Professional Documents

Culture Documents

7

Uploaded by

MrtbagYouCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

7

Uploaded by

MrtbagYouCopyright:

Available Formats

Universit

e dEvry-Val-dEssonne

Master Finance - Paris Saclay - M2 GRA

D

epartement d

economie

Juliana CAICEDO-LLANO

juliana.caicedollano@univ-evry.fr

2015-2016

Portfolio Simulation Project

Introduction

This projects objective is to make students understand the dynamics of financial markets

and investment decisions. The students can use different tools from Thomson Reuters Eikon or

Bloomberg applications or any other available tool to manage portfolios. This activity allows

students to apply the concepts learned in different masters courses to select bonds, stocks,

or other financial assets, or build an asset allocation portfolios as well as to evaluate the

performance of their portfolios and use risk management tools. Weekly objectives are fixed

during the period of simulation. At the final date each group will present portfolios results

and decisions to the class.

Markets

Each group works on a different portfolio among the following possibilities :

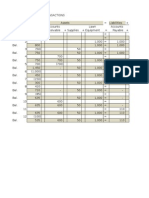

Group

1

2

3

4

5

6

7

8

9

10

11

12

13

14

Portfolio

Global asset allocation

Global equity allocation

Global sector allocation

French stocks Big Caps

French stocks Value

European stocks Value

European stocks Big Caps

US High Risk Stocks

Fixed Income Government

Fixed Income Corporate

International Stocks

Foreign Exchange

Global Commodities

US technology stocks

Methods

Students should use different methodologies studied in class (Portfolio management, Econometrics, Risk Management, Risk based investments, Asset allocation... ) as well as different

tools (Excel/VBA, R/Matlab, Reuters/Bloomberg...)

Rules of the Game

1. First Steps

(a) Students have to constitute a group (2 students per group) and choose a portfolio.

(b) Define the investment goals and a Benchmark for the portfolio.

(c) The initial amount allowed to each group is set at 100 000 000 EUR.

(d) Define the legal framework appling to the specific portfolio.

(e) Choose the initial set of assets as well as the amounts that would be invested on

each asset.

(f) Send the initial positions (RIC, Nb of contracts, amounts and percentages in an

Excel file)

2. Build a strategy

(a) Choose a methodology of portfolio management studied in class or elsewhere

(b) Choose a programming language (R/Matlab/VBA/Excel)

(c) Implement the portfolio strategy

3. Every week

(a) The portfolio has to be rebalanced weekly

(b) The valuation will be made with the closing prices of every Friday (The decisions

can be sent before this closing time and the latest on Monday 9 :00 hrs)

(c) The maximum number of assets in a portfolio is set to 30

(d) The maximum weight allowed to each asset is : 5% (15% for allocation portfolios)

(e) Minimum rebalancing : 15% of portfolio value

(f) Each portfolio maintains a cash position of 3%-5%

(g) Send the target positions (RIC, Nb of contracts, amounts and percentages in an

Excel file)

(h) Send a report explaining the investment decisions and a description of the important

events in the market having an impact on the portfolio (word or pdf file, 12 - 1 page)

4. Mid-term report

(a) Summarize initial positions

(b) Summarize weekly report

(c) Evaluate the performance of the portfolio from the initial date to the mid-term date.

5. Final report

The group evaluates the performance of the portfolio during the period of the simulation.

A global report of 2 pages including (at least) the following information :

(a) Description of the important events on the economic environment

(b) Total portfolio gain/loss in dollar and percentage terms

(c) A comparison to the benchmark portfolios actual and percentage gain/loss

(d) Other performance measures Description of the portfolio allocation

(e) Assessment of the investment goals

2

(f) A report on the difficulties found during the simulation

6. Additional suggested information :

Measure of historical risk and return for different assets in the portfolio

Betas for each security and for the whole portfolio

Description of a model used to make portfolio choices

Performance attribution analysis

Grading will be based on the consistency of the selections and reports and not on the

investment performance of the portfolios.

