Professional Documents

Culture Documents

Compresspdf 7HnINAmT

Uploaded by

Ratsih0 ratings0% found this document useful (0 votes)

22 views13 pagescompression techniques

Original Title

compresspdf_7HnINAmT

Copyright

© © All Rights Reserved

Available Formats

PDF or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this Documentcompression techniques

Copyright:

© All Rights Reserved

Available Formats

Download as PDF or read online from Scribd

0 ratings0% found this document useful (0 votes)

22 views13 pagesCompresspdf 7HnINAmT

Uploaded by

Ratsihcompression techniques

Copyright:

© All Rights Reserved

Available Formats

Download as PDF or read online from Scribd

You are on page 1of 13

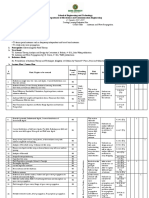

EAE ae

_ wt Rae Ra wiser

setae eter wee we yer EEF YR,

Sbeoralasatn Kenia, Stlimla "3 eie. apes. Atentoat

Ph YE aE aR war | Seer oes a

ee Sy yas gs abrierebec cones Sy lr

Aretirereah Fe 4 98 prose ee

Bene fe ae afybelevet S Se “ORT Case, fay 4

pa ae &. frees, Fonbeion, AKaaturen’, Naty Qetie

Sar BTL Goiteament J liga keuncttons “O . pil:

PPO Numba eer Pemioreay Senenpilt ‘ysbborae s

er ama Br carey arb

ay FE case. “Pro NewoBetat

7 a"; wer yer / FT persion Come frig

a Rim ‘ tie ae - HR. eeka ora ag i

a Pee) Sr "

ension GIR’ gear bene l S ia Heres

Ce eR, TEP z]

O3 TRON 2 orn oral dectt, Ned Betas

FW Chale wpateusabeos GT Concene of Pho, Br

Pp = a ab Ff Pr, ef) Meee en Ry Bs oor

Gos pesefes Lie No. M- i/p2afzor4 - PP cleft) 08.08. 08

> Apes ee Fag. No. 8, Dae No. 3% Borsa

"ey (sate) gier “= ig wera =)

Wee z Sap weap 5 ET Shae Sy aban

wae Te Salt Be aT a ear =ag, fey

Pao, Bak, New Tbelhi eae or HRT LTT

“cam Copy tr Ne. pac/ab-No[PEN/RK/ 2018-201 4/ona—He

ean YOu fey roll a

Bre

Sr pe sxe

ar

wae ve cd Ts

ape OFT ee ver ¥y

in, ag —freane weneats oper 2D ers

arr BFA. £5 Bs iy 5 Ae afte, DAT

s TPT office > owe agi 3 aa off Peer

eg ante Ae oh chday Roar! F)

ky HER, aera Se “aR FR Gey of or

SET aT BT FR a Wee 7 ar

hension GRE TE = denefel eS ores

Fond ey ~afere =e eel Oi gre iB)

“) (a

fe a2 oF llG

(Ras Kumar

(Rebel. Cx Epgineer Aanictant

Doorclaratar Kena, Seino

Enpbyrent No. R507 (Teen One. Trousanol Fveptusctred Nie)

