Professional Documents

Culture Documents

Capital Gains Tax

Uploaded by

Shiena Lou B. Amodia-Rabacal0 ratings0% found this document useful (0 votes)

57 views2 pagesTaxation

Copyright

© © All Rights Reserved

Available Formats

DOCX, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentTaxation

Copyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

57 views2 pagesCapital Gains Tax

Uploaded by

Shiena Lou B. Amodia-RabacalTaxation

Copyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

You are on page 1of 2

Capital Gains Tax Philippines

Capital Gains Tax is a tax imposed on the gains presumed to have been realized by the

seller from the sale, exchange, or other disposition of capital assets located in the

Philippines, including pacto de retro sales and other forms of conditional sale.

Documentary Stamp Tax Philippines

Documentary Stamp Tax is a tax on documents, instruments, loan agreements, and

papers evidencing the acceptance, assignment, sale, or transfer of an obligation, rights,

or property incident thereto.

Donors Tax Philipppines

Donors Tax is a tax on a donation or gift, and is imposed on the gratuitous transfer of

property between two or more persons who are living at the time of the transfer.

Estate Tax Philippines

Estate Tax is a tax on the right of the deceased person to transmit his/her estate to

his/her lawful heirs and beneficiaries at the time of death and on certain transfers which

are made by law as equivalent to testamentary disposition.

Income Tax Philippines

Income Tax is a tax on all yearly profits arising from property, profession, trades or

offices, or as a tax on a persons income, emoluments, profits, and the like.

Percentage Tax Philippines

Percentage Tax is a business tax imposed on persons or entities who sell or lease goods,

properties, or services in the course of trade or business whose gross annual sales or

receipts do not exceed P550,000 and are not VAT-registered.

Value Added Tax (VAT) Philippines

Value Added Tax (VAT) is a business tax imposed and collected from the seller in the

course of trade or business on every sale of properties (real or personal), lease of goods

or properties (real or personal), or vendors of services. It is an indirect tax, thus, it can

be passed on to the buyer.

Withholding Tax on Compensation Philippines

Withholding Tax on Compensation is the tax withheld from individuals receiving purely

compensation income.

Expanded Withholding Tax Philippines

Expanded Withholding Tax is a creditable tax prescribed for certain domestic (Philippine)

payors and is creditable against the income tax due of the payee for the taxable quarter

year. The expanded withholding tax normally covers services.

Final Withholding Tax Philippines

Final Withholding Tax is a withholding tax which is prescribed only for certain payors and

is not creditable against the income tax due of the payee for the taxable year. Income

Tax withheld constitutes the full and final payment of the Income Tax due from the

payee on the said income.

Withholding Tax on Government Money Payments Philippines

Withholding Tax on Government Money Payments is the withholding tax withheld by

government offices and instrumentalities, including government-owned or controlled

corporations and local government units, before making any payments to resident

suppliers of goods and services.

You might also like

- Income Taxation GuideDocument543 pagesIncome Taxation Guidemae annNo ratings yet

- Gross IncomeDocument32 pagesGross IncomeMariaCarlaMañagoNo ratings yet

- Income Tax On IndividualsDocument25 pagesIncome Tax On IndividualsMohammadNo ratings yet

- Vat On Sales of Goods or PropertiesDocument10 pagesVat On Sales of Goods or Propertiesgoerginamarquez100% (1)

- Pfrs 2 Share-Based PaymentsDocument3 pagesPfrs 2 Share-Based PaymentsR.A.No ratings yet

- RFBT-09 (Banking Laws)Document13 pagesRFBT-09 (Banking Laws)Erlinda MolinaNo ratings yet

- CorporationDocument18 pagesCorporationSarah GoNo ratings yet

- Auditing Problems: Audit of ReceivablesDocument4 pagesAuditing Problems: Audit of ReceivablesMa. Trixcy De VeraNo ratings yet

- Business TaxesDocument47 pagesBusiness TaxesJoyce MorganNo ratings yet

- Senior Citizen and PWD Benefits ActDocument8 pagesSenior Citizen and PWD Benefits ActAngelica Nicole TamayoNo ratings yet

- Module 4 - Introduction To Partnership and Partnership FormationDocument14 pagesModule 4 - Introduction To Partnership and Partnership Formation1BSA5-ABM Espiritu, CharlesNo ratings yet

