Professional Documents

Culture Documents

10-Practical Questions of Individuals (78-113)

Uploaded by

Sajid SaithOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

10-Practical Questions of Individuals (78-113)

Uploaded by

Sajid SaithCopyright:

Available Formats

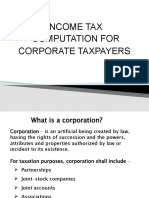

Chapter 10: Income Tax Practical Questions of Individuals

Chapter 10

Income Tax Practical Questions of Individuals

Notes for students:

1. Certain dates and information have been changed to solve the questions

based on the tax year 2017

2. Basic knowledge and features of Final Tax Regime (FTR) are included in the

syllabus. Detailed knowledge, items covered under FTR and their rates are not

included in the syllabus. Therefore, the students are supposed to have basic

knowledge of FTR before attempting the practical questions of individuals. We

are explaining FTR features and selected items of FTR in this chapter to

facilitate the solution of practical questions of individuals.

This chapter includes the following questions:

ICAP CAF

Q.

Reference

No.

10.1

Q.15 Sept 2004

10.2

Q.15

March

2005

10.3

Q.2 Sept 2005

10.4

10.5

Mark

s

17

22

16

15

12

10.6

Q.1 March 2006

Q.2(a)

March

2007

Q.1 March 2009

10.7

Q.1 Sept 2009

21

10.8

Q.1 March 2011

20

10.9

Q.1 Sept 2011

19

10.10

Q.1 March 2013

20

ICAP Module CFAP

Q.

Reference

No.

10.11

Q.1 Dec 2009

18

Mark

s

18

Remarks i.e. special features in the

question

Fee for attending BOD meetings

Tax borne by the employer on specific

perquisites

Foreign source salary, TV and VCR provided for

use

Service income from abroad

Forfeited deposit

Foreign source salary

Foreign source salary

Change in slab due to tax borne by the

employer

Specified amount of tax borne by the company

Two pensions

Foreign source business income and Pakistan

source business loss

Deduction for use of car

Golden handshake as separate block of income

Taxability of bonus shares including their

disposal

Remarks i.e. special features in the

question

Specific amount of tax to be borne by the

employer

Forfeited deposit

Loan received in cash

78

Chapter 10: Income Tax Practical Questions of Individuals

10.12

Q.1 June 2011

20

10.13

Q.1 Dec 2012

25

10.14

10.15

Q.1 Dec 2013

Q.6 June 2015

22

8

Compensation under the redundancy scheme

taxable @ last 3 years average rate of tax

Returning expatriate

Refrigerator, cooking range and washing

machine provided by the employer for use

Rent of agricultural land

Loan for renovation of residential house

Dividend in specie

Compensation for delayed refund

Voluntary waiver of leave encashment by the

employee

Royalty income

SALIENT FEATURES OF FTR S 8 and 169

a) Tax deductible or collectible at source related to the items of FTR shall become

full and final discharge of tax liability and normal slab rates do no apply in this

case. However, any incorrect tax deduction shall be adjusted accordingly.

b) No expense, deduction or allowance against presumed income is allowed.

c) Losses cannot be adjusted against presumed income.

d) Tax liability under FTR shall not be reduced by any tax credit / rebate (except in

case of BMR etc. refer chapter of losses).

Q.3(d) March 2016 ICAP CAF

Under the provisions of the Income Tax Ordinance, 2001 explain the general

provisions/rules which may apply to income subject to final tax.

(Marks 6)

ITEMS UNDER FTR AND TAX THEREON

1. Dividend income S 5 and 150

Tax shall be deducted @ 12.5% of gross dividend which shall be considered full

and final tax for a person including a corporate shareholder.

2. Value of bonus shares sections 236M and 236N

Value of bonus shares is taxable under FTR @ 5% of the day-end price on the first

day of closure of books in case of a listed company. Value in case of unlisted

company shall be the value as may be prescribed by the FBR.

3. Prizes and winnings S 156

a) Tax shall be deducted of the gross amount of the following:

i.

ii.

79

15% on Prize on prize bond and cross-word puzzle (20% for non-filer)

20% on Raffle, Lottery, Prize on winning a quiz or Prize offered by

companies for promotion of sales.

Chapter 10: Income Tax Practical Questions of Individuals

b) If the said prize or winning is not in cash then the payer is required to collect

tax at the specified tax rate of the FMV of prize from the recipient of prize.

4. Income from services rendered or construction contract outside Pakistan shall be

taxable at the specified fixed rates if such receipts are brought into Pakistan

through normal banking channel clauses 3 Part II 2nd Schedule.

Specified rates are as under:

For contracts: 3.5% for a company and 3.75% for an individual or AOP

For services:

- 0.75% for amount received by electronic and print media for advertising

services

- 5% for sportspersons

- 4% for service income by a company; and

- 5% for service income by an individual or AOP

5. Interest income S 151:

5.1 Tax shall be deducted @ 10% (for filer) on the amount of profit on debt (after

deducting Zakat) to a resident person:

a) Profit on certificates under National Savings Scheme including Defence Saving

Certificates (DSC) and Post Office Saving Account.

b) Bank profit including profit and loss sharing (PLS) account

c) Profit on certificates, debentures etc. (other than shares) issued by a company

or a financial institution.

d) Profit on securities issued by the government such as Pakistan Investment

Bonds.

The tax rates applicable on the above interest income are:

For a company

For an individual and AOP:

Where profit on debt does not exceed

Rs.25,000,000

Where

profit

on

debt

exceeds

Rs.25,000,000 but does not exceed

Rs.50,000,000

Where

profit

on

debt

exceeds

Rs.50,000,000

Tax rate

31%

10%

Rs.2,500,000 + 12.5% of amount

exceeding Rs.25,000,000

Rs.5,625,000 + 15% of amount

exceeding Rs.50,000,000

Interest income as above (a) to (d) shall be taxable under FTR for a person other than

a company. However, payer of the interest income in the above cases would deduct

tax @ 10% after deducting zakat. If the tax liability is more than the tax deduction at

source then the balance is payable with the return of income.

Note for students:

80

Chapter 10: Income Tax Practical Questions of Individuals

Payment on account of profit on debt i.e. interest is not subject to withholding

tax in every case e.g. payment on account of interest on loan through loan

agreement is not subject to tax deduction and therefore the same is taxable

under normal tax structure.

Therefore, if an individual gives loan to a company through loan agreement

(other than through debentures etc.) then no tax shall be deducted in this case

and the interest income shall be taxable under the head income from other

sources at normal slab rates.

5.2

Interest income is exempt in certain cases and therefore no tax shall be

deducted. Few examples are:

a)

Interest payable to a non-resident on a loan in foreign exchange against

Export Letter of Credit which is used exclusively for export of goods

manufactured in Pakistan clause 72 Part I 2nd Schedule.

b)

Profit from foreign currency accounts by Citizens of Pakistan residing

abroad, Foreign Nationals residing in or outside Pakistan and foreign

entities registered and operating abroad clause 78 Part I 2 nd Schedule.

c)

Profit from rupee account by a citizen of Pakistan residing abroad where

foreign exchange remittance is made exclusively for this purpose clause

79 Part I 2nd Schedule.

d)

Profit on Certificates of Investment issued by the Investment Banks clause

78 Part I 2nd Schedule.

e)

Interest income by a non-resident if loan agreement is approved for tax

exemption purpose.

f)Profit received by a non-resident on a security approved by the FBR issued by

a resident where: (section 46)

The persons are not associates

The security was widely issued outside Pakistan for raising a loan for a

business in Pakistan

The profit was paid outside Pakistan

Q.1(b) Dec 2006 ICAP CFAP

GM Ltd is considering an option to issue TFC outside Pakistan for the

purpose of raising funds for use in its business in Pakistan. To induce the

investors for acquiring TFCs of the Company, it intends to advertise that

the income on the same will not be taxable in Pakistan.

Required: List down the conditions to be fulfilled for claiming exemption

on profit on debt payable on TFCs being issued by the Company.

(Marks 5)

PRACTICAL QUESTIONS OF INDIVIDUALS

Q.10.1 (Q.15 Sept 2004 ICAP CAF)

81

Chapter 10: Income Tax Practical Questions of Individuals

Mr. A is the Chief Executive of a multinational company (unlisted). Details of his

emoluments are as follows:

Rs.

(a) Basic salary

4,004,520

(b) Bonus

1,980,642

(c) Utility allowance

400,452

(d) Leave encashment

538,083

(e) Other allowance

90,000

(f) House rent allowance 1,802,040

Apart from the above, he is eligible to receive Directors Fee of Rs.52,000. The

company has paid this amount after deduction of tax @ 20%.

