Professional Documents

Culture Documents

迴歸模式與類神經網路在台股指數期貨預測之研究

Uploaded by

didy3366Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

迴歸模式與類神經網路在台股指數期貨預測之研究

Uploaded by

didy3366Copyright:

Available Formats

Vol.2, No.

1, 2006 83-99

The Application of Regression Model and Artficial Neural Network for Studying the Taiwan

Stock Index Future

1

2

3

( Received: Nov. 7, 2005First Revision: Apr. 10, 2006Accepted: May. 12, 2006 )

87721

1055

5

Abstract

Taiwan stock market formally established Taiwan Stock Index Future Contract on July

21, 1998, it could be said a milestone for Taiwan finance career's liberalization and

internationalization. It offers investors the new investment product and hedging risk tools, and

also offers speculators and arbitragers the opportunity of making more profit at less fund.

Especially, the higher futures transactions, the more potential of futures market in these few

years. Artificial Neural Network is a tool of information technique that rapidly rises in these

few years. Especially using in finance field, the performance is very outstanding. So this

study tries to use Artificial Neural Network and Regression Analysis of statistical methods in

order to predict the next day closing index of FITX, and then find the suitable prediction

1

83

Vol.2, No.1, 2006

model to create the better rate of gaining profit. The results of the study are: At the aspect of

the Back-Propagation network, it could be found that the model with hidden layer is not big

difference than the model without hidden layer for the prediction performance. At the aspect

of Regression Analysis, By ruling out three outliers and by stepwise regression analysis to

select the five variables of the closing index, basis difference, up and down, 10 days W%R

and 5 days BIAS into the model. At the aspect of improving Artificial Neural Network, the

five variables selected by using stepwise regression analysis method are regard as input

variables. It could be found that the model without hidden layer is better than the model with

hidden layer for the prediction performance, but the difference is small. At the prediction

performance of three models comparison aspect, It could be found the performance of

improving model of Artificial Neural Network is the better choice, Regression Analysis is the

best one, but Artificial Neural Network is the worst one. So it is not certainly better when

variables are more but create too much complex, on the contrary, decrease some effects

between some variables. Improving model of Artificial Neural Network is to simplify

variables in order to decrease effects and get better prediction performance.

Keywords : Taiwan stock index future, Artificial neural network, Regression analysis

1.

1.1

86

87721(TAIFEX, Taiwan Futures Exchange)

FITX

84

1.2

(FITX)8912

21911218

1.

2.

3.

4.

2.

(2003)

2.1

(processing element, PE)

(layer)(network)(artificial neuron)

()

Yj = f (Wij X i j ), i = 1, ..., p; j = 1, ..., n

i

Xi;

Yj;

f(Transfer Function);

Wij;

j(Threshold)

1

2.2 (Back-Propagation Network, BPN)

Rumelhart McClelland PDP 1986

(layered feed-forward network)

Sigmoid functiontanH function

(the gradient steepest descent method)

85

Vol.2, No.1, 2006

W1j

X1

Wij

Xi

= f (W ij X i j )

Yj

Xp

Wpj

1

(Back-Propagation Learning Algorithm)

2001

NeuralWorks Professional /PLUS: NW2

Delta-Rule2003a&b

3.

Kimoto Asakawa(1990)

Chiang, Urban,

Baldridge(1995) 1981

1986 101 15

Warner Misra(1996)

(1997)

(2001)

(TAIMEX)

87 9 2 88 12 28 14

86

(2002)

(2002) 680

(2005)

1

1

Cheng Titterington(1994)

1 Cheng

Titterington(1994)

4.

4.1

:

4.2

2

5 20

(2001)

(2004)

87

Vol.2, No.1, 2006

1990 Kimoto

Asakawa

1995 Chiang,Urban,

Baldridge

1996 Warner

Misra

1997

2001

2002

2002

2005

88

2(2001)9KDMA

RSI

ARBR

5.

