Professional Documents

Culture Documents

SMch14Beams

Uploaded by

jeankoplerOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

SMch14Beams

Uploaded by

jeankoplerCopyright:

Available Formats

Chapter 14

FOREIGN CURRENCY FINANCIAL STATEMENTS

Answers to Questions

1

A companys functional currency is the currency of the primary economic environment in which it

operates. It is normally the currency in which it receives most of its payments from customers and in

which it pays most of its liabilities. Other factors that are considered in determining the functional

currency include whether its sales prices are determined primarily by local competition or local

government regulation instead of short-run exchange rate changes or worldwide markets.

The functional currency determination (local currency or parent currency or some other currency) is

critical in determining what approach to converting financial statements to the ultimate reporting

currency is used: the current rate or the temporal method. If the functional currency is the local currency,

the current rate method is used. If it is the parent currency, the temporal method is used. If it is some

other currency, then both approaches may need to be used.

A highly inflationary economy under GAAP is one that has cumulative inflation of approximately 100

percent or more over a three-year period. The functional currency is assumed to be the reporting currency

(for U.S. companies, the dollar) which means that the foreign currency financial statements must be

remeasured into the dollar using the temporal method. The effect of the hyperinflation is then reflected in

the current years consolidated income statement which would not be the case if the current rate method

were used. Judgment must be exercised in applying this rule to avoid changing functional currencies

frequently due to minor differences in the inflation rate.

The functional currency of a foreign subsidiary does not affect the original recording of the business

combination. This is because all assets, liabilities, and equities of the foreign subsidiary are converted into

U.S. dollars at the current exchange rate in effect on the date of consummation of the business

combination. As a result, no special procedure must be applied at the date of original recording of a

foreign subsidiary.

The current rate method is used when the foreign subsidiarys local currency is determined to be the

subsidiarys functional currency. The subsidiarys financial statements must be translated using the

current rate method into the reporting entitys currency (typically the parents currency).

The temporal method is used when the foreign subsidiarys currency is determined to be the reporting

entitys currency (typically the parents currency). The subsidiarys financial statements must be

remeasured using the temporal method into the reporting entitys currency.

Since the functional currency is not the parents currency, no direct impact on the reporting entitys

(parents) cash flows is expected due to exchange rate changes. The effects of exchange rate changes are

reflected in the consolidated statements accumulated comprehensive income account instead of being

included in the income statement.

Since the functional currency is assumed to be the reporting entitys (or parents) currency, a direct impact

on the parents cash flows is expected due to exchange rate changes. The effects of exchange rate changes

are reflected in the consolidated income statement.

A foreign subsidiarys financial statements could be both translated and remeasured if the entitys books

are maintained in a different currency than the functional currency and the functional currency is not the

reporting entitys local currency. In this case, the entitys financial statements must be remeasured into

the functional currency using the temporal method. The gain or loss on remeasurement is included in

income. The functional currency financial statements are then translated into the reporting entitys

currency using the current rate method. The gain or loss on the translation is included in accumulated

other comprehensive income. In this situation, the consolidated financial statements would include both a

14-2

Foreign Currency Financial Statements

remeasurement gain or loss in income and the a translation adjustment included in accumulated other

comprehensive income.

9

No, it would not be appropriate to use the annual average exchange rate. Theoretically, the exchange rate

at the date each transaction occurs should be used. Given that this is not practical, reasonable

assumptions are made concerning what exchange rate to use. The use of an average exchange rate is

appropriate when sales are earned evenly during the year and expenses are incurred evenly during the

year. A reasonable assumption for a holiday tree grower would be to use the average exchange rate during

the quarter from October through December since those are the months that trees are typically sold. For

expenses, examining the months that are the most labor intensive (such as planting, fertilizing and

harvesting) and using a reasonable weighting of those months exchange rates would be a reasonable way

of determining the rate for those costs.

10

The parent purchased the subsidiary for an amount in excess of book value. This excess was attributable

to an unrecorded patent. Recall that the excess amount would not be included on the subsidiarys books.

The consolidated financial statements, however, would include both the amortization of the patent and the

patent. Since the current rate method is being used, the impact of the change in exchange rates on the

patent and the amortization is included in the translation adjustment to be included in consolidated

comprehensive income. The subsidiarys translation adjustment would not include this because the patent

was not included in the books. Thus, the consolidated translation adjustment is larger than the

subsidiarys translation adjustment.

11

The temporal method requires remeasuring expenses of a foreign subsidiary. Expenses related to

monetary items are remeasured at appropriately weighted average exchange rates for the period. Those

types of expenses are either paid in cash or recorded as liabilities which will require the eventual payment

of cash. Those that relate to nonmonetary items are remeasured at historical exchange rates. Expenses

related to nonmonetary items would be those related to inventory and plant assets. Under the current rate

method, all accounts are translated at the weighted average rate.

12

If the functional currency is subsidiarys local currency, the current rate method is used, and the gain or

loss on the hedge of a net investment in a foreign subsidiary is reported in other comprehensive income.

If the functional currency is the parents currency, the temporal method is used, and the gain or loss is

included in current period income.

