Professional Documents

Culture Documents

2016 11 16 PH e JFC

Uploaded by

mrepzzzOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

2016 11 16 PH e JFC

Uploaded by

mrepzzzCopyright:

Available Formats

WE D 16 N O V 2016

JOLLIBEE FOODS CORPORATION:

9M16 results disappoint on higher-than-expected

operating expenses

Results disappoint on higher-than-expected operating expenses. JFC registered profits of

Php4.4Bil in 9M16, up 13.8% y/y. Although 9M16 profits were in line with expectations at 70.2% of

our full year forecast, this was only because of the lower-than-expected effective tax rate at 17.6%

compared to the 20.3% a year ago. Revenues were up 12.8% y/y to Php82.2Bil and were in line

COL and consensus estimates at 72.6% and 72.8%, respectively. However, the strong performance

of revenues was offset by the higher-than-expected operating expenses which grew by 21% y/y to

Php10.2Bil. The figure already accounted for 74.1% of our full year forecast. Note that operating

expenses in the first nine months of 2014 and 2015 accounted for only 70.9% and 67.0% of full

year total, respectively. This brought 9M16 operating income to Php4.9Bil, up by only 11.4%,

underperforming both COL and consensus forecast. In fact, 3Q16 operating profits were down 6.7%

to only Php1.4Bil.

Operating expenses continue to exceed expectations. Although we already anticipated an

increase, the actual increase in JFCs operating expenses continued to exceed our expectations.

JFCs operating expenses jumped by 17.1% to Php2.8Bil during 3Q16. This brought 9M16 operating

expenses higher by 21% to Php10.2Bil. The said figure already accounts for 74.1% of our full year

forecast. Note that operating expenses during the first nine months of 2014 and 2015 accounted

for only 70.9% and 67.0% of full year total, respectively. JFC attributed the increase in operating

expenses to higher average headcount per domestic store in line with its efforts to improve customer

service. JFCs decision to outsource its IT requirements to IBM also pushed up its costs. Total

personnel costs, professional fees and contracted services increased by 25.0% to Php5.1Bil during

the first nine months of 2016.

Reiterate HOLD rating. We reiterate our HOLD rating on JFC with a FV estimate of Php204/

sh. Although we like JFC fundamentally given its dominant position in the domestic quick service

restaurant industry as well as for the improving profitability of its international business, valuations

are unattractive. At its current price of Php208/sh, JFC it is trading at 32.0X 2017E P/E and above

our FV estimate.

FORECAST SUMMARY:

Year to December 31 (Php Mil)

Revenues

% change y/y

Gross Profit

%change y/y

Gross Profit Margin (%)

Operating Income

%change y/y

Operating Margin (%)

Net Income

%change y/y

Net Margin (%)

EPS (in Php)

%change y/y

RELATIVE VALUE

P/E(X)

P/BV(X)

ROE(%)

Dividend Yield (%)

2013

80,283

13.0

14,998

18.8

18.7

5,931

36.5

7.4

4,672

25.3

5.8

4.36

24.1

2014

90,671

12.9

16,943

13.0

18.7

6,137

3.5

6.8

5,362

14.8

5.9

4.96

13.6

2015

100,780

11.1

17,888

5.6

17.7

5,355

-12.7

5.3

4,929

-8.1

4.9

4.53

-8.6

2016E

113,285

12.4

21,184

18.4

18.7

7,477

39.6

6.6

6,249

26.8

5.5

5.79

27.8

2017E

125,264

10.6

23,550

11.2

18.8

8,393

12.2

6.7

7,024

12.4

5.6

6.50

12.4

47.7

9.9

21.5

2.4

42.0

8.2

21.6

0.7

45.9

7.4

17.0

0.8

36.0

6.4

19.0

0.8

32.0

5.7

18.7

1.0

SHARE DATA

HOLD

Rating

Ticker

JFC

Fair Value (Php)

204.00

Current Price

214.40

Upside (%)

