Professional Documents

Culture Documents

Revised tax withholding tables

Uploaded by

ShairaCerenoOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Revised tax withholding tables

Uploaded by

ShairaCerenoCopyright:

Available Formats

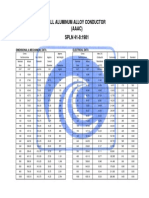

REVISED WITHHOLDING TAX TABLES

Effective January 1, 2009

DAILY

Exemption

Status

0.00

0.00

1.65

8.25

28.05

74.26

165.02

412.54

(000P) +0% over +5% over +10% over +15% over +20% over +25% over +30% over +32% over

A. Table for employees without qualified dependent

1. Z

0.0

33

99

231

462

825

1,650

2. S/ME

50.0

165

198

264

396

627

990

1,815

B. Table for single/married employee with qualified dependent child(ren)

1. ME1 / S1

75.0

248

281

347

479

710

1,073

1,898

2. ME2 / S2

100.0

330

363

429

561

792

1,155

1,980

3. ME3 / S3

125.0

413

446

512

644

875

1,238

2,063

4. ME4 / S4

150.0

495

528

594

726

957

1,320

2,145

0.00

0.00

9.62

48.08

163.46

432.69

961.54

2,403.85

WEEKLY

Exemption

Status

+0% over +5% over +10% over +15% over +20% over +25% over +30% over +32% over

A. Table for employees without qualified dependent

1. Z

0.0

192

577

1,346

2,692

4,808

9,615

2. S/ME

50.0

962

1,154

1,538

2,308

3,654

5,769

10,577

B. Table for single/married employee with qualified dependent child(ren)

1. ME1 / S1

75.0

1,442

1,635

2,019

2,788

4,135

6,250

11,058

2. ME2 / S2

100.0

1,923

2,115

2,500

3,269

4,615

6,731

11,538

3. ME3 / S3

125.0

2,404

2,596

2,981

3,750

5,096

7,212

12,019

4. ME4 / S4

150.0

2,885

3,077

3,462

4,231

5,577

7,692

12,500

0.00

0.00

20.83

104.17

354.17

937.50

2,083.33

5,208.33

SEMI-MONTHLY

Exemption

Status

+0% over +5% over +10% over +15% over +20% over +25% over +30% over +32% over

A. Table for employees without qualified dependent

1. Z

0.0

417

1,250

2,917

5,833

10,417

20,833

2. S/ME

50.0

2,083

2,500

3,333

5,000

7,917

12,500

22,917

B. Table for single/married employee with qualified dependent child(ren)

1. ME1 / S1

75.0

3,125

3,542

4,375

6,042

8,958

13,542

23,958

2. ME2 / S2

100.0

4,167

4,583

5,417

7,083

10,000

14,583

25,000

3. ME3 / S3

125.0

5,208

5,625

6,458

8,125

11,042

15,625

26,042

4. ME4 / S4

150.0

6,250

6,667

7,500

9,167

12,083

16,667

27,083

MONTHLY

Exemption

0.00

0.00

41.67

208.33

708.33

1,875.00

4,166.67

10,416.67

Status

+0% over +5% over +10% over +15% over +20% over +25% over +30% over +32% over

A. Table for employees without qualified dependent

1. Z

0.0

833

2,500

5,833

11,667

20,833

41,667

2. S/ME

50.0

4,167

5,000

6,667

10,000

15,833

25,000

45,833

B. Table for single/married employee with qualified dependent child(ren)

1. ME1 / S1

75.0

6,250

7,083

8,750

12,083

17,917

27,083

47,917

2. ME2 / S2

100.0

8,333

9,167

10,833

14,167

20,000

29,167

50,000

3. ME3 / S3

125.0

10,417

11,250

12,917

16,250

22,083

31,250

52,083

4. ME4 / S4

150.0

12,500

13,333

15,000

18,333

24,167

33,333

54,167

Legend: Z-Zero exemption S-Single ME-Married Employee

1;2;3;4-Number of qualified dependent children

S/ME = P50,000 EACH WORKING EMPLOYEE Qualified

Dependent Child = P25,000 each but not exceeding four (4)

children

USE TABLE A FOR SINGLE/MARRIED EMPLOYEES WITH

NO QUALIFIED DEPENDENT

1. Married Employee (Husband or Wife) whose spouse is

unemployed.

