Professional Documents

Culture Documents

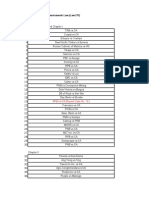

NEGO Digests

Uploaded by

Christine Laroga0 ratings0% found this document useful (0 votes)

13 views4 pagesnegotiable instruments law case digest

Copyright

© © All Rights Reserved

Available Formats

DOCX, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this Documentnegotiable instruments law case digest

Copyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

13 views4 pagesNEGO Digests

Uploaded by

Christine Laroganegotiable instruments law case digest

Copyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

You are on page 1of 4

Banco Atlantico v.

Auditor General RULING: The record shows that the

GR No. L-33549 | January 31, 1978 check was issued for the sum of

US109.10 for the payment of said

FACTS: Banco Atlantico is doing payees salary and the other check in

business in Madrid Spain. Virginia the amount of US75.00 in

Boncan, Finance Officer in the reimbursement of Virginia Boncans

Philippine Embassy in Madrid, living quarters allowance. There is

negotiated with Banco Atlantico a also a showing that the US90,000.00

Philippine embassy check signed by check was payable on demand but

Luis M. Gonzales, its ambassador and Boncan asked that the same be not

by said Virginia Boncan in the sum of presented for collection until a later

US10,109.10 payable to Azucena Pace date, Banco Atlantico should have

and drawn against the Philippine been put on guard that there was

National Bank branch in New York USA. something wrong with the check. The

The check was endorsed by Azucena fact that the amount involved was

Pace and Virginia Boncan. Banco quite big and the payees request that

Atlantio paid the full amount without it be paid on a later date was proof of

clearing the check. Subsequently, two a glaring infirmity or defect in the

other checks was negotiated to Banco instrument. Therefore, Banco Atlantico

Atlantico, it paid the corresponding was not a holder in due course

amounts of US35,000.75 and because it had knowledge of the

US90,000.00 to Virginia Boncan infirmity or defect of the check

without clearing the check with the

drawee bank. The petitioner paid the amounts of the

three checks in question to Boncan

Upon presentment of Banco Atlantico without previously clearing the said

for acceptance and payment of the checks with the drawee bank. This is

aforesaid checks by Banco Atlantico, contrary to normal or ordinary banking

the drawee bank dishonored the practice specially so where the drawee

checks by non-acceptance on the bank is a foreign bank nd the amounts

ground that the drawer had ordered involved were large. The drawer of the

payments to be stopped. Upon receipt aforementioned checks was not even

of the notice of dishonor, the the client of Banco Atlantico. There is

collecting bank of the petitioner sent a a showing that Boncan has a special

notice of protest with respect to the relationship with the employees and

checks in question. Thus, they filed a chiefs of the petitioner that it

money claim with the Auditor General. disregarded the elementary principles

that should attend banking

The claimant Banco Atlantico transactions.

contended that it has every right to

recover from the Embassy as drawer The Philippine embassy in Madrid, as

of the checks because it is a holder in drawer, cannot be held liable. It is

due course. apparent that the said checks were

altered fraudulently by Virginia Boncan

ISSUE: Whether Banco Atlantico can as to their amounts and, therefore,

recover from the Philippine Embassy wholly inoperative. No right of

the corresponding amount of the payment thereof against any party

checks in question. thereto could have been acquired by

the petitioner.

ISSUE: whether Ocampo may be

Vicente de Ocampo v. Anita considered as holder in due course.