During the year he has sold shares that were acquired through exercise of a Stock

Option three years ago. The gain on sale amounts to Rs.4,206,000.

He also owns a property which has been let out on rent. The details of rent received

and expenses incurred are as follows:

(a) Rent Rs.40,000 per month. The property was let out on rent for the whole year.

The annual letting value of the house is Rs.450,000. No income tax was

deducted by the tenant.

(b) He has paid property tax amounting to Rs.11,500.

(c) During the year he has paid Rs.6,000 for repairs and maintenance.

He has also earned profit of Rs.6,500 on PLS (profit and loss sharing) Account.

During the year the following amounts were withheld at source towards income tax.

(a) From salary income Rs.1,800,000 other than directors fee

(b) From profit on PLS Account Rs.650

You are required to compute the taxable income and tax liability for the tax year

20X8.

(Marks 17)

Q.10.2 (Q.15 March 2005 ICAP CAF)

Mr B is the Chief Executive of a Multinational Company. Details of his emoluments

are as follows:

Rs.

(a) Basic Salary

8,800,000

(b) Bonus

5,000,000

(c) Utility allowance

880,000

(d) Relocation allowance 200,000

Apart from the above he is provided with the following perquisites / benefits:

(i)

(ii)

(iii)

A free unfurnished accommodation by the employer with land area of 2100 sq.

yds.

Motor vehicle for both private and official use, cost of acquisition of which was

Rs.2,000,000.

Children education fees for the year Rs.105,000.

82

Chapter 10: Income Tax Practical Questions of Individuals

(iv)

House servant salaries for the year Rs.230,000.

According to the terms of employment the tax liability of Mr. B on the above

benefits and perquisites from (i) to (iv) above is borne by the employer. Tax liability

on other remuneration is borne by himself.

Mr. B also owns a property which was let out on rent for a part of the year details of

income and expenses incurred are as follows:

(a) Rent Rs.50,000 per month.

(b) The property was let out on rent from December to June

(c) Property tax paid Rs.35,000.

The Bank account of Mr. B was credited with profit during the year amounting to

Rs.6,300.

During the year the following amounts were withheld at source as Income Tax:

Rs.

(a) From salary income

3,786,000

(b) Tax paid by the employer 1,883,571

(c) From profit on bank account

630

(d) On receipt of rent

7,500

You are required to compute the taxable income and tax liability for the tax year

20X8.

(Marks 22)

Q.10.3 (Q.2 Sept 2005 ICAP CAF)

Mr. Imran is a citizen of Pakistan. During the first nine months of the tax year, he

worked as financial controller of a Pakistan based unlisted subsidiary company of a

multinational group. After that he was transferred and employed as Head of Finance

of the UAE based subsidiary of the Group. Mr. Imrans family stayed in Dubai

throughout the year. The detail of income earned by him during the year is given

below:

From the UAE company

Mr. Imran earned US $ 30,000 during the three-months employment in the UAE. No

tax is deducted from salary earned and paid in the UAE.

To relocate Mr. Imran in UAE, the UAE Company incurred one time miscellaneous cost

of Rs.100,000 to move the household items of Mr. Imran from Pakistan to Dubai.

From Pakistan subsidiary

(a) Basic salary Rs.500,000 p.m.

(b) Medical allowance Rs.45,000 per month (no free medical or hospitalization

facility is given to Mr. Imran under the terms of employment).

(c) The company has provided Mr. Imran a TV and VCR costing Rs.40,000 on which

the company charges depreciation @ 20% in its books of accounts.

83

Chapter 10: Income Tax Practical Questions of Individuals

(d) Company has provided interest free loan to Mr. Imran amounting to Rs.5 million

which remained outstanding throughout his employment with the company

(Pakistan subsidiary). Mr. Imran acquired a flat from the amount of loan and

rented it out @ Rs.50,000 per month for a period of seven months. He also paid

Rs.35,000 as property tax during the period.

(e) *His familys housing cost in Dubai, borne by the company amounts to

Rs.30,000 per month.

(f) Mr. Imrans travelling and related cost borne by the Pakistan subsidiary to meet

his family, amounts to Rs.30,000 p.m.

(g) During the employment with the Pakistan subsidiary, Mr. Imran had exercised

option to acquire 300 shares of the parent company @ US $ 8 per share. At the

time when the option was exercised, the value of the share was US $ 10

(Rs.580) per share. Furthermore, during the year Mr. Imran sold 200 options

previously received by him at a price of US $ 3 per option (Rs.171) after holding

it for more than a year. Neither the Pakistan subsidiary nor Mr. Imran incurred

any cost in this regard.

Required: Compute the taxable income of Mr. Imran for the tax year 20X8 based on

the data provided above.

(Marks 16)

*Note for students:

Housing cost in Dubai paid by the Pakistani company is being considered as

reimbursement of personal expense of Mr. Imran and not as accommodation

provided by the company. If it is considered as accommodation provided by the

company then 45% of the basic salary would be the taxable amount in this respect.

Q.10.4 (Q.1 March 2006 ICAP CAF)

Ms. FH was working as a Marketing Head with Consumer Products Ltd (CPL) at

following emoluments:

(i) Basic salary

Rs.100,000 per month

(ii) House rent allowance Rs.40,000 per month

(iii) Utilities allowance

Rs.15,000 per month

In addition to the above cash emoluments, she was provided with a Honda Civic car,

exclusively for official use. The cost of car to the Company was Rs.1,000,000. As per

Companys policy, the car was sold to Ms. FH during the year at the WDV of

Rs.100,000 whereas the FMV of the same at the time of sale was Rs.300,000.

In May 20X8, Ms. FH was approached by Pharma Industries (Pvt) Ltd (PIL). They

offered her employment at a higher salary and some extra benefits, along with a one

time payment of Rs.200,000 as an inducement to accept their offer. Ms. FH accepted

PILs offer by resigning from CPL with effect from 1.6.20X8. She joined PIL from

1.7.20X8. The amount of Rs.200,000 was, however, paid to her on 29.6.20X8.

During the year, Ms. FH has also undertaken the following transactions:

84

Chapter 10: Income Tax Practical Questions of Individuals

(i)

Shares in Queens Pakistan (Pvt) Ltd were sold for Rs.500,000. These shares

were acquired in the year 20X3 at a cost of Rs.200,000.

(ii)

A residential plot inherited in the year 20X1 was sold for Rs.1,000,000. The

FMV of the plot at the time of inheritance was Rs.200,000.

(iii)

A painting purchased at a cost of Rs.100,000 was sold for Rs.75,000.

(iv)

She had won a cash prize of Rs.250,000 in a quiz show. Tax of Rs.50,000 was

deducted from the prize money under section 156.

(v)

Gross dividend income of Rs.50,000 from a listed company. Dividend was

received after deduction of tax of Rs.6,250 under section 150.

(vi)

She received a fee of Rs.100,000 in consideration for preparing a research

paper for a foreign University. She incurred Rs.10,000 on the printing of

research paper and courier charges for sending the paper abroad.

(vii) An amount of Rs.50,000 was donated to an approved charitable institution.

In the light of above information, compute the taxable income of Ms. FH for the tax

year 20X8 by giving brief explanation for the items not included in the taxable

income.

(Marks 15)

Q.10.5 (Q.2(a) March 2007 ICAP CAF)

Explain the correct tax treatment in the tax year 20X8 in each of the following

situations:

(i) In 20X1, Mr. H inherited a rare sculpture of Buddha which had a FMV of

Rs.200,000 on the date of inheritance. In February 20X8, the sculpture was

sold by him at Rs.500,000.

(ii) In July 20X7, Mr. Y entered into an agreement for sale of his residential plot to

Mr. M, who paid an advance of Rs.500,000. According to the agreement, Mr. M

was required to pay the balance by 28.8.20X7. However, instead of paying the

balance amount, he terminated the sale agreement. Mr. Y forfeited the

advance of Rs.500,000 in accordance with the terms of the agreement.

(iii) In September 20X7, Mr. S sold his personal car, Toyota Corolla, to one of his

cousins at a price of Rs.50,000 whereas the FMV of the car was Rs.200,000.

The car was purchased by him in the year 20X4 at a cost of Rs.300,000.

(iv) Mr. I was working as a Chief Financial Officer in DW Pakistan (Pvt) Ltd, which is

a wholly owned subsidiary of DW AG, Germany. According to the Companys

policy, Mr. I was sent on secondment to Germany on 1.1.20X8 for a period of

five years. During this period, half of his salary will be credited to his bank

account in Pakistan, whereas the remaining portion will be received by him in

Germany.

