Professional Documents

Culture Documents

Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)

Uploaded by

Shyam SunderOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)

Uploaded by

Shyam SunderCopyright:

Available Formats

A ArWArfrrem

1@'

oo'',ilil3H=I?j!1i"_,iiii'i''J[,T#l5,ui1'iis*

Road'

Fax : 0731-2548156, ClN.: 165910MP1989P1C032799

Date: I l/l1/2016

To,

Mr. S. Subramaniam

DCS CRD

The Stock Exchange. Mumbai

l't Floor New Trading Wing

Rotunda Building P.J. Tower'

Dalal Street Fort

MUMBAT.4OOOOl

BSE CODE: 531378

Subiect: OU

Ref. . Resnlation 33(3) of SEBI (listins oblisation & disclosure re uirements

ulation 2015.

Dear Sir,

board of directors

are pleased to inform you that a meeting of the

decisions were taken.

t t,n duy, of Novembe r 2016 and the following

we

of the company was'held on Friday

30

the quarterly financiar accounts for the quarter ended

The board of directors of the company approved

September, 2016.

You are requested to please take on record the said information'

Thanking you

Yours faithfully,

FOT,

ANJANI FINANCE

(SATISH PRASAD DHA{GhB)

Managing Director

(DIN: 06s94368)

A AISTAT{IreM

/@

',fl8'sl'=i1:?:ii:,[iiftT[$ffLT?ti:'is*;*""0

Fax : 0731-2548156, ClN.: L65910MP1989P1C032299

ANJAIII FINANCE LIMITED

144, BA*,RANG NAGAR, BEHIND PASHUPATI IIATH MANDIR' M R 9 RoAD, INDoRE-M.P.

CIN : L5591OMP1989PLCO32799

ANNE>(['R.E

(r#ararnanr

^f Arrait.ffi

the

Year Ended 3O/O9 l2O 16.

3 months

Particulars

1. Income from OPerations

(a) Net Sales/ Income from

Operations (Net of excise dutY)

(b) Other OperatinS_lnegme

Total income from Operations (netl

ended

lsoloe 12016l

Corresponding 3 Year to date

figures for

months ended in

Preceding 3

current period

the previous

months ended

ended

year

l3o l0,612016l

13o loe l2ot6l

l3o loe l2o1s)

(a) Cost of Materials consumed

(b) Purchase of stock-in-trade

( in Lacs)

Year to

I

I

ended

I

I

date

figures for the

previous year

13,o

loe l2o1s)

I

I

I

Previous year

ended

13t l0,312016l

(Un-Audited)

(Audited)

(Un-Audited)

(Un-Auditedl

(Un-Auditedl

(Auditedl

26.58

30.62

29.51

57.2

55.92

95.t2

0.00

55.92

95,L2

26.58

30.62

29.5L

57.2

2. Dxpenses

0

2.42

2.25

2.t8

4.67

3.80

8.46

0.61

0.61

3.90

L.22

4.78

2.43

7.t5

7.3

9.73

14.45

L4.92

L9.77

10.18

10.16

15.81

20.34

23.5

30.66

L6.40

20..46

L3.7

35.86

32.42

64.47

0.00

16.4L

20.46

13.7

36.8b

32.42

64.47

10.19

10.09

6.92

20.28

t7 .L

37.L4

6.22

LO.37

6.78

16.58

L5.32

27.32

0.00

6.22

to.37

6.78

16.58

L5.32

27.32

10. Tax expense

L.29

2.OO

2.56

3.L7

2.56

(o.o7l

11.Net Profit / (Loss) from ordinary

activities after tax (9 + 1O)

4.93

8.37

4.22

13.41

L2,76

27.25

(c) Changes in inventories of

finished goods, work-in-Progress

and stock-in-trade

(d) Employee benefits expense

(e) Depreciation and amortisation

expense

(f)Other expenses(AnY item

exceeding LOoh of the total

expenses relating to continuing

operations to be shown separately)

