Professional Documents

Culture Documents

Segment and Interim Reporting Questions

Uploaded by

ralphalonzo0 ratings0% found this document useful (0 votes)

666 views2 pagesTarlac Company signed a contract on October 1, 2005 to sell one of its business segments for P45 million. The segment had revenues of P30 million and expenses of P38 million in 2005. Additionally, the contract requires Tarlac to pay P3 million in employee termination costs by June 30, 2006. Before income tax, the loss from discontinued operations that will be reported for 2005 is P12 million.

Siasi Company approved the disposal of its food distribution division on October 1, 2005, which is expected to be sold in August 2006. For 2005, the division had revenues of P35 million and P15 million with expenses of P27 million and P10 million respectively. The carrying amount of assets

Original Description:

123

Original Title

38 - Segment and Interim Reporting

Copyright

© © All Rights Reserved

Available Formats

DOC, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentTarlac Company signed a contract on October 1, 2005 to sell one of its business segments for P45 million. The segment had revenues of P30 million and expenses of P38 million in 2005. Additionally, the contract requires Tarlac to pay P3 million in employee termination costs by June 30, 2006. Before income tax, the loss from discontinued operations that will be reported for 2005 is P12 million.

Siasi Company approved the disposal of its food distribution division on October 1, 2005, which is expected to be sold in August 2006. For 2005, the division had revenues of P35 million and P15 million with expenses of P27 million and P10 million respectively. The carrying amount of assets

Copyright:

© All Rights Reserved

Available Formats

Download as DOC, PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

666 views2 pagesSegment and Interim Reporting Questions

Uploaded by

ralphalonzoTarlac Company signed a contract on October 1, 2005 to sell one of its business segments for P45 million. The segment had revenues of P30 million and expenses of P38 million in 2005. Additionally, the contract requires Tarlac to pay P3 million in employee termination costs by June 30, 2006. Before income tax, the loss from discontinued operations that will be reported for 2005 is P12 million.

Siasi Company approved the disposal of its food distribution division on October 1, 2005, which is expected to be sold in August 2006. For 2005, the division had revenues of P35 million and P15 million with expenses of P27 million and P10 million respectively. The carrying amount of assets

Copyright:

© All Rights Reserved

Available Formats

Download as DOC, PDF, TXT or read online from Scribd

You are on page 1of 2

Page 1 of 2

REVIEW OF FINANCIAL ACCOUNTING THEORY AND PRACTICE

SEGMENT AND INTERIM REPORTING

1. On October 1, 2005, when the carrying amount of the net assets of a business

segment was P50,000,000, Tarlac Company signed a legally binding contract to sell the

business segment. The sale is expected to be completed by March 31, 2006, at a

selling price of P45,000,000. In addition, prior to March 31, 2006, the sale contract

obliges Tarlac Company to terminate the employment of certain employees of the

business segment incurring an expected termination cost of P3,000,000 to be paid on

June 30, 2006.

The segments revenues and operating expenses for 2005,

respectively, were P30,000,000 and P38,000,000. Before income tax, how much will

be reported as loss from discontinued operations for 2005?

a. P16,000,000

b. P10,000,000

c. P12,000,000

d. P 700,000

2. Siasi Company is a diversified company with nationwide interests in commercial real

estate developments, banking, mining and food distribution. The food distribution

division was deemed to be inconsistent with the long-term direction of the company.

On October 1, 2005, the board of directors voted to approve the disposal of this

division. The sale is expected to occur in August 2006. The food distribution had the

following revenue and expenses in 2005: January 1 to September 30, revenue of

P35,000,000 and expenses of P27,000,000; October 1 to December 31, revenue of

P15,000,000 and expenses of P10,000,000. The carrying amount of the divisions

assets at December 31, 2005 was P56,000,000 and the recoverable amount was

estimated to be P59,000,000. The sale contract requires Siasi to terminate certain

employees incurring an expected termination cost of P4,000,000 to be paid by

December 15, 2006. The income tax rate is 32%. The income statement for the year

ended December 31, 2005 will report income from discontinued operation at

a. P12,000,000

b. P 8,160,000

c. P 9,000,000

d. P 6,120,000

3. Concepcion Company and its divisions are engaged solely in manufacturing

operations. The following data pertain to the industries in which operations were

conducted for the year ended December 31, 2005.

