Professional Documents

Culture Documents

Sucoff: From The Courthouse To The Police Station

Uploaded by

New England Law ReviewOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Sucoff: From The Courthouse To The Police Station

Uploaded by

New England Law ReviewCopyright:

Available Formats

SUCOFF - FINAL (DO NOT DELETE)

11/2/2011 4:12 PM

Notes

From the Courthouse to the Police

Station: Combating the Dual Biases That

Surround Federal Money-Laundering

Asset Forfeiture

OWEN SUCOFF*

ABSTRACT

The money-laundering asset forfeiture laws were enacted during the

height of Congresss two-decade fight against the financial underpinnings

of organized crime and the drug trade and represent the farthest-reaching

provisions of their kind. They provide for the forfeiture of all property

involved in an offense, a definition that includes anything which makes

a laundering offense either harder to detect or easier to commit.

Despite being a powerful tool in the legitimate fight against crime,

laundering forfeitures broad reach brings serious risks of abuse, and

institutional biases favoring increased forfeiture have developed in both

the courtroom and the police station. An expansive interpretation of the

involved in language combines with both the limited utility of the

Excessive Fines Clause and a complete lack of judicial discretion on the

part of sentencing judges to create a judicial bias in favor of forfeiture. A

similar enforcement bias, borne from the Department of Justices policy

of using forfeiture as a revenue generator, encourages law enforcement

agencies to increase both the magnitude and quantity of forfeitures.

This Note argues that recurring abuse of the forfeiture power can only

be prevented through a combination of two major reforms: (1) amendment

Candidate for Juris Doctor, New England Law | Boston (2012). B.A., Public Policy,

Vanderbilt University (2007). I would like to thank my father, who encouraged me to work

through the pain, and my mother, who was always there when I wasnt able to.

*

93

SUCOFF - FINAL (DO NOT DELETE)

94

11/2/2011 4:12 PM

New England Law Review

v. 46 | 93

of the money-laundering-forfeiture statute to include a proportionality

requirement fashioned after the Excessive Fines Clause; and (2) alteration

of the equitable-sharing disbursement program to eliminate the profit

incentives encouraging increased forfeitures.

INTRODUCTION

hoever first said crime doesnt pay was lying.1 A decade

ago, the Internal Revenue Service estimated that the United

States illegal drug trade alone accounts for fifty billion

dollars per year.2 With an eye towards reducing that figure, Congress, in

the 1970s, passed the first of the modern regime of forfeiture statutes.3

These laws provided the Government with the tools to pursue a new

enforcement strategy that would strike at the core of the criminal

undergroundits economic underpinnings.4 Disappointed with the early

lack of results, Congress undertook a two-decade expansion of federal

forfeiture law, gradually extending the reach of the statutes in an attempt

to increase mass forfeitures.5 The money-laundering-forfeiture provisions

were among those extensions and, by allowing forfeiture of all property

involved in an offense, represent perhaps the farthest reaching of all

their kind.6

Though a powerful tool in the legitimate fight against crime, the

operative framework that evolved around the money-laundering-forfeiture

statute brings serious risks of abuse, and institutional biases favoring

increased forfeiture have developed in both the courtroom and the police

station.7 An expansively broad interpretation of the involved in language

allows for the forfeiture of assets loosely connected to an offense as being

used to facilitate crimea category encompassing property far in advance

of a laymans understanding of facilitation.8 Assisting this reach is the

statutes exhaustive list of predicate crimes, whose proceeds, when

transferred, trigger the application of the accompanying forfeiture

1

CAMBRIDGE INTERNATIONAL DICTIONARY OF IDIOMS 84 (1998).

Ann Jennings Maron, Comment, Is the Excessive Fines Clause Excessively Kind to Money

Launderers, Drug Dealers, and Tax Evaders?, 33 J. MARSHALL L. REV. 243, 243 (1999).

2

3 James Bovard, Seizure Fever: The War on Property Rights, 46 THE FREEMAN: IDEAS ON

LIBERTY, Jan. 1996, at 6, 6.

4

B. FREDERIC WILLIAMS, JR. & FRANK D. WHITNEY, FEDERAL MONEY LAUNDERING: CRIMES

11.3, at 385-86 (1999).

5 See id. at 385-87.

6 See 18 U.S.C. 981 (2006); 18 U.S.C. 982 (2006 & Supp. III 2010).

7 See infra Part III.

8 See United States v. 38 Whalers Cove Drive, 954 F.2d 29, 33 (2d Cir. 1992) (upholding

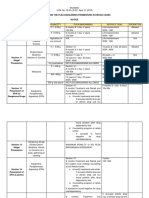

forfeiture of a condo worth $145,000 on the strength of two cocaine sales totaling $250).

AND FORFEITURES

SUCOFF - FINAL (DO NOT DELETE)

2011

Combating the Dual Forfeiture Biases

11/2/2011 4:12 PM

95

provisions to nearly every crime imaginable. 9 The extremely limited utility

of the Excessive Fines Clausethe only constitutional protection for

forfeiture defendantsdoes little to alleviate the risks.10 Prohibiting

grossly disproportionate forfeitures in theory, the only Supreme Court

exploration of the Clause in over two hundred years severely limited its

application, and lower courts have proven to be adept at finding seizures

reasonable.11 These tenets of forfeiture jurisprudence combine with

sentencing judges complete lack of forfeiture discretion to create a heavy

judicial bias against defendants and in favor of forfeiture.12

But offenders have more to worry about than institutional judicial

prejudice; the law enforcement machines deck is stacked against them

also.13 The enforcement bias begins with the Department of Justice (the

Department) policy that pursues revenue generation as a substantial goal

of forfeiture.14 In furtherance of this policy, the Department has created a

disbursement system designed to pad both state and federal agency

budgets with the proceeds from forfeited asset sales. 15 This profit incentive

encourages law enforcement agencies to increase the quantity and

magnitude of forfeitures, resulting in considerable abuse of the system.16

This Note will argue that recurring abuse of the forfeiture power can only

be prevented through a combination of two major reforms: (1) amendment

of the money-laundering-forfeiture statute to lessen its expansive reach by

including a proportionality requirement; and (2) alteration of the equitablesharing disbursement program to eliminate the profit incentives

encouraging increased forfeitures.17

Part I will outline the basic operation of the money-laundering statutes

and the history and congressional climate surrounding their enactment. It

will then explore the extent to which the laundering-forfeiture statute

See 18 U.S.C. 1956(c)(7) (2006 & Supp. III 2010).

See U.S. CONST. amend. VIII.

11 See United States v. Bajakajian, 524 U.S. 321, 337 (1998); infra note 122 and accompanying

text.

10

12

See 18 U.S.C. 982(a)(1) (2006) (using the mandatory phrase shall order . . . forfeit in

response to judges role in forfeiture sentencing); see also 13 FEDERAL PROCEDURE, LAWYERS

EDITION 35:786, at 587 (2006).

13 See infra Part III.B.

14 See MARIAN R. WILLIAMS ET AL., INST. FOR JUSTICE, POLICING FOR PROFIT: THE ABUSE OF

CIVIL ASSET FORFEITURE 25 (2010), available at http://www.ij.org/images/pdf_folder/

other_pubs/assetforfeituretoemail.pdf.

15

See ASSET FORFEITURE AND MONEY LAUNDERING SECTION, U.S. DEPT OF JUSTICE, ASSET

FORFEITURE POLICY MANUAL 127 (2008) [hereinafter ASSET FORFEITURE POLICY MANUAL].

16 See id.; Radley Balko, The Forfeiture Racket, REASON, Feb. 2010, at 33, 34; Bovard, supra

note 3, at 9-10.

17

See infra Part IV.

SUCOFF - FINAL (DO NOT DELETE)

96

11/2/2011 4:12 PM

New England Law Review

v. 46 | 93

reaches a defendants property. Part II will discuss the minimal protection

against excessive forfeitures that the Eighth Amendment provides

defendants. Part III will explore how current Department policies

regarding forfeiture procedure and disbursement of seized assets create

strong profit incentives in forfeiture, and how they open the door for

federal and state abuse of the statute. It will then explore some examples of

past abuse, before discussing how previous attempts at reform have fallen

short. Part IV will propose that future prevention of past abuses can only

be achieved by jointly addressing the flaws inherent in the forfeiture

system: the statutes lack of proportionality and the incentive-laden law

enforcement apparatus through which forfeiture is pursued.

I.