Total Expense

from operations before

other income, finance costs and

exceptional items lL 'A

@poss)

4. Other Income

5. Profit

(Loss) from

ordinary activities

before finance costs and exceptional

items (3 + 4)

A

I

(r

Part I

Fina'rrna

Cncrfq

7. Proftt / (Loss) from ordinarY

activities after finance costs but

before excentional iteUS-I5-f,L

8. Exceptional Items

g.ProIit / (Loss) from ordinarY

activities before tax l7 + q)-

!2. Dxtraordinary items (net of tax {

expense

Lakhs)

13. Net Profit / (Loss)

111+

for the period

121

14. Share of Profit / (loss) of

associates *

15. Minority Interest*

16. Net Profit / (Loss) after taxes,

minority interest and share of profit

(loss) of

associates

(13

r.7 3

4.93

8.37

4.22

13.41

L2.76

25.52

0.00

0.00

4.93

8.37

4.22

13.41

t2.76

25.52

1014.33

1014.33

1014.33

1014.33

1014.33

1014.33

0.05

0.05

0.08

0.08

0.04

o.o4

0.13

0.13

0.13

0.13

o.25

o.25

0.0s

0.05

0.08

0.08

0.04

0.04

0.13

0.13

0.13

o.25

o.25

L4 + 151*

17. Paid -up equity share capital (Face

Value of the Share shall be indicated)

18. Reserve excluding Revaluation

Reserves as per balance sheet of

previous accounting year

19.i Earnings Per Share (before

extraordinary items) (of t lO / - each)

(not annualised):

(a) Basic

(b) Diluted

19.ii Earnings Per Share (after

extraordinary items) (of t LO /- each)

(not annualised):

(a) Basic

(b) Diluted

0.13

A ANrANrrum

&'

"'f,1sd=,?1i]fiIt,l^i1'J.Hjffi ,}ifl?#fi

r'r*'"0

Annexure IV

quarterlY results

and Capital Employed aloag wlth the

Reporting of Segmeat wlse Revenue' Results

Corresponding 3 Year to date

figures for

months ended in

current Period

the previous

ended

year

l3,o loe l2ot6l

l3o loe 12o15)

3 months

ended

13o

1. Segment Revenue (net

l0,612016l

In Lacs

Year to date

figures for the

previous year

ended

l3OlOe l2ot6l

sale/income

from each segment should be disclosed

under this head)

ent - A (Financial OPeration)

(b) Segment - B (Power Generation from

Wind Mill)

Less: Inter Segment Revenue

fVet sales/Income @

2. Segment Results (Profit)(+1/ Loss (-)

before tax and interest from Each

segment)#

t"t S.g*."t - e (F.i"*ti^l OP'

(b) Segment - B (Power Generation from

(7.76\

(s.88)

(2.7s\

(4.s6)

Wind Mill)

i) Interestnn

ii) Other Un-allocable Expenditure net off

(iii)

u@

Total Profit Before Tax

3. Capital Employed (Segment assets

Segment Liabilitie:)

u.1

S.g*e

(b) Segment

Wind Mill)

- B (Power Generation

575.85

1551.75

t475.27

575. 85

1503.21

from

1-599,14

record by the board of directors at its meeting

by the audit committee and were taken on

01. The above financiar results were reviewed

Note:

held on 11'11'2016.

o2.Theabovefinancialresultsforthequarterended30thSeptember,2016andfortheyearended3lstMarch2016havebeenaudited

by the auditor ofthe comPanY'

complaints'

03.. The Company has no outstanding shareholders

ofthe Board

FINANCF/LIffiSEP

ANJAITI

For,

BY Order

Place: Indore

Date : 11 I LL l2OL6

SATISH DHANGAR

MANAGING DIRECTOR

DIN: 06594368

i?,

:l:

I-IMIT,EP F,EUtEw RFpORI

R

EVJ E$r*Rfi HO

Rr

3H,

* NIAFI *. FI $t*f* c E krll{.r, THp,

ff Ep RH

We have reviewed the accompanying staterflent af unaudit*d finar"lcial results

for the peri*d end*d 3*/*s/7*16. This

$[eteiltent is the responsibility of the Carnpany's t"Xanagernent and has been

approved by the Board sf Directors.'Our responsibility ls t* isst*e a repoft on

thece financinl $t*ter'*ents based on our review,

of *.|Y#*NI FINAI\IQ,H

We c*nducted our revi*w in acccrdance with th* Standard ** Keview

Cngagem*nt ($R.E) 24flt), Engagements to fl,eview Financial Statements

issued by the Institute of Chnrtered Accountants of India. This standard

requires that ws plan and perforyt the review ta obtain nr*derate as$uranc*

as ta whether the finanei*l staternents are free of rrtaterial misstaternent. A

review is limited prinr*arily to inquiries of company perssnnel and analytieal

pr*e*dxres npplied to financial data and thus provlde less assurance than an

audit. We have not perf*rmed an nudit and aecordi*6ly* w* dr not expres$

an audit opinion.

Bosed oR sur reyiew eorrducted as aboven n*tl"linE has come to cur attention

beNleve that the accompanying steternent of unapdited

financial results prepered in acesrdance with applicable accounting standards

and other recognired aec*untir*g practices and policies h*s not diselosed the

informatioa: required to be disclosed in terms of RequNetinn 33 cf the SESI

(LODR) fr.eEulations, ?015 including th* manner in whieh it !s to be disclosed,

that eauses us tc

or:

that it cofltain$ any rnaterial misstatement.

Fffiffis PE&Ffiffiffiffiffi& ffi&ffiJ&,TY& &. fl#

c

r-I

&ffiTffiw#ffi &f, f; {} t, HTefil

Htrex ffiffi,ru #wxeffirffi

t:kt

t;i

ffiL&#ffir ff.f{-ffiffiffiffi

ffi&Tffiffi* kffif kkf ffimgffi

ffi

ffi3&?Y&

EffiTffiHffi

'* 4Z&&8

*

;*ffi. t*orya f;*strt{tr* 1S &#{:# **wr** &p*d, *pp*cite *asket **$l tt*nt#?*x,lnd*r* 45?SG3 {M"P}

$$S*63s&23

&qebi}ff

Ss}?*}}S?#,

&*?&3&2,

*istr {#} #ffir,- }$}$#34 fr$3}?$#,

U&t; wwnry-cxmkb,e;*n't, fi-rn*il; iiai*ok$h*tm*it"s*m" !*f*#sa mkh.c*r*

A AntAmffim

ffim

/Fwrfl

M4,Balarang Nagar, Behind Pashupati Nath Mandir, M.R. 9 Road,

INDoRE-4'?011 (M.P.) lNDlA, Phone : 0731-2538617

Fax: A731-2548156, ClN.; 165910MP1989P1C032799

.*

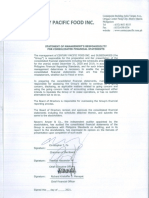

CEO & GFO Gertificate under Regulati,on 33(2) (a)

Regulation 2015

of SEFI

(LODR)

To,

The Board of Directors of

Anjani Finance Limited

qe

A. We have reviewed financial statements and the cash flow statement of Anjani Finance

Limited for the Quarter ended on 30ff Sepember, 2016 and to the best of our knowledge and

belief:

these statements do not contain any materially untrue statement or omit any materi al fact

or contain statements that might be misleading;

(2) these statements together present a true and fair view of the listed entity affairs and are in

compliance with existing accounting standards, applicable laws and regulations.

(l)

B. There are, to the best of our knowledge and belief no transactions entered into by the listed

entity, during the quarter ended 30l09l20l61vhich are ftaridulent, illegalror viofative of

Company's Code of Conduct.