- Chapter 12 Transfer TaxationDocument14 pagesChapter 12 Transfer TaxationCamila MolinaNo ratings yet

- Direct Tax Code Simplifies TaxationDocument4 pagesDirect Tax Code Simplifies TaxationHardip MatholiyaNo ratings yet

- Taxation 888 PowerpointDocument888 pagesTaxation 888 PowerpointMelanie OngNo ratings yet

- Ale Aubrey Bsma 3 1.lguDocument6 pagesAle Aubrey Bsma 3 1.lguAstrid XiNo ratings yet

- Final Income TaxationDocument15 pagesFinal Income TaxationElizalen MacarilayNo ratings yet

- Audit of Receivable PDFDocument7 pagesAudit of Receivable PDFRyan Prado Andaya100% (1)

- 01 Introduction and FormationDocument18 pages01 Introduction and Formationm_kobayashiNo ratings yet

- Reviewer On Intro To TaxDocument7 pagesReviewer On Intro To Taxjulius art maputiNo ratings yet

- Standard Costing and Variance Analysis FormulasDocument2 pagesStandard Costing and Variance Analysis FormulasRashid HussainNo ratings yet

- Tax SemisDocument50 pagesTax SemisTeam MindanaoNo ratings yet

- Rodel's 2020 Income Tax Computation with Itemized DeductionsTITLE Mulry's 2020 Taxable Income and Tax Payable TITLE Sharon's Various 2020 Tax Computations as Resident, Non-Resident ETB and NETBDocument5 pagesRodel's 2020 Income Tax Computation with Itemized DeductionsTITLE Mulry's 2020 Taxable Income and Tax Payable TITLE Sharon's Various 2020 Tax Computations as Resident, Non-Resident ETB and NETByezaquera100% (1)

- Conceptual Framework and Accounting StandardsDocument3 pagesConceptual Framework and Accounting StandardsGenena QuitasolNo ratings yet

- The Public Accounting Profession EnvironmentDocument3 pagesThe Public Accounting Profession EnvironmentBianca LizardoNo ratings yet

- Business Combination AccountingDocument3 pagesBusiness Combination AccountingBrian PuangNo ratings yet

- Revenues and Other ReceiptsDocument4 pagesRevenues and Other ReceiptsWawex DavisNo ratings yet

- Gross Income Deductions - Lecture Handout PDFDocument4 pagesGross Income Deductions - Lecture Handout PDFKarl RendonNo ratings yet

- H01 - Principles of TaxationDocument9 pagesH01 - Principles of TaxationRachel FuentesNo ratings yet

- Working Capital and Short-Term FinancingDocument5 pagesWorking Capital and Short-Term FinancingDivine VictoriaNo ratings yet

- Module 1 Intro To Transfer Tax, Law of SuccessionDocument33 pagesModule 1 Intro To Transfer Tax, Law of SuccessionVenice Marie ArroyoNo ratings yet

- Exercise No.4 Bus. Co.Document56 pagesExercise No.4 Bus. Co.Jeane Mae BooNo ratings yet

- Chapter 9 Term PaperDocument3 pagesChapter 9 Term PaperMardy TarrozaNo ratings yet

- Chapter 23 - Working Capital Management - General IssuesDocument86 pagesChapter 23 - Working Capital Management - General IssuesKamal Singh ChouhanNo ratings yet

- Accounting ChangesDocument5 pagesAccounting Changeskty yjmNo ratings yet

- Chapter 11 Capital Budgeting: Answers To QuestionsDocument35 pagesChapter 11 Capital Budgeting: Answers To Questionsafsdasdf3qf4341f4asDNo ratings yet

- Fund, Which Is Separate From The Reporting Entity For The Purpose ofDocument7 pagesFund, Which Is Separate From The Reporting Entity For The Purpose ofNaddieNo ratings yet

- FEU Institute Succession and Transfer TaxationDocument5 pagesFEU Institute Succession and Transfer TaxationNah HamzaNo ratings yet

- Obe Course Syllabus TrnstaxDocument4 pagesObe Course Syllabus TrnstaxKenneth Bryan Tegerero TegioNo ratings yet

- Audit of The Payroll and Personnel CycleDocument31 pagesAudit of The Payroll and Personnel Cyclerico_putra_1No ratings yet

