Professional Documents

Culture Documents

ResMed Q2 2017 Investor Presentation

Uploaded by

medtechyCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

ResMed Q2 2017 Investor Presentation

Uploaded by

medtechyCopyright:

Available Formats

Investor Presentation

Q2 2017

January 23, 2017

Safe Harbor Statement

Statements contained in this presentation that are not historical facts are forwardlooking statements as contemplated by the Private Securities Litigation Reform Act

of 1995. These forward-looking statements including statements regarding

ResMed's projections of future revenue or earnings, expenses, new product

development, new product launches and new markets for its products and the

integration of acquisitions are subject to risks and uncertainties, which could

cause actual results to materially differ from those projected or implied in the

forward-looking statements. Additional risks and uncertainties are discussed in

ResMeds periodic reports on file with the U.S. Securities & Exchange Commission.

ResMed does not undertake to update its forward-looking statements.

2017 ResMed I 2

ResMed Driving Value for Shareholders

Long-term growth

opportunities across all three horizons

of ResMeds strategy

Reduce healthcare costs;

improve outcomes

Improve quality of life for patients

Prevent chronic disease progression

Reduce costs of managing chronic disease

Proven innovator

in products and Connected Care for sleep apnea, COPD,

neuromuscular disease and other chronic diseases

Underpenetrated markets

For sleep-disordered breathing and respiratory care

2017 ResMed I 3

Disciplined financial

management

Operational excellence,

strong capital deployment history,

committed to investing in innovation and

returning excess cash to shareholders

Number of Patient Lives Impacted

ResMeds growth strategy

Changing lives with every breath

20 million lives changed in 2020

Improve patient quality of life

Slow chronic disease progression

Reduce healthcare system costs

Horizon 1

Lead SDB Industry

Ground breaking end-to-end

connected care solutions

Horizon 3

Invest in Portfolio of

New Market Options

Sleep & Consumer Wellness

Horizon 2

Scale-Up Respiratory Care

and Connected COPD

Connected respiratory care solutions

for COPD, obesity-hypoventilation

syndrome, and neuromuscular

disease, including ALS

Integrate with connected solutions

Engagement in Sleep Health

Expansion of ResMed brand

Connected Care Expansion

Connected devices, analytics, population

health models

Care coordination

Out of hospital SaaS Solutions

Adjacent Market Development

A-Fib, HFpEF, Asthma

Expansion in High Growth Markets China, E. Europe, India, Brazil, S.E. Asia

Time to Material Growth Impact

PEOPLE, LEADERSHIP AND CULTURE

GLOBAL LEADERSHIP IN DIGITAL HEALTH AND CONNECTED CARE

OPERATING EXCELLENCE LEVERAGE MARKET-LEADING SCALE

2017 ResMed I 4

Global leader in sleep apnea management

AirSense 10

2017 ResMed I 5

myAir

AirViewTM

Strong pipeline of sleep products

2017 ResMed I 6

Full spectrum of products for respiratory care

Portable Oxygen Concentrator

Activox

Bilevel Ventilation

AirCurve 10

AcuCare high flow nasal cannula

Non-invasive Ventilation (NIV)

Lumis

Stellar

Patient Acuity

2017 ResMed I 7

Life Support Ventilation

Astral

Astral with RCM

End-to-end solutions for sleep apnea & respiratory care

Over 2 million cloud-connected med devices liberating data daily through AirView

3rd Party

Diagnostics

DIAGNOSIS

2017 ResMed I 8

THERAPY

MONITORING & MGMT.