C. We accept responsibility for establishing and maintaining internal controls for financial

reporting and we have evaluated the effectiveness of intemal control systems of the Company

pertaining to Financial Reporting and they have disclosed to the Auditors and the Audit

Cornmittee, deficiencies in the design or operation of intemal controls, if any, of which we

are aware and the steps we have taken or proposes to take to rectify these deficiencies,

D. We have indicated to the Auditors and the Audit Committee:

(i) that there are no significant changes in internal control over financial reporting during the

quarter;

(ii) that there are no significant changes in accounting policies during the quarter; subject to

changes in the Same and that the same have been disclosed in the Notes to the Financial

Statement and

significarr[ fraud of wtrich we beoome aware"and the

involvement there in, if any, of the Management or an employee having a significant role

(iii) that there are no instances of

(Satish Prasad Dhongo

ll/h ole-Time-D ire cto r &

DII{: 06594368

Place: Indore

Dated: 28110120T6

&

4,o

You might also like

- Standalone Financial Results, Limited Review Report For June 30, 2016 (Result)Document4 pagesStandalone Financial Results, Limited Review Report For June 30, 2016 (Result)Shyam SunderNo ratings yet

- Standalone Financial Results, Limited Review Report For June 30, 2016 (Result)Document4 pagesStandalone Financial Results, Limited Review Report For June 30, 2016 (Result)Shyam SunderNo ratings yet

- Standalone Financial Results, Form A, Auditors Report For March 31, 2016 (Result)Document6 pagesStandalone Financial Results, Form A, Auditors Report For March 31, 2016 (Result)Shyam SunderNo ratings yet

- Standalone Financial Results, Limited Review Report For June 30, 2016 (Result)Document6 pagesStandalone Financial Results, Limited Review Report For June 30, 2016 (Result)Shyam SunderNo ratings yet

- Financial Results, Limited Review Report, Results Press Release For December 31, 2015 (Result)Document8 pagesFinancial Results, Limited Review Report, Results Press Release For December 31, 2015 (Result)Shyam SunderNo ratings yet

- Standalone & Consolidated Financial Results, Limited Review Report For June 30, 2016 (Result)Document6 pagesStandalone & Consolidated Financial Results, Limited Review Report For June 30, 2016 (Result)Shyam SunderNo ratings yet

- Standalone Financial Results, Limited Review Report For June 30, 2016 (Result)Document3 pagesStandalone Financial Results, Limited Review Report For June 30, 2016 (Result)Shyam SunderNo ratings yet

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Document4 pagesStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderNo ratings yet

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Document4 pagesStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderNo ratings yet

- Financial Results, Limited Review Report For December 31, 2015 (Result)Document7 pagesFinancial Results, Limited Review Report For December 31, 2015 (Result)Shyam SunderNo ratings yet

- Financial Results, Limited Review Report For December 31, 2015 (Result)Document8 pagesFinancial Results, Limited Review Report For December 31, 2015 (Result)Shyam SunderNo ratings yet

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Document4 pagesStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderNo ratings yet

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Document4 pagesStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderNo ratings yet

- Standalone Financial Results, Limited Review Report For June 30, 2016 (Result)Document5 pagesStandalone Financial Results, Limited Review Report For June 30, 2016 (Result)Shyam SunderNo ratings yet

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Document4 pagesStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderNo ratings yet

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Document6 pagesStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderNo ratings yet

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Document6 pagesStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderNo ratings yet

- Standalone & Consolidated Financial Results, Form A, Auditors Report For March 31, 2016 (Result)Document9 pagesStandalone & Consolidated Financial Results, Form A, Auditors Report For March 31, 2016 (Result)Shyam SunderNo ratings yet

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Document4 pagesStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderNo ratings yet

- Standalone Financial Results, Limited Review Report For June 30, 2016 (Result)Document4 pagesStandalone Financial Results, Limited Review Report For June 30, 2016 (Result)Shyam SunderNo ratings yet

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Document5 pagesStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderNo ratings yet

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Document5 pagesStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderNo ratings yet