The Money-Laundering Offenses and Their Subsequent Forfeitures

A. What Is Money Laundering?

In its most simple form, money laundering is the process used by a

successful criminal to legitimize his illicit wealth. 18 In a basic laundering

scheme, the proceeds of a separate criminal offense are transferred in such

a way as to conceal their source, confuse or break the money trail, and

return them to the offender safe for general use.19 This conception of money

laundering reflects the popular, traditional understanding of the term, and

embodies the belief of key Senators involved with the passage of the

original Money Laundering Control Act of 1986.20 Traditional money

laundering is covered by 1956 and 1957 of Title 18 of the U.S. Code,

which broadly prohibits all financial transaction[s] involving the

proceeds of specified unlawful activity (SUA).21 Included within the

sections definitions is a thorough list of SUAs that, for all intents and

18

WILLIAMS & WHITNEY, supra note 4, 1.1, at 4.

See JIMMY GURUL & SANDRA GUERRA, THE LAW OF ASSET FORFEITURE 7-3(a), at 204-05

(1998).

19

20 See 132 CONG. REC. 17,571 (1986) (statement of Sen. Joseph Biden) (Money laundering is

the process by which the proceeds of crime are disguised to appear legitimate, using ordinary

and not-so-ordinary financial transactions.); id. at 18,487 (statement of Sen. Orrin Hatch)

(Money laundering is the process by which one conceals the existence, illegal source, or

illegal application of income and camouflages the source of that income to make it appear

legitimate.).

21 18 U.S.C. 1956-1957 (2006 & Supp. III 2010). Notably, federal money-laundering law

reaches a number of activities that exist outside of this traditional understanding, such as

currency reporting requirements and bulk-cash smuggling. However, this Note is

predominantly concerned with the traditional money-laundering actions covered by

1956 and 1957. See 31 U.S.C. 5313(a) (2006) (requiring banks to file reports for all cash

transactions in excess of the amount prescribed by the Secretary of Treasury); 31 U.S.C.

5332(a) (2006) (criminalizing the unreported personal transfer of cash in excess of $10,000 into

or out of the United States).

SUCOFF - FINAL (DO NOT DELETE)

2011

11/2/2011 4:12 PM

Combating the Dual Forfeiture Biases

97

purposes, covers every potential criminal act that might yield some

property to forfeit.22 These SUAs are prerequisites to money-laundering

offenses, and they enable prosecutors to apply the unusual breadth of

laundering forfeiture to a huge number of circumstances where forfeiture

was not previously allowed.23

The statute contemplates two major forms of money laundering: (1) the

use of criminal proceeds towards the further commission of crime;24 and (2)

the transfer of dirty money in such a way as to make it seem clean.25

Each form of the offense requires the defendant to have both knowledge

that the property involved represents the proceeds of some form of

unlawful activity and intent either to further promote a criminal act or to

conceal those proceeds.26 Section 1956 further criminalizes reverse money

launderingsituations in which clean money is transferred into or out

of the United States to finance dirty activity.27 In this case, the property

transferred need not be the proceeds of an SUA if it is transferred with the

intent to promote a future SUA.28 Finally, 1957 prohibits the transfer of

property derived from an SUA with a value over $10,000, differing from

1956 only in that it lacks an intent requirement; a defendant who spends

$10,001 dirty dollars is guilty, regardless of whether or not he intended

to conceal the proceeds or promote a further SUA. 29

B. A Brief History of Forfeiture Law and the Development of the

Money-Laundering-Forfeiture Statutes

The basic principles of forfeiture law are deeply rooted in AngloAmerican legal history.30 The first historical example of civil asset forfeiture

22 18 U.S.C. 1956(c)(7). (Two criminal acts notably absent are tax evasion and foreign

fraud offenses. Stefan D. Cassella, The Forfeiture of Property Involved in Money Laundering

Offenses, 7 BUFF. CRIM. L. REV. 583, 612 (2004).

23

See Cassella, supra note 22, at 618-19.

18 U.S.C. 1956(a)(1)(A)(i). This type of activity is known as promotional money

laundering. WILLIAMS & WHITNEY, supra note 4, 5.1.4, at 134.

24

25 18 U.S.C. 1956(a)(1)(B)(i) (concerning transactions designed to disguise the nature, the

location, the source, the ownership, or the control of proceeds of specified unlawful activity).

This type of activity is known as concealment money laundering. WILLIAMS & WHITNEY,

supra note 4, 5.1.6.1, at 152.

26

18 U.S.C. 1956(a)(1).

See id. 1956(a)(2)(A); Cassella, supra note 22, at 613.

28 Cassella, supra note 22, at 613.

29 18 U.S.C. 1957(c) (2006); see GURUL & GUERRA, supra note 19, 7-3(a), at 204-05.

30 See Calero-Toledo v. Pearson Yacht Leasing Co., 416 U.S. 663, 680-83 (1974) (tracing the

history of forfeiture law from English common law to the present); Eric Moores, Note,

Reforming the Civil Asset Forfeiture Reform Act, 51 ARIZ. L. REV. 777, 780-82 (2009).

27

SUCOFF - FINAL (DO NOT DELETE)

98

11/2/2011 4:12 PM

New England Law Review

v. 46 | 93

was the deodand.31 The King, upon the death of one of his subjects,

would be granted the value of the object that caused the deaththe worth

of the sword that caused the killing blow, for example. 32 Though originally

based on religious tenets, the practice soon shirked that connotation and

became a source of Crown revenue, instituted as a penalty for

carelessness.33 Early English law also provided for criminal forfeitures

resulting from felony or treason convictions, punishing those who

offended the Kings peace.34 The power of forfeiture as a revenue

generating tool was not lost in transition, and in its first hundred years,

over 80% of the United Statess revenues were raised from common law

forfeitures premised on Englands admiralty laws.35

Despite this deep tradition, major moves to create a modern statutory

forfeiture scheme did not come until 1970 with the passage of the

Continuing Criminal Enterprise Act36 and the Racketeer Influenced and

Corrupt Organizations Act.37 In the fifteen years following, disappointment

with the infrequency and low magnitude of federal forfeitures spurred

Congress to repeatedly expand the scope of existing forfeiture provisions

to reach as much property as possible.38 In 1986, as part of this expansion

and in coordination with the Money Laundering Control Act, Congress

enacted the general asset forfeiture provisions that apply to moneylaundering offenses, codified at 981 and 982 of Title 18 of the U.S.

Code.39

C. The Congressional Climate Surrounding the Laundering and

Forfeiture Statutes

Sections 981 and 982 were put into effect in the midst of a tide of

congressional action aimed at expanding the use of forfeiture as a tool to

attack the economic aspects of drug trafficking and racketeering. 40 There

31

See Calero-Toledo, 416 U.S. at 680-81.

Id. at 681.

33 Id.

34 Id. at 682 (The convicted felon forfeited his chattels to the Crown and his lands

escheated to his lord; the convicted traitor forfeited all of his property, real and personal, to

the Crown.).

32

35

Maron, supra note 2, at 247 & n.30.

Pub. L. No. 91-513, 84 Stat. 1265 (codified as amended at 21 U.S.C. 848 (2006)).

37 Pub. L. No. 91-452, 84 Stat. 941-44, 901(a) (codified as amended at 18 U.S.C. 1961-68

(2006 & Supp. II 2009)).

36

38

See Moores, supra note 30, at 781-82.

See 18 U.S.C. 981 (2006) (civil forfeiture); 18 U.S.C. 982 (2006) (criminal forfeiture);

WILLIAMS & WHITNEY, supra note 4, 1.8, at 16; Cassella, supra note 22, at 614.

40 See WILLIAMS & WHITNEY, supra note 4, 11.3, at 385-87; see also S. REP. NO. 98-225, at 91

(1984), reprinted in 1984 U.S.C.C.A.N. (98 Stat.) 3182, 3374 (intending to provide authority

39

SUCOFF - FINAL (DO NOT DELETE)

2011

Combating the Dual Forfeiture Biases

11/2/2011 4:12 PM

99

was strong bipartisan support for this expansion of forfeiture authority,

and Congress emphasized its disappointment in the use of the new power

up to that pointit had expected the seizure of a far greater amount of

drug trafficking profits.41 Just prior to passage of the laundering-forfeiture

provisions, the drug-forfeiture statute was characterized as telling the

courts to take the broadest possible view of what property is subject to

confiscation.42 Congresss intent for the statute to reach as far as possible is

reflected by commentary that was proposed for inclusion during the

debate.43 It would have explicitly allowed for the seizure of the broadest

possible range of profits and property controlled by drug traffickers.44

D. Property Subject to Forfeiture Under the Money-Laundering Statute

Sections 981 and 982 provide for the civil and criminal forfeiture,

respectively, of any property involved in a violation of the newly

codified laundering offenses.45 Furthermore, if any of that involved

property is sold, transformed, or transferred, then any property traceable

to such property is also forfeitable.46 Courts in seven circuits have

interpreted the phrase involved in broadly, as reaching beyond the

actual property being laundered to commissions and fees paid to the

launderer, as well as any other property facilitating the offense; 47 no circuit

designed to strip *criminal organizations+ of their economic power, and noting that forfeiture

is the mechanism through which these attacks should be made).