Pearson Education, Inc. publishing as Prentice Hall

14-3

Chapter 14

SOLUTIONS TO EXERCISES

Solution E14-1

1

2

3

4

5

6

c

a

c

a

b

b

7

8

9

c

b

a

4

5

b

a

Solution E14-2 [Based on AICPA]

1

2

3

c

d

d

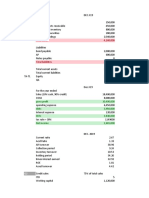

Solution E14-3

Pai Company and Subsidiary

Consolidated Balance Sheet

at January 1, 2011

Current assets [$3,000,000 - $990,000 + (100,000 $1.65)]

$2,175,000

Land [$800,000 + (200,000 $1.65)]

1,130,000

Buildings net [$1,200,000 + (250,000 $1.65)]

1,612,500

Equipment net [$1,000,000 + (100,000 $1.65)]

1,165,000

Goodwill [$990,000 cost - (450,000 fair value $1.65)]

247,500

$6,330,000

Current liabilities [$600,000 + (50,000 $1.65)]

682,500

Notes payable [$1,000,000 + (150,000 $1.65)]

1,247,500

Capital stock

3,000,000

Retained earnings

1,400,000

$6,330,000

Pearson Education, Inc. publishing as Prentice Hall

14-4

Foreign Currency Financial Statements

Solution E14-4

Foreign currency statements

Inventory will be carried at the 10,000 euros historical cost.

Remeasured statements (Temporal Method)

Inventory will be carried at cost of $5,300.

Under translated statements (Current Rate Method)

Inventory will be carried at year-end current rate of $6,000.

Solution E14-5

1

Patent at acquisition of Sim

Cost of Sim

Book value acquired: (35,000,000 Euros $.030)

Patent in dollars

$1,200,000

1,050,000

$ 150,000

Patent in Euros ($150,000/$.030)

2

5,000,000 Eu

Patent amortization in dollars

Patent amortization in Euros (5,000,000/10 years)

= 500,000 Euros

Patent amortization in $ (500,000 Euros $.032 average

rate)

16,000

Entry to record patent amortization

Income from Sim

Investment in Sim

Equity adjustment from translation of

Patent

$16,000

3,000

To record patent amortization and the equity adjustment

translation of patent computed as follows:

Beginning patent

5,000,000 Euros

$.030

$

Amortization

(500,000)

.032

4,500,000

Equity adjustment

Ending patent

4,500,000

.034

$

Pearson Education, Inc. publishing as Prentice Hall

19,000

from

150,000

(16,000)

134,000

19,000

153,000

14-5

Chapter 14

Solution E14-6

Preliminary computations

Cost of investment in Sta

Book value acquired (90,000 $1.66)

Excess in dollars

$163,800

149,400

$ 14,400

Excess allocated to equipment (6,000 $1.66)

Patent

$ 4,440

$ 14,400

Equity adjustment from excess allocated to equipment on December 31,

2011

Depreciation of excess based on (6,000/3 years)

Undepreciated excess balance at year-end based on

(4,000 $1.64 current rate)

Add: Depreciation on excess based on 2011

2,000 $1.65 average rate

2,000

$

Equity adjustment from translation of excess allocated

to equipment (loss)

6,560

3,300

9,860

9,960

Less: Beginning excess based on U.S. dollars

9,960

100

Equity adjustment from excess allocated to patent on December 31, 2011.

Patent (must be carried in ) $4,440/$1.66 = 2,675 patent

Patent amortization is 2,675 / 10 years =

Unamortized excess balance at year-end based on

(2,408 $1.64 current rate)

Add: Amortization of patent based on

(267 $1.65 average rate)

Less: Beginning patent based on U.S. dollars

Equity adjustment from translation of patent (loss)

267

$

3,949

$

$

$

441

4,390

4,440

50

Not required: The entry to record the decrease in the equity adjustment

related to equipment and patent would be as follows:

Income from Sta

Equity adjustment from translation (equipment)

Equity adjustment from translation of patent

Investment in Sta

$3,741

100

50

$

3,891

To adjust the income from Sta for depreciation on the excess

allocated to equipment ($3,300) and amortization of patent ($441),

and to record a decrease in the equity adjustment from translation

for the foreign exchange rate changes.

Pearson Education, Inc. publishing as Prentice Hall

14-6

Foreign Currency Financial Statements

Solution E14-7

Preliminary computations

Investment cost

Book value acquired (1,400,000 Eu $.75 exchange rate)

Excess cost over book value acquired

$1,350,000

1,050,000

$ 300,000

Excess allocated to undervalued land (400,000 Eu $.75)

300,000

300,000

308,000

8,000

Equity adjustment from translation on excess allocated to land

Excess on land at January 1, 2011

Less: Excess on land at December 31, 2011

(400,000 Eu $.77 current rate at year-end)

Equity adjustment from translation - gain (credit)

Solution E14-8 [Based on AICPA]

1

a

Exchange loss of $15,000 less an exchange gain on the account payable of

$4,000 ($64,000 original payable - $60,000 year-end adjusted balance) =

$11,000 loss.

b

Translated at historical rate: 25,000/2.2 = $11,364

d

Depreciation on the property, plant, and equipment is computed as

follows:

Property, Plant

Exchange

Property, Plant

Amortization

Annual

and Equipment

Rate

and Equipment

Period

Depreciation

2011 2,400,000 LCU

1.6

=

$1,500,000

10 years

=

$150,000

2012 1,200,000 LCU

1.8

=

666,667

10

years

=

66,667

3,600,000 LCU

$2,166,667

$216,667

a

5.7 LCU to $1, the rate in effect when the dividend was paid.

d

Long-term receivables 1,500,000 LCU 1.5 =

Long-term debt 2,400,000 LCU 1.5 =

c

All three accounts are translated at current rates.

c

Cumulative inflation rate = (330 - 150)/150 = 120%

Pearson Education, Inc. publishing as Prentice Hall

$1,000,000

$1,600,000

14-7

Chapter 14

SOLUTIONS TO PROBLEMS

Solution P14-1

1

Paks income from Sco for 2011

Investment cost of 40% interest in Sco

Less: Book value acquired ($2,400,000 40%)

Patent in dollars at acquisition

$1,080,000

(960,000)

$ 120,000

Patent in euros at acquisition

$120,000/$.60 exchange rate =

Equity in Scos income ($310,000 40%)

