Professional Documents

Culture Documents

The Hamiltonian Report Aug. 2009 Kush Jenkins

Uploaded by

Kwan BoothCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

The Hamiltonian Report Aug. 2009 Kush Jenkins

Uploaded by

Kwan BoothCopyright:

Available Formats

Volume 1, Issue 1

And The Beat Goes On!!

August 24, 2009

As I watched the Dow end will pass. pany to beat estimates.

the week up 184.56 points, Remember, earning is king

despite a bear of a Monday, on Wall Street. Without

I could hear the hooves to What the Wall Streeters earnings, you are sitting on

the bulls galloping. Now, I know is that there are two an Enron.

cannot even get a hot dog things on the horizon that

from the hot dog lady with- should scare everybody

out someone asking me currently in the market.

about the markets. When I The first, is volume. Due to

told everyone at Dow 8,000 the summer vacation sea-

and falling to start edging son, a lot of institutional

their way back into the buyers have been out of the

market, I could not get a office. Soaking it up on

friendly ear. Today, with Martha’s Vineyard or tak-

all of the easy money made ing the family to see the

at Dow 9500, people are Grand Canyon. So, right

CPM INVESTMENT STRATEGIES, LLC PRESENTS:

asking where the next Avis now, there is very little in

or Bank of America is. the way of volume to sup-

port the recent gains. Ex-

pect low volume until after

This is when I am at my the Labor Day holiday,

most bearish. The pull back when all hands, and

is coming. It has to come. money, are back on deck.

The Hamiltonian

This is what the “random

walk” is all about. Walking

a little forward, a little The second issue is earn-

backward, back forward, ings. No matter the opti-

and so forth. mistic statements our fed

chief, Ben Bernanke, puts

out, companies are lacking

But recently, we have been the earnings power to sup-

walking straight ahead port all of the recent run

since the 2007—2008 ups in stocks.

moonwalk in stocks. This

recent market has been

making stars of every Joe Currently, stocks have used

who is willing to close their cost cutting measure to

eyes and pick a stock out of beat estimates. That trick

a hat. People are doubling will only last but so long.

their money without even Eventually, the company’s

picking up an income state- earnings will have to in-

ment. These are the glory crease in order for the com-

days boys and soon they

Report

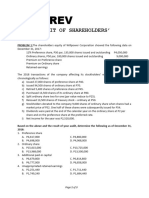

Stocks I am watching

Special points of interest:

Smith and Wesson (SWHC) $5.91

Preliminary Q2 GDP numbers will be re-

Citigroup (C) $4.70

leased by the Labor Departments. Consen-

Barrick Gold (ABX) $34.67 sus estimates are looking for a –1.4, which

is an increased contraction from initial

ProShares Ultrashort Gas & Oil (DUG) $15.78 estimates. I hope Obama is not playing the

same revision game the Bush administration

Ford (F) $7.74 subscribed to.

Chevron (CVX) $69.73

AT&T (T) $26.00

The Hamiltonian Report

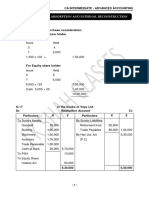

Dates to Mark on Your Calendar

MONDAY:

Israel’s Central Bank is expected to tighten. Can anyone say inflation?

The famed “Cash for Clunkers” ends at 8 pm. Someone asked me should they take apart in such so-

cialism. I said, “Why not? Goldman Sachs did not have such a moral dilemma when they picked up

their check.”

TUESDAY:

CONSUMER CONFIDENCE! Maybe just another reason to let a bull get a little bully.

WEDNESDAY:

Durable Goods Orders for July.

New Home Sales for July. Remember, last months surprise number rose some homebuilders.

FDIC is going to vote on a measure to make it easy for private equity firms to buy troubled banks. I

like Shelia Bair but I am cool on this idea on it’s face.

THURSDAY:

Preliminary Q2 GDP numbers could feed a bear.

FRIDAY:

July Personal Income and Personal Consumption. Consensus looking for a .1% rise in personal in-

come and a –1.3% fall in personal consumption in July. People, save your money.

Univ. of Michigan consumer sentiment in August. Michigan needs something to be on the rise in Ann

Arbor since the football team appears poised to pull another one. Consensus is looking at a 64, com-

pared to a 63.2 in July.