Example of porfolio projects from previous years

1. Fundamental analysis of comodities

2. Trend following Eurostoxx 50

3. CPPI on US growth stocks

4. Tracking error minimisation FTSE Eurofirst 80

5. ERC - US high risk stocks

6. Minimum variance - CAC40

7. Technical analysis - Emerging stocks

8. Top down approach on French Value Stocks

You might also like

- Hirshleifer - On The Theory of Investment Decision (Extended Fisher Borrowing Lending Rate Different)Document25 pagesHirshleifer - On The Theory of Investment Decision (Extended Fisher Borrowing Lending Rate Different)MrtbagYouNo ratings yet

- Anglais 3eme AnnéeDocument3 pagesAnglais 3eme AnnéeMrtbagYouNo ratings yet

- Di 1Document7 pagesDi 1Elizabeth DibanadaneNo ratings yet

- Numerical Ability GREDocument6 pagesNumerical Ability GREMrtbagYouNo ratings yet

- Admissions Guide For International Students (Anglais) 1Document23 pagesAdmissions Guide For International Students (Anglais) 1MrtbagYouNo ratings yet

- 2015 GKS Graduate Program Guidelines (English-Korean)Document45 pages2015 GKS Graduate Program Guidelines (English-Korean)Dwi RahayuNo ratings yet

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5794)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (895)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (344)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (399)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (588)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (73)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (120)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- Financial Futures MarketsDocument48 pagesFinancial Futures MarketsAnthony KwoNo ratings yet

- wealthAR 2016 2017Document160 pageswealthAR 2016 2017sharkl123No ratings yet

- Shangrila 2010Document107 pagesShangrila 2010Nana ShahNo ratings yet

- Derivatives: Analysis and ValuationDocument34 pagesDerivatives: Analysis and ValuationVanessa DavisNo ratings yet

- SIP Return CalculatorDocument6 pagesSIP Return CalculatorAnuj MasareNo ratings yet

- Financial Management: Sandeep GokhaleDocument90 pagesFinancial Management: Sandeep GokhaleVikram Singh Thakur100% (1)

- EC Bulletin Annual Incentive Plan Design SurveyDocument6 pagesEC Bulletin Annual Incentive Plan Design SurveyVikas RamavarmaNo ratings yet

- Risk ManagementDocument18 pagesRisk ManagementAbhra MukherjeeNo ratings yet

- An Overview of The Financial SystemDocument20 pagesAn Overview of The Financial SystemLazaros Karapou100% (1)

- Stocks and BondsDocument28 pagesStocks and BondsPrincess Macariola100% (1)

- Olma Deal Book BRDocument94 pagesOlma Deal Book BRColin SiNo ratings yet

- Working CapitalDocument62 pagesWorking CapitalSahil SethiNo ratings yet

- Extended Report EW-CompassDocument21 pagesExtended Report EW-CompassSanjay JainNo ratings yet

- Ninjatrader Futures Contract Details PDFDocument3 pagesNinjatrader Futures Contract Details PDFBogdanC-tinNo ratings yet

- Bodie Kane Marcus InvestmentsDocument38 pagesBodie Kane Marcus InvestmentsZaindi Zidane100% (2)

- Executive SummaryDocument17 pagesExecutive SummarySiva GuruNo ratings yet

- Investment Options in IndiaDocument25 pagesInvestment Options in IndiaamiNo ratings yet

- Are Limit Hits Industry-SpecificDocument6 pagesAre Limit Hits Industry-SpecificLondonNo ratings yet

- Auditing MiscDocument11 pagesAuditing MiscLlyod Francis LaylayNo ratings yet

- Jim's LawncareDocument18 pagesJim's LawncareJakeDickersonNo ratings yet

- Portfolio Optimization For Efficient Stock Portfolios:: Applications and DirectionsDocument26 pagesPortfolio Optimization For Efficient Stock Portfolios:: Applications and DirectionsCharlie YouNo ratings yet

- Warren, Accounting, 21st EditionDocument64 pagesWarren, Accounting, 21st EditionAnda ChipstarNo ratings yet

- Case 1: ABC Co Acquired The Net Assets of XYZ Co For P800,000. All The Assets and Liabilities BookDocument3 pagesCase 1: ABC Co Acquired The Net Assets of XYZ Co For P800,000. All The Assets and Liabilities BookkimkimNo ratings yet

- TxtartDocument384 pagesTxtartapi-27370939100% (1)

- AmalgamationDocument12 pagesAmalgamationNirav JadavNo ratings yet

- The Case Reliance PetroleumDocument4 pagesThe Case Reliance PetroleumManish Patel100% (1)

- Geo DPZ PPT Final SlidesDocument16 pagesGeo DPZ PPT Final Slideszyzzbk_1No ratings yet

- A Guide To Joe Dinapoli'S D-Levels™ Studies Using GFT'S Dealbook FX® 2Document20 pagesA Guide To Joe Dinapoli'S D-Levels™ Studies Using GFT'S Dealbook FX® 2Nei Lima100% (1)

- Algorithmic Market Making StrategiesDocument34 pagesAlgorithmic Market Making Strategiessahand100% (1)

- Valuation PresentationDocument44 pagesValuation PresentationAleem AbdulNo ratings yet