(Marks 12)

Q.10.6 (Q.1 March 2009 ICAP CAF)

Mr. Manto worked as an employee in Berlin Hotel, Germany for a period of five years.

During the said period he did not visit Pakistan for a single day. He returned to

85

Chapter 10: Income Tax Practical Questions of Individuals

Pakistan on 1.7.20X7 and immediately joined as a General Manager in a well-reputed

hotel, based in Karachi.

Assume that the details of his income for the tax year 20X8 are as follows:

(i)

Basic salary (per month) Rs.100,000

House rent allowance (per month) Rs.30,000

Medical allowance (per month) Rs.10,000

(ii)

Besides medical allowance, he is also entitled to free medical treatment at

approved hospitals.

(iii)

He has been provided a company maintained 1600cc car which was used partly

for official and partly for personal purposes. The hotel has leased the car from a

bank. The gross lease rentals payable over the period of lease amount to

Rs.2,700,000. The fair market value of the car at the time of lease was

Rs.1,600,000. The total lease rentals paid by the hotel during the year

amounted to Rs.800,000.

(iv)

He is entitled to lunch at the hotels restaurants where the usual charges are

Rs.400 per person. He is entitled to concessional rate of Rs.40 per day which is

deducted from his salary. Assume that there are 300 working days in the year.

(v)

He went for a training course to Islamabad where boarding and lodging cost

amounting to Rs.150,000 was borne by the hotel. He incurred a further expense

of Rs.125,000 which was reimbursed by the hotel.

(vi)

Provident fund was deducted @10% of his basic salary. An equal amount was

contributed by the hotel. Interest credited to his provident fund account

amounted to Rs.48,000.

(vii) As per terms of employment agreed with Mr. Manto, tax payable on salary will

be borne by the hotel.

(viii) On 15.7.20X7, he received a lump sum amount of Rs.4,000,000 through a

normal banking channel as final settlement from Berlin Hotel.

(ix)

On 1.8.20X7, he inherited 25,000 shares of a private limited company. The

estimated fair market value of the shares, on the date of inheritance, was Rs.42

per share. He sold all the shares on 28.2.20X8 at Rs.62 per share.

Required:

(a) Compute Mr. Mantos taxable income and tax payable.

(b) Briefly explain the treatment of items which are not considered in the above

computation.

(Marks 18)

Q.10.7 (Q.1 Sept 2009 ICAP CAF)

Mr. Zulfiqar, a senior executive of Mirza Petroleum Ltd (MPL), retired on 31 st March

after completion of 19 years of dedicated service. The details of Mr. Zulfiqars income

for the year ended 30.6.20X8 are given below:

Income from MPL

(i)

Monthly remuneration:

86

Chapter 10: Income Tax Practical Questions of Individuals

Basic salary

Medical allowance

Utilities allowance

Cost of living allowance

Total monthly salary

Rs.

280,000

45,000

45,000

25,000

395,000

Market value of rent free accommodation provided 120,000

(ii)

As per terms of employment, tax liability of Mr. Zulfiqar to the extent of

Rs.200,000 is to be borne by MPL.

(iii)

On his retirement, he received gratuity of Rs.2,660,000 from an unrecognized

gratuity fund maintained by MPL.

(iv)

He is receiving pension amounting to Rs.50,000 per month from the date of his

retirement.

Other Information

(v) He is also receiving pension amounting to Rs.12,000 per month from a

multinational company where he worked from 1975 to 1995.

(vi)

A plot inherited from his father was sold for Rs.5,000,000. Fair market value of

the plot at the time of inheritance in the year 20X1 was Rs.1,000,000.

(vii) On 1st January, he rented out one of his residential bungalows for Rs.100,000

per month and received advance rent for two years.

(viii) Rs.500,000 were invested in new shares offered by a listed company.

(ix)

He paid mark up amounting to Rs.250,000 on a house loan obtained from a

scheduled bank. The house is being used for his residence.

(x)

He incurred a loss of Rs.20,000 on sale of a painting.

Required:

(a) Compute taxable income and tax liability of Mr. Zulfiqar.

(b) Briefly comment on the items which are not considered in the above computation.

(Marks 21)

Q.10.8 (Q.1 March 2011 ICAP CAF)

Mr. M was employed with Melody Ltd (ML) as an event organizer. On 30.6.20X7 he

resigned from his employment without completion of notice period. On 1.7.20X7 he

joined another company Rock Star Ltd (RSL) as a senior event organizer. Following

information is available relating to his assessment for the tax year 20X8:

(a) On 1.7.20X7 RSL paid Rs.280,000 to ML as compensation in lieu of un-served

notice period by Mr. M.

(b) On 15.7.20X7 Mr. M received a gratuity of Rs.350,000 from an unrecognized

gratuity fund maintained by ML. He also received Rs.150,000 as leave

encashment.

87

Chapter 10: Income Tax Practical Questions of Individuals

(c) In accordance with the terms of his employment with RSL, Mr. M was provided

with the following emoluments / benefits during the tax year 20X8:

(i)

Basic salary of Rs.245,000 per month and utility allowance of Rs.21,000 per

month.

(ii)

A reimbursement of personal medical expenses up to 15% of the annual

basic salary and Rs.250,000 on account of hospitalization charges of his

daughter were made after procuring hospital bills showing the national tax

number of the hospital. These bills were also attested and certified by RSL.

(iii)

For the first two months of his employment, a pick and drop facility was

provided to Mr. M at a monthly rent of Rs.25,000. On 1.9.20X7 RSL provided

a company maintained 1300 cc car which was partly used for private

purposes. The cost of the car was Rs.1,500,000.

(iv)

Monthly salary of Rs.6,000 was paid to Mr. Ms house keeper. Mr. M however,

reimbursed 20% of the house keepers salary to RSL.

(v)

A special allowance of Rs.50,000 was paid to meet expenses necessarily to

be incurred in the performance of his official duties. Actual expenditure was

Rs.40,000.

(vi)

On 1.1.20X8, he was provided an interest free loan of Rs.1,500,000. The

prescribed benchmark rate is 10% per annum.

(vii) A commission of Rs.500,000 for introducing new clients to the company.

Withholding tax was deducted by RSL @ 12% from such payments.

(viii) The tax deducted at source from his salary by RSL for the tax year 20X8

amounted to Rs.550,000 [other than tax deducted on commission].

(d) Apart from his employment with RSL, Mr. M also organized events for private

clients. He received a total of Rs.1,000,000 from such clients. No tax was

deducted from such receipts. However, he incurred an overall loss of Rs.350,000

on organizing these events.

(e) On 31.5.20X8 he received Rs.180,000 from Mr. A as consideration for vacating his

bungalow.

(f) He also received a share of profit from a business in Malaysia equivalent to Pak.

Rs.535,000. He paid Rs.130,000 in taxes in Malaysia on such income.

[Note for students: Foreign source loss cannot be adjusted against Pakistan

source income but Pakistan source loss can be adjusted against foreign source

income refer chapter on losses]

(g) Mr. M acquired 10,000 shares of a listed company from the Privatization

Commission of Pakistan at a price of Rs.100 per share on 31.5.20X7. He was

allowed a tax credit of Rs.100,000 in tax year 20X7 against this investment. On

20.5.20X8 he sold all the shares for Rs.1,000,000. These figures include incidental

expenses.

88

Chapter 10: Income Tax Practical Questions of Individuals

Required: Compute the taxable income, tax liability and tax payable / refundable, if

any, by Mr. M for the tax year 20X8.

(Marks 20)

Q.10.9 (Q.1 Sept 2011 ICAP CAF)

Mr. Khursheed, a Pakistani national, was employed as the chief financial officer in

Zulfiqar Gas Company (ZGC), since 20X1. Following information pertains to his

income for the tax year 2017:

(I) Income from ZGC

Khursheed was employed with ZGC up to 31.12.2016. During this period he received

the following emoluments:

Basic salary of Rs.400,000 per month, medical allowance of Rs.75,000 per

month and utility allowance equivalent to 10% of basic salary.

A company-maintained car for official and private use. The car was purchased

two years ago at a cost of Rs.5 million. According to the companys policy,

ZGC deducted Rs.10,000 per month from his salary, for private use of the car.

Khursheed had undergone a major surgery during the year and incurred an

expenditure of Rs.1,500,000. ZGC reimbursed the entire amount as a special case as

it was not covered under the terms of employment.

Due to poor health, Khursheed opted for early retirement on 31.12.2016 under the

companys voluntary retirement scheme. He received the following benefits on his

retirement:

Rs.7,500,000 as a golden handshake under the voluntary retirement scheme.

