Professional Documents

Culture Documents

Beams9esm ch01

Uploaded by

BriandLukeOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Beams9esm ch01

Uploaded by

BriandLukeCopyright:

Available Formats

Chapter 1

Chapter 1

BUSINESS COMBINATIONS

Answers to Questions

1

A business combination is a union of business entities in which two or more previously separate and

independent companies are brought under the control of a single management team. FASB Statement No.

141 describes three situations that establish the control necessary for a business combination, namely,

when one or more corporations become subsidiaries, when one company transfers its net assets to another,

and when each combining company transfers its net assets to a newly formed corporation.

The dissolution of all but one of the separate legal entities is not necessary for a business combination. An

example of one form of business combination in which the separate legal entities are not dissolved is when

one corporation becomes a subsidiary of another. In the case of a parent-subsidiary relationship, each

combining company continues to exist as a separate legal entity even though both companies are under the

control of a single management team.

A business combination occurs when two or more previously separate and independent companies are

brought under the control of a single management team. Merger and consolidation in a generic sense are

frequently used as synonyms for the term business combination. In a technical sense, however, a merger is

a type of business combination in which all but one of the combining entities are dissolved and a

consolidation is a type of business combination in which a new corporation is formed to take over the

assets of two or more previously separate companies and all of the combining companies are dissolved.

Goodwill arises in a business combination accounted for under the purchase method when the cost of the

investment (price paid plus direct costs) exceeds the fair value of identifiable net assets acquired. Under

FASB Statement No. 142, goodwill is no longer amortized for financial reporting purposes and will have

no effect on net income, unless the goodwill is deemed to be impaired. If goodwill is impaired, a loss will

be reocnized.

Negative goodwill is the opposite of goodwill. It results from a purchase business combination in which

the fair value of identifiable net assets acquired exceeds the investment cost. Any negative goodwill must

be applied to a proportionate reduction of noncurrent assets other than marketable securities. If negative

goodwill is greater than the fair value of all noncurrent assets acquired other than marketable securities,

the excess is written off as an extraordinary loss on the income statement under FASB Statement No. 141.

Business Combinations

SOLUTIONS TO EXERCISES

Solution E1-1

1

2

3

4

5

a

b

a

c

d

Solution E1-2 [AICPA adapted]

1

d

Plant and equipment should be recorded at $45,000, the $55,000 fair

value less the $10,000 excess fair value of net assets acquired over

investment cost.

c

Investment cost

$800,000

Less: Fair value of net assets

Cash

Inventory

Property and equipment net

Liabilities

Goodwill

$ 80,000

190,000

560,000

(180,000)

650,000

$150,000

Solution E1-3

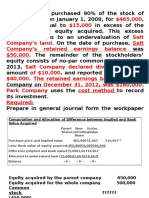

Stockholders equity Pillow Corporation on January 3

Capital stock, $10 par, 300,000 shares outstanding

$3,000,000

Additional paid-in capital

[$200,000 + $1,500,000 $5,000]

1,695,000

Retained earnings

Total stockholders equity

600,000

$5,295,000

Entry to record combination:

Investment in Sleep-bank

Capital stock, $10 par

Additional paid-in capital

3,000,000

1,500,000

1,500,000

Investment in Sleep-bank

Additional paid-in capital

Cash

10,000

5,000

15,000

Check: Net assets per books

Goodwill

Less: Issuance of stock

$3,800,000

1,510,000

(15,000)

$5,295,000

2

Chapter 1

Business Combinations

Solution E1-4

Journal entries on IceAges books to record the purchase

Investment in Jester

2,550,000

Common stock, $10 par

1,200,000

Additional paid-in capital

1,350,000

To record issuance of 120,000 shares of $10 par common stock with a fair

value of $2,550,000 for the common stock of Jester in a purchase

business combination.

Investment in Jester

25,000

Additional paid-in capital

15,000

Expenses of combination

20,000

Other assets

60,000

To record costs of registering and issuing securities as paid-in

capital, direct cost of combination as investment, and indirect costs of

combination as expenses.

