Professional Documents

Culture Documents

2010 BIR-RMC Contents

Uploaded by

Mary Grace Caguioa AgasCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

2010 BIR-RMC Contents

Uploaded by

Mary Grace Caguioa AgasCopyright:

Available Formats

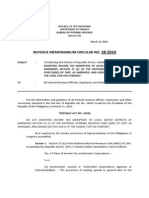

BUREAU OF INTERNAL REVENUE

2010 REVENUE MEMORANDUM CIRCULAR

2010 BUREAU OF INTERNAL REVENUE

REVENUE MEMORANDUM CIRCULAR

RMC NO.

SUBJECT MATTER

RMC No. 1-2010

Defers the implementation of RR No. 7-2009 relative to the eDST System

RMC No. 2-2010

Publishes the full text of Memorandum Circular No. 1, Series of 2006 of the

Office of the Ombudsman

RMC No. 3-2010

Publishes the full text of Proclamation No. 1841 entitled Declaring the Regular

Holidays, Special (Non-Working) Days, and Special Holiday (for All Schools) for

the Year 2010

RMC No. 4-2010

Notifies the loss of 5 pads of unused Accountable Form No. 51-Official Receipt

RMC No. 5-2010

Publishes the 2010 Calendar of Activities under the BIR People Wellness

Program

RMC No. 6-2010

Publishes the full text of the Memorandum of Agreement between BIR and

PNP

RMC No. 7-2010

Publishes the full text of the Memorandum of Agreement between the BIR, LTO

and Insurance Commission

RMC No. 8-2010

Circularizes the release of BIR Weekender Briefs and other publications of the

BIR

RMC No. 9-2010

Notifies the loss of one original copy of Tax Credit Certificate issued to Fil-Am

Foods, Inc. (now Pilmico Animal Nutrition Corporation)

RMC No. 10-2010

Prescribes the 2010 Strategy Map of the BIR

RMC No. 11-2010

Circularizes the full text of COMELEC Resolution No. 8737

RMC No. 12-2010

Circularizes the full text of Joint Rules and Regulations Implementing Articles

60, 61 and 144 of Republic Act No. 9520, otherwise known as the Philippine

Cooperative Code of 2008 in relation to RA No. 8424 or the National Internal

Revenue Code, as amended

RMC No. 13-2010

Publishes the full text of Administrative Order No. 277 entitled Creating an

Independent Committee to Review, Assess and Evaluate All the Important

Smuggling and Tax Evasion Cases Handled by the Bureau of Internal Revenue

and the Bureau of Customs

RMC No. 14-2010

Circularizes the full text of Joint Circular No. 2009-1A of the Department of

Budget and Management, Bureau of Internal Revenue and National Tobacco

Administration, amending the guidelines and procedures on the release of the

share of Local Government Units

RMC No. 15-2010

Publishing the Full Text of Memorandum Circular No. 30, Series of 2009 of the

Civil Service Commission

RMC No. 16-2010

Requirestaxpayers todisclose theirelection to use the Optional Standard

Deduction for taxable year 2009.

RMC No. 17-2010

Publishing the full text of Administrative Order No. 277-A entitled Amending

Section 2 of Administrative Order No. 277, Series of 2010 Creating an

Independent Committee to Review, Assess and Evaluate All the Important

Smuggling and Tax Evasion Cases Handled by the Bureau of Internal Revenue

and the Bureau of Customs

RMC No. 18-2010

Clarifies the coverage and taxability of amusement places under Section

125(b) of the National Internal Revenue Code of 1997, as amended

RMC No. 19-2010

Directs all concerned BIR offices to continue tax investigation of Cooperatives

RMC No. 20-2010

Circularizes the revocation of BIR Ruling No. DA-245-2005 relative to the joint

venture transactions between Meridien East Realty and Development

Corporation and Century Properties, Inc.

