Professional Documents

Culture Documents

HOW 1. Personal Delivery 2. Mail Defect in Notice

Uploaded by

Megan Mateo0 ratings0% found this document useful (0 votes)

24 views4 pagesnego

Original Title

Neg Ooow

Copyright

© © All Rights Reserved

Available Formats

DOCX, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this Documentnego

Copyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

24 views4 pagesHOW 1. Personal Delivery 2. Mail Defect in Notice

Uploaded by

Megan Mateonego

Copyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

You are on page 1of 4

Sec.

93 EFFECT WHERE NOTICE IS GIVEN

BY PARTY ENTITLED THERETO:

Inures to the benefit of:

1. Holder

2. All parties subsequent to the party whom

notice is given including parties subsequent

to the holder who gave notice

EXAMPLE

MP

PA

AB

BC

C D holder

DE

If D only notifies C, P A B are discharged

from liability cause lack of notice

o Notice to C makes him party entitiled to

give instrument as he might be

compelled to pay the holder, and who

upon taking it p have a right to

reimbursement from party whom notice

is given

If C w/in the time fixed by gives notice to P

A B, inures to benefit of D holder and E

subsequent holder tho they themselves did

not give notice to P

Cs notice to A inures to A B D E. Hence A

not discharged by failure of D to notify kasi

notified naman siya by person entitled to

give notice

B X, agent of C

X may give notice kay principal or directly

dun sa secondarily liable

If residing sa same place, notice must be

given w/in the next following day; Oct 11,

edi notice must b be given not later than oct

12

If kay C, same duration lang ng notice as if

siya holder; has in turn until next day of Oct

12; so Oct 13

2. Directly to parties secondarily liable

- Must do so w/in limits prescribed in sec 102,

103, 10p4, 107 unless they are discharged

form lack of notice UNLESS PRINCIPAL

NOTIFIES THEM W/IN THE SAME TIME

Sec 95 WHEN NOTICE SUFFICIENT

FORM OF NOTICE

1. In writing or merely oral

a. Telephone, provided it be clearly

shown that the party notified was

really communicated w/; fully

identified as the party at the receiving

end of line

b. Telegraph

2. Notice w/c contains a copy of the

instrument and declares that payment

has been demanded and refused

o But mere statement that instrument is

due and payable; insufficient

SEC 94 WHEN AGENT MAY GIVE NOTICE

WHEN AND TO WHOM

1. Either to his principal

- Must notify w/in the same time refered to as

if he were the holder; upon recieveing

notice, has also the same time for giving

notice to parties secondarily liable as if

instrument was dishonored on the day that

he recvd the notice

EXAMPLE:

MP

PA

AB

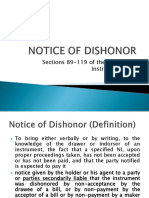

CONTENTS

1. Identity of the instrument

2. Fact that it has been dishonored by nonacceptance or non-payment

3. Statement from the party gibing notice

intends to look to the party addressed for

payment

HOW

1.

2.

Personal delivery

Mail

DEFECT IN NOTICE

1.

2.

3.

Lack of signature or insufficiency would not

invalidate it; any insufficiency may be

supplemented and validated by oral

communication

Misdescription of instrument will not vitiate it

unless it misleads the party to whom it is sent.

Basta he is not misled by the misdescription,

notice is sufficieny

Notice of dishonor need not state that the sender

looks to the indorser for payment, where it may

be inferred that the indorsee looks to the

indorser, and no other inference could be

reasonably drawn from the notice

SEC 97 TO WHOM NOTICE IS GIVEN

G.R. No. 101163 January 11, 1993

STATE INVESTMENT HOUSE, INC., petitioner,

vs.

COURT OF APPEALS and NORA B.

MOULIC, respondents.

BELLOSILLO, J.:

Facts:

Private respondent Nora B. Moulic issued to Corazon

Victoriano, as security for pieces of jewelry to be

sold on commission, two (2) post-dated Equitable

Banking Corporation checks in the amount of Fifty

Thousand Pesos (P50,000.00) each, one dated 30

August 1979 and the other, 30 September 1979.

Thereafter, the payee negotiated the checks to

petitioner State Investment House. Inc. (STATE).

MOULIC failed to sell the pieces of jewelry, so she

returned them to the payee before maturity of the

checks. The checks, however, could no longer be

retrieved as they had already been negotiated.