41

S. REP. NO. 98-225, at 91; see WILLIAMS & WHITNEY, supra note 4, 11.3, at 386.

WILLIAMS & WHITNEY, supra note 4, 11.3, at 386 (quoting 130 CONG. REC. 29,697 (1984)

(statement of Senator DAmato)).

42

43

See id.

Id. at 386 n.23.

45 See 18 U.S.C. 981(a)(1)(A), 982(a)(1) (2006). Courts interpret the language of the two

provisions identically and often rely on precedent concerning one to interpret the other. See

United States v. Tencer, 107 F.3d 1120, 1134 n.5 (5th Cir. 1997). Additionally, the drugforfeiture statute also employs the involved in standard, 21 U.S.C. 853 (2006), and courts

rely on cases interpreting 853 in their discussions of 981 and 982. See United States v.

Myers, 21 F.3d 826, 829 & n.3 (8th Cir. 1994) (noting that the language of the moneylaundering statutes is very similar to that of 853 and deciding the issue on drug forfeiture

precedent); WILLIAMS & WHITNEY, supra note 4, 11.7.3, at 395 (tracing the courts use of 853

as applied to the money-laundering provisions). Note also that any property subject to civil

forfeiture is also subject to criminal forfeiture. See 28 U.S.C. 2461(c) (2006).

44

46

18 U.S.C. 981(a)(1)(A), 982(a)(1); WILLIAMS & WHITNEY, supra note 4, 11.1, at 382.

See United States v. Puche, 350 F.3d 1137, 1153 (11th Cir. 2003) (affirming judgment on

facilitation grounds); United States v. McGauley, 279 F.3d 62, 76 n.14 (1st Cir. 2002) (following

Bornfield, Tencer, and Baker, and citing legislative history); United States v. Baker, 227 F.3d 955,

967-68 (7th Cir. 2000) (stating that all real and personal property used to commit the moneylaundering offense is subject to forfeiture as property involved in the offense); United States

v. Wyly, 193 F.3d 289, 302 (5th Cir. 1999) (affirming judgment on facilitation grounds); United

47

SUCOFF - FINAL (DO NOT DELETE)

100

11/2/2011 4:12 PM

New England Law Review

v. 46 | 93

has shown any indication of ruling to the contrary. 48 Consequently,

forfeitable property can be characterized in one of four ways, each of which

is contoured by the wide berth courts grant to the statute: 1) the proceeds

of the SUA offense being laundered; 2) property other than the SUA

proceeds which is also part of the subject matter of the money laundering

offense; 3) property used to facilitate the money laundering offense; and 4)

property . . . involved in, or used to commit, the SUA offense.49

1.

Proceeds of the Specified Unlawful Activity

Determining what property constitutes proceeds of an SUA offense

rests on a fairly straightforward principleif the laundered property was

obtained as a result of the SUA, it is forfeitable. 50 Where an offender steals

$57,000, and deposits $23,000 of it into his wifes bank account, that $23,000

constitutes the proceeds of the SUA that were involved in the moneylaundering offense.51 Courts have also held that it is appropriate to forfeit

proceeds of the SUA that the defendant attempted or conspired to launder,

even if the act was not completed.52

2.

Subject Matter of the Laundering Transaction

Property other than SUA proceeds comprising the subject matter of a

laundering transaction is generally either the clean money in a reverselaundering offense or the subject of a purchase, sale, or exchange

intended to clean the money being paid.53 This segment of forfeitable

property is the other side of the laundering transaction.54 Where an

States v. Matai, Nos. 97-4129, 97-4130, 1999 WL 61913, at *5 (4th Cir. Feb. 10, 1999) (per

curiam) (affirming judgment on facilitation grounds); United States v. Bornfield, 145 F.3d

1123, 1135 (10th Cir. 1998) (following Tencer); United States v. Hawkey, 148 F.3d 920, 927-28

(8th Cir. 1998) (following Bornfield and Tencer); see also Smith v. United States, 508 U.S. 223, 235

(1993) (acknowledging involved in as an expansive statutory term, and holding that a gun

could be involved in an offense despite its not being used during commission); Cassella, supra

note 22, at 615 & n.80 (collecting aforementioned circuit cases).

48

Cassella, supra note 22, at 615.

Id. at 615-16.

50 Id. at 616-17.

51 See United States v. Trost, 152 F.3d 715, 721 (7th Cir. 1998).

52 See United States v. Hasson, 333 F.3d 1264, 1279 (11th Cir. 2003) (holding that forfeiture

for money-laundering conspiracy includes the amount derived from uncharged conduct and

conduct on which defendant may have been acquitted); United States v. $15,270,885.69

Formerly on Deposit in Account No. 8900261137, No. 99 Civ. 10255(RCC), 2000 WL 1234593,

at *4 (S.D.N.Y. Aug. 31, 2000) (holding that money in a bank account can be forfeited as

property involved in an attempt to commit money laundering).

49

53

54

Cassella, supra note 22, at 620.

See id.

SUCOFF - FINAL (DO NOT DELETE)

2011

Combating the Dual Forfeiture Biases

11/2/2011 4:12 PM

101

offender misappropriates $140,000 and uses it to purchase a motor home,

the motor home is part of the subject matter of the laundering offense, even

though it is not a proceed of the SUA.55 Clearly, however, the motor home

is involved in the laundering transaction.56 An important upshot of this

reasoning is that the proceeds generated by the laundering offense do not

act as a limit on the amount of property subject to forfeiture.57 If a gold

dealer exchanges legitimate gold for $700,000 of illegitimate cash, realizing

a profit of $10,000, the entire $700,000 is involved, and the dealer can be

held accountable for its forfeit.58

Commingled propertyotherwise clean property that has been mixed

with dirty propertyhas also repeatedly been found to be part of the

subject matter of a laundering offense. 59 This happens most often where an

offender will deposit dirty money into an account already containing

other clean money.60 In United States v. McGauley, a defendant convicted

of laundering was ordered to forfeit the entire contents of a bank account

almost $50,000of which only $155 was illicit.61 McGauley took $49,497

from a previously existing account, and combined it with the $155 check in

a new one.62 The court upheld the judgment, concluding that there is no de

minimis exception on the forfeiture of legitimate funds commingled with

illegitimate ones.63

Though commingling is commonly seen in connection with fungible

currency, it can also occur with tangible property. 64 If the motor home

offender used the misappropriated funds to finance only half of the

purchase, the entire motor home would still be forfeitable, regardless of the

fact that half of its value was legitimately derived. 65 This is an instructive

55

See United States v. Hawkey, 148 F.3d 920, 928 (8th Cir. 1998).

See WILLIAMS & WHITNEY, supra note 4, 11.5, at 389-90.

57 Cassella, supra note 22, at 629.

58 See United States v. Hendrickson, 22 F.3d 170, 173, 175 (7th Cir. 1994).

59 See United States v. McGauley, 279 F.3d 62, 71 (1st Cir. 2002) (allowing forfeiture of

$49,000, of which only $155 was illicit); United States v. Braxtonbrown-Smith, 278 F.3d 1348,

1352-53 (D.C. Cir. 2002) (finding any withdrawal from a commingled account sufficient to

show money laundering; strict tracing of SUA proceeds through commingled account

impossible); United States v. Wilkinson, 137 F.3d 214, 222 (4th Cir. 1998) (finding that the

government is entitled to presume that funds up to the full amount originally derived from

crime were involved in the transaction).

60 See, e.g., McGauley, 279 F.3d at 71.

61 Id. at 70, 77.

62 Id. at 70.

63 Id. at 71 (denying petitioners theory of a de minimis exception to the amount of

involved funds that must be proceeds of SUA); see also infra Part I.D.3.

56

64

65

GURUL & GUERRA, supra note 19, 7-3(b), at 205.

See United States v. 1700 Duncanville Rd., 90 F. Supp. 2d 737, 739-40, 742 (N.D. Tex.

SUCOFF - FINAL (DO NOT DELETE)

102

11/2/2011 4:12 PM

New England Law Review

v. 46 | 93

example of how the breadth of laundering forfeiture laws can exceed the

actual amount of a defendants transgression.66

3.

Property that Facilitates the Laundering Offense

Property is also subject to forfeiture if it facilitates the commission of a

money-laundering offense. 67 Facilitation theory is much broader than the

proceeds and subject matter theories and allows for forfeiture of any

property that makes the prohibited conduct easier to commit or harder to

detect.68 The standard is not an onerous one and potentially includes any

property external to the transaction itself, provided that it is used in some

way to assist with the commission of the crime. 69 It is through this avenue

of forfeiture that a defendant faces the greatest risk of losing assets far in

excess of his offense.70

A typical example of facilitation theory is the forfeiture of a vehicle

used to transport drugs; however, the threshold is much lower than the

actual transportation of contraband.71 Cars have been found as facilitating

when used simply to transport the dealer to the spot of the sale.72 In one

case, a car was forfeited where the defendants propped the hood up and

2000), affd 250 F.3d 738 (5th Cir. 2001) (holding the entirety of the property forfeitable as

involved in the laundering offense where defendant deposited at least $109,919 of food

stamp fraud proceeds into a commingled account, then used those commingled funds along

with an extra clean $300,000 to purchase a house).