PRASAR BHARATI

INDIA PUBLIC SERVICE BROADCASTER

PRASAR BHARAT! SECTT

2m Floor, PTE Building,

Sansad Marg. New Delhi-116 901

No, Me1/126/2016-PRC Dated 04:05, 16

SPEAKING ORDER

WHEREAS the Mindairy of 1é B vide tts Order Nu. 910/173/97

BUD) dated 25/02.1999 granted higher scales te cerain categories of

e Programme & Engincering staff of All India Racio and Doordarshan

Fu AND WHEREAS ab per sub-scctions 1) (1) and (2) of the Prasar

“Sf Bharati (Broadcasting Corporation of India} Act, 1990 all officers and

Bue s recruited for the purpose of Akashvanj and Doordarshan

tu 0.2007 shall be an decmed depistation te Prasar Bharvu,

AND WBEREAS as per sub-secucn 11 (Lo! the Act, the of

and employees referred te aub-seotions (1) and (2) shall be enstied

the pay and all other benelits as adimissinie to an employer of t

Genin! Government

AND WHEREAS in the light ol above provisions of the Act

Prasi: Bharad Board is its iieeting held on 06.08.2012

approved prasit of MACP co the omployers of Prasar Bhareti in general

wand to employees in 11 caiegor ad by Ministry of f & B's onier

dated 25.02, 1999 in particular

AND WHEREAS references ceqarding upplicability of MACP io

* all employees of Prusar Bharati and non-settleruent of retirement dues

of retiring/renired cmployecs were received in Prasar Bharati

ereupon the hatter wax further examined in

Finance Wing of Frayar Bharati and in the Nght of

the peavisions of the Prasar Bharat: (Greadeasting Cu:porauon of

India) Act, 1990 as aforesaid and vide communitation No.

Misc.1/40/2012-PPC dated 10,10.2013 it was-clarified that action of

| MIR) Roardarshan to grant MACP te all categories of employees were

\walid and yastified

ND (WHEREAS the Miniery of 1 & B vide irs lever No

S/2015-BA[E) dated 08.09.2014 informed Prosar Bharuti that

be the DoPée vide an [D Note dated 10.07.2015 had upined Lhat ‘as the

i 5 henefits under the MACP Scheme are allowed in the Grade Pay

oN

“an a Sage bors

aoe Foley

career would be

der the MACP

ieny, any Gperada’ ed dunng their

fted agninen the throe upgradation permissitile

seme!

(ND WHEREAS the matter wae again Taken up pith the

Aipimery of @-Beatating clearly that higher scales granted to the U°

ate of Programme & Engineering staff ‘of All Indie Radio and

Joordarehati by Exe Minrstry of f & Bivide ite Nin BOT B/O7—

3(0} daced 25,02.1800 were not upgsaeaninas bu; wenre upseitislly

wphice ccatee: awh a8 cach covered: by clarification Be. OS in

job? Oifice Memorardiom No, 4503+ 1(D) sinted 18.07.2001

thet, therefor, the Dope s advice dated 10.07.3015 rite

Geter we i own clarificacnd and that in view of this the mutter

sould Ge taken up with the DoP&'T

Ministry on the sutuuine of temo

sented

and

AND WHERPAS |1 was brought t

Sechetarint that pursuant £0 the Minixtry of 1 & Bie aloreeaid dared

5,00 2018 recovenes were being made fram ermpleyees cavered by

Miowty off 4 8 order dated 25 02,1999 regarding higher yay soules

cela received Gnsnicial wperadanons under ACPFMACS, ieuding

thuse retiring,

AND WHEREAS

ec matier WS bike up by Wrasar Bharan

Seorsraray yath the Minky of | A which al ings advice {ror

Me Ministry of baw granted stay on reonvery being made on

f grunt of MACE. os per DoPAT advices <

rineetveth 14 Pra

AND WHEREAS cepiey of Mininiry

S/2014-BA(EIPL Daied 17.02.2015 were cre:

he pay & AO of ALR and Goordarshac by Prasar Bharat:

niarat (Budget & Accounts Wing) wide leer Me, PE 14) /203%

Rdmen dated 19 022075 wih the rcquest te keep in abeyance

Trovenes prvaccraat al graat of MACH Cl! further orsern,

AND WHEREAS QUIT vide ia Office Memorandum No-

ajFarty dated 2nd March, 2016 hes clearly outlined

tons Linder which recovenes cannot be made evan if the pr

wooly DOPT Order a passed an the Supreme

has be

Court dudgment dated 1612.4014 in the case of State of Punjab %

fixed ¢F

‘(Ors #8 Pafig Masin (White Weaher| etc in CA No.t

Larinigpout of SLE(C) Nout LOBd of 2062)

