47.6

44.4

Net Profit Margin (%)

24.4

26.0

27.8

27.3

24.4

EBIT Margin (%)

Dividend Payout ratio

Net Debt/Equity

RoE (%)

RoCE (%)

Source: Company, Karvy Research

37.9

0.0

0.1

38.8

0.0

0.0

41.0

0.2

41.1

0.2

36.4

0.2

0.0

(0.1)

(0.2)

20.3

20.8

23.8

28.0

26.6

14.2

FY13

FY14

FY15

FY16E

FY17E

8.0

9.5

9.2

10.1

13.1

28.6

35.7

64.7

71.3

82.1

37.7

35.0

14.1

16.0

Exhibit 61: Valuation Parameters

YE Mar

EPS (Rs.)

DPS (Rs.)

BV (Rs.)

PE (x)

P/BV (x)

EV/EBITDA (x)

EV/Sales (x)

Source: Company, Karvy Research

0.0

33.1

9.3

24.0

10.9

0.0

27.8

7.4

21.3

9.8

1.5

28.8

4.1

18.6

8.2

1.5

26.2

3.7

15.1

7.2

2.0

20.1

3.2

11.1

4.9

19

Aug 13, 2015

Wonderla Holidays Ltd

Stock Ratings

Buy

Sell

Hold

Absolute Returns

> 15%

5-15%

<5%

Connect & Discuss More at

1800 425 8283 (Toll Free)

research@karvy.com

Live Chat

in

You

Tube

Disclaimer

Analyst certification: The following analyst(s), Vignesh S B K, who is (are) primarily responsible for this report and whose name(s) is/are mentioned therein,

certify (ies) that the views expressed herein accurately reflect his (their) personal view(s) about the subject security (ies) and issuer(s) and that no part of his

(their) compensation was, is or will be directly or indirectly related to the specific recommendation(s) or views contained in this research report.

Disclaimer: Karvy Stock Broking Limited [KSBL] is a SEBI registered Stock Broker, Depository Participant, Portfolio Manager and also distributes financial

products. The subsidiaries and group companies including associates of KSBL provide services as Registrars and Share Transfer Agents, Commodity Broker,

Currency and forex broker, merchant banker and underwriter, Investment Advisory services, insurance repository services, financial consultancy and advisory

services, realty services, data management, data analytics, market research, solar power, film distribution and production, profiling and related services.

Therefore associates of KSBL are likely to have business relations with most of the companies whose securities are traded on the exchange platform. The

information and views presented in this report are prepared by Karvy Stock Broking Limited and are subject to change without any notice. This report is based

on information obtained from public sources , the respective corporate under coverage and sources believed to be reliable, but no independent verification has

been made nor is its accuracy or completeness guaranteed. The report and information contained herein is strictly confidential and meant solely for the selected

recipient and may not be altered in any way, transmitted to, copied or distributed, in part or in whole, to any other person or to the media or reproduced in any

form, without prior written consent of KSBL. While we would endeavor to update the information herein on a reasonable basis, KSBL is under no obligation

to update or keep the information current. Also, there may be regulatory, compliance or other reasons that may prevent KSBL from doing so. The value and

return on investment may vary because of changes in interest rates, foreign exchange rates or any other reason. This report and information herein is solely for

informational purpose and shall not be used or considered as an offer document or solicitation of offer to buy or sell or subscribe for securities or other financial

instruments. Though disseminated to all the customers simultaneously, not all customers may receive this report at the same time. KSBL will not treat recipients

as customers by virtue of their receiving this report. Nothing in this report constitutes investment, legal, accounting and tax advice or a representation that any

investment or strategy is suitable or appropriate to your specific circumstances. This material is for personal information and we are not responsible for any loss

incurred based upon it. The investments discussed or recommended in this report may not be suitable for all investors. Investors must make their own investment

decisions based on their specific investment objectives and financial position and using such independent advice, as they believe necessary. While acting upon

any information or analysis mentioned in this report, investors may please note that neither KSBL nor any associate companies of KSBL accepts any liability

arising from the use of information and views mentioned in this report. Investors are advised to see Risk Disclosure Document to understand the risks associated

before investing in the securities markets. Past performance is not necessarily a guide to future performance. Forward-looking statements are not predictions

and may be subject to change without notice. Actual results may differ materially from those set forth in projections.

