Professional Documents

Culture Documents

Microequities Deep Value Microcap Fund June 2010 Update

Uploaded by

Microequities Pty LtdCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Microequities Deep Value Microcap Fund June 2010 Update

Uploaded by

Microequities Pty LtdCopyright:

Available Formats

MICROEQUITIES ASSET MANAGEMENT

DEEP VALUE MICROCAP FUND UPDATE, JUNE 2010 PERFORMANCE UPDATE

Dear Investor,

Markets and Economy

Financial markets continue to ponder whether the threat of European economic stagnation will derail the world’s economic

recovery into a double dip recession or whether the recovery story remains intact. We appreciate the cultural nexus with Europe

and even to an extent, its overstated residence in the psyche of markets. However, investment decisions aren’t made on

emotional influences. They are made, or should be made, on rational appraisal and analysis of prevailing data and its probable

future implications. In this context we remain firmly grounded in the view, that’s whilst Europe is likely to enter a period of

substantial below average economic growth, the drivers of the current world economic growth, i.e. the emerging economies of

Asia (China, India and other South East Asian economies) will continue to achieve strong economic growth over the short to

medium term thus securing a world economic recovery.

At the domestic level, we are timidly encouraged by the recent developments in Canberra pointing to amplifying the terms of

reference in negotiating an outcome for the proposed Resource Super Profits Tax (RSPT). The proposed tax has had a palpable

effect on new investment in mining assets. We note that certainty on tax, a key variable in the economic viability of any project is

an absolute prelude to any investment decisions. We hope the government understands this basic premise of investing.

Microequities Deep Value Microcap Fund returned a positive +0.45% versus the All Ordinaries Index negative -2.89% in June;

this brings the total return net of fees to 84.66% for the Fund compared to 38.99% for the All Ordinaries since inception in

March 2009.

Whilst the fund provided a modest net return for the month, it posted a significant outperformance in a challenging month.

Various companies within our portfolio have recently provided updated guidance indicating improved operating performances.

Additionally a number of other companies in our portfolio have reaffirmed previously stated guidance. Our portfolio contains

some quality growing businesses and we remain undeterred by the recent market volatility. The fundamentals of our investment

businesses remain sound. On that market volatility, it is interesting to note that since the Fund’s inception, the four months in

which the All Ordinaries has achieved a negative return, our Deep Value Microcap Fund has out-performed the benchmark index

on each of those four occasions. For a fund that is purportedly in a riskier asset class, our deep value approach has so far

withstood market forces better than the large cap counterparts.

Written by Carlos Gil, Chief Investment Officer.

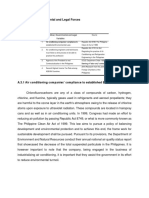

1.9% 3.7% Cash

Software & Services

Latest Unit Price

4.3%

12.7% Telecommunications Services $1.8466

Food Products Latest Fund Performance as at

4.9% 38.6%

Hotels Restaurants & Leisure 30/06/2010

Consumer Durables Apparel 1 Month +0.45%

7.0%

Media 3 Month -8.18%

Capital Goods

6 Month -2.62%

3.8% Healthcare

6.9% 12 Month +58.59%

4.6% 7.9% Metals & Mining

Since

Technology Hardware & Equipment +84.66%

th Inception

*Deep Value Portfolio as of 30 of June 2010

(Net of Fees)

Suite 702, 109 Pitt Street Sydney NSW 2000 Office: +61 2 9231 6169 Fax: +61 2 9475 1156 invest@microequities.com.au

You might also like

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5794)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (895)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (588)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (345)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (121)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (400)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (74)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- Personalizing Your Own Compliance Manual Template 3Document20 pagesPersonalizing Your Own Compliance Manual Template 3williamhancharekNo ratings yet

- BMW India PVT LTDDocument87 pagesBMW India PVT LTDshobhitNo ratings yet

- Microequities High Income Value Microcap Fund May 2012 UpdateDocument1 pageMicroequities High Income Value Microcap Fund May 2012 UpdateMicroequities Pty LtdNo ratings yet