Current assets

1,100,000

Plant assets

1,775,000

Liabilities

300,000

Investment in Jester

2,575,000

To record allocation of the $2,575,000 cost of Jester Company to

identifiable assets and liabilities according to their fair values,

computed as follows:

Cost

$2,575,000

3,000,000

$ 425,000

Fair value acquired

Negative goodwill

Plant assets at fair value

$2,200,000

Less: Negative goodwill

Cost allocated to plant assets

425,000

$1,775,000

Chapter 1

Solution E1-5

Journal entries on the books of Danders Corporation to record merger with

Harrison Corporation:

Investment in Harrison

530,000

Common stock, $10 par

180,000

Additional paid-in capital

150,000

Cash

200,000

To record issuance of 18,000 common shares and payment of cash in the

acquisition of Harrison Corporation in a merger.

Investment in Harrison

70,000

Additional paid-in capital

30,000

Cash

100,000

To record costs of registering and issuing securities and additional

direct costs of combination.

Cash

40,000

Inventories

100,000

Other current assets

20,000

280,000

Plant assets net

Goodwill

230,000

Current liabilities

30,000

Other liabilities

40,000

Investment in Harrison

600,000

To record allocation of cost to assets received and liabilities assumed

on the basis of their fair values and to goodwill computed as follows:

Cost of investment

Fair value of assets acquired

Goodwill

$600,000

370,000

$230,000

Business Combinations

SOLUTIONS TO PROBLEMS

Solution P1-1

Preliminary computations

Cost of investment in Sain at January 2

(30,000 shares $20) + $25,000 direct costs of combination

Book value acquired

Excess cost over book value acquired

$625,000

(440,000)

$185,000

Excess allocated to:

Current assets

Remainder to goodwill

Excess cost over book value acquired

$ 40,000

145,000

$185,000

Pine Corporation

Balance Sheet at January 2, 2006

Assets

Current assets

($130,000 + $60,000 + $40,000 excess - $40,000 direct costs)

190,000

Land ($50,000 + $100,000)

150,000

Buildings net ($300,000 + $100,000)

400,000

Equipment net ($220,000 + $240,000)

460,000

Goodwill

Total assets

145,000

$1,345,000

Liabilities and Stockholders Equity

Current liabilities ($50,000 + $60,000)

110,000

Common stock, $10 par ($500,000 + $300,000)

800,000

Additional paid-in capital

[$50,000 + ($10 30,000 shares) $15,000 costs of issuing

and registering securities]

335,000

Retained earnings

Total liabilities and stockholders equity

100,000

$1,345,000

Chapter 1

Solution P1-2

Preliminary computations

Cost of acquiring Seabird ($825,000 + $100,000 direct costs)

Fair value of assets acquired and liabilities assumed

Goodwill from acquisition of Seabird

$925,000

670,000

$255,000

Pelican Corporation

Balance Sheet

at January 2, 2006

Assets

Current assets

Cash [$150,000 + $30,000 - $140,000 expenses paid]

40,000

Accounts receivable net [$230,000 + $40,000 fair value]

270,000

Inventories [$520,000 + $120,000 fair value]

640,000

Plant assets

Land [$400,000 + $150,000 fair value]

550,000

Buildings net [$1,000,000 + $300,000 fair value]

1,300,000

Equipment net [$500,000 + $250,000 fair value]

Goodwill

Total assets

750,000

255,000

$3,805,000

Liabilities and Stockholders Equity

Liabilities

Accounts payable [$300,000 + $40,000]

Note payable [$600,000 + $180,000 fair value]

340,000

780,000

Stockholders equity

Capital stock, $10 par [$800,000 + (33,000 shares $10)]

1,130,000

Other paid-in capital

[$600,000 - $40,000 + ($825,000 - $330,000)]

1,055,000

Retained earnings

Total liabilities and stockholders equity

500,000

$3,805,000

Business Combinations

Solution P1-3

Persis issues 25,000 shares of stock for Sinecos outstanding shares:

1a

Investment in Sineco

750,000

Capital stock, $10 par

250,000

Other paid-in capital

500,000

To record issuance of 25,000, $10 par shares with a market price

of $30 per share in a purchase business combination with Sineco.

