Professional Documents

Culture Documents

Visa Security Tokenization Infographic

Uploaded by

nirajCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Visa Security Tokenization Infographic

Uploaded by

nirajCopyright:

Available Formats

All you need to know about

Tokenization

Visa Token Service, a new security technology from

Visa, replaces sensitive account information, such as

the 16-digit account number, with a unique digital

identier called a token. The token allows payments to

be processed without exposing actual account details

that could potentially be compromised.

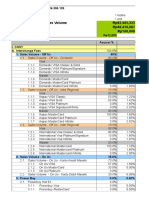

How Visa Token Service Works

The Visa Token Service enables digital payment service providers and nancial institutions to offer their

customers a safe way to shop online and with mobile devices. Heres how a token is initiated.

Step 1 Step 2 Step 3

Consumer enrolls their Visa account with a The digital payment service provider Visa shares the token

digital payment service (such as an online requests a payment token from Visa for request with the

retailer or mobile wallet) by entering their the enrolled account. account issuer (such as

primary account number (PAN), security code the consumers bank).

1 and other payment account information. 2 3

VisaNet Issuer

40

00

CA

RD

12

HOL

34

DE

R

56

01/

NA

1

00

6

ME

90

10

Enter payment details below: PAN

4000 1234 5600 9010

01/16

CARDHOLDER NAME

PAN

4000 1234 5600 9010

01/16

CARDHOLDER NAME

?

61,802,000,000

Token Requestor Enter payment

Consumer details below:

PAN

4000 1234 5600 9010

01/16

CARDHOLDER NAME

Token Vault

5 4

Step 5 Step 4

Visa shares the token with the token requestor With the account issuers

for online and mobile (NFC) payment use. A approval, Visa replaces

payment token can be limited to a specic mobile the consumers PAN with

device, eCommerce merchant or number of a unique digital identier

purchases (say, a limit of ve) before expiring. (the token).

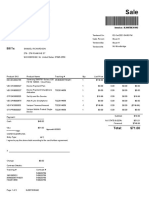

How Tokens Are Used

As consumers increasingly shop with connected devices, the need for a seamless and secure digital

payment experience becomes crucial. Without exposing the consumers account to fraud, tokenization

enables frictionless, card-free payments in digital commerce environments.

1 PAIR JEANS

$ 27.00

Checkout

946

936

Checkout

2 PIZZAS

$20.00

Oranges Apples Mangos

Check

out

4000

1234

CARDHOL

5600

DER 01/16

NAME

9010

Pizza Delivery

Online In-Store In-App

Making eCommerce purchases is Tokenization provides a secure way The ability to pay with Visa is increasingly

becoming commonplace. Tokenization for consumers to make in-store embedded in innovative mobile

provides online retailers with an innovative payments by simply waving their applications that make it even easier to

and secure way of handling payments. device near the payment terminal. pay for your transaction on the go.

PAY NOW

1 PAIR JEANS

$ 27.00

4000 1234 5600 9010

01/16

CARDHOLDER NAME

PROCEED TO 1

CHECKOUT 2 PIZZAS

$20.00

1 Payment initiated

The consumer initiates a payment

2 Merchant sends token to acquirer

Depending on the commerce environment, the digital

online, in-store or in-app. payment service provider (e-wallet, eCommerce

merchant or app) passes the token to the acquirer

as part of an authorization request.

Acquirer

3 Acquirer routes the token

The acquirer receives the token and routes it to

Visas network to begin processing the transaction.

6 Transaction completed

The token and payment

authorization are routed back to

the merchant's bank, the acquirer.

VisaNet

61,802,000,000

5 Issuer returns token and authorization

The issuer accepts or declines the transaction and sends

4 Visa sends token

to card issuer

its response back to Visa.

Visa sends the token, along with the

payment card details, to the issuer

for authorization.