2. Married Employee (Husband or Wife) whose spouse is a

non-resident citizen receiving income from foreign sources

3. Married Employee (Husband or Wife) whose spouse is

engaged in business

4. Single

6. Zero Exemption for employees with multiple employers for

their 2nd, 3rd..employers (main employer claims personal &

additional exemption

7. Zero Exemption for those who failed to file Application for

Registration

USE TABLE B FOR THE FOLLOWING SINGLE/MARRIED

EMPLOYEES WITH QUALIFIED DEPENDENT

1. Employed husband and husband claims exemptions of

children

2. Employed wife whose husband is also employed or

engaged in business; husband waived claim for dependent

children in favor of the employed wife

3. Single with qualified dependent children

You might also like

- Revised Withholding Tax TablesDocument1 pageRevised Withholding Tax TablesJonasAblangNo ratings yet

- Revised Withholding Tax TablesDocument1 pageRevised Withholding Tax Tablesrupertville12No ratings yet

- Philippines BIR Tax Rates 2009Document0 pagesPhilippines BIR Tax Rates 2009kamkamtoy100% (1)

- REVISED WITHHOLDING TAXDocument1 pageREVISED WITHHOLDING TAXEmil A. MolinaNo ratings yet

- PHILIPPINE REVISED WITHHOLDING TAX TABLESDocument1 pagePHILIPPINE REVISED WITHHOLDING TAX TABLESJhon Karl AndalNo ratings yet

- Revised Withholding Tax TablesDocument2 pagesRevised Withholding Tax TablesReylan San PascualNo ratings yet

- REVISED WITHHOLDING TAX TABLESDocument1 pageREVISED WITHHOLDING TAX TABLESVita DepanteNo ratings yet

- Withholding Tax RateDocument1 pageWithholding Tax RateJamie Jimenez CerreroNo ratings yet

- Payroll SystemDocument21 pagesPayroll SystemyuunissNo ratings yet

- Guide to Philippine Withholding TaxesDocument33 pagesGuide to Philippine Withholding TaxesBfp Basud Camarines NorteNo ratings yet

- Withholding Tax From BIR WebsiteDocument37 pagesWithholding Tax From BIR Websitepeanut47No ratings yet

- Withholding TaxDocument46 pagesWithholding TaxDura LexNo ratings yet

- For The Period July 6, 2008 To December 31, 2008 Revised Transitional Withholding Tax Tables Annex "D"Document1 pageFor The Period July 6, 2008 To December 31, 2008 Revised Transitional Withholding Tax Tables Annex "D"yousefNo ratings yet

- TablesDocument1 pageTablesArmelia CododNo ratings yet

- Old Taxation TablesDocument2 pagesOld Taxation TablesBai NiloNo ratings yet

- Burner Tilt Protocol of Unit#4 Remote OperationDocument3 pagesBurner Tilt Protocol of Unit#4 Remote OperationSony RamaNo ratings yet

- Tabela T StudentDocument2 pagesTabela T StudentCátia SofiaNo ratings yet

- Malla Micrones Feed O/F: R Ʃ JK % C.C U/F O/FDocument16 pagesMalla Micrones Feed O/F: R Ʃ JK % C.C U/F O/FAdeli Mireya Garcia TristanNo ratings yet

- CIVILIAN SALARY SCHEDULEDocument27 pagesCIVILIAN SALARY SCHEDULEDanSedigoNo ratings yet