Rs.9,100,000 from an unapproved gratuity fund maintained by ZGC.

Transfer of companys car for Rs.2,600,000. The amount was deducted from

his final settlement. The fair market value of the car as of 31.12.2016 was

Rs.2,800,000.

The tax deducted at source from the salary amounted to Rs.3,600,000.

(II) Other Information

On 1.1.2017, Khursheed commenced business of marketing of horticultural

plants and related items. However, due to intense competition, he had to

wind-up this venture on 31.5.2017. During this period, he had incurred a loss

of Rs.750,000.

[Note for students: Business loss can be adjusted against any other head of

income except salary, income from property and FTR refer chapter on

losses]

89

He purchased 5,000 shares for Rs.500,000 from initial public offering of a new

listed company before 1.7.2012. He claimed a tax credit of Rs.60,000 on such

investment, against the tax payable for the tax year 2011. On 15.7.2016, he

sold these shares for Rs.700,000. Incidental expenses are included in these

figures.

Chapter 10: Income Tax Practical Questions of Individuals

He incurred a loss of Rs.500,000 on the sale of his shareholdings in a private

limited company.

He sold his personal car at a profit of Rs.300,000.

On 1.3.2017, he purchased an apartment for Rs.5,000,000. 60% of this

amount was financed by a scheduled bank under housing finance scheme.

During the tax year 2017, he paid markup amounting to Rs.127,500. On

1.4.2017, he rented out the flat to Mr. AS at a monthly rent of Rs.100,000 and

received advance rent for eight months.

His average tax rate for the preceding three years is 18%.

Required:

(a) Compute the amount of taxable income, tax liability and tax payable /

(refundable), if any, for the tax year 2017.

(13 marks)

(b) Briefly comment on the items which are not considered by you in the above

computation.

(6 marks)

Q.10.10 (Q.1 March 2013 ICAP CAF)

Mr. Creative is working as Director Human Resources at Artistic Technologies Ltd

(ATL). Following are the details of his income/receipts during the latest tax year:

(a) Monthly cash remuneration from ATL:

Basic salary

Rs.300,000

Utility allowance

15% of basic salary

Medical allowance 12% of basic salary

(b) In addition to above, he was also provided the following benefits in accordance

with his terms of employment:

(i) Rent-free furnished accommodation in a bungalow situated on a 500 square

yard plot of land. Rent for a comparable accommodation facility in the vicinity

is Rs.120,000 per month.

(ii) An 1800cc company-maintained car. The car was purchased two years ago at

a cost of Rs.1,600,000 and is used both for official and personal purposes.

(c) A house owned by Mr. Creative had been leased-out by him at a monthly rent of

Rs.50,000. The lease expired on 31 December. Mr. Creative refused to renew the

lease in spite of the tenants offer to renew the lease after increasing the rent by

10%. He returned the non-adjustable deposit of Rs.300,000 to the tenant, which

was received two years ago.

The house was immediately leased to his cousin without any security deposit on a

monthly rent of Rs.48,000.

(d) Five years ago, Mr. Creative had purchased 20,000 shares of Rs.10 each, of an

unlisted public company @ Rs.140 per share. After one year of acquisition, he

received 8,000 bonus shares from the company. The value of such bonus shares

90

Chapter 10: Income Tax Practical Questions of Individuals

was Rs.142 per share at the time of issuance of bonus shares and Mr. Creative

had paid the tax on the value of such bonus shares. During the latest tax year, he

sold 75% of the bonus shares at a price of Rs.145 per share.

(e) During the latest tax year, following investments were made:

Rs.

Approved voluntary pension fund

600,000

Open-end mutual fund

1,100,000

(f) During the latest tax year, he redeemed 4,000 units of an open-end mutual fund

at Rs.58.6 per unit. These units were purchased at the beginning of the previous

tax year at Rs.50 per unit and Mr. Creative had claimed a tax credit of Rs.40,000

on this investment. The given figures include incidental expense.

(g) Donations of Rs.50,000 were paid to charitable institutions listed in the Second

Schedule of the Income Tax Ordinance, 2001.

(h) Tax deducted at source from his salary was Rs.737,000.

Required: Compute the taxable income, tax liability and tax payable for the latest

tax year.

(Marks 20)

Q.10.11 (Q.1 Dec 2009 ICAP CFAP)

Ms. Saima is a telecommunication engineer working with a leading GSM operator as

their chief technical officer for the last many years. She has provided you with the

following information relating to her assessment for the year ended 30.6.20X9:

(i)

Monthly salary of Rs.500,000 was paid to her by the company consisting of the

following:

Rs.

Basic Salary

400,000

Medical allowance

40,000

Conveyance allowance

60,000

The salary was credited to her bank account on the 25 th of every month. She

incurred actual medical expenses of Rs.100,000 during the year. These expenses

were reimbursed to her by the company in accordance with the terms of her

employment.

(ii) She received a bonus of Rs.1 million. Employer also agreed to pay tax on such

bonus to the extent of Rs.200,000.

(iii) Apart from her employment with a GSM operator, she also served as a visiting

faculty member at a local engineering university and received a total of

Rs.450,000 net of tax deduction at source @ 10%. Ms. Saima incurred an

expenditure of Rs.70,000 towards this service.

(iv) In August 20X8, she participated and won prize money of Rs.200,000 in a quiz

competition arranged by Pakistan Urdu Academy. The prize money was paid to

her after tax deduction of Rs.40,000.

(v) She inherited a plot of land from her father on his death in July 20X1. On

1.10.20X8 she entered into a contract of sale with Mr. Moin for a consideration of

91

Chapter 10: Income Tax Practical Questions of Individuals

Rs.50 million. Mr. Moin paid a deposit of Rs.1 million and agreed to pay the

balance within one month of the date of contract. On due date, Mr. Moin

defaulted in making the payment upon which Ms. Saima forfeited the deposit in

accordance with the terms of the contract. Later on, the plot was sold to Mr.

Parkash at a price of Rs.50 million.

(vi) Ms. Saima purchased another plot of land for a consideration of Rs.56 million.

She borrowed Rs.5 million from her sister for the purchase of this plot. The

amount was received in cash.

(vii) Ms. Saima also inherited a painting from her father few years ago. The painting

was valued at Rs.500,000 at the time of inheritance. On 1.4.20X9 she gifted the

painting to her brother who came from Canada after five years. He went back to

Canada after staying in Pakistan for a period of two months. The value of the

painting was Rs.1 million when it was gifted.

Required: Compute the taxable income of Ms. Saima for the tax year 20X9. Give

brief reasons under the Income Tax Ordinance, 2001 in support of your treatment of

each of the above items.

(Marks 18)

Q.10.12 (Q.1 June 2011 ICAP CFAP)

Mr. Khan has been working for a listed company Turtle Ltd (TL) for the last many

years. The details of his emoluments during the tax year ended 30.6.20X4 are as

under:

Rs.

Basic salary (per month)

350,000

Conveyance allowance (per month)

50,000

In addition to the above cash emoluments, Mr. Khan was also provided with the

following:

(a) A rent free furnished accommodation with a fair market rent of Rs.100,000 per

month.

(b) An 1800cc company maintained car, both for business and private use. The car

was purchased by TL on 1.7.20X1 at a fair market value of Rs.2,000,000.

(c) On 1.7.20X3 he was provided with an interest free loan of Rs.2,500,000 which is

repayable in lumpsum in December 20X4. The prescribed benchmark rate is 10%

per annum.

In order to increase its operational efficiency, TL announced a redundancy scheme to

its employees. Mr. Khan opting for the scheme resigned from TL with effect from

1.1.20X4. Upon resignation, 25% of his outstanding loan balance was waived by TL

and the remaining loan amount was adjusted from his final settlement. He received

the following payments from TL:

Rs.

Compensation under the redundancy scheme 4,000,000

Gratuity under unapproved scheme

2,000,000

Following further information is also available:

(i) Tax of Rs.1,837,000 was withheld by TL from the above payments.

92

Chapter 10: Income Tax Practical Questions of Individuals

(ii) Mr. Khan was allowed to purchase the 1800cc car at an accounting book value of

Rs.1,000,000 which he sold immediately in the open market at a price of

Rs.1,500,000.

(iii) On 1.3.20X4 Mr. Khan rented out the ground floor of his bungalow to Mr. Riaz, for

establishing a departmental store, at a monthly rent of Rs.137,500. Due to the

strategic location of the store, he also received adjustable and non-adjustable

deposits of Rs.600,000 and Rs.500,000 respectively.