Issuer

For more information visit: www.visa.com/digitalsolutions

Source: Visa

You might also like

- Section 1. What's New: This Readme File Contains These SectionsDocument6 pagesSection 1. What's New: This Readme File Contains These SectionsNishant SharmaNo ratings yet

- Guide To Payment Services in SLDocument86 pagesGuide To Payment Services in SLTharuka WijesingheNo ratings yet

- UAEFTS P2P Payment FileDocument45 pagesUAEFTS P2P Payment FileSalmanFatehAli0% (1)

- ArticleforPaymentsSystemsMagazine-13 11 05Document14 pagesArticleforPaymentsSystemsMagazine-13 11 05Syed RazviNo ratings yet

- Under The Guidance Of: A Summer Training Report ONDocument50 pagesUnder The Guidance Of: A Summer Training Report ONAnil BatraNo ratings yet

- 048 Tag Personalisation Service Fact SheetDocument2 pages048 Tag Personalisation Service Fact SheetJohn WilliamsNo ratings yet

- 2.5 Support of Merchant Volume Indicator ValuesDocument10 pages2.5 Support of Merchant Volume Indicator ValuesYasir RoniNo ratings yet

- Security Guide of UnionPay Card Personalization+Service+ProviderDocument41 pagesSecurity Guide of UnionPay Card Personalization+Service+ProviderVKM2013No ratings yet

- 3.11 Changes To Visa Settlement Service Reporting For Load and Reload TransactionsDocument15 pages3.11 Changes To Visa Settlement Service Reporting For Load and Reload TransactionsYasir RoniNo ratings yet

- How To Understand Payment Industry in BrazilDocument32 pagesHow To Understand Payment Industry in BrazilVictor SantosNo ratings yet

- Visa ACP FactsheetDocument2 pagesVisa ACP Factsheetkim carigtanNo ratings yet

- ISO 20022 and the Evolution of Standards in European Card PaymentsDocument20 pagesISO 20022 and the Evolution of Standards in European Card PaymentsLuis F JaureguiNo ratings yet

- Cisp What To Do If CompromisedDocument60 pagesCisp What To Do If CompromisedkcchenNo ratings yet

- Dynamic Currency Conversion Performance GuideDocument24 pagesDynamic Currency Conversion Performance GuideElvis RenNo ratings yet

- PP MTIP UserGuide Dec2011Document201 pagesPP MTIP UserGuide Dec2011AzzaHassanienNo ratings yet

- Ethoca Merchant Data Provision API Integration Guide V 3.0.1 (February 13, 2019)Document13 pagesEthoca Merchant Data Provision API Integration Guide V 3.0.1 (February 13, 2019)NastasVasileNo ratings yet

- Swift 1Document31 pagesSwift 1Freeman JacksonNo ratings yet

- Transaction Processing Rules MC ESPAÑOLDocument397 pagesTransaction Processing Rules MC ESPAÑOLGimmy RodriguezNo ratings yet

- EPC020-08 Book 3 - Data Elements - SCS Volume v7.1Document104 pagesEPC020-08 Book 3 - Data Elements - SCS Volume v7.1Makarand LonkarNo ratings yet

- Pin Block Formats Explained in DetailDocument3 pagesPin Block Formats Explained in DetailJinay SanganiNo ratings yet

- Acquirer Credit and Debit ManualDocument771 pagesAcquirer Credit and Debit ManualMohammed Abdul KhuddoosNo ratings yet

- 80 Byte Population Guide - v15.94Document216 pages80 Byte Population Guide - v15.94HMNo ratings yet

- Terminal Information To Enhance Contactless Application SelectionDocument10 pagesTerminal Information To Enhance Contactless Application SelectionSaradhi MedapureddyNo ratings yet

- QVSDC IRWIN Testing ProcessDocument8 pagesQVSDC IRWIN Testing ProcessLewisMuneneNo ratings yet

- MIR Contactless Terminal Kernel Specification 2.1Document128 pagesMIR Contactless Terminal Kernel Specification 2.1yoron liu100% (1)

- M/Chip Functional Architecture For Debit and Credit: Applies To: SummaryDocument12 pagesM/Chip Functional Architecture For Debit and Credit: Applies To: SummaryAbiy MulugetaNo ratings yet

- Dynamic Currency Conversion Explained ? 1666789070Document1 pageDynamic Currency Conversion Explained ? 1666789070Ramachandran LakshmananNo ratings yet

- Visa Chip Simplifying ImplementationDocument2 pagesVisa Chip Simplifying Implementationjagdish kumarNo ratings yet

- POS DynmCurrConvDocument58 pagesPOS DynmCurrConvPaulo LewisNo ratings yet

- Terms and DefinitonsDocument23 pagesTerms and DefinitonsMai Nam ThangNo ratings yet

