Professional Documents

Culture Documents

Journal PDF

Uploaded by

shrutimalOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Journal PDF

Uploaded by

shrutimalCopyright:

Available Formats

INTERNATIONAL JOURNAL OF SOCIAL SCIENCES

& INTERDISCIPLINARY RESEARCH

Online Available at indianresearchjournals.com

Vol.1 No. 4, April 2012, ISSN 2277 3630

IMPACT OF CRUDE OIL PRICE ON INDIAN ECONOMY

*Dr. ANSHUL SHARMA, **Mr. GURMEET SINGH, ***Ms. MANISHA SHARMA, ****Ms. POOJA GUPTA

*S.D. College of Management,Israna, Panipat.

**Naraini Group of Institution, Karnal.

***S.D. College of Management,Israna, Panipat.

****S.D. College of Management, Israna, Panipat.

ABSTRACT

In this paper, an empirical analysis is used to compare the effects of crude oil price on Indian

economy because India's imports of oil are increasing. Our import dependence has reached 80 per cent and is likely to

keep growing. At the same time 2008 saw an unprecedented rise in oil price on the world market. Oil price volatility has

also increased. Though future oil prices are difficult to predict, they are generally expected to rise. The oil prices have

started rising significantly since the initiation of the twenty first century. Theoretically, one can judge the impact of an oil

price shock. The immediate effect of the oil price shock is the increased Cost of production due to increased fuel cost.

Whenever there is an overall inflation in the economy, the cost of production would also rise causing a decrease in

supply. On the other hand, inflation implies a fall in the purchasing power of people. In short, oil price fluctuation has

adverse effects on the economy. The paper seeks to find out the impact on the Indian economy.

KEY WORDS: Crude Oil Price, Indian Economy, Inflation, Price Volatility, Oil Price Trends, India's GDP, Price

Controls and Subsidies.

INTRODUCTION

India's growing dependence on imported oil products and

the dramatic rise in the prices of crude oil to as high as

$148/bbl. the international market in July 2008, followed by

an equally dramatic fall, pose significant policy challenges.

The Government's efforts to insulate domestic Consumers,

at least to some extent, resulted in huge fiscal burden for the

Government and financial problems for the public sector oil

marketing companies. But for the steep fall in crude Price, it

would have most likely disrupted the growth process of our

economy. Crude oil is one of the most necessitated

worldwide required commodities and India is importing

100 million tons of crude oil and other petroleum products

and spending huge amount of foreign exchange. Such huge

imports of petroleum products will have large impact on

Indian economy especially when the crude oil prices in the

international market shoots up. Any slightest fluctuation in

crude oil prices can have both direct and indirect influence on

the Indian economy. The rise in crude oil prices has affected

the Indian economy quite significantly and the country has

to produce about one trillion worth of GDP to fulfill the

needs of its huge population. In order to produce this one

trillion dollar worth of output, India needs 2.5 million of oil

per day which is 6.5 percent of total world demand for oil.

ABOUT CRUDE OIL

Crude oil is a naturally-occurring substance found in certain

rock formations in the earth and this is mixture of mud &

organic material is rich in hydrogen & carbon. Over millions

of years this layer of organic rich mud becomes buried

thousands of feet deep in the earth and temperature of the

earth becomes hotter as you go deeper in to the earth. The

combination of increasing temperature & pressure on the

organic mixture causes change in to crude oil.

OVERVIEW OF LITERATURE

Oil price shocks have received considerable importance in

the empirical literature. Macroeconomists have viewed

changes in the oil prices as an important source of economic

fluctuations as the oil shocks of mid and late 1970s was

followed by low growth, high unemployment, and high

inflation in most of the developed countries. However, the

shocks of late 1990s and of 2000, although they were of the

same size and magnitude comparable to 1970s, but in

contrast, GDP growth and inflation have remained relatively

stable in much of the industrialized world. But this was the

situation only until 2007, 2008 has witnessed a worst

recession around the developed world, conforming to what

had happened after 1970s oil shock.