-4.85

SHARE PRICE MOVEMENT

110

100

90

80

16-Aug-16

16-Sep-16

JFC

16-Oct-16

16-Nov-16

PSEi

ABSOLUTE PERFORMANCE

1M

3M

YTD

JFC

-11.04

-15.26

-2.10

PSEi

-5.77

-12.79

0.15

MARKET DATA

Market Cap

Outstanding Shares

52 Wk Range

3Mo Ave Daily T/O

230,493.41Mil

1,075.06Mil

191.00 - 260.00

128.07Mil

Andy Dela Cruz Analyst

andy.delacruz@colfinancial.com

*So urce: JFC, COL estimates

Disclaimer: All content provided in COL Reports are meant to be read in the COL Financial website. Accuracy and completeness of content cannot be guaranteed if reports are viewed outside of

the COL Financial website as these may be subject to tampering or unauthorized alterations.

E ar n i n g s A n al ysi s I Jo l l i b ee Foods C or por ati on

WED 16 NOV 2016

Results disappoint on higher-than-expected operating expenses

JFC registered profits of Php4.4Bil in 9M16, up 13.8% y/y. Although 9M16 profits were in line with

expectations at 70.2% of our full year forecast, this was only because of the lower-than-expected

effective tax rate at 17.6% compared to the 20.3% a year ago. Revenues were up 12.8% y/y to

Php82.2Bil and were in line COL and consensus estimates at 72.6% and 72.8%, respectively.

However, the strong performance of revenues was offset by the higher-than-expected operating

expenses which grew by 21% y/y to Php10.2Bil. The figure already accounted for 74.1% of our full

year forecast. Note that operating expenses in the first nine months of 2014 and 2015 accounted

for only 70.9% and 67.0% of full year total, respectively. This brought 9M16 operating income to

Php4.9Bil, up by only 11.4%, underperforming both COL and consensus forecast. In fact, 3Q16

operating profits were down 6.7% to only Php1.4Bil.

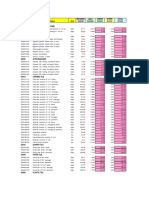

Exhibit 1: Results Summary

in PhpMil

Revenues

Gross Profit

Gross Margin (%)

Operating Income

Operating Margin (%)

Net Income

Net Margin (%)

3Q15

3Q16

% Change

9M15

9M16

% Change

25,052

4,519

18.0

1,493

6.0

1,258

5.0

27,816

4,972

17.9

1,393

5.0

1,335

4.8

11.0

10.0

(6.7)

6.1

-

72,908

12,808

17.6

4,413

6.1

3,858

5.3

82,241

15,078

18.3

4,916

6.0

4,389

5.3

12.8

17.7

11.4

13.8

-

% of Forecast

COL

Consensus

72.6

72.8

71.2

70.8

65.8

66.0

70.2

69.5

-

Source: JFC, COL Estimates, Bloomberg

Strong revenue growth and gross margin expansion sustained

JFCs 9M16 revenues grew by 12.8% to Php82.2Bil driven by the 6% growth in same store sales

as well as the 6.4% contribution of new stores. Revenues from domestic operations grew by 15.8%

to around Php65.0Bil as domestic sales experienced a 14.1% growth in 3Q16. On the other hand,

international revenues grew by only3.1% to Php17.5Bil due to the continuous weakness in its

Chinese operations. On the positive side, growth of its international business improved relative to

previous quarters and JFC remains hopeful that the momentum will continue.

Gross margins for 9M16 also improved to 18.3% from 17.3% from the same period last year. JFC

attributed the improvement to the same stores sales growth of 6%, as well as the stable input costs

over the period.

Operating expenses continue to exceed expectations

Although we already anticipated an increase, the actual increase in JFCs operating expenses

continued to exceed our expectations. JFCs operating expenses jumped by 17.1% to Php2.8Bil

during 3Q16. This brought 9M16 operating expenses higher by 21% to Php10.2Bil. The said figure

already accounts for 74.1% of our full year forecast. Note that operating expenses during the first

nine months of 2014 and 2015 accounted for only 70.9% and 67.0% of full year total, respectively.

JFC attributed the increase in operating expenses to higher average headcount per domestic store

in line with its efforts to improve customer service. JFCs decision to outsource its IT requirements

to IBM also pushed up its costs. Total personnel costs, professional fees and contracted services

increased by 25.0% to Php5.1Bil during the first nine months of 2016.