RMC No. 21-2010

Reiterates the applicable penalties for employers who fail to withhold, remit,

do the year-end adjustment and refund employees of the excess withholding

taxes on compensation

RMC No. 22-2010

Publishes the full text of Republic Act No. 10001 entitled An Act Reducing the

Taxes on Life Insurance Policies, Amending for this Purpose Sections 123 and

183 of the National Internal Revenue Code of 1997, as Amended

RMC No. 23-2010

Publishes the full text of Republic Act No. 9999 entitled An Act Providing a

Mechanism for Free Legal Assistance and for Other Purposes

RMC No. 24-2010

Further defers the implementation of Revenue Regulations No. 7-2009 relative

to the Electronic Documentary Stamp Tax (eDST) System

RMC No. 25-2010

Publishes the full text of the Memorandum of Agreement between the Bureau

of Internal Revenue and the Office of the Solicitor General

RMC No. 26-2010

Publishes the full text of the Memorandum of Agreement between the BIR and

the National Bureau of Investigation and Criminal Investigation and Detection

Group

RMC No. 27-2010

Circularizes the full text of Department Order No. 6-2010 entitled Amending

Further Ministry Order Nos. 20-86 and 21-86, as Amended by Department

Order Nos. 12-89, 13-89, 10-92, 21-99 and 35-04 Creating the Committees on

Real Property Valuation to Determine the Zonal Values of Real Properties for

Purposes of Computing Any Internal Revenue Tax

RMC No. 28-2010

Circularizes the full text of Republic Act No. 10026 entitled An Act Granting

Income Tax Exemption to Local Water Districts by Amending Section 27(C) of

the National Internal Revenue Code (NIRC) of 1997, as Amended, and Adding

Section 289-A to the Code, for the Purpose

RMC No. 29-2010

Publishes the full text of Republic Act No. 10021 entitled An Act to Allow the

Exchange of Information by the Bureau of Internal Revenue on Tax Matters

Pursuant to Internationally-Agreed Tax Standards, Amending Sections 6(F), and

270 of the National Internal Revenue Code of 1997, as Amended, and for

Other Purposes

RMC No. 30-2010

Clarifies Revenue Memorandum Circular No. 72-2009, which reiterated the

imposition of the Value-Added Tax on Tollway Operators

RMC No. 31-2010

Prescribes the use of the new Documentary Stamp Tax to be affixed to taxable

documents of taxpayers mandated to use the Electronic Documentary Stamp

Tax System

RMC No. 32-2010

Prescribes the policies relative to the acceptance of "Out-of-District" Income

Tax Returns

RMC No. 33-2010

Prescribesthe policiesin securingcertified true copies of Income Tax Returns

and Audited Financial Statements

RMC No. 34-2010

Publishes the full text of the Memorandum of Agreement between the BIR and

Creba Land Services and Title Warranty Corporation

RMC No. 35-2010

Publishes the full text of the Memorandum of Agreement between the BIR and

Philippine-Chinese Charitable Association, Inc. (owner and operator of the

Chinese General Hospital and Medical Center)

RMC No. 36-2010

Publishes the full text of the Memorandum of Agreement between the BIR and

Securities and Exchange Commission

RMC No. 37-2010

Publishes the full text of the Memorandum of Agreement among the BIR,IBP,

PICPA and PCCI relative to the "Handang Maglingkod" Project

RMC No. 38-2010

Notifies the loss of several accountable forms

RMC No. 39-2010

Directs the Revenue District Offices to verify the VAT Compliance of Health

Maintenance Organizations

RMC No. 40-2010

Prescribes the guidelines in registration, update and tagging of Registration

Information of political parties, candidates & campaign contributors relative to

Project Iboto Mo

RMC No. 41-2010

Publishes the full text of the Memorandum of Agreement among the BIR, Civil

Service Commission and National Computer Center re: Call Center ng Bayan

Project

RMC No. 42-2010

Notifies the loss of 2 sets of unused BIR Form No. 2524 Revenue Official

Receipt

RMC No. 43-2010

Circularizes the full text of the Memorandum of Agreement between the BIR

and the Office of the Ombudsman

RMC No. 44-2010

Publishes the full text of the Memorandum of Agreement between the BIR and

Lyceum of the Philippines University

RMC No. 45-2010

Circularizes Section 4 and 5 of Republic Act No. 9994,relative to the grant of

additional benefits and privileges to Senior Citizens, further amending

Republic Act No. 7432, as amended

RMC No. 46-2010

Circularizes Sec. 35 of Republic Act No. 10066 entitled An Act Providing for

the Protection and Conservation of the National Cultural Heritage,

Strengthening the National Commission for Culture and Arts (NCAA) and Its

Affiliated Cultural Agencies, And For Other Purposes"

RMC No. 47-2010

Circularizes Section 14 of Republic Act No. 10028, An Act Expanding the

Promotion of Breastfeeding, Amending for the Purpose Republic Act No. 7600,

otherwise known as An Act Providing Incentives to All Government and

Private Health Institutions with Rooming-In and Breastfeeding Practices, and

for Other Purposes

RMC No. 48-2010

Publishes the full text of Department of Justice decision on the case of

Philippine National Oil Corporation vs. BIR dated April 16, 2010

RMC No. 49-2010

Further amends certain portions of RMC No. 30-2008, as amended by RMC No.

