Professional Documents

Culture Documents

Gold Monetization Scheme: Its Implications On Indian Economy

Uploaded by

Asutosh PatroOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Gold Monetization Scheme: Its Implications On Indian Economy

Uploaded by

Asutosh PatroCopyright:

Available Formats

Gold Monetization

Scheme: Its implications

on Indian Economy

Submitted by: Group 1

Aayush Jain (UM15311)

Asutosh Patro (UM15321)

Kiran Sundar Hande (UM15331)

Pratik Kumar (UM15341)

Sanjog Saran (UM15351)

Srusti Pradyota Dash

(UM15361)

Vidish Mantri (UM15371)

Gold Monetization Scheme: Its implications of Indian economy

Table of Contents

1. Objective

2. Importance of Gold 2

3. Demand and Supply of Gold

4. Economic Contribution of Gold

5. Pricing of Gold4

6. Gold money rift

7. Gold Deposit Scheme, 1999

8. Gold Monetization Scheme, 2015

9. Macroeconomic Impact

10. Challenges

11. Conclusion

References 10

Annexure-I: List of Tables

11

Annexure-II: Process of gold monetization

12

1 | Page

Gold Monetization Scheme: Its implications of Indian economy

1. Objective:

The objective is to study the Gold Monetization scheme, its need and effects. The study also

gives a brief overview on demand, supply and economic contribution of gold in India and how

gold monetization scheme affect them. The study also explains the variations in macroeconomic

variables like unemployment etc. followed by the challenges it faces.

2. Importance of Gold:

Gold has always been an integral part of the socio-economic ethos of the Indian household.

Whether purchased for personal consumption or as an investment or a gift, this is the one

commodity which invariably exists in the portfolio of every Indian household. This has been

continuing for generations too when India was formerly referred to as Sone ki chidiya or the

Golden Bird.

Its only because of the importance of gold in Indian household that the policies on gold

formulated by the government are based on a set of assumptions which might not hold true for

any other nation. These assumptions are

Price of gold in India will never wane.

Indians will never part with their gold easily.

Women have a great deal of sentimental value attached with gold jewellery and they will

never part with their jewellery.

Even between cash and gold, people here will always opt for gold as it holds a higher

value in their minds than cash.

All these assumptions only highlight the basic fact that we Indians value our gold more than

anything.

Let alone the common man, even the government of India used 67 tons of its gold reserves back

in 1991 to secure an emergency loan of $2.2 billion from the IMF to get itself out of a tight spot

and clear its balance of payment dues. So much is the importance of gold in peoples minds that

the same government which issued the gold airlift collapsed within a few months of doing so.

But, of late survey results have shown that this love for gold is diminishing, opening gates for

policy makers to find ways to monetize this enormous amount of gold stored in Indian

households.

3. Demand and Supply of Gold:

Demand for gold in India is interwoven with culture, tradition, the desire for beauty and the

desire for financial protection. It is used as jewellery and as an asset. Over the past five years,

annual demand has averaged 895 tonnes, equivalent to 26 per cent of total physical demand

worldwide. . However, as India has little domestic supply of gold, demand is primarily satisfied

by imports. Gold is the safest instrument to protect their savings from inflation, currency

2 | Page

Gold Monetization Scheme: Its implications of Indian economy

depreciation and also can be easily liquidated in case of family emergency during their absence.

However investment demand surged to 29% to 266 tonnes in the year 2013.

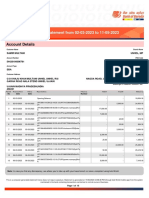

Fig1: Consumer demand and imports

700

600

500

400

300

200

Fabrication

Demand(tonnes)

Investment

Demand(tonnes)

100

0

Rise and fall in equity market also

affect the investment demand of gold. When market is bullish, investors liquidate their gold

holdings and invest in equities. This heavy sell off is absorbed by jewellery fabricators.

3 | Page

Gold Monetization Scheme: Its implications of Indian economy

However, as India has little domestic supply of gold, demand is primarily satisfied by imports.

The cost of these imports is responsible for todays current account deficit (CAD) and the

amount of foreign exchange spent for gold is significant. Time and again government comes up

with policies to curb this demand of gold. In many countries where domestic mined production is

low, recycled gold makes significant contribution to supply. In India this has rarely been the case.