Gatchalian

GR No. L-15126 | November 30, RULING: No. Gatchalian had no

1961 obligation or liability to the Ocampo

Clinic and that the amount of the

FACTS: Gatchalian had drawn a check check did not correspond exactly with

payable to plaintiff Ocampo on the the obligation of Gonzales for the

amount of P600 as an evidence of the hospitalization expense; and that the

formers good faith that she had the check had two parallel lines in the

intention on purchasing the latters upper left hand corner, which practice

car. The said check was intended only means that the check could only be

for the safekeeping by Manuel deposited but may not be converted

Gonzales and to be returned to into cash. All these circumstance

Gatchalian the following day. However, should have put Ocampo to inquiry as

Manuel Gonzales failed to return the to the why and wherefore of the

aforesaid check the following day possession of the check by Manuel

which prompted Gatchalian to issue a Gonzales. It was the payees duty to

Stop Payment Order on the check ascertain from the holder Manuel

with the drawee bank. Gonzales what the nature of the

latters title to the check was or the

It was found that Manuel Gonzales nature of his possession. Having failed

delivered the check to the Ocampo in this respect, Ocampo was guilty of

Clinic in payment of the fees and gross neglect in not finding out the

expenses arising from the nature of the title and possession of

hospitalization of his wife. Ocampo Manuel Gonzales, amounting to legal

accepted the check applying P441.75 absence of good faith, and it may not

as payment for the aforesaid fees and be considered as a holder of the check

delivering the amount of P158.25 in good faith. Although gross

representing the balance on the negligence does not of itself constitute

amount of the said check. bad faith, it is evidence from which

bad faith may be inferred.

In their appeal, Gatchalian contends

that the check is not a negotiable The rule that a possessor of an

instrument and that Ocampo is not a instrument is prima facie a holder in

holder in due course because she had due course does not apply because

no intention to transfer her property there was a defect in the title of the

and it was merely for safekeeping, holder (Gonzales), because the

therefore, there was no delivery instrument is not payable to him or to

required by law. bearer. Under the circumstances of the

case, instead of the presumption that

In his response, Ocampo contends that payee was holder in good faith, the

Manuel Gonzales was the agent of the fact is that it acquired possession of

drawer Gatchalian insofar as the the instrument under circumstances

possession of the check is concerned. that should have put it to inquiry as to

So when Gonzales negotiated the the title of the holder who negotiated

check with the intention of getting its the check to it. The burden was,

value from Ocampo, negotiation took therefore, placed upon it to show that

place without the latters fault. notwithstanding the suspicious

circumstances, it acquired the check in

actual good faith. The circumstances be deposited with the PI Bank, and

were such as ought to have excited that actual payment of the value of

the suspicion of a prudent and careful the warrants would be made only after

man, and he made no inquiry, he did the same had been duly accepted and

not stand in the legal position of a cleared by the Treasurer and the

bona fide holder. proceeds thereof duly credited to the

account of the Corporacion in the PI

Republic v. Equitable Banking Bank. After being cleared, the

Corporation warrants were paid by the treasurer.

GR No. L-15894-5 | January 30, Thereafter, the treasurer returned the

1964 warrants on the ground that they had

been forged, that the value thereof be

FACTS: charged against the accounts of the PI

Bank in the Clearing Office and

GR L-15894 credited back to the demand deposit

The Republic seeks to recover from of the Bureau of the Treasury.

Equitable Banking Corporation the

sum of 17,100 representing the These claims for refund are based

aggregate value of four (4) treasury upon a common groundalthough

warrants paid to said bank by the said twenty-eight (28) warrants were

treasurer of the Philippines. These executed on genuine government

warrants were deposited with the forms, the signature thereon of the

Equitable Bank by its depositors, drawing office and that of the

namely, Robert Wong, Lu Chiu Kau and representative of the Auditor General

Chung Ching. In due course, the in that office are forged.

Equitable Bank cleared said warrants,

thru the clearing office, then collected The clearing of the aforementioned

the corresponding amounts from the twenty-eight (28) warrants thru the

Treasurer and credited to its Clearing Office was made pursuant to

depositors accounts. Thereafter, the the "24-hour clearing house rule",

treasurer notified Equitable Bank of which had been adopted by the

the alleged defect and demanded Central Bank in a conference with

reimbursement of the amount but this representatives and officials of the

demand was rejected by Equitable different banking institutions in the

Bank. Philippines. However, the Government

maintains that it is not bound by this

GR L-15895 rule because: (1) the Treasury is not a

The Republic seeks to recover from bank; and (2) the Treasurer has

the Bank of the Philippine Islands the objected to the application of said rule

total sum of P342,767.63, to his office.

representing the aggregate value of

twenty four (24) warrants similarly ISSUE: Whether the treasury is

paid by the treasury. It was alleged entitled to refund for the warrants it

that the Corporation de los Padres has paid to both banks.

