Professional Documents

Culture Documents

5000 d1 Fill 15e

Uploaded by

NamPr05Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

5000 d1 Fill 15e

Uploaded by

NamPr05Copyright:

Available Formats

Clear Data

Help

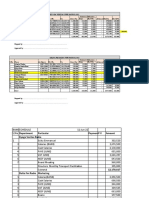

Protected B when completed

T1-2015

Federal Worksheet

Use the following charts to make your calculations according to the line instructions in the General Income Tax and Benefit Guide.

Keep this worksheet for your records. Do not attach it to the return you send us.

Instalments

See "Should you be paying your taxes by instalments?" in the guide.

1

2

3

Total payable from line 435 of your return (not including the amount on line 421 and the amount on line 430)

Total credits from line 482 of your return

Total of amounts on lines 448, 450, 457, and 476 of your return

Line 2 minus line 3

=

Line 1 minus line 4

4

5

You may have to pay your 2016 taxes by instalments if for 2016 and for either 2015 or 2014 the amount on line 5 is more than $3,000.

Line 235 Social benefits repayment

Amount from line 113 of your return

Amount from line 146 of your return

Add lines 1 and 2.

Overpayment of old age security benefits recovered (box 20 of your T4A(OAS) slip)

Line 3 minus line 4 (if negative, enter "0")

6

7

8

9

+

+

=

10

11

+

=

=

=

14

15

16

17

18

12

13

+

=

Amount from line 234 of your return

EI benefits repayment from line 4 of the chart on your T4E slip (if any)

Universal child care benefit (UCCB) (line 117 of your return)

Registered disability savings plan (RDSP) income (line 125 of your return)

Add lines 7, 8, and 9.

Line 6 minus line 10

UCCB repayment (line 213 of your return)

RDSP income repayment (included in the amount on line 232 of your return)

Add lines 12 and 13.

Add lines 11 and 14.

Base amount

Line 15 minus line 16 (if negative, enter "0")

Multiply the amount on line 17 by 15%.

1

2

3

4

5

+

=

Enter the amount from line 5 or line 18, whichever is less.

Enter the amount from line 7 above (if any).

Add lines 19 and 20.

Enter this amount on lines 235 and 422 of your return.

72,809.00

19

20

21

Line 301 Age amount

Maximum claim

Your net income from line 236 of your return

Base amount

Line 2 minus line 3 (if negative, enter "0")

Multiply the amount on line 4 by 15%.

Line 1 minus line 5 (if negative, enter "0")

Enter this amount on line 301 of Schedule 1.

5000-D1

7,033.00 1

35,466.00

2

3

4

Clear Data

Help

Protected B when completed

Line 314 Pension income amount

1

2

3

4

Amount from line 115 of your return

Foreign pension income you included on line 115 and deducted on line 256

Income from a U.S. individual retirement account (IRA) included on line 115

+

Amounts from a RRIF or a PRPP included on line 115 and

transferred to an RRSP, a RRIF, a PRPP, or an annuity

+

Add lines 2, 3, and 4.

=

Line 1 minus line 5

Annuity payments from line 129 of your return (box 16 of your T4RSP slip) only if you were 65 years of age or

older on December 31, 2015, or you received the payments because of the death of your spouse or common-law

partner

Add lines 6 and 7.

5

6

+

=

7

A

Enter on line 314 of Schedule 1 $2,000 or the amount on line A, whichever is less. However, if you and your spouse or common-law partner

are electing to split your eligible pension income, enter the amount from line A on line A of Form T1032, Joint Election to Split Pension

Income. Follow the instructions at Step 4 of Form T1032 to calculate the pension income amount to enter on line 314 of your and your

spouse's or common-law partner's Schedule 1.

Line 316 Disability amount (for self)

(supplement calculation if you were under 18 years of age on December 31, 2015)

4,607.00 1

2

2,699.00 3

Maximum supplement

Total of child care and attendant care expenses for you, claimed by you or by

another person

Base amount

Line 2 minus line 3 (if negative, enter "0")

Line 1 minus line 4 (if negative, enter "0")

4

5

Enter on line 316 of Schedule 1 $7,899 plus the amount from line 5 (maximum $12,506), unless you are completing this chart to calculate

the amount at line 318.