- Standalone Financial Results, Limited Review Report For June 30, 2016 (Result)Document4 pagesStandalone Financial Results, Limited Review Report For June 30, 2016 (Result)Shyam SunderNo ratings yet

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Document4 pagesStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderNo ratings yet

- Standalone Financial Results, Limited Review Report For June 30, 2016 (Result)Document5 pagesStandalone Financial Results, Limited Review Report For June 30, 2016 (Result)Shyam SunderNo ratings yet

- Standalone Financial Results, Limited Review Report For June 30, 2016 (Result)Document4 pagesStandalone Financial Results, Limited Review Report For June 30, 2016 (Result)Shyam SunderNo ratings yet

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Document4 pagesStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderNo ratings yet

- Standalone Financial Results, Auditors Report For March 31, 2016 (Result)Document4 pagesStandalone Financial Results, Auditors Report For March 31, 2016 (Result)Shyam SunderNo ratings yet

- Standalone & Consolidated Financial Results, Form A, Auditors Report For March 31, 2016 (Result)Document10 pagesStandalone & Consolidated Financial Results, Form A, Auditors Report For March 31, 2016 (Result)Shyam SunderNo ratings yet

- Standalone Financial Results, Limited Review Report For June 30, 2016 (Result)Document3 pagesStandalone Financial Results, Limited Review Report For June 30, 2016 (Result)Shyam SunderNo ratings yet

- Standalone & Consolidated Financial Results, Limited Review Report For September 30, 2016 (Result)Document6 pagesStandalone & Consolidated Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderNo ratings yet

- Standalone Financial Results, Limited Review Report For June 30, 2016 (Result)Document3 pagesStandalone Financial Results, Limited Review Report For June 30, 2016 (Result)Shyam SunderNo ratings yet

- Financial Results, Limited Review Report For December 31, 2015 (Result)Document4 pagesFinancial Results, Limited Review Report For December 31, 2015 (Result)Shyam SunderNo ratings yet

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Document5 pagesStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderNo ratings yet

- Financial Results & Limited Review Report For Dec 31, 2015 (Standalone) (Result)Document4 pagesFinancial Results & Limited Review Report For Dec 31, 2015 (Standalone) (Result)Shyam SunderNo ratings yet

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Document5 pagesStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderNo ratings yet

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Document6 pagesStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderNo ratings yet

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Document7 pagesStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderNo ratings yet

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Document4 pagesStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderNo ratings yet

- Financial Results, Limited Review Report For December 31, 2015 (Result)Document4 pagesFinancial Results, Limited Review Report For December 31, 2015 (Result)Shyam SunderNo ratings yet

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Document4 pagesStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderNo ratings yet

- Announces Q2 Results (Standalone) & Limited Review Report (Standalone) For The Quarter Ended September 30, 2016 (Result)Document4 pagesAnnounces Q2 Results (Standalone) & Limited Review Report (Standalone) For The Quarter Ended September 30, 2016 (Result)Shyam SunderNo ratings yet

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Document3 pagesStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderNo ratings yet

- Standalone Financial Results, Limited Review Report For June 30, 2016 (Result)Document5 pagesStandalone Financial Results, Limited Review Report For June 30, 2016 (Result)Shyam SunderNo ratings yet

- Standalone Financial Results, Limited Review Report For June 30, 2016 (Result)Document3 pagesStandalone Financial Results, Limited Review Report For June 30, 2016 (Result)Shyam SunderNo ratings yet

- Standalone Financial Results, Limited Review Report For June 30, 2016 (Result)Document4 pagesStandalone Financial Results, Limited Review Report For June 30, 2016 (Result)Shyam SunderNo ratings yet

- Financial Results, Limited Review Report For December 31, 2015 (Result)Document3 pagesFinancial Results, Limited Review Report For December 31, 2015 (Result)Shyam SunderNo ratings yet

- Financial Results, Limited Review Report For December 31, 2015 (Result)Document5 pagesFinancial Results, Limited Review Report For December 31, 2015 (Result)Shyam SunderNo ratings yet