59-2008 relative to the taxability of insurance companies for Minimum

Corporate Income Tax, Business Tax and Documentary Stamp Tax purposes

RMC No. 50-2010

Publishes the full text of Memorandum Order No. 314 regarding the Approved

2010 Investment Priorities Plan

RMC No. 51-2010

Provides basic questions and answers to clarify the issues

implementation of the Electronic Documentary Stamps Tax System

RMC No. 52-2010

Publishes the full text of Joint Order No. 1-2010 issued by the Secretary

ofFinance and Commissioners of the Bureau of Customs and BIRentitled

"Valuation of Motor Vehicles"

RMC No. 53-2010

Circularizes Sec. 23 of the Republic Act No. 10086 entitled An Act

Strengthening Peoples Nationalism through Philippine History by Changing

the Nomenclature of the National Historical Institute into the National

Historical Commission of the Philippines, Strengthening its Powers, and For

Other Purposes

RMC No. 54-2010

Circularizes the revocation of BIR Ruling No. DA (C-322) 789-2009 relative to

the issues on residential condominium project known as The Ritzville

Residence of Ernesto Chuakaw, et al.

RMC No. 55-2010

Circularizes the revocation of BIR Rulings issued to G&W Architects, Engineers

and Projects Development Consultants relative to its Build-To-Own

transactions

RMC No. 56-2010

Disseminates the most recent policies on the audit of all internal revenue tax

liabilities for the year 2009

in

the

RMC No. 57-2010

Circularizes Sections 3, 4 and 7 of Republic Act No. 10083, an Act

amendingthe Aurora Special Economic Zone Act of 2007

RMC No. 58-2010

Circularizes Sections 10 to18 of RA No. 9856 entitled An Act Providing the

Legal Framework for Real Estate Investment Trust and For Other Purposes

RMC No. 59-2010

Circularizes Sections 5(c) and 6 of Republic Act No. 10072 entitled An Act

Recognizing the Philippine National Red Cross as an Independent,

Autonomous, Non-Governmental Organization Auxiliary to the Authorities of

the Republic of the Philippines in the Humanitarian Field, to be known as the

Philippine National Red Cross

RMC No. 60-2010

Clarifies the coverage of RMO No. 56-2010 relative to the use of updated

medium for submitting the Summary List of Sales and Purchases (SLSP)

RMC No. 61-2010

Suspends the generation and issuance of electronic Letter of Authority (eLAs),

revokes RMC No. 56-2010and clarifies the use of BIR Form 0421 Tax

Verification Notices

RMC No. 62-2010

Publishes the full text of Department Order No. 18-2010issued bythe

Department of Finance relative to the nationwide coverage of the Mandatory

Marking of Kerosene

RMC No. 63-2010

Imposes the Value-Added Tax on Tollway Operators

RMC No. 64-2010

Publishes the full text of Wage Order No. NCR-15, Providing an Increase in the

Minimum Wage in the National Capital Region

RMC No. 65-2010

Notifies the loss of 1 pad of unused BIR Form No. 2524 Revenue Official

Receipt

RMC No. 66-2010

Circularizes the full text of the Memorandum of Agreement between the BIR

and Tax Management Association of the Philippines, Inc.,and the Mechanics

and Entry Form for theSearch for the Best Tax Collection, Tax Administration

or Taxpayer Service Enhancement Project

RMC No. 67-2010

Circularizes the revocation of BIR Ruling No. DA-722-2006issued in favor of

Atlas Consolidated Mining and Development Corporation

RMC No. 68-2010

Prescribes the guidelines and procedures in granting the request of Large

Taxpayers for extension in complying with the requirementsfor themandatory

use of Computerized Accounting System

RMC No. 69-2010

Notifies the loss of 1 set of used but unissued BIR Form No. 1954 - Certificate

Authorizing Registration

RMC No. 70-2010

Circularizes the revocation of BIR Ruling Nos. DA-413-04 and DA-436-04 and

clarifies the basis in computing depreciation of property, plant and equipment

RMC No. 71-2010

Notifies the loss of 2 sets of unused BIR Form No. 2524(Revenue Official

Receipt)

RMC No. 72-2010

Notifies the loss of several accountable forms

RMC No. 73-2010

Notifies the loss of several BIR Form No. 19.14 (Apprehension Receipt)

RMC No. 74-2010

Notifies the disposal of 412 sets of old blank Tax Debit Memo (BIR Form No.