Consequently, before their maturity dates, MOULIC

withdrew her funds from the drawee bank. Upon

presentment for payment, the checks were dishonored

for insufficiency of fund.

STATE then allegedly notified MOULIC of the

dishonor of the checks and requested that it be paid in

cash instead, although MOULIC avers that no such

notice was given her. STATE sued to recover the

value of the checks plus attorney's fees and expenses

of litigation.

IMOULIC contends that she incurred no obligation

on the checks because the jewelry was never sold and

the checks were negotiated without her knowledge

and consent. She also instituted a Third-Party

Complaint against Corazon Victoriano, who later

assumed full responsibility for the checks. The trial

court dismissed the Complaint as well as the ThirdParty Complaint, and ordered STATE to pay

MOULIC P3,000.00 for attorney's fees.

STATE elevated the order of dismissal to the Court of

Appeals, but the appellate court affirmed the trial

court on the ground that the Notice of Dishonor to

MOULIC was made beyond the period prescribed by

the Negotiable Instruments Law and that even if

STATE did serve such notice on MOULIC within the

reglementary period it would be of no consequence

as the checks should never have been presented for

payment. The sale of the jewelry was never effected;

the checks, therefore, ceased to serve their purpose as

security for the jewelry.

Issue:

1. WON STATE is a holder in due course

2. WON Notice of Dishonor is necessary

Held:

1. Yes. Sec. 52 of the Negotiable Instruments Law

provides Sec. 52. What constitutes a holder in

due course. A holder in due course is a holder

who has taken the instrument under the

following conditions: (a) That it is complete and

regular upon its face; (b) That he became the

holder of it before it was overdue, and without

notice that it was previously dishonored, if such

was the fact; (c) That he took it in good faith and

for value; (d) That at the time it was negotiated

to him he had no notice of any infirmity in the

instrument or defect in the title of the person

negotiating it.

Culled from the foregoing, a prima facie presumption

exists that the holder of a negotiable instrument is a

holder in due course. 2 Consequently, the burden of

proving that STATE is not a holder in due course lies

in the person who disputes the presumption. In this

regard, MOULIC failed.

The evidence clearly shows that: (a) on their faces the

post-dated checks were complete and regular: (b)

petitioner bought these checks from the payee,

Corazon Victoriano, before their due dates; 3 (c)

petitioner took these checks in good faith and for

value, albeit at a discounted price; and, (d) petitioner

was never informed nor made aware that these

checks were merely issued to payee as security and

not for value.

Consequently, STATE is indeed a holder in due

course. As such, it holds the instruments free from

any defect of title of prior parties, and from defenses

available to prior parties among themselves; STATE

may, therefore, enforce full payment of the checks. 4

MOULIC cannot set up against STATE the defense

that there was failure or absence of consideration.

MOULIC can only invoke this defense against

STATE if it was privy to the purpose for which they

were issued and therefore is not a holder in due

course.

another to protect herself. After withdrawing her

funds, she could not have expected her checks to be

honored. In other words, she was responsible for the

dishonor of her checks, hence, there was no need to

serve her Notice of Dishonor, which is simply

bringing to the knowledge of the drawer or indorser

of the instrument, either verbally or by writing, the

fact that a specified instrument, upon proper

proceedings taken, has not been accepted or has not

been paid, and that the party notified is expected to

pay it. 8

2.

The drawing and negotiation of a check have certain

effects aside from the transfer of title or the incurring

of liability in regard to the instrument by the

transferor. The holder who takes the negotiated paper

makes a contract with the parties on the face of the

instrument. There is an implied representation that

funds or credit are available for the payment of the

instrument in the bank upon which it is

drawn. 10 Consequently, the withdrawal of the money

from the drawee bank to avoid liability on the checks

cannot prejudice the rights of holders in due course.

In the instant case, such withdrawal renders the

drawer, Nora B. Moulic, liable to STATE, a holder in

due course of the checks.

No. The need for such notice is not absolute;

there are exceptions under Sec. 114 of the

Negotiable Instruments Law:

Sec. 114. When notice need not be given to drawer.

Notice of dishonor is not required to be given to

the drawer in the following cases:; (e) Where the

drawer had countermanded payment.