Patent amortization for 2011

200,000 euros/10 years $.62 average rate

Income from Sco for 2011

2

200,000 euros

$

124,000

(12,400)

111,600

Investment in Sco at December 31, 2011

Investment cost

Add: Income from Sco

Less: Dividends ($192,000 40%)

Add: Equity adjustment from translation

($212,000 40%)

Add: Equity adjustment from patent computed as:

Beginning balance

$120,000

Less: Patent amortization

12,400

Less: Unamortized patent at year end

117,000

Investment in Sco December 31, 2011

$1,080,000

111,600

(76,800)

84,800

9,400

$1,209,000

Proof of investment balance

Net assets at December 31, 2011 of $2,730,000 40%

Add: Unamortized patent (180,000 euros $.65)

Investment balance

Pearson Education, Inc. publishing as Prentice Hall

$1,092,000

117,000

$1,209,000

14-8

Foreign Currency Financial Statements

Solution P14-2

1

Excess Patent at January 1, 2011:

Cost

Book value of interest acquired

(4,000,000 LCUs $.15) 40%

Excess Patent

Excess Patent in LCUs $102,000/$.15 = 680,000 LCUs

Alternatively,

68,000 LCUs ($.15 - $.14) =

612,000 LCUs ($.15 - $.13) =

$ 79,560

$102,000

(9,520)

(79,560)

$ 12,920

$

680

12,240

$12,920

Income from Sor 2011:

Equity in income ($112,000 40%)

Less: Excess Patent amortization

Income from Sor 2011

9,520

Equity adjustment from Excess Patent:

Beginning balance in U.S. dollars

Less: Amortization for 2011

Less: Ending balance

Equity adjustment from Excess Patent

Unamortized Excess Patent at December 31, 2011:

(680,000 - 68,000 LCUs amortization) $.13 current rate

(240,000)

$102,000

Excess Patent amortization 2011:

Excess Patent in LCUs 680,000/10 years $.14 average

rate =

$342,000

$ 44,800

(9,520)

$ 35,280

Investment in Sor balance at December 31, 2011:

Cost January 1

Add: Income 2011

Less: Dividends ($56,000 40%)

Less: Equity adjustment ($84,000 40%)

Less: Equity adjustment from Excess Patent

Investment in Sor December 31, 2011

$342,000

35,280

(22,400)

(33,600)

(12,920)

$308,360

Check: Net assets $228,800 ($572,000 40%) plus $79,560 unamortized

Excess Patent = $308,360 investment in Sor at December 31, 2011.

Pearson Education, Inc. publishing as Prentice Hall

14-9

Chapter 14

Solution P14-3

1

Soo Company, Ltd.

Translation Worksheet for 2011

British

Pounds

Debits

Cash

Accounts receivable net

Inventories

Equipment

Cost of sales

Depreciation expense

Operating expenses

Dividends

20,000

70,000

50,000

800,000

350,000

80,000

100,000

30,000

1,500,000

Credits

Accumulated depreciation

Accounts payable

Capital stock

Retained earnings

Sales

Equity adjustment from translation

330,000

70,000

400,000

100,000

600,000

Exchange

Rate

$1.65

1.65

1.65

1.65

1.63

1.63

1.63

1.62

C

C

C

C

A

A

A

R

$1.65 C

1.65 C

1.60 H

measured

1.63

1,500,000

2

US Dollars

$

33,000

115,500

82,500

1,320,000

570,500

130,400

163,000

48,600

$2,463,500

$

544,500

115,500

640,000

160,000

978,000

25,500

$2,463,500

Journal entries 2011

January 1, 2011

Investment in Soo

Cash

To record purchase of Soo at book value.

During 2011

Cash

$800,000

$800,000

$ 48,600

Investment in Soo

To record dividends from Soo.

$ 48,600

December 31, 2011

Investment in Soo

$139,600

Income from Soo

$114,100

Equity adjustment from translation

25,500

To record income from Soo and enter equity adjustment for currency

fluctuations.

Check:

Investment in Soo 1/1

Dividends

Income from Soo

Equity adjustment

Investment in Soo 12/31

$800,000

(48,600)

114,100

25,500

$891,000

Capital stock

Retained earnings 1/1

Add: Income

Less: Dividends

Stockholders equity

Current rate

Pearson Education, Inc. publishing as Prentice Hall

400,000

100,000

70,000

(30,000)

540,000

$

1.65

$891,000

14-10

Foreign Currency Financial Statements

Solution P14-4

Preliminary computations

Investment cost

$4,000,000

Less: Book value of interest acquired

2,800,000

(7,000,000 euros $.50 exchange rate 80% interest)

Patent

$1,200,000

Patent in euros ($1,200,000/$.50 exchange rate) = 2,400,000 euros

Patent amortization based on euros 2,400,000 euros/10 years = 240,000 euros

1

Sul Corporation

Translation Worksheet

at and for the year ended December 31, 2011

Euros

Debits

Cash

Accounts receivable

Inventories

Equipment

Cost of sales

Depreciation expense

Operating expenses

Dividends

1,000,000

2,000,000

4,000,000

8,000,000

4,000,000

800,000

2,700,000

500,000

23,000,000

Credits

2,400,000

Accumulated depreciation

equipment

Accounts payable

3,600,000

Capital stock

5,000,000

Retained earnings, January 1

2,000,000

Sales

10,000,000

Equity adjustment from translation

23,000,000

2

Exchange

Rate

U.S. Dollars

$.6000

.6000

.6000

.6000

.5500

.5500

.5500

.5400

C $

600,000

C

1,200,000

C

2,400,000

C

4,800,000

A

2,200,000

A

440,000

A

1,485,000

H

270,000

$13,395,000

.6000 C $ 1,440,000

.6000

.5000

.5000

.5500

C

H

H

A

2,160,000

2,500,000

1,000,000

5,500,000

795,000

$13,395,000

Pets income from Sul 2011

Share of Suls net income ($5,500,000 sales $2,200,000 cost of sales - $440,000 depreciation $1,485,000 operating expenses)