2321)

RMC No. 75-2010

Enjoins participation to the celebration of the 21st National Statistics Month in

October 2010

RMC No. 76-2010

Notifies the loss of 1 set of unused BIR Form No. 2524 Revenue Official

Receipt

RMC No. 77-2010

Publishes the full text of Memorandum Circular No. 3entitled "Directing the

Formulation of the Medium-Term Philippine Development Plan (MTPDP) and the

Medium-Term Public Investment Program (MTPIP) for 2010-2016"

RMC No. 78-2010

Notifies the loss of4 sets of unused BIR Form No. 2524 Revenue Official

Receipt

RMC No. 79-2010

Providesadditional guidelines on the implementation of the eREG System

RMC No. 80-2010

Provides basic questions and answers relative to the issuance of Electronic

Letters of Authority

RMC No. 81-2010

Clarifies the documentary requirements for the application for Certificate of

Tax Exemption for Cooperatives (BIR Form No. 1945)

RMC No. 82-2010

Provides basic questions and answers to clarify issues relative to the filing of

BIR Form No. 1947

RMC No. 83-2010

Notifies the loss of quadruplicate copies from 4 unused BIR Form No. 2524 Revenue Official Receipt

RMC No. 84-2010

Prescribes the guidelines and procedures in requiring all taxpayers engaged in

the customs brokerage business to submit a list of their respective importers

with their Accreditation Number

RMC No. 85-2010

Announces the grace period in thefiling of BIR Form No. 1947

RMC No. 86-2010

Publishes the full text of Opinion No. 48, S. 2010 of the Department of Justice

RMC No. 87-2010

Notifies the loss of 1 set of unused BIR Form No. 0421 - Tax Verification Notice

RMC No. 88-2010

Notifies the loss of 2 sets of unused BIR Form No. 2524 - Revenue Official

Receipt

RMC No. 89-2010

Notifies the loss of 40 sets of unused BIR Form No. 0535 - Taxpayer

Information Sheet

RMC No. 90-2010

Notifies the loss of6 sets of unused BIR Form No. 2524 - Revenue Official

Receipt

RMC No. 91-2010

Provides basic questions and answers to clarifythe increase in the Statutory

Minimum Wage and other concerns in relation to the Income Tax Exemption

given to Minimum Wage Earner

RMC No. 92-2010

Prescribes the re-implementation ofthe Electronic Sales (eSales) reporting on

a pilot mode

RMC No. 93-2010

Circularizes the full text of Bank Bulletin No. 2010-34 relative to the splitting of