- DDS File Format & ArchitectureDocument14 pagesDDS File Format & ArchitectureSalmanFatehAliNo ratings yet

- INR and NPR transaction summary reportDocument1 pageINR and NPR transaction summary reportriteshNo ratings yet

- MC - InterchangeManualMEACustomer (1) 2Document2,031 pagesMC - InterchangeManualMEACustomer (1) 2hanane eddahoumiNo ratings yet

- Achieving Treasury Visibility by Leveraging SWIFT: Scott Montigelli KyribaDocument3 pagesAchieving Treasury Visibility by Leveraging SWIFT: Scott Montigelli Kyribabeevant100% (1)

- Harmonisation of ISO 20022: Partnering With Industry For Faster, Cheaper, and More Transparent Cross-Border PaymentsDocument13 pagesHarmonisation of ISO 20022: Partnering With Industry For Faster, Cheaper, and More Transparent Cross-Border PaymentsAryan HateNo ratings yet

- Part II Extended Purchase Specification Based On Contactless Low-Value Payment ApplicationDocument67 pagesPart II Extended Purchase Specification Based On Contactless Low-Value Payment ApplicationMai Nam ThangNo ratings yet

- SWIFT Joining Process: List of DocumentsDocument35 pagesSWIFT Joining Process: List of DocumentsJohn SamboNo ratings yet

- Cloud Connect Client Implementation GuideDocument20 pagesCloud Connect Client Implementation GuideJonathan BautistaNo ratings yet

- VOP Enrollment API August 2016Document45 pagesVOP Enrollment API August 2016ladzzz123No ratings yet

- MACA ManualDocument597 pagesMACA ManualPrabin ShresthaNo ratings yet

- SCB Tariff 2021Document15 pagesSCB Tariff 2021Fuaad DodooNo ratings yet

- Acquirer Credit and Debit - Dual MessageDocument641 pagesAcquirer Credit and Debit - Dual MessageMohammed Abdul KhuddoosNo ratings yet

- Very Easy Money Transfer: E-ChequeDocument15 pagesVery Easy Money Transfer: E-ChequeKartheek AldiNo ratings yet

- PRIME Issuer Transactions V1.1Document44 pagesPRIME Issuer Transactions V1.1Sivakumar VeerapillaiNo ratings yet

- J-Secure 2.0 Acquirer Implementation Guide - v1.2Document32 pagesJ-Secure 2.0 Acquirer Implementation Guide - v1.2mitxael83No ratings yet

- Transaction Processing Rules June 2016Document289 pagesTransaction Processing Rules June 2016Armando ReyNo ratings yet

- Ingenico Driver Installer Release NotesDocument5 pagesIngenico Driver Installer Release NotestimmyJackson100% (1)

- 1119 PDFDocument5 pages1119 PDFMusafir AdamNo ratings yet

- VisaDocument16 pagesVisaMasud RanaNo ratings yet

- Customer Interface Specification: 14 April 2016Document1,049 pagesCustomer Interface Specification: 14 April 2016Prabin ShresthaNo ratings yet

- EMVCo 3DS SDKSpec 220 122018Document130 pagesEMVCo 3DS SDKSpec 220 122018klcekishoreNo ratings yet

- Card Acceptance Guidelines Visa Merchants PDFDocument81 pagesCard Acceptance Guidelines Visa Merchants PDFsanpikNo ratings yet

- Authorization ManualDocument471 pagesAuthorization ManualRobertoNo ratings yet

- Visa Rules PublicDocument941 pagesVisa Rules PublicSrinivas KNo ratings yet

- VISA Dynamic Passcode AuthenticationDocument4 pagesVISA Dynamic Passcode AuthenticationBudi SugiantoNo ratings yet

- Part III Debit Credit Application Terminal SpecificationDocument161 pagesPart III Debit Credit Application Terminal SpecificationMai Nam ThangNo ratings yet

- Samoa Session2 Sagar Sarbhai PDFDocument30 pagesSamoa Session2 Sagar Sarbhai PDFAnonymous 4ThfhDBajNo ratings yet

- Unisys + C2P OPFDocument4 pagesUnisys + C2P OPFdebajyotiguhaNo ratings yet

- RBB Revenue TSA Account - Esewa 2023-02-27Document1 pageRBB Revenue TSA Account - Esewa 2023-02-27suvalove335No ratings yet