However, recent data indicates that recycling can play a part in the Indian gold market.

Domestic recycled gold increased 29 per cent to 116 tonnes in 2009, following a sharp spike in

gold prices. Recycled supplies rose from 59 tonnes in 2011 to 113 tonnes in 2012 and 101 tonnes

in 2013, following government restrictions and a depreciation in the rupee. Moreover, our survey

reveals that Indian consumers are willing to recycle their gold, armed with appropriate

incentives. The major countries India imports its gold from are Switzerland, U.A.E, South

Africa, Australia, U.S.A, Hong Kong, U.K., Germany, Chinese Republic and Netherland.

Fig 3: Gold demand vs Gold supply in 2013

4.

Gross value added (in $ billion)

0% 5%

40%

55%

Economic Contribution of Gold:

Consumption (gold bar and

coins)

Jewellery fabrication and

consumption

Technology fabrication

demand

Recycling

Fig 2: Fabrication demand vs Investment demand (in bars)

Indian gold market is primarily driven by

Fig 4: Value addition in different component of demand

consumption and fabrication of gold. Both

have significant impact on economic value

addition, adds to GNP contribution to foreign exchange and balance of trade. As per report

commissioned by world gold council, PricewaterhouseCoopers estimated that gold has

contributed to $30 billion to Indian economy in the year 2012.

5. Pricing of Gold :

4 | Page

Gold Monetization Scheme: Its implications of Indian economy

Contrary to popular belief, the precious metals, gold and silver, are not traded on the London

Metal Exchange, but on the over-the-counter market usually referred to as the London Bullion

Market. The LME works with the precious metal community to help deliver pricing solutions for

the benefit of the whole market which is determined by forces of demand and supply.

Fig 5: Gold prices in rupees per ounce

6. Gold Money Rift:

Under international Gold standard, if a country's economy did not fare well with too much

money supply in relation to production and trade, its reserves would go down, as because of

inflation in that country, exports would go down, and imports would increase. The outflow of

Gold would automatically lead to a rise in interest rates, reduction in domestic credit and money

supply, and a relative fall in prices in relation to those abroad. These would lead to a resurgence

of exports and Gold reserves would be replenished. When internationally Gold supplies were

5 | Page

Gold Monetization Scheme: Its implications of Indian economy

augmented, the world money supply would go up and consequently there would be a rise in the

price level the world over. But if the growth of Gold supplies was lagging behind world

production, the general prices of world commodities would be going down. Any country which

had a productivity advantage would find its prices of exports relatively lowered; and with larger

exports its Gold reserves would move up and money supply would also go up in that country.

Consequently, prices in general would go up. Hence its relative advantage would be reduced. The

world as a whole would be getting the benefit of the productivity improvements in that country

through lower prices of such commodities. This was one of the key points stated by C.N. Vakil

and a group of 140 economists in a memorandum to the Government known as SEMIBOMBLA

(Scheme of the economists for the Monetary Immobilization through Bond Medallions and

Blocked Assets). The objective was to achieve 30% cut in money supply to control inflation.

7. Gold Deposit Scheme, 1999

The Central Government, with a view to bring privately held stock of gold in circulation, reduce

the countrys reliance on import of gold and providing its owners with some income apart from

freeing them from the problems of storage, movement and security of gold in their possession

had notified Gold Deposit Scheme 1999 on September 14, 1999. Then RBI on 5th October,

1999 had formulated guidelines for Gold Deposit Scheme to enable banks authorized to deal in

gold to prepare their own Gold Deposit Schemes. Thus, we can say Gold Deposit Scheme was

introduced in 1999 by GoI and was to be implemented through Banks as per guidelines framed

by RBI with the following purpose:

To mobilize the idle gold in the country so that the same can be put into productive use

To provide an opportunity to the gold holders, to earn interest income on their idle asset

(gold) with safety, liquidity and tax benefits, and continue to enjoy the appreciation in the

gold prices

Reasons behind the miserable failure of GDS are follows:

The increase in gold demand would more or less match the quantity of gold deposited

under the GDS.

The government would lose a lot of money if rupee devalues sharply against US$ or POG

rises sharply during the tenure of deposit.