Percentage owned

$ 1,375,000

80%

Equity in Suls net income

Less: Patent amortization (240,000 euros $.55 average

rate)

1,100,000

(132,000)

Income from Sul

Pearson Education, Inc. publishing as Prentice Hall

968,000

14-11

Chapter 14

Solution P14-4

3

(continued)

Investment in Sul December 31, 2011

Investment January 1, 2011

Add: Income from Sul

Add: Equity adjustment from translation ($795,000 80%)

Add: Equity adjustment from Patent

[$1,200,000 Patent at beginning of the period - $132,000

Patent amortization (2,160,000 euros unamortized

Patent $.60 current rate)]

Less: Dividends ($270,000 80%)

Investment in Sul December 31, 2011

$4,000,000

968,000

636,000

(228,000)

(216,000)

$5,160,000

Solution P14-5

Sar Company

Remeasurement Worksheet at December 31, 2011

British

Cash

Accounts receivable

Short-term note receivable

Inventories

Land

Buildings net

Equipment net

Cost of sales

Depreciation expense

Other expenses

Dividends

Exchange loss on remeasurement

50,000

200,000

50,000

150,000

300,000

400,000

500,000

650,000

200,000

400,000

100,000

Exchange

Rate

$1.70

1.70

1.70

1.68

1.60

1.60

1.60

*

1.60

1.65

1.64

C

C

C

H

H

H

H

H

H

A

C

C

C

H

M

1.65 A

3,000,000

Accounts payable

Bonds payable 10%

Bond interest payable

Capital stock

Retained earnings

Sales

*

180,000

500,000

20,000

500,000

300,000

1,500,000

3,000,000

U.S. Dollars

$1.70

1.70

1.70

1.60

85,000

340,000

85,000

252,000

480,000

640,000

800,000

1,058,000

320,000

660,000

164,000

61,000

$4,945,000

306,000

850,000

34,000

800,000

480,000

2,475,000

$4,945,000

Cost of sales = Beginning inventory (200,000 $1.60) + purchases (600,000

$1.65) - ending inventory (150,000 $1.68) = $1,058,000

Pearson Education, Inc. publishing as Prentice Hall

14-12

Foreign Currency Financial Statements

Solution P14-6

Stu Corporation

Remeasurement Worksheet

December 31, 2011

New Zealand

Dollars

Debits

Cash

Accounts receivable net

Inventories

Prepaid expenses

Land

Equipment

Cost of sales

Depreciation expense

Other operating expenses

Dividends

Remeasurement loss

15,000

60,000

30,000

10,000

45,000

60,000

120,000

12,000

28,000

20,000

Exchange Rate

$ 0.65

0.65

0.66

0.70

0.70

Note 1

Note 2

Note 3

Note 4

0.66

C

C

H

H

H

M

M

M

M

H

U.S. Dollars

400,000

Credits

Accumulated depreciation

Accounts payable

Capital stock

Retained earnings

Sales

22,000

18,000

150,000

10,000

200,000

400,000

Note 5 M

$ 0.65 C

0.70 H

M

0.67 A

9,750

39,000

19,800

7,000

31,500

41,800

82,200

8,360

19,000

13,200

1,450

$273,060

$ 15,360

11,700

105,000

7,000

134,000

$273,060

Note 1

Original equipment (50,000 NZ$ $.70) + equipment purchased in

2006 (10,000 NZ$ $.68)

Note 2

Beginning inventory (50,000 NZ$ $.70) + purchases (100,000 NZ$

$.67) - ending inventory (30,000 NZ$ $.66)

Note 3

Depreciation on original equipment (50,000 NZ$ 20% $.70) +

depreciation on new equipment (10,000 NZ$ 20% $.68)

Note 4

Other operating expenses consist of the prepaid supplies used

(8,000 NZ$ $.70) + current year outlays (20,000 NZ$ $.67)

Note 5

Accumulated depreciation on the original equipment (20,000 NZ$

$.70) + accumulated depreciation on the equipment purchased (2,000

NZ$ $.68)

Pearson Education, Inc. publishing as Prentice Hall

14-13

Chapter 14

Solution P14-7

1

Sar Company

Translation Worksheet

at and for the year ended December 31, 2011

Sheqels

Debits

Cash

Trade receivables

Inventories

Land

Equipment net

Buildings net

Expenses

Exchange loss (advance)*

Dividends

Equity adjustment

Total

Credits

Accounts payable

Other liabilities

Advance from Pel

Common stock

Retained earnings January 1

Sales

Total

*

Translation

Rate

40,000

50,000

150,000

160,000

300,000

500,000

400,000

20,000

100,000

$.30

.30

.30

.30

.30

.30

.32

.32

.33

C

C

C

C

C

C

A

A

R

$ 12,000

15,000

45,000

48,000

90,000

150,000

128,000

6,400

33,000

40,600

$568,000

$.30

.30

.30

.35

.35

.32

C

C

C

H

H

A

$ 36,000

18,000

42,000

175,000

105,000

192,000

$568,000

1,720,000

120,000

60,000

140,000

500,000

300,000

600,000

1,720,000

U.S. $

Sar increased its advance by 20,000 sheqels and recognized a 20,000 sheqel

loss.

Journal entries to account for the investment in Sar:

January 1, 2011

Investment in Sar

$308,000

Cash

To record the investment in Sar Co.