95

Dr. ANSHUL SHARMA, Mr. GURMEET SINGH, Ms. MANISHA SHARMA, Ms. POOJA GUPTA

OBJECTIVE OF THE STUDY

1. To study the economic growth of Indian crude oil.

2. To analyse trend in oil price.

3. To study the relationship between oil prices & inflation.

4. To analyse the factors that affect to the crude oil prices.

5. To study the steps taken by the govt. and RBI to

minimize the impact of crude oil on Indian economy.

6. To study the impact of higher oil prices on Indian

economy.

CRUDE OIL PRICES HAVE BEEN BUFFETED BY

MANY FACTORS

2 PRODUCTION: Production in industries such as

manufacturing, transportation, and electricity

generation demands a substantial amount of oil.

Therefore, oil supply side measures in harmony with

economic growth are needed. In addition to supply side

measures, demand side management measures are also

needed. The oil intensity in India is much larger than

those in the developed countries.

2 NATURAL CAUSES: In recent years, global

community has witnessed many events which in turns

have volatility effects on the price level of crude oil. Like

hurricane Katrina and other type of tropical cyclone

have hit the major portion of globe, which as a result

driven the crude oil prices to reach at its peak.

2 INVENTORY: In throughout the world, oil producers

and consumers get stock their crude oil for their future

requirements. This gives rise to speculation on price

expectations and sale/arbitrage chances in case any

unexpected thing cracks during supply and demand

equations. Any upward or downward movement in

inventory level shoots up volatility in price index of

crude oil.

2 DEMAND: With a sharp rise in economic demand,

requirement of crude oil is increasing to manifold in

context to the limited supply. The high demand

economy of crude oil is putting undue pressure on the

available fixed resources. The major gap created between

demand and supply of crude oil is forcing the price curve

of crude oil to rise in upward direction.

ECONOMIC GROWTH AND OIL PRICE TRENDS

Price of crude oil is the critical importance to today's Indian

economy and given that oil is the largest traded well, both in

volume and value terms. Higher oil prices increase economic

growth by raising 'real resource' prices, through what we can

call 'the revenue effect.' The pro-growth impact of oil does

not stop there, because fast increasing values of merchandise

trade due to higher 'real resource' prices directly leads to fast

growth of liquidity When oil prices start to decline, investors

and economists get worried. Oil prices in large part reflect

global sentiment towards our economic future - prosperous,

growing economies need more oil while slumping,

shrinking economies need less, and so the price of crude

indicates whether the majority believes we are headed for

good times or bad. That explains the worry - those worried

investors and economists are using oil prices as an indicator,

and falling prices indicate bad times ahead. The imbalance

between scarce supply and growing demand, and

expectations that this imbalance will persist in the future;

have led to upward pressure on oil prices and greater market

reactions to any actual or perceived disruptions in available

supply. Under such tight market conditions, it is often the

case that only large price increases can re-establish

equilibrium between supply and demand. Consequently,

large or rapid movements in oil prices are not inconsistent

with the fundamentals of supply and demand; such price

movements, by themselves, do not indicate that prices have

become divorced from fundamentals.

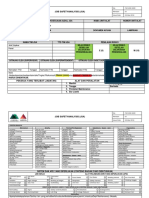

Historical Crude Oil Price Movements

Source: U.S. Energy Information Administration.

96

IMPACT OF CRUDE OIL PRICE ON INDIAN ECONOMY

R E LAT I O N S H I P B E T W E E N E C O N O M I C

GROWTH AND OIL PRICES

There are a number of evidences to support bidirectional or

unidirectional causality between energy consumption and

economic growth. Despite the expanding literature on the

study of causal relationships between energy consumption

and economic growth, to the best of the author's knowledge,

there have been some studies specifically addressing the

causal relationship between oil consumption and economic

growth. The direction of causality between oil consumption

and economic growth has significant policy implications for

countries, enjoying implicit generous subsidies for energy.

On the other hand, if unidirectional causality runs from

energy consumption to income, reducing energy

consumption. Numerous studies have been conducted to

examine the relationship between energy consumption and

economic growth; the overall findings show that there is a

strong relationship between energy consumption and

economic growth.