some Revenue District Offices and the necessary enhancement to the

Authorized Agent Banks' systems

RMC No. 94-2010

Notifies the loss of two (2) sets of BIR Form No. 2524 Revenue Official

Receipt

RMC No. 95-2010

Circularizes the increase of Excise Tax rates on alcohol and tobacco

productseffective January 1, 2011

RMC No. 96-2010

Notifies the loss of 9 unused pads of BIR Form No. 2524 - Revenue Official

Receipt

RMC No. 97-2010

Clarifies the VAT exemption of services by agricultural contract growers

RMC No. 98-2010

Prescribes the guidelines and procedures for the treatment of unserved Letter

Notices, Letter of Authorities and Tax Verification Notices in instances where

the concerned taxpayers cannot be located

RMC No. 99-2010

Circularizes the full text of Department Administrative Order No. 10-08, further

amending the revised Implementing Rules and Regulations of Act No. 3883, as

amended, otherwise known as the Business Name Law

DATE OF ISSUE

8-Jan-10

12-Jan-10

12-Jan-10

15-Jan-10

20-Jan-10

21-Jan-10

21-Jan-10

26-Jan-10

4-Feb-10

4-Feb-10

8-Feb-10

12-Feb-10

22-Feb-10

23-Feb-10

25-Feb-10

1-Mar-10

4-Mar-10

8-Mar-10

8-Mar-10

9-Mar-10

9-Mar-10

9-Mar-10

9-Mar-10

16-Mar-10

17-Mar-10

17-Mar-10

22-Mar-10

23-Mar-10

25-Mar-10

26-Mar-10

30-Mar-10

12-Apr-10

21-Apr-10

22-Apr-10

22-Apr-10

23-Apr-10

6-May-10

11-May-10

21-May-10

26-May-10

27-May-10

27-May-10

31-May-10

2-Jun-10

2-Jun-10

2-Jun-10

2-Jun-10

7-Jun-10

7-Jun-10

7-Jun-10

15-Jun-10

22-Jun-10

25-Jun-10

28-Jun-10

28-Jun-10

29-Jun-10

1-Jul-10

1-Jul-10

1-Jul-10

13-Jul-10

14-Jul-10

15-Jul-10

20-Jul-10

29-Jul-10

3-Aug-10

10-Aug-10

10-Aug-10

13-Aug-10

20-Aug-10

24-Aug-10

6-Sep-10

6-Sep-10

14-Sep-10

20-Sep-10

27-Sep-10

30-Sep-10

4-Oct-10

22-Oct-10

26-Oct-10

2-Nov-10

5-Nov-10

5-Nov-10

18-Nov-10

18-Nov-10

18-Nov-10

22-Nov-10

24-Nov-10

24-Nov-10

24-Nov-10

1-Dec-10

2-Dec-10

2-Dec-10

3-Dec-10

8-Dec-10

13-Dec-10

14-Dec-10

21-Dec-10

21-Dec-10

29-Dec-10

You might also like

- The Regulatory Environment: Part Two of The Investors' Guide to the United Kingdom 2015/16From EverandThe Regulatory Environment: Part Two of The Investors' Guide to the United Kingdom 2015/16No ratings yet

- 2009 BIR-RMC ContentsDocument56 pages2009 BIR-RMC ContentsMary Grace Caguioa AgasNo ratings yet

- April 2010 Tax BriefDocument10 pagesApril 2010 Tax BriefAna MergalNo ratings yet

- RMCDocument7 pagesRMCKim TabayocyocNo ratings yet

- 1999 BIR-RR ContentsDocument5 pages1999 BIR-RR ContentsMary Grace Caguioa AgasNo ratings yet

- Bir Revenue RegulationDocument140 pagesBir Revenue RegulationMartin EspinosaNo ratings yet

- Accomp Report 2012 FinalDocument196 pagesAccomp Report 2012 FinalJu LanNo ratings yet

- 2001 BIR-RR ContentsDocument5 pages2001 BIR-RR ContentsMary Grace Caguioa AgasNo ratings yet

- BIR MonitorDocument9 pagesBIR MonitorCandiceCocuaco-ChanNo ratings yet

- 2014 BIR-RMC ContentsDocument13 pages2014 BIR-RMC ContentsMary Grace Caguioa AgasNo ratings yet

- Business Legislation: CBIA Summary ofDocument31 pagesBusiness Legislation: CBIA Summary ofMalvamel G LennonNo ratings yet

- 3-9 TransportDocument16 pages3-9 TransportAnastasi MokgobuNo ratings yet

- DILG Memo Circular 2011-08Document15 pagesDILG Memo Circular 2011-08Erika Mae GumabolNo ratings yet

- Ra 9178 PDFDocument69 pagesRa 9178 PDFRhyz Taruc-ConsorteNo ratings yet

- Law 227 - 2015 - Tax CodeDocument363 pagesLaw 227 - 2015 - Tax Codecatacata100% (1)

- G.R. No. 195390Document12 pagesG.R. No. 195390Michael MartinNo ratings yet

- RR No. 11-2015Document2 pagesRR No. 11-2015GoogleNo ratings yet

- Act No. 13 (E)Document5 pagesAct No. 13 (E)ManInTheBushNo ratings yet

- practicenotes2011Document24 pagespracticenotes2011NkondeNo ratings yet

- 79.02 - Trinidad and Tobago Central Bank ActDocument80 pages79.02 - Trinidad and Tobago Central Bank ActOilmanGHNo ratings yet

- Department of Public Works and Highways: Central OfficeDocument18 pagesDepartment of Public Works and Highways: Central OfficeANGELICA GACUYANo ratings yet

- Peraturan Menteri Keuangan Nomor - 18 - PMK.03 - 2021 (ENGLISH)Document138 pagesPeraturan Menteri Keuangan Nomor - 18 - PMK.03 - 2021 (ENGLISH)ticketnhotelsNo ratings yet

- European Commission guidance on economic operator registrationDocument37 pagesEuropean Commission guidance on economic operator registrationh2dcuNo ratings yet

- Attrition ActDocument28 pagesAttrition ActKagawad HacketNo ratings yet

- Revenue Issuances On Excise TaxesDocument5 pagesRevenue Issuances On Excise TaxesZeroNo ratings yet

- 2006 BIR-RMC ContentsDocument22 pages2006 BIR-RMC ContentsMary Grace Caguioa AgasNo ratings yet