- F&O Report 02 March 2012-Mansukh Investment and Trading SolutionDocument6 pagesF&O Report 02 March 2012-Mansukh Investment and Trading SolutionMansukh Investment & Trading SolutionsNo ratings yet

- Indian Institute of Technology: Delhi: Schedule of Minor Tests, 2011-2012 (I Semester)Document9 pagesIndian Institute of Technology: Delhi: Schedule of Minor Tests, 2011-2012 (I Semester)Mohit SharmaNo ratings yet

- Espectro de Pseudoaceleraciones - Norma Tecnica de Edificacion E.030Document1 pageEspectro de Pseudoaceleraciones - Norma Tecnica de Edificacion E.030Yonel NúñezNo ratings yet

- Revised Withholding Tax Tables 1601CDocument2 pagesRevised Withholding Tax Tables 1601CChard San Buenaventura PerveraNo ratings yet

- Income Tax in The PhilippinesDocument6 pagesIncome Tax in The PhilippinesdinvNo ratings yet

- 04handout2 CostAcctgRecitationDocument3 pages04handout2 CostAcctgRecitationDummy GoogleNo ratings yet

- Stainless Steel Pipe Bursting Pressures by SizeDocument2 pagesStainless Steel Pipe Bursting Pressures by SizeRaymond MetselaarNo ratings yet

- Witholding TaxDocument41 pagesWitholding TaxEstudyante BluesNo ratings yet

- Is en Tropic TableDocument1 pageIs en Tropic Tabledudyjohn991No ratings yet

- Aluminum Conductor Steel Reinforced (ACSR) SPLN 41-7:1981: Dimensional & Mechanical Data Electrical DataDocument1 pageAluminum Conductor Steel Reinforced (ACSR) SPLN 41-7:1981: Dimensional & Mechanical Data Electrical DataHikmat BakhtiarNo ratings yet

- Tabel Distribusi Student - S - TDocument2 pagesTabel Distribusi Student - S - TRahma WatiNo ratings yet

- Anéis do grupo 501 para encomendaDocument3 pagesAnéis do grupo 501 para encomendaAlexandre CorreaNo ratings yet

- Grupo:: Seeger RenoDocument4 pagesGrupo:: Seeger RenoandrelorandiNo ratings yet

- WP-1 WP-2 WP-3 WP-4 Total: Tabla 1 Costo Presupuestado SemanasDocument15 pagesWP-1 WP-2 WP-3 WP-4 Total: Tabla 1 Costo Presupuestado Semanasjose blancoNo ratings yet

- Catalogo Leeson Electric Co PDFDocument534 pagesCatalogo Leeson Electric Co PDFmtbecerrapNo ratings yet

- E Mercedes Benz TrucksDocument10 pagesE Mercedes Benz TrucksIsrael Moller Wildcat0% (2)

- Aneis-Elasticos Din 471 EixoDocument4 pagesAneis-Elasticos Din 471 EixoRonaldo LufixNo ratings yet

- Anéis de Retenção para Eixos: Grupo: 501Document4 pagesAnéis de Retenção para Eixos: Grupo: 501Gerson MachadoNo ratings yet

- Anéis de Retenção para Eixos: Grupo: 501Document4 pagesAnéis de Retenção para Eixos: Grupo: 501Gerson MachadoNo ratings yet

- Object distance and image distance measurementsDocument2 pagesObject distance and image distance measurementsdist5219No ratings yet

- Tabela Anel Elástico InternoDocument2 pagesTabela Anel Elástico InternoJuvenal CorreiaNo ratings yet

- Cost and ProfitDocument10 pagesCost and ProfitRommel Anthony TayagNo ratings yet

- Withholding Tax Table 1Document1 pageWithholding Tax Table 1Elton SUicoNo ratings yet