66 See also United States v. One 1987 Mercedes Benz 300E, 820 F. Supp. 248, 252 (E.D. Va.

1993) (holding that where a car payment is made with SUA proceeds, the payment is a

transaction and the entire car is forfeited as involved in the offense regardless of whether

other payments have been made legitimately).

67

18 U.S.C. 981(a)(1)(A) (2006).

United States v. Tencer, 107 F.3d 1120, 1134 (5th Cir. 1997) (Facilitation occurs when the

property makes the prohibited conduct less difficult or more or less free from obstruction or

hindrance. (quoting United States v. Schifferli, 895 F.2d 987, 990 (4th Cir. 1990))). Tencer

defined the term facilitate in the context of the drug-forfeiture statute, however recall that

past interpretations of the drug-forfeiture statute are used to illuminate the meaning of the

laundering-forfeiture statute. See sources cited supra note 45.

69 See WILLIAMS & WHITNEY, supra note 4, 11.7.1, at 393. But see Cassella, supra note 22, at

642-43 (noting that some courts employ a substantial connection requirement and have

disallowed forfeiture on grounds that the connection between the property and the offense

was too incidental).

70 Compare United States v. Wyly, 193 F.3d 289, 303 (5th Cir. 1999) (using facilitation theory

to uphold the forfeiture of a $4 million business against the laundering of $175,000), with

United States v. Trost, 152 F.3d 715, 721 (7th Cir. 1998) (ordering the forfeiture of $57,000, the

amount illegally procured, rather than the entire amount transferred through the account).

71 See WILLIAMS & WHITNEY, supra note 4, 11.7.3, at 395.

72 See, e.g., United States v. One Lot of U.S. Currency ($68,000), 927 F.2d 30, 31 (1st Cir.

1992).

68

SUCOFF - FINAL (DO NOT DELETE)

2011

11/2/2011 4:12 PM

Combating the Dual Forfeiture Biases

103

leaned behind it while negotiating as if checking the engine. 73 One example

of the far reach of facilitation-based forfeiture is United States v. Rivera.74

Rivera sold heroin out of his horse ranch, and the court allowed the

forfeiture of a herd of horses stabled on the ranch. 75 The horses facilitated

the drug operation, according to the court, by making the ranch appear

legitimate and by providing Rivera the opportunity to use horse-related

terminology as code for drugs. 76 In a similar fashion, the clean money in

an account containing commingled funds is also subject to forfeiture under

facilitation theoryif the funds are pooled to disguise the nature and the

source of the scheme, they make the offense more difficult to detect solely

by existing in the account.77

4.

Property Central to the Offense That Is Not Directly

Involved in the Laundering Transaction

The final category of property forfeitable in a money-laundering

offense is property central to or closely connected with the underlying

criminal scheme, though not necessarily directly involved in the

laundering itself.78 In United States v. Wyly, Wyly colluded with Rinicker, a

public official in charge of contracting out the construction and operation

of a new, privately owned county jail.79 In return for secret kickbacks

amounting to a 30% share of the prison profits, Rinicker arranged for the

Sheriffs office to lease the prison that Wyly would construct. 80 After

securing a money-laundering conviction, the Government sought forfeiture

of the public money paid to the contractor, the kickback money paid to

Rinicker, and the newly constructed jail itself.81 The money Wyly was paid

for his work was derived via bribery (the SUA) and was forfeitable as

proceeds of the SUA.82 Similarly, the kickback payments paid by Wyly

were forfeitable as part of the subject matter of the laundering transaction. 83

73

United States v. One 1977 Lincoln Mark V. Coupe, 643 F.2d 154, 157 (3d Cir. 1981).

884 F.2d 544 (11th Cir. 1989).

75 Id. at 546.

76 Id.

77 See United States v. Tencer, 107 F.3d 1120, 1135 (5th Cir. 1997); see also United States v.

Bornfield, 145 F.3d 1123, 1134 (10th Cir. 1998) (holding that forfeiture of clean funds is

appropriate if government shows that defendant pooled the funds to aid the laundering

transaction); GURUL & GUERRA, supra note 19, 7-3(b), at 205.

74

78

79

80

81

82

83

GURUL & GUERRA, supra note 19, 7-3(b), at 205.

United States v. Wyly, 193 F.3d 289, 292 (5th Cir. 1999).

Id.

Id. at 293, 302.

Id. at 302 (*Defendants+ other forfeited property is forfeitable as proceeds.).

Id. at 293; see also supra Part I.D.2.

SUCOFF - FINAL (DO NOT DELETE)

104

11/2/2011 4:12 PM

New England Law Review

v. 46 | 93

But the jail itself was neither the subject matter of the transaction, in the

sense that it was part of the exchange, nor did it facilitate the laundering in

the traditional sense, by making the crime easier to commit or harder to

detect.84 Even still, the court applied facilitation theory, ruling that the

prison[] was the source of the criminal proceeds and was indispensible to

the money-laundering conspiracy. Without the prison, there could have

been no bribery . . . or money laundering.85 The substantial nexus that

the jail shared with the underlying crimes demanded that it be included

within the forfeiture order.86

E. Judicial Discretion and Standards of ProofSome Basic Forfeiture

Procedures

The procedures connected to the forfeiture process only serve to

strengthen the apparent inevitability of the forfeiture of property having

only a loose connection to a laundering offense. 87 Primarily, the sentencing

judge is afforded no discretion regarding the approval of forfeiture. 88 If,

after hearing the judges explanation of the forfeiture statute, the jury finds

the involved in standard to be satisfied, the judge must order the

property forfeited.89 This lack of input stands in stark contrast to a judges

role during the rest of the sentencing process, in which he personally

determines a sentence consisting of a combination of imprisonment,

probation, and treatment, among other things. 90 Indeed, the Supreme Court

recently invalidated a provision of the federal sentencing laws that

required judges to adopt a specific sentence set forth in the U.S. Sentencing

Guidelines.91 Nevertheless, there is no dispute that the sentencing judge

84

See Cassella, supra note 22, at 657.

Wyly, 193 F.3d at 302.

86 See id.

87 See 18 U.S.C. 982(a)(1) (2006) (mandating judges to order forfeiture if property is found

to be involved in the offense); John L. Worrall, The Civil Asset Forfeiture Reform Act of 2000: A

Sheep in Wolfs Clothing?, 27 POLICING: INTL J. POLICE STRATEGIES & MGMT. 220, 225 (2004)

(detailing standards of proof).

88 18 U.S.C. 982(a)(1) (The court, in imposing sentence . . . shall order that the person

forfeit . . . any property . . . involved in *the+ offense.) (emphasis added); 13 FEDERAL

PROCEDURE, supra note 12, 35:786, at 587; cf. 31 U.S.C. 5332 (2006) (containing the moneylaundering forfeiture provision for bulk cash smuggling added by the USA PATRIOT Act,

which likewise uses the word shall).

85

89 See sources cited supra note 88. However, defendants who are subject to forfeiture are

not completely without recourse, and the Eighth Amendments (limited) protection for those

seeking to prevent the forfeit of their assets is discussed later. See infra Part II.

90 See 18 U.S.C. 3582(a) (2006).

91 United States v. Booker, 543 U.S. 220, 233-37 (2005) (invalidating the mandatory nature

of the Sentencing Guideliness sentencing ranges as violating the Sixth Amendment right to

SUCOFF - FINAL (DO NOT DELETE)

2011

11/2/2011 4:12 PM

Combating the Dual Forfeiture Biases

105

has no option or discretion concerning the forfeiture of property

involved in a laundering offense.92

The standard of proof that the government must show under the

federal statute varies between seizures and forfeitures.93 To allow for the

seizure of property, the seizing agent must obtain a warrant based on a

judicial determination of probable cause that the terms of the forfeiture

statute, criminal or civil, have been satisfied.94 To allow for the forfeiture of

property, the agent must show that the same property satisfies the statute,

but by a preponderance of the evidence.95 The standard of proof required

of state agents is typically even less, allowing seizure upon reasonable

suspicion and forfeiture upon probable cause. 96

II. The Eighth Amendments Excessive Fines Clause Provides

Defendants with Limited Protection Against Unreasonable

Forfeitures.

Having seen the almost unlimited reach of the laundering forfeiture

statutes, concerns are rightfully raised about how aggressively the

Government might employ them.97 These concerns are somewhat

alleviated by the constitutional check on this broad reach: the Eighth

Amendments Excessive Fines Clause.98

The Eighth Amendment to the U.S. Constitution mandates that

[e]xcessive bail shall not be required, nor excessive fines imposed, nor

cruel and unusual punishments inflicted.99 Of those three clauses, the one

barring the imposition of excessive fines has received the least amount of

a jury trial, and imparting upon sentencing judges the discretion to depart from those ranges).