Case at bar, MOULIC'S actuations leave much to be

desired. She did not retrieve the checks when she

returned the jewelry. She simply withdrew her funds

from her drawee bank and transferred them to

You might also like

- STATE INVESTMENT HOUSE, INC. Vs CADocument5 pagesSTATE INVESTMENT HOUSE, INC. Vs CAClaudia Rina LapazNo ratings yet

- DischargeDocument16 pagesDischargeJubsNo ratings yet

- State Investment House, Inc. Vs CADocument5 pagesState Investment House, Inc. Vs CAInez Monika Carreon PadaoNo ratings yet

- 05 State Investment House, Inc V CA (G.R. No. 10116 - January 11, 1993)Document3 pages05 State Investment House, Inc V CA (G.R. No. 10116 - January 11, 1993)teepeeNo ratings yet

- Ambot Sa KinabuhiDocument55 pagesAmbot Sa Kinabuhiadonis.orillaNo ratings yet

- NIL - Discharge Cases Negotiable InstrumentsDocument8 pagesNIL - Discharge Cases Negotiable Instrumentsblackphoenix303No ratings yet

- Escober, Alon & Associates For Petitioner. Martin D. Pantaleon For Private RespondentsDocument17 pagesEscober, Alon & Associates For Petitioner. Martin D. Pantaleon For Private RespondentsCarla Eclarin BojosNo ratings yet

- G.R. No. 101163 January 11, 1993 STATE INVESTMENT HOUSE, INC., Petitioner, COURT OF APPEALS and NORA B. MOULIC, Respondents. Bellosillo, J.Document4 pagesG.R. No. 101163 January 11, 1993 STATE INVESTMENT HOUSE, INC., Petitioner, COURT OF APPEALS and NORA B. MOULIC, Respondents. Bellosillo, J.Junaid DadayanNo ratings yet

- Midterms - Case DigestsDocument192 pagesMidterms - Case DigestskuheDSNo ratings yet

- 47 State Investment House V CADocument2 pages47 State Investment House V CAAngelica YatcoNo ratings yet

- G.R. No. 101163Document4 pagesG.R. No. 101163lalisa lalisaNo ratings yet

- CASE #5 State Investment House Vs Court of AppealsDocument3 pagesCASE #5 State Investment House Vs Court of AppealspistekayawaNo ratings yet

- 1991-1996 BAR Mercantile QuestionsDocument63 pages1991-1996 BAR Mercantile QuestionsasdgafsdgadfgNo ratings yet

- NIL.11.2 State Investment House vs. CA, 217 SCRA 32 FACTS: Nora B. Moulic Issued To Corazon Victoriano, As Security For Pieces of JewelryDocument2 pagesNIL.11.2 State Investment House vs. CA, 217 SCRA 32 FACTS: Nora B. Moulic Issued To Corazon Victoriano, As Security For Pieces of JewelryMidzmar KulaniNo ratings yet

- Negotiable Instruments - Notice of DishonorDocument26 pagesNegotiable Instruments - Notice of DishonorRM MallorcaNo ratings yet

- Nego Digest P.3Document20 pagesNego Digest P.3meriiNo ratings yet

- Nego Cases 1Document14 pagesNego Cases 1Choystel Mae ArtigasNo ratings yet

- G.R. No. 101163 January 11, 1993 State Investment House, Inc., Petitioner, vs. Court of Appeals and Nora B. MOULIC, Respondents. Bellosillo, J.Document54 pagesG.R. No. 101163 January 11, 1993 State Investment House, Inc., Petitioner, vs. Court of Appeals and Nora B. MOULIC, Respondents. Bellosillo, J.MV GardoseNo ratings yet

- Nego Notice of DishonorDocument26 pagesNego Notice of DishonorRyan Vic AbadayanNo ratings yet

- STATE INVESTMENT INC. v. COURT OF APPEALS & NORA MOULICDocument2 pagesSTATE INVESTMENT INC. v. COURT OF APPEALS & NORA MOULICKatrina PerezNo ratings yet

- State Investment House v. CADocument2 pagesState Investment House v. CARouel F. SantiagoNo ratings yet

- State Investment House Inc. vs. CADocument18 pagesState Investment House Inc. vs. CAJeremy MorenoNo ratings yet

- Negotiable Instrument (Discharge of Instrument)Document15 pagesNegotiable Instrument (Discharge of Instrument)Sara Andrea Santiago100% (1)

- Week 1 DigestDocument13 pagesWeek 1 DigestMike Zaccahry MilcaNo ratings yet

- Section 89 and AboveDocument20 pagesSection 89 and AboveEllyza SerranoNo ratings yet

- (Nego Questions FINALS RecitDocument10 pages(Nego Questions FINALS RecitBoomBoom100% (2)