- Microequities High Income Value Microcap Fund April 2012 UpdateDocument1 pageMicroequities High Income Value Microcap Fund April 2012 UpdateMicroequities Pty LtdNo ratings yet

- Microequities High Income Value Microcap Fund July 2012 UpdateDocument1 pageMicroequities High Income Value Microcap Fund July 2012 UpdateMicroequities Pty LtdNo ratings yet

- Microequities Deep Value Microcap Fund October 2011 UpdateDocument1 pageMicroequities Deep Value Microcap Fund October 2011 UpdateMicroequities Pty LtdNo ratings yet

- Microequities Deep Value Microcap Fund December 2011 UpdateDocument1 pageMicroequities Deep Value Microcap Fund December 2011 UpdateMicroequities Pty LtdNo ratings yet

- Microequities Deep Value Microcap Fund April 2012 UpdateDocument1 pageMicroequities Deep Value Microcap Fund April 2012 UpdateMicroequities Pty LtdNo ratings yet

- Microequities Deep Value Microcap Fund January 2012 UpdateDocument1 pageMicroequities Deep Value Microcap Fund January 2012 UpdateMicroequities Pty LtdNo ratings yet

- Microequities Deep Value Microcap Fund April 2011 UpdateDocument1 pageMicroequities Deep Value Microcap Fund April 2011 UpdateMicroequities Pty LtdNo ratings yet

- Microequities Deep Value Microcap Fund September 2011 UpdateDocument1 pageMicroequities Deep Value Microcap Fund September 2011 UpdateMicroequities Pty LtdNo ratings yet

- Microequities Deep Value Microcap Fund May 2011 UpdateDocument1 pageMicroequities Deep Value Microcap Fund May 2011 UpdateMicroequities Pty LtdNo ratings yet

- Microequities Deep Value Microcap Fund March 2011 UpdateDocument1 pageMicroequities Deep Value Microcap Fund March 2011 UpdateMicroequities Pty LtdNo ratings yet

- Microequities Deep Value Microcap Fund June 2011 UpdateDocument1 pageMicroequities Deep Value Microcap Fund June 2011 UpdateMicroequities Pty LtdNo ratings yet

- Microequities Deep Value Microcap Fund July 2011 UpdateDocument1 pageMicroequities Deep Value Microcap Fund July 2011 UpdateMicroequities Pty LtdNo ratings yet

- Microequities Deep Value Microcap Fund January 2011 UpdateDocument1 pageMicroequities Deep Value Microcap Fund January 2011 UpdateMicroequities Pty LtdNo ratings yet

- Microequities Deep Value Microcap Fund August 2010 UpdateDocument1 pageMicroequities Deep Value Microcap Fund August 2010 UpdateMicroequities Pty LtdNo ratings yet

- Microequities Deep Value Microcap Fund December 2010 UpdateDocument1 pageMicroequities Deep Value Microcap Fund December 2010 UpdateMicroequities Pty LtdNo ratings yet

- Microequities Deep Value Microcap Fund September 2010 UpdateDocument1 pageMicroequities Deep Value Microcap Fund September 2010 UpdateMicroequities Pty LtdNo ratings yet

- Microequities Deep Value Microcap Fund February 2011 UpdateDocument1 pageMicroequities Deep Value Microcap Fund February 2011 UpdateMicroequities Pty LtdNo ratings yet

- Microequities Deep Value Microcap Fund July 2010 UpdateDocument1 pageMicroequities Deep Value Microcap Fund July 2010 UpdateMicroequities Pty LtdNo ratings yet

- Microequities Deep Value Microcap Fund IMDocument28 pagesMicroequities Deep Value Microcap Fund IMMicroequities Pty LtdNo ratings yet

- Cash Converters International at Microequities 2010 Rising Stars Microcap ConferenceDocument35 pagesCash Converters International at Microequities 2010 Rising Stars Microcap ConferenceMicroequities Pty LtdNo ratings yet

- Institutional Membership FormDocument2 pagesInstitutional Membership Formdhruvi108No ratings yet