92 Cf. Mark A. Rush & Heather Hackett, USA PATRIOT ActMoney Laundering and

Asset Forfeiture 19 (Dec. 13, 2001), available at http://www.klgates.com/files/ Publication/

d6611cd7-df27-43a7-be9a-7c874cee170d/Presentation/PublicationAttachment/89ca6905-002a4150-93a1-3b3066a5c601/assetforfeiture.pdf (The sentencing judge has no option or discretion

concerning the forfeiture of funds involved in bulk cash smuggling.).

93 Note that a seizure is the initial confiscation of property by a law enforcement officer

for detainment pending a forfeiture determination. See BLACKS LAW DICTIONARY 1480-81 (9th

ed. 2009); Worrall, supra note 87, at 222. A forfeiture is the judicial or administrative act of

transferring title from the original owner to the governmental body pursuing the action.

BLACKS LAW DICTIONARY 722 (9th ed. 2009).

94 ASSET FORFEITURE POLICY MANUAL, supra note 15, at 14.

95 Worrall, supra note 87, at 225.

96 WILLIAMS ET AL., supra note 14, at 22 tbl. 2. These relaxed state standards often carry

heavy implications of joint state-federal abuse of the federal statute. See infra Part III.B.

97

98

99

See supra Part I.D.

U.S. CONST. amend. VIII.

Id.

SUCOFF - FINAL (DO NOT DELETE)

106

11/2/2011 4:12 PM

New England Law Review

v. 46 | 93

treatment by the Supreme Court.100 The Courts first foray into its

application of the Clause came in Austin v. United States and its companion

case Alexander v. United States, where the Court held that forfeitures that

served a punitive function were properly considered fines and subject to

Eighth Amendment analysis.101 These cases, however, gave no indication as

to how that analysis should proceed.102

The Court revisited the issue in 1998 in what has become the seminal

case on Eighth Amendment limitations on forfeitures.103 In United States v.

Bajakajian, for the first time, the Supreme Court struck down a forfeiture

order as constitutionally excessive.104 Defendant Bajakajian, upon boarding

an international flight, was found with $357,000.105 Instead of reporting the

sum in accordance with the law, he had tucked it away in his carry-on

luggage.106 The Government sought forfeiture of all $357,000, the District

Court denied the request on Eighth Amendment grounds, and the Ninth

Circuit affirmed.107 The Supreme Court, reacting to the part of the Ninth

Circuits opinion that invalidated a portion of an act of Congress, granted

certiorari and held that a punitive forfeiture is unconstitutionally excessive

when it is grossly disproportional to the gravity of the defendants

offense.108

The context of the case, however, paints an unsure picture of the

standards application to money-laundering forfeitures as a whole.109

100

Id.; see United States v. Bajakajian, 524 U.S. 321, 327 (1998).

Austin v. United States, 509 U.S. 602, 604 (1993); Alexander v. United States, 509 U.S.

544, 559 (1993); see Brant C. Hadaway, Comment, Executive Privateers: A Discussion On Why the

Civil Asset Forfeiture Reform Act Will Not Significantly Reform the Practice of Forfeiture, 55 U.

MIAMI L. REV. 81, 101 (2000).

102 See Cassella, supra note 22, at 640, 652.

103 See Bajakajian, 524 U.S. at 334.

104 Id. at 324.

105 Id. at 334-35.

106 Id.

107 Id. at 325-26.

108 Id. at 327, 336-37. Before confronting the question of whether the forfeiture was

excessive, the Court first had to find that forfeitures were, in fact, fines. See id. at 328. In doing

so, it emphasized the in personam nature of the criminal forfeiture at issue; because the

forfeiture was punitive, it constituted a fine. See id. at 332. Despite this, the Court

acknowledged that civil in rem forfeitures with a partial punitive purpose could also be

considered under the purview of the Eighth Amendment. Id. at 331 n.6. Congress has since

endorsed that view, statutorily extending Eighth Amendment protection to all civil

forfeitures. See 18 U.S.C. 983(g) (2006); see also United States v. Ahmad, 213 F.3d 805, 815 (4th

Cir. 2000) (stating that Bajakajian applies equally to criminal forfeitures and to civil forfeitures

of non-instrumentalities); 2 IAN M. COMISKY ET AL., TAX FRAUD & EVASION 13.04[8][a] (2010).

109 Though its practical application is unclear, there is no dispute that the grossly

disproportional analysis is properly applied to other laundering offenses. See Ahmad, 213

101

SUCOFF - FINAL (DO NOT DELETE)

2011

11/2/2011 4:12 PM

Combating the Dual Forfeiture Biases

107

Bajakajian involved a failure to report charge110a non-traditional form

of laundering triggered where a traveler fails to declare that he is carrying

$10,000 or more when entering or leaving the country. 111 In finding the

$357,000 fine grossly disproportional, the Court emphasized the fact that

Bajakajians crime was merely a reporting offense and involved no proven

affirmative illegal conduct.112 The money was legally obtained and was

otherwise unrelated to any other illegal activities.113 It was permissible

to transport . . . out of the country so long as he reported it.114

The upshot of using this sort of charge as the threshold for the

excessive fine inquiry is that it sets a very high bar for a showing of

disproportionality.115 The factors the Court relied on in finding the

forfeiture excessive will rarely, if ever, present themselves in more

traditional laundering cases.116 All property subject to traditional

laundering forfeiture, by its definition, is related to some specified

unlawful activity; similarly, to fit the terms of the statutes, that property

must be related in some way to some affirmative illegal conduct. 117 The

implication is that defendants who are convicted of either of the two

traditional money-laundering offenses per se cannot exhibit the factors that

the Supreme Court has identified as indicative of a disproportionate

forfeitureboth require the presence of proceeds of specified unlawful

activity.118 Almost as if in agreement with this impossibility, the Court

distinguished Bajakajian from the class of persons for whom the statute

was . . . designed; [h]e is not a money launderer, a drug trafficker, or a

tax evader.119 As Bajakajians actions technically constituted money

laundering, the Court must have been comparing him to traditional

launderersthose either using criminal proceeds in furtherance of other

crimes or transferring those dirty proceeds so as to make them clean.120

Presumably, a similar forfeiture would not be excessive against a more

F.3d at 814-17 (applying Bajakajian analysis to structured transaction violations).

110

Bajakajian, 524 U.S. at 324.

31 U.S.C. 5316(a)(1)(A) (2006).

112 Bajakajian, 524 U.S. at 337-38.

113 Id. at 337 (The money was the proceeds of legal activity and was to be used to repay a

lawful debt.).

114 Id. at 323.

115 See Melissa A. Rolland, Comment, Forfeiture Law, The Eighth Amendment's Excessive Fines

Clause, and United States v. Bajakajian, 74 NOTRE DAME L. REV. 1371, 1396 (1999).

111

116

117

118

119

120

See id.

18 U.S.C. 1956 (2006).

See id.

Bajakajian, 524 U.S. at 338.

See id.

SUCOFF - FINAL (DO NOT DELETE)

108

11/2/2011 4:12 PM

New England Law Review

v. 46 | 93

traditional criminal.121 In accordance with these concerns, Eighth

Amendment challenges to traditional laundering forfeitures have almost

exclusively been dismissed.122

III. The Present Structure of the Asset Forfeiture Apparatus Has Proven

Ripe for Abuse.

The broadly interpreted involved in language, the lack of judicial

discretion, and the low standard of proof required for forfeiture all interact

to create a statutory bias in favor of forfeiture; when combined with the

reluctance of courts to extend Eighth Amendment protection to traditional

laundering forfeitures, this bias becomes a judicial mandate, forcing

defendants to rely solely on prosecutorial discretion to prevent the

unreasonable loss of their property.123 The internal structure of the law

enforcement mechanism, however, indicates that this reliance may be

misplaced.124 Policy manuals and practice guides released by the

Department emphasize revenue collection as a major goal of forfeiture,125

while the federal system for disbursing property seized jointly by state and

federal enforcement teams encourages police forces to extend forfeitures as

far as is legally acceptable.126 Indeed, past abuses of asset forfeiture were so

egregious that reforms passed the House by an overwhelming majority,

121

See id.