(MAE)

(MSE):

(Mean Absolute ErrorMAE)

MAE

MAE = Oi - Ei n

Oi:Ei:n:

(Mean Square ErrorMSE)

MAEMSE

MSE = (Oi - Ei)2 n

5.1

NW2

(MA)

10

(RSI)

5

(KD)

9

(DMI)

10

(BIAS)

5

(W%R)

(VR)

10

10

AR

BR

20

20

89

(MACD)

9

(PSY)

10

Vol.2, No.1, 2006

5.1.1

(FITX)

891221911218490

89122191

61936291620911218128

5.1.2

4.2

3

(Sigmoid function)

(0,1)(0.2,0.8)

5.1.3

Delta-Rule

NW21

(Lcoef Ratio)0.5(momentum)0.9, 0.4 0.1

X1:

X2:

X3:

X4:

X5:

X6:

X7:10

X8:5RSI

X9:9K

X10:9D

X11:9MACD

X12:10DI

X13:10DI

X14:5BIAS

X15:10W%R

X16:10PSY

X17:10VR

X18:20AR

X19:20BR

Y:

90

5.1.4

(2003b)12

1(2003b)

0

(2003b)4-164-17

01

+/2

++

2(TanH)

5.1.5

(Correlation Coefficient) (Root of Mean Square Error,

RMSE) [-1,1]RMSE

RMSE =(Oi - Ei) 2n1/2

Oi: Ei: n:

RMSE

19 0

1

RMSE 5.1.1 5.1.5

NW2 18 (2003) 35

36 4-2 4-6(2003)

19 20 1

1 0.9

(Sigmoid function)

MAE 72.866 MSE 10231.49

2

5.2

5.2.1

5.13

Yi = 0 + 1X1i + 2X2i + +19X19i +i

iiid N( 0, 2), i=1, 2, , 362.

91

Vol.2, No.1, 2006

6000

5500

5000

4500

4000

20

0

2/

20 6/20

02

/

20 6/30

02

/

20 7/10

02

/

20 7/20

02

/7

20 /30

02

20 /8/9

02

/

20 8/19

02

/8

20 /29

02

20 /9/

02 8

/

20 9/18

02

/

20 9/28

02

20 /10

0 2 /8

/

20 10/1

02 8

/1

20 0/28

02

20 /11

0 2 /7

/

20 11/1

02 7

/1

20 1/27

02

20 /12

0 2 /7

/1

2/

17

3500

89122191619362

91620911218128

(stepwise regression)

(outlier)359

-25.961

48.858

-0.566

0.572

(X1)

0.997

0.008

128.064

0.000

(X5)

0.655

0.160

4.104

0.000

BIAS (X14)

16.683

4.589

3.635

0.000

0.713

0.282

2.526

0.012

-0.167

0.073

-2.282

0.023

(C)

W%R (X15)

(X6)

92

5

Y= 25.961+0.997X1 +0.655X50.167X6+16.683 X14 +0.713 X15

(Adjusted R2)98.1% (ANOVA)

6

5.2.2

3

90 1 16 90 12 12 91 1 21 339351

361 3

5.1.2 3

(0,1)(0.2,0.8)

3

3

5.2.3

1. Kolmogorov-Smirnov p =0.2 0.05

2.

3.

MAE72.878MSE9709.518

3

195343523.890

39068704.778

3762311.771

353

10658.107

199105835.661

358

93

3665.633

0.000

Vol.2, No.1, 2006

6000

5500

5000

4500

4000

20

02

/6

20 /20

02

/6

20 /30

02

/7

20 /10

02

/7

20 /20

02

/7

/

20 30

02

20 /8/9

02

/8

20 /19

02

/8

/

20 29

02

20 /9/8

02

/9

20 /18

02

/9

20 /28

02

/

20 10/8

02

/1

20 0/1

02 8

/1

0

20 /28

02

/

20 11/7

02

/1

20 1/1

02 7

/1

1

20 /27

02

20 /12/

02 7

/1

2/

17

3500

3

5.3

5.1 19

5.2

5.1

TanH 21 (2003) 45

46 4-11 4-16(2003)

5 6 1 0.1

(Sigmoid Function)