Dominicos had acquired these

warrants from its employee Jacinto RULING: the Treasury is a member of

Carranza who asked the corporation to the aforementioned Clearing Office

encash such warrants the Corporacion and it shows that the former "has

acceded to Carranza's request, agreed to clear its clearable items

provided that the warrants would first through" the latter "subject to the

rules and regulations of the Central Treasury. Moreover, the same had not

Bank." Besides, the above quoted rule advertised the loss of genuine forms of

applies not only to banks, but, also, to its warrants. Neither had the PI Bank

the institutions and entities, therein nor the Equitable Bank been informed

alluded to. of any irregularity in connection with

any of the warrants involved in, these

The Treasury had not only been two (2) cases or after the warrants had

negligent in clearing its own warrants, been cleared and honoredwhen the

but had, also, thereby induced the PI Treasury gave notice of the forgeries

Bank and the Equitable Bank to pay adverted to above. As a consequence,

the amounts thereof to said the loss of the amounts thereof is

depositors. The gross nature of the mainly imputable to acts and

negligence of the Treasury becomes omissions of the Treasury, for which

more apparent when we consider that the PI Bank and the Equitable Bank

each one of the twenty-four (24) should not and cannot be penalized.

warrants involved in G. R. No. L-15895

was for over P5,000, and, hence, Mesina v. IAC

beyond the authority of the auditor of GR No. L-70145 | November 13,

the Treasurywhose signature 1986

thereon had been forgedto approve.

In other words, the irregularity of said FACTS: Respondent Jose Go

warrants was apparent on the face purchased from Associated Bank

thereof, from the viewpoint of the Cashiers

You might also like

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5794)

- Case Doctrines - Civ ProDocument8 pagesCase Doctrines - Civ ProChristine LarogaNo ratings yet

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- Rules of Court Outlined 2Document20 pagesRules of Court Outlined 2Christine LarogaNo ratings yet

- Case DigestDocument3 pagesCase DigestChristine LarogaNo ratings yet

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- BSP VS CoaDocument50 pagesBSP VS CoaChristine LarogaNo ratings yet

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (895)

- Insurance NotesDocument1 pageInsurance NotesChristine LarogaNo ratings yet

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (344)

- FRANCISCO I. CHAVEZ, Petitioner, Judicial and Bar Council, Sen. Francis Joseph G. Escudero and Rep. Niel C. TUPAS, JR., Respondents. FactsDocument5 pagesFRANCISCO I. CHAVEZ, Petitioner, Judicial and Bar Council, Sen. Francis Joseph G. Escudero and Rep. Niel C. TUPAS, JR., Respondents. FactsChristine LarogaNo ratings yet

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (399)

- Real Mortgage CasesDocument179 pagesReal Mortgage CasesChristine LarogaNo ratings yet

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (588)

- Nego Digest - AssignmentDocument5 pagesNego Digest - AssignmentChristine LarogaNo ratings yet

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- Case Digest in Civ ProDocument2 pagesCase Digest in Civ ProChristine LarogaNo ratings yet

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- 5.3 Explain Double Insurance and Over InsuranceDocument2 pages5.3 Explain Double Insurance and Over InsuranceChristine LarogaNo ratings yet

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- Case Digest in Civ ProDocument2 pagesCase Digest in Civ ProChristine LarogaNo ratings yet

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Boy Scouts of The Phil Vs COADocument34 pagesBoy Scouts of The Phil Vs COAadelskeeeeeNo ratings yet

- List of Cases Digest Assignment Edited With GRsDocument22 pagesList of Cases Digest Assignment Edited With GRsChristine LarogaNo ratings yet

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (73)