4 of 2014

AND WHEREAS ic fas agnin the Hou Gf Prussr

aiithat in resniect of employees noverad by 25.02. 1999 order ancl

Whe Suoe got Beatci wyerrdations under ACP/MACM, the Pay

en rage zt

ne ti

Accounte Uthive (PAO| are refixing their pay in the lower pay scale and

ch employnes includa those who are retiring of on the veret of

retirement thus adversely affecting their pensienary benefits. A

fumber of representations from suck employees and these deprived of

MACP have already been sent to the Ministry by Prasar Bharati

AND WHEREAS Pay fiction is a fiction of the Ai tree

herity and PAD hag fo authority to refix tie pay of employees who

‘HO Under their administrative control,

NOW THEREFORE, it is hercty ordered that PAO “shall

immediatcly desist from refixine the pay of employees of alt india {

Radio and Doordarshan ond shall alsa male na recove

ar pensionary benefits of such employees without 94

from the concerned administrative authorities in All india Radio and

Dourdarsian PAO shail alse not held up or delay the release of

fetirement bestelits 6 Such employees on ground of excess payment

made on account of grant of financial uperadations under ACP/MACP.

‘This igsues with the approval of CEQ. Prasar Bharati

is Faster

(K-Srinivasen)

Deputy BirectorPEC}

Copy

) The Pay @ Ancourdls. Officer, AIR & Doordarshan 7th Feor,

IRLA, Phase V, Srochane Bhawan, Ladhi Road, New Delhi

L19093

iZ The Controller ef Accounts, Pay & Accounts Office PRLA),

isicy oF | & B, 7th Floor, [KLA, Phage V, Scochana Bhawan,

Ladh, Rowd, New Dejhl: 110003 for necessary action,

(3) Director Genegal, ALR / Director General. Dacrdarshan for wide

‘dissemination

of Copy to DNGET) for upicuding in Prasar Bharati website.

Page dot

3 Mig Apis ne

Be CRE - } “oy sus ro

‘Most Urgen

ravayn accounts orice (WW

DOORDARSHAN yl >} p Lé

ROOM NO.214, 2" FLOOR VAD apt ee 2c

AKASITWANI BHAWAN Beat DPE

PARLIAMENT STREET, NEW DELI! =

Sehant

No. PAODD-NIMPENIR/2016-2007! [5444 4 6 Dated: 2106 2016

Te 4

The Dy. Direeter General (Prow)

x Dootdsrshan Kensra

Soimliel (HPS :

- Hension eaxe in respect of Sh. Raj Kumar, Ea-SEA, Retd, on 30.11

15.

f No SML-DDK-27(2)2016-A/874 dhited 07.6.2006 ide

lal huave been forwarded to this offive and leuer No, SM

21.6.2016 Ln thts conreetion it is stated that:

1 hae beth revised! reduced ay Inspection Unit, DG. Doordarstin New Delhi vide

ter No. 1D(14)201 STDC: DEAol-S246 dated 16.05.2016, The overpaid amount an

of re-fixing / reduced pay has nol been intimated. The due & drawa statement (showing

the recoveruble amount) to this office at the earliest.

= No 0.31086! 10/2015.CWRVo

ance Clearance: Cerificate (VEC) vide: lett

28.01.2016. abe Vinllance satu 2 the deputation period in other Bepr

Thig: office vide otter No PAOMDNIDPEN/RK OT TVIIS-17 dosed 124.3016 (copy

enelosd} have ak ta furnish the VEO ineluding deputation period, ifany. But the same hss

mor heen fumivhed by your Dept, It omy be certified that the official was never gone on

dopiriation period during his serviee, if yes, the VCC to be revised ineladed deputation period