MAE 73.441 MSE

10075.31 4

0 0

94

6000

5500

5000

4500

4000

20

02

/6

20 /20

02

/

20 6/30

02

/7

20 /10

02

/7

20 /20

02

/7

20 /30

02

20 /8/9

02

/8

20 /19

02

/8

20 /29

02

20 /9/8

02

/9

20 /18

02

/

20 9/28

02

20 /10/

02 8

/

20 10/1

02 8

/1

20 0/28

02

20 /11/

02 7

/

20 11/1

02 7

/1

20 1/27

02

20 /12/

02 7

/1

2/

17

3500

4

5.4

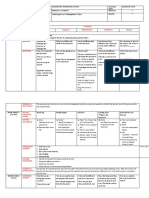

7 MAE MSE

7 MAE MSE

MAE

MSE

72.866

10231.49

72.878

73.441

95

9709.518

10075.31

Vol.2, No.1, 2006

ANN

ANN

6000

5500

5000

4500

4000

20

02

/6

20 /20

02

/6

20 /30

02

/7

20 /10

02

/7

20 /20

02

/7

/3

20 0

02

/

20 8/9

02

/8

20 /19

02

/8

/2

20 9

02

/

20 9/8

02

/9

20 /18

02

/9

20 /28

02

/

20 10/8

02

/1

20 0/18

02

/1

0

20 /28

02

/

20 11/7

02

/1

20 1/17

02

/1

1

20 /27

02

/

20 12/7

02

/1

2/

17

3500

6.

6.1

1.

MAE 72.866 MSE 10231.49

2.

10 (W%R)5 (BIAS) 5

MAE 72.878 MSE 9709.518

3. 5

MAE 73.441 MSE 10075.31

5.1.4 (2003b)

96

4.

5.

6.

(2002)

2002

6.2

(Warner

and Misra, 1996)

6.3

(2001)8

8

89.12.2191.12.18

(2001) 87.9.288.12.28

19 (2001) 13

9 KD

97

Vol.2, No.1, 2006

MA RSI

ARBR

TanH 0.9 & 0.1

(2001)

89.12.2191.12.18

87.9.288.12.28

10 5 RSI9

K 9 D 9 MACD

10 DI10 DI5 BIAS

10 W%R10 PSY10 VR

20 AR20 BR (19 )

3MA-6MA6RSI9KDDIF

MACD (13 )

()

Sigmoid Function &

TanH 0 1

Delta Rule 1

0.9,0.4 0.1

Sigmoid Function

0 1

Delta Rule 1

0.4

98

1.

(2003)

EMBA

2. (2002)-

3. (1997)-

4. (2003)

5. (2004)

5

6. (2001)

36 91-109

7. (2005)

117-139

8. (2003a)

9. (2003b) 8

10. (2002)

11. http://www.taifex.com.tw/

12. Cheng, B. , D. M. Titterington, (1994), Neural Networks: A Review from a Statistical

Perspective (including discussion), Statistical Science, l.(1), pp.2-54.

13. Chiang, W. C., T. L. Urban, and G. W. Baldridge (1995), A Neural Network

Approach to Mutual Fund Net Asset Value Forecasting, Omega, Int. J. Mgmt. Sci.

24(2), pp.205-210.

14. Kimoto, T., K. Asakawa (1990), Stock Market Prediction System with Modular

Network, in Proc. IEEE Int. Conf. Neural Network, 1, pp.1-6.

15. Rumelhart, D. E., J. L McClelland and the PDP Research Group (1986), Parallel

Distributed Processing: Explorations in the Microstructure of Cognition, MIT press,

Cambridge, MA.

16. Warner, B., M. Misra (1996), Understanding Neural Networks as Statistical Tools,

The American Statistician, 50(4), pp.284-293.