- Tax BT Introduction To VATDocument5 pagesTax BT Introduction To VATJoshua Phillip TorcedoNo ratings yet

- Income Taxation-FinalsDocument14 pagesIncome Taxation-FinalsTheaNo ratings yet

- Semis Tax PPTSDocument271 pagesSemis Tax PPTSTeam MindanaoNo ratings yet

- CHAPTER 6 FINANCIAL ASSETSDocument23 pagesCHAPTER 6 FINANCIAL ASSETSYay YayNo ratings yet

- INCOME TAX | Final Tax, Passive Income, Non-ResidentsDocument14 pagesINCOME TAX | Final Tax, Passive Income, Non-ResidentsShane Mark CabiasaNo ratings yet

- Auditing Cash BalancesDocument6 pagesAuditing Cash BalancesCJ GranadaNo ratings yet

- Revenue and Other Receipts - ScriptDocument30 pagesRevenue and Other Receipts - ScriptChristine Leal-Estender100% (2)

- AFAR - Part 1Document18 pagesAFAR - Part 1Myrna LaquitanNo ratings yet

- Copy Individual Income TaxDocument10 pagesCopy Individual Income TaxMari Louis Noriell MejiaNo ratings yet

- Afar 2019Document9 pagesAfar 2019TakuriNo ratings yet

- Individual Income TaxationDocument50 pagesIndividual Income TaxationGab RielNo ratings yet

- Unit IA ID. Rematch Unit Drill On Cash and Cash Equivalents Petty Cash Bank Recon Proof of Cash 1Document5 pagesUnit IA ID. Rematch Unit Drill On Cash and Cash Equivalents Petty Cash Bank Recon Proof of Cash 1MARK JHEN SALANGNo ratings yet

- Ch07 Gross EstateDocument8 pagesCh07 Gross EstateRenelyn FiloteoNo ratings yet

- Investment in AssociateDocument11 pagesInvestment in AssociateElla MontefalcoNo ratings yet

- Departmental Finals Answer Key PDFDocument4 pagesDepartmental Finals Answer Key PDFJacob AcostaNo ratings yet

- CASH MANAGEMENT AND WORKING CAPITAL OPTIMIZATIONDocument2 pagesCASH MANAGEMENT AND WORKING CAPITAL OPTIMIZATIONR100% (1)

- Ap 06 REO Receivables - PDF 074431Document19 pagesAp 06 REO Receivables - PDF 074431ChristianNo ratings yet

- Chapter 4 The Revenue CycleDocument9 pagesChapter 4 The Revenue Cycleangelie mendozaNo ratings yet

- 7.0 Capital Gains TaxationDocument23 pages7.0 Capital Gains TaxationElle VernezNo ratings yet

- GlossaryDocument5 pagesGlossaryAila Fatima MiguelNo ratings yet

- Summary of New Points of The Labor Code 2019Document4 pagesSummary of New Points of The Labor Code 2019Shiena Lou B. Amodia-RabacalNo ratings yet

- 1.152 Summary of Significant SC Tax Decisions (July To December 2015)Document5 pages1.152 Summary of Significant SC Tax Decisions (July To December 2015)Sharon BakerNo ratings yet

- Gsis Vs Heirs of CaballeroDocument6 pagesGsis Vs Heirs of CaballeroShiena Lou B. Amodia-RabacalNo ratings yet

- Chu Vs CunananDocument6 pagesChu Vs CunananShiena Lou B. Amodia-RabacalNo ratings yet

- Interprovincial Autobus Vs CIRDocument4 pagesInterprovincial Autobus Vs CIRShiena Lou B. Amodia-RabacalNo ratings yet

- Republic of The Philippines Supreme Court Manila en Banc Atty. Tomas Ong CabiliDocument10 pagesRepublic of The Philippines Supreme Court Manila en Banc Atty. Tomas Ong CabiliShiena Lou B. Amodia-RabacalNo ratings yet

- Phil Interisland Shipping Vs CADocument8 pagesPhil Interisland Shipping Vs CAShiena Lou B. Amodia-RabacalNo ratings yet

- Felix vs. CaDocument6 pagesFelix vs. CaShiena Lou B. Amodia-RabacalNo ratings yet

- DM Ferrer Vs USTDocument5 pagesDM Ferrer Vs USTShiena Lou B. Amodia-RabacalNo ratings yet