Disclaimer: All content provided in COL Reports are meant to be read in the COL Financial website. Accuracy and completeness of content cannot be guaranteed if reports are viewed outside

of the COL Financial website as these may be subject to tampering or unauthorized alterations.

E ar n i n g s A n al ysi s I Jo l l i b ee Foods C or por ati on

W ED 16 NOV 2016

Smash Burger improving due to network expansion

On the positive side, Smash Burgers operations are starting to see growth as it added 11 new

stores (net of closures) in 3Q16. The Smash Burger JVs equity in net loss increased marginally by

only Php1.6Mil to Php198.4Mil in 9M16 from Php196.8Mil in 1H16, increasing our confidence that

the burger chain will meet JFCs target to breakeven by end-2017.

Reiterate HOLD rating

We reiterate our HOLD rating on JFC with a FV estimate of Php204/sh. Although we like JFC

fundamentally given its dominant position in the domestic quick service restaurant industry as

well as for the improving profitability of its international business, valuations are unattractive. At

its current price of Php208/sh, JFC it is trading at 32.0X 2017E P/E and above our FV estimate.

Disclaimer: All content provided in COL Reports are meant to be read in the COL Financial website. Accuracy and completeness of content cannot be guaranteed if reports are viewed outside

of the COL Financial website as these may be subject to tampering or unauthorized alterations.

E ar n i n g s A n al ysi s I Jo l l i b ee Foods C or por ati on

WED 16 NOV 2016

Important Rating Definitions

BUY

Stocks that have a BUY rating have attractive fundamentals and valuations based on our analysis. We expect the share price to outperform the market in the

next six to 12 months.

HOLD

Stocks that have a HOLD rating have either 1) attractive fundamentals but expensive valuations 2) attractive valuations but near-term earnings outlook might

be poor or vulnerable to numerous risks. Given the said factors, the share price of the stock may perform merely in line or underperform in the market in the

next six to twelve months.

SELL

We dislike both the valuations and fundamentals of stocks with a SELL rating. We expect the share price to underperform in the next six to12 months.

Important Disclaimer

Securities recommended, offered or sold by COL Financial Group, Inc. are subject to investment risks, including the possible loss of the principal amount

invested. Although information has been obtained from and is based upon sources we believe to be reliable, we do not guarantee its accuracy and said

information may be incomplete or condensed. All opinions and estimates constitute the judgment of COLs Equity Research Department as of the date of the

report and are subject to change without prior notice. This report is for informational purposes only and is not intended as an offer or solicitation for the purchase

or sale of a security. COL Financial and/or its employees not involved in the preparation of this report may have investments in securities of derivatives of the

companies mentioned in this report and may trade them in ways different from those discussed in this report.

COL Research Team

April Lynn Tan, CFA

VP & Head of Research

april.tan@colfinancial.com

Charles William Ang, CFA

George Ching

Richard Laeda, CFA

Deputy Head of Research

Senior Research Manager

Senior Research Manager

charles.ang@colfinancial.com george.ching@colfinancial.com richard.laneda@colfinancial.com

Frances Rolfa Nicolas

Andy Dela Cruz

Justin Richmond Cheng

Research Analyst Research Analyst Research Analyst

rolfa.nicolas@colfinancial.com andy.delacruz@colfinancial.com justin.cheng@colfinancial.com

Kyle Velasco

Research Analyst

kyle.velasco@colfinancial.com

Contact

COL Financial Group, Inc.

2402-D East Tower, Philippine Stock Exchange Centre,

Exchange Road, Ortigas Center, Pasig City

1605 Philippines

Tel No. +632 636-5411

Fax No. +632 635-4632

Website: www.colfinancial.com

Disclaimer: All content provided in COL Reports are meant to be read in the COL Financial website. Accuracy and completeness of content cannot be guaranteed if reports are viewed outside

of the COL Financial website as these may be subject to tampering or unauthorized alterations.