Interest earned on gold certificates is not taxable while interest income on rupee deposits

is taxable.

8. Gold Monetization Scheme, 2015

The objectives of the Gold Monetization scheme are:

To mobilize a part of an estimated 20,000 tonnes of gold held by households and

institutions in the country

To provide a fillip to the gems and jewellery sector in the country by making gold

available as raw material on loan from the banks.

To be able to reduce reliance on import of gold over time to meet the domestic demand.

6 | Page

Gold Monetization Scheme: Its implications of Indian economy

Purity

Testing

Deposit

Gold savings

account

Transfer of

gold to

refineries

There are two different gold deposit schemes as under:

8.1 Short Term Bank Deposit (STBD)

Period: 1-3 years (with a roll over in multiples of one year)

Liability of banks

Interest rate: As per discretion of bank

Premature withdrawal subject to such minimum lock-in period and penalties

Redemption of principal and interest at maturity: Indian Rupee equivalent of the

deposited gold and accrued interest based on the price of gold prevailing at the time of

redemption, or in gold.

The deposit will attract CRR and SLR requirements as per applicable instructions of RBI from

the date of credit of the amount to the deposit account. However, the stock of gold held by banks

in their books will be an eligible asset for meeting the SLR requirement in terms of RBI Master

Circular - Cash Reserve Ratio (CRR) and Statutory Liquidity Ratio (SLR) dated 1 July 2015.

8.2 Medium and Long Term Government Deposit (MLTGD)

Period: 5-7 for medium term and 12-15 years for long term

Interest rate: 2.25% on medium term and 2.5% on long term

Liability of central government

Premature withdrawal: Minimum lock-in period and penalties as per Central

Government.

Redemption of the

Fig 5: Gold prices in rupees per ounce

deposit including

interest accrued will be only in Indian Rupee equivalent of the value of the gold and

accumulated interest as per the price of gold prevailing at the time of redemption

8.3. Utilization of Deposited Gold

CRR/SLR: Deposit the mobilized gold as part of their CRR/SLR requirements with RBI

7 | Page

Gold Monetization Scheme: Its implications of Indian economy

Foreign Currency: Generate foreign currency for onward lending to exporters / importers

Coins: Convert mobilized gold into coins for onward sale to their customers

Exchanges: Trade on domestic commodity exchanges

8.4. Lending to jewellers

This follows double entry book keeping. The process can be summarized as:

Gold Loan Account: On the basis of the terms and conditions of the banks, jeweller will

get a Gold Loan Account opened at the bank

Delivery of gold to jewellers: When a gold loan is sanctioned, the jewellers will receive

physical delivery of gold from the refiners. The banks will in turn make the requisite

entry in the jewellers Gold Loan Account.

Interest received by banks: The interest rate charged by the banks will have to cover the

interest rate paid to the depositors of gold, fee paid to the refiners and Purity Verification

Centres, profit margin of the banks

9. Macro-Economic Impact:

Current Account Deficit: This gold monetization scheme and Sovereign Gold Bonds

scheme will help in reducing the demand for physical gold. Demand for gold in country

is majorly met through imports; this scheme will help in maintaining Indias Current

Account Deficit. It is expected that gold monetisation will lead to government savings of

$8 billion in the first year.

Unemployment: The liquidity of gold will boost jewellery and gems industry. Jewellers

can easily get gold on loan and perform value addition. Thus generating employment

opportunities.

GDP - Incremental gold demand in India is largely met by imports, with net imports

worth 1.7% of gross domestic product (GDP) in financial year (FY) 2015. Around 700900 tonnes of gold are imported every year by India and it accounts for a significant

portion of physical demand. So if demand of gold decreases, the imports will decrease

resulting in an increase in GDP. Also decrease in unemployment and value addition in

fabrication will increase GDP.

SLR/CRR- Banks can use the mobilized gold as part of their CRR/SLR requirements with

RBI which help in increasing the cash liquidity with banks and effectively give boost to

RBIs effort of banks transferring the repo rate cut to the end customers with decrease in

borrowing rate.

Consumer Price Index (CPI) - There is a positive correlation between consumer price

index (CPI) inflation and gold purchases. There has been a 28% increase in the price of

gold in terms of rupee over the past 5 years. So if gold demand decreases due to decrease

in demand of gold because of gold monetization scheme the CPI would decrease.