Fe Speaking onder dated 03,6.2016 (enclosed with vour letter dated 21.3 2016) is nol sgpliesdle

in uny 252.30 all the Cenrral Cov, employees are governed by CCS Pension Rides and PAO

is bound to follow any onder thrcugh DaP'Ty Mirstry af Finaace, Dept of Psp, through CCA

of the concerned Minisery

4. AL may please be confit, whether the roeavery [nh aceouint of averpaid aslaryy He to be

made from DCRG or any other head as per Rules. Otherwise tor waiwing ai? ike recovery on

Alc.of éverpaid salary. the expressed approval of Ministry of Finanee, Dept of Expensiiture

vested ta nee inte the matter and do the needful and forwurd 1

office without further delay for early setilement of the eese.

hove details tw this

Yours faitlatully

Humbesval Beat, Mange! Township, Distt. Ropu

Copy

|. Sh. Raj Kumar, Pree Nuge

for information p

2. P§w ADG BEA). Prowr Bharati, PT) Building, New Delhi

(Panjab ~

joeoneytion

sd

Sr. Accounts Officer

F No, 18/03/201 $-Estt. (Pay-D)

Government of India

Ministry of Personnel, Publit Grievanoes & Pensions

Department of Personnel & ‘Training

New Dethi, the 2" March, 2016

ORFICE MEMORANDUM

‘Sub: Recovery of wrongful / excess payments made ta Government rervants,

‘The undersigned is directed to refer to this Department's OM Na, 18/26/201 L-Rstt

(Pay-D) dated 6" February, 2014 wherein certain instructions have been issued! to deal

‘with the issue of recovery of wrongful / excess payments made to Gavernment servants in

view of the law declared by Courts, particulasly, in the case of Chandi Prasad Unlyial And

Ora. vs. State of Uttarakhund And Ory, 2022 AIR SCW 4742, (2012) & SCC 417, Para

3Gv) of the OM inder-atia provides that recovery should be made in all cases of

‘overpayment barring few exceptions of extreme hardships.

2, The iscue has subsesuecitly came up for consideration before the Hon"ble Supreme

Court in the ease of Stare of Punjab & Ors v9 Rafiq Masih (White Washer) etc in CA

Na LIS27 of 2004 (Arising out af SLP(C) No.1 1684 of 2012) wherein Hon'ble Court on

18.12.2014 decided a bunch of cases in which monetary benefits were given to employees

fn excess of their entitlement duc to-uninteotiona! mistakes committed by the comeemed

competent authorities, tn determining the emoluments payable to them, and the

employees were not guilty of fumishing any incorrect information / misrepresentation /

fraud, which had ted the concemed competent authorities to commit the mistake of

making the highec payment to the employces. “the employees were as innacedt as their

employers in the wrongful determination of their inflated emoluments. The Hon’ble

Supreme Court in its judgment dated 18° December, 2014 Jild has, iuer-alia, observed

as under:

“7. Having examined a wuinber of judemtents rendered by this Cours, we

are of the view, thal orders passed by the employer seeking recovery of

monciary benefits wrongly exrended ro employees, can only be interfered with,

Jn cases where such recovery would result in a hardship of a matters, which

would far wmuweixhs, the equilable balenice of the employer's right ro recover, fn

other words, interference would be ealded fav, anly ih such cases where, it vould

be lutguttous to recover the payment made, In order to asvertatn the parameters

of the above consideration, and the test 10 be applied, reference needs ta be

made to situations when this Court exempted employes from suck recovery,

even in exercise of its jurisdiction uncler Article 142 af the Constitution of india.

Repeated exercise of such power, “for doing complete justice im any cause”

would establish that the recovery being effected was Inigultous, and therefore,

arbitrary, and accordingly, she Interference at she hands of this Cours."