- Ae (C)Document1 pageAe (C)Akesh LimNo ratings yet

- EY Tax Alert Madras HC Rules Income Under Time Charter Arrangement For Ships As RoyaltyDocument6 pagesEY Tax Alert Madras HC Rules Income Under Time Charter Arrangement For Ships As Royaltyace kingNo ratings yet

- Project Report MbaDocument17 pagesProject Report MbaBhaviktishaSingla100% (2)

- BRAC Bank Limited - Cards P@y Flex ProgramDocument3 pagesBRAC Bank Limited - Cards P@y Flex Programaliva78100% (2)

- Temp Duty Claim GCIDocument23 pagesTemp Duty Claim GCIAkshaya PalaniswamyNo ratings yet

- Indian Association of Soil and Water ConservationistsDocument521 pagesIndian Association of Soil and Water Conservationistsshyam143225No ratings yet

- Spy Gap StudyDocument30 pagesSpy Gap StudyMathias Dharmawirya100% (1)

- Skylark Skygondola PresentationDocument87 pagesSkylark Skygondola PresentationrohanbagadiyaNo ratings yet

- VJEPADocument6 pagesVJEPATrang ThuNo ratings yet

- Southeast Asia Thriving in The Shadow of GiantsDocument38 pagesSoutheast Asia Thriving in The Shadow of GiantsDDNo ratings yet

- 04 Trenovski Tashevska 2015 1 PDFDocument21 pages04 Trenovski Tashevska 2015 1 PDFArmin ČehićNo ratings yet

- Anarchist's EconomicsDocument11 pagesAnarchist's EconomicsJoseph Winslow100% (4)

- Leaflet Lokotrack - st4.8 Product - Spread 4524 12 21 en Agg HiresDocument2 pagesLeaflet Lokotrack - st4.8 Product - Spread 4524 12 21 en Agg Hiresjadan tupuaNo ratings yet

- Power and Energy Crisis of BangladeshDocument2 pagesPower and Energy Crisis of BangladeshRajkumar SarkerNo ratings yet

- Free Talk SeniorDocument102 pagesFree Talk SeniorCharmen Joy PonsicaNo ratings yet

- Statement of Prepaid Account: Zay Ye Htut 27 Street A Naw Ya Htar. 11181 YANGON YangonDocument1 pageStatement of Prepaid Account: Zay Ye Htut 27 Street A Naw Ya Htar. 11181 YANGON YangonKoKoNo ratings yet

- Review of Literature On Financial Performance Analysis of Sugar Industries in IndiaDocument2 pagesReview of Literature On Financial Performance Analysis of Sugar Industries in IndiaArunkumarNo ratings yet

- Etis ToolkitDocument36 pagesEtis ToolkitPatricia Dominguez SilvaNo ratings yet

- Forbo Marmoleum Click Techn - Specs PDFDocument1 pageForbo Marmoleum Click Techn - Specs PDFDoutor InácioNo ratings yet

- Global Political EconomyDocument58 pagesGlobal Political EconomyRhenmar Morales Galvez50% (2)

- Qrcar002 en PDFDocument2 pagesQrcar002 en PDFSeba311No ratings yet

- Heritage Doll CompanyDocument11 pagesHeritage Doll CompanyDeep Dey0% (1)

- Why Blue-Collar Workers Quit Their JobDocument4 pagesWhy Blue-Collar Workers Quit Their Jobsiva csNo ratings yet

- Asg1 - Nagakin Capsule TowerDocument14 pagesAsg1 - Nagakin Capsule TowerSatyam GuptaNo ratings yet

- Cognos LearningDocument12 pagesCognos LearningsygladiatorNo ratings yet

- A3. Political, Governmental and Legal ForcesDocument5 pagesA3. Political, Governmental and Legal ForcesAleezah Gertrude RegadoNo ratings yet

- Chapter-5: Findings Summary, Suggestions AND ConclusionDocument7 pagesChapter-5: Findings Summary, Suggestions AND ConclusionPavan Kumar SuralaNo ratings yet