- AaacDocument1 pageAaacAnonymous 9Tdyr1No ratings yet

- ALL ALUMINUM ALLOY CONDUCTOR (AAAC) SPECIFICATIONSDocument1 pageALL ALUMINUM ALLOY CONDUCTOR (AAAC) SPECIFICATIONSAkbar Nicko RamadhanNo ratings yet

- Aaac PDFDocument1 pageAaac PDFAkbar Nicko RamadhanNo ratings yet

- Aaac PDFDocument1 pageAaac PDFAnonymous 9Tdyr1No ratings yet

- Anél de Retenção - TabelaDocument2 pagesAnél de Retenção - TabelaDanilo HoskenNo ratings yet

- Lamp IranDocument14 pagesLamp IranMohammad Haris MNo ratings yet

- Mil Pay Table 1985Document1 pageMil Pay Table 1985Charles TurnerNo ratings yet

- Anel de Retenção para Furos Din 472Document2 pagesAnel de Retenção para Furos Din 472Evandro AntonettiNo ratings yet

- Selangor: Transaction Statistics Q3 2015Document14 pagesSelangor: Transaction Statistics Q3 2015Evaline JmNo ratings yet

- KilimoDocument51 pagesKilimomomo177sasaNo ratings yet

- 2C00135Document60 pages2C00135rizwan hasmiNo ratings yet

- DBM LBP SSL3Document12 pagesDBM LBP SSL3Nening Gina B JordanNo ratings yet

- Circlip CatalogueDocument18 pagesCirclip CatalogueCALVINNo ratings yet

- Peng Teknologi InformasiDocument6 pagesPeng Teknologi InformasiYudo RamadhanNo ratings yet

- IIT Delhi Minor Test Schedule 2011-2012Document9 pagesIIT Delhi Minor Test Schedule 2011-2012akashmehtapunjabNo ratings yet

- LyricsDocument2 pagesLyricsShairaCerenoNo ratings yet

- LyricsDocument2 pagesLyricsShairaCerenoNo ratings yet

- LyricsDocument2 pagesLyricsShairaCerenoNo ratings yet

- Praise You, LordDocument1 pagePraise You, LordShairaCerenoNo ratings yet

- Praise You, LordDocument1 pagePraise You, LordShairaCerenoNo ratings yet

- Planetshakers - Praise You, LordDocument1 pagePlanetshakers - Praise You, LordShairaCerenoNo ratings yet

- Praise You, LordDocument1 pagePraise You, LordShairaCerenoNo ratings yet

- Annualized Witholding TaxDocument9 pagesAnnualized Witholding TaxShairaCerenoNo ratings yet

- NumbersDocument5 pagesNumbersShairaCerenoNo ratings yet

- HAPPYDocument1 pageHAPPYShairaCerenoNo ratings yet

- Kitchen Basic Salary (SMW) OT Slwop LateDocument2 pagesKitchen Basic Salary (SMW) OT Slwop LateShairaCerenoNo ratings yet

- Pnoy To Keep Hands Off Binay'S TroublesDocument1 pagePnoy To Keep Hands Off Binay'S TroublesShairaCerenoNo ratings yet

- MusicDocument14 pagesMusicShairaCerenoNo ratings yet

- Licensing Officer ResumeDocument4 pagesLicensing Officer ResumeShairaCerenoNo ratings yet

- Literature: Thank You God by Liam McdaidDocument11 pagesLiterature: Thank You God by Liam McdaidShairaCerenoNo ratings yet

- Verified Counterclaim of The Commonwealth To Bennett WaslhDocument4 pagesVerified Counterclaim of The Commonwealth To Bennett WaslhwmasspiNo ratings yet

- Recommendations for Medical Student Letters of ReferenceDocument5 pagesRecommendations for Medical Student Letters of ReferenceCaroline HeipleNo ratings yet

- Breaker HMCPDocument8 pagesBreaker HMCPjp304No ratings yet

- Confidentiality Agreement For Consultants, ContractorsDocument7 pagesConfidentiality Agreement For Consultants, ContractorsGryswolfNo ratings yet