See Calero-Toledo v. Pearson Yacht Leasing Co., 416 U.S. 663, 668, 690 (1974)

(upholding, against a due process challenge, seizure of an innocent owner's $19,800 yacht

upon which a marijuana cigarette was discovered); United States v. 38 Whalers Cove Drive,

954 F.2d 29, 32, 38-39 (2d Cir. 1992) (finding forfeiture of a $145,000 condo not grossly

disproportionate to the offense, a $250 drug sale, after applying the grossly

disproportionate standard from the Eighth Amendments Cruel and Unusual Punishment

Clause). Forfeiture of the subject matter of a laundering offense is never excessive. See United

States v. Trost, 152 F.3d 715, 721 (7th Cir. 1998); supra note 108 and accompanying text. There

are no cases on record where a court has struck down the forfeiture of commingled funds on

Eighth Amendment grounds. Cassella, supra note 22, at 640. Similarly, facilitation theory

has been a strong repellant to Eighth Amendment challenges. See United States v. Wyly, 193

F.3d 289, 302-04 (5th Cir. 1999) (upholding forfeiture of a $4 million business against the

laundering of $175,000).

122

123

See supra Part I.D-E.

See infra Part III.A-B.

125 See JOHN L. WORRALL, U.S. DEPT OF JUSTICE, PROBLEM-ORIENTED GUIDES FOR POLICE:

RESPONSE GUIDES SERIES NO. 7: ASSET FORFEITURE 2 (2008), available at http://www.

popcenter.org/responses/pdfs/asset_forfeiture.pdf; U.S. DEPT OF JUSTICE ASSET FORFEITURE

PROGRAM, NATIONAL ASSET FORFEITURE STRATEGIC PLAN 2008-2012: TAKING THE PROFIT OUT

OF CRIME 25 (2008) [hereinafter TAKING THE PROFIT OUT OF CRIME], available at

http://www.justice.gov/criminal/afmls/pubs/pdf/strategicplan.pdf.

124

126

WILLIAMS ET AL., supra note 14, at 25.

SUCOFF - FINAL (DO NOT DELETE)

2011

Combating the Dual Forfeiture Biases

11/2/2011 4:12 PM

109

and the Senate soon after.127 Even still, these reforms failed to mitigate the

substantial profit incentives facing law enforcement offices to maximize

assets forfeited.128

A. Department of Justice Policy and Procedure Is Focused on Revenue

Collection.

The Departments Asset Forfeiture Program (the Program), through

its various subordinate agencies, is responsible not only for setting the

national policies and procedures surrounding the extent and operation of

federal asset forfeiture, but also for providing guidelines for the creation

and operation of new local forfeiture units.129 On its most public forum, its

website, the Program states its mission as employ[ing] asset forfeiture

powers in a manner that enhances public safety and security.130 This

pronouncement notwithstanding, the policies and procedures put forth by

the Program and its subordinates often place revenue collection on equal

footing with the disruption of criminal enterprise and the deterrence of

crime.131 It is not difficult to see the potential for abuse in a system where

the same organization that is responsible for putting operational limits on

forfeiture amounts has a central goal to maximize revenues derived from

those same forfeitures.132

Examples of this doublespeak are numerous: the Departments guide,

designed to aid police forces in founding a new asset forfeiture unit,

encourages them to see the obvious advantage of asset forfeiture[:] . . . its

potential to boost an agencys bottom line.133 In the section titled The

127 Worrall, supra note 87, at 221; see Civil Asset Forfeiture Reform Act of 2000, Pub. L. No.

106-185, 114 Stat. 202.

128

See Balko, supra note 16, at 36.

See ASSET FORFEITURE PROGRAM, U.S. DEPT JUST., http://www.justice.gov/

jmd/afp/index.html (last visited Oct. 27, 2011) [hereinafter ASSET FORFEITURE PROGRAM]. For a

list of subordinate agencies and their particular responsibilities, see Participants and Roles,

ASSET FORFEITURE PROGRAM, U.S. DEPT JUST., http://www.justice.gov/jmd/afp/

05participants/index.htm (last visited Oct. 27, 2011).

130 ASSET FORFEITURE PROGRAM, supra note 129.

131 See WORRALL, supra note 125, at 13-14; TAKING THE PROFIT OUT OF CRIME, supra note 125,

at 25-26.

129

132

See Katherine Baicker & Mireille Jacobson, Finders Keepers: Forfeiture Laws, Policing

Incentives, and Local Budgets, 91 J. PUB. ECON. 2113, 2130 (2007) (When we consider the . . .

incentives faced by police, we see that arrests increase substantially when police get to keep

more of the proceeds.); WILLIAMS ET AL., supra note 14, at 20 (*T+here is evidence that

prosecutorial discretion has been inappropriately influenced by the presence of asset

forfeiture options.); Worrall, supra note 87, at 227.

133 WORRALL, supra note 125, at 14.; see Joseph Petrocelli, Asset Forfeiture: You Can Use

Criminals Ill-Gotten Gains to Help Fund Your Departments War On Crime, POLICE: THE LAW

SUCOFF - FINAL (DO NOT DELETE)

110

11/2/2011 4:12 PM

New England Law Review

v. 46 | 93

Need for Forfeiture, it discusses shrinking budgets and expensive and

time consuming police work at length, mentioning its use as an

enforcement tool only in passing.134 Combating the drug trade is likewise

mentioned incidentally.135 Further on, it warns the would-be asset-seizer

that if budget-setting authorities catch wind of forfeiture success, the

local government may reduce the offices budgetary allocation, expecting it

to make up the difference with seizures. 136 Not only does this practical

discussion encourage the use of forfeitures to fund police activity, it also

anticipates the feedback loop that results in an increasing amount of

seizures and essentially cautions fledgling forfeiture agents not to be too

public about their revenue successes. 137

The

budget-shoring

focus

present

in

the

Departments

recommendations to local start-up agencies might be understood as a

practical response to a small police force lacking the resources to effectively

maintain a forfeiture unit; this handicap, however, does not translate as

well to the Program itself.138 Yet the Programs major policy document, the

National Asset Forfeiture Strategic Plan (the Strategic Plan), exhibits the

same perspective.139 Developed over two years by representatives from

every agency participating in the Program, the Strategic Plan was an

opportunity for the entire asset forfeiture community to speak with one

unified voice to enhance and coordinate the use of this critical law

enforcement tool: forfeiture.140 And in that unified voice, the Program

declared that it would, as a priority tactic, seek waivers to allow the use

of money from the Assets Forfeiture Fund (the Fund)141 to pay the

ENFORCEMENT MAGAZINE, Feb. 2010, at 22, 22 (Where can [you] find the funds necessary . . .

? One answer is to take the funds from the criminals.).

134 Id. at 2 (Though it is an enforcement tool, asset forfeiture can assist in the budgeting

realm by helping to offset the costs associated with fighting crime.).

135 Id.

136 Id. at 16-17.

137 See Baicker & Jacobson, supra note 132, at 2124-25, 2128-29 (examining empirically the

amount that local counties offset police seizures by reducing police budgets).

138

See Petrocelli, supra note 133, at 22 (suggesting forfeiture as a solution to smaller police

budgets and increased societal demands on police). Compare Baicker & Jacobson, supra note

132, at 2122 tbl. 1, 2123 (noting that local county budgets are only $55 per capita), with AUDIT

DIVISION, U.S. DEPT OF JUSTICE, ASSETS FORFEITURE FUND AND SEIZED ASSET DEPOSIT FUND

ANNUAL FINANCIAL STATEMENTS FISCAL YEAR 2010, at 7, 8 (2011) available at http://

www.justice.gov/jmd/afp/01programaudit/fy2010-afs-rpt.pdf (noting that the Asset Forfeiture

Fund enjoys a budget of over $2.4 billion).

139

140

141

TAKING THE PROFIT OUT OF CRIME, supra note 125, at 25-26.

Id. at 3, 5.

The Fund was established to receive the proceeds of forfeiture and to pay any

SUCOFF - FINAL (DO NOT DELETE)

2011

Combating the Dual Forfeiture Biases

11/2/2011 4:12 PM

111

salaries of those working for the Program.142

B. The Equitable-Sharing Disbursement Program Creates a Large Profit

Incentive to Maximize Seizures.

As Department policies of revenue generation push federal actors

towards larger forfeitures, the federal-state system for disbursement of

seized assets pushes state actors likewise.143 This equitable sharing

system was established in 1984 with the passage of the Comprehensive

Crime Control Act and allows for the value of assets seized by federal

agents to be shared with any state or local agencies that participate in the

arrest, provided that the shared funds are used for law enforcement

purposes only.144 State agents participating in a joint investigative

forfeiturein which both state and federal agents concurrently investigate

a crimeare eligible to receive a percentage of the assets value in

proportion with the number of man-hours they contributed.145

It is with adoptive forfeitures, however, that the full magnitude of

the equitable-sharing profit incentive blossomed.146 Under the adoptiveforfeiture framework, a state agencyhaving fully completed an

investigation, arrest, and seizurecan turn both the case and the seized

assets over to an appropriate federal agency.147 The federal agency will

associated costs, including the costs of managing and disposing of property, satisfying valid

liens, mortgages, and other innocent owner claims, and costs associated with accomplishing

the legal forfeiture of the property. The Fund, ASSET FORFEITURE PROGRAM, U.S. DEPT OF

JUSTICE, http://www.justice.gov/jmd/afp/02fundreport/02_2.html (last updated Aug. 2011).