- Anukret On Tax Incentive in Securities Sector EnglishDocument4 pagesAnukret On Tax Incentive in Securities Sector EnglishChou ChantraNo ratings yet

- Tax Reform For Acceleration and Inclusion Act: Under RA 10963 or Train LawDocument5 pagesTax Reform For Acceleration and Inclusion Act: Under RA 10963 or Train LawRose Jean BronNo ratings yet

- 2013 BIR-RR ContentsDocument5 pages2013 BIR-RR ContentsMary Grace Caguioa AgasNo ratings yet

- ACL An Introduction November 2010Document31 pagesACL An Introduction November 2010rahhar001No ratings yet

- Philippine Tax System Changes Under RA 10963Document17 pagesPhilippine Tax System Changes Under RA 10963franz mallariNo ratings yet

- Case No. 3 Soriano v. Secretary of Finance, G.R. No. 184450, January 24, 2017Document8 pagesCase No. 3 Soriano v. Secretary of Finance, G.R. No. 184450, January 24, 2017gerald quijanoNo ratings yet

- Boletín 9 Feb 2009 EnglishDocument8 pagesBoletín 9 Feb 2009 EnglishRodriguez-Azuero AbogadosNo ratings yet

- Manila: The President of The PhilippinesDocument3 pagesManila: The President of The PhilippinesmeriiNo ratings yet

- AMEND SEC 27 (C), RA No. 10026Document4 pagesAMEND SEC 27 (C), RA No. 10026Bing MendozaNo ratings yet

- Lifting Suspension of Revenue IssuancesDocument3 pagesLifting Suspension of Revenue IssuancesGil PinoNo ratings yet

- GPPB Resolution No. 09-2020 With SGD PDFDocument17 pagesGPPB Resolution No. 09-2020 With SGD PDFmichelleNo ratings yet

- BoceaDocument25 pagesBoceaRam Migue SaintNo ratings yet

- 5 Province of Batangas vs. Romulo, GR 152774, May 27, 2004Document16 pages5 Province of Batangas vs. Romulo, GR 152774, May 27, 2004Perry YapNo ratings yet

- USPTO Funding For 2009 and For 2010Document6 pagesUSPTO Funding For 2009 and For 2010Daniel BallardNo ratings yet

- Ab - 103 - Taxation - Personal Income and Corportation TaxesDocument156 pagesAb - 103 - Taxation - Personal Income and Corportation TaxesCalWonkNo ratings yet

- Tax Assessment On DST As Amended by TRAIN LawDocument19 pagesTax Assessment On DST As Amended by TRAIN LawdignaNo ratings yet

- AssignmentDocument6 pagesAssignmentWinona Marie BorlaNo ratings yet

- Agm 2010Document40 pagesAgm 2010Shouravpedia™No ratings yet

- RA 9178 BMBE ActDocument69 pagesRA 9178 BMBE Actinvictusinc100% (1)

- Proposed Reforms On Value-Added Tax: Executive Order (EO) No. 273Document53 pagesProposed Reforms On Value-Added Tax: Executive Order (EO) No. 273Pari DelictoNo ratings yet

- 2015 Tax and Corporate Udpates Course OutlineDocument10 pages2015 Tax and Corporate Udpates Course OutlineReal TaberneroNo ratings yet

- 9.villafuerte Vs RobredoDocument9 pages9.villafuerte Vs RobredoLord AumarNo ratings yet

- Arkansas Bill SB81Document4 pagesArkansas Bill SB81capsearchNo ratings yet

- Government Regulation No 46 of 2007Document10 pagesGovernment Regulation No 46 of 2007Martin KalajzichNo ratings yet

- ICE Group interim financial statementsDocument118 pagesICE Group interim financial statementsEsteban MuñozNo ratings yet

- Tax Alert (April 2020) FinalDocument30 pagesTax Alert (April 2020) FinalRheneir MoraNo ratings yet

- Memorandum of Agreement Between BIR and BLGFDocument8 pagesMemorandum of Agreement Between BIR and BLGFCarla GrepoNo ratings yet

- 2000 BIR-RR ContentsDocument5 pages2000 BIR-RR ContentsMary Grace Caguioa AgasNo ratings yet

- Standards of Intrastat DeclarationDocument25 pagesStandards of Intrastat DeclarationMiron XescuNo ratings yet

- VAT IssuancesDocument26 pagesVAT IssuancesjoshuaNo ratings yet

- HUMSS - Introduction To World Religions & Belief Systems CGDocument12 pagesHUMSS - Introduction To World Religions & Belief Systems CGOwen Radaza Pirante89% (44)