(iv) On 1.4.20X4 he rented out the residential portion of the bungalow to a

Commercial Bank for their marketing executive. He received gross amount of

Rs.2,400,000 as two years advance rent. The Bank deducted tax of Rs.230,000

from such payment.

(v) A donation of Rs.500,000 was made to an un-approved trust for the construction

of mosque.

(vi) Five years ago, Mr. Khan was issued shares in TL. The fair market value of shares

at the time of issue was Rs.500,000. He disposed off these shares in June 20X4 at

a gain of Rs.500,000.

Required: Compute the taxable income, tax liability and tax payable/ refundable, if

any, to Mr. Khan for the tax year 20X4. The average rate of tax of Mr. Khan for the

last three years was 18%. Note: Show all exemptions, exclusions and disallowances

where relevant.

(Marks 20)

Q.10.13 (Q.1 Dec 2012 ICAP CFAP)

Mr. Yaqeen, a Pakistani citizen, returned to Pakistan on 30.6.20X1 after residing for six

years in Norway. On 1.7.20X1 he joined a private hospital KKUH and received the

following emoluments:

Rs.

Basic salary (per month)

500,000

Medical allowance (per month) 60,000

Leave fare assistance

240,000

On 1.1.20X2 Mr. Yaqeen resigned from the hospital and joined Dil (Private) Ltd (DPL),

a company engaged in health care and production of dental products. Mr. Yaqeen

received Rs.3,000,000 from DPL as consideration for joining the company. DPL agreed

to pay following emoluments to Mr. Yaqeen for the tax year 20X2:

Rs.

Basic salary (per month)

800,000

Medical allowance (per month) 80,000

Utilities allowance (per month) 100,000

On 1.1.20X2 DPL provided him with refrigerator, cooking range and washing machine

for his use at home. The book value of these appliances was Rs.200,000 and these

were returnable to the company after four years. 15% depreciation was charged by

DPL on these appliances.

93

Chapter 10: Income Tax Practical Questions of Individuals

On 31.3.20X2 he was given an option to purchase 2,000 shares of DPL at Rs.50 per

share. The break-up value of the company on that date was Rs.150 per share. Mr.

Yaqeen did not exercise this option till 30.6.20X2.

On 1.4.20X2 he received a loan of Rs.5,000,000 from DPL for the purchase of a

house. The profit on loan was payable @ 8% per annum. The prescribed bench mark

rate is 10% per annum.

Other information relevant to Mr. Yaqeen for the tax year 20X2 is as under:

(i) On 30.4.20X2 he received salary arrears of Rs.900,000 from his ex-employer in

Norway.

(ii) Mr. Yaqeen had 30 acres of agricultural land in Dheer which he did not cultivate

himself. During tax year 20X2 he received annual rent of Rs.600,000 from the

tenant cultivating the land.

(iii) On 1.5.20X2 he spent Rs.800,000 on the renovation of his residential house. The

entire amount was obtained as a loan from a scheduled bank on which a profit of

Rs.20,000 was paid to the bank during the tax year 20X2.

(iv) On 15.6.20X2 he received insurance claim of Rs.600,000 against theft of a

painting which was stolen on 31.5.20X2. The painting was purchased by him on

1.1.20X1 for Rs.350,000. He had paid insurance premium of Rs.24,000 and also

paid lawyers fee of Rs.50,000 who represented him in the settlement

proceedings.

(v) On 15.7.20X1 Mr. Yaqeen received 20,000 shares in AB (Private) Ltd (ABL), a

company incorporated under the Companies Ordinance, 1984 as a dividend in

specie. On 30.6.20X2 he sold 15,000 shares in ABL for Rs.425,000. The fair

market value of these shares, on the date of issue, was estimated at Rs.25 per

share.

Required: Under the provisions of Income Tax Ordinance, 2001 compute the taxable

income and net tax payable for the tax year 20X2. Give brief reasons for the

treatment of items in (iv) and (v) above. Also explain the treatment of any items that

are not appearing in your computation.

(Marks 25)

Q.10.14 (Q.1 Dec 2013 ICAP CFAP)

Mr. Iqbal, aged 45 years, is working as a Chief Engineer in a listed company Tameer

Ltd (TL). The company is engaged in the manufacture of chipboards for the local

market. He derived following emoluments during the tax year ended 30.6.20X4:

Rs.

Basic salary (per month)

300,000

Cost of living allowance (per month)

50,000

Milk allowance (per month)

10,000

In addition to the above emoluments, Mr. Iqbal was also provided the following:

(i) Special bonus equal to one months basic salary paid on 5.6.20X4.

94

Chapter 10: Income Tax Practical Questions of Individuals

(ii) A new company maintained car for his personal use. The car was purchased on

1.3.20X4 at a cost of Rs.1,800,000. However, the cost of the car would have been

Rs.3,000,000 had the company obtained it on finance lease. Mr. Iqbal, in

accordance with the terms of his employment, purchased his previous car from TL

for Rs.250,000. This car was provided to him solely for business purposes. The fair

market value of the car at the time of sale to Mr. Iqbal was Rs.600,000.

(iii) A reimbursement of Rs.36,000 in respect of drivers salary. Mr. Iqbal paid

Rs.60,000 to the driver for four months.

(iv) A fully furnished accommodation in DHA, Karachi. The fair market value of the

rent was estimated to be Rs.85,000 per month.

(v) An option to acquire 4,000 shares in TLs parent company, Tameer Inc. which is

listed on New York Stock Exchange was granted to him in May 20X3. Mr. Iqbal

exercised the option on 5.1.20X4 at a price of USD 1.5 per share. The market

value of the shares at the close of business on 5.1.20X4 was USD 2.5 per share.

He sold 3,000 shares on 30.6.20X4 at a price of USD 3 per share. The dollar rupee

parity on both the above dates was USD 1 = Rs.100.

(vi) On 15.5.20X4 Mr. Iqbal was provided 800 shares in TL as a reward for his

excellent performance. However, he was restricted from selling or transferring

these shares before 16.11.20X4. The market value of these shares at the close of

business on 15.5.20X4 was Rs.12.5 per share.

Mr. Iqbal received additional income from the following sources, for the tax year

20X4:

(i) Brokerage fee of Rs.200,000 in connection with the transfer of two apartments in

Islamabad. The brokerage fee was received in cash. Mr. Iqbal incurred an expense

of Rs.30,000 against telephone costs and air travel to Islamabad in connection

with the above deal. He also paid Rs.10,000 as a gift to his brother for showing

the apartments to his clients in Islamabad.

(ii) Profit of Rs.150,000 on a savings account maintained with an Islamic bank. The

bank deducted withholding tax of Rs.15,000.

(iii) Zakat of Rs.25,000 has been deducted by the bank.

(iv) He also received an income tax refund of Rs.225,000 related to tax year 20X2.

The amount included Rs.25,000 being compensation for delayed refund.

(v) Annual rent of Rs.800,000 from letting out a building to KK Enterprise. Following

expenses were incurred by Mr. Iqbal in relation to the building: Repairs

Rs.200,000, Fire insurance premium Rs.30,000, Ground rent Rs.10,000,

Watchmans salary Rs.8,000 and Interest of Rs.15,000 on a loan obtained for

building renovation by creating first charge on the building in favour of a

scheduled bank.

Other related information is as under:

95

TL deducted withholding tax of Rs.1,200,000 from Mr. Iqbals salary during

tax year 20X4.

Chapter 10: Income Tax Practical Questions of Individuals

On 1.7.20X3, Mr. Iqbal acquired a life insurance policy and paid a premium

of Rs.500,000. He also contributed Rs.1,600,000 to an approved pension fund.

On 1.6.20X3, he purchased 50,000 shares in a listed company AB Ltd at a

price of Rs.20 each. On 1.1.20X4, AB Ltd announced 20% right shares to

existing shareholders at a price of Rs.18 per share. On 25.1.20X4, Mr. Iqbal

subscribed the right issue in full.

During tax year 20X3 his assessed taxable income was Rs.3,000,000.

Required: Under the Income Tax Ordinance, 2001 and Rules made thereunder,

compute the taxable income and income tax payable by or refundable to Mr. Iqbal for

the tax year ended 30.6.20X4. Show all exemptions, exclusions and disallowances

where relevant.

(Marks 22)

Q.10.15 (Q.6 June 2015 ICAP CFAP)

Mr. Pansari, a Pakistani citizen, is working as a company secretary in Sukoon Ltd (SL),

an un-listed public company, engaged in the business of production and supply of

olive oil.

Following are the details of his emoluments during the year ended 30.6.20X4:

Basic salary per month

Conveyance allowance per month

Rs.