- Provisions Common To Pledge and Mortgage CasesDocument104 pagesProvisions Common To Pledge and Mortgage CasesChristine LarogaNo ratings yet

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- ST Anne Vs ParelDocument4 pagesST Anne Vs ParelChristine LarogaNo ratings yet

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- Antichresis 2 Cases OnlyDocument20 pagesAntichresis 2 Cases OnlyJohn Ernest Virgil ZalduaNo ratings yet

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- Admin LawDocument44 pagesAdmin LawChristine LarogaNo ratings yet

- XU Law - PROSPECTOUS PDFDocument1 pageXU Law - PROSPECTOUS PDFChristine LarogaNo ratings yet

- XU Law - PROSPECTOUS PDFDocument1 pageXU Law - PROSPECTOUS PDFChristine LarogaNo ratings yet

- Bpi Vs Bpi Employees UnionDocument34 pagesBpi Vs Bpi Employees UnionChristine LarogaNo ratings yet

- RULES OF COURT OutlinedDocument38 pagesRULES OF COURT OutlinedChristine LarogaNo ratings yet

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- Boy Scouts of The Phil Vs COADocument34 pagesBoy Scouts of The Phil Vs COAadelskeeeeeNo ratings yet

- Case List Civ ProDocument6 pagesCase List Civ ProChristine LarogaNo ratings yet

- Taxation Full Text CasesDocument880 pagesTaxation Full Text CasesChristine LarogaNo ratings yet

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- Taxation Full Text CasesDocument880 pagesTaxation Full Text CasesChristine LarogaNo ratings yet

- FRANCISCO I. CHAVEZ, Petitioner, Judicial and Bar Council, Sen. Francis Joseph G. Escudero and Rep. Niel C. TUPAS, JR., Respondents. FactsDocument5 pagesFRANCISCO I. CHAVEZ, Petitioner, Judicial and Bar Council, Sen. Francis Joseph G. Escudero and Rep. Niel C. TUPAS, JR., Respondents. FactsChristine LarogaNo ratings yet

- CiviproDocument188 pagesCiviproIan InandanNo ratings yet

- Legal Standing Moot CourtDocument2 pagesLegal Standing Moot CourtChristine LarogaNo ratings yet

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (120)

- Financial Accounting SyllabusDocument2 pagesFinancial Accounting Syllabusp.sankaranarayananNo ratings yet

- REDD - The Leading Provider of Emerging Market Event Driven IntelligenceDocument1 pageREDD - The Leading Provider of Emerging Market Event Driven IntelligenceArtem RozhokNo ratings yet

- New Balance $798.07 Minimum Payment Due $40.00 Payment Due Date 07/17/22Document7 pagesNew Balance $798.07 Minimum Payment Due $40.00 Payment Due Date 07/17/22Aravind NandaNo ratings yet

- File 2. AbstrakDocument2 pagesFile 2. AbstrakWeli SarnelaNo ratings yet

- Analysis of Credit Risk, Liquidity and Profitability of The Trade Bank of Iraq For The Period (2012-2021)Document25 pagesAnalysis of Credit Risk, Liquidity and Profitability of The Trade Bank of Iraq For The Period (2012-2021)Ali Abdulhassan AbbasNo ratings yet

- Hill CountryDocument8 pagesHill CountryAtif Raza AkbarNo ratings yet

- Investment BankingDocument28 pagesInvestment Bankinganbubalraj100% (3)

- BBCF4023 - MTDocument5 pagesBBCF4023 - MTbroken swordNo ratings yet

- Lesson 7 - Financial ForecastingDocument24 pagesLesson 7 - Financial Forecastingkylasaragosa04No ratings yet

- Chapter 1:-The Nature of Capital MarketDocument9 pagesChapter 1:-The Nature of Capital MarketJaideep SharmaNo ratings yet

- Magic Formula Investing HKDocument46 pagesMagic Formula Investing HKMeester KewpieNo ratings yet

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- Assignment On Currency CrisisDocument7 pagesAssignment On Currency CrisisMehedi Hassan RanaNo ratings yet