PATIENT ENGAGEMENT

BILLING & INTEGRATIONS

Global leader in Connected Care for medical devices

AirView hasover

4million+patients

200,000+ diagnostictests

processedinthecloud

15APIcallspersecond

fromintegrators

2017 ResMed I 9

2 million+patients

monitoredathomewith

connectedcare

Brightree has45million+

patientaccountsaspartofits

postacutecarenetwork

1,000+ patientsaday

signupfor myAir

Liberating sleep data and providing predictive analytics

Over 1 billion nights of sleep data

Receiving over 2 million nights of data daily

Clinically proven devices and solutions

Leading solutions consulting services

improve healthcare outcomes

unlock value for patients, physicians, providers and payers

2017 ResMed I 10

Sleep apnea is a huge and underpenetrated market

Sleep Heart Health Study: 26% of adults have sleep apnea

Eastern Europe

China

South Korea

India

Brazil

<15% penetration

2017 ResMed I 11

<10% penetration

<1% penetration

High growth markets

COPD is a large and growing market

Chronic obstructive pulmonary disease (COPD) is the third leading cause

of death worldwide1

More than 200 million people worldwide are estimated to have COPD2

Largely undiagnosed COPD sufferers in high-growth markets such as China, India, Brazil

and E. Europe may be well over 100 million3

Cost to healthcare systems from COPD is enormous:

Europe: ~48 billion per year4

US: ~$50 billion per year5

More than 3 million people worldwide die each year

due to COPD5

1World

Health Organization. The top 10 causes of death: Fact sheet: No310 (2014, May) accessed 20Jul16

Ferkol T et al. Annals ATS 2014

estimates based on World Health Organization estimates and Zhong et al. "Prevalence of Chronic Obstructive Pulmonary Disease in China Respiratory and Critical Care

4 European Respiratory Society, European Lung White Book http://www.erswhitebook.org/chapters/the-economic-burden-of-lung-disease/ accessed 20Jul16

5 Guarascio et al. Dove Med Press, 2013 Jun 17

6 World Health Organization. Chronic obstructive pulmonary disease (COPD): Fact sheet No315. 2015 accessed 20Jul16

2

3 Company

2017 ResMed I 12

Opportunity to shift care from hospital to home

$10,000

Healthcare Costs per Capita (USD)

8,713

$8,000

6,325

$6,000

4,819

3,713

$4,000

3,077

3,235

3,866

4,124

4,904

4,351

3,453

$2,000

$0

Source: Organization for Economic Cooperation and Development, OECD Health Statistics 2015, July 2015. As compiled by the Peter G. Peterson Foundation. Per capita

health expenditures all from 2013, except Australia for which 2012 data are the latest available. Chart uses purchasing power parities to convert data into U.S. dollars

2017 ResMed I 13

AirSolutions - Better outcomes, improved efficiencies

%

21

patient adherence

with automated

compliance

coaching1

1.

2.

3.

4.

Labor

Costs2

New

Patient

Setups3

Hwang, et al., Tele-OSA study, Abstract SLEEP 2016

Munafo, et al. Sleep Breath 2016

Data based on monthly patient setups and compliance rates of DME customers from February

2014 March 2015. Historical results for this provider over the stated time

Crocker, et al., Abstract CHEST 2016

2017 ResMed I 14

59%

55%

Worlds largest study for adherence

> 128,000 patients

%

24

patient adherence

with patient

engagement4

Non-Invasive Ventilation: Reduces hospital admissions

Combining non-invasive ventilation

with home oxygen therapy:

Reduced likelihood of hospital

re-admission or death by 51%

Increased time to re-admission to

hospital or death by ~90 days

References: Murphy et al. European Respiratory Society 2016 Late-Breaking Abstract

2017 ResMed I 15

NIV: Potential to improve outcomes in COPD

Mortality risk reduced by over 60%* using

long-term non-invasive ventilation (NIV)

treatment in severe, hypercapnic chronic

obstructive pulmonary disease (COPD)

12% mortality (NIV intervention group)

33% mortality (control group)

Significant potential for NIV growth:

NIV underpenetrated as treatment for COPD

Control Group

Intervention Group

p=0.0004

0.30

Cumulative Mortality

One-year mortality in the two matched

COPD cohorts:

0.40

0.20

0.10

Key growth areas: US, Europe, China, Brazil

0

0

100

200

Time

(Days after randomization)