IMPACT ON INDIA'S GDP AND INFLATION

India's crude oil import bill may cross USD100 billion if the

global price stays firm at USD 100-USD 120 a barrel. If that

happens, it will upset the delicate fiscal balance, expand

deficit, increase the subsidy bill that continues to bloat year

after year and fuel inflationary expectations. Rising crude oil

prices will impact inflation whether the government absorbs

the burden or passes it to the consumer by increasing prices

of petroleum products. If the government acts as a buffer, the

oil subsidy bill will rise and affect fiscal deficit. This will

indirectly fan inflation. The recent strengthening of crude oil

prices could impact economic growth momentum in the

country for the current fiscal. The main factors that would be

responsible for economic growth moderation in 2011-12

would be crude oil prices and RBI's tightening of monetary

policy in response to oil prices. Rising crude price will lead

higher inflation and higher inflation attracts monetary

tightening. Monetary tightening would lead to a squeeze on

aggregate demand, impacting economic growth. There will

be an impact on the price level and on inflation. Its

magnitude will depend on the degree of monetary

tightening and the extent to which consumers seek to offset

the decline in their real incomes through higher wage

increases, and producers seek to restore profit margins.

STEPS TAKEN BY THE GOVT. AND RBI TO

MINIMISE THE IMPACT

STEPS TAKEN BY GOVERNMENT:

2 Provided huge amount of subsidies to oil companies:

The country is struggling to attract investment in the

fuels sector. The government actively started wooing

not only private participation but also foreign private

participation in all the energy sectors of the country. In

order to make investments in the energy sector

attractive, the government had to implement strong

reform measures in this sector. In 1991, the Indian

government began major and irreversible structural

changes aimed at radically reforming the economy.

These efforts have continued and have already resulted

in massive deregulation and a significant opening of the

Indian economy.

2 Increased domestic price of diesel and petrol: I Import

parity pricing has been a commonly used approach in a

regulatory context or inn making a case for tariff

protection. The argument in support of this approach is

that in a situation where there is no domestic

manufacture of a product, the cost of supplying it in the

domestic market will be the landed cost which is the

import parity price. However, even in a situation where

there is domestic manufacture import parity price can be

taken as the international competitive price that sets the

ceiling for the domestic price. When domestic refiners

are given the import parity price, they enjoy a rent which

is equivalent to the differential in ocean freight and

associated costs as between crude and products. Since

the price increase will be larger in remote and hilly areas,

the Government may want to consider some other way

of softening the impact of freight in these areas.

2 Start looking for alternate energy options to prevent

future oil shocks: Oil being the most important of our

fuels today, the term "alternative energy" is commonly

taken to mean all other energy sources and is used here in

that context. Realizing that oil is finite in practical terms,

there is increasing attention given to what alternative

energy sources are available to replace oil. Alternative

energy refers to energy sources that have no undesired

consequences such for example fossil fuels or nuclear

energy. Alternative energy sources are renewable and are

thought to be "free" energy sources. They all have lower

97

Dr. ANSHUL SHARMA, Mr. GURMEET SINGH, Ms. MANISHA SHARMA, Ms. POOJA GUPTA

carbon emissions, compared to conventional energy

sources. These include Biomass Energy, Wind Energy,

Solar Energy, Geothermal Energy, Hydroelectric

Energy sources.

STEPS TAKEN BY R.B.I.:

2 Increase in CRR: Cash Reserve Ratio is that portion of

banks total deposits which Banks have to park with

Central Bank. A bank earns its income through lending

at higher rates and paying low rate of interest on

Deposits. So any increase in CRR leads to lesser amount

of money at disposal of banks, which can be given as

advances and loans, thereby sucking liquidity in

market.If RBI decides to increase the percent of this, the

available amount with the banks comes down. RBI is

using this method (increase of CRR rate), to drain out

the excessive money from the banks.

Some of the expected outcomes of the hike in key

rates by the Reserve Bank of India are:

(i) Inflation will be contained and inflationary expectations

will be anchored.

(ii) The recovery process will be sustained.

(iii) The government's borrowing requirements and the

private credit demand will be met.