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Document4 pagesStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderNo ratings yet

- Standalone Financial Results, Form A, Auditors Report For March 31, 2016 (Result)Document7 pagesStandalone Financial Results, Form A, Auditors Report For March 31, 2016 (Result)Shyam SunderNo ratings yet

- Standalone Financial Results, Limited Review Report For June 30, 2016 (Result)Document3 pagesStandalone Financial Results, Limited Review Report For June 30, 2016 (Result)Shyam SunderNo ratings yet

- Standalone & Consolidated Financial Results, Auditors Report For March 31, 2016 (Result)Document9 pagesStandalone & Consolidated Financial Results, Auditors Report For March 31, 2016 (Result)Shyam SunderNo ratings yet

- Standalone & Consolidated Financial Results, Limited Review Report For June 30, 2016 (Result)Document10 pagesStandalone & Consolidated Financial Results, Limited Review Report For June 30, 2016 (Result)Shyam SunderNo ratings yet

- Standalone Financial Results, Limited Review Report For June 30, 2016 (Result)Document4 pagesStandalone Financial Results, Limited Review Report For June 30, 2016 (Result)Shyam SunderNo ratings yet

- Standalone Financial Results, Form A, Auditors Report For March 31, 2016 (Result)Document9 pagesStandalone Financial Results, Form A, Auditors Report For March 31, 2016 (Result)Shyam SunderNo ratings yet

- Standalone Financial Results, Limited Review Report For December 31, 2016 (Result)Document4 pagesStandalone Financial Results, Limited Review Report For December 31, 2016 (Result)Shyam SunderNo ratings yet

- Standalone Financial Results, Form A, Auditors Report For March 31, 2016 (Result)Document6 pagesStandalone Financial Results, Form A, Auditors Report For March 31, 2016 (Result)Shyam SunderNo ratings yet

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Document4 pagesStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderNo ratings yet

- Public Sector Accounting and Administrative Practices in Nigeria Volume 1From EverandPublic Sector Accounting and Administrative Practices in Nigeria Volume 1No ratings yet

- Operating a Business and Employment in the United Kingdom: Part Three of The Investors' Guide to the United Kingdom 2015/16From EverandOperating a Business and Employment in the United Kingdom: Part Three of The Investors' Guide to the United Kingdom 2015/16No ratings yet

- Order of Hon'ble Supreme Court in The Matter of The SaharasDocument6 pagesOrder of Hon'ble Supreme Court in The Matter of The SaharasShyam SunderNo ratings yet

- JUSTDIAL Mutual Fund HoldingsDocument2 pagesJUSTDIAL Mutual Fund HoldingsShyam SunderNo ratings yet

- Mutual Fund Holdings in DHFLDocument7 pagesMutual Fund Holdings in DHFLShyam SunderNo ratings yet

- HINDUNILVR: Hindustan Unilever LimitedDocument1 pageHINDUNILVR: Hindustan Unilever LimitedShyam SunderNo ratings yet

- Settlement Order in Respect of Bikaner Wooltex Pvt. Limited in The Matter of Sangam Advisors LimitedDocument2 pagesSettlement Order in Respect of Bikaner Wooltex Pvt. Limited in The Matter of Sangam Advisors LimitedShyam SunderNo ratings yet

- Exit Order in Respect of The Spice and Oilseeds Exchange Limited, SangliDocument5 pagesExit Order in Respect of The Spice and Oilseeds Exchange Limited, SangliShyam SunderNo ratings yet

- PR - Exit Order in Respect of Spice & Oilseeds Exchange Limited (Soel)Document1 pagePR - Exit Order in Respect of Spice & Oilseeds Exchange Limited (Soel)Shyam SunderNo ratings yet

- Financial Results For Mar 31, 2014 (Result)Document2 pagesFinancial Results For Mar 31, 2014 (Result)Shyam SunderNo ratings yet

- Standalone Financial Results For March 31, 2016 (Result)Document11 pagesStandalone Financial Results For March 31, 2016 (Result)Shyam SunderNo ratings yet