yy Associates of KSBL might have managed or co-managed public offering of securities for the subject company or might have been mandated by the subject

company for any other assignment in the past twelve months.

yy Associates of KSBL might have received compensation from the subject company mentioned in the report during the period preceding twelve months from

the date of this report for investment banking or merchant banking or brokerage services from the subject company in the past twelve months or for services

rendered as Registrar and Share Transfer Agent, Commodity Broker, Currency and forex broker, merchant banker and underwriter, Investment Advisory

services, insurance repository services, consultancy and advisory services, realty services, data processing, profiling and related services or in any other

capacity.

yy KSBL encourages independence in research report preparation and strives to minimize conflict in preparation of research report.

yy Compensation of KSBLs Research Analyst(s) is not based on any specific merchant banking, investment banking or brokerage service transactions.

yy KSBL generally prohibits its analysts, persons reporting to analysts and their relatives from maintaining a financial interest in the securities or derivatives of

any companies that the analysts cover.

yy KSBL or its associates collectively or Research Analysts do not own 1% or more of the equity securities of the Company mentioned in the report as of the

last day of the month preceding the publication of the research report.

yy KSBL or its analysts did not receive any compensation or other benefits from the companies mentioned in the report or third party in connection with

preparation of the research report and have no financial interest in the subject company mentioned in this report.

yy Accordingly, neither KSBL nor Research Analysts have any material conflict of interest at the time of publication of this report.

yy It is confirmed that KSBL and Research Analysts, primarily responsible for this report and whose name(s) is/ are mentioned therein of this report have not

received any compensation from the subject company mentioned in the report in the preceding twelve months.

yy It is confirmed that Vignesh S B K, Research Analyst did not serve as an officer, director or employee of the companies mentioned in the report.

yy KSBL may have issued other reports that are inconsistent with and reach different conclusion from the information presented in this report.

yy Neither the Research Analysts nor KSBL have been engaged in market making activity for the companies mentioned in the report.

yy We submit that no material disciplinary action has been taken on KSBL by any Regulatory Authority impacting Equity Research Analyst activities.

Karvy Stock Broking Limited

Plot No.31, 6th Floor, Karvy Millennium Towers, Financial District, Nanakramguda, Hyderabad, 500 032, India

Tel: 91-40-2331 2454; Fax: 91-40-2331 1968

For More updates & Stock Research, visit www.karvyonline.com

20

You might also like

- AngelBrokingResearch WonderlaHolidays IC 310815Document18 pagesAngelBrokingResearch WonderlaHolidays IC 310815PrashantKumarNo ratings yet

- WonderlaDocument6 pagesWonderlaVishal KumarNo ratings yet

- Global Theme Park Market: Trends & Opportunities (2014-19) - New Report by Daedal ResearchDocument10 pagesGlobal Theme Park Market: Trends & Opportunities (2014-19) - New Report by Daedal ResearchDaedal ResearchNo ratings yet

- Investor Presentation: June-2016Document34 pagesInvestor Presentation: June-2016Ashish SachdevaNo ratings yet

- Post Graduate Programme Post Graduate Programme in Management: 2010 - 2012Document22 pagesPost Graduate Programme Post Graduate Programme in Management: 2010 - 2012Ashiq AbdullahNo ratings yet

- Elara Capital - Agri InputsDocument80 pagesElara Capital - Agri InputsAditya AgarwalNo ratings yet

- Customer Satisfaction of TATA NANO CustomersDocument13 pagesCustomer Satisfaction of TATA NANO Customersrahul vatsyayan100% (5)

- Apollo Tyre MPDocument78 pagesApollo Tyre MPNaresh KumarNo ratings yet

- Water Market Intelligence - TechSci ResearchDocument8 pagesWater Market Intelligence - TechSci ResearchTechSciResearchNo ratings yet

- FM Cia3Document30 pagesFM Cia3dhrivsitlani29No ratings yet

- Marketing Management of Ro SystemDocument15 pagesMarketing Management of Ro SystemPramit Kumar PattanaikNo ratings yet

