Professional Documents

Culture Documents

Commercial Paper - Maggs - Fall 2003 (Codelist)

Uploaded by

Clayton Blazek0 ratings0% found this document useful (0 votes)

21 views2 pagesOriginal Title

Commercial Paper - Maggs - Fall 2003 (Codelist).doc

Copyright

© © All Rights Reserved

Available Formats

DOC, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

© All Rights Reserved

Available Formats

Download as DOC, PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

21 views2 pagesCommercial Paper - Maggs - Fall 2003 (Codelist)

Uploaded by

Clayton BlazekCopyright:

© All Rights Reserved

Available Formats

Download as DOC, PDF, TXT or read online from Scribd

You are on page 1of 2

3-103 NI definitions

3-104 Negotiable Instrument definition

3-105 Issue of instrument (1st delivery; by maker/drawer)

3-106 Unconditional promise or order

3-108 Payable on demand or at definite time

3-109 Payable to bearer or to order

3-110 Identification of person to whom instrument is payable (issuers intent)

3-112 Interest (need not be fixed; may reference outside information)

3-114 Contradictory terms of instrument (written typed printed; words numbers)

3-116 Joint and several liability; contribution (co-makers)

3-117 Other agreements affecting instrument

3-118 Statute of limitations

3-201 Negotiation (involuntary/voluntary transfer to new holder transfer + indorsement)

3-202 Negotiation subject to rescission

3-203 Transfer of instrument; rights acquired by transfer (shelter doctrine)

3-204 Indorsement

3-205 Special indorsement, blank indorsement, anomalous indorsement

3-301 Person entitled to enforce instrument (holder, non-holder in possession, loser)

3-302 Holder in due course

3-303 Value and consideration

3-304 Overdue instrument

3-305 Defenses and claims in recoupment (HIDC only subject to real defenses)

3-306 Claims to an instrument (HIDC not subject to ownership claim)

3-308 Proof of signatures and status as HIDC

3-309 Enforcement of lost, destroyed, or stolen instrument

3-310 Effect of instrument on obligation for which taken (merger doctrine)

3-311 Accord and satisfaction

3-312 Lost, destroyed, or stolen bank check (declaration of loss, 90 days, Diaz)

3-401 Signature

3-402 Signature by representative

3-403 Unauthorized signature (ineffective except as forgers signature in GF/value)

3-404 Impostors, fictitious payees (only properly payable if from issuer) (loss indemnif.)

3-405 Employers responsibility for fraudulent indorsement by employee

3-406 Customer negligence; bank contributory negligence (forgery/alteration)

3-407 Alteration

3-408 Drawee not liable on unaccepted draft

3-409 Acceptance of draft; certified check

3-411 Refusal to pay bank checks wrongful dishonor (incidental + consequential)

3-412 Obligation of issuer of note or cashiers check

3-413 Obligation of acceptor

3-414 Obligation of drawer ((e): w/o recourse, but not for checks)

3-415 Obligation of indorser ((b): w/o recourse; (e): 30 days)

3-416 Transfer warranties

3-417 Presentment warranties

3-418 Payment or acceptance by mistake (restitution, but Price v. Neal)

3-419 Instruments signed for accommodation (direct benefit test)

3-420 Conversion (issuer cant bring claim) (transfer; improper payment)

3-501 Presentment

3-502 Dishonor

3-601 Discharge and effect of discharge (not effective against HIDC)

3-602 payment

4-103 Ordinary care of bank

4-104 Definitions ((a)(10): midnight deadline; (a)(11): settle)

4-105 Definitions of types of banks

4-108 Time of receipt of items (may fix cutoff of 2 pm or later)

4-109 Delays (limited exception to midnight deadline)

4-201 Provisional status of credits

4-202 Responsibility for collection or return; when action timely (midnight deadline)

4-207 Transfer warranties

4-208 Presentment warranties

4-209 Encoding and retention warranties (loss suffered + expenses + loss of interest)

4-210 Security interest of bank (value = credit withdrawn or applied); FIFO withdrawals

4-211 When bank gives value for purposes of HIDC (extent of security interest)

4-214 Right of charge-back or refund (if no final settlement); liability of collecting bank (delay loss)

4-215 When provisional debits and credits become final

4-301 Return of items by payor bank (by midnight deadline)

4-302 Payor banks responsibility (accountable) for late return of item

4-401 When bank may charge customers account (properly payable if authorized)

4-402 Banks liability to customer for wrongful dishonor (actual damagesmaybe consequential)

4-403 Customers right to stop payment (14 day lapse if oral)

4-406 Customers duty to inspect statement (provable loss, same wrongdoer)

4-407 Payor banks right to subrogation on improper payment

4A-102 Cmt.: 4A = exclusive remedy (no common law claims)

4A-103 Payment order definitions

4A-104 Funds transfer definitions

4A-202 Authorized and verified payment orders ((b): security procedure effective)

4A-203 Unenforceability of certain verified payment orders (customer proves not insider)

4A-207 Misdescription of beneficiary (number trumpscan recover under mistake/restitution)

4A-209 Acceptance of payment order

4A-211 Cancellation and amendment of payment order

4A-212 Liability and duty of receiving bank regarding unaccepted payment order (no duty, unless agmt.)