References: Khnlein et al. Lancet Respir Med 2014

* Mortality reduction is 60% on a relative basis from 33% mortality to 12% mortality, which is 21% reduction on an absolute basis

2017 ResMed I 16

300

Longer term growth through a portfolio of options

Adjacent Market Development

A-Fib, HFpEF, Asthma, Monitoring

Stroke

62%

Sleep & Consumer wellness

Atrial Fibrillation

49%

Engagement in Sleep Health

Expansion of ResMed brand

Heart Failure

76%

Type 2 Diabetes

72%

Connected Care Expansion

Connected devices, predictive analytics,

population health models

Care coordination services

Post acute care SaaS Solutions

2017 ResMed I 17

Drug-Resistant Hypertension

83%

Morbid Obesity

77%

Disciplined financial track record

Revenue ($B)

8%

CAGR

Adjusted Net Income ($M)

10%

CAGR

$1.8

$379

$234

$1.2

2011

2016

Adjusted EPS

12%

CAGR

2011

2016

Free Cash Flow ($M)

$2.68

18%

CAGR

$489

$1.49

$217

2011

Fiscal Years ended June 30

2017 ResMed I 18

2016

2011

2016

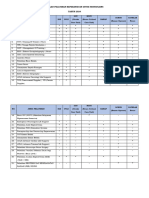

Q2 2017 results

Key Financial Metrics

Revenue

Non-GAAP gross margin*

Non-GAAP operating profit*

Non-GAAP net income*

Non-GAAP EPS*

Q2 2017

$530.4M

+17% (+18% CC)

58.3%

$131.6M

+13%

$103.3M

+1%

$0.73

0%

Cash flow from operations

$119.9M

Free cash flow

$105.2M

* Excludes for the impact of the Astral battery field safety notification expenses, release of SERVE-HF accrual, restructuring expenses, acquisition

related expenses and amortization of acquired intangible assets from their evaluation of ongoing operations.

2017 ResMed I 19

Diversified revenue sources by region & product

Brightree

6%

EMEA

24%

Americas

Devices

62%

57%

APAC

Masks and

Accessories

14%

37%

Note: Represents Q2 2017 revenue breakdown

2017 ResMed I 20

Operating Excellence: a continuous process at ResMed

Invest in innovation

& unlock acquisition

value

Efficiencies in

product supply &

manufacturing

2017 ResMed I 21

ResMeds

Operating

Excellence

Process

Grow

operating

margins

Expand

Operating

Leverage

Proven capital management

Capital Deployment

Investment for Growth

New Products

Geographic expansion

Acquisitions

Free Cash Flow returned

to Shareholders

Last twelve months combined

dividend and stock repurchase

= 47% of free cash flow

Increasing Dividend

YTD FY 2017 dividend payout

ratio of 61% of net income

FY 2017 dividend per share

increased by 10% over prior

year

Combined dividend and buy-back over rolling 5 years

= 81% of free cash flow

Through Q2 FY2017

2017 ResMed I 22

Changing Lives with Every Breath

In the last 12 months, we changed

more than 10 million lives.

Our aspiration is to change

20 million lives by 2020

2017 ResMed I 23

ResMed Driving Value for Shareholders

Long-term growth

opportunities across all three horizons

of ResMeds strategy

Reduce healthcare costs;

improve outcomes

Improve quality of life for patients

Prevent chronic disease progression

Reduce costs of managing chronic disease

Proven innovator

in products and Connected Care for sleep apnea, COPD,

neuromuscular disease and other chronic diseases

Underpenetrated markets

For sleep-disordered breathing and respiratory care

2017 ResMed I 24

Disciplined financial

management

Operational excellence,

strong capital deployment history,

committed to investing in innovation and

returning excess cash to shareholders

Contact Investor Relations

Phone: (858) 836-5971

Email: investorrelations@resmed.com

Website: www.investors.resmed.com

2017 ResMed I 25

You might also like

- Amgen 2019 JP Morgan PresentationDocument32 pagesAmgen 2019 JP Morgan PresentationmedtechyNo ratings yet