(iv) Policy instruments will be further aligned in a manner

consistent with the evolving state of the economy.

2 Repo Rates: Repo rate is the rate at which the RBI

lends shot-term money to the banks against securities. When

the repo rate increases borrowing from RBI becomes more

expensive. Therefore, we can say that in case, RBI wants to

make it more expensive for the banks to borrow money, it

increases the repo rate; similarly, if it wants to make it

cheaper for banks to borrow money, it reduces the repo rate.

IMPACT OF HIGHER OIL PRICES

The boost to economic growth in oil-exporting countries

provided by higher oil prices in the past has always been less

than the loss of economic growth in importing countries,

such that the net effect has always been negative. The growth

of the Indian economy has always fallen sharply in the wake

of each major run-up in oil prices. This is mainly because the

propensity to consume of net importing countries that lose

from higher prices is generally higher than that of the

exporting countries. Demand in the latter countries tends to

rise only gradually in response to higher prices and export

earnings, so that net global demand tends to fall in the short

term. In particular, the results do not take into account the

secondary effects of higher oil prices on consumer and

business confidence or possible changes in fiscal and

monetary policies. The loss of business and consumer

confidence resulting from an oil shock could lead to

significant shifts in levels and patterns of investment, savings

and spending. A loss of confidence and inappropriate policy

responses, especially in the oil-importing countries, could

amplify the economic effects in the medium term.

PRICE CONTROLS AND SUBSIDIES

Many emerging market and developing economies use

subsidies and other administrative measures to control

domestic fuel prices. These administered prices are generally

set below global market prices and, therefore, artificially

boost the demand for oil. Indeed, essentially all of the

increase in oil consumption this year is expected to be in

India where fuel prices are subsidized and demand is not

fully responsive to price signals. Price controls and subsidies

interfere with the economic link between market prices and

consumption.

CONCLUSION

India's imports of oil are increasing. Our import dependence

has reached 80 per cent and is likely to keep growing. At the

same time 2008 saw an unprecedented rise in oil price on the

World market. Oil price volatility has also increased. Though

future oil prices are difficult to predict, they are generally

expected to rise. Given our increasing dependence on

imports effect to the Indian economy. By the increase in the

price of crude oil the inflation increases, Government have to

spend too much on subsidy, our exports become weaker,

investment decreases and GDP is also affected.

REFERENCES:

1. Aunaas, T., A. Olsen, and E. Zachariassen, "The Effects

of Oil and Oil Dispersants on the Ministry of New &

Renewable Energy. 2009. National Policy on Biofuel.

Government of India.

2. ADB (Asian Development Bank). 2008.

Asian

Development Outlook 2008: Update.

3. AE Brazil. 2008. "Brazil Gasoline Prices 38.6% Higher

Than Abroad." Dec. 4.

98

IMPACT OF CRUDE OIL PRICE ON INDIAN ECONOMY

4. All Africa. 2007a. "Fuel Shortage-Why Govt Moved to

Control Prices." Nov. 20.

5. Asian News International. 2008. "Nepal Oil

Corporation Makes Profit for First Time in Two Years."

Oct. 19.

6. AP (Associated Press). 2008a. "Jordan Raises Fuel

Prices for 5th Time in 2 Years

7. Bacon, Robert, and Masami Kojima. 2006a. Coping

with Higher Oil Prices.

8. BMI Daily Oil and Gas Alert. 2009a. "Abuja's Fuel Price

Liberalisation Threatens Civil Unrest." May 13.

9. Bernanke, B., Gertler, M. and M. Watson. (1997).

Systematic Monetary Policy and the Effect of Oil Price

Shocks, Brookings Papers on Economic Activity 1: 91142.

10. Business Line. 2009. "Oil Companies Get Rup 21,942

Crore Bonds" Feb. 5.

11. Business Recorder. 2009. "Government Releases Rs

Two Billion PDC, but Still Owes Rs 18 Billion." Feb. 3.

12. Cambodia Daily. 2008. "For Some, Oil Price Decrease Is

Not Enough." Oct. 23.