Foreign Exchange Reserves: A big chunk of forex reserves is spent on mee1ting the

demand of gold in the country and this can be saved if GMS is successful. This forex can

be used for other purposes.

8 | Page

Gold Monetization Scheme: Its implications of Indian economy

Boost to overall demand: Since gold imports amount to almost about 1.7% of GDP, if

government is able to save even 0.1 % of GDP due to decrease in imports and invest

those money in economy it will generate about 0.33 % of GDP as income (Average

Multiplier value in India).This 0.33 % would effectively increase the consumption of

people by 0.231 % of GDP (MPC in India is 0.7) which would boost the private sector.

Impact on stock-exchange: Stock investors keep a track of long term trade deficit of the

country. Since India largely depends on gold imports which contributes considerable

amount to trade deficit, reduction in trade deficit due to gold monetisation and bond

schemes would help in strengthening investors outlook towards country. Effectively

strengthening stock exchange as is observed in the case of Turkey.

10. Challenges:

There are several challenges that hinder GMS to achieve its objectives, such as:

a. Risk Management

The risk management of Gold Monetization Scheme is crucial for the banks. The bank would

give interest in gold while it gets interest from the jewelers in cash. This anomaly might put a

challenge before the banks if gold prices rise swiftly. The increase in interest rate parallel to

the price rise of the gold may go out of scope for banks. This situation can put banks to loss.

b. Source of Funds

The government has not clarified the rules for unaccounted gold. The most of household gold

in India is unaccounted. People generally do not have the receipt of family gold. On the other

hand, the government is talking tough about the black money. The strict posture of

government on black money may deter many potential depositors. They would not be able to

tell the source of funds of the gold.

c. Cultural Challenges

The Indian people value the gold as an investment, but more than that it is a prized

possession. Parting the gold jewelry for a small interest would be very difficult for them.

Also, gold jewellery, especially inherited, has sentimental value and many won't like to see it

melted down. However, convincing people to actually melt them for a minuscule return of

will be very difficult while they are losing out on making charges of the ornament.

d. Other Challenges

The gold deposited has to be pure 24 carat gold while in jewellery the purity of gold varies

between 20-23 carats. Amount paid on taxes, making charge, stones and gems, silver/zinc

used is not accounted and this loss is on depositor.

11. Conclusion:

The response Gold monetization received was quite lukewarm. Only 400gms of gold was

deposited in first two weeks. The major reason behind such a muted response is explaining the

source of gold thereby income tax. Very recently, temple authorities of Tirupati Balaji and Siddhi

9 | Page

Gold Monetization Scheme: Its implications of Indian economy

Vinayak temples have shown their interest towards gold monetization scheme. Both have

planned to stash in 1.5 tonnes and 160kg respectively. For bankers, in order to mitigate situation

of fluctuation in prices, the government will be creating a gold reserve fund to bear risks arising

out of variations in gold prices. The benefit to the Government through the reduction in the cost

of borrowing would be transferred to the Gold Reserve Fund. The fund would get money from

the government. Since, the Government would reduce its borrowing cost because of this scheme;

the benefit would be transferred into the gold reserve funds. Possible measures to boost this

schemes are increasing the interest rates so that depositor can cover the losses, providing tax

benefits to depositors, create awareness through television advertisements. RBI Governor

Raghuram Rajan has made statement We need some tuning which indicates these fallacies has

been identified and shall be addressed by RBI and GoI. Gems and Jewellery industries are very

excited with this scheme and are involved in making this scheme lucrative.

References

[1] Draft Gold Monetization scheme MyGov

[2] Government to discuss changes to gold monetization scheme after muted response

http://articles.economictimes.indiatimes.com/2015-11-30/news/68661731_1_gold-depositscheme-banks-first-source

[3] RBI notification: Master Direction No.DBR.IBD.No.45/23.67.003/2015-16 (Introducing

Gold Monetization Scheme)

[4] RBI notification: DBR.IBD.BC.53/23.67.003/2015-16 (Interest Rates)

[5] @book{gandhi2003globalised, title={Globalised Indian Economy: Contemporary Issues and