Segments

1

2

3

4

5

6

Total revenue

13,000,000

10,000,000

8,000,000

3,000,000

3,500,000

2,500,000

40,000,000

Operating profit

4,000,000

2,000,000

1,500,000

1,000,000

800,000

700,000

10,000,000

Identifiable assets

25,000,000

20,000,000

15,000,000

7,000,000

8,000,000

5,000,000

80,000,000

In its segment information for 2005, how many reportable segments does Concepcion

have?

a. Three

b. Four

c. Five

d. Six

Page 2 of 2

4. Panamao Company, a publicly owned corporation, is subject to the requirements for

segment reporting. In its income statement for the year ended December 31, 2005,

Panamao reported revenue of P150,000,000, operating expenses of P100,000,000 and

net income of P50,000,000. Operating expenses include payroll costs of P20,000,000.

Panamaos combined identifiable assets of all industry segments at December 31,

2005 were P80,000,000. The reported revenue includes P120,000,0000 of sales to

external customers. External revenue reported by operating segments must be at least

a. P112,500,000

b. P 90,000,000

c. P 37,500,000

d. P 60,000,000

5. Pura Company has three manufacturing divisions, each of which has been determined

to be a reportable segment. Common costs are appropriately allocated on the basis of

each divisions sales in relation to Puras aggregate sales. In 2005, Division I had sales

of P6,000,000, which was 20% of Puras total sales, and had traceable operating costs

of P3,800,000. In 2005, Pura incurred operating costs of P1,000,000 that were not

directly traceable to any of the divisions. In addition, Pura incurred interest expense of

P600,000 in 2005. In reporting segment information, what amount should be shown as

operating profit of Division I for 2005?

a. P2,000,000

b. P1,880,000

c. P1,400,000

d. P2,200,000

6. Camiling Company has estimated that total depreciation expense for the year ending

December 31, 2005 will amount to P2,000,000, and the 2005 year-end bonuses to

employees will total P4,000,000. Camiling paid P500,000 property taxes assessed for

the year 2005. On June 30, 2005, Camiling incurred a permanent inventory loss from

market decline of P800,000 and loss on sale of land of P200,000. In the interim

income statement for the six months ended June 30, 2005, what total amount of

expenses relating to these items should be reported?

a. P4,250,000

b. P3,750,000

c. P3,850,000

d. P3,450,000

7. Talipao Companys P10,000,000 net income for the quarter ended September 30,

2005, included the following after-tax items

A P1,200,000 gain realized on April 30, 2005 was allocated equally to the second,

third and fourth quarters of 2005.

A P3,000,000 cumulative loss resulting from a change in inventory valuation method

was recognized on August 2, 2005.

In addition, Talipao paid P600,000 on February 1, 2005, for 2005 calendar-year

property tax. Of this amount, P150,000 was allocated to the third quarter of 2005. For

the quarter ended September 30, 2005, Talipao should report net income of

a. P12,600,000

b. P11,800,000

c. P12,750,000

d. P 9,600,000

- end -

You might also like

- Chapters-1-10-Exam-Problem (2) Answer JessaDocument6 pagesChapters-1-10-Exam-Problem (2) Answer JessaLynssej BarbonNo ratings yet

- CPA Review Problems on Operating Segment and Interim ReportingDocument3 pagesCPA Review Problems on Operating Segment and Interim ReportingLui100% (2)

- Cash and Acrrual Basis QUIZDocument2 pagesCash and Acrrual Basis QUIZMarii M.100% (1)

- Chapter 13: Operating Segment Segment Reporting - Core PrincipleDocument10 pagesChapter 13: Operating Segment Segment Reporting - Core PrinciplePaula BautistaNo ratings yet

- Quiz 2 Statement of Comprehensive Income Cash Vs Accrual BasisDocument11 pagesQuiz 2 Statement of Comprehensive Income Cash Vs Accrual BasisHaidee Flavier SabidoNo ratings yet

- SegmentDocument8 pagesSegmentChelsea Anne Vidallo100% (1)

- Statement of Comprehensive IncomeDocument3 pagesStatement of Comprehensive IncomeHaidee Flavier SabidoNo ratings yet