You might also like

- Masonry Cost EstimatesDocument1 pageMasonry Cost EstimatesmrepzzzNo ratings yet

- Construction Cost Breakdown SheetDocument3 pagesConstruction Cost Breakdown SheetmrepzzzNo ratings yet

- FinishesDocument6 pagesFinishesmrepzzzNo ratings yet

- Field FormulasDocument39 pagesField FormulasRoma EstradaNo ratings yet

- Preboard Schedule 2018 PDFDocument2 pagesPreboard Schedule 2018 PDFmrepzzzNo ratings yet

- ELECTRICAL COSTCODE PRICELISTDocument2 pagesELECTRICAL COSTCODE PRICELISTmrepzzzNo ratings yet

- FurnishingsDocument1 pageFurnishingsJeffreyNo ratings yet

- Costcode Description Unit Material Qr/Unit Labor Hrs/Unit Labor Qr/Unit Other Qr/Unit Total Qr/Unit 14 Conveying Systems 14200 ElevatorsDocument1 pageCostcode Description Unit Material Qr/Unit Labor Hrs/Unit Labor Qr/Unit Other Qr/Unit Total Qr/Unit 14 Conveying Systems 14200 ElevatorsmrepzzzNo ratings yet

- ConcreteDocument4 pagesConcretemrepzzzNo ratings yet

- Door and Window Cost EstimatesDocument2 pagesDoor and Window Cost EstimatesJeffreyNo ratings yet

- EquipmentDocument1 pageEquipmentmrepzzzNo ratings yet

- 2012 Green Plumbing Mechanical CodeDocument173 pages2012 Green Plumbing Mechanical CodeAS VatsalNo ratings yet

- Interlocking & Curb Stone Rev.1Document3 pagesInterlocking & Curb Stone Rev.1Shaddy Joseph Endrawes100% (1)

- NBCPDocument17 pagesNBCPArch. Jan EchiverriNo ratings yet

- Oral Practical & Experience Part 1Y2018 PDFDocument139 pagesOral Practical & Experience Part 1Y2018 PDFmrepzzzNo ratings yet

- Engineering Mathematics FormulaDocument4 pagesEngineering Mathematics FormulaMaw IubuybNo ratings yet

- BXPHARMADocument4 pagesBXPHARMASayeedNo ratings yet

- BXPHARMADocument4 pagesBXPHARMASayeedNo ratings yet

- Qcs 2007 0110Document6 pagesQcs 2007 0110RotsapNayrbNo ratings yet

- TV SpliterDocument12 pagesTV SpliterSherif M. ElgebalyNo ratings yet

- Quality of Bid ChecklistDocument5 pagesQuality of Bid ChecklistmrepzzzNo ratings yet

- School CodeDocument68 pagesSchool CodemrepzzzNo ratings yet

- Estimating Acoustical Ceilings ChecklistDocument1 pageEstimating Acoustical Ceilings ChecklistRyanNo ratings yet

- Qcs 2007 Section 1 Part-1 IntroductionDocument6 pagesQcs 2007 Section 1 Part-1 IntroductionRotsapNayrbNo ratings yet

- StaadPro Knowledge BaseDocument251 pagesStaadPro Knowledge Baseingsabrina100% (1)

- BXPHARMADocument4 pagesBXPHARMASayeedNo ratings yet

- R3 DReferDocument335 pagesR3 DReferbenness11No ratings yet

- July 2015 Master Plumber Terms IncludedDocument5 pagesJuly 2015 Master Plumber Terms Includedzenzen1100% (1)

- QCS General Index PDFDocument1 pageQCS General Index PDFmrepzzzNo ratings yet

- Board of Master Plumber-SBDocument7 pagesBoard of Master Plumber-SBdereckaNo ratings yet

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5783)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (890)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (399)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (587)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (265)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (72)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (344)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2219)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (119)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- OpenRTB 3.0 Draft Framework For Public CommentDocument36 pagesOpenRTB 3.0 Draft Framework For Public CommentCecilia MarineroNo ratings yet

- SMU A S: Retail MarketingDocument27 pagesSMU A S: Retail MarketingGYANENDRA KUMAR MISHRANo ratings yet