Investment in Sineco

30,000

Other paid-in capital

20,000

Cash

50,000

To record costs of combination in a purchase business combination

with Sineco.

Cash

Inventories

Other current assets

Land

Plant and equipment net

Goodwill

Liabilities

Investment in Sineco

10,000

60,000

100,000

100,000

350,000

210,000

50,000

780,000

To record allocation of investment cost to identifiable assets and

liabilities according to their fair values and the remainder to

goodwill. Goodwill is computed: $780,000 cost - $570,000 fair

value of net assets acquired.

1b

Persis Corporation

Balance Sheet

January 2, 2006

(after purchase business combination)

Assets

Cash [$70,000 + $10,000]

Inventories [$50,000 + $60,000]

Other current assets [$100,000 + $100,000]

Land [$80,000 + $100,000]

Plant and equipment net [$650,000 + $350,000]

Goodwill

Total assets

80,000

110,000

200,000

180,000

1,000,000

210,000

$1,780,000

Liabilities and Stockholders Equity

Liabilities [$200,000 + $50,000]

$ 250,000

Capital stock, $10 par [$500,000 + $250,000]

750,000

Other paid-in capital [$200,000 + $500,000 - $20,000]

680,000

Retained earnings

100,000

Total liabilities and stockholders equity

$1,780,000

Chapter 1

Solution P1-3 (continued)

Persis issues 15,000 shares of stock for Sinecos outstanding shares:

2a

450,000

Investment in Sineco (15,000 shares $30)

Capital stock, $10 par

150,000

Other paid-in capital

300,000

To record issuance of 15,000, $10 par common shares with a market

price of $30 per share.

Investment in Sineco

30,000

Other paid-in capital

20,000

Cash

50,000

To record costs of combination in the purchase of Sineco.

Cash

10,000

Inventories

60,000

Other current assets

100,000

Land

80,000

280,000

Plant and equipment net

Liabilities

50,000

Investment in Sineco

480,000

To assign the $480,000 cost of Sineco to current assets and

liabilities on the basis of their fair values and to noncurrent

assets on the basis of fair value less a proportionate share of

the excess of fair value over investment cost as follows:

Fair value of net assets acquired

Investment cost

Excess fair value over cost

Excess allocated to reduce:

Land ($100,000/$450,000 $90,000)

Plant and equipment

($350,000/$450,000 $90,000)

Reduction in fair value of

noncurrent assets

$570,000

480,000

$ 90,000

$ 20,000

70,000

$ 90,000

10

Business Combinations

Solution P1-3 (continued)

2b

Persis Corporation

Balance Sheet

January 2, 2006

(after purchase business combination)

Assets

Cash [$70,000 + $10,000]

Inventories [$50,000 + $60,000]

Other current assets [$100,000 + $100,000]

Land [$80,000 + $80,000]

Plant and equipment net [$650,000 + $280,000]

Total assets

80,000

110,000

200,000

160,000

930,000

$1,480,000

Liabilities and stockholders equity

Liabilities [$200,000 + $50,000]

$ 250,000

Capital stock, $10 par [$500,000 + $150,000]

650,000

Other paid-in capital [$200,000 + $300,000 - $20,000]

480,000

Retained earnings

100,000

Total liabilities and stockholders equity

$1,480,000

10

Chapter 1

11

Solution P1-4

1

Schedule to allocate investment cost to assets and liabilities

Investment cost, January 1, 2006

Fair value acquired from Sen ($360,000 100%)

Excess fair value acquired over cost

$300,000

360,000

$ 60,000

Allocation:

Initial

Allocation

$

10,000

20,000

30,000

100,000

150,000

150,000

(30,000)

(70,000)

(60,000)

$ 300,000

Cash

Receivables net

Inventories

Land

Buildings net

Equipment net

Accounts payable

Other liabilities

Excess fair value

Totals

Final

Reallocation

Allocation

--$ 10,000

--20,000

--30,000

$ (15,000)

85,000

(22,500)

127,500

(22,500)

127,500

--(30,000)

--(70,000)

60,000

--0

$ 300,000

Phule Corporation

Balance Sheet

at January 1, 2006

(after combination)

Liabilities

Assets

Cash

Receivables net

Inventories

Land

Buildings net

Equipment net

25,000

60,000

150,000

130,000

327,500

307,500

Total assets $1,000,000

Accounts payable

Note payable (5 years)

Other liabilities

Liabilities

120,000

200,000

170,000

490,000

Stockholders Equity

Capital stock, $10 par

Other paid-in capital

Retained earnings

Stockholders equity

Total equities

11

300,000

100,000

110,000

510,000

$1,000,000

12

Business Combinations

Solution P1-5

1

Journal entries to record the acquisition of Dawn Corporation

Investment in Dawn

Capital stock, $10 par

Other paid-in capital

Cash

2,500,000

1,000,000

1,000,000

500,000

To record purchase of Dawn for 100,000 shares of common stock and

$500,000 cash.

Investment in Dawn

Other paid-in capital

Cash

100,000

50,000

150,000

To record payment of costs to register and issue the shares of

stock ($50,000) and other costs of combination ($100,000).

Cash

Accounts receivable

Notes receivable

Inventories

Other current assets

Land

Buildings

Equipment

Accounts payable

Mortgage payable, 10%

Investment in Dawn

240,000

360,000

300,000

500,000

200,000

190,000

1,140,000

570,000

300,000

600,000

2,600,000

To assign the cost of Dawn to current assets and liabilities on

the basis of their fair values and to noncurrent assets on the

basis of fair value less a proportionate share of the excess of

fair value over investment cost as shown in the following

allocation schedule:

Purchase price

Fair value of net assets acquired

Negative goodwill

$2,600,000

2,700,000

$ 100,000

Excess applied to reduce noncurrent assets (noncurrent assets

$100,000/$2,000,000 excess = 5% reduction):

Land

Buildings

Equipment

200,000 - $10,000 =

1,200,000 - 60,000 =

600,000 - 30,000 =

12

$ 190,000

1,140,000

570,000

Chapter 1

13

Solution P1-5 (continued)

2

Celistia Corporation

Balance Sheet

at January 2, 2006

(after business combination)

Assets

Current Assets

Cash

Accounts receivable net

Notes receivable net

Inventories

Other current assets

$ 2,590,000

1,660,000

1,800,000

3,000,000

900,000

Plant Assets

Land

Buildings net

Equipment net

Total assets

$ 2,190,000

10,140,000

10,570,000

$ 9,950,000

22,900,000

$32,850,000

Liabilities and Stockholders Equity

Liabilities

Accounts payable

Mortgage payable, 10%

$ 1,300,000

5,600,000

$ 6,900,000

Stockholders Equity

Capital stock, $10 par

$11,000,000

Other paid-in capital

8,950,000

Retained earnings

6,000,000

Total liabilities and stockholders equity

25,950,000

$32,850,000

13

You might also like

- B. Woods Chapter 1Document16 pagesB. Woods Chapter 1Dareen AyeshaNo ratings yet

- CH 01 SMDocument13 pagesCH 01 SMSpaet HendraNo ratings yet

- Advance Accounting Beams 10th eDocument15 pagesAdvance Accounting Beams 10th eHecel OlitaNo ratings yet

- Solution Manual Advanced Accounting Beams 11e Chp1 PDFDocument14 pagesSolution Manual Advanced Accounting Beams 11e Chp1 PDFArifta Nur Rahmat100% (21)