- Practical Accounting 1 2011Document17 pagesPractical Accounting 1 2011abbey89100% (2)

- FAR.2845 Statement of Profit or Loss and OCI PDFDocument6 pagesFAR.2845 Statement of Profit or Loss and OCI PDFGabriel OrolfoNo ratings yet

- 13213213operating SegmentDocument2 pages13213213operating SegmentGlen JavellanaNo ratings yet

- Financial Accounting Vol.3 ADocument10 pagesFinancial Accounting Vol.3 ALovely Lorelie Del Mundo Planos29% (14)

- Operating Segment.Document14 pagesOperating Segment.Honey LimNo ratings yet

- C. Either A or B.: Discussion ProblemsDocument8 pagesC. Either A or B.: Discussion ProblemsGlen JavellanaNo ratings yet

- ACTIVITY 3 - Operating Segments PDFDocument3 pagesACTIVITY 3 - Operating Segments PDFEstilo0% (2)

- Change in Accounting Policy and EstimatesDocument6 pagesChange in Accounting Policy and EstimatesMark IlanoNo ratings yet

- FAR 2&3 Test BankDocument63 pagesFAR 2&3 Test BankRachelle Isuan TusiNo ratings yet

- ACTIVITY 5 Interim Reporting PDFDocument2 pagesACTIVITY 5 Interim Reporting PDFEstiloNo ratings yet

- Accrual Basis, Cash Basis, Single Entry & Error CorrectionDocument3 pagesAccrual Basis, Cash Basis, Single Entry & Error CorrectionYour MaterialsNo ratings yet

- QuestionsDocument16 pagesQuestionsRuby JaneNo ratings yet

- Practical Accounting Problems SolvedDocument11 pagesPractical Accounting Problems SolvedStela Marie CarandangNo ratings yet

- Cash & AccrualDocument14 pagesCash & Accrualanggandakonoh100% (2)

- Toa 25 Cash To Accrual Correction of ErrorsDocument3 pagesToa 25 Cash To Accrual Correction of Errorsmae tuazonNo ratings yet

- ACCTGREV1 - 008 Operating Segments and Interim ReportingDocument2 pagesACCTGREV1 - 008 Operating Segments and Interim ReportingNhaj100% (3)

- Ochon TOADocument12 pagesOchon TOAAnonymous 9NXVxh4R9No ratings yet

- Ch15 CASH FLOW STATEMENTSDocument6 pagesCh15 CASH FLOW STATEMENTSralphalonzo100% (1)

- Segment ReportingDocument2 pagesSegment ReportingNicole Chenper ChengNo ratings yet

- Review Accounting Cash Accrual ConceptsDocument4 pagesReview Accounting Cash Accrual ConceptsForkenstein0% (1)

- Single Entry and Cash and AccrualDocument7 pagesSingle Entry and Cash and AccrualRinna LegaspiNo ratings yet

- Events After The Reporting Period NCA Held For Disposal Discontinued OperationsDocument2 pagesEvents After The Reporting Period NCA Held For Disposal Discontinued OperationsJeremiah DavidNo ratings yet

- Brines Christian Joseph C. Operating SegmentsDocument58 pagesBrines Christian Joseph C. Operating SegmentsAllana MierNo ratings yet

- 009 Cash Basis Accrual BasisDocument4 pages009 Cash Basis Accrual BasisRosanna Romanca50% (2)

- Statement of Financial PositionDocument3 pagesStatement of Financial PositionDJ NicartNo ratings yet

- pg.565-593 of Financial Accounting Book 2014 ValixDocument29 pagespg.565-593 of Financial Accounting Book 2014 ValixPeter Paul Enero Perez50% (2)

- Seatwork 02 Statement of Income (TEST I) Multiple Choice: Shade Your Answer With YELLOWDocument5 pagesSeatwork 02 Statement of Income (TEST I) Multiple Choice: Shade Your Answer With YELLOWChristine Joy LanabanNo ratings yet

- Cost Behavior AnalysisDocument18 pagesCost Behavior AnalysiskathleenNo ratings yet

- Correct Financial Records ErrorsDocument7 pagesCorrect Financial Records ErrorsJoy Miraflor AlinoodNo ratings yet

- Orang Co. perpetual inventory system calculationsDocument3 pagesOrang Co. perpetual inventory system calculationsJobelle Candace Flores AbreraNo ratings yet