Money from the Fund can properly be used to pay any necessary expenses associated with

forfeiture operations such as property seizure, detention, management, forfeiture, and

disposal. Id. The Fund may also be used to finance certain general investigative expenses.

Id.

142 TAKING THE PROFIT OUT OF CRIME, supra note 125, at 25-26. For perspective, other

priority tactics included: making effective use of forfeiture in terrorism cases and using

forfeiture to recover victims assets. Id. at 41-42.

143

See WILLIAMS ET AL., supra note 14, at 25; Petrocelli, supra note 133, at 22.

Eric Blumenson & Eva Nilsen, Policing for Profit: The Drug Wars Hidden Economic

Agenda, 65 U. CHI. L. REV. 35, 50-51 & n.62 (1998); see ASSET FORFEITURE POLICY MANUAL, supra

note 15, at 127 (Equitable sharing is the process by which state and local law enforcement

agencies can recover federally forfeited assets, or the proceeds from the sales of those assets . .

. .); ASSET FORFEITURE & MONEY LAUNDERING SECTION, U.S. DEPT OF JUSTICE, GUIDE TO

EQUITABLE SHARING FOR STATE AND LOCAL LAW ENFORCEMENT AGENCIES 16-18 (2009)

[hereinafter GUIDE TO EQUITABLE SHARING FOR STATE AND LOCAL LAW ENFORCEMENT

AGENCIES] (listing all proper uses for shared funds).

145 WILLIAMS ET AL., supra note 14, at 25.

146 See Worrall, supra note 87, at 227.

147 WILLIAMS ET AL., supra note 14, at 25; see also ASSET FORFEITURE POLICY MANUAL, supra

note 15, at 33-34.

144

SUCOFF - FINAL (DO NOT DELETE)

112

11/2/2011 4:12 PM

New England Law Review

v. 46 | 93

handle the case and, if successful, can transfer up to 80% of the assets

value back over to the original state agency. 148 The true economic value of

this system to the law enforcement community becomes apparent when

viewed in the context of state regulations that earmark forfeiture proceeds

for non-law enforcement purposes.149 By filing for an adoptive forfeiture,

local police departments can skirt these state mandates and escape with up

to 80% of their forfeiture, a much greater percentage than typically allowed

under state law; by that same token, the Department can receive a 20%

share or more while expending minimal investigative or law enforcement

resources.150 Furthermore, by bringing the cases into federal court, federal

prosecutors can unlock the long reach of the money-laundering-forfeiture

statutes, potentially subjecting the same defendant to a much broader

forfeiture order.151

Equitable sharing essentially federalizes state forfeitures. 152 First, local

police seize property in accordance with state forfeiture procedures

requiring a less onerous standard of proof.153 Then, they transfer that

property to the relevant federal agencythe transfer of which, in civil

cases, exempts the seizure from the warrant requirement.154 Finally, the

agency completes the forfeiture, the seized (now forfeited) assets go into

the Fund, and the state agency receives their 80% cut.155 Not surprisingly,

such a streamlined operation attracts pointed criticism. 156

C. Asset Disbursement Profit Incentives Have Previously Resulted in

Gross Abuses of Forfeiture Power.

The heavy reliance of state and local police forces on forfeiture

proceeds combined with the ability to reap a huge percentage of those

proceeds purely for law enforcement spending has resulted in a number of

highly publicized abuses of forfeiture power. 157 Perhaps the most widely

148

See Worrall, supra note 87, at 227.

See WILLIAMS ET AL., supra note 14, at 25 (*S+tate law typically mandates that the

proceeds [of forfeiture] be distributed to specific non-law enforcement purposes . . . .). The

incentive is so great that the Departments Asset Forfeiture and Money Laundering Section

implores federal agents to process equitable sharing claims quickly, as state and local agencies

have come to rely on them. ASSET FORFEITURE POLICY MANUAL, supra note 15, at 127.

150 See Blumenson & Nilsen, supra note 144, at 52-54.

151 See, e.g., 18 U.S.C. 981 (2006); 18 U.S.C. 982 (2006 & Supp. III 2010).

152 See Blumenson & Nilsen, supra note 144, at 51-52, 54.

153 See id. at 51, 54.

154 2 COMISKY ET AL., supra note 108, 13.02[1][a].

155 See Blumenson & Nilsen, supra note 144, at 51; U.S. DEPT OF JUST., supra note 141.

156 See generally Balko, supra note 16; WILLIAMS ET AL., supra note 14, at 25; Worrall, supra

note 87, at 227.

149

157

See NPR, SPECIAL SERIES, Dirty Money: Asset Seizures and Forfeitures, http://

SUCOFF - FINAL (DO NOT DELETE)

2011

Combating the Dual Forfeiture Biases

11/2/2011 4:12 PM

113

controversial was the case of Donald Scott, a reclusive multimillionaire

rancher in Malibu, California.158 In October 1992, a task force comprised of

L.A. County sheriffs deputies, U.S. Drug Enforcement Administration

(DEA) agents, National Park Service officials, and others burst through

Scotts door in the early morning.159 Reacting to his wifes screams, and

partially blind from recent cataract surgery, he came out of his bedroom

clutching a .38-caliber revolver.160 Deputies ordered him to drop it; as he

did, they shot him in the chest twice, killing him. 161 The posse was

searching for a large cache of marijuana plants on the strength of a tip

from an anonymous informant who claimed there were thousands of . . .

plants on the property.162 Despite this, a multi-hour search of the ranch

turned up not a single plant.163

In the aftermath of the shooting, Ventura County District Attorney

Michael Bradburys investigation turned up some disturbing facts. 164 The

DEA agents present that night had prepared the necessary paperwork to

seize the ranch in advance of the raid.165 Scotts ranch was worth $5 million,

and he had repeatedly rebuffed National Park Service attempts to purchase

his landthe Service wished to incorporate it into a nearby National

Recreation Area.166 Scotts close friend and executor, Nicholas Gutsue,

openly suspected that the agencies had struck a similar deal to that

discussed earlier: the DEA would seize the property via the wide-reaching

federal forfeiture statutes, the Park Service would purchase the land, and

the other participating agenciesfederal, state, and localwould split the

proceeds.167

www.npr.org/series/91856663/dirty-money-asset-seizures-and-forfeitures (last visited Oct. 27,

2011).

158

See Ron Soble, Death of a Tycoon: Killed in a Raid, Rancher Don Scott Was a Man of Legends,

L.A. TIMES, Oct. 11, 1992, http://articles.latimes.com/1992-10-11/local/me-257_1_don-scott; see

also Richard Miniter, Ill-Gotten Gains: Police and Prosecutors Have Their Own Reasons to Oppose

Forfeiture-Law Reform, REASON, Aug.-Sept. 1993, at 32, 32. Though the forfeiture in this case

was to be effected via the drug-forfeiture statute, 21 U.S.C. 853 (2006), the incentives that

spurred the raid are the same as those affecting use of the laundering-forfeiture statutes, 18

U.S.C. 1956-1957 (2006 & Supp. III 2010). See Soble, supra.

159

160

161

162

163

164

165

166

167

Soble, supra note 158.

Id.

Id.

Miniter, supra note 158, at 32.

Soble, supra note 158.

Miniter, supra note 158, at 32.

Id.

Id.

Id.; see supra text accompanying notes 153-55.

SUCOFF - FINAL (DO NOT DELETE)

114

11/2/2011 4:12 PM

New England Law Review

v. 46 | 93

Regardless of whether or not the conspiracy ran as deep as Gutsue

imagined, Bradbury was convinced forfeiture was a major objective of the

raid; not only did two participating agents admit that the topic had been

discussed in a prior briefing, but the sheriffs department was found to

have both a property appraisal statement for the ranch and a parcel map

listing property values of neighboring plots. 168 In any case, it is clear

enough that the structure of the federal forfeiture system was broad

enough to at least pique the interests of the agents involved, if not actively

influence their conduct.169

Though Donald Scott may have felt it the hardest, he is certainly not

the only civilian to have been affected by this sort of forfeiture abuse. 170

Paul Born, recently out of prison, was contacted by an undercover officer

who offered to sell him cocaine; Paul declined.171 Later, the officer called

Borns home and arranged to purchase two ounces of cocaine from a thirdparty residing there.172 After the sale, which took place in another location

and at which Born was not present, federal prosecutors filed a civil

forfeiture complaint seeking to confiscate the house; the order was granted

on the grounds that the house telephone was used to set up the sale,

sufficiently facilitating the drug crime.173

In Nebraska, Emiliano Gonzolez was pulled over for speeding.174

Officers searched a cooler in his car and discovered approximately $125,000

in cash, which they seized.175 On appeal, the court found unconvincing

Gonzolezs claim that the cash represented the combined life savings of

him and two others, pooled together to buy a refrigerated truck for his

produce business, despite the corroborating testimony from his two

partners.176 It reasoned that possession of a large sum of cash is strong

evidence of a connection with drug activity, and found that such

possession, combined with Gonzolezs initial (false) denial of a criminal

record (one driving under the influence conviction), was a sufficient

showing to satisfy the Governments forfeiture burden.177 The list goes

168

Miniter, supra note 158, at 33.