450,000

50,000

In addition to the above cash emoluments, Mr. Pansari was also provided with the

following:

(i)

A 2000cc company maintained car both for business and private use. The car

was purchased in tax year 20X3 at a cost of Rs.3,000,000. However, the current

market value of the car is Rs.3,500,000.

(ii)

A special payment of Rs.75,000 in lieu of leave was made available to him. Mr.

Pansari however, voluntarily waived his right to receive such payment.

(iii)

Free provision of two cans of olive oil per month. The market value of each can

was Rs.500.

(iv)

In July 20X2 he was granted an employee stock option to purchase up to 15,000

shares in SLs holding company Trio Ltd, situated in Bermuda, at an option price

of USD 3 per share. The shares were required to be purchased within 18 months

from the option date. Mr. Pansari exercised the option in September 20X3 to

purchase 8,000 shares when the market price of the shares was USD 5 per

share. After two months of the acquisition, Mr. Pansari sold 6,000 shares at a

price of USD 8.5 per share. [Assume the dollar rupee parity on the above dates

was USD 1 = PKR 102].

Following further information is also available:

96

Chapter 10: Income Tax Practical Questions of Individuals

(i)

Received a royalty of Rs.2,000,000 from K Publishing on a book written on Wild

Hunting. Mr. Pansari completed the book in 19 months and all the costs relating

to its publication were borne by the publisher. The applicable tax rates in tax

years 20X2 and 20X3 were 16% and 18% respectively.

(ii)

Received a pension of Rs.50,000 from his ex-employer.

(iii)

Rs.200,000 gross fee for attending a directors meeting of SLs associated

company Nice (Pvt) Ltd held in June 20X3 received in July 20X3 after tax

deduction @ 20%.

(iv)

There was a brought forward capital loss of Rs.25,000. The loss was suffered by

Mr. Pansari on sale of shares in Ghareeb (Pvt) Ltd in the immediately preceding

tax year.

Required: Under the provisions of the Income Tax Ordinance, 2001 and Rules made

thereunder, compute the taxable income of Mr. Pansari for the tax year 20X4.

Note: Show all relevant exemptions, exclusions and disallowances.

(Marks 8)

ANSWERS

Answer to Q.10.1

Mr. A

Tax Year 20X8

Computation of taxable income and tax liability

Rs.

SALARY

Basic salary

Bonus

Utility allowance

Leave encashment

Other allowance

House rent allowance

Directors fee

CAPITAL GAIN

Gain on sale of shares of an unlisted company i.e. private

company

97

4,004,520

1,980,642

400,452

538,083

90,000

1,802,040

52,000

8,867,737

4,206,000

Chapter 10: Income Tax Practical Questions of Individuals

75% is taxable being holding period is more than one

year

INCOME FROM PROPERTY

Actual rent Rs.480,000 or fair market rent Rs.450,000 whichever is

higher

Taxable income

Less: Property income taxable at separate rates

Income taxable at normal slab rates

Tax liability (salaried case)

Income tax on Rs.7,000,000

Income tax on Rs.5,022,237 @ 30%

Income tax on property income 5% of (Rs.480,000

200,000)

Total tax liability

Less: Tax withheld from salary 1,800,000 + 10,400

Tax payable with return of income

3,154,500

480,000

12,502,23

7

480,000

12,022,23

7

1,422,000

1,506,671

2,928,671

14,000

2,942,671

1,810,400

1,132,271

Note for income covered under FTR: Bank profit is taxable under FTR @ 10%.

Answer to Q.10.2

Mr. B

Tax Year 20X8

Computation of taxable income and tax liability

SALARY

Basic salary

Bonus

Utility allowance

Relocation allowance

Accommodation: 45% of basic salary

Car: 5% of Rs.2 million

Children Education Fee

House servant salaries

Tax borne by the employer (working note)

Taxable salary

Income from property Chargeable rent 7 x 50,000

Taxable income

Less: Property income taxable at separate rates

Income taxable at normal slab rates

Rs.

8,800,000

5,000,000

880,000

200,000

3,960,000

100,000

105,000

230,000

1,883,571

21,158,57

1

350,000

21,508,57

1

350,000

21,158,57

1

98

Chapter 10: Income Tax Practical Questions of Individuals

Tax liability (salaried case)

Income tax on Rs.7,000,000

Income tax on Rs.14,158,571 @ 30%

Income tax on property income 5% of (Rs.350,000

200,000)

Total tax liability

Less: Tax paid by the employer

Tax withheld from salary

On receipt of rent

1,422,000

4,247,571

5,669,571

7,500

1,883,5

71

3,786,0

00

7,500

5,677,071

5,677,071

Tax payable

Nil

Note for tax borne by the employer:

Taxable perquisites on which tax shall be borne by the employer

Accommodation: 45% of basic salary

Car: 5% of Rs.2 million

Children Education Fee

House servant salaries

3,960,000

100,000

105,000

230,000

4,395,000

As taxable salary exceeds Rs.7 million, applicable tax rate would be 30%

Tax @ 30% on Rs.4,395,000

Grossed up tax 1,318,500 / 70%

1,318,500

1,883,571

Note for income covered under FTR: Bank profit is taxable under FTR @ 10%.

Answer to Q.10.3

Mr. Imran

Tax Year 20X8

Computation of taxable income

Rs.

SALARY from UAE company

Exempt from tax in Pakistan (Note)

SALARY from Pakistan subsidiary

Basic salary 500,000 x 9

Medical allowance 45,000 x 9

Less: Exempt up to 10% of basic salary

TV and VCR: 20% of 40,000 = 8,000 x (9/12)

Interest free loan: 5 million x 10% for 9 months

Housing cost in Dubai paid by the Pakistani company:

30,000 x 9

Traveling cost: 30,000 x 9

Employee Share Scheme

99

--

4,500,000

405,000

450,000

Nil

6,000

375,000

270,000

270,000

Chapter 10: Income Tax Practical Questions of Individuals

- Disposal of option 200 shares x 171

- Shares acquisition ($10 - $8) x 58 x 300

Taxable salary

Income from property Chargeable rent 7 x 50,000

Taxable income

Less: Property income taxable at separate rates

Income taxable at normal slab rates

34,200

34,800

69,000

5,490,000

350,000

5,840,000

350,000

5,490,000

Note for salary from UAE company:

Salary earned outside Pakistan shall be exempt if a citizen of Pakistan leaves Pakistan

during a tax year and remains abroad during that tax year Section 51(2).

Therefore, foreign source salary of Mr. Imran would not be taxable in Pakistan.

Answer to Q.10.4

Ms. FH

Tax Year 20X8

Computation of taxable income

Rs.

SALARY

Basic salary 100,000 x 11

House rent allowance 40,000 x 11

Utility allowance 15,000 x 11

Purchase of car from the employer 300,000 100,000

Payment to accept the offer of PIL

CAPITAL GAIN

Shares in Queens Pakistan (Pvt) Ltd (500,000 200,000) x

75%

Taxable income

1,100,000

440,000

165,000

200,000

200,000

2,105,000

225,000

2,330,000

Notes for items not included in taxable income:

a) Car for office use: No amount is taxable if the car is used exclusively for office

use.

b) Residential plot: Gain on disposal of immovable property held for more than

3 years is not taxable and therefore gain on disposal of residential plot

inherited in the year 20X1 is not included in taxable income.

c) Painting: Painting is a capital asset. However, there is a specific category of

capital assets including painting on which capital gain, if any, is taxable but

capital loss is not recognized. Therefore, capital loss on disposal of painting is

not considered in the computation of income.

100

Chapter 10: Income Tax Practical Questions of Individuals

d) Donation: Rebate is allowed on donation to an approved charitable institution

through banking channel.

Notes on income covered under FTR:

The following items are covered under Final Tax Regime whereby tax deduction at

source is considered as full and final tax and therefore these items are not included in

normal taxable income:

Gross amount

Final Tax

Cash prize in a quiz show 20%

250,000

50,000

Dividend 12.5%

50,000

6,250

Service income from outside Pakistan 5%

100,000

5,000

[Clause 3 Part II 2nd Schedule]

Answer to Q.10.5

(i)

A rare sculpture is a capital asset and its disposal is taxable under the head

Capital Gain. Where a taxable capital asset is held for more than one year

then 25% of the capital gain is exempt and 75% is taxable. Therefore, capital

gain of Rs.500,000 200,000 = 300,000 x 75% = Rs.225,000 is taxable.

(ii)

Forfeited deposit under a contract for sale of immovable property is included

in the definition of rent under the head income from property which is taxable

as separate block of income at the specified rates without considering

expenses related to property.