13. Economic Regulation Measures in the Petroleum

Downstream Sub-Sector (INQP-07-001)." Order 070 1 0 . w w w. e w u r a . g o . t z / p d f /

N o t i c e s / B o a r d % 2 0 O r d e r % 2 0

on%20Petroleum%20Final.pdf.

14. Hunt, R., P. Isard and D. Laxton (2002) 'The

Macroeconomic Effects of Higher Oil Prices' National

Institute Economic Review no 179 January 2002

15. Jimnez-Rodrguez, R. and M. Snchez. (2004). Oil

Price Shocks and Real GDP Growth: Empirical

Evidence for Some OECD Countries, ECB Working

Paper Series, no. 362. 16.

Kaufmann, R. (2003).

The Short Run Outlook for World Oil Prices,

Pr e s e n t a t i o n f o r t h e U N Pr o j e c t L I N K ,

http://www.un.org/esa/analysis/link/presentations03/k

auffman_0403.PDF 17.

Lee, K., Ni, S. and R.

Ratti (1995). Oil Shocks and the Macroeconomy: the

Role of Price Variability, Energy Journal 16:39-5

18. Ojha, V., S. Pohit, and B. Pal. 2009. Climate Change

Impact on the Indian Economy-A CGE 19.

Ojha, V. et al. 2009. Social Accounting Matrix for India.

Proceedings of the 17th International

99

You might also like

- NISM Series V A Mutual Fund Distributors Workbook August 2014 Feb 2015Document246 pagesNISM Series V A Mutual Fund Distributors Workbook August 2014 Feb 2015bhishmaNo ratings yet

- BCom Banking and InsuranceDocument106 pagesBCom Banking and InsuranceUtsav SinhaNo ratings yet

- Rise & Impact of Crude Oil Price in IndiaDocument10 pagesRise & Impact of Crude Oil Price in IndiaRandal SchroederNo ratings yet

- Burgundy INVESTMENT Perspective presentation-Apr-June 2015 - 01 PDFDocument26 pagesBurgundy INVESTMENT Perspective presentation-Apr-June 2015 - 01 PDFshrutimalNo ratings yet

- Guide to Letters of Credit for Importers and ExportersDocument48 pagesGuide to Letters of Credit for Importers and ExportersAmit RaiNo ratings yet

- Crude Oil Scenario & Indian EconomyDocument4 pagesCrude Oil Scenario & Indian EconomyshrutimalNo ratings yet

- Paper Boat - Aam PannaDocument5 pagesPaper Boat - Aam PannashrutimalNo ratings yet

- An abstract on the effects of the past Mutual Fund MarketsDocument55 pagesAn abstract on the effects of the past Mutual Fund MarketsshrutimalNo ratings yet

- Burgundy INVESTMENT Perspective presentation-Apr-June 2015 - 01 PDFDocument26 pagesBurgundy INVESTMENT Perspective presentation-Apr-June 2015 - 01 PDFshrutimalNo ratings yet

- Dissertation Format For Website (Compatibility Mode)Document29 pagesDissertation Format For Website (Compatibility Mode)Raj MohanNo ratings yet

- Treasury Management-ShrutiDocument17 pagesTreasury Management-ShrutishrutimalNo ratings yet

- New Microsoft Power Point PresentationDocument1 pageNew Microsoft Power Point PresentationshrutimalNo ratings yet

- Wealth TaxDocument3 pagesWealth TaxshrutimalNo ratings yet

- Chimia OrganicaDocument1 pageChimia OrganicaSorin DanielNo ratings yet

- Methods of Media Research MethodsDocument20 pagesMethods of Media Research MethodsshrutimalNo ratings yet

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5794)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (399)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (894)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (587)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (265)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (73)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (344)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2219)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (119)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- X ( J / ËEÚŒ ( EÚ - EÚ Æ ( Æ "I HDocument8 pagesX ( J / ËEÚŒ ( EÚ - EÚ Æ ( Æ "I Hsuneel kumar rathoreNo ratings yet

- Consumable Material Data ATR V11 Rev Oct 19Document42 pagesConsumable Material Data ATR V11 Rev Oct 19Scot0% (1)