Line 318 Disability amount transferred from a dependant

Base amount

If the dependant was under 18 years of age on December 31, 2015, enter the amount from line 5 of his or her

chart for line 316. Otherwise, enter "0".

Add lines 1 and 2.

Total of amounts your dependant can claim on lines 1 to 19 of his or her Schedule 1

Add lines 3 and 4.

Dependant's taxable income (line 260 of his or her return)

Line 5 minus line 6 (if negative, enter "0")

7,899.00 1

+

=

+

=

Enter on line 318 of Schedule 1 the amount from line 3 or line 7, whichever is less. If you are claiming this amount for more than one

dependant, enter the total amount on line 318.

5000-D1

2

3

4

5

6

7

Clear Data

Help

Protected B when completed

Line 410 Federal political contribution tax credit

If your total federal political contributions (line 409 of your Schedule 1) were $1,275 or more, enter $650 on line 410 of your Schedule 1.

Otherwise, complete the appropriate column depending on the

amount on line 409.

Line 409 is

$400 or less

Line 409 is

more than $400 but

not more than $750

Line 409 is

more than $750

Enter your total contributions.

Line 1 minus line 2 (cannot be negative)

Multiply line 3 by line 4.

Add lines 5 and 6.

Enter this amount on line 410 of your Schedule 1.

=

+

0.00

75%

0.00

=

+

400.00

=

+

50%

300.00

750.00 2

33.33%

475.00

3

4

5

6

7

Line 452 Refundable medical expense supplement

Read the conditions for line 452 in the guide to determine if you can claim this credit.

+

=

Universal child care benefit (UCCB) (line 117 of your return) or

the benefit of your spouse or common-law partner from page 1 of your return

Add lines 8 and 9.

Adjusted family net income: add lines 7 and 10.

Base amount

Line 11 minus line 12 (if negative, enter "0")

+

=

6

7

+

=

10

11

12

13

+

=

UCCB repayment (line 213 of your return) plus the UCCB repayment of

your spouse or common-law partner from page 1 of your return

RDSP income repayment (included in the amount on line 232

of your and your spouse's or common-law partner's returns)

Registered disability savings plan (RDSP) income

(line 125 of your and your spouse's or common-law partner's returns)

Add lines 4 and 5.

Line 3 minus line 6

1

2

Your net income from line 236 of your return

Net income of your spouse or common-law partner from page 1 of your return

Add lines 1 and 2.

25,939.00

Enter $1,172 or 25% of the total of line 215 (of your return) and line 332 (of Schedule 1), whichever is less.

Multiply the amount on line 13 by 5%.

14

15

Line 14 minus line 15 (if negative, enter "0")

Enter this amount on line 452 of your return.

16

5000-D1

You might also like

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5795)

- Activate Key Tags - The War AmpsDocument1 pageActivate Key Tags - The War AmpsNamPr05No ratings yet

- Evenflo ExerSaucer TripFun ManualDocument26 pagesEvenflo ExerSaucer TripFun ManualNamPr05No ratings yet

- NSPE Guidelines For Proffesional EngineersDocument9 pagesNSPE Guidelines For Proffesional EngineersNamPr05No ratings yet

- App-F-Ethics Case StudiesDocument28 pagesApp-F-Ethics Case StudiesNamPr05No ratings yet

- Cricket Program (2015 To 2019)Document3 pagesCricket Program (2015 To 2019)Deep JoshiNo ratings yet

- Jap Aadh Sach Jugaadh Sach Hai Bhee Sach Naanak Hosee Bhee Sach 1Document1 pageJap Aadh Sach Jugaadh Sach Hai Bhee Sach Naanak Hosee Bhee Sach 1NamPr05No ratings yet

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (895)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (588)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (400)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (74)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (345)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (121)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- Manitoba PC 2016 Platform Costing DocumentDocument3 pagesManitoba PC 2016 Platform Costing DocumentPCManitobaNo ratings yet

- D.FORM For LandDocument2 pagesD.FORM For LandSowmya Sanisetty100% (5)

- Fiscal Rules and Fiscal Responsibility Laws in Case of ThailandDocument20 pagesFiscal Rules and Fiscal Responsibility Laws in Case of ThailandADBI EventsNo ratings yet