- SciDocument3 pagesSciJomar VillenaNo ratings yet

- Cordillera Career Development College problems and solutionsDocument10 pagesCordillera Career Development College problems and solutionsapatosNo ratings yet

- CASH TO ACCRUAL SINGLE ENTRY With ANSWERSDocument8 pagesCASH TO ACCRUAL SINGLE ENTRY With ANSWERSRaven SiaNo ratings yet

- I Am Sharing 'SIM-ANSWERS - 6th-Exam-Topics - Hyperinflation - PABRES' With YouDocument9 pagesI Am Sharing 'SIM-ANSWERS - 6th-Exam-Topics - Hyperinflation - PABRES' With YouJeric TorionNo ratings yet

- Discontinued Operation: Pfrs 5Document19 pagesDiscontinued Operation: Pfrs 5FRITZ IVAN DENIELLE M. GERONANo ratings yet

- May 2017Document7 pagesMay 2017Patrick Arazo0% (1)

- Intermediate Accounting Practice Sets 1Document17 pagesIntermediate Accounting Practice Sets 1Mhaydel Garcia67% (3)

- Toa.m-1402. Review of The Accounting ProcessDocument5 pagesToa.m-1402. Review of The Accounting ProcessLINDIE MARIE RABENo ratings yet

- 1GGJ42AOFPKHYIMZCONI4A0IGQQB7ADocument3 pages1GGJ42AOFPKHYIMZCONI4A0IGQQB7Ajaymark canayaNo ratings yet

- Bvps and EpsDocument30 pagesBvps and EpsRenzo Melliza100% (1)

- Quiz FinalDocument6 pagesQuiz FinalChriztel Joy Manansala100% (1)

- CHAPTER 10 - Interim Financial ReportingDocument11 pagesCHAPTER 10 - Interim Financial ReportingStychri Alindayo77% (13)

- MANAGEMENT ADVISORY SERVICES TOPICSDocument19 pagesMANAGEMENT ADVISORY SERVICES TOPICSNovie Marie Balbin AnitNo ratings yet

- Drill Business CombinationDocument4 pagesDrill Business CombinationPrankyJellyNo ratings yet

- Chapter 5 System Development and Program Change Activities PT 10Document2 pagesChapter 5 System Development and Program Change Activities PT 10Hiraya ManawariNo ratings yet

- NCA Held For Sale Discontinued OperationsDocument15 pagesNCA Held For Sale Discontinued OperationsDog WatcherNo ratings yet

- 162.005.exercises and AssignDocument2 pages162.005.exercises and AssignAngelli Lamique50% (2)

- Segment reporting and discontinued operationsDocument12 pagesSegment reporting and discontinued operationsAnalie Mendez100% (2)

- Income Statement QuestionsDocument2 pagesIncome Statement QuestionsMarc Eric RedondoNo ratings yet

- P1 - Winding UpDocument23 pagesP1 - Winding Upjinky2470% (10)

- 37 - Income StatementDocument2 pages37 - Income StatementROMAR A. PIGANo ratings yet

- Northern Metro Review School of Accountancy Quiz #1Document2 pagesNorthern Metro Review School of Accountancy Quiz #1SHENo ratings yet

- Ppe ApDocument5 pagesPpe ApGrace A. Manalo0% (1)

- FAR - Revaluation Increase and DecreaseDocument1 pageFAR - Revaluation Increase and DecreaseralphalonzoNo ratings yet

- Sunday Monday Tuesday Wednesday Thursday Friday SaturdayDocument1 pageSunday Monday Tuesday Wednesday Thursday Friday SaturdayralphalonzoNo ratings yet

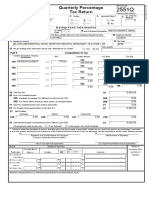

- Quarterly Percentage Tax Return: 12 - DecemberDocument1 pageQuarterly Percentage Tax Return: 12 - DecemberralphalonzoNo ratings yet

- Chapter 4 and Chapter 5Document9 pagesChapter 4 and Chapter 5ralphalonzoNo ratings yet

- 08 Investmentquestfinal PDFDocument13 pages08 Investmentquestfinal PDFralphalonzo0% (1)