- Promotion of Bajaj Finance EMI Card at Future India Outlets: Summer Internship Project Report OnDocument22 pagesPromotion of Bajaj Finance EMI Card at Future India Outlets: Summer Internship Project Report OnSushant PawarNo ratings yet

- Marketing Management of Ro SystemDocument16 pagesMarketing Management of Ro SystemPramit Kumar PattanaikNo ratings yet

- 9D Research GroupDocument8 pages9D Research Groupapi-291828723No ratings yet

- Group 4 - Apollo TyresDocument33 pagesGroup 4 - Apollo TyresNikita KhandujaNo ratings yet

- Final ReportDocument13 pagesFinal Reportapi-384939961No ratings yet

- 9D Research GroupDocument8 pages9D Research Groupapi-291828723No ratings yet

- Industry Review ReportDocument7 pagesIndustry Review ReportSomil TurakhiaNo ratings yet

- Final Report SampleDocument42 pagesFinal Report SampleVenkata VihariNo ratings yet

- PRS TyresDocument47 pagesPRS TyresSenthuran MBANo ratings yet

- Indoco RemediesDocument19 pagesIndoco RemediesMNo ratings yet

- Renub Research: Published: September, 2012Document19 pagesRenub Research: Published: September, 2012api-114525849No ratings yet

- SPL Report - 2022Document34 pagesSPL Report - 2022Siew Ming SooNo ratings yet

- Gold Stone Fund (GroupB12)Document18 pagesGold Stone Fund (GroupB12)anamika prasadNo ratings yet

- Literature Review On Automobile Industry 2009Document5 pagesLiterature Review On Automobile Industry 2009afmzeracmdvbfe100% (1)

- BAIBF 09012 ManuDocument5 pagesBAIBF 09012 ManuManu VargheseNo ratings yet

- AnandRathi Relaxo 05oct2012Document13 pagesAnandRathi Relaxo 05oct2012equityanalystinvestorNo ratings yet

- Automobile Literature ReviewDocument8 pagesAutomobile Literature Reviewbzknsgvkg100% (1)

- India Tyre Market Forecast and Opportunities, 2017 - SampleDocument10 pagesIndia Tyre Market Forecast and Opportunities, 2017 - SampleTechSciResearchNo ratings yet

- Quest Kingdom FinalDocument33 pagesQuest Kingdom FinalHenil PatelNo ratings yet

- Brand Image - HyundaiDocument60 pagesBrand Image - HyundaiSathishPerla100% (1)

- 9D Research GroupDocument8 pages9D Research Groupapi-291828723No ratings yet

- Strategic Road Maps For Auto Mobile IndustryDocument34 pagesStrategic Road Maps For Auto Mobile IndustryHeena Pahuja100% (1)

- Aid for Trade in Asia and the Pacific: Promoting Connectivity for Inclusive DevelopmentFrom EverandAid for Trade in Asia and the Pacific: Promoting Connectivity for Inclusive DevelopmentNo ratings yet

- 9D Research GroupDocument8 pages9D Research Groupapi-291828723No ratings yet

- Apollo Tyres - PPT (Final)Document21 pagesApollo Tyres - PPT (Final)akli12100% (3)

- Batteries Investor Presentation August 2016Document32 pagesBatteries Investor Presentation August 2016AshredNo ratings yet

- La Opala RG - Initiating Coverage - Centrum 30062014Document21 pagesLa Opala RG - Initiating Coverage - Centrum 30062014Jeevan PatwaNo ratings yet

- APOLLO TYRES SWOT - Internal AnalysisDocument8 pagesAPOLLO TYRES SWOT - Internal Analysisshazia ahmadNo ratings yet

- Continental Tyre SIPDocument41 pagesContinental Tyre SIPSushant PawarNo ratings yet

- Bank On Sundram Fasteners For Latest Diwali Bonanza: Why Buy?Document4 pagesBank On Sundram Fasteners For Latest Diwali Bonanza: Why Buy?Dynamic LevelsNo ratings yet

- A Case Study On Ashok Leyland, India Joint Venture With Nissan Motor Company, JapanDocument28 pagesA Case Study On Ashok Leyland, India Joint Venture With Nissan Motor Company, JapanSantosh Chourpagar50% (4)

- Finacial Analysis - PDF Best OneDocument11 pagesFinacial Analysis - PDF Best OneharshNo ratings yet