- RecentUpdate Introduction To Macroeconomics ECO2001 Final Assessment DBDocument8 pagesRecentUpdate Introduction To Macroeconomics ECO2001 Final Assessment DBdavid barnwellNo ratings yet

- QPDsDocument4 pagesQPDsDanisa NdhlovuNo ratings yet

- SupplyOutward CE 028Document1 pageSupplyOutward CE 028skgts787737No ratings yet

- Payment Receipt: Service - Helpdesk@maxlifeinsuranceDocument1 pagePayment Receipt: Service - Helpdesk@maxlifeinsuranceSHIRIDI SAI INDUSTRIESNo ratings yet

- Ca Audit Report 2324Document6 pagesCa Audit Report 2324UmasankarNo ratings yet

- Show All Work For Credit: Introduction To Income Taxation Brown Homework Set #5 (Chapter 7)Document2 pagesShow All Work For Credit: Introduction To Income Taxation Brown Homework Set #5 (Chapter 7)para uqeenNo ratings yet

- Carbide Chemical Company-Replacement of Old Machines-Discounting of CashflowsDocument1 pageCarbide Chemical Company-Replacement of Old Machines-Discounting of CashflowsRajib Dahal50% (2)

- Trend Analysis: Income StatementDocument7 pagesTrend Analysis: Income StatementHamza AmjedNo ratings yet

- Ram Pal SinghDocument1 pageRam Pal SinghSACHIN MATHURNo ratings yet

- 600 Food For Thought-PuneDocument1 page600 Food For Thought-PuneRohit Singh RajputNo ratings yet

- Employee Welfare & Erisa - CihonDocument21 pagesEmployee Welfare & Erisa - CihonAnand SinghNo ratings yet

- HQ06-1 - Fringe BenefitsDocument7 pagesHQ06-1 - Fringe BenefitsHannah Jane Oblena100% (1)

- 011 CIR V General FoodsDocument2 pages011 CIR V General FoodsJacob Dalisay100% (3)

- Mentor Tax Increment Financing LegislationDocument8 pagesMentor Tax Increment Financing LegislationThe News-HeraldNo ratings yet

- TB Sung Fatt 31 IpruDocument1 pageTB Sung Fatt 31 IpruangkatekagNo ratings yet

- Salient Features of The TRAIN Law: Atty. Richard M. Fulleros, Cpa, MbaDocument11 pagesSalient Features of The TRAIN Law: Atty. Richard M. Fulleros, Cpa, MbadhettsoohNo ratings yet

- 529 Plan Basics - College Saving PlansDocument8 pages529 Plan Basics - College Saving Planscharanmann9165No ratings yet

- Prudential SurrenderDocument5 pagesPrudential SurrenderBriltex IndustriesNo ratings yet

- B. Winnings Not Exceeding 10,000 D. Interest Income From Bank DepositsDocument3 pagesB. Winnings Not Exceeding 10,000 D. Interest Income From Bank DepositsVanesa Calimag ClementeNo ratings yet

- Please Take A Moment To Read and Acknowledge The Following Terms and ConditionsDocument1 pagePlease Take A Moment To Read and Acknowledge The Following Terms and ConditionsMary MurphyNo ratings yet

- Application For Registration: Kawanihan NG Rentas InternasDocument4 pagesApplication For Registration: Kawanihan NG Rentas InternasCarl PedreraNo ratings yet

- Court of Tax AppealsDocument47 pagesCourt of Tax AppealsLady Paul SyNo ratings yet

- p6 7 You Are Given The Following Details For The Year PDFDocument1 pagep6 7 You Are Given The Following Details For The Year PDFhassan taimourNo ratings yet

- Taxation Vietnam (F6) : Nguyễn Thị Thanh Hoài November 29, 2023Document118 pagesTaxation Vietnam (F6) : Nguyễn Thị Thanh Hoài November 29, 2023minhnguyennhat2003No ratings yet

- GST Green VortexDocument3 pagesGST Green Vortexakhil kwatraNo ratings yet

- Bank Schedle Sept 2022Document10 pagesBank Schedle Sept 2022Mercy FaithNo ratings yet

- Combined EnfacementDocument1 pageCombined EnfacementkumarNo ratings yet