- Standalone Financial Results, Auditors Report For March 31, 2016 (Result)Document5 pagesStandalone Financial Results, Auditors Report For March 31, 2016 (Result)Shyam SunderNo ratings yet

- Financial Results & Limited Review Report For Sept 30, 2015 (Standalone) (Result)Document4 pagesFinancial Results & Limited Review Report For Sept 30, 2015 (Standalone) (Result)Shyam SunderNo ratings yet

- Financial Results, Limited Review Report For December 31, 2015 (Result)Document4 pagesFinancial Results, Limited Review Report For December 31, 2015 (Result)Shyam SunderNo ratings yet

- Settlement Order in Respect of R.R. Corporate Securities LimitedDocument2 pagesSettlement Order in Respect of R.R. Corporate Securities LimitedShyam SunderNo ratings yet

- Financial Results For June 30, 2014 (Audited) (Result)Document3 pagesFinancial Results For June 30, 2014 (Audited) (Result)Shyam SunderNo ratings yet

- Financial Results & Limited Review Report For June 30, 2015 (Standalone) (Result)Document3 pagesFinancial Results & Limited Review Report For June 30, 2015 (Standalone) (Result)Shyam SunderNo ratings yet

- Financial Results For September 30, 2013 (Result)Document2 pagesFinancial Results For September 30, 2013 (Result)Shyam SunderNo ratings yet

- Financial Results For Dec 31, 2013 (Result)Document4 pagesFinancial Results For Dec 31, 2013 (Result)Shyam Sunder0% (1)

- Standalone Financial Results For September 30, 2016 (Result)Document3 pagesStandalone Financial Results For September 30, 2016 (Result)Shyam SunderNo ratings yet

- Financial Results For June 30, 2013 (Audited) (Result)Document2 pagesFinancial Results For June 30, 2013 (Audited) (Result)Shyam SunderNo ratings yet

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Document4 pagesStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderNo ratings yet

- Standalone Financial Results For June 30, 2016 (Result)Document2 pagesStandalone Financial Results For June 30, 2016 (Result)Shyam SunderNo ratings yet

- PDF Processed With Cutepdf Evaluation EditionDocument3 pagesPDF Processed With Cutepdf Evaluation EditionShyam SunderNo ratings yet

- Standalone Financial Results, Limited Review Report For December 31, 2016 (Result)Document5 pagesStandalone Financial Results, Limited Review Report For December 31, 2016 (Result)Shyam SunderNo ratings yet

- Transcript of The Investors / Analysts Con Call (Company Update)Document15 pagesTranscript of The Investors / Analysts Con Call (Company Update)Shyam SunderNo ratings yet

- Investor Presentation For December 31, 2016 (Company Update)Document27 pagesInvestor Presentation For December 31, 2016 (Company Update)Shyam SunderNo ratings yet

- Standalone Financial Results, Limited Review Report For December 31, 2016 (Result)Document3 pagesStandalone Financial Results, Limited Review Report For December 31, 2016 (Result)Shyam SunderNo ratings yet

- Standalone Financial Results, Limited Review Report For June 30, 2016 (Result)Document3 pagesStandalone Financial Results, Limited Review Report For June 30, 2016 (Result)Shyam SunderNo ratings yet

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Document4 pagesStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderNo ratings yet

- Standalone Financial Results, Limited Review Report For June 30, 2016 (Result)Document4 pagesStandalone Financial Results, Limited Review Report For June 30, 2016 (Result)Shyam SunderNo ratings yet

- Standalone Financial Results, Limited Review Report For December 31, 2016 (Result)Document4 pagesStandalone Financial Results, Limited Review Report For December 31, 2016 (Result)Shyam SunderNo ratings yet

- 2018 01 10 MiMedx Investor Presentation FINALDocument43 pages2018 01 10 MiMedx Investor Presentation FINALmedtechyNo ratings yet