January 2, 2011

Advance to Sar

$ 42,000

Cash

To record advance to Sar denominated in U.S. dollars.

$308,000

$ 42,000

June 2011

Cash

$ 33,000

Investment in Sar

$ 33,000

To record receipt of dividends (100,000 sheqels $.33).

December 31, 2011

Investment in Sar

Equity adjustment from translation

Income from Sar

To record equity in Sar.

Income from Sar

Equity adjustment from translation

Investment in Sar

$ 17,000

40,600

$ 57,600

$

2,560

3,840

Pearson Education, Inc. publishing as Prentice Hall

6,400

14-14

Foreign Currency Financial Statements

To record equity adjustment from Patent amortization computed as

follows:

Patent amortization 80,000 sheqels/10 years $.32 rate = $2,560

Ending balance 72,000 sheqels $.30 rate = $21,600

$28,000 beginning balance - $21,600 ending balance = $6,400

Pearson Education, Inc. publishing as Prentice Hall

14-15

Chapter 14

Solution P14-8

Preliminary computations

Investment cost of SAA

Book value acquired (8,000,000 LCU $.190)

Patent

$1,710,000

(1,520,000)

$ 190,000

Patent based on LCU ($190,000/$.190)

Amortization of Patent (1,000,000 LCU/10 years)

1,000,000 LCU

100,000 LCU

Patent amortization for 2011 (100,000 LCU $.185)

18,500

Unamortized Patent at December 31, 2011

(900,000 LCU $.180)

162,000

9,500

Equity adjustment for Patent for 2011:

Beginning balance

Less: Amortization

Less: Ending balance

Reconciliation of investment account:

Investment in SAA January 1, 2011

Add: Income from SAA for 2011

($360,750 - $18,500 Patent amortization)

Equity adjustment from translation ($84,750 100%)

Equity adjustment from Patent

Dividends from SAA

Investment in SAA December 31, 2011

$190,000

(18,500)

(162,000)

$1,710,000

342,250

(84,750)

(9,500)

(185,000)

$1,773,000

Pearson Education, Inc. publishing as Prentice Hall

14-16

Foreign Currency Financial Statements

Solution P14-8 (continued)

1

Journal entries to account for the investment in SAA

January 1, 2011

Investment in SAA

$1,710,000

Cash

To record purchase of SAA stock for cash.

$1,710,000

July 1, 2011

Advance to SAA

$ 333,000

Cash

$ 333,000

To record short-term advance to SAA denominated in dollars.

September 1, 2011

Cash

$ 185,000

Investment in SAA

$ 185,000

To record receipt of dividends when exchange rate is $.185.

December 31, 2011

Investment in SAA

Equity adjustment from translation

Income from SAA

To record equity in income of SAA.

276,000

84,750

$

360,750

Income from SAA

$

18,500

Equity adjustment from translation

9,500

Investment in SAA

$

28,000

To record Patent amortization and equity adjustment from Patent

computed as follows:

Patent amortization: 100,000 LCU $.185 average rate = $18,500

Equity adjustment: $190,000 beginning Patent balance - $18,500

amortization - (900,000 LCU unamortized Patent at year end $.180

current rate) = $9,500

Pearson Education, Inc. publishing as Prentice Hall

14-17

Chapter 14

Solution P14-8 (continued)

PWA Corporation and Subsidiary

Consolidation Working Papers

for the year ended December 31, 2011

PWA

Income Statement

Sales

Income from SAA

Expenses

Exchange loss

Net income

Retained Earnings

Retained earnings PWA

Balance Sheet

Cash

Accounts receivable

Advance to SAA

Inventories

Land

$1,679,500

(1,158,500)

(9,250)

$ 511,750

856,500

$

511,750

(300,000)

570,000

745,750

99,000

90,000

90,720

128,500

333,000

120,000

100,000

600,000

511,750

(300,000)

185,000

$1,068,250

$

d

300,000

390,000

388,000

1,140,000

900,000

1,200,000

a

157,250

b 1,615,750

b 180,500 c

18,500

Patent

189,720

218,500

333,000

270,000

288,000

540,000

1,773,000

856,500

b 570,000

360,750

(185,000)

$1,068,250

Buildings net

Investment in SAA

Equity adjustment PWA

Consolidated

Statements

569,500 $1,110,000

342,250

a 342,250

(400,000)

(740,000) c 18,500

(9,250)

$ 511,750 $ 360,750

Equipment net

Accounts payable

Advance from PWA

Other liabilities

Capital stock

Retained earnings

Adjustments and

Eliminations

Retained earnings SAA

Net income

Dividends

Retained earnings

December 31, 2011

SAA

$3,445,220

$2,187,000

162,000

$3,688,220

162,720

308,500

2,000,000

1,068,250

(94,250)

Equity adjustment SAA

135,000

333,000 d 333,000

108,000

950,000 b 950,000

745,750

(84,750)

$3,445,220

297,720

416,500

2,000,000

1,068,250

(94,250)

84,750

$2,187,000

Pearson Education, Inc. publishing as Prentice Hall

$3,688,220

14-18

Foreign Currency Financial Statements

Solution P14-9

1

San Corporation

Adjusted Trial Balance Translation Worksheet

at December 31, 2011

LCUs

Debits

Cash

Accounts receivable

Inventories

Land

Buildings

Equipment

Cost of sales

Depreciation expense

Other expenses

Exchange loss

Dividends

Equity adjustment

Credits

Accumulated depreciation buildings

Accumulated depreciation equipment

Accounts payable

Short-term loan from Par

Capital stock

Retained earnings January 1

Sales

Rate

U.S. Dollars

150,000

180,000

230,000

250,000

600,000

800,000

200,000

100,000

120,000

30,000

100,000

--2,760,000

$.20

.20

.20

.20

.20

.20

.22

.22

.22

.22

.21

C

C

C

C

C

C

A

A

A

A

R

$ 30,000

36,000

46,000

50,000

120,000

160,000

44,000

22,000

26,400

6,600

21,000

44,000

$606,000

300,000

400,000

130,000

230,000

800,000

200,000

700,000

2,760,000

$.20

.20

.20

.20

.24

.24

.22

C

C

C

C

H

H

A

$ 60,000

80,000

26,000

46,000

192,000

48,000

154,000

$606,000

Journal entries for 2011 [Pars books]

January 1, 2011

Investment in San

$216,000

Cash

$216,000

To record purchase of 90% interest in San: 1,000,000 LCU $.24

exchange rate 90% interest.