- Celgene January 2019 Investor-PresentationDocument26 pagesCelgene January 2019 Investor-PresentationmedtechyNo ratings yet

- Amarin ICER CVD Final Evidence Report 101719Document161 pagesAmarin ICER CVD Final Evidence Report 101719medtechyNo ratings yet

- Transform Olympus 2019Document12 pagesTransform Olympus 2019medtechyNo ratings yet

- Conmed and Buffalo Filter Acquisition PresentationDocument6 pagesConmed and Buffalo Filter Acquisition PresentationmedtechyNo ratings yet

- Boston Scientific / BTG Acquisition PresentationDocument18 pagesBoston Scientific / BTG Acquisition PresentationmedtechyNo ratings yet

- RTI Surgical Acquires Paradigm SpineDocument13 pagesRTI Surgical Acquires Paradigm SpinemedtechyNo ratings yet

- Stereotaxis Investor Presentation 4Q2018Document17 pagesStereotaxis Investor Presentation 4Q2018medtechy100% (1)

- Endologix Investor Meeting 10-02-18Document45 pagesEndologix Investor Meeting 10-02-18medtechyNo ratings yet

- Otonomy OTO-413 Presentation (November 5, 2018)Document10 pagesOtonomy OTO-413 Presentation (November 5, 2018)medtechyNo ratings yet

- NUVA Second Quarter 2018 Supplemental SlidesDocument14 pagesNUVA Second Quarter 2018 Supplemental SlidesmedtechyNo ratings yet

- CB Insights Amazon in Healthcare BriefingDocument83 pagesCB Insights Amazon in Healthcare BriefingmedtechyNo ratings yet

- Cardinal Health Q4 FY18 Earnings DeckDocument22 pagesCardinal Health Q4 FY18 Earnings DeckmedtechyNo ratings yet

- CB Insights Amazon in Healthcare BriefingDocument83 pagesCB Insights Amazon in Healthcare BriefingmedtechyNo ratings yet

- Allergan Q2 2018 Earnings PresentationDocument52 pagesAllergan Q2 2018 Earnings PresentationmedtechyNo ratings yet

- 2018 ADA Analyst Meeting FINALDocument29 pages2018 ADA Analyst Meeting FINALmedtechyNo ratings yet

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (895)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5794)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (400)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (588)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (74)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (344)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (121)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- Casti2017 PDFDocument186 pagesCasti2017 PDFAnson JohnNo ratings yet

- Challenges, Interests and Decisions 2021 Cl.10Document5 pagesChallenges, Interests and Decisions 2021 Cl.10Larisa MaritoiNo ratings yet

- PRELIM CHN LECTURE HandoutsDocument22 pagesPRELIM CHN LECTURE HandoutsJOYCE ANN PEREGRINONo ratings yet

- VU Research Portal: From Gender Variance To Gender DysphoriaDocument17 pagesVU Research Portal: From Gender Variance To Gender DysphoriaSento BrietNo ratings yet

- ITI Decision Tree Immediate PlacementDocument1 pageITI Decision Tree Immediate Placementxiaoxin zhangNo ratings yet

- The Cost of Growing Up in A Dysfunctional FamilyDocument6 pagesThe Cost of Growing Up in A Dysfunctional Familyamos wabwileNo ratings yet

- Impaired Tissue PerfusionDocument2 pagesImpaired Tissue PerfusionLeo Mar MakilanNo ratings yet

- Title: Author: Publisher: Isbn10 - Asin: Print Isbn13: Ebook Isbn13: Language: Subject Publication Date: LCC: DDC: SubjectDocument341 pagesTitle: Author: Publisher: Isbn10 - Asin: Print Isbn13: Ebook Isbn13: Language: Subject Publication Date: LCC: DDC: SubjectLouNo ratings yet