(iii) Car held for personal use is not a capital asset and therefore its disposal does

not fall within the ambit of capital gain. Sale of a personal car is a capital

receipt which is not taxable under any head of income.

(iv) Salary shall be Pakistan source income where the salary is received from any

employment exercised in Pakistan, wherever paid. As the services are

performed outside Pakistan, salary in this case shall be foreign source salary.

Foreign source salary shall be exempt if a citizen of Pakistan leaves Pakistan

during a tax year and remains abroad during that tax year Section 51(2).

Therefore, foreign source salary in this case would not be taxable in Pakistan.

Answer to Q.10.6

(a)

Mr. Manto

Tax year 20X8

Computation of Taxable Income and Tax payable

Rs.

Salary

Basic salary

House rent allowance

Medical allowance

Company maintained car: 5% of the FMV of Rs.1,600,000

Provident fund (assumed to be recognised)

101

1,200,000

360,000

120,000

80,000

Chapter 10: Income Tax Practical Questions of Individuals

Companys contribution 10% of basic salary

120,000

Less: Exempt up to Rs.150,000 or 10% of basic +

Dearness allowance whichever is lower

120,000

Nil

Interest credited 48,000 / (120,000 + 120,000) = 20%

Interest credited @ 20%

48,000

Less: Interest @ 16% i.e. Rs.38,400 or 1/3rd of basic +

Dearness allowance whichever is lower

38,400

9,600

Taxable salary excluding tax borne by the company

1,769,600

Tax borne by the company (working note)

159,612

Taxable salary

1,929,212

Capital Gain

Sale proceed 62 x 25,000

1,550,000

Less: FMV at the time of inheritance is deemed cost @ 421,050,000

Fully taxable being holding period not more than one year

500,000

Taxable income

2,429,212

Working for Tax borne by the company

Taxable salary excluding tax borne by the company Rs.1,769,600

In this case tax slab will change due to tax borne by the employer

Taxable salary excluding tax borne by the employer 1,769,600

Initial tax of the next slab

137,000

1,906,600

Income tax on Rs.1,800,000

Income tax on Rs.106,600 @ 17.5% = 18,655

Grossed up amount of Rs.18,655 / 82.5%

Grossed up tax

Proof of the above grossed up figure

Taxable salary excluding tax borne by the

employer

Tax borne by the employer

Taxable salary

Tax on Rs.1,800,000

Tax on Rs.129,212 @ 17.5%

137,000

22,612

159,612

1,769,600

159,612

1,929,212

137,000

22,612

159,612

Tax liability (salaried case)

Income tax on Rs.1,800,000

Income tax on Rs.629,212 @ 17.5%

Less: Tax borne by the employer

Tax payable with the return of income

137,000

110,112

247,112

159,612

87,500

(b) Explanations for items not taken into consideration

102

Chapter 10: Income Tax Practical Questions of Individuals

1. Free medical treatment

Free medical treatment is exempt if it is in accordance with terms of

employment where National Tax Number of the medical practitioner along

with employers attestation are available. However, in this case medical

allowance is fully taxable.

2. Lunch

Certain perquisites without marginal cost to the employer are exempt which

include free or subsidized food provided by hotels and restaurants to its

employees during duty hours.

3. Training course

It is assumed that the training course was required and beneficial for

performance of office duty. Any perquisite or allowance solely expended for

office purpose is not a part of salary.

4. Final settlement from Berlin Hotel

If an individual citizen of Pakistan (returning expatriate) is resident in the

current tax year but was non-resident in the 4 preceding tax years, his

foreign-source income shall be exempt in the current tax year and in the

following tax year.

Mr. Manto was out of Pakistan for the last 5 years and returned to Pakistan in

the beginning of the tax year 20X8. Therefore, he is a returning expatriate as

per Pakistan tax law and his foreign source income including salary income

would be exempt from tax.

Answer to Q.10.7

(a)

Mr. Zulfiqar

Tax year 20X8

Computation of Taxable Income and Tax payable

Salary

Basic salary 280,000 x 9

Medical allowance 45,000 x 9

405,000

Less: Exempt up to 10% of basic salary

252,000

Utility allowance 45,000 x 9

Cost of living allowance 25,000 x 9

Rent free accommodation 45% of basic salary

Tax liability borne by the employer

Gratuity from unrecognised fund

2,660,000

Less: Exempt up to Rs.75,000 or 50% of amount

receivable whichever is lower

75,000

Pension

9 months from a multinational company (one pension is received)

3 months (more than one pension): Rs.50,000 per month or

Rs.12,000 per month whichever is lower is taxable

Taxable salary

103

Rs.

2,520,000

153,000

405,000

225,000

1,134,000

200,000

2,585,000

exempt

36,000

7,258,000

Chapter 10: Income Tax Practical Questions of Individuals

Income from property Chargeable rent 100,000 x 6

Total income

Less: Mark up paid on housing scheme to a scheduled bank

Taxable income

Less: Property income taxable at separate rates

Income taxable at normal slab rates

600,000

7,858,000

250,000

7,608,000

600,000

7,008,000

Tax liability (salaried case)

Income tax on Rs.7,000,000

Income tax on Rs.8,000 @ 30%

1,422,000

2,400

1,424,400

20,000

1,444,400

Income tax on property income

Total tax liability

Less: Tax credit on investment in shares

(1,444,400 / 7,608,000) x 500,000

Total tax liability

Tax to be borne by the employer

Tax liability of Mr. Zulfiqar

94,926

1,349,474

200,000

1,149,474

(b) Explanations for items not taken into consideration

Residential plot: Gain on disposal of immovable property held for more than 3

years is not taxable and therefore gain on disposal of residential plot inherited in the

year 20X1 is not included in taxable income.

Painting: Painting is a capital asset. However, there is a specific category of capital

assets including painting on which capital gain, if any, is taxable but capital loss is

not recognized. Therefore, capital loss on disposal of painting is not considered in the

computation of income.

Answer to Q.10.8

Mr. M

Tax Year 20X8

Computation of taxable income and tax liability

SALARY

Profit in lieu of salary

Gratuity received from unrecognized fund maintained by

ML

Less: Exempt up to lower of 50% of gratuity or Rs.75,000

Leave encashment

Basic salary (245,000 x 12)

Utility allowance (21,000 x 12)

Company maintained car (5% of Rs.1,500,000 x 10/12)

Salary of house keeper (6,000 x 12 x 80%)

Interest free loan (1,500,000 x 10% x 6/12)

Commission from ML

INCOME FROM BUSINESS

Rs.

350,000

75,000

280,000

275,000

150,000

2,940,000

252,000

62,500

57,600

75,000

500,000

4,592,100

104

Chapter 10: Income Tax Practical Questions of Individuals

Foreign source business income from Malaysia

Pakistan source business loss

535,000

(350,00

0)

INCOME FROM OTHER SOURCES

Consideration received for vacating possession (180,000 /

10)

18,000

Taxable income

4,795,100

Tax liability (salaried case)

Income tax on Rs.4,000,000

Income tax on Rs.795,100 @ 27.5%

Less: Tax credit on foreign source income on lower of:

Tax paid in Malaysia

Pakistan tax payable (815,653 / 4,795,100) x 185,000

Whichever is lower

Reversal of tax credit on investments in shares

Income tax liability

Less: Tax withheld from salary

Tax withheld on commission receipts (500,000 x 12%)

Tax payable with return of income

185,000

597,000

218,653

815,653

130,000

31,469

550,000

60,000

31,469

784,184

100,000

884,184

610,000

274,184

Notes:

a) Profits in lieu of salary: Compensation paid by RSL in lieu of un-served

notice period by Mr. M is taxable as profits in lieu of salary as the same is

received as consideration to enter into employment agreement with RSL.

b) Company maintained car: 5% of the cost of car to the employer is taxable

where the car is used for office and private purposes.

c) Interest free loan: Since interest free loan is obtained from employer, such

benefit at the benchmark rate at 10% is taxable as salary.

d) Commission received: Commission is received from the employer while

performing employment duties it is therefore taxable as salary and the tax

withheld from commission is adjustable from tax payable. However, if

commission is received from any person other than employer, it is taxable

under the head Income from Business under FTR.

e) Receipts from Private clients: Receipts from private clients is not a part of

employment it is therefore taxable as Income from Business. Business loss

can be adjusted against any head of income other than salary, income from

property and FTR.

f)

105

Tax credit recouped: Tax credit allowed on shares is subject to the condition

that the shares must be held for a period of 24 months from the date of

purchase. Since they have been disposed off within a period of 24 months

therefore the tax credit availed previously is recouped in the current tax year.