May 1, 2010

Advance to San

$ 46,000

Cash

$ 46,000

To record short-term loan to San denominated in U.S. dollars:

200,000 LCU $.23 exchange rate.

Pearson Education, Inc. publishing as Prentice Hall

14-19

Chapter 14

Solution P14-9 (continued)

September 2011

Cash

$ 18,900

Investment in San

$ 18,900

To record receipt of dividends from San (100,000 LCU $.21

exchange rate 90% interest)

December 31, 2011

Investment in San

$ 9,900

Equity adjustment from translation

39,600

Income from San

$ 49,500

To record investment income from San of $49,500 computed as

[$154,000 revenue ($44,000 cost of sales + $22,000 depreciation

expense + $26,400 other expenses + $6,600 exchange loss)] 90%

and to record equity adjustment from translation of $39,600

computed as $44,000 90%.

Supporting computations

Investment balance January 1, 2011

Less: Dividends

Add: Income from San

Less: Equity adjustment from translation

Investment balance December 31, 2011

Noncontrolling interest at January 1, 2011 date of

acquisition

1,000,000 LCU $.24 10%

Less: Noncontrolling interests share of the equity

adjustment

from translation for 2011 ($44,000 10%)

Beginning Noncontrolling interest in consolidation working

Papers

Pearson Education, Inc. publishing as Prentice Hall

$216,000

(18,900)

49,500

(39,600)

$207,000

$ 24,000

(4,400)

$ 19,600

14-20

Foreign Currency Financial Statements

Solution P14-9 (continued)

3

Par Corporation and Subsidiary

Consolidation Working Papers

for the year ended December 31, 2011

Par

Income Statement

Sales

Income from San

Cost of sales

Depreciation expense

Other expenses

Exchange loss

Noncontrolling income

Net income

Retained Earnings

Retained earnings

Par

Retained earnings

San

Net income

Dividends

Retained earnings

December 31, 2011

Balance Sheet

Cash

Accounts receivable

Loan to San

Inventories

Land

Buildings net

Equipment net

Investment in San

Accounts payable

Loan from Par

Capital stock

Retained earnings

Equity adjustment

Par

Equity adjustment

San

Adjustments and

Eliminations

San 90%

$ 800,000 $ 154,000

49,500

a

(400,000)

(44,000)

(81,000)

(22,000)

(200,000)

(26,400)

(6,600)

Noncontro Consolidated

lling

Statements

Interest

$

(444,000)

(103,000)

(226,400)

(6,600)

(5,500)

$ 5,500

$ 168,500

55,000

$ 220,000

$

168,500

(100,000)

48,000

954,000

49,500

168,500

220,000

48,000

55,000

(21,000)

18,900

168,500

(100,000)

(2,100)

$ 288,500

82,000

288,500

30,000

36,000

77,000

126,000

47,000

90,000

46,000

110,000

150,000

180,000

160,000

156,000

200,000

240,000

80,000

240,000

207,000

a 30,600

b 176,400

$ 990,000

$ 302,000

$ 241,100

500,000

288,500

46,000

46,000

50,000

60,000

26,000

46,000

192,000

82,000

$1,039,000

$

c 46,000

b 192,000

500,000

288,500

(39,600)

(39,600)

(44,000)

$ 990,000

267,100

44,000

19,600

$ 302,000

Noncontrolling interest January 1, 2011

Noncontrolling interest December 31, 2011

19,600

$23,000

23,000

$1,039,000

Pearson Education, Inc. publishing as Prentice Hall

14-21

Chapter 14

Pearson Education, Inc. publishing as Prentice Hall

You might also like

- EMI Group PLC Case - RichaDocument9 pagesEMI Group PLC Case - RichaRahul UdainiaNo ratings yet

- Translation of Financial Statements of Foreign AffiliatesDocument15 pagesTranslation of Financial Statements of Foreign Affiliatesayu wanasari100% (2)

- Translation of Foreign Financial StatementsDocument34 pagesTranslation of Foreign Financial Statementsandrearys100% (2)

- Cashflow Statements IAS 7 - P4Document10 pagesCashflow Statements IAS 7 - P4Vardhan Chulani100% (1)

- Survey of Accounting 7th Edition Warren Test BankDocument27 pagesSurvey of Accounting 7th Edition Warren Test Bankdevinsmithddsfzmioybeqr100% (13)

- Cash and Accrual Basis, Single Entry SystemDocument6 pagesCash and Accrual Basis, Single Entry SystemEuniceChung100% (1)

- Beams Adv Acc CH 14Document21 pagesBeams Adv Acc CH 14Josua PranataNo ratings yet

- Beams Aa13e SM 14Document21 pagesBeams Aa13e SM 14Valencia AnggieNo ratings yet

- Foreign Currency Financial Statements: Answers To Questions 1Document21 pagesForeign Currency Financial Statements: Answers To Questions 1Puspita DewiNo ratings yet

- Chapter 6-Foreign Currency Translation Introduction and BackgroundDocument21 pagesChapter 6-Foreign Currency Translation Introduction and BackgroundRakeshNo ratings yet