“10, in view of the afore-stated constittional mandate, equity and good

conscience, in the matter af livelihood of the people of this country, has fo be the

Contd, on 99.2

basis of all governmental actions. An action of the State, erdering a recovery

from on employee, would be in order. x0 long ax it isnot rendered infguitous to

phe extent, that the acvion of récovery would be more unfair, more wrongful

more improper, and more unwarranted, than the corresponding right of the

employer, (0 recover the creount. Or int other words, ll such thae as the

recover’ would have a harsh and arbitrary effect on the employee, it would be

permissible in deve. Orders pesved in given situations repeatedly. ever in

exorcise of tho power vested in this Court tncler Article 14? of the Constitution

of India, will disclose the parameters of the realm of an action of recovery fof an

excess amount paid to an employee) which would breach the obligations of the

State, to citizens of this conntry, and render the ction arbitrary, and therefore,

violative of the mandate contained in Ardele 14 of the Constitution of India.”

3. The issue that was required ta be adjudicated by che Hon'ble Supreme Court was

whether all the privale respondents, uguinsl wham an Orde of tesovery (of the excess

amount) has been made, should be exempted in nw, from the reimbursement of the same

to the employer. For the applicability of the instant order, and the conclusians recorded

bby them thereinatter, the ingredionta depicted in paras 243 of the judgment ure essentially

indispensuble,

4, ‘The Hon'ble Suprome Court while observing that it is not possible to postilate all

situations of hardship which would govern employees on the issuo of recovery, where

payments have mistakenly been made hy the employer, in excess of their entitlement has

summarized the following few situations, wherein recoveries by the emplayers would be

impermissible in law:

fi) Recovery from employees betonging to Class-il and Clase IV service (or

Group ‘Cand Group 'D' service)

(i) Recovery feom retired emplayees, ur employees who wre dire fo retiee within

ene year, of the order of recovery,

Recovery from employees, when the excess payment has been made for a

period in excess of five years, before the order of reeavery ix fsiuedt

(ry) Recovery in cases where an employes has wrongfully been requirecl so

discharge duties of a higher post, and kas been poid accordingly, even

though Fe shauld have rightfully heen required ta work against an infertor

ast

i) ar iia abe wind Ua Curt apd i Santi el ee a

mace from the employee, would be iniquitous or harsh ar arbitrary to such

er extent, as would fer outweigh the equitable balance of the employer's

right fo recover,

5. ‘The matter has, consequently, bees examined in consultation with the Department

of Expenditure und the Department of Legal Affiirs. The Ministries / Deparnnents are

advised to deal with the issue of erongful / exeess payments made to Government

servants in sccordancs with above decision of the Hon'ble Supreme Caurt in Ca

No. 11527 of 2014 (arising out of SEP (C) No.1 1584 of 2012) in State of Punjab and

others etc us Rafig Masih (White Washer} etc. However, wherever the waiver of recovery

in the sbove-mentioned situations is considered. the same may be allowed with the

z

contd. on pq.3

‘express approvul of Department of Expenditure in tems of this Department's OM

‘No.1 826/201 |-Estt (Pay-I) dated. 6" February, 2014

6 Ingo ar as persons serving in the Indian Audit and Accounts Department are

concerted, these orders are issued with the concurrence of the Comptroller and Auditor

General of India.

7. Hindi version will follow, Reape

(AK, fain)

Deputy Secrotary to the Government of india

L. Alll Ministries / Departments of Government of india

NIC, DOP&T — with a request t upload this OM on the Department's website

under OMs & Orders (Establishment —» Pay Rules) and alsa under “What is New".

‘Copy also forwarded to:

1, The Comptroller & Auditor Genetal of India.

2. Seoreiary General, Supreme Court of In

3. Controller General of Accounts / Controlfer of Accounts, Ministry of Finance,

4. Union Public Service Commission / Lok Sabha Seett. ¢ Rajya Sabha Seen. /

Cabinel Secll. (Central Vigilanes Commission / President's Scett / Vice

President's Seed. ¢ Prime Minister’s Office J Niti Aayoe.