Chapter 10: Income Tax Practical Questions of Individuals

Explanations for items not taken into consideration

a) Reimbursement of medical expenses: Reimbursement of medical

expenses is exempt as the same is attested and certified by RSL and NTN of

hospital is also available.

b) Pick and drop facility: Since the facility is provided exclusively for business

purpose the same is therefore exempt.

c) Special Allowance: Any special allowance paid to meet expenses incurred in

performing official duties is exempt irrespective of the actual expenditure

incurred.

Answer to Q.10.9

Mr. Khursheed

Tax Year 2017

Computation of taxable income and tax liability

Rs.

SALARY

Basic salary 400,000 x 6

Utility allowance 2,400,000 x 10%

Medical allowance 75,000 x 6

Less: 10% of basic salary

Medical reimbursement not in accordance with terms

Company maintained car (5% of Rs.5,000,000 x 6/12)

Less: amount deducted from salary 10,000 x 6

Golden handshake payment

Gratuity from unapproved fund

Less: Rs.75,000 or 50% of gratuity whichever is lower

Vehicle purchased from employer 2,800,000 2,600,000

Taxable salary

450,000

240,000

125,000

60,000

9,100,0

00

75,00

0

INCOME FROM PROPERTY

Chargeable rent 100,000 x 3

INCOME FROM BUSINESS

Tax loss on private business (It can be c/f but can not be

adjusted against salary, income from property and FTR)

Total income

Less: Mark up under housing finance scheme

Taxable income

2,400,000

240,000

210,000

1,500,000

65,000

7,500,000

9,025,000

200,000

21,140,00

0

300,000

(750,00

0)

--21,440,00

0

127,500

21,312,50

0

106

Chapter 10: Income Tax Practical Questions of Individuals

Bifurcation of taxable income

Golden handshake [taxable @ 18% as separate block of

income]

Income from property taxable at separate rates

Income taxable at normal rates

7,500,000

300,000

13,512,50

0

21,312,50

0

Tax liability (salaried case)

Income tax on Rs.7,000,000

Income tax on Rs.6,512,500 @ 30%

1,422,000

1,953,750

3,376,250

1,350,000

5,000

Income tax on golden handshake of Rs.7,500,000 @ 18%

Income tax on property income @ 5% of (Rs.300,000

200,000)

4,731,250

3,600,000

1,131,250

Less: Tax withheld from salary

Tax payable with return of income

Explanations for items not taken into consideration

a) Gain on sale of listed shares: Where shares of a listed company were

acquired before 1.7.2012 then gain on disposal of such shares is exempt from

tax and therefore not included in taxable income.

b) Reversal of tax credit on investment in listed shares is not required as the

shares were disposed of after 24 months.

c) Capital loss: Where a person sustains capital loss on disposal of shares of a

private company it can not be set-off against any other head of income but it

can be carried forward for subsequent six tax years against capital gain.

d) Sale of personal car: Car held for personal use is not included in the

definition of capital asset nor is it stock in trade and therefore its disposal is

not a taxable activity in the hands of Mr. Khursheed.

Answer to Q.10.10

Mr. Creative

Tax Year ____

Computation of taxable income and tax liability

Rs.

SALARY

Basic salary 300,000 x 12

Utility allowance 15% of basic salary

Medical allowance 12% of basic salary

Less: 10% of basic salary

Accommodation 45% of basic salary

Company maintained car 5% of Rs.1,600,000

Taxable salary

107

432,000

360,000

3,600,000

540,000

72,000

1,620,000

80,000

5,912,000

Chapter 10: Income Tax Practical Questions of Individuals

INCOME FROM PROPERTY

Chargeable rent (50,000 x 6) + (55,000 x 6)

CAPITAL GAIN

Disposal of bonus shares of unlisted company u/s 37

Sale proceed 6,000 bonus shares x Rs.145

Amount already taxed as dividend @ Rs.142

630,000

870,000

852,000

18,000

75% is taxable being holding period more than one

year

13,500

Disposal of mutual funds taxable u/s 37A

4,000 x (Rs.58.6 50)

34,400

Total income

Less: Donation under 2nd Schedule

6,589,900

50,000

Taxable income

Income from property taxable at separate rates

Capital gain u/s 37A taxable at separate rate

Income taxable at normal slab rates

6,539,900

630,000

34,400

Tax liability (salaried case)

Income tax on Rs.4,000,000

Income tax on Rs.1,875,500 @ 27.5%

Income tax on property income Rs.20,000 + 10% of

Rs.30,000

Income tax on capital gain 12.5% of Rs.34,400

Tax rebate on mutual fund

Amount eligible for rebate = actual cost or 20% of

taxable income or Rs.1,500,000 whichever is lower =

Rs.1,100,000

1,140,063 / 6,539,900 x 1,100,000

Reversal of tax credit on investments in mutual fund

[disposal within the period of 24 months]

Tax rebate on APF

Amount of eligible for rebate = actual amount or 20%

of taxable income whichever is lower = Rs.600,000

1,140,063 / 6,539,900 x 600,000

Income tax liability

Less: Tax withheld from salary

Tax payable with return of income

664,400

5,875,500

597,000

515,763

23,000

4,300

1,140,063

191,757

(40,000)

104,595

256,352

883,711

737,000

146,711

Answer to Q.10.11

Ms. Saima

108

Chapter 10: Income Tax Practical Questions of Individuals

Tax Year 20X9

Computation of taxable income

SALARY

Basic salary 400,000 x 12 months

Medical allowance 40,000 x 12

Conveyance allowance 60,000 x 12

Reimbursement of medical expenses exempt

Bonus

Tax borne by the employer

Taxable salary

4,800,000

480,000

720,000

-1,000,000

200,000

7,200,000

Income from Property

Forfeited deposit against contract for sale of plot as rent

1,000,000

Income from Business

Service income 450,000 / 90%

Less: Expenditures related to service income

500,000

70,000

Capital Gain

Consideration received (i.e. FMV of painting at the time of gift)1,000,000

Less: Deemed cost i.e. FMV at the time of inheritance

500,000

Capital gain

500,000

75% of the gain as the holding period is more than one year

Income from Other sources

Loan received in cash

Taxable income

Less: Property income taxable at separate rates

Income taxable at normal rates

430,000

375,000

5,000,000

14,005,000

1,000,000

13,005,000

Notes:

(1) Medical allowance is fully taxable where medical expenses are reimbursed as

per policy. However, reimbursement of medical expenses is exempt assuming

that NTN of medical practitioner and employers attestation are available.

(2) Tax borne by the employer is a taxable perquisite.

(3) Service income as a visiting faculty is taxable under NTR as business income.

(4) Prize winning in a quiz competition is taxable under FTR @ 20% and the tax

deduction is the full and final discharge of tax liability. Therefore, it is not

included in normal taxable income.

(5) Sale of plot inherited is exempt as the holding period is more than 3 years.

However, deposit forfeited under a contract for sale of immovable property is

included in the definition of rent and therefore taxable under the head income

from property as separate block of income.

(6) Loan received in cash is taxable under the head income from other sources.

(7) Gift of painting to brother is taxable under the head capital gain as the

painting is a capital asset. Non-recognition rule is not applicable in this case

109

Chapter 10: Income Tax Practical Questions of Individuals

as the recipient of gift is a non-resident person. FMV at the time of gift is

treated as consideration received and FMV at the time of inheritance from her

father is treated as deemed cost of the painting.

Answer to Q.10.12

Mr. Khan

Tax Year 20X4

Computation of taxable income and tax liability

SALARY

Basic salary 350,000 x 6 months

Conveyance allowance 50,000 x 6

Rent free accommodation 45% of basic salary

Company maintained car 2,000,000 x 5% for 6 months

Interest free loan 2,500,000 x 10% for 6 months

Waiver of loan 25% of Rs.2,500,000

Compensation under redundancy scheme (separate block of income)

Gratuity from unapproved scheme

2,000,000

Less: exempt up to Rs.75,000 or 50% of amount receivable

whichever is lower

75,000

Car purchased from the employer:

FMV Rs.1,500,000 payment Rs.1,000,000

Taxable salary

Income from property

Rent of ground floor Rs.137,500 x 4 months

10% of non-adjustable deposit of Rs.500,000

Rent of residential portion Rs.2,400,000 x 3/24

Capital Gain

Gain on disposal of listed company shares

Taxable income

Breakup of taxable income

Compensation taxable as separate block of income

Income from property taxable at separate rates

Capital gain u/s 37A taxable at separate rates