- ACC4100Chapter10 Spring2024Document10 pagesACC4100Chapter10 Spring2024nissimsteinbergNo ratings yet

- Akl - Chap 10 - HoyleDocument10 pagesAkl - Chap 10 - Hoylelina nur hamidahNo ratings yet

- Translation of Foreign Financial Statements (IAS 21)Document6 pagesTranslation of Foreign Financial Statements (IAS 21)misonim.eNo ratings yet

- Translation of Foreign Currency Financial StatementsDocument27 pagesTranslation of Foreign Currency Financial StatementsSurip BachtiarNo ratings yet

- Chapter 10 IMSMDocument56 pagesChapter 10 IMSMZachary Thomas CarneyNo ratings yet

- Akuntansi Keuangan Lanjutan 2: Program Studi Akuntansi Fakultas Ilmu Sosial Dan Humaniora Universitas Bunda MuliaDocument34 pagesAkuntansi Keuangan Lanjutan 2: Program Studi Akuntansi Fakultas Ilmu Sosial Dan Humaniora Universitas Bunda MuliaTeissyaNo ratings yet

- Translation of FC FSDocument5 pagesTranslation of FC FSDeo CoronaNo ratings yet

- Translation of Foreign Currency Financial StatementsDocument49 pagesTranslation of Foreign Currency Financial Statementssepri24100% (1)

- Chap 010Document64 pagesChap 010Hemali MehtaNo ratings yet

- Translation ExposureDocument12 pagesTranslation ExposureArunVellaiyappanNo ratings yet

- Afar 2 Module CH 13Document12 pagesAfar 2 Module CH 13Joyce Anne Mananquil100% (1)

- Afar 2 Module CH 13Document12 pagesAfar 2 Module CH 13Ella Mae TuratoNo ratings yet

- Advanced Accounting Hoyle 10th Edition Solutions ManualDocument50 pagesAdvanced Accounting Hoyle 10th Edition Solutions ManualBrentBrowncgwzm100% (77)

- FA ProjectDocument14 pagesFA ProjectxyzhjklNo ratings yet

- Worldwide Financial Procedures: Foreign Currency TranslationDocument14 pagesWorldwide Financial Procedures: Foreign Currency TranslationCésar FloresNo ratings yet

- Hoyle 11e Chapter 10Document57 pagesHoyle 11e Chapter 10bliska100% (2)

- Reading 16 - Multinational Operations: Similar Guidance)Document6 pagesReading 16 - Multinational Operations: Similar Guidance)Juan MatiasNo ratings yet

- Chapter 10 IMSMDocument57 pagesChapter 10 IMSMjthemansmith1No ratings yet

- Translation of Foreign Currency Financial Statements: Chapter OutlineDocument62 pagesTranslation of Foreign Currency Financial Statements: Chapter OutlineJordan YoungNo ratings yet

- Module 3-Topic 1Document15 pagesModule 3-Topic 1MILBERT DE GRACIANo ratings yet

- Translation ExposureDocument25 pagesTranslation ExposureNGA HUYNH THI THUNo ratings yet

- Foreign OperationsDocument30 pagesForeign OperationspavishalekhaNo ratings yet

- Foreign Currency WileyDocument8 pagesForeign Currency WileyLoraine Garcia GacuanNo ratings yet

- Advanced Accounting 6th Edition Jeter Solutions Manual Full Chapter PDFDocument67 pagesAdvanced Accounting 6th Edition Jeter Solutions Manual Full Chapter PDFpucelleheliozoa40wo100% (14)

- Advanced Accounting 6th Edition Jeter Solutions ManualDocument47 pagesAdvanced Accounting 6th Edition Jeter Solutions Manualbacksideanywheremrifn100% (30)

- Aasc 10Document34 pagesAasc 10Ying LiuNo ratings yet

- IAS21SBRDocument29 pagesIAS21SBRademoji00No ratings yet

- Revision B326Document17 pagesRevision B326c.ronaldo.bedoNo ratings yet

- Lecture Note-Foreign SubsidiaryDocument10 pagesLecture Note-Foreign Subsidiaryptnyagortey91No ratings yet

- International: Financial ManagementDocument28 pagesInternational: Financial ManagementfatimamahamNo ratings yet

- Foreign ExchangeDocument13 pagesForeign ExchangeRhia ReyesNo ratings yet

- Forex RisksDocument10 pagesForex RiskshvikashNo ratings yet

- Bhsa IngrisDocument31 pagesBhsa IngrisindahNo ratings yet

- CH 13Document45 pagesCH 13Licia SalimNo ratings yet

- Translation of Foreign Currency Financial Statements: Chapter OutlineDocument34 pagesTranslation of Foreign Currency Financial Statements: Chapter OutlineVictor_Chern_596No ratings yet

- Ifm Module 6 TheoryDocument5 pagesIfm Module 6 TheoryAlissa BarnesNo ratings yet

- Advanced Accounting 12th Edition Hoyle Solutions Manual DownloadDocument64 pagesAdvanced Accounting 12th Edition Hoyle Solutions Manual DownloadMay Madrigal100% (22)

- Translation of Financial Statements of Foreign AffiliatesDocument37 pagesTranslation of Financial Statements of Foreign AffiliateschristoperedwinNo ratings yet

- International Accounting 7th Edition Choi Solutions ManualDocument13 pagesInternational Accounting 7th Edition Choi Solutions Manualsaintcuc9jymi8100% (20)

- Topic 8 Acct ExpoDocument3 pagesTopic 8 Acct ExpoYee Sook YingNo ratings yet

- Solution Chapter 10Document48 pagesSolution Chapter 10Mike Alexander100% (1)