You might also like

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5794)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (400)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (895)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (588)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (74)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (344)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (121)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- My Affidavit For LawyerDocument4 pagesMy Affidavit For LawyerJohn GuillermoNo ratings yet

- Introduction To IFRS: AccountingDocument16 pagesIntroduction To IFRS: AccountingmulualemNo ratings yet

- Sample Employment ContractDocument2 pagesSample Employment Contracttimmy_zamora100% (1)

- Powerpoint Report PledgeDocument12 pagesPowerpoint Report PledgeElysia PerezNo ratings yet

- Budgetcircular2010 11Document109 pagesBudgetcircular2010 11Vikas AnandNo ratings yet

- Monetary Policy Statement October 2020Document2 pagesMonetary Policy Statement October 2020African Centre for Media ExcellenceNo ratings yet

- Audit of SheDocument3 pagesAudit of ShePrince PierreNo ratings yet

- Petition For Issuance of Letter of AdministrationDocument4 pagesPetition For Issuance of Letter of AdministrationMa. Danice Angela Balde-BarcomaNo ratings yet

- Strategic Management: Implementing Strategies: Marketing IssuesDocument37 pagesStrategic Management: Implementing Strategies: Marketing IssuesAli ShanNo ratings yet

- CHAPTER 1, 2, 3 and 4Document33 pagesCHAPTER 1, 2, 3 and 4Jobelle MalabananNo ratings yet

- Chapter 6 Self Test Taxation Discussion Questions PDF FreeDocument9 pagesChapter 6 Self Test Taxation Discussion Questions PDF FreeJanjan RiveraNo ratings yet

- Capital Budgeting Techniques: Multiple Choice QuestionsDocument10 pagesCapital Budgeting Techniques: Multiple Choice QuestionsRod100% (1)

- Volvo Working Capital ManagementDocument108 pagesVolvo Working Capital ManagementRaj MurthyNo ratings yet

- Economic Analysis and Decision Making: SayedmohammadrezamirforughyDocument2 pagesEconomic Analysis and Decision Making: SayedmohammadrezamirforughyMaiwand KhanNo ratings yet

- IB ChallanDocument1 pageIB ChallanPrasad HiremathNo ratings yet

- Asset AllocationDocument8 pagesAsset AllocationAnonymous Hw6a6BYS3DNo ratings yet

- Margalla Services Officers Mess-169Document1 pageMargalla Services Officers Mess-169Wasi MohammadNo ratings yet

- Quant Interview PrepDocument25 pagesQuant Interview PrepShivgan Joshi67% (3)

- BPD AssignmentDocument2 pagesBPD AssignmentSoniya ShahuNo ratings yet

- 5 Amalgamation, Absorption and External Reconstruction - HomeworkDocument21 pages5 Amalgamation, Absorption and External Reconstruction - HomeworkYash ShewaleNo ratings yet

- Diagnostic Investments QuestionsDocument5 pagesDiagnostic Investments Questionscourse heroNo ratings yet

- Ci17 5Document11 pagesCi17 5robmeijerNo ratings yet

- Nego Digest Week 2Document13 pagesNego Digest Week 2Rufino Gerard MorenoNo ratings yet

- Job Vacancy - PT Hale InternationalDocument3 pagesJob Vacancy - PT Hale InternationalFebrihybridNo ratings yet

- FAR 4204 (Receivables)Document10 pagesFAR 4204 (Receivables)Maximus100% (1)

- What Is A Financial Intermediary (Final)Document6 pagesWhat Is A Financial Intermediary (Final)Mark PlancaNo ratings yet

- Wyckoff Methode With Supply and - Alex RayanDocument49 pagesWyckoff Methode With Supply and - Alex RayanmansoodNo ratings yet

- Cover LetterDocument2 pagesCover LetterRojim OtadoyNo ratings yet

- WRD 27e SE PPT Ch16Document24 pagesWRD 27e SE PPT Ch16Hằng Nga Nguyễn ThịNo ratings yet

- FINANCIAL RISK MANAGEMENT TEST 1 AnswersDocument2 pagesFINANCIAL RISK MANAGEMENT TEST 1 AnswersLang TranNo ratings yet