5. Governments of all States and Union Territories

6. Deparment of Personnel and Training (AIS Division) / JCA /Admn. Section

7, Sestetary, National Council of JCM (Staf¥ Side), 12-C. Perez Shah Road, New

Delbi

% All Members of Staff Side of the National Council of JCM / Departmental

Couneil

9, All Officers / Seetions of Department of Personne! and ‘Training J Department of

Administrative Reforms & Public Grievances / Department of Pensions &

Pensioners’ Welfare / PESB

10, Joint Secretary (Pers), Deparment of Expenditure, Ministry of Finance,

HL. Additional Secretary (Union Territories), Ministry of Home AfMuirs.

You might also like

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Abstract & Souviner BookDocument250 pagesAbstract & Souviner BookRatsihNo ratings yet

- Bahra University: School of Electronics & CommunicationDocument35 pagesBahra University: School of Electronics & CommunicationRatsihNo ratings yet

- Bahra University: School of Electronics & CommunicationDocument44 pagesBahra University: School of Electronics & CommunicationRatsihNo ratings yet

- Perception Study For Make in IndiaDocument8 pagesPerception Study For Make in IndiaRatsihNo ratings yet

- Appendix Questionnaire/Survey Questionnaire For Contribution of Make in India in Indian Economy DevelopmentDocument5 pagesAppendix Questionnaire/Survey Questionnaire For Contribution of Make in India in Indian Economy DevelopmentRatsih100% (1)

- PDFDocument168 pagesPDFRatsihNo ratings yet

- On The Propagation of Light in Media With Periodic StructureDocument4 pagesOn The Propagation of Light in Media With Periodic StructureRatsihNo ratings yet

- Antenna and Wave PropagationDocument3 pagesAntenna and Wave PropagationRatsihNo ratings yet

- Abstract - IIT Mandi 28sep2018Document1 pageAbstract - IIT Mandi 28sep2018RatsihNo ratings yet

- Fun With ElectronicsDocument1 pageFun With ElectronicsRatsihNo ratings yet

- Bahra University: Shimla HillsDocument1 pageBahra University: Shimla HillsRatsihNo ratings yet

- Solution of Fun With ElectronicsDocument6 pagesSolution of Fun With ElectronicsRatsihNo ratings yet

- BeeeDocument6 pagesBeeeRatsihNo ratings yet

- Microwave Circuits and Application 2nd TestDocument13 pagesMicrowave Circuits and Application 2nd TestRatsihNo ratings yet

- Analysis of Electrical CircuitsDocument2 pagesAnalysis of Electrical CircuitsRatsihNo ratings yet

- Birds Leaving High-Radiation Areas: StudyDocument2 pagesBirds Leaving High-Radiation Areas: StudyRatsihNo ratings yet

- Electonic Devices - S. SharmaDocument116 pagesElectonic Devices - S. SharmaRatsihNo ratings yet

- Atmospheric Effects On ElectroDocument35 pagesAtmospheric Effects On ElectroRatsihNo ratings yet

- Concessions Based On Merit: Offered CoursesDocument1 pageConcessions Based On Merit: Offered CoursesRatsihNo ratings yet

- List of Faulty Equipment'S in Lab: S.no Equipment Detail Fault Detail Cost of Repair Remarks Action TakenDocument1 pageList of Faulty Equipment'S in Lab: S.no Equipment Detail Fault Detail Cost of Repair Remarks Action TakenRatsihNo ratings yet

- Control SystemDocument62 pagesControl SystemRatsih100% (1)

- Prashan Mantri Jeevan Jyoti Bima YojanaDocument2 pagesPrashan Mantri Jeevan Jyoti Bima YojanaRatsihNo ratings yet

- Miniaturization of Microstrip Patch Antenna Using Metamaterial As SubstrateDocument2 pagesMiniaturization of Microstrip Patch Antenna Using Metamaterial As SubstrateRatsihNo ratings yet

- Capacity of Wireless Channels LectureDocument19 pagesCapacity of Wireless Channels LectureRatsihNo ratings yet

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5794)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (400)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (588)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (895)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (74)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (345)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (121)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)