- Accounting ExposureDocument33 pagesAccounting ExposurenusratjahanNo ratings yet

- Advanced Class NotesDocument32 pagesAdvanced Class NotesShiela LlenaNo ratings yet

- Accounting Standard On Foreign Exchange RatesDocument19 pagesAccounting Standard On Foreign Exchange RatesMukesh ManwaniNo ratings yet

- CH 08Document37 pagesCH 08川流No ratings yet

- Translation ExposureDocument12 pagesTranslation Exposureirfan7867809No ratings yet

- Advanced Accounting 13th Edition Hoyle Solutions Manual DownloadDocument65 pagesAdvanced Accounting 13th Edition Hoyle Solutions Manual DownloadMay Madrigal100% (23)

- FCCDocument24 pagesFCCsamuel debebeNo ratings yet

- Tutorial 10 SolutionsDocument6 pagesTutorial 10 SolutionsSean AustinNo ratings yet

- 10 Chap10Document33 pages10 Chap10hoang nguyen dangNo ratings yet

- Applied Corporate Finance. What is a Company worth?From EverandApplied Corporate Finance. What is a Company worth?Rating: 3 out of 5 stars3/5 (2)

- Financial Accounting and Reporting Study Guide NotesFrom EverandFinancial Accounting and Reporting Study Guide NotesRating: 1 out of 5 stars1/5 (1)

- Current Assets Harta LancarDocument3 pagesCurrent Assets Harta LancarnandaseptNo ratings yet

- Sample SignaturesDocument6 pagesSample SignaturesomarhanandehNo ratings yet

- Accounting Information System (Chapter 3)Document50 pagesAccounting Information System (Chapter 3)Cassie67% (6)

- MERK Annual Report 2013Document109 pagesMERK Annual Report 2013nandaseptNo ratings yet

- GEMA Annual Report 2013Document241 pagesGEMA Annual Report 2013nandaseptNo ratings yet

- GDYR Annual ReportDocument111 pagesGDYR Annual ReportnandaseptNo ratings yet

- Indian Equity MarketDocument26 pagesIndian Equity Marketnavu811No ratings yet

- Advanced Financial Accounting QuizDocument53 pagesAdvanced Financial Accounting Quizanon nimusNo ratings yet

- Final Exam 10 PDF FreeDocument12 pagesFinal Exam 10 PDF FreeMariefel OrdanezNo ratings yet

- Cash and Accrual Basis of Accounting, Single Entry and Error CorrectionDocument11 pagesCash and Accrual Basis of Accounting, Single Entry and Error CorrectionJoana Trinidad100% (3)

- Lub-Rref (Bangladesh) Ltd. IPO NoteDocument8 pagesLub-Rref (Bangladesh) Ltd. IPO NoteAhm FerdousNo ratings yet

- Chapter 3 SoCEDocument7 pagesChapter 3 SoCESyrill CayetanoNo ratings yet

- 04 Extra Question Pack For Chapter 4 After Initial AcquisitionDocument3 pages04 Extra Question Pack For Chapter 4 After Initial AcquisitionhlisoNo ratings yet

- Scrap 5Document14 pagesScrap 5Bryent GawNo ratings yet

- Financial MGT ADocument390 pagesFinancial MGT ADeogratias ManyamaNo ratings yet

- DDMPR Q1 2021 Quarterly ReportDocument36 pagesDDMPR Q1 2021 Quarterly ReportChristian John RojoNo ratings yet

- SFM MaterialDocument106 pagesSFM MaterialAlok67% (3)

- Sol. Man. - Chapter 15 - Accounting For CorporationsDocument15 pagesSol. Man. - Chapter 15 - Accounting For Corporationspehik100% (1)

- Chapter 22 Accounting ChangesDocument59 pagesChapter 22 Accounting ChangesYudi 'abay'No ratings yet

- Income Statement 2014 2015: 3. Net Revenue 5. Gross ProfitDocument71 pagesIncome Statement 2014 2015: 3. Net Revenue 5. Gross ProfitThu ThuNo ratings yet

- Consolidations - Changes in Ownership InterestsDocument34 pagesConsolidations - Changes in Ownership InterestsKaremAl-AradiNo ratings yet

- Problem No. 1: QuestionsDocument9 pagesProblem No. 1: QuestionsApril Ross TalipNo ratings yet

- TheoriesDocument13 pagesTheoriesZee RoeNo ratings yet

- 1621 Acct6174 Tabe TK1-W3-S4-R1 Team1Document11 pages1621 Acct6174 Tabe TK1-W3-S4-R1 Team1Raisul Ma'arif100% (1)

- Modified UCA Cash Flow FormatDocument48 pagesModified UCA Cash Flow FormatJohan100% (1)

- Jun18l1fra-C02 QaDocument18 pagesJun18l1fra-C02 QajuanNo ratings yet

- Disscor Budget 2020 FDocument114 pagesDisscor Budget 2020 FRicardo DelacruzNo ratings yet

- Week 6 Assignment FNCE UCWDocument1 pageWeek 6 Assignment FNCE UCWamyna abhavaniNo ratings yet

- Fin CH 2 ProblemsDocument9 pagesFin CH 2 Problemsshah118850% (4)

- Accounting Principles: Corporations: Organization and Capital Stock TransactionsDocument58 pagesAccounting Principles: Corporations: Organization and Capital Stock TransactionsThế Vinh100% (1)

- AFAR8719 - Foreign-Currency-Transaction-and-Translation Solutions PDFDocument2 pagesAFAR8719 - Foreign-Currency-Transaction-and-Translation Solutions PDFSid TuazonNo ratings yet

- Cash Flow (Soal)Document28 pagesCash Flow (Soal)Vincent kuswandiNo ratings yet