Perspectives}, author={Gandhi, P.J.}, isbn={9788176294416},

url={https://books.google.co.in/books?id=qgMeXF9KEJIC}, year={2003}, publisher={Deep \&

Deep}}

[6] GFMS gold survey report 2014

[7] FICCI World Gold council report on Why India needs a gold policy

[8] http://in.reuters.com/article/india-gold-idINL3N13P3CK20151130

[9] http://www.moneylife.in/article/will-the-new-gold-monetisation-scheme-work/43941.html

[10]http://www.allbankingsolutions.com/Banking-Tutor/Gold/Gold-Deposit-Scheme-1999.htm

[11] The Economic Times articles on Gold Monetization Scheme

http://economictimes.indiatimes.com/topic/Gold-Monetization-Scheme

[12] Five year gold prices: http://www.bullion-rates.com/gold/INR/Year-5-chart.htm

10 | P a g e

Gold Monetization Scheme: Its implications of Indian economy

[13] World Gold Council Press Release (Tuesday 8th October, 2013): The direct economic impact

of gold by PricewaterhouseCoopers

11 | P a g e

Gold Monetization Scheme: Its implications of Indian economy

Annexure I: List of Tables

Yea

r

200

4

200

5

200

6

200

7

200

8

200

9

201

0

201

1

201

2

201

3

Fabrication

Demand(tonnes)

Investment

Demand(tonnes)

Domestic Production

(tonnes)

465.2

76.2

3.5

540

102.8

470.9

139.8

2.5

521.7

148.6

2.9

533.7

159.9

2.6

387.9

117.5

2.1

604

266.3

2.8

608

288

2.3

505.2

205.9

1.7

265.8

506.6

Table 1: Demand and Domestic production

Component of demand

Consumption (gold bar and coins)

Jewellery fabrication and

consumption

Technology fabrication demand

Recycling

Gross value added (in $

billion)

17.6

% of

total

54.83%

12.8

0.1

1.6

39.88%

0.31%

4.98%

Table 2: Component of demand and value addition

Ye

ar

200

0

200

1

200

2

200

3

200

Annual Average

Prices (Rs/10g)

11,013

10,480

11,555

12,193

12,792

12 | P a g e

Gold Monetization Scheme: Its implications of Indian economy

4

200

5

200

6

200

7

200

8

200

9

201

0

201

1

201

2

201

3

12,943

16,833

16,593

20,085

22,634

24,266

29,104

32,963

29,310

Table 3: Real gold prices in INR (CPI deflated- Constant 2013 money terms)

13 | P a g e

Gold Monetization Scheme: Its implications of Indian economy

Annexure-II

Gold Monetization Process Flow

14 | P a g e

You might also like

- 10 - Chaper 3Document31 pages10 - Chaper 3anithaivaturiNo ratings yet

- Technological: 3. PESTEL AnalysisDocument4 pagesTechnological: 3. PESTEL AnalysisShruti GargNo ratings yet

- Impact of Gold On EconomyDocument50 pagesImpact of Gold On Economypm1233210% (1)

- Gold Monetization Scheme - Old Wine in New Bottle!!!: Prof. Paramjeet Kaur, Dr. Shreya ViraniDocument7 pagesGold Monetization Scheme - Old Wine in New Bottle!!!: Prof. Paramjeet Kaur, Dr. Shreya ViraniChitraNo ratings yet

- India's Gold Rush Its Impact and SustainabilityDocument35 pagesIndia's Gold Rush Its Impact and SustainabilitySCRIBDEBMNo ratings yet

- PESTEL - TanishqDocument6 pagesPESTEL - TanishqNikhil PatilNo ratings yet

- Special Address D P Jhawar EdelweissDocument4 pagesSpecial Address D P Jhawar EdelweissOlivia JacksonNo ratings yet

- Gold Import PolicyDocument39 pagesGold Import PolicydeanNo ratings yet

- Gold in The Indian Economic System Y.V.ReddyDocument11 pagesGold in The Indian Economic System Y.V.ReddySreekanth ReddyNo ratings yet

- India Heart of Gold Revival 10 Nov 2010Document28 pagesIndia Heart of Gold Revival 10 Nov 2010derailedcapitalism.comNo ratings yet

- Introduction and MethodologyDocument3 pagesIntroduction and MethodologyJoshua JNo ratings yet