See supra Part III.D.

170 Moores, supra note 30, at 778-79 (noting examples of abuse).

171 United States v. 916 Douglas Ave., 903 F.2d 490, 491 (7th Cir. 1990).

172 Id.

173 Id. at 493-94 (It is irrelevant whether the property's role in the crime is integral,

essential or indispensable. The term facilitate implies that the property need only make the

prohibited conduct less difficult or more or less free from hinderance *sic+. (quoting United

States v. Schifferli, 895 F.2d 987, 990 (4th Cir. 1990) (internal quotation marks omitted))).

169

174

175

176

177

United States v. $124,700, in U.S. Currency, 458 F.3d 822, 823 (8th Cir. 2006).

Id. at 824.

Id.

Id. at 824-26.

SUCOFF - FINAL (DO NOT DELETE)

2011

Combating the Dual Forfeiture Biases

11/2/2011 4:12 PM

115

on.178

D. Reform Efforts Thus Far Have Not Removed Incentives for Abuse.

The increasing accumulation of similar experiences of abuse spurred a

public outcry for reform, and then-House Judiciary Chairman Henry Hyde

was finally able to push his Civil Asset Forfeiture Reform Act (CAFRA)

through Congress.179 CAFRA made a number of positive procedural

changes to the then-lawless state of civil forfeiture, but the majority of them

did not trigger protection until after seizure.180 Faced with the monetary

and temporal cost of defending against forfeiture, many aggrieved parties

simply choose not to challenge the order.181

Further, CAFRA did nothing to alter the institutionalized incentives

that arise when law enforcement agencies have the power to both seize

property and use it to fund their operations.182 The ineffective nature of the

reform is backed by hard numbersthe relative increase in Fund activity

from 1996 (four years before CAFRA) to 2008 (eight years after) is

exponentially larger than that same increase between 1985 and 1996.183 Not

only has CAFRA failed to obstruct federal forfeiture, the net amount of

assets forfeited has exploded since its inception.184

178 See Bovard, supra note 3, at 9-10 (citing as examples of abuse: seizure of $250,000 from

decedent owners heirs on strength of a confidential informants tip that deceased had taken

payment to allow his dock to be used for drug sales two years prior; seizure at an airport of

$113,000 that a Vietnamese woman had collected from twenty community families to bring

back to children in her home village); see also Balko, supra note 16, at 33 (noting the seizure of

$17,500 on suspicion arising from a single previous marijuana chargethe driver was

bringing the balance of a car accident settlement to buy his aunt a new car).

179

Worrall, supra note 87, at 221.

See id. at 228.

181 See WILLIAMS ET AL., supra note 14, at 13.

182 Moores, supra note 30, at 783. Some relevant procedural changes CAFRA brought about

include: increase of the governments forfeiture burden to a preponderance of the evidence;

addition of an innocent owner defense; requirement that indigents be provided counsel;

mandatory release of property where seizure (but not forfeiture) would be an undue

hardship; creation of a cause of action against the government for wrongful forfeiture; and

extension of the statute of limitations on forfeiture challenges. Worrall, supra note 87, at 228.

183 Moores, supra note 30, at 783-84 (tracing fund activity between 1985 and 1996 (increase

of $311 million) and 1996 and 2008 (increase of approximately $1 billion)).

180

184

Id. at 784.

SUCOFF - FINAL (DO NOT DELETE)

116

11/2/2011 4:12 PM

New England Law Review

v. 46 | 93

ANALYSIS

IV. The Dual Concerns of the Forfeiture Statutes Expansive Reach and

the Law Enforcement Communitys Profit Incentive Must Be

Addressed if Future Abuse Is to Be Prevented.

At this point it is clear that the current structure of the federal moneylaundering-asset forfeiture scheme is significantly tilted towards granting

forfeiture requests.185 An extremely broad interpretation of the involved

in standard combined with the total lack of judicial discretion over

forfeiture orders creates a judicial bias strongly in favor of forfeiture

success.186 Concurrently, the perks of the equitable-sharing system

compound upon the Departments already existing focus on revenue

generation through forfeiture to create an analogous enforcement bias.187

The fact that both the bodies individually instigating and adjudicating the

average forfeiture proceeding are biased in favor of success is evidence

enough that challenging parties need to be afforded more protection,

especially considering the limited application of the Constitution to the

issue.188 The aforementioned judicial bias can be combated by amending

the terms of the forfeiture statute to add a provision requiring the amount

forfeited to be proportional to the severity of the crime.189 Likewise,

imposing heavy limitations on the equitable-sharing payout scheme could

minimize the profit incentives responsible for the enforcement bias.190

Though realistically neither bias can be completely eliminated, a reform

program aimed at lessening both would effectively reduce the risk of

further forfeiture abuse.191

185

See supra Part III.D.

See 18 U.S.C. 982(a)(1) (2006) (The court, in imposing sentence . . . shall order that the

person forfeit . . . any property . . . involved in *the+ offense.) (emphasis added); see also

Cassella, supra note 22, at 615-16.

186

187 See Blumenson & Nilsen, supra note 144, at 51-54; WORRALL, supra note 125, at 13-14; see

also supra Part III.B.

188

See discussion supra Parts I.E, III.A-B; see, e.g., United States v. Bajakajian, 524 U.S. 321

(1998).

189 See Cassella, supra note 22, at 603-04 (demonstrating that the crux of an Eighth

Amendment analysis is proportionality between crime and punishment).

190

191

See Moores, supra note 30, at 801-02.

See Cassella, supra note 22, at 603.

SUCOFF - FINAL (DO NOT DELETE)

2011

11/2/2011 4:12 PM

Combating the Dual Forfeiture Biases

117

A. Combating Bias Through ProportionalityAmendment of the

Forfeiture Statute to Codify the Bajakajian Balancing Test

The addition of a proportionality requirement to 981 and 982 would

be a significant step towards mitigating the risk that property loosely

connected to a money-laundering offense will get swept away by the

federal courts almost pro forma approval of forfeiture orders.192 The task

of crafting such a requirement includes at its core the protection of those

defendants excluded by Bajakajian (traditional money launderers)it is

essential that the proportionality test be applied to every forfeiture

sought.193 However, the standard must be flexible enough to avoid

interfering with the legitimate enforcement of forfeiture authority. 194

The grossly disproportional requirement set by the Supreme Court is

a fine place to start, and in fact, the search need not progress much further;

a closer look at Bajakajian and its progeny reveals a very workable

balancing test.195 The Bajakajian test asks whether the amount of the

forfeiture is grossly disproportional to the gravity of [the] defendants

offense.196 In so determining, the Court considered four factors: (1) the

nature and extent of the crime, (2) whether the violation was related to

other illegal activities, (3) the other penalties that may be imposed for the

violation, and (4) the extent of the harm caused.197

The major obstacle to Eighth Amendment protection of money

launderers seized property is not the proportionality inquiry itself or its

factors but the effect that the specific facts of Bajakajian had on the

subsequent application of the test.198 Bajakajians level of criminal non-

192

See supra note 88 and accompanying text.

See Bajakajian, 524 U.S. at 338-39 (evaluating plaintiffs nontraditional laundering crime

with a proportionality analysis).

193

194 See Craig Gaumer, A Prosecutors Secret Weapon: Federal Civil Forfeiture Law, 55 U.S.

ATTYS BULL. 59, 59 (Nov. 2007) (providing the history of forfeiture laws and their legitimate

enforcement purposes).

195 See Bajakajian, 524 U.S. at 334-38; see, e.g., United States v. 817 N.E. 29th Drive, 175 F.3d

1304, 1311 (11th Cir. 1999) (deeming it improper to factor in the personal characteristics of the

owner, the character of his property, and the value of any remaining assets); United States v.

Dicter, 198 F.3d 1284, 1292 n.11 (11th Cir. 1999) (denying personal impact of forfeiture on

specific defendant as a factor to consider under Bajakajian).

196

Bajakajian, 524 U.S. at 334.

United States v. $100,348.00 in U.S. Currency, 354 F.3d 1110, 1122 (9th Cir. 2004).

198 See Bajakajian, 524 U.S. at 338 (explaining that the nature of the crime was relatively

inoffensive, the actions were unrelated to other illegal activities, and *t+he money was the