- Real Estate Mortgage Requisites and RemediesDocument11 pagesReal Estate Mortgage Requisites and RemediesralphalonzoNo ratings yet

- FAR - Conceptual FrameworkDocument8 pagesFAR - Conceptual FrameworkralphalonzoNo ratings yet

- T02 - Capital BudgetingDocument121 pagesT02 - Capital Budgetingralphalonzo75% (4)

- Donor - S Tax - Oct 2017 - GCC - Self Test - Quiz 2Document3 pagesDonor - S Tax - Oct 2017 - GCC - Self Test - Quiz 2ralphalonzoNo ratings yet

- MAS - DOL Vs DFLDocument3 pagesMAS - DOL Vs DFLralphalonzoNo ratings yet

- Deductions From Gross IncomeDocument1 pageDeductions From Gross IncomeralphalonzoNo ratings yet

- Business Law and TaxationDocument15 pagesBusiness Law and TaxationKhim Dagangon100% (1)

- TAX - Gross Estate RemindersDocument2 pagesTAX - Gross Estate RemindersralphalonzoNo ratings yet

- FAR - DerivativesDocument1 pageFAR - DerivativesralphalonzoNo ratings yet

- Estate Taxation Self-TestDocument4 pagesEstate Taxation Self-TestralphalonzoNo ratings yet

- RFBT - Directors and Stockholders' MeetingDocument1 pageRFBT - Directors and Stockholders' MeetingralphalonzoNo ratings yet

- 7 Remedial PDFDocument66 pages7 Remedial PDFMinahNo ratings yet

- HyperinflationDocument2 pagesHyperinflationralphalonzoNo ratings yet

- Afar AUD FAR MAS RFBT TAX TheoryDocument1 pageAfar AUD FAR MAS RFBT TAX TheoryralphalonzoNo ratings yet

- PRTC at 1st PreboardDocument11 pagesPRTC at 1st PreboardralphalonzoNo ratings yet

- A. Variable Costs, P18 Million. B. Fixed Costs. P12 Million. C. Operating Income, P4 Million. D. Break-Even Sales Volume, P20 MillionDocument11 pagesA. Variable Costs, P18 Million. B. Fixed Costs. P12 Million. C. Operating Income, P4 Million. D. Break-Even Sales Volume, P20 Millionralphalonzo100% (1)

- PRTC Mas First PBDocument11 pagesPRTC Mas First PBralphalonzo100% (2)

- PRTC TOA First PreboardDocument9 pagesPRTC TOA First PreboardralphalonzoNo ratings yet

- RFBT - Forms of Partnership ContractsDocument1 pageRFBT - Forms of Partnership ContractsralphalonzoNo ratings yet

- PRTC P2 1st PreboardDocument10 pagesPRTC P2 1st PreboardRommel Royce0% (1)

- PRTC AP First PBDocument9 pagesPRTC AP First PBralphalonzoNo ratings yet

- MAS.M-1405 Cost of Capital Straight ProblemsDocument12 pagesMAS.M-1405 Cost of Capital Straight ProblemsralphalonzoNo ratings yet

- Cost-Volume-Profit Relationslt R,) 56. The Company's Overall Contribution Margin Ratio Fur The Sales Mix Expected Is H. 45%. D. 60%Document10 pagesCost-Volume-Profit Relationslt R,) 56. The Company's Overall Contribution Margin Ratio Fur The Sales Mix Expected Is H. 45%. D. 60%ralphalonzoNo ratings yet

- PRTC Mas First PBDocument11 pagesPRTC Mas First PBralphalonzo100% (2)

- Chapter 1 With Reference To ICAP 2015 Study TextDocument10 pagesChapter 1 With Reference To ICAP 2015 Study TextralphalonzoNo ratings yet

- Industry Analysis of InsuranceDocument48 pagesIndustry Analysis of InsuranceDebojyotiSahoo100% (1)

- Ch15 Solutions 13eDocument12 pagesCh15 Solutions 13echandel08No ratings yet

- Risk Analysis Techniques in Capital BudgetingDocument49 pagesRisk Analysis Techniques in Capital BudgetingjayminashahNo ratings yet

- The Geopolitics of Mexico - A Mountain Fortress Besieged - StratforDocument13 pagesThe Geopolitics of Mexico - A Mountain Fortress Besieged - StratforAbe Schreier100% (1)