- Origin of Sati Practice?: SanskritDocument3 pagesOrigin of Sati Practice?: SanskritNaman MishraNo ratings yet

- Love and Money Scene (Maliah and Emily)Document3 pagesLove and Money Scene (Maliah and Emily)Emily SummersNo ratings yet

- Soal Ulangan Conditional Sentence XIDocument2 pagesSoal Ulangan Conditional Sentence XIDimas EspressoloNo ratings yet

- Case Study - Pharma IndustryDocument2 pagesCase Study - Pharma IndustryMazbahul IslamNo ratings yet

- Easement Contract SampleDocument3 pagesEasement Contract SampleEkie GonzagaNo ratings yet

- North KoreaDocument2 pagesNorth KoreamichaelmnbNo ratings yet

- Sec 73 of The Indian Contract ActDocument28 pagesSec 73 of The Indian Contract ActAditya MehrotraNo ratings yet

- Philippine Presidents Administration EcoDocument32 pagesPhilippine Presidents Administration EcoLucille BallaresNo ratings yet

- PCC v. CIRDocument2 pagesPCC v. CIRLDNo ratings yet

- Mock Bar Test 1Document9 pagesMock Bar Test 1Clark Vincent PonlaNo ratings yet

- Full Text of Supreme Court Judgement in Ayodhya Land Dispute CaseDocument1,045 pagesFull Text of Supreme Court Judgement in Ayodhya Land Dispute CaseNDTV96% (26)

- Assignment: Grave and Sudden Provocation:An Analysis As Defence With Respect To Provisions of Indian Penal CodeDocument31 pagesAssignment: Grave and Sudden Provocation:An Analysis As Defence With Respect To Provisions of Indian Penal Codevinay sharmaNo ratings yet

- ISLAMIC CODE OF ETHICS: CORE OF ISLAMIC LIFEDocument2 pagesISLAMIC CODE OF ETHICS: CORE OF ISLAMIC LIFEZohaib KhanNo ratings yet

- Costs and Consequences of War in IraqDocument2 pagesCosts and Consequences of War in Iraqnatck96No ratings yet

- Warmbier V DPRK ComplaintDocument22 pagesWarmbier V DPRK ComplaintLaw&Crime100% (1)

- Careful. B) A Careless Driver Is A Danger To The PublicDocument2 pagesCareful. B) A Careless Driver Is A Danger To The PublicMargarita MakarovaNo ratings yet

- Conrad 1Document15 pagesConrad 1newnomiNo ratings yet

- Moot MemorialDocument18 pagesMoot MemorialHarshit Chordia100% (1)

- Major Political Ideologies in 40 CharactersDocument3 pagesMajor Political Ideologies in 40 CharactersMarry DanielNo ratings yet

- G.R. Nos. 113255-56 People vs. Gonzales, 361 SCRA 350 (2001)Document6 pagesG.R. Nos. 113255-56 People vs. Gonzales, 361 SCRA 350 (2001)Shereen AlobinayNo ratings yet

- Affidavit of Adverse Claim (Gaby S. Tay)Document3 pagesAffidavit of Adverse Claim (Gaby S. Tay)Benedict Ontal100% (2)

- 18 2023 6 39 14 AmDocument5 pages18 2023 6 39 14 AmIsa Yahya BayeroNo ratings yet

- Mitchell Press ReleaseDocument4 pagesMitchell Press ReleaseWSLSNo ratings yet

- SPM TRIAL 2007 English Paper 2Document19 pagesSPM TRIAL 2007 English Paper 2Raymond Cheang Chee-CheongNo ratings yet

- ART 1106-1126 Case RulingsDocument4 pagesART 1106-1126 Case RulingsErika Cristel DiazNo ratings yet

- Challan Office Copy Challan Candidate'SDocument1 pageChallan Office Copy Challan Candidate'SVenkatesan SwamyNo ratings yet