- Demand and Supply Analysis of Gold in IndianDocument11 pagesDemand and Supply Analysis of Gold in IndianBhavani Singh Rathore50% (2)

- Gold Monetization Scheme: Research ReportDocument9 pagesGold Monetization Scheme: Research ReportVarun MaggonNo ratings yet

- WGC Stratstruck - Case StudyDocument17 pagesWGC Stratstruck - Case StudyMehak AhujaNo ratings yet

- Retail Research: Gold ETF and Gold Funds - A ReviewDocument27 pagesRetail Research: Gold ETF and Gold Funds - A ReviewVenkat GVNo ratings yet

- Demand and Supply of Gold in India by Pooja YadavDocument11 pagesDemand and Supply of Gold in India by Pooja YadavPOOJA YADAVNo ratings yet

- Ntroduction TO Gold: Gold Is Not A Profitable AssetDocument5 pagesNtroduction TO Gold: Gold Is Not A Profitable AssetArmaan AroraNo ratings yet

- Introduction of Gold Monetization SchemesDocument81 pagesIntroduction of Gold Monetization Schemesnamita patharkar0% (1)

- Gold Monetization Scheme.Document26 pagesGold Monetization Scheme.keerthiNo ratings yet

- Gold MarketDocument25 pagesGold MarketVirendra Jha100% (1)

- Emerging Thoughts:: Hite AperDocument4 pagesEmerging Thoughts:: Hite AperwwpopsNo ratings yet

- Chapter - Ii Review of LiteratureDocument20 pagesChapter - Ii Review of LiteratureDivik KumarNo ratings yet

- On Gems and JewelaryDocument32 pagesOn Gems and Jewelarydeepikakeerthichilkuri100% (1)

- The Fundamental of LoanDocument6 pagesThe Fundamental of LoanPratiksha MisalNo ratings yet

- Rajesh Exports Ltd.Document18 pagesRajesh Exports Ltd.Prisha BhatiNo ratings yet

- Research Paper On GoldDocument7 pagesResearch Paper On GoldjayminashahNo ratings yet

- Investing in Gold Is Very ImportantDocument15 pagesInvesting in Gold Is Very ImportantZiaul HaqueNo ratings yet

- Lighthouse - Goldbug Galore - 2017-04Document11 pagesLighthouse - Goldbug Galore - 2017-04Alexander GloyNo ratings yet

- Gold Prices FluctuationsDocument6 pagesGold Prices Fluctuationskuldeep_chand10No ratings yet

- Should RBI Allow Banks To Buy GoldDocument5 pagesShould RBI Allow Banks To Buy GoldMonu SharmaNo ratings yet

- Growing Appetite For GoldDocument2 pagesGrowing Appetite For GoldCritiNo ratings yet

- Reliance - Gold Savings Fund Product NoteDocument9 pagesReliance - Gold Savings Fund Product NoteNISHANTHCANNo ratings yet

- An Assignment On: The Impact of Gold Price Changes in IndiaDocument14 pagesAn Assignment On: The Impact of Gold Price Changes in IndiafazilonelyNo ratings yet

- International Finance Assignment Submitted By:-: Syeda Maham Waseem (170156)Document6 pagesInternational Finance Assignment Submitted By:-: Syeda Maham Waseem (170156)Maham WasimNo ratings yet

- EE Version 1.1Document26 pagesEE Version 1.1yoville5No ratings yet

- RGSF Product Note Oct 2012 PDFDocument10 pagesRGSF Product Note Oct 2012 PDFinfosipriNo ratings yet

- Investment Attitude in Gold-An Investors Perspective: Vipin Benny, Biju John. M.Document5 pagesInvestment Attitude in Gold-An Investors Perspective: Vipin Benny, Biju John. M.Himanshi100% (1)

- Assessment - 2 - S3867445 2Document10 pagesAssessment - 2 - S3867445 2ng kelvinNo ratings yet

- Indias Gold Market Reform and GrowthDocument149 pagesIndias Gold Market Reform and GrowthtmeygmvzjfnkqcwhgpNo ratings yet

- MEproject Group JDocument17 pagesMEproject Group JRachit GauravNo ratings yet

- Project Report On Gems and Jewelry IndustryDocument61 pagesProject Report On Gems and Jewelry IndustryAmy Sharma53% (15)