- Business Combinations: Answers To Questions 1Document14 pagesBusiness Combinations: Answers To Questions 1Rury NoeripahNo ratings yet

- Ch01 Beams12ge SMDocument11 pagesCh01 Beams12ge SMWira MokiNo ratings yet

- Solution - Chapter 1Document8 pagesSolution - Chapter 1Nezo Qawasmeh75% (4)

- Advanced Financial Accounting IDocument7 pagesAdvanced Financial Accounting IRoNo ratings yet

- Business Combinations ExplainedDocument13 pagesBusiness Combinations Explainedzandra SumbarNo ratings yet

- Consolidated Financial Statements DefinitionDocument17 pagesConsolidated Financial Statements DefinitionBelay MekonenNo ratings yet

- Chapter 17 - Consolidated Financial Statements: Intragroup TransactionsDocument14 pagesChapter 17 - Consolidated Financial Statements: Intragroup TransactionsShek Kwun HeiNo ratings yet

- ECU Topic 4Document8 pagesECU Topic 4Pinky RoseNo ratings yet

- Business Combinations: Answers To Questions 1Document14 pagesBusiness Combinations: Answers To Questions 1MUFC SupporterNo ratings yet

- Consolidated FsDocument7 pagesConsolidated FsfreyawonderlandNo ratings yet

- Solution Manual For Advanced Accounting 11th Edition by Beams 3 PDF FreeDocument14 pagesSolution Manual For Advanced Accounting 11th Edition by Beams 3 PDF Freeluxion bot100% (1)

- Consolidations - Subsequent To The Date of AcquisitionDocument42 pagesConsolidations - Subsequent To The Date of AcquisitionAla'aEQahwajiʚîɞNo ratings yet

- A) Using The Equity MethodDocument6 pagesA) Using The Equity MethodZandrea LopezNo ratings yet

- Consolidated financials for purchase business combinationsDocument29 pagesConsolidated financials for purchase business combinationsMulugeta NiguseNo ratings yet

- Chapter 8 Consolidation IDocument18 pagesChapter 8 Consolidation IAkkama100% (1)

- Elliott Homework Week1Document8 pagesElliott Homework Week1Juli ElliottNo ratings yet

- Beams Aa13e SM 01Document14 pagesBeams Aa13e SM 01jiajiaNo ratings yet

- Business CombinationsDocument18 pagesBusiness Combinationszubair afzalNo ratings yet

- Business Combinations: Answers To Questions 1Document14 pagesBusiness Combinations: Answers To Questions 1rendy adiwigunaNo ratings yet

- ACC 401 Homework CH 4Document4 pagesACC 401 Homework CH 4leelee03020% (1)

- IFRS Chapter 9 The Consolidated Statement of Financial PositonDocument44 pagesIFRS Chapter 9 The Consolidated Statement of Financial PositonMahvish Memon0% (1)

- ch03, AccountingDocument27 pagesch03, AccountingEkta Saraswat Vig50% (2)

- IFRS 3 Business CombinationDocument15 pagesIFRS 3 Business CombinationAquino KimalexerNo ratings yet

- Concepts Review and Critical Thinking Questions 4Document6 pagesConcepts Review and Critical Thinking Questions 4fnrbhcNo ratings yet

- Attachment (20) Lesson 4Document22 pagesAttachment (20) Lesson 4Lillian JoyNo ratings yet

- Lesson 36Document3 pagesLesson 36Abdul MananNo ratings yet

- Chapter 7 Stockholers Equity FinalDocument77 pagesChapter 7 Stockholers Equity FinalSampanna ShresthaNo ratings yet

- CH 11 Exam PracticeDocument20 pagesCH 11 Exam PracticeSvetlanaNo ratings yet

- Group Accounts - ConsolidationDocument14 pagesGroup Accounts - ConsolidationWinnie GiveraNo ratings yet