- Fishers TheoryDocument11 pagesFishers TheoryShradha ChopadeNo ratings yet

- The Fundamentals of Managerial Economics: Dr. Abdullah M. Al-AnsiDocument30 pagesThe Fundamentals of Managerial Economics: Dr. Abdullah M. Al-AnsiEbrar AnsiNo ratings yet

- 632dea5fbb6c8 Sample Question Booklet NEO 2022Document59 pages632dea5fbb6c8 Sample Question Booklet NEO 2022HariniNo ratings yet

- MKT 201 Term PaperDocument17 pagesMKT 201 Term PaperUllash JoyNo ratings yet

- Recipe Cost CalculatorDocument5 pagesRecipe Cost CalculatorTanveer HussainNo ratings yet

- Dwnload Full Contemporary Financial Management 14th Edition Moyer Solutions Manual PDFDocument35 pagesDwnload Full Contemporary Financial Management 14th Edition Moyer Solutions Manual PDFquachhaitpit100% (15)

- 2012tracpro Forklift CatalogDocument68 pages2012tracpro Forklift CatalogDiego negro BudilicriNo ratings yet

- 2023 Econ Grade 11 p2 Nov MGDocument21 pages2023 Econ Grade 11 p2 Nov MGnhlesekaneneNo ratings yet

- Nymstar Limited General Business TermsDocument22 pagesNymstar Limited General Business TermsBidhinNo ratings yet

- Seth Klarman Letter 1999 PDFDocument32 pagesSeth Klarman Letter 1999 PDFBean LiiNo ratings yet

- Medical records project management questionsDocument46 pagesMedical records project management questionsOssama KheadryNo ratings yet

- A Project Report On "Consumer Satisfaction On Bota Mo:Mo"Document14 pagesA Project Report On "Consumer Satisfaction On Bota Mo:Mo"Pragyan KoiralaNo ratings yet

- Reliance Industries Limited issues purchase order to Bhakti EnterprisesDocument23 pagesReliance Industries Limited issues purchase order to Bhakti EnterprisesumeshNo ratings yet

- Shipbuilding Workshop Nov2018 3 1Document25 pagesShipbuilding Workshop Nov2018 3 1jamesNo ratings yet

- Block 4Document115 pagesBlock 4Bhavana RoyNo ratings yet

- 22K00151 - RCSPSDocument75 pages22K00151 - RCSPSRosales Gemson LysterNo ratings yet

- Demand and Supply-It's What Economics Is About! Lesson Plan: Inside The VaultDocument15 pagesDemand and Supply-It's What Economics Is About! Lesson Plan: Inside The VaultVikas RathiNo ratings yet

- Lec-8 Price OptimizationDocument9 pagesLec-8 Price OptimizationPavan YadavNo ratings yet

- Gcse Business Topic 1.5 Understanding External Influences On BusinessDocument10 pagesGcse Business Topic 1.5 Understanding External Influences On BusinessBH 7moodNo ratings yet

- Review On Fundamentals of AccountingDocument18 pagesReview On Fundamentals of AccountingFat AjummaNo ratings yet

- Psychology of Human Misjudgement PDFDocument13 pagesPsychology of Human Misjudgement PDFNaman JainNo ratings yet

- MGMT 4Document26 pagesMGMT 4Said GunayNo ratings yet

- Nepal Accounting Standards On InventoriesDocument8 pagesNepal Accounting Standards On InventoriesGemini_0804No ratings yet

- Reduce Garment Export Waste ProfitsDocument8 pagesReduce Garment Export Waste Profitsanshushah_144850168No ratings yet

- A Study On Derivatives and Risk ManagementDocument77 pagesA Study On Derivatives and Risk ManagementShabeerNo ratings yet

- CACell Intermediate Account Full Book-151-200Document50 pagesCACell Intermediate Account Full Book-151-200kalyanikamineniNo ratings yet

- REVIEW of AGRICULTURE - Efficient Agricultural MarketingDocument8 pagesREVIEW of AGRICULTURE - Efficient Agricultural MarketingkarankhatiNo ratings yet

- User's Guide Materials Control: ProductionDocument52 pagesUser's Guide Materials Control: ProductionRanko LazeskiNo ratings yet