- Credtrans Cases 1-10Document40 pagesCredtrans Cases 1-10Charles Roger RayaNo ratings yet

- Fulltext Cases Nos. 9-18-27Document8 pagesFulltext Cases Nos. 9-18-27Mohamad JobNo ratings yet

- Presentment For Payment Consists ofDocument3 pagesPresentment For Payment Consists ofWilma P.100% (1)

- Credtrans Finals CasesDocument114 pagesCredtrans Finals Cases001nooneNo ratings yet

- State Vs CADocument2 pagesState Vs CANivra Lyn EmpialesNo ratings yet

- Negotiable InstrumentsDocument11 pagesNegotiable InstrumentsFersal AlbercaNo ratings yet

- Negotiable Instrument Law Case DigestDocument35 pagesNegotiable Instrument Law Case DigestbulacanNo ratings yet

- Negotiable Instrument (Part III) M.CDocument6 pagesNegotiable Instrument (Part III) M.Csad nuNo ratings yet

- State Investment House, Inc. vs. Court of AppealsDocument10 pagesState Investment House, Inc. vs. Court of AppealsFD BalitaNo ratings yet

- State Inv. vs. CA 217 SCRA 32 FactsDocument1 pageState Inv. vs. CA 217 SCRA 32 FactsNivra Lyn EmpialesNo ratings yet

- 65 State Investment House vs. IACDocument4 pages65 State Investment House vs. IACCharm Divina LascotaNo ratings yet

- Chapter 4-Liabilities of PartiesDocument15 pagesChapter 4-Liabilities of PartiesSteffany RoqueNo ratings yet

- State Investment House v. CADocument9 pagesState Investment House v. CAAna BalceNo ratings yet

- 01 Case Digest Statement Investment House, Inc Vs CADocument3 pages01 Case Digest Statement Investment House, Inc Vs CARio AborkaNo ratings yet

- RFBT Negotiable Instruments LawDocument8 pagesRFBT Negotiable Instruments LawKatzkie Montemayor Godinez100% (1)

- NIL-Guide Questions and Answers-2Document4 pagesNIL-Guide Questions and Answers-2AG OrtegaNo ratings yet

- NEGO Samplex FinalsDocument4 pagesNEGO Samplex FinalsJhomel Delos ReyesNo ratings yet

- Digest 2Document6 pagesDigest 2Van CazNo ratings yet

- Chan Wan Vs Tan KimDocument12 pagesChan Wan Vs Tan KimCarlo ColumnaNo ratings yet

- Nego DefensesDocument12 pagesNego DefensesKent Wilson Orbase AndalesNo ratings yet

- Negotiable Instruments Case Digest 6 PDF FreeDocument50 pagesNegotiable Instruments Case Digest 6 PDF FreeJr MateoNo ratings yet

- Nego Case DigestDocument16 pagesNego Case DigestFatimaNo ratings yet

- 210427429-Nego - pdf12345 (Dragged) 28Document1 page210427429-Nego - pdf12345 (Dragged) 28Christian Lemuel Tangunan TanNo ratings yet

- Forged Signature Effect Of.: Nego Finals NotesDocument3 pagesForged Signature Effect Of.: Nego Finals NotesGabrielAblolaNo ratings yet

- Roberto Dino vs. Maria Luisa Judal-Loot FactsDocument4 pagesRoberto Dino vs. Maria Luisa Judal-Loot FactsLeeNo ratings yet

- State Investment Vs CA and MoulicDocument10 pagesState Investment Vs CA and MoulicArlyn R. RetardoNo ratings yet

- State Investment House, Inc., vs. Court of Appeals and Nora B. Moulic DIGESTDocument1 pageState Investment House, Inc., vs. Court of Appeals and Nora B. Moulic DIGESTMALALA MALALA100% (1)

- Garin DigestDocument6 pagesGarin DigestConcepcion Mallari GarinNo ratings yet

- Negotiable InstrumentsDocument23 pagesNegotiable InstrumentssanalkarollilNo ratings yet

- 01 Maralit vs. Imperial G.R. No. 130756, 21 January 1999, SCRA 605 FactsDocument12 pages01 Maralit vs. Imperial G.R. No. 130756, 21 January 1999, SCRA 605 FactsMadeleine DinoNo ratings yet

- Motions, Affidavits, Answers, and Commercial Liens - The Book of Effective Sample DocumentsFrom EverandMotions, Affidavits, Answers, and Commercial Liens - The Book of Effective Sample DocumentsRating: 4.5 out of 5 stars4.5/5 (14)