- Laporan Kasus SACG Dan Katarak Kongenital Pada AniridiaDocument15 pagesLaporan Kasus SACG Dan Katarak Kongenital Pada AniridiaIntan EkarulitaNo ratings yet

- BSCC 3-7Document5 pagesBSCC 3-7stella revai mugadzawetaNo ratings yet

- Semr Finals AUBF UrinalysisDocument6 pagesSemr Finals AUBF UrinalysisKrenz CatiboNo ratings yet

- Association of Streptococcus Mutans Collagen Binding GenesDocument9 pagesAssociation of Streptococcus Mutans Collagen Binding GenesSITI AZKIA WAHIDAH RAHMAH ZEINNo ratings yet

- Overview and Objectives: Session 01Document30 pagesOverview and Objectives: Session 01ONG Grupo Creare100% (1)

- June 2022 QP - Component 3 Eduqas Biology A-LevelDocument44 pagesJune 2022 QP - Component 3 Eduqas Biology A-LeveltariffgillNo ratings yet

- ScabiesDocument18 pagesScabiesRashidul IslamNo ratings yet

- Efecto de Hiv1 en Mujeres Embarazadas de RwandaDocument8 pagesEfecto de Hiv1 en Mujeres Embarazadas de RwandaIsmaelJoséGonzálezGuzmánNo ratings yet

- Orientation L2F - April 6Document5 pagesOrientation L2F - April 6JD AguilarNo ratings yet

- Article II Protection Rights of Children: Child Abuse, Exploitation, and DiscriminationDocument12 pagesArticle II Protection Rights of Children: Child Abuse, Exploitation, and DiscriminationMicky MoranteNo ratings yet

- Ayurvedic Concept of Food and NutritionDocument8 pagesAyurvedic Concept of Food and NutritionsatishNo ratings yet

- Shear's Cysts of The Oral and Maxillofacial Regions-10-14Document5 pagesShear's Cysts of The Oral and Maxillofacial Regions-10-14muhammad arif100% (1)

- HemoroidDocument24 pagesHemoroidfauzieNo ratings yet

- Hepatoprotective Activity of Berberisaristata Root Extract Against Chemical Induced Acute Hepatotoxicity in RatsDocument4 pagesHepatoprotective Activity of Berberisaristata Root Extract Against Chemical Induced Acute Hepatotoxicity in RatsAmit patelNo ratings yet

- Pililla NHS Covid-19 ConplanDocument4 pagesPililla NHS Covid-19 ConplanNick TejadaNo ratings yet

- RH Incompatibility: A Case Analysis OnDocument62 pagesRH Incompatibility: A Case Analysis OnMonique LeonardoNo ratings yet

- Usulan Pelatihan Devisi NeurosainsDocument2 pagesUsulan Pelatihan Devisi NeurosainsianNo ratings yet

- Holy Infant College Tacloban City NSTP - Cwts Unit First AidDocument40 pagesHoly Infant College Tacloban City NSTP - Cwts Unit First AidWinsley RazNo ratings yet

- COVID-19: Group 3 Kamalpreet Kaur, Harpreet Kaur, Jaisleen Kaur, Tanupreet KaurDocument16 pagesCOVID-19: Group 3 Kamalpreet Kaur, Harpreet Kaur, Jaisleen Kaur, Tanupreet KaurKamalpreet KaurNo ratings yet

- 1987, Andrew Steptoe - Stage Fright in Orchestral Musicians A Study of Cognitive and BehaviouralDocument9 pages1987, Andrew Steptoe - Stage Fright in Orchestral Musicians A Study of Cognitive and BehaviouralEko A. SaputroNo ratings yet

- SB-100 - v10 Purple ConditionerDocument6 pagesSB-100 - v10 Purple ConditionerpranksterboyNo ratings yet

- CheyenneDocument19 pagesCheyennePsycholytic_elfNo ratings yet