99

You might also like

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (119)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (265)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (399)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (587)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2219)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5794)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (344)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (890)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (73)

- OOPS using C++ Question BankDocument32 pagesOOPS using C++ Question BankPushpa Bg100% (1)

- Sal de CrosetatDocument3 pagesSal de CrosetatMădălina Pisău100% (1)

- Steel and Timber Report Compiled (Aaa) PDFDocument42 pagesSteel and Timber Report Compiled (Aaa) PDFLee Chen ChoonNo ratings yet

- The Interpretive TheoryDocument15 pagesThe Interpretive TheorySomia Zergui100% (14)

- Open Die ForgingDocument7 pagesOpen Die ForgingCharanjeet Singh0% (1)

- Axial Piston Pump Series PV: Variable DisplacementDocument32 pagesAxial Piston Pump Series PV: Variable DisplacementGyanaranjan NayakNo ratings yet

- Citect V7.0 Error Codes PDFDocument13 pagesCitect V7.0 Error Codes PDFWahyu PrakosoNo ratings yet

- CmeDocument41 pagesCmekhalis@hotmail.com100% (1)

- 555 Timer 40khz IRDocument2 pages555 Timer 40khz IRapi-3712130No ratings yet

- AminesDocument12 pagesAminesEmelda BanumathyNo ratings yet

- Backing Up BitLocker and TPM Recovery Information To AD DSDocument14 pagesBacking Up BitLocker and TPM Recovery Information To AD DSnoNo ratings yet

- MSC Thesis Final Version Stephan de HoopDocument92 pagesMSC Thesis Final Version Stephan de HoopSanjay singhNo ratings yet

- Chapter 3 - Methods of Analysis: N N N N A A A ADocument15 pagesChapter 3 - Methods of Analysis: N N N N A A A AvampakkNo ratings yet

- Skripsi #2 Tanpa HyperlinkDocument19 pagesSkripsi #2 Tanpa HyperlinkindahNo ratings yet

- Control Charts For Lognormal DataDocument7 pagesControl Charts For Lognormal Dataanjo0225No ratings yet

- 1910 179bookletDocument12 pages1910 179bookletRichard DeNijsNo ratings yet

- HP Application Lifecycle Management Readme: What's New Installation InstructionsDocument36 pagesHP Application Lifecycle Management Readme: What's New Installation InstructionsBrandon GarciaNo ratings yet

- KeyWords ISTQB FL v3.1Document1 pageKeyWords ISTQB FL v3.1testa4 zentestNo ratings yet

- KTG Week 1Document22 pagesKTG Week 1Rebecca Soriano SantosNo ratings yet

- Innovative Injection Rate Control With Next Generation Common Rail Fuel Injection SystemDocument8 pagesInnovative Injection Rate Control With Next Generation Common Rail Fuel Injection SystemRakesh BiswasNo ratings yet

- Faculty of Engineering and Computing Sciences: Annexure-IDocument2 pagesFaculty of Engineering and Computing Sciences: Annexure-IAkshay MehtaNo ratings yet

- 2 Nuts and Bolts: 2.1 Deterministic vs. Randomized AlgorithmsDocument13 pages2 Nuts and Bolts: 2.1 Deterministic vs. Randomized AlgorithmsEdmund ZinNo ratings yet

- Design of Bulk CarrierDocument7 pagesDesign of Bulk CarrierhoangductuanNo ratings yet

- Airy stress function enables determination of stress components in pure beam bendingDocument19 pagesAiry stress function enables determination of stress components in pure beam bendingmaran.suguNo ratings yet

- Transient Step Response Specification of Z-Source DC-DC ConverterDocument5 pagesTransient Step Response Specification of Z-Source DC-DC ConverterijsretNo ratings yet

- Unitplan2 Chi-SquareDocument11 pagesUnitplan2 Chi-Squareapi-285549920No ratings yet

- Fiber Optics Unit 3Document82 pagesFiber Optics Unit 3NIKHIL SOLOMON P URK19CS1045No ratings yet

- Maths EnglishDocument26 pagesMaths EnglishmeenasarathaNo ratings yet

- RWM61 Data SheetDocument3 pagesRWM61 Data SheetBarth XaosNo ratings yet

- Grade 6 MathDocument12 pagesGrade 6 Mathapi-264682510No ratings yet