- RBB Revenue TSA Account - ESewa 2023-01-31Document1 pageRBB Revenue TSA Account - ESewa 2023-01-31Sanjay Kumar MahatoNo ratings yet

- 2015 Uerm Alumni Convention Registration FormsDocument7 pages2015 Uerm Alumni Convention Registration FormsLaurence Tabanao GayaoNo ratings yet

- AgentCalcs Software Order Form - Jensen Hughes PDFDocument2 pagesAgentCalcs Software Order Form - Jensen Hughes PDFJUVENTINONo ratings yet

- Virtual Pos Tech SheetDocument2 pagesVirtual Pos Tech SheetJonathan VardouniotisNo ratings yet

- Trs EnrollmentDocument1 pageTrs EnrollmentBrandon MillsNo ratings yet

- Improving Agribank's International Debit Card ServicesDocument32 pagesImproving Agribank's International Debit Card ServicesLe duc NghiaNo ratings yet

- Spbu 24.306.139Document6 pagesSpbu 24.306.139fernandotariganNo ratings yet

- April 2011 IssueDocument110 pagesApril 2011 IssuePumper MagazineNo ratings yet

- Statement 20200901 20200910Document15 pagesStatement 20200901 20200910Dika MongkolNo ratings yet

- Customer Satisfaction and AwarenessDocument63 pagesCustomer Satisfaction and Awarenessdeepika90236No ratings yet

- Haritha - Salesforce Vlocity - DeveloperDocument11 pagesHaritha - Salesforce Vlocity - DeveloperMadhav GarikapatiNo ratings yet

- Order Cisco exam vouchersDocument1 pageOrder Cisco exam vouchersilirisaiNo ratings yet

- Electronic Payment System (EPS)Document37 pagesElectronic Payment System (EPS)Jivika Patil100% (1)

- Atm OutsourcingDocument61 pagesAtm OutsourcingMahalakshmi RavikumarNo ratings yet

- Bank of America Visa CCDocument2 pagesBank of America Visa CCGerson Chirinos100% (2)

- FS12 3103 003 CardWizard OVDSDocument4 pagesFS12 3103 003 CardWizard OVDSAndersson NunesNo ratings yet

- Bill To:: NJ-WoodbridgeDocument3 pagesBill To:: NJ-WoodbridgeKenneth Sanders67% (3)

- Eastern Bank Ltd. - Visa Corporate Platinum Credit CardDocument5 pagesEastern Bank Ltd. - Visa Corporate Platinum Credit CardJubayer BhuiyanNo ratings yet

- Financial Service Provided by HDFCDocument93 pagesFinancial Service Provided by HDFCBruce JamiesonNo ratings yet

- PreviewDocument5 pagesPreviewFaz AliNo ratings yet

- 04-Lic Credit CardDocument25 pages04-Lic Credit Cardinammurad12No ratings yet

- Organized Crime InvetigationDocument81 pagesOrganized Crime InvetigationArgie DionioNo ratings yet

- Authorizattion System ManualDocument433 pagesAuthorizattion System ManualPaul_Escudier_EXP100% (8)

- Flexipay FormDocument1 pageFlexipay FormNunu JieNo ratings yet

- CIBC Account StatementDocument4 pagesCIBC Account Statementsarah100% (4)

- DB Elavon Application V0222 ENGDocument6 pagesDB Elavon Application V0222 ENGsrmmontgomery srmmontgomerytelus.netNo ratings yet

- Đề Toeic Reading - Từ MS Hoa ToeicDocument29 pagesĐề Toeic Reading - Từ MS Hoa Toeichoang trinh100% (1)

- Aerosus TrainingDocument101 pagesAerosus TrainingMladen RadojevicNo ratings yet

- Bill Statement: Previous Charges Amount (RM) Current Charges Amount (RM)Document6 pagesBill Statement: Previous Charges Amount (RM) Current Charges Amount (RM)Akram YasinNo ratings yet

- Emv Chip Card FaqsDocument1 pageEmv Chip Card FaqsMuhammad AzharNo ratings yet

- Creditcardprocessing SEprojectDocument12 pagesCreditcardprocessing SEprojectMalla Abhinaya100% (2)