- Mashaweer Case StudyDocument4 pagesMashaweer Case StudyDona Meyer100% (2)

- Chapter 1Document33 pagesChapter 1Momentum PressNo ratings yet

- Baf Blackbook Gold Part 2Document6 pagesBaf Blackbook Gold Part 2suparnakonarNo ratings yet

- Nielsen VN - Vietnam Consumer Confidence - Quarter II 2010Document3 pagesNielsen VN - Vietnam Consumer Confidence - Quarter II 2010OscarKhuongNo ratings yet

- Microeconomics: MarketsDocument4 pagesMicroeconomics: MarketsRei Diaz ApallaNo ratings yet

- CAPSIM Tips on Sector Growth, Leverage, InventoryDocument4 pagesCAPSIM Tips on Sector Growth, Leverage, InventoryTomi Chan100% (3)

- 1994 ADB Report On RP Mineral Sector 2010Document295 pages1994 ADB Report On RP Mineral Sector 2010Richard BalaisNo ratings yet

- Financial Analysis Reveals Canara Bank's StrugglesDocument13 pagesFinancial Analysis Reveals Canara Bank's StrugglesSattwik rathNo ratings yet

- CFL 2010 Retaining Wall Inventory Condition PDFDocument188 pagesCFL 2010 Retaining Wall Inventory Condition PDFHarvin Julius LasqueroNo ratings yet

- 2019 08 15 GE Whistleblower ReportDocument175 pages2019 08 15 GE Whistleblower ReportCNBC.com100% (6)

- Chapter 12 Solution of Fundamental of Financial Accouting by EDMONDS (4th Edition)Document67 pagesChapter 12 Solution of Fundamental of Financial Accouting by EDMONDS (4th Edition)Awais AzeemiNo ratings yet

- FGP WPMP BrochureDocument12 pagesFGP WPMP BrochureArbiMuratajNo ratings yet

- Assignment Print ViewDocument103 pagesAssignment Print ViewHARISHPBSNo ratings yet

- Midterm Exam With Key Ia3 PcuDocument6 pagesMidterm Exam With Key Ia3 PcuLyka CataynaNo ratings yet

- Investment Catalogue in Strategic Sectors 2015 2017 InglésDocument122 pagesInvestment Catalogue in Strategic Sectors 2015 2017 InglésEdwin CandoNo ratings yet

- International Financial ManagementDocument20 pagesInternational Financial ManagementKnt Nallasamy GounderNo ratings yet

- Justice, Individual Rights, and Responsibilities To StakeholdersDocument3 pagesJustice, Individual Rights, and Responsibilities To StakeholdersHARIZASANCHNo ratings yet

- Indofood Sukses Makmur TBK (INDF IJ) : Strong Performance From All SegmentsDocument6 pagesIndofood Sukses Makmur TBK (INDF IJ) : Strong Performance From All SegmentsPutu Chantika Putri DhammayantiNo ratings yet

- SFAC No 5Document29 pagesSFAC No 5FridRachmanNo ratings yet

- Darryl Shen - OrderImbalanceStrategy PDFDocument70 pagesDarryl Shen - OrderImbalanceStrategy PDFmichaelguan326No ratings yet

- ETSY - Etsy, IncDocument10 pagesETSY - Etsy, Incdantulo1234No ratings yet

- Ulip Multimeter: Power House of Information For All ULIP PLANSDocument33 pagesUlip Multimeter: Power House of Information For All ULIP PLANSjay18No ratings yet

- JLL - Global Real Estate Capital Flows - 11Document30 pagesJLL - Global Real Estate Capital Flows - 11Arun ChitnisNo ratings yet

- Statement of Cash Flows 3Document7 pagesStatement of Cash Flows 3Rashid W QureshiNo ratings yet

- CSS Ratio AnalysisDocument9 pagesCSS Ratio AnalysisMasood Ahmad AadamNo ratings yet

- Perbandingan Kinerja Keuangan Perusahaan Manufaktur Menggunakan Analisis Rasio KeuanganDocument22 pagesPerbandingan Kinerja Keuangan Perusahaan Manufaktur Menggunakan Analisis Rasio KeuanganIrma Retno DewiNo ratings yet