- Bagunu Vs AggabaoDocument14 pagesBagunu Vs AggabaoShiena Lou B. Amodia-RabacalNo ratings yet

- Hospital ChecklistDocument1 pageHospital ChecklistLen Manuel ArsenueNo ratings yet

- Supreme Court rules on inheritance dispute between heirs of man with two wivesDocument4 pagesSupreme Court rules on inheritance dispute between heirs of man with two wivesShiena Lou B. Amodia-RabacalNo ratings yet

- Arruego Vs CADocument3 pagesArruego Vs CAShiena Lou B. Amodia-RabacalNo ratings yet

- Manuel vs. CADocument1 pageManuel vs. CAShiena Lou B. Amodia-RabacalNo ratings yet

- Olsen Vs TrinidadDocument3 pagesOlsen Vs TrinidadShiena Lou B. Amodia-RabacalNo ratings yet

- Model AC PrimaryDocument6 pagesModel AC PrimaryDar MendozaNo ratings yet

- Social Audit Working Doc Report SampleDocument5 pagesSocial Audit Working Doc Report SampleShiena Lou B. Amodia-Rabacal100% (4)

- Model AC PrimaryDocument6 pagesModel AC PrimaryDar MendozaNo ratings yet

- Agrarian Law and Social LegislationDocument27 pagesAgrarian Law and Social LegislationIvy Beronilla LubianoNo ratings yet

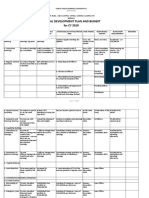

- Annual Development Plan and Budget SampleDocument14 pagesAnnual Development Plan and Budget SampleShiena Lou B. Amodia-Rabacal91% (34)

- Timta Coop A Cbo v2 Dof As of 07.26.18 CleanddtDocument9 pagesTimta Coop A Cbo v2 Dof As of 07.26.18 CleanddtShiena Lou B. Amodia-RabacalNo ratings yet

- Govt MGT Audit Report TemplateDocument7 pagesGovt MGT Audit Report TemplateRheneir Mora100% (3)

- 109 People Vs MartinDocument11 pages109 People Vs MartinKay AvilesNo ratings yet

- Lim Tan Ho Vs RamoleteDocument9 pagesLim Tan Ho Vs RamoleteShiena Lou B. Amodia-RabacalNo ratings yet

- VAT on Toll Fees CaseDocument7 pagesVAT on Toll Fees CaseR.A. GregorioNo ratings yet

- G.R. No. 143076 - Philreca vs. DilgDocument11 pagesG.R. No. 143076 - Philreca vs. DilgseanNo ratings yet

- San Beda Insurance Mem AidDocument24 pagesSan Beda Insurance Mem AidSean GalvezNo ratings yet

- Tax Review Class-Msu Case DigestDocument156 pagesTax Review Class-Msu Case DigestShiena Lou B. Amodia-RabacalNo ratings yet

- G.R. No. L-7859 - Lutz Vs Araneta (22 Dec 55)Document3 pagesG.R. No. L-7859 - Lutz Vs Araneta (22 Dec 55)jdz1988No ratings yet

- City Govt. of Quezon City vs. Ericta - DIGESTDocument2 pagesCity Govt. of Quezon City vs. Ericta - DIGESTblessaraynes100% (1)

- Local Body Tax in Pune Municipal Corporation (LBT in PMC) - 0Document20 pagesLocal Body Tax in Pune Municipal Corporation (LBT in PMC) - 0nikhilpasariNo ratings yet

- Liquidated CaseDocument4 pagesLiquidated CaseJam CastilloNo ratings yet

- SO1 Invitation September 14, 2019Document2 pagesSO1 Invitation September 14, 2019Vince PenuelaNo ratings yet

- Terminiello v. City of ChicagoDocument3 pagesTerminiello v. City of ChicagoMenchu MabanNo ratings yet

- Camera Release Form - MLKDocument1 pageCamera Release Form - MLKTTPNo ratings yet

- THE Curious Case of Zimbabwe'S Generals: Do You Want To Advertise?Document10 pagesTHE Curious Case of Zimbabwe'S Generals: Do You Want To Advertise?Managing EditorNo ratings yet