- 2018 Compendium Volume 2 UpstreamDocument437 pages2018 Compendium Volume 2 UpstreamLoren SanapoNo ratings yet

- 3.2 Business Profit TaxDocument53 pages3.2 Business Profit TaxBizu AtnafuNo ratings yet

- America Movil SAB de CVDocument11 pagesAmerica Movil SAB de CVLuis Fernando EscobarNo ratings yet

- CFA 2024 L1 Quick SheetDocument6 pagesCFA 2024 L1 Quick SheetMashref HoqueNo ratings yet

- Chapter 6-Problems (Scanned Copy)Document5 pagesChapter 6-Problems (Scanned Copy)codebreaker911No ratings yet

- CA ProjectDocument21 pagesCA Projectkalaswami100% (1)

- Venture Capital in India 2017 ProjectDocument80 pagesVenture Capital in India 2017 Projectakki_655150% (2)

- Concept of Social Cost Benefit AnalysisDocument25 pagesConcept of Social Cost Benefit AnalysisSunny KhushdilNo ratings yet

- RMC No 23-2012 - Withholding of TaxesDocument7 pagesRMC No 23-2012 - Withholding of TaxesJOHAYNIENo ratings yet

- Accounting 1Document8 pagesAccounting 1Jane ebonaNo ratings yet

- Garden Sillk MillDocument132 pagesGarden Sillk MillYogesh JasoliyaNo ratings yet

- 2010 Taxation Law Bar Examination QuestionsDocument5 pages2010 Taxation Law Bar Examination QuestionsMowan100% (1)

- Debt Securities ReviewerDocument30 pagesDebt Securities Reviewerjhie boterNo ratings yet

- BCOM Syllabus MBB and Ram ThakurDocument4 pagesBCOM Syllabus MBB and Ram ThakurAnimeshSahaNo ratings yet

- Creba v. Romulo Case DigestDocument2 pagesCreba v. Romulo Case DigestApril Rose Villamor67% (6)

- (CaseSt1) Balance Sheet, Short 2020 PBDocument11 pages(CaseSt1) Balance Sheet, Short 2020 PBtitu patriciuNo ratings yet

- Free Wood Pellet Manufacturer Business PlanDocument19 pagesFree Wood Pellet Manufacturer Business PlanFurqon Hidayatulloh75% (4)

- Ch3.2 - HomeworkDocument2 pagesCh3.2 - HomeworkArcherDash Love GeometrydashNo ratings yet

- Treasury Management and Financial Accounting Practices of Berger Paints Bangladesh LimitedDocument48 pagesTreasury Management and Financial Accounting Practices of Berger Paints Bangladesh LimitedNazah Saiyara Ahmed100% (1)

- Caiib-Abm-Important FormulaDocument3 pagesCaiib-Abm-Important FormulaVasimNo ratings yet

- Chapter 12Document17 pagesChapter 12khae123No ratings yet

- Annex D CNPF Annual Report 2020 - Consolidated Financial StatementsDocument113 pagesAnnex D CNPF Annual Report 2020 - Consolidated Financial StatementsJC LastimosoNo ratings yet

- FINAL EditedDocument18 pagesFINAL EditedLhennedy Sabugal TamarayNo ratings yet

- Tax Booklet As of 10 November 2016 PDFDocument20 pagesTax Booklet As of 10 November 2016 PDFmaronbNo ratings yet

- Christine Surya - CVDocument4 pagesChristine Surya - CVCaleb Holy Sabbath ManurungNo ratings yet

- Financial Ratio Analysis Aldar UpdatedDocument36 pagesFinancial Ratio Analysis Aldar UpdatedHasanNo ratings yet

- Negotiation Role PlayDocument3 pagesNegotiation Role PlayRijurahul Agarwal SinghNo ratings yet

- Planning FmlaDocument10 pagesPlanning FmlaNoah Mzyece DhlaminiNo ratings yet

- Railway Service Pension Rules 1993 PDFDocument149 pagesRailway Service Pension Rules 1993 PDFAnil100% (1)