- The 5 Elements of the Highly Effective Debt Collector: How to Become a Top Performing Debt Collector in Less Than 30 Days!!! the Powerful Training System for Developing Efficient, Effective & Top Performing Debt CollectorsFrom EverandThe 5 Elements of the Highly Effective Debt Collector: How to Become a Top Performing Debt Collector in Less Than 30 Days!!! the Powerful Training System for Developing Efficient, Effective & Top Performing Debt CollectorsRating: 5 out of 5 stars5/5 (1)

- U.S. v. Sun Myung Moon 532 F.Supp. 1360 (1982)From EverandU.S. v. Sun Myung Moon 532 F.Supp. 1360 (1982)No ratings yet

- Katarungang Pambarangay Law For RemDocument2 pagesKatarungang Pambarangay Law For RemMegan MateoNo ratings yet

- Crim Law SyllabusDocument9 pagesCrim Law SyllabusMegan MateoNo ratings yet

- Remedial Law Syllabus NotesDocument8 pagesRemedial Law Syllabus NotesMegan MateoNo ratings yet

- Rule 5-10 CivPro Dean JaraDocument7 pagesRule 5-10 CivPro Dean JaraMegan MateoNo ratings yet

- Katarungang Pambarangay & Small ClaimsDocument10 pagesKatarungang Pambarangay & Small ClaimsMegan MateoNo ratings yet

- RA 11222 Simulation of BirthDocument7 pagesRA 11222 Simulation of BirthMegan MateoNo ratings yet

- Tax Remedies OutlineDocument5 pagesTax Remedies OutlineMegan MateoNo ratings yet

- Case Digests Credit Transactions Dean AlbanoDocument24 pagesCase Digests Credit Transactions Dean AlbanoMegan MateoNo ratings yet

- Commercial Law Review Justice DimaampaoDocument19 pagesCommercial Law Review Justice DimaampaoMegan MateoNo ratings yet

- Chapter 3 Case Digests Admin Atty. GallantDocument4 pagesChapter 3 Case Digests Admin Atty. GallantMegan MateoNo ratings yet

- Negotiable Instruments Law ReviewerDocument7 pagesNegotiable Instruments Law ReviewerMegan MateoNo ratings yet

- Insurance Case Digests Atty. YamamotoDocument7 pagesInsurance Case Digests Atty. YamamotoMegan MateoNo ratings yet

- Wills Case Digest MATEODocument13 pagesWills Case Digest MATEOMegan Mateo100% (1)

- Negotiable Instruments Case Digests For November 8Document3 pagesNegotiable Instruments Case Digests For November 8Megan MateoNo ratings yet

- Pubcorp Finals 1Document16 pagesPubcorp Finals 1Megan MateoNo ratings yet

- Pubcorp Atty Pascasio Case DigestDocument34 pagesPubcorp Atty Pascasio Case DigestMegan Mateo100% (1)

- Property Finals CasesDocument9 pagesProperty Finals CasesMegan MateoNo ratings yet

- Elec Finals Digests MateoDocument15 pagesElec Finals Digests MateoMegan Mateo100% (1)

- Criminal Procedure CASESDocument1 pageCriminal Procedure CASESMegan MateoNo ratings yet

- Elec Midterms DigestsDocument25 pagesElec Midterms DigestsMegan MateoNo ratings yet

- Sales Finals ReviewerDocument30 pagesSales Finals ReviewerEmil OngNo ratings yet

- Pubcorp Midterms DigestDocument22 pagesPubcorp Midterms DigestMegan MateoNo ratings yet

- Human Rights Law Reviewer Commissioner SarmientoDocument5 pagesHuman Rights Law Reviewer Commissioner SarmientoMegan Mateo82% (11)

- Code of Judicial Ethics Group 1Document24 pagesCode of Judicial Ethics Group 1Megan Mateo50% (2)

- Hacienda Luisita Vs PARC DigestDocument3 pagesHacienda Luisita Vs PARC DigestMegan Mateo100% (3)

- Loading N Unloading of Tanker PDFDocument36 pagesLoading N Unloading of Tanker PDFKirtishbose ChowdhuryNo ratings yet

- Executive Summary - Pseudomonas AeruginosaDocument6 pagesExecutive Summary - Pseudomonas Aeruginosaapi-537754056No ratings yet

- ST JohnDocument20 pagesST JohnNa PeaceNo ratings yet

- Building New Boxes WorkbookDocument8 pagesBuilding New Boxes Workbookakhileshkm786No ratings yet