- Resignation Letter FormatDocument1 pageResignation Letter FormatMary Grace Caguioa AgasNo ratings yet

- Red 13 - Ci - Cred - 1Document15 pagesRed 13 - Ci - Cred - 1miles1280No ratings yet

- Emmc CPD Package 8Document1 pageEmmc CPD Package 8Mary Grace Caguioa AgasNo ratings yet

- 04 22 2014 G. R. No. 182894 Valino Vs AdrianoDocument2 pages04 22 2014 G. R. No. 182894 Valino Vs AdrianoMary Grace Caguioa AgasNo ratings yet

- Bernas Case Book Part 1Document363 pagesBernas Case Book Part 1Mary Grace Caguioa Agas100% (12)

- 04 22 2014 G. R. No. 182894 Valino Vs AdrianoDocument2 pages04 22 2014 G. R. No. 182894 Valino Vs AdrianoMary Grace Caguioa AgasNo ratings yet

- Minoru Fujiki Vs Maria Paz Galela Marinay G. R. No. 196049 June 26, 2013Document2 pagesMinoru Fujiki Vs Maria Paz Galela Marinay G. R. No. 196049 June 26, 2013Mary Grace Caguioa AgasNo ratings yet

- Susan Lim-Lua vs Danilo Y. Lua ruling on spousal support deductionsDocument1 pageSusan Lim-Lua vs Danilo Y. Lua ruling on spousal support deductionsMary Grace Caguioa AgasNo ratings yet

- Boc 2016 Mercantile PDFDocument332 pagesBoc 2016 Mercantile PDFMark Catabijan Carriedo100% (1)

- List Accredited CPAs Philippines May 2017Document736 pagesList Accredited CPAs Philippines May 2017Mary Grace Caguioa Agas100% (1)

- Revised Penal Code - Book 1 - Reyes PDFDocument941 pagesRevised Penal Code - Book 1 - Reyes PDFHezekiah Joshua88% (8)

- Secretarys Certificate To File Cases With Full PreDocument2 pagesSecretarys Certificate To File Cases With Full PreMary Grace Caguioa AgasNo ratings yet

- WMMC CPD Package 4 2017 RevisedDocument1 pageWMMC CPD Package 4 2017 RevisedMary Grace Caguioa AgasNo ratings yet

- 7th - EQUITY PDFDocument2 pages7th - EQUITY PDFMary Grace Caguioa AgasNo ratings yet

- 8th - NOTE 1-14Document12 pages8th - NOTE 1-14Mary Grace Caguioa AgasNo ratings yet

- 7th EquityDocument2 pages7th EquityMary Grace Caguioa AgasNo ratings yet

- 9th - Coop Prof Note 15-23Document3 pages9th - Coop Prof Note 15-23Mary Grace Caguioa AgasNo ratings yet

- 6th - Cash FlowsDocument1 page6th - Cash FlowsMary Grace Caguioa AgasNo ratings yet

- 5th - Statment of OperationsDocument1 page5th - Statment of OperationsMary Grace Caguioa AgasNo ratings yet

- 2nd - Statement of RepDocument1 page2nd - Statement of RepMary Grace Caguioa AgasNo ratings yet

- ABC DEVELOPMENT COOPERATIVE Financial Statements 2009-2008Document1 pageABC DEVELOPMENT COOPERATIVE Financial Statements 2009-2008Mary Grace Caguioa AgasNo ratings yet

- 1689rmc03 03 PDFDocument1 page1689rmc03 03 PDFHarryNo ratings yet

- XXX Ccounting Ffice: Management's Responsibility For The Financial StatementsDocument1 pageXXX Ccounting Ffice: Management's Responsibility For The Financial StatementsMary Grace Caguioa AgasNo ratings yet

- 1st - Statement of ResponsibilityDocument1 page1st - Statement of ResponsibilityMary Grace Caguioa AgasNo ratings yet

- Republic of The Philippines Department of Finance Bureau of Internal RevenueDocument6 pagesRepublic of The Philippines Department of Finance Bureau of Internal RevenueJess FernandezNo ratings yet

- XXX Ccounting Ffice: Management's Responsibility For The Financial StatementsDocument1 pageXXX Ccounting Ffice: Management's Responsibility For The Financial StatementsMary Grace Caguioa AgasNo ratings yet

- RR 1-2016Document5 pagesRR 1-2016nijuyonNo ratings yet

- 02-2003 Staggered Filing of ReturnDocument4 pages02-2003 Staggered Filing of Returnapi-247793055No ratings yet