- LRN LetterDocument2 pagesLRN LettersubratdasbaliNo ratings yet

- Bond Portfolio Management StrategiesDocument23 pagesBond Portfolio Management Strategiesashudadhich100% (2)

- Sample Agreement MT103 ONE WAY C-2Document9 pagesSample Agreement MT103 ONE WAY C-2Vaithiswari100% (3)

- Hansen AISE IM Ch13Document59 pagesHansen AISE IM Ch13Aliyah rifdha syamNo ratings yet

- Financial Performance of Kerala Gramin Bank Special Reference To Southern AreaDocument81 pagesFinancial Performance of Kerala Gramin Bank Special Reference To Southern AreaPriyanka Ramath100% (1)

- Bank Reconciliation Statement:: Unit - 6Document4 pagesBank Reconciliation Statement:: Unit - 6deepshrmNo ratings yet

- Beat The Bank TutorialDocument3 pagesBeat The Bank TutorialgirliepoplollipopNo ratings yet

- Class On Pay Fixation in 8th April.Document118 pagesClass On Pay Fixation in 8th April.Crick CompactNo ratings yet

- Assignment Smo Stock ExchangeDocument4 pagesAssignment Smo Stock ExchangeYadwinder SinghNo ratings yet

- Corvin Codirla - The 3 Pillars of Success Trading FXDocument32 pagesCorvin Codirla - The 3 Pillars of Success Trading FXBobNo ratings yet

- Business Finance Week 7 Basic Long-Term Financial ConceptsDocument16 pagesBusiness Finance Week 7 Basic Long-Term Financial ConceptsJessa Gallardo0% (1)

- Pepsico Inc 2019 Annual ReportDocument1 pagePepsico Inc 2019 Annual ReportToodley DooNo ratings yet

- Purchase Order No. 05873069 (40) Dated - 24 .07.2013Document9 pagesPurchase Order No. 05873069 (40) Dated - 24 .07.2013Global LogisticsNo ratings yet

- "Credit Risk Management": Tribhuvan University Faculty of Management A Project Proposal OnDocument14 pages"Credit Risk Management": Tribhuvan University Faculty of Management A Project Proposal Onrk shahNo ratings yet

- Fintech Report 2016Document69 pagesFintech Report 2016indratetsuNo ratings yet

- Penjelasan Tentang Saving-Investment GapDocument40 pagesPenjelasan Tentang Saving-Investment GapbahrulNo ratings yet

- FINS 3616 Tutorial Questions-Week 7 - AnswersDocument2 pagesFINS 3616 Tutorial Questions-Week 7 - AnswersbenNo ratings yet

- Financial Services QBDocument89 pagesFinancial Services QBVimal RajNo ratings yet

- Getting Through: Cold Calling Techniques To Get Your Foot In The DoorFrom EverandGetting Through: Cold Calling Techniques To Get Your Foot In The DoorRating: 4.5 out of 5 stars4.5/5 (63)

- Wall Street Money Machine: New and Incredible Strategies for Cash Flow and Wealth EnhancementFrom EverandWall Street Money Machine: New and Incredible Strategies for Cash Flow and Wealth EnhancementRating: 4.5 out of 5 stars4.5/5 (20)

- How to Win a Merchant Dispute or Fraudulent Chargeback CaseFrom EverandHow to Win a Merchant Dispute or Fraudulent Chargeback CaseNo ratings yet

- University of Berkshire Hathaway: 30 Years of Lessons Learned from Warren Buffett & Charlie Munger at the Annual Shareholders MeetingFrom EverandUniversity of Berkshire Hathaway: 30 Years of Lessons Learned from Warren Buffett & Charlie Munger at the Annual Shareholders MeetingRating: 4.5 out of 5 stars4.5/5 (97)

- Introduction to Negotiable Instruments: As per Indian LawsFrom EverandIntroduction to Negotiable Instruments: As per Indian LawsRating: 5 out of 5 stars5/5 (1)