- Demand and Supply of GoldDocument8 pagesDemand and Supply of GoldChirag LaxmanNo ratings yet

- GoldDocument10 pagesGoldShikha TiwaryNo ratings yet

- Gold in The Investment Portfolio: Frankfurt School - Working PaperDocument50 pagesGold in The Investment Portfolio: Frankfurt School - Working PaperSharvani ChadalawadaNo ratings yet

- International Finance (Sagnik Biswas)Document3 pagesInternational Finance (Sagnik Biswas)Sagnik BiswasNo ratings yet

- 1gold Report PDFDocument86 pages1gold Report PDFrahul84803No ratings yet

- BB - Dec 2017 - IGPC Article570bDocument6 pagesBB - Dec 2017 - IGPC Article570bGopal JahagirdarNo ratings yet

- Gold-Physical Vs MF DemystifiedDocument4 pagesGold-Physical Vs MF Demystifiedmcube4uNo ratings yet

- Gold Gold Etf HDFC BankDocument27 pagesGold Gold Etf HDFC BankAakash SaxenaNo ratings yet

- IndiaDocument76 pagesIndiamliber000No ratings yet

- Gold Prices in IndiaDocument7 pagesGold Prices in IndiatechcaresystemNo ratings yet

- Government Intervene To Regulate The Prices of GoldDocument2 pagesGovernment Intervene To Regulate The Prices of GoldArush SaxenaNo ratings yet

- Latest Issue: Gold Demand Trends Q3 2012Document9 pagesLatest Issue: Gold Demand Trends Q3 2012Manish Jains JainsNo ratings yet

- Sovereign Gold Bonds - InfoDocument5 pagesSovereign Gold Bonds - InfoShawn SriramNo ratings yet

- India Gold Market Innovation and Evolution PDFDocument92 pagesIndia Gold Market Innovation and Evolution PDFPreethu IndhiraNo ratings yet

- Gold Loans Aid Financial InclusionDocument2 pagesGold Loans Aid Financial InclusionkristokunsNo ratings yet

- Turkey Gold in ActionDocument20 pagesTurkey Gold in ActionDerlis CalderonNo ratings yet

- How to Invest in Gold: A guide to making money (or securing wealth) by buying and selling goldFrom EverandHow to Invest in Gold: A guide to making money (or securing wealth) by buying and selling goldRating: 3 out of 5 stars3/5 (1)

- Gold Mining Adventures: A Step-by-Step Guide to Unveil TreasuresFrom EverandGold Mining Adventures: A Step-by-Step Guide to Unveil TreasuresNo ratings yet

- Bosch CRMDocument9 pagesBosch CRMAsutosh PatroNo ratings yet

- Victoria Heavy Equipment Limited AnalysisDocument17 pagesVictoria Heavy Equipment Limited AnalysisAsutosh PatroNo ratings yet

- Trade Map JK PaperDocument6 pagesTrade Map JK PaperAsutosh PatroNo ratings yet

- Coca Cola BAVDocument13 pagesCoca Cola BAVAsutosh PatroNo ratings yet

- Vendors: Telecom Vendors: Retail: 1.5 Lakhs + SellersDocument1 pageVendors: Telecom Vendors: Retail: 1.5 Lakhs + SellersAsutosh PatroNo ratings yet

- Impact of Budget 2016 On Indian IndustryDocument13 pagesImpact of Budget 2016 On Indian IndustryAsutosh PatroNo ratings yet

- TamoDocument16 pagesTamoAsutosh PatroNo ratings yet

- Micro Economic and Public Policy, Cross ElasticityDocument11 pagesMicro Economic and Public Policy, Cross ElasticityHasril HasanNo ratings yet

- M1-The Reality of Dynamism and Hypercompetition: A Strategic Management ModelDocument55 pagesM1-The Reality of Dynamism and Hypercompetition: A Strategic Management ModelMetch ApphiaNo ratings yet

- Comparative Study of Investment Vs RISK SYNDocument12 pagesComparative Study of Investment Vs RISK SYNAnonymous F6fyRYGOqGNo ratings yet

- Property Tax Circuit BreakersDocument60 pagesProperty Tax Circuit BreakersLincoln Institute of Land PolicyNo ratings yet