- 2015 BIR-RR ContentsDocument7 pages2015 BIR-RR ContentsMary Grace Caguioa AgasNo ratings yet

- Form 26AS: Annual Tax Statement Under Section 203AA of The Income Tax Act, 1961Document4 pagesForm 26AS: Annual Tax Statement Under Section 203AA of The Income Tax Act, 1961Rakshit KashyapNo ratings yet

- Tax Deducted at SourceDocument23 pagesTax Deducted at SourcePrathamesh ParkerNo ratings yet

- Polycab Cable Price ListDocument1 pagePolycab Cable Price ListnavneetNo ratings yet

- Flipkart Labels 23 Feb 2024-12-13Document9 pagesFlipkart Labels 23 Feb 2024-12-13chhavientzNo ratings yet

- San Beda College Alabang Income Taxation CourseDocument5 pagesSan Beda College Alabang Income Taxation CourseMichael SanchezNo ratings yet

- Tax invoice for MB ANOKHA batteryDocument1 pageTax invoice for MB ANOKHA batteryRahul DeyNo ratings yet

- Service Acceptance Form: AL WATANIA Maintenance Al Nouras WorkshopDocument1 pageService Acceptance Form: AL WATANIA Maintenance Al Nouras Workshopkariem noweerNo ratings yet

- Profit Sharing Agreement SampleDocument4 pagesProfit Sharing Agreement SampleCatherine LopezNo ratings yet

- Form 16 SummaryDocument9 pagesForm 16 SummarySujata ChoudharyNo ratings yet

- Guru Gobind Singh Indraprastha University Dwarka, Delhi - 110064Document3 pagesGuru Gobind Singh Indraprastha University Dwarka, Delhi - 110064Krishna RajputNo ratings yet

- NTN Procedure FinalDocument5 pagesNTN Procedure FinalTalhaNo ratings yet

- Ganraj ConstructionDocument2 pagesGanraj ConstructionSUNIL GAIKWADNo ratings yet

- Turn Over Analysis: Sss Contribution ExpenseDocument4 pagesTurn Over Analysis: Sss Contribution ExpenseEunice OrtileNo ratings yet

- Income-Tax Law: A Capsule For Quick Recap: Chapter 9: Advance Tax and Tax Deduction at SourceDocument5 pagesIncome-Tax Law: A Capsule For Quick Recap: Chapter 9: Advance Tax and Tax Deduction at Sourcem310235No ratings yet

- Audit & Taxation Course at Dow University Covers Key PrinciplesDocument5 pagesAudit & Taxation Course at Dow University Covers Key PrinciplesMuhammad RizwanNo ratings yet

- M8 practiceDocument22 pagesM8 practiceleeminleeNo ratings yet

- June 2019Document55 pagesJune 2019manju enterprisesNo ratings yet

- Sample Income Tax FormDocument8 pagesSample Income Tax FormSadav ImtiazNo ratings yet

- B18 LabuanDocument4 pagesB18 LabuanhativernNo ratings yet

- Philippine Taxation Principles and Concepts Review QuizDocument9 pagesPhilippine Taxation Principles and Concepts Review Quizariaseg100% (1)

- What is a 501(c)(3) OrganizationDocument10 pagesWhat is a 501(c)(3) OrganizationSebastian GhermanNo ratings yet

- IntaxationDocument3 pagesIntaxationErinNo ratings yet

- House Budget Committee Republicans Letter On Debt LimitDocument4 pagesHouse Budget Committee Republicans Letter On Debt LimitFox NewsNo ratings yet

- 1 CIR V Hambrecht - QuistDocument2 pages1 CIR V Hambrecht - Quistaspiringlawyer1234No ratings yet

- Income Capital ItemsDocument2 pagesIncome Capital ItemsDeepti KukretiNo ratings yet

- Billing 453117135 525bf0db87902Document1 pageBilling 453117135 525bf0db87902Fabrizio FloresNo ratings yet

- Partnership vs Corporation Law QuestionsDocument2 pagesPartnership vs Corporation Law Questionserica insiongNo ratings yet

- Solved Rail Chapter 1Document7 pagesSolved Rail Chapter 1spectrum_48No ratings yet

- BcrvresDocument90 pagesBcrvresMohammed AliNo ratings yet

- IT-AE-41-G02 - Guide To Complete The Tax Directive Application Forms - External GuideDocument50 pagesIT-AE-41-G02 - Guide To Complete The Tax Directive Application Forms - External GuidercpretoriusNo ratings yet