4A-301 Execution and execution date

4A-302 Obligations of receiving bank in execution of payment order

4A-303 Erroneous execution of payment order (recovery under restitution)

4A-305 Liability for late or improper execution or failure to execute payment order (no consequential)

4A-402 Obligation of sender to pay receiving bank ((c), (d): money back guarantee)

4A-404 Obligation of beneficiarys bank to pay and give notice to beneficiary

5-102 Definitions ((a)(9): issuer; (a)(10): letter of credit) (*cf guarantee)

5-103 Scope: independence principle (no merger doctrine)

5-108 Issuers rights and obligations (honor strict compliance; standard practice; (i): reimbursement)

5-111 Remedies: applicant damages less any saved (no consequential); ben. amt. of letter + atty. fees

5-117 Subrogation of issuer, applicant, and nominated person

CC 229.10 Low risk, 1st $100: one day

CC 229.12 (b): local = 2 day; (c): non-local = 5 day

CC 229.13 (b)-(f), (h)(2): exceptions = reasonable period

CC 229.30 Expeditious return requirement (2/4 day test, forward collection test, midnight deadline except.)

CC 229.33 Notice of nonpayment

CCPA 170 Asserting defenses

CCPA 103(o) Unauthorized use definition

CCPA 133 Unauthorized use - liability

You might also like

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (121)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (588)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (400)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5794)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (345)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (895)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (74)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- Dispute The Debt LetterDocument4 pagesDispute The Debt Lettercamwills2100% (5)

- PayPal Complaint Feb 28Document36 pagesPayPal Complaint Feb 28jeff_roberts881100% (4)

- Francisco Realty and Development Corp. vs. Court of AppealsDocument1 pageFrancisco Realty and Development Corp. vs. Court of AppealsKatherine EvangelistaNo ratings yet

- Yamane Vs BA Lepanto DIGESTDocument1 pageYamane Vs BA Lepanto DIGESTJazem Ansama100% (1)

- Evidence Bar Q&ADocument3 pagesEvidence Bar Q&AGrace D100% (1)

- Rabuya Family Home NotesDocument4 pagesRabuya Family Home NotesJeffrey EndrinalNo ratings yet

- The People of The Philippines VsDocument1 pageThe People of The Philippines VsVic FrondaNo ratings yet

- Concepcion v. Sta AnaDocument3 pagesConcepcion v. Sta AnaKORINA NGALOYNo ratings yet

- Runnymede Skeleton ArgumentDocument5 pagesRunnymede Skeleton ArgumentSQUASH13No ratings yet

- CIACDocument30 pagesCIACJay-r TumamakNo ratings yet

- China Banking Corp. v. Court of Appeals, 270 SCRA 503 (1997)Document15 pagesChina Banking Corp. v. Court of Appeals, 270 SCRA 503 (1997)inno KalNo ratings yet

- Legal Ethics Landmark Full Cases Part 3Document90 pagesLegal Ethics Landmark Full Cases Part 3ETHEL JOYCE BAUTISTA. SUMERGIDONo ratings yet

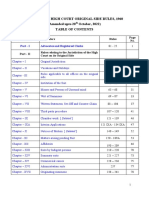

- BHC Original Side Rules, 1960Document661 pagesBHC Original Side Rules, 1960Hamza LakdawalaNo ratings yet

- Legal Requirements For A Person Entering Into A Contract: MinorDocument5 pagesLegal Requirements For A Person Entering Into A Contract: MinorMohit RanaNo ratings yet

- Article 1556-1560Document3 pagesArticle 1556-1560VhertotNo ratings yet

- Pengurusan Endah ParadeDocument29 pagesPengurusan Endah ParadeHafizah SulaimanNo ratings yet

- Tender TNDocument29 pagesTender TNRaj BorkuteNo ratings yet

- Supreme Court: Republic of The Philippines Manila en BancDocument4 pagesSupreme Court: Republic of The Philippines Manila en Banceinel dcNo ratings yet

- Carmelcraft Corp Vs NLRCDocument3 pagesCarmelcraft Corp Vs NLRCJoshua L. De JesusNo ratings yet

- Full Text Cases #1 Human Relations (11 Cases)Document73 pagesFull Text Cases #1 Human Relations (11 Cases)Mohammad Ali Malo UsmanNo ratings yet

- United Paperworkers International Union, Plaintiff-Appellee-Cross-Appellant, v. International Paper Company, Defendant-Appellant-Cross-AppelleeDocument16 pagesUnited Paperworkers International Union, Plaintiff-Appellee-Cross-Appellant, v. International Paper Company, Defendant-Appellant-Cross-AppelleeScribd Government DocsNo ratings yet

- Summer Issue 2016 ILI Law ReviewDocument12 pagesSummer Issue 2016 ILI Law ReviewMahendra VenkatNo ratings yet

- Ibf Mui Agreement 2010 2011Document23 pagesIbf Mui Agreement 2010 2011raghuroxxNo ratings yet

- 6009 2019 Judgement 06-May-2019Document29 pages6009 2019 Judgement 06-May-2019Kavita TangadeNo ratings yet

- United States Court of Appeals, Eleventh CircuitDocument6 pagesUnited States Court of Appeals, Eleventh CircuitScribd Government DocsNo ratings yet

- Kerala Torts (Miscellaneous Provisions) Act, 1976Document5 pagesKerala Torts (Miscellaneous Provisions) Act, 1976Latest Laws TeamNo ratings yet

- Budimpestanska KonvencijaDocument34 pagesBudimpestanska Konvencijabambie86No ratings yet

- 10 People V OlarteDocument4 pages10 People V OlarteJenicaNo ratings yet

- United States Court of Appeals, Tenth CircuitDocument7 pagesUnited States Court of Appeals, Tenth CircuitScribd Government DocsNo ratings yet