- Chapter 1-Introduction To OshaDocument32 pagesChapter 1-Introduction To OshafettaneNo ratings yet

- Crr704of2017 91 JudgementDocument15 pagesCrr704of2017 91 Judgementnaveen KumarNo ratings yet

- Memorandum Circular 78 On Classified MattersDocument21 pagesMemorandum Circular 78 On Classified MattersRoy BasanezNo ratings yet

- Camitan vs. FidelityDocument2 pagesCamitan vs. FidelityPMV50% (2)

- Answer (Petition For Habeas Corpus)Document10 pagesAnswer (Petition For Habeas Corpus)Ahmad Abduljalil100% (2)

- Municipal Corporation of Delhi Vs Subhagwanti & Others (With ..Document6 pagesMunicipal Corporation of Delhi Vs Subhagwanti & Others (With ..Harman Saini100% (1)

- Employee Statement FormDocument5 pagesEmployee Statement Formloredana100% (1)

- Warren H. Wheeler, an Infant, and J. H. Wheeler, His Father and Next Friend, and C. C. Spaulding, Iii, an Infant, and C. C. Spaulding, Jr., His Father and Next Friend v. Durham City Board of Education, a Body Politic in Durham County, North Carolina, 309 F.2d 630, 4th Cir. (1962)Document5 pagesWarren H. Wheeler, an Infant, and J. H. Wheeler, His Father and Next Friend, and C. C. Spaulding, Iii, an Infant, and C. C. Spaulding, Jr., His Father and Next Friend v. Durham City Board of Education, a Body Politic in Durham County, North Carolina, 309 F.2d 630, 4th Cir. (1962)Scribd Government DocsNo ratings yet

- Philippine Politics Governance MODULE 9&10 WEEK1&2Document11 pagesPhilippine Politics Governance MODULE 9&10 WEEK1&2Viñas, Diana L.No ratings yet

- The Kadi Case: What Relationship Is There Between The Universal Legal Order Under The Auspices of The United Nations and The EU Legal Order?Document11 pagesThe Kadi Case: What Relationship Is There Between The Universal Legal Order Under The Auspices of The United Nations and The EU Legal Order?shahab88No ratings yet

- Everett Vs CADocument3 pagesEverett Vs CAFrancis MasiglatNo ratings yet

- Supreme Court Review Judgment on Taj Heritage Corruption CaseDocument22 pagesSupreme Court Review Judgment on Taj Heritage Corruption CaseBhupendra CharanNo ratings yet

- Juan David Ortiz Warrants and Affidavits (Redacted)Document34 pagesJuan David Ortiz Warrants and Affidavits (Redacted)callertimesNo ratings yet

- The American Pageant - Chapter 23 Review SheetDocument3 pagesThe American Pageant - Chapter 23 Review SheetJoesterNo ratings yet

- Guardians and Guardianship (Rules 92-97)Document33 pagesGuardians and Guardianship (Rules 92-97)Ronna Faith MonzonNo ratings yet

- DAVID NIEDRIST v. Bristol Township, Bristol Township Police, Falls Township Police & Levittown-Fairless Hills Rescue SquadDocument27 pagesDAVID NIEDRIST v. Bristol Township, Bristol Township Police, Falls Township Police & Levittown-Fairless Hills Rescue SquadTom Sofield100% (1)

- Yeo v. Town of Lexington, 1st Cir. (1997)Document134 pagesYeo v. Town of Lexington, 1st Cir. (1997)Scribd Government DocsNo ratings yet

- Consent bars adultery caseDocument2 pagesConsent bars adultery caseJoel MilanNo ratings yet

- 2 Compliance Questionnaire STANDARDDocument3 pages2 Compliance Questionnaire STANDARDchung elaineNo ratings yet

- Alberto Vs Dela CruzDocument3 pagesAlberto Vs Dela CruzRolando ReubalNo ratings yet

- 12.2 ISM Internal AuditingDocument3 pages12.2 ISM Internal Auditingsimon_midjajaNo ratings yet

- Waiver, Release and Quitclaim: Republic of The Philippines) City of Manila) S.SDocument2 pagesWaiver, Release and Quitclaim: Republic of The Philippines) City of Manila) S.SMina MagallonesNo ratings yet

- De Los Santos V SagalongosDocument3 pagesDe Los Santos V SagalongosDuffy DuffyNo ratings yet