- ADS 460 Management Principles and Practices: Topic 1: Introduction To ManagementDocument33 pagesADS 460 Management Principles and Practices: Topic 1: Introduction To ManagementNURATIKAH BINTI ZAINOL100% (1)

- PFI High Flow Series Single Cartridge Filter Housing For CleaningDocument2 pagesPFI High Flow Series Single Cartridge Filter Housing For Cleaningbennypartono407No ratings yet

- 90FF1DC58987 PDFDocument9 pages90FF1DC58987 PDFfanta tasfayeNo ratings yet

- Ingles Avanzado 1 Trabajo FinalDocument4 pagesIngles Avanzado 1 Trabajo FinalFrancis GarciaNo ratings yet

- Course Specifications: Fire Investigation and Failure Analysis (E901313)Document2 pagesCourse Specifications: Fire Investigation and Failure Analysis (E901313)danateoNo ratings yet

- Week 8: ACCG3001 Organisational Planning and Control Tutorial In-Class Exercise - Student HandoutDocument3 pagesWeek 8: ACCG3001 Organisational Planning and Control Tutorial In-Class Exercise - Student Handoutdwkwhdq dwdNo ratings yet

- Arduino Based Voice Controlled Robot: Aditya Chaudhry, Manas Batra, Prakhar Gupta, Sahil Lamba, Suyash GuptaDocument3 pagesArduino Based Voice Controlled Robot: Aditya Chaudhry, Manas Batra, Prakhar Gupta, Sahil Lamba, Suyash Guptaabhishek kumarNo ratings yet

- SILABO 29-MT247-Sensors-and-Signal-ConditioningDocument2 pagesSILABO 29-MT247-Sensors-and-Signal-ConditioningDiego CastilloNo ratings yet

- Hip NormDocument35 pagesHip NormAiman ArifinNo ratings yet

- PC210 8M0Document8 pagesPC210 8M0Vamshidhar Reddy KundurNo ratings yet

- Droplet Precautions PatientsDocument1 pageDroplet Precautions PatientsMaga42No ratings yet

- Year 9 - Justrice System Civil LawDocument12 pagesYear 9 - Justrice System Civil Lawapi-301001591No ratings yet

- CNC USB English ManualDocument31 pagesCNC USB English ManualHarold Hernan MuñozNo ratings yet

- Feasibility Study of Diethyl Sulfate ProductionDocument3 pagesFeasibility Study of Diethyl Sulfate ProductionIntratec SolutionsNo ratings yet

- Agricultural Economics 1916Document932 pagesAgricultural Economics 1916OceanNo ratings yet

- Reflections On Free MarketDocument394 pagesReflections On Free MarketGRK MurtyNo ratings yet

- Instructions For Microsoft Teams Live Events: Plan and Schedule A Live Event in TeamsDocument9 pagesInstructions For Microsoft Teams Live Events: Plan and Schedule A Live Event in TeamsAnders LaursenNo ratings yet

- Mat Boundary Spring Generator With KX Ky KZ KMX KMy KMZDocument3 pagesMat Boundary Spring Generator With KX Ky KZ KMX KMy KMZcesar rodriguezNo ratings yet

- Daraman vs. DENRDocument2 pagesDaraman vs. DENRJeng GacalNo ratings yet

- Health Insurance in Switzerland ETHDocument57 pagesHealth Insurance in Switzerland ETHguzman87No ratings yet

- HSBC in A Nut ShellDocument190 pagesHSBC in A Nut Shelllanpham19842003No ratings yet

- Configuring Master Data Governance For Customer - SAP DocumentationDocument17 pagesConfiguring Master Data Governance For Customer - SAP DocumentationDenis BarrozoNo ratings yet

- NOP PortalDocument87 pagesNOP PortalCarlos RicoNo ratings yet

- Experiment On Heat Transfer Through Fins Having Different NotchesDocument4 pagesExperiment On Heat Transfer Through Fins Having Different NotcheskrantiNo ratings yet

- Expense Tracking - How Do I Spend My MoneyDocument2 pagesExpense Tracking - How Do I Spend My MoneyRenata SánchezNo ratings yet

- Fernando Salgado-Hernandez, A206 263 000 (BIA June 7, 2016)Document7 pagesFernando Salgado-Hernandez, A206 263 000 (BIA June 7, 2016)Immigrant & Refugee Appellate Center, LLCNo ratings yet