- Corporate FinanceDocument25 pagesCorporate FinanceTrần Ngọc TrungNo ratings yet

- Consolidation of Financial InformationDocument40 pagesConsolidation of Financial InformationAla'aEQahwajiʚîɞNo ratings yet

- Business Combinations: Answers To Questions 1Document7 pagesBusiness Combinations: Answers To Questions 1ohbNo ratings yet

- Chapter 3 Business CombinationDocument9 pagesChapter 3 Business CombinationAnonymous XOv12G100% (1)

- Bahan Ajar Penggabungan UsahaDocument6 pagesBahan Ajar Penggabungan UsahaZachra MeirizaNo ratings yet

- Bahan Ajar Penggabungan UsahaDocument6 pagesBahan Ajar Penggabungan UsahaZachra MeirizaNo ratings yet

- Consolidation HandoutDocument17 pagesConsolidation Handoutdemeketeme2013No ratings yet

- Chapter Learning ObjectivesDocument10 pagesChapter Learning ObjectivesChathura DalugodaNo ratings yet

- AKL1 TugasDocument2 pagesAKL1 TugasFarrell DmNo ratings yet

- Fin 311 Chapter 02 HandoutDocument7 pagesFin 311 Chapter 02 HandouteinsteinspyNo ratings yet

- Consolidated Financial Statements ExplainedDocument12 pagesConsolidated Financial Statements ExplainedJhosua TampubolonNo ratings yet

- Financial Statements: An OverviewDocument34 pagesFinancial Statements: An OverviewMUSTAFA KAMAL BIN ABD MUTALIP / BURSAR100% (1)

- Lecture 4-PostDocument40 pagesLecture 4-PostcoolirlbbNo ratings yet

- Chapter 4Document25 pagesChapter 4Anonymous XOv12G67% (3)

- Business Combination TypesDocument4 pagesBusiness Combination Typesnur fitri melatiNo ratings yet

- Chapter 8Document6 pagesChapter 8Nor AzuraNo ratings yet

- Understanding Financial Statements (Review and Analysis of Straub's Book)From EverandUnderstanding Financial Statements (Review and Analysis of Straub's Book)Rating: 5 out of 5 stars5/5 (5)

- Intermediate Accounting 2: a QuickStudy Digital Reference GuideFrom EverandIntermediate Accounting 2: a QuickStudy Digital Reference GuideNo ratings yet

- CPA Financial Accounting and Reporting: Second EditionFrom EverandCPA Financial Accounting and Reporting: Second EditionNo ratings yet

- Oesch, 2016 PDFDocument40 pagesOesch, 2016 PDFBriandLukeNo ratings yet

- Suk, 2016 PDFDocument37 pagesSuk, 2016 PDFBriandLukeNo ratings yet

- Gleason, 2017Document21 pagesGleason, 2017BriandLukeNo ratings yet

- 2012 Laporan Tahunan BNIDocument640 pages2012 Laporan Tahunan BNIBriandLukeNo ratings yet

- Pengaruh Sanksi Perpajakan, Kesadaran Perpajakan, Pelayanan Fiskus PDFDocument30 pagesPengaruh Sanksi Perpajakan, Kesadaran Perpajakan, Pelayanan Fiskus PDFMekatel EngineeringNo ratings yet

- Bni Ar2013 Eng Fin PDFDocument514 pagesBni Ar2013 Eng Fin PDFBriandLukeNo ratings yet

- Arens12e 14 PDFDocument39 pagesArens12e 14 PDFBriandLukeNo ratings yet

- RRChapter 09Document43 pagesRRChapter 09BriandLukeNo ratings yet

- Bank ReconciliationDocument2 pagesBank Reconciliationthaiseer_mohamedNo ratings yet

- CV Template Finance Financial AccountantDocument1 pageCV Template Finance Financial AccountantBriandLukeNo ratings yet

- Business Combinations ExplainedDocument13 pagesBusiness Combinations ExplainedBriandLukeNo ratings yet