- Civil Engineering - Challenges and OpportunitiesDocument6 pagesCivil Engineering - Challenges and OpportunitiessmwNo ratings yet

- Measure Progress Using Working HoursDocument3 pagesMeasure Progress Using Working HoursLaiqueShahNo ratings yet

- Credit Management Policy of Janata Bank LimitedDocument35 pagesCredit Management Policy of Janata Bank Limitedআবরার নেহালNo ratings yet

- Income Tax Certificate SuccessuptechDocument2 pagesIncome Tax Certificate Successuptecheandc.bdNo ratings yet

- Chap 13Document53 pagesChap 13axl11No ratings yet

- Office of The Mayor: Republic of The Philippines Province of Occidental Mindoro Municipality of SablayanDocument4 pagesOffice of The Mayor: Republic of The Philippines Province of Occidental Mindoro Municipality of Sablayanbhem silverioNo ratings yet

- Intermediate Examination Syllabus 2016 Paper 7: Direct Taxation (DTX)Document18 pagesIntermediate Examination Syllabus 2016 Paper 7: Direct Taxation (DTX)GopalNo ratings yet

- Standard Costing 1.1Document3 pagesStandard Costing 1.1Lhorene Hope DueñasNo ratings yet

- Introduction To Forex - Forex Made Easy PDFDocument33 pagesIntroduction To Forex - Forex Made Easy PDFKundan Kadam100% (1)

- Session 1 - FDDocument24 pagesSession 1 - FDDaksh KhullarNo ratings yet

- Social Entrepreneurs - The Jobs LetterDocument12 pagesSocial Entrepreneurs - The Jobs Lettervivianz100% (2)

- TSRTCMSRDEOIDocument15 pagesTSRTCMSRDEOIdishaNo ratings yet

- Not Profit Organisations - Additional Practice Que. Set - AnswersDocument13 pagesNot Profit Organisations - Additional Practice Que. Set - AnswersRushikesh100% (1)

- AE12 Module 1 Economic Development A Global PerspectiveDocument3 pagesAE12 Module 1 Economic Development A Global PerspectiveSaclao John Mark GalangNo ratings yet

- 9-28-21 Mexico Market UpdateDocument14 pages9-28-21 Mexico Market UpdateSchneiderNo ratings yet

- Ibm 5Document4 pagesIbm 5Shrinidhi HariharasuthanNo ratings yet

- FPA Candidate HandbookDocument32 pagesFPA Candidate HandbookFreddy - Marc NadjéNo ratings yet

- Who Is An Entrepreneur? Distinguish Between Owner Manager and EntrepreneurDocument7 pagesWho Is An Entrepreneur? Distinguish Between Owner Manager and EntrepreneurShyme FritsNo ratings yet

- Bahasa Indonesia RidhoDocument3 pagesBahasa Indonesia RidhoRidho FirdausmanNo ratings yet

- Assignment Strategic ManagementDocument9 pagesAssignment Strategic ManagementHarpal PanesarNo ratings yet

- Irrelevant-Potential Socio-Economic Implications of Future Climate Change and Variability For Nigerien Agriculture-A Countrywide Dynamic CGE-Microsimulation AnalysisDocument15 pagesIrrelevant-Potential Socio-Economic Implications of Future Climate Change and Variability For Nigerien Agriculture-A Countrywide Dynamic CGE-Microsimulation AnalysisWalaa MahrousNo ratings yet

- What Is Talent ManagementDocument8 pagesWhat Is Talent ManagementarturoceledonNo ratings yet

- A True Indicator of The Success of A BusinessDocument4 pagesA True Indicator of The Success of A BusinessNguyen Ngoc Yen VyNo ratings yet

- XXXXXXXXXX6781 - 20230615160830874376 (1) - UnlockedDocument16 pagesXXXXXXXXXX6781 - 20230615160830874376 (1) - UnlockedRajendra SharmaNo ratings yet

- Nota Principle of CorporateDocument145 pagesNota Principle of CorporateAhmad MustapaNo ratings yet

- New Issue MarketDocument15 pagesNew Issue Marketshivakumar NNo ratings yet

- Trident's Expertise V1.5Document17 pagesTrident's Expertise V1.5tridentNo ratings yet