- Python For Oil & Gas 2024Document12 pagesPython For Oil & Gas 2024godwanaNo ratings yet

- HADocument64 pagesHAlpczyfansNo ratings yet

- 6 - Malaysia Production Sharing Contract (PSC)Document33 pages6 - Malaysia Production Sharing Contract (PSC)Kaoru Amane100% (3)

- Trading JournalDocument15 pagesTrading JournalvijeshNo ratings yet

- Ethanol Plant From PSA Off Gases Ex HGU-Installation-Panipat Refinery-IOCL-EIA ReportDocument354 pagesEthanol Plant From PSA Off Gases Ex HGU-Installation-Panipat Refinery-IOCL-EIA ReportSRINIVASAN TNo ratings yet

- 8 - in Pit Dyke Constrcution Planning - Treacy Et AlDocument15 pages8 - in Pit Dyke Constrcution Planning - Treacy Et Alleandro.geotecniaNo ratings yet

- 11PetronasAzani ManafDocument21 pages11PetronasAzani ManafwilsonKhor100% (2)

- C5Document31 pagesC5kouider100% (1)

- Natural Gas Engineering: PETR5350/6350Document42 pagesNatural Gas Engineering: PETR5350/6350rickNo ratings yet

- Astm D2007 - 1 (En)Document8 pagesAstm D2007 - 1 (En)Jessica CehNo ratings yet

- This Is To Certify That, Student of Class XII-Science, KENDRIYA Vidyalaya, Arjangarh, Has Satisfactorily Completed The Chemistry Project EntitledDocument27 pagesThis Is To Certify That, Student of Class XII-Science, KENDRIYA Vidyalaya, Arjangarh, Has Satisfactorily Completed The Chemistry Project EntitlednishitaNo ratings yet

- PRPQ 410 GK SeriesDocument36 pagesPRPQ 410 GK SeriesJaime Albarrán FaríasNo ratings yet

- IECEx TOTAL Standards AngolaDocument31 pagesIECEx TOTAL Standards AngolaIso macnamareNo ratings yet

- Power Crisis in The PhilippinesDocument4 pagesPower Crisis in The PhilippinesRenz Anthony EspinoNo ratings yet

- Forecast Mensual Representantes de VentasDocument12 pagesForecast Mensual Representantes de VentasPaolita SarchiNo ratings yet

- ESMER BrochureDocument5 pagesESMER BrochureFabricioNo ratings yet

- JSA Pemasangan Pengambilan SampahDocument12 pagesJSA Pemasangan Pengambilan SampahIndra LeonNo ratings yet

- MEPC.282 70 SEEMP GuidelinesDocument19 pagesMEPC.282 70 SEEMP GuidelinesFarich FirmansyahNo ratings yet

- Module-2 - 18CIV59 - Question BankDocument7 pagesModule-2 - 18CIV59 - Question BankSadh SNo ratings yet

- HPCL Interview QuestionsDocument2 pagesHPCL Interview QuestionsShashank KumarNo ratings yet

- Coconut Processing: Drying of Foods Solar Drying Tray Dryers Drying of FoodsDocument4 pagesCoconut Processing: Drying of Foods Solar Drying Tray Dryers Drying of Foodsmicheal kaggwaNo ratings yet

- Historical Development of Science and TechnologyDocument18 pagesHistorical Development of Science and TechnologyKris MontesNo ratings yet

- Argus Oil Market Discussions: LPGDocument42 pagesArgus Oil Market Discussions: LPGALI ABBASNo ratings yet

- Fuel Oil WikipediaDocument7 pagesFuel Oil WikipediacantgetausernameNo ratings yet

- Multi Product Sulphonation PlantDocument3 pagesMulti Product Sulphonation PlantBhanu PathalaNo ratings yet

- General Quote / Offer (2021) : Operational TermsDocument8 pagesGeneral Quote / Offer (2021) : Operational TermsBenjamin HidayatNo ratings yet

- Lattice Wax StructureDocument5 pagesLattice Wax StructureMarc CornellNo ratings yet

- Valve Twin SealDocument28